Market Overview

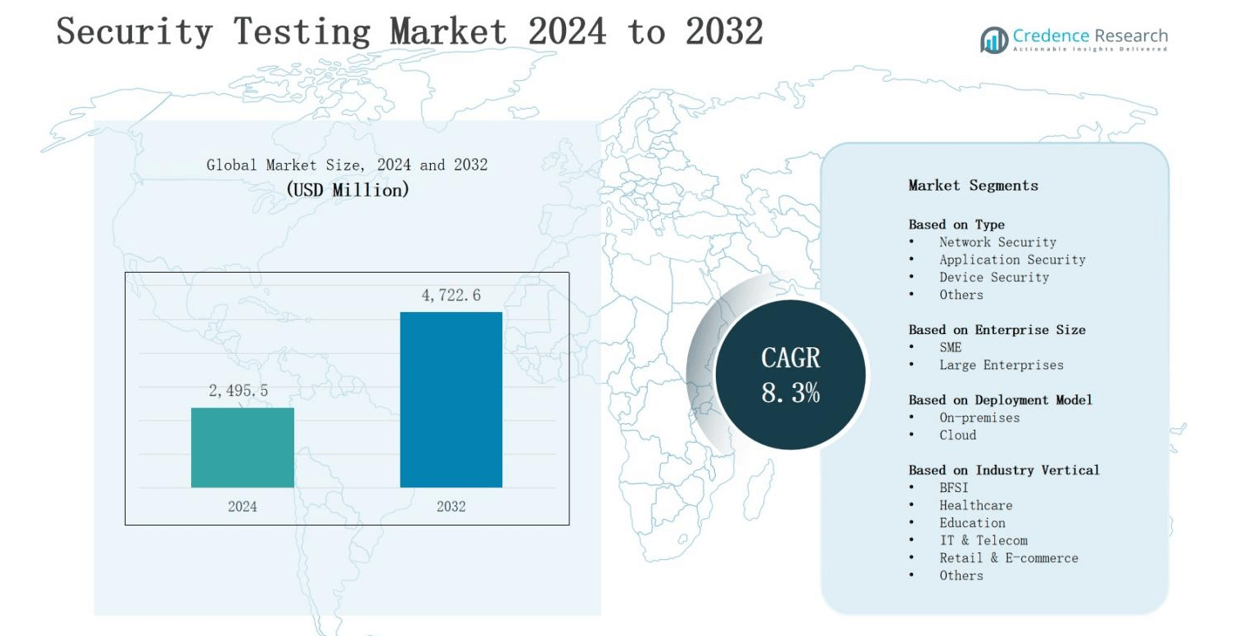

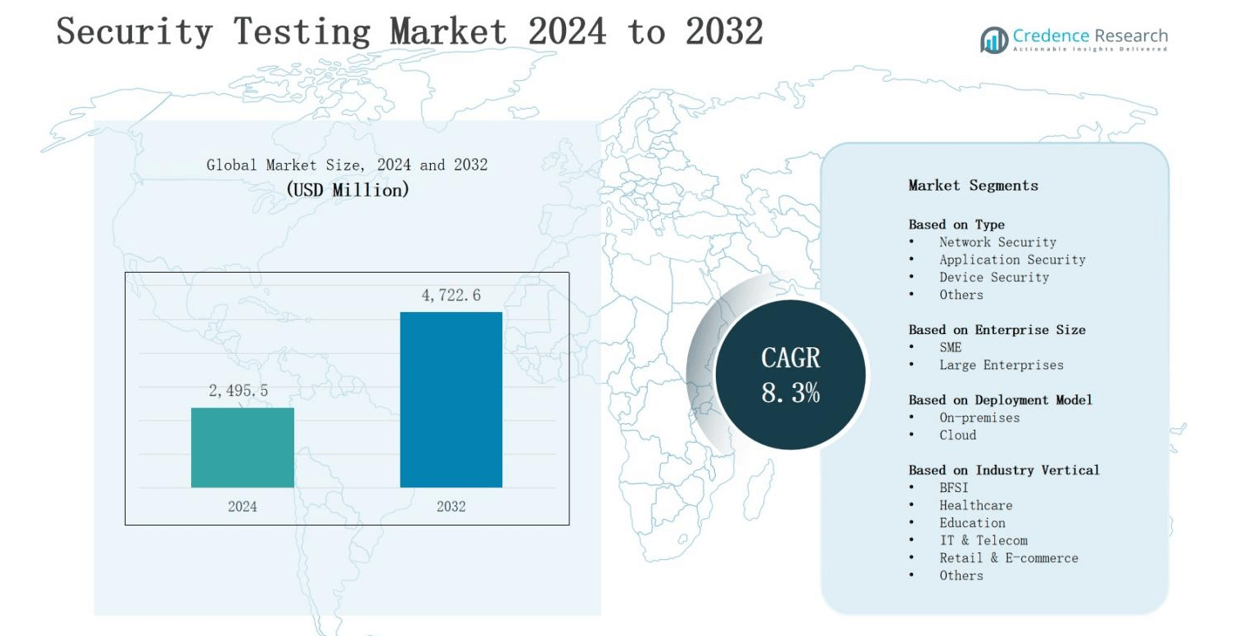

The security testing market is projected to grow from USD 2,495.5 million in 2024 to USD 4,722.6 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Security Testing Market Size 2024 |

USD 2,495.5 million |

| Security Testing Market, CAGR |

8.3% |

| Security Testing Market Size 2032 |

USD 4,722.6 million |

The security testing market is driven by the rising frequency of cyberattacks, strict regulatory requirements, and the growing adoption of cloud-based applications. Organizations increasingly invest in advanced security testing solutions to safeguard sensitive data and maintain compliance. The rapid digital transformation across industries further fuels demand for automated and AI-powered testing tools. Trends highlight the integration of DevSecOps, continuous testing in agile environments, and the use of penetration testing services for proactive risk management. Increasing reliance on IoT devices and mobile applications also expands the market scope, creating strong growth opportunities for specialized security testing providers.

The security testing market shows diverse regional dynamics, with North America leading at 37% driven by strong regulations and advanced infrastructure. Europe follows with 28% supported by GDPR and industry adoption, while Asia-Pacific holds 24% fueled by rapid digitalization and rising IoT usage. Latin America secures 6% with growing awareness in banking and telecom, and the Middle East & Africa accounts for 5% supported by government digital initiatives. Key players include Cisco, Synopsys, Veracode, SecureWorks, Rapid7, Checkmarx Ltd., OpenText, Qualys, Inc., and Intertek Group PLC.

Market Insights

- The security testing market will grow from USD 2,495.5 million in 2024 to USD 4,722.6 million by 2032, at a CAGR of 8.3%, driven by rising cyber threats and compliance.

- Application security dominates with 38% share, followed by network security at 32%, device security at 20%, and others at 10%, reflecting diverse enterprise priorities across digital infrastructures.

- Large enterprises lead with 65% market share due to complex IT needs and regulatory demands, while SMEs hold 35%, adopting affordable cloud-based testing platforms to strengthen cybersecurity resilience.

- Cloud deployment leads with 58% share, supported by scalability and cost efficiency, while on-premises holds 42%, driven by industries prioritizing stricter control, compliance, and internal infrastructure security.

- Regionally, North America leads with 37%, Europe follows with 28%, Asia-Pacific holds 24%, Latin America secures 6%, and the Middle East & Africa account for 5% share respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Cybersecurity Threats and Data Breaches

The security testing market is expanding due to escalating cyber threats and data breaches targeting enterprises across industries. It supports organizations in identifying vulnerabilities before they are exploited by malicious actors. Companies face significant financial and reputational risks from attacks, driving proactive investments in robust testing solutions. It enables continuous monitoring and protection of critical systems. The market benefits from rising global awareness of security risks and compliance obligations.

- For instance, Microsoft reported blocking over 70 billion email and identity threats in 2023 using its security and testing solutions, highlighting how large-scale enterprises are strengthening proactive defenses.

Stringent Regulatory Standards and Compliance Requirements

The security testing market benefits from strict regulatory frameworks across regions that mandate strong cybersecurity practices. Governments and industry bodies enforce rules such as GDPR, HIPAA, and PCI DSS, requiring regular vulnerability assessments. It compels enterprises to invest in advanced testing services to avoid penalties and reputational harm. Strong compliance pressures push adoption across banking, healthcare, and retail sectors. The market growth aligns with rising enforcement of data protection laws.

- For instance, Visa and Mastercard require merchants to maintain PCI DSS compliance, and in 2019, Target Corporation faced additional compliance scrutiny following its widely reported data breach, underscoring the necessity of regular penetration testing and monitoring.

Adoption of Cloud Services and Digital Transformation

The security testing market grows with the widespread adoption of cloud computing, mobile applications, and digital transformation strategies. Enterprises shifting workloads to cloud platforms face rising exposure to complex cyber risks. It drives demand for scalable, automated testing solutions that address hybrid and multi-cloud environments. Companies require end-to-end security validation across networks, applications, and devices. This trend supports market growth as businesses strengthen resilience against evolving threats.

Integration of Advanced Technologies in Testing Solutions

The security testing market evolves with the integration of artificial intelligence, automation, and DevSecOps practices. These technologies improve efficiency and accuracy in detecting vulnerabilities and streamline testing processes. It enables faster response to risks while reducing human errors in manual testing. Organizations leverage continuous testing in agile development cycles for secure software delivery. Growing reliance on IoT and connected devices further accelerates the need for innovative testing approaches.

Market Trends

Growing Demand for Cloud-Based Security Testing Solutions

The security testing market is witnessing a strong shift toward cloud-based testing platforms as enterprises embrace cloud adoption at scale. It supports flexible, scalable, and cost-efficient testing processes that match modern IT environments. Companies prefer cloud-native tools to secure multi-cloud and hybrid infrastructure. This trend reflects the increasing complexity of digital ecosystems. Vendors are developing SaaS-based testing platforms to meet enterprise demand, accelerating innovation and broader market penetration globally.

- For instance, Qualysec specializes in cloud penetration testing for AWS, Azure, and GCP environments, offering comprehensive security assessments and regulatory compliance support tailored for fintech and SaaS companies globally.

Integration of Artificial Intelligence and Automation in Testing

The security testing market benefits from the rapid adoption of artificial intelligence and automation in testing methodologies. AI-driven tools enhance accuracy in detecting vulnerabilities, reducing manual errors and response time. It supports predictive analytics to identify potential risks in real time. Automation streamlines testing workflows, supporting faster product deployment cycles. Organizations view intelligent testing as critical for handling advanced threats, strengthening long-term growth in the cybersecurity solutions landscape.

Rising Adoption of DevSecOps and Continuous Testing Practices

The security testing market aligns with the growing implementation of DevSecOps and continuous testing strategies within enterprises. These practices integrate security into software development cycles from the start. It ensures early detection of vulnerabilities, reducing remediation costs and risks. Businesses adopting agile development prefer testing solutions embedded within CI/CD pipelines. The demand highlights the need for proactive defense strategies that evolve alongside rapid application releases and updates.

Expanding Need for IoT and Mobile Application Security

The security testing market experiences growth due to the widespread use of IoT devices and mobile applications. These technologies create new attack surfaces, requiring advanced and customized testing services. It ensures secure integration across networks, sensors, and mobile platforms. Enterprises deploy testing tools to validate applications before large-scale rollouts. The surge in connected ecosystems highlights demand for specialized providers offering targeted solutions for mobile and IoT vulnerabilities.

- For instance, Bosch IoT Suite, deployed in connected mobility and smart home projects, undergoes continuous vulnerability assessments to ensure secure operation of devices and data flows across millions of IoT endpoints.

Market Challenges Analysis

High Implementation Costs and Resource Constraints

The security testing market faces a significant challenge from high implementation costs and limited skilled resources. Small and medium enterprises struggle to afford advanced solutions, restricting adoption across certain regions. It requires continuous investments in specialized tools, trained professionals, and infrastructure, which strain budgets. Organizations often delay or minimize testing efforts, exposing themselves to greater risks. The lack of skilled cybersecurity experts further slows market growth and limits timely adoption.

Complexity of Evolving Threats and Integration Issues

The security testing market also encounters challenges from the rapid evolution of cyber threats and integration barriers. Advanced attacks demand sophisticated tools that must adapt quickly, increasing pressure on providers. It complicates the task of ensuring consistent protection across dynamic IT environments. Businesses also face difficulties integrating testing solutions with existing legacy systems, creating gaps in security coverage. These obstacles limit efficiency and reduce the effectiveness of comprehensive testing strategies.

Market Opportunities

Expansion of Cloud, IoT, and Mobile Ecosystems

The security testing market holds strong opportunities with the rapid expansion of cloud computing, IoT, and mobile ecosystems. Enterprises are moving critical operations to digital platforms, creating a higher demand for scalable testing solutions. It enables organizations to protect sensitive applications across diverse environments while ensuring compliance with industry standards. The surge in connected devices and mobile applications widens the market scope. Providers offering customized solutions for emerging technologies gain a competitive advantage globally.

Adoption of AI-Driven and Automated Testing Solutions

The security testing market also benefits from the growing adoption of AI-driven and automated testing tools. Enterprises are investing in intelligent platforms that improve detection accuracy, streamline processes, and reduce reliance on manual testing. It strengthens proactive defense strategies by offering predictive insights and real-time monitoring. Companies adopting DevSecOps practices prefer advanced automated tools integrated within agile development pipelines. This trend provides opportunities for vendors delivering innovative, cost-effective, and adaptable testing solutions.

Market Segmentation Analysis:

By Type

In the security testing market, application security dominates with a share of 38%, driven by the rising demand to safeguard business-critical applications from vulnerabilities and breaches. Network security follows with 32%, supported by growing investments in securing enterprise infrastructure. Device security accounts for 20%, fueled by the adoption of IoT and connected devices. The remaining 10% is held by other testing types, focusing on specialized and niche security needs across industries.

- For instance, Palo Alto Networks has incorporated IoT device profiling and risk-based security testing into its Cortex XSIAM platform to address vulnerabilities in connected devices.

By Enterprise Size

Large enterprises lead the security testing market with a 65% share, supported by higher budgets, complex IT infrastructure, and strict compliance requirements. It drives demand for advanced and comprehensive testing solutions. SMEs hold 35%, increasingly adopting affordable, cloud-based security testing platforms. Growth in this segment is driven by rising awareness of cyber risks and regulatory pressures, pushing smaller firms to strengthen cybersecurity strategies despite limited resources.

- For instance, JPMorgan Chase invests over $600 million annually in cybersecurity, including regular penetration testing and red-team exercises to safeguard its global banking systems.

By Deployment Model

Cloud deployment holds the largest share at 58% in the security testing market, fueled by the scalability, cost efficiency, and ease of integration it offers. Enterprises prefer cloud-based testing solutions to secure multi-cloud and hybrid environments. On-premises deployment accounts for 42%, supported by industries such as banking and healthcare requiring stricter data control. It remains relevant where organizations prioritize internal infrastructure security and compliance with data residency regulations.

Segments:

Based on Type

- Network Security

- Application Security

- Device Security

- Others

Based on Enterprise Size

Based on Deployment Model

Based on Industry Vertical

- BFSI

- Healthcare

- Education

- IT & Telecom

- Retail & E-commerce

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the security testing market with a 37% share, driven by advanced cybersecurity infrastructure and strong regulatory frameworks. The presence of leading technology providers and early adoption of AI-driven testing solutions further strengthen growth. It is supported by high investments from enterprises in financial services, healthcare, and government sectors. Rising data breach incidents and cloud adoption push companies to prioritize testing solutions. The region continues to be the global hub for innovation in cybersecurity technologies.

Europe

Europe holds a 28% share of the security testing market, supported by strict compliance laws such as GDPR and strong industry adoption. Enterprises focus on application and network security to align with evolving data protection requirements. It benefits from rising digitalization across banking, manufacturing, and automotive industries. Demand is also supported by growing cloud adoption among enterprises across Western and Central Europe. Regional governments actively fund cybersecurity programs, enhancing the adoption of advanced testing solutions.

Asia-Pacific

Asia-Pacific accounts for a 24% share of the security testing market, driven by rapid digital transformation and rising internet penetration. Countries such as China, India, and Japan are investing heavily in cloud adoption and cybersecurity frameworks. It is further supported by the booming e-commerce and banking industries, which demand advanced application security solutions. SMEs in the region are adopting cost-effective cloud-based testing platforms. Growing mobile usage and IoT expansion create significant opportunities for testing providers.

Latin America

Latin America represents a 6% share of the security testing market, supported by rising cybersecurity awareness among enterprises. Governments are tightening regulations to combat growing cyber threats, driving adoption of testing services. It is mainly supported by industries such as banking, energy, and telecommunications, which face increasing risks. Cloud adoption is growing in Brazil and Mexico, creating demand for scalable testing solutions. Regional vendors are expanding partnerships to strengthen cybersecurity capabilities.

Middle East & Africa

The Middle East & Africa holds a 5% share of the security testing market, with growth driven by increasing government investments in digital infrastructure and cybersecurity initiatives. Countries in the Gulf Cooperation Council are adopting advanced solutions to protect financial and energy sectors. It is further supported by rising digital banking and smart city projects. Enterprises in South Africa are investing in application and network testing. Limited skilled resources remain a challenge but adoption continues to rise.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synopsys

- Veracode

- SecureWorks

- Rapid7

- OpenText

- Intertek Group PLC

- Cisco

- Checkmarx Ltd.

- Qualys, Inc.

Competitive Analysis

The security testing market is highly competitive, with global and regional players focusing on innovation, scalability, and compliance-driven solutions. It is shaped by strong demand for application, network, and cloud security testing across industries. Key players such as Cisco, Synopsys, Veracode, SecureWorks, Rapid7, Checkmarx Ltd., OpenText, Qualys, Inc., and Intertek Group PLC compete by expanding service portfolios and integrating AI-driven automation into testing platforms. Vendors focus on partnerships, acquisitions, and continuous technology upgrades to address evolving cyber threats. Growing emphasis on DevSecOps integration and real-time vulnerability management strengthens competitive differentiation. Companies prioritize SaaS-based offerings to attract SMEs while catering to large enterprises with comprehensive, compliance-focused solutions. Strategic regional expansions in Asia-Pacific, Europe, and North America reinforce global positioning. Intensified competition drives vendors to deliver value-added services, faster deployment, and advanced analytics to gain market share. The security testing market continues to evolve with increasing reliance on digital transformation, pushing providers to maintain agility and deliver advanced, customer-centric security testing capabilities that support enterprise resilience against emerging threats.

Recent Developments

- In July 2025, Palo Alto Networks announced the $25 billion acquisition of CyberArk, enhancing its identity and privileged access management capabilities to strengthen its Strata and Cortex security platforms.

- In March 2025, Alphabet confirmed the $32 billion acquisition of Wiz, an Israeli cloud security startup, to expand Google’s cloud and AI-driven security services, while keeping Wiz independent across cloud platforms.

- In February 2025, Sonar (SonarSource) acquired AutoCodeRover, integrating agentic AI technology to improve its static code analysis and software development tools.

- In May 2025, Elastic acquired Keep, an Israeli open-source AIOps platform that helps manage alerts and incident response using AI.

Market Concentration & Characteristics

The security testing market demonstrates moderate to high concentration, with global leaders and specialized regional providers competing to capture enterprise demand. It is characterized by strong reliance on innovation, compliance alignment, and continuous technology integration to meet evolving cyber threats. Leading vendors such as Cisco, Synopsys, Veracode, SecureWorks, Rapid7, Checkmarx Ltd., OpenText, Qualys, Inc., and Intertek Group PLC focus on expanding portfolios with AI-driven automation, penetration testing, and cloud-native solutions. The market reflects high entry barriers due to technical expertise requirements, regulatory compliance, and investment in scalable platforms. Enterprises prioritize vendors with proven expertise, advanced analytics, and integration capabilities across diverse IT infrastructures. It supports both SMEs seeking cost-efficient solutions and large enterprises demanding comprehensive frameworks. Growing demand for SaaS-based platforms, DevSecOps integration, and multi-cloud compatibility strengthens competition, while continuous digital transformation across industries ensures sustained opportunities for established leaders and emerging players in global markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Enterprise Size, Deployment Model, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven security testing solutions will grow to improve accuracy and reduce vulnerabilities.

- Cloud-based testing platforms will expand as enterprises secure hybrid and multi-cloud digital environments.

- DevSecOps adoption will rise, embedding security testing throughout agile software development life cycles.

- IoT expansion will drive higher demand for device security testing across connected networks and applications.

- Mobile application security testing will strengthen as businesses protect user data and digital transactions.

- SMEs will increasingly adopt cost-efficient SaaS-based testing solutions to meet compliance and regulatory requirements.

- Large enterprises will continue investing in advanced penetration testing and vulnerability management solutions globally.

- Regional governments will enforce stricter cybersecurity laws, encouraging enterprises to adopt regular security testing.

- Automated testing tools will dominate, reducing reliance on manual methods and improving overall efficiency.

- Global players will expand partnerships and acquisitions to strengthen market presence and enhance service offerings.