Market Overview:

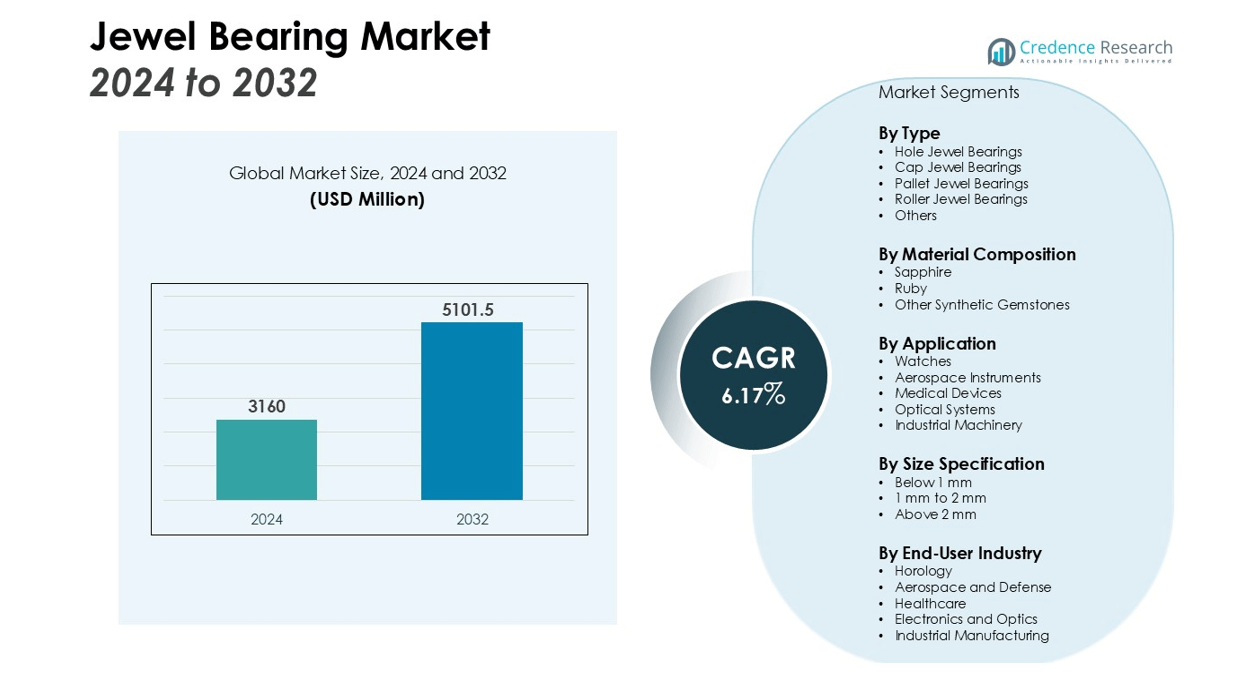

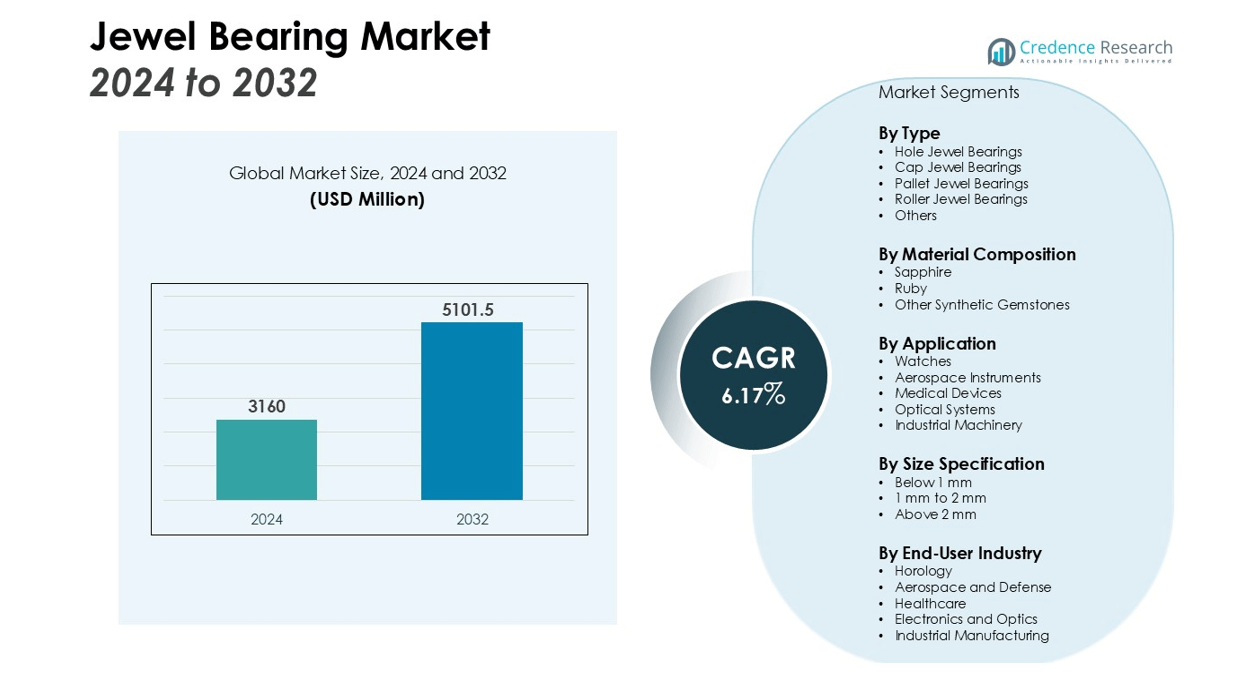

The Jewel Bearing Market size was valued at USD 3160 million in 2024 and is anticipated to reach USD 5101.5 million by 2032, at a CAGR of 6.17% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Jewel Bearing Market Size 2024 |

USD 3160 million |

| Jewel Bearing Market, CAGR |

6.17% |

| Jewel Bearing Market Size 2032 |

USD 5101.5 million |

Market growth is primarily driven by the rising adoption of jewel bearings in luxury timepieces, where precision and longevity are critical. Additionally, their expanding use in aerospace instruments, optical devices, and medical technologies reinforces demand, supported by their ability to operate in extreme conditions with minimal lubrication. The increasing focus on energy efficiency and extended product life cycles further strengthens their adoption across diverse applications.

Regionally, Europe holds a leading share of the market, supported by its strong luxury watchmaking industry and advanced engineering sector. North America also shows significant demand, driven by the aerospace and healthcare industries. Meanwhile, Asia-Pacific is witnessing the fastest growth, fueled by expanding electronics manufacturing hubs in China, Japan, and South Korea, alongside increasing investments in precision engineering solutions.

Market Insights:

- The Jewel Bearing Market was valued at USD 3160 million and is projected to reach USD 5101.5 million, advancing at a CAGR of 6.17% during the forecast period.

- Demand is strongly influenced by the luxury watchmaking industry, where jewel bearings ensure precision, durability, and long service life.

- Expanding applications in aerospace, optical devices, and medical technologies strengthen adoption due to their resilience in extreme environments.

- Rising emphasis on energy efficiency and extended product lifecycles drives integration into advanced machinery and high-precision instruments.

- High manufacturing costs and limited raw material availability remain key barriers, impacting smaller producers and restricting cost competitiveness.

- Europe leads with 38% market share, supported by its established watchmaking heritage and advanced engineering capabilities.

- Asia-Pacific, with a 24% share, is expected to witness the fastest growth, fueled by electronics manufacturing hubs and rising investments in precision engineering.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Precision in Timekeeping and Luxury Watches

The Jewel Bearing Market benefits significantly from the demand for precision in luxury timepieces and advanced horology. Jewel bearings ensure smooth operation, reduce friction, and extend the service life of mechanical watch movements. High-end watchmakers continue to prioritize these components due to their durability and ability to maintain accuracy over decades. It strengthens the relevance of jewel bearings in a market segment where craftsmanship, performance, and longevity remain essential.

- For instance, Rolex’s Caliber 3235 movement contains exactly 31 jewel bearings that contribute to its certified performance as a chronometer, ensuring long-term precision and reliability.

Expanding Applications Across Aerospace, Optical, and Medical Devices

The Jewel Bearing Market gains momentum from its growing role in aerospace instruments, optical systems, and medical technologies. Jewel bearings function reliably in harsh environments where mechanical resilience and minimal lubrication are critical. Aerospace altimeters, microscopes, and surgical equipment integrate these bearings to improve precision and reduce operational wear. It enhances efficiency and safeguards sensitive instruments, thereby broadening adoption beyond traditional watchmaking.

Rising Focus on Energy Efficiency and Product Life Extension

The Jewel Bearing Market is supported by the rising emphasis on energy efficiency and longer product life cycles across industries. Jewel bearings require limited maintenance and exhibit minimal wear, making them ideal for long-lasting performance in complex machinery. Their ability to minimize friction directly contributes to energy savings and operational stability. It drives preference among manufacturers seeking to reduce total ownership costs and enhance system reliability.

Advancements in Synthetic Material Development and Engineering Innovations

The Jewel Bearing Market experiences growth from technological advancements in synthetic sapphire and ruby production. Manufacturers invest in advanced processes to create bearings with higher hardness, improved thermal stability, and consistent quality. These innovations enhance resistance to wear and expand the scope of high-performance applications. It positions jewel bearings as a critical component in the evolution of precision engineering technologies across multiple sectors.

- For instance, Rubicon Technology has advanced synthetic sapphire growth technology achieving wafer diameters up to 150 mm, enhancing component precision and durability in high-tech applications.

Market Trends:

Integration of Jewel Bearings into Emerging Precision Engineering Applications

The Jewel Bearing Market is witnessing a trend of integration into a wider range of precision engineering applications beyond traditional horology. Aerospace instruments, medical diagnostic tools, and optical devices are increasingly adopting jewel bearings for their durability, resistance to wear, and ability to function without frequent lubrication. Miniaturization across industries is accelerating demand, as smaller yet more efficient bearings are required to maintain accuracy in compact devices. It is supporting adoption in semiconductor inspection equipment, laboratory instruments, and navigation systems where precise motion control is critical. The growing reliance on reliable components that can withstand high stress and fluctuating temperatures further strengthens this trend. Manufacturers are also focusing on enhancing product design to meet the evolving requirements of sectors that demand high reliability and extended performance cycles.

- For instance, NASA’s jewel bearing assembly for spacecraft applications was successfully tested to operate smoothly at rotational speeds of 5,500 revolutions per minute (rpm) using an air impeller, underscoring its durability and precision under extreme conditions.

Advancements in Synthetic Sapphire and Ruby Manufacturing Processes

The Jewel Bearing Market is also shaped by advancements in the manufacturing of synthetic sapphire and ruby, which are the primary materials used in jewel bearings. Producers are employing advanced crystal growth techniques to deliver consistent hardness, thermal stability, and improved structural integrity. These developments allow bearings to achieve higher efficiency in demanding environments such as aerospace and defense systems. It is enabling the expansion of jewel bearings into fields where conventional metal bearings are less effective. The focus on sustainable and scalable production methods is also gaining traction, supporting broader availability and cost efficiency. Continuous research and development is expected to accelerate performance improvements, ensuring jewel bearings remain indispensable in precision-driven industries worldwide.

- For instance, Kyocera mass-produces single-crystal synthetic sapphire wafers up to 200 millimeters in diameter using edge-defined film-fed growth (EFG) methods, enabling high-quality substrates for advanced optical and electronic applications.

Market Challenges Analysis:

High Manufacturing Costs and Limited Raw Material Availability

The Jewel Bearing Market faces the challenge of high production costs linked to the precision and expertise required in manufacturing. Synthetic sapphire and ruby, the primary materials, demand advanced crystal growth and processing methods that raise overall expenses. Limited availability of high-quality raw materials further adds to cost pressures, restricting economies of scale. It creates barriers for smaller manufacturers that struggle to compete with established players. Price sensitivity in certain end-use industries also limits adoption, especially in markets where cost reduction remains a priority. These factors collectively impact growth potential despite the proven advantages of jewel bearings in precision systems.

Competition from Alternative Bearing Technologies and Substitutes

The Jewel Bearing Market also contends with competition from alternative bearing solutions such as ceramic and advanced polymer bearings. These substitutes offer cost-effective performance for applications that do not require the durability of sapphire or ruby. Rapid innovation in lightweight materials and engineered composites continues to provide viable options in price-sensitive segments. It challenges jewel bearing adoption, particularly in mid-tier applications where performance trade-offs are acceptable. Market players must address this issue by emphasizing the superior longevity, energy efficiency, and low-maintenance qualities of jewel bearings. Sustained investment in innovation and value-driven positioning remains critical to mitigate the risk of substitution.

Market Opportunities:

Rising Adoption in High-Precision Industries and Advanced Technologies

The Jewel Bearing Market presents strong opportunities through its rising use in high-precision industries such as aerospace, healthcare, and optical systems. Jewel bearings offer unmatched durability, low friction, and operational stability, making them critical for equipment that requires accuracy and long service life. The expansion of medical diagnostics, surgical instruments, and laboratory devices creates new avenues for adoption. It supports greater integration in sectors where precision is linked directly to safety and performance outcomes. The growth of optical technologies, including microscopes, telescopes, and semiconductor inspection tools, further enhances demand. This diversification reduces reliance on traditional watchmaking, positioning jewel bearings in fast-growing technology-driven markets.

Expansion Through Synthetic Material Innovation and Sustainable Production

The Jewel Bearing Market also holds opportunities through continuous advancements in synthetic sapphire and ruby production. Improved material consistency, cost efficiency, and scalability open the door for wider adoption across both high-end and mid-tier applications. Manufacturers are focusing on sustainable production processes that reduce energy consumption and ensure material availability. It creates potential for expanded market reach by balancing performance benefits with affordability. Growing demand for energy-efficient components in electronics and industrial equipment aligns with the value proposition of jewel bearings. These developments are expected to accelerate penetration into emerging markets where precision engineering and sustainability standards are gaining importance.

Market Segmentation Analysis:

By Type

The Jewel Bearing Market is segmented by type into hole jewel bearings, cap jewel bearings, pallet jewel bearings, roller jewel bearings, and others. Hole and cap jewel bearings dominate usage in precision watches and aerospace instruments, where accuracy and reduced friction are critical. Pallet and roller jewel bearings are vital in mechanical systems that require long-lasting wear resistance. It continues to gain traction in specialized optical and navigation equipment due to their reliability in high-stress conditions.

- For instance, Omega’s Co-Axial Master Chronometer Caliber 8900 utilizes 39 jewel bearings to ensure smooth mechanical performance and enhanced precision under rigorous conditions.

By Material Composition

The Jewel Bearing Market by material composition includes sapphire, ruby, and other synthetic gemstones. Synthetic sapphire holds the largest share due to its hardness, durability, and resistance to heat and chemicals. Ruby also remains an important material in watchmaking and aerospace, supported by its proven stability and performance. It benefits from ongoing research into advanced crystal growth methods that improve quality and scalability.

- For instance, Industrial Jewels manufactures ruby jewel bearings with a surface finish polish as fine as 0.025 microns, ensuring extremely low friction and long life in high-precision applications.

By Application

The Jewel Bearing Market by application covers watches, aerospace instruments, medical devices, optical systems, and industrial machinery. Watches remain the largest application area, driven by the luxury timepiece sector where precision and longevity are critical. Aerospace instruments and medical devices are experiencing growing adoption due to their need for high-performance, low-maintenance components. Optical systems and industrial machinery further expand the scope, where it supports operational efficiency in demanding environments.

Segmentations:

By Type

- Hole Jewel Bearings

- Cap Jewel Bearings

- Pallet Jewel Bearings

- Roller Jewel Bearings

- Others

By Material Composition

- Sapphire

- Ruby

- Other Synthetic Gemstones

By Application

- Watches

- Aerospace Instruments

- Medical Devices

- Optical Systems

- Industrial Machinery

By Size Specification

- Below 1 mm

- 1 mm to 2 mm

- Above 2 mm

By End-User Industry

- Horology

- Aerospace and Defense

- Healthcare

- Electronics and Optics

- Industrial Manufacturing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Position in Europe Driven by Luxury Watchmaking and Engineering

Europe accounted for 38% of the Jewel Bearing Market, making it the largest regional contributor. The region’s dominance is supported by its established luxury watchmaking industry and advanced engineering capabilities. Switzerland, Germany, and France remain leading contributors due to their strong presence in horology and precision manufacturing. Strict quality standards and emphasis on product longevity reinforce the adoption of jewel bearings across aerospace and optical instruments. It benefits from a mature supply chain that supports innovation in synthetic materials and specialized applications. Government-backed initiatives promoting advanced manufacturing also contribute to consistent demand growth in the region.

Expanding Role of North America Through Aerospace and Healthcare Sectors

North America represented 27% of the Jewel Bearing Market, supported by strong demand from aerospace and healthcare sectors. The United States drives adoption through its established base in avionics, diagnostic systems, and high-end engineering solutions. Jewel bearings play a critical role in ensuring operational efficiency and long-term reliability in these industries. It is further supported by investments in research and development aimed at enhancing advanced material capabilities. The region’s emphasis on innovation and high-value manufacturing creates sustained opportunities for market players. Healthcare modernization and precision-based medical instruments continue to strengthen the demand outlook.

Rapid Growth in Asia-Pacific Supported by Electronics and Industrial Expansion

Asia-Pacific held 24% of the Jewel Bearing Market and is expected to register the fastest growth during the forecast period. China, Japan, and South Korea lead adoption due to their strong focus on precision engineering and large-scale production facilities. Rising demand for consumer electronics and optical devices further enhances the scope of jewel bearings in the region. It is also influenced by increasing government investments in advanced technologies and infrastructure. The availability of cost-effective manufacturing capabilities makes Asia-Pacific an attractive growth hub for both regional and global producers. This momentum positions the region as the fastest-growing market over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SKF

- Swiss Jewel Company

- Adamant Co., Ltd.

- NTN Corporation

- Schaeffler Group

- Namiki Precision Jewel Co., Ltd.

- Bird Precision

- Boca Bearing Company

- Zoom Scientific World

- Ubah Instruments Pvt. Ltd

Competitive Analysis:

The Jewel Bearing Market is characterized by the presence of specialized manufacturers focusing on precision engineering and material innovation. Leading players emphasize synthetic sapphire and ruby production to meet the demand for durability, thermal stability, and wear resistance. It relies on technological advancements to improve quality, reduce costs, and expand applications beyond watchmaking into aerospace, healthcare, and optical devices. Companies are strengthening their portfolios through investments in research and development aimed at enhancing performance and efficiency. Partnerships with watchmakers, medical device producers, and aerospace firms support market visibility and long-term growth. Competitive intensity remains high, with firms differentiating through product innovation, reliability, and cost-effectiveness. It continues to attract attention from industries requiring accuracy and longevity, ensuring steady opportunities for both established players and emerging entrants.

Recent Developments:

- In March 2025, SKF launched an updated brand identity featuring a redesigned logo, fresher blue color, new typeface, and more distinctive photography to increase stakeholder value.

- In July 2025, NTN began mass production of the “Low Dust Generation Bearing for Servo Motors” that significantly reduces dust generation.

Market Concentration & Characteristics:

The Jewel Bearing Market reflects a moderately concentrated structure with a limited number of specialized manufacturers dominating supply. It is defined by high entry barriers due to the precision engineering, advanced crystal growth, and material expertise required in production. Leading players focus on synthetic sapphire and ruby bearings, ensuring consistency in quality and performance across critical applications. The market emphasizes durability, friction reduction, and long service life, which align with the needs of luxury watchmaking, aerospace, medical devices, and optical systems. It is further characterized by steady innovation, niche specialization, and strong reliance on long-term partnerships with high-value industries.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material Composition, Application, Size Specification, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Jewel Bearing Market will continue to expand with strong demand from the luxury watchmaking sector, where craftsmanship and precision remain vital.

- Rising adoption in aerospace and defense systems will enhance its relevance, supported by the need for durability in extreme operating conditions.

- Growing integration into medical devices such as surgical instruments and diagnostic equipment will create new revenue streams.

- It will benefit from the increasing role of optical technologies, including microscopes and telescopes, where accuracy and stability are essential.

- Advancements in synthetic sapphire and ruby production will improve material availability and reduce cost pressures for manufacturers.

- Expansion in electronics and semiconductor inspection tools will strengthen adoption across fast-growing precision engineering markets.

- Energy efficiency requirements in industrial applications will drive greater use of jewel bearings to minimize friction and extend equipment life.

- Regional growth in Asia-Pacific will accelerate, driven by large-scale electronics production and investments in precision technology.

- The market will face challenges from substitutes such as ceramic and polymer bearings, requiring stronger emphasis on performance differentiation.

- Long-term opportunities will emerge through sustainable production processes and innovations in high-performance jewel bearing designs tailored for next-generation industries.