Market Overview

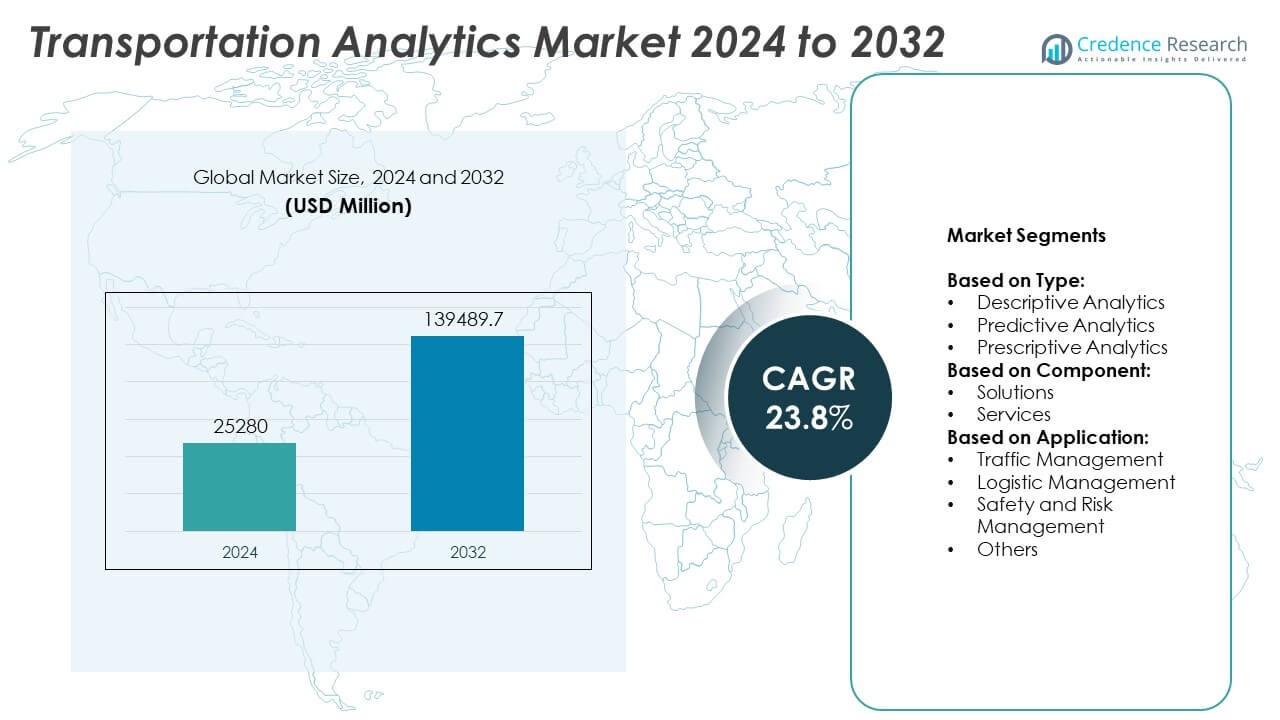

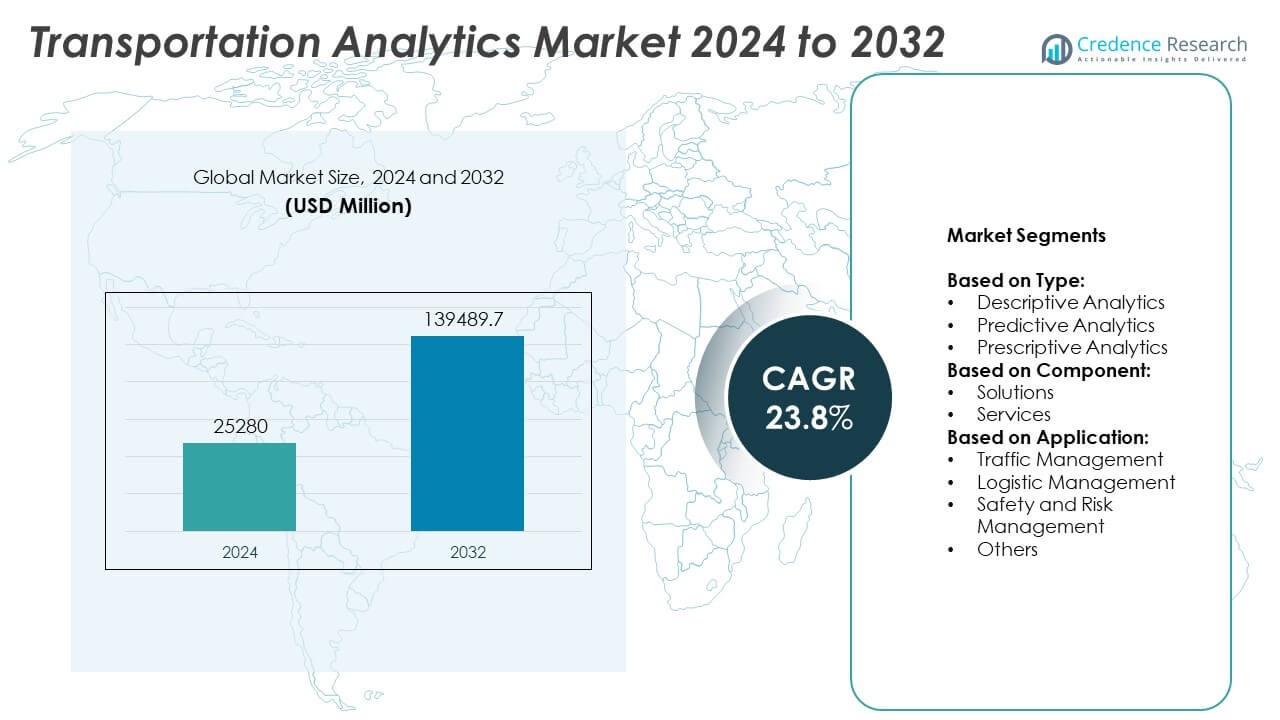

The Transportation Analytics Market size was valued at USD 25,280 million in 2024 and is anticipated to reach USD 139,489.7 million by 2032, growing at a CAGR of 23.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transportation Analytics Market Size 2024 |

USD 25,280 Million |

| Transportation Analytics Market, CAGR |

23.8% |

| Transportation Analytics Market Size 2032 |

USD 139,489.7 Million |

The Transportation Analytics market grows on the strength of rising urban congestion, smart city development, and the need for efficient logistics planning. Governments and enterprises adopt analytics platforms to enhance traffic flow, reduce emissions, and improve safety. Advancements in AI, machine learning, and IoT enable real-time data processing and predictive insights across transport systems. Cloud-based deployment and connected mobility ecosystems drive scalable adoption.

The Transportation Analytics market demonstrates strong adoption across North America, Europe, and Asia-Pacific, driven by digital infrastructure investments, regulatory support, and urban mobility demands. North America leads in early deployment of smart traffic and logistics platforms, while Europe emphasizes sustainable transportation and multimodal integration. Asia-Pacific shows rapid growth due to expanding urban populations and government-backed smart city initiatives. Key players driving innovation in this space include Siemens Mobility, SAP SE, and TomTom NV. These companies offer advanced analytics solutions that support real-time decision-making, route optimization, and predictive maintenance across diverse transportation networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Transportation Analytics market was valued at USD 25,280 million in 2024 and is projected to reach USD 139,489.7 million by 2032, growing at a CAGR of 23.8%.

- Rising traffic congestion, urbanization, and demand for real-time decision-making are driving the adoption of analytics platforms in transportation systems.

- Integration of AI, machine learning, IoT, and cloud-based solutions is reshaping how transport agencies manage traffic, logistics, and safety operations.

- Major players such as Siemens Mobility, SAP SE, TomTom NV, and IBM Corporation invest in platform innovation, predictive tools, and multimodal data solutions.

- Data privacy concerns, high implementation costs, and a shortage of analytics professionals remain key restraints limiting wider market penetration.

- North America leads in technology deployment and infrastructure readiness, followed by Europe with a focus on sustainability and multimodal mobility, and Asia-Pacific with fast-paced digital transport initiatives.

- The market shows growing potential across logistics optimization, connected vehicle systems, and smart city traffic management, supported by public-private collaborations.

Market Drivers

Rising Need for Traffic Management and Congestion Reduction

Urban population growth and rapid motorization place intense pressure on existing transportation infrastructure. Governments and municipalities seek analytics tools to improve traffic flow, reduce congestion, and prevent road bottlenecks. The Transportation Analytics market supports these goals by enabling real-time traffic monitoring and predictive modeling. It empowers city planners to implement dynamic traffic light systems and optimize road usage. Authorities rely on data-driven insights to make informed decisions on lane usage, toll operations, and infrastructure investments. The market grows with increased deployment of smart city initiatives across metropolitan regions.

- For instance, TomTom processes probe traces from over 600 million connected devices worldwide every day, enabling real-time traffic data for navigation and congestion analysis.

Growth in Smart Mobility and Connected Vehicle Ecosystems

Automotive OEMs and technology firms develop connected vehicle solutions that generate large volumes of transport-related data. These systems require analytics platforms to interpret driving behavior, vehicle conditions, and route efficiency. The Transportation Analytics market benefits from this trend by offering advanced tools for route optimization, driver safety scoring, and vehicle diagnostics. It also facilitates seamless integration with intelligent transport systems and vehicle-to-everything (V2X) networks. Companies invest in analytics to improve fleet performance and passenger experience. The growing adoption of mobility-as-a-service (MaaS) further expands demand for integrated transport data solutions.

- For instance, Trimble Inc. supports over 130,000 fleets globally through its TMW. Suite and MAPS platforms, providing over 11 million monthly route optimization computations for freight and logistics operations.

Increasing Demand for Logistics Optimization and Supply Chain Efficiency

Global e-commerce expansion and supply chain complexity fuel the need for logistics analytics. Businesses adopt transportation analytics to reduce delivery times, cut operational costs, and improve order accuracy. The Transportation Analytics market addresses these needs by supporting route planning, real-time shipment tracking, and inventory forecasting. It enables logistics providers to detect disruptions and adjust strategies with minimal downtime. The market expands as companies seek predictive tools to optimize last-mile delivery and warehouse integration. Data-driven logistics operations strengthen resilience against fluctuating demand and environmental factors.

Government Policies Supporting Sustainable and Data-Driven Mobility

Regulatory mandates encourage cleaner, safer, and more efficient transportation systems. Public agencies adopt transportation analytics to evaluate emission levels, monitor compliance, and support green mobility planning. The Transportation Analytics market grows with public funding allocated to smart transport infrastructure and carbon reduction initiatives. It also helps authorities improve public transport scheduling and service reliability. Governments collaborate with private firms to implement intelligent transit networks powered by analytics. These efforts align with broader goals of sustainability, energy efficiency, and urban mobility innovation.

Market Trends

Expansion of AI and Machine Learning for Predictive Transport Insights

Artificial intelligence and machine learning drive a shift toward predictive analytics in transportation systems. These technologies analyze historical and real-time data to forecast traffic patterns, delays, and system inefficiencies. The Transportation Analytics market incorporates AI to enable scenario simulations and dynamic decision-making. It supports transit authorities in deploying proactive responses to congestion, accidents, and demand surges. AI-powered platforms help optimize routing for logistics providers and improve energy efficiency in public transport fleets. Companies invest in self-learning algorithms to enhance service reliability and operational precision.

- For instance, Cubic Corporation’s NextBus system enables over 25 transit agencies across North America to manage 6,000+ buses with real-time arrival predictions based on live GPS data and historic route analytics.

Proliferation of IoT Devices and Sensor-Based Infrastructure

Internet of Things (IoT) technologies reshape the data collection landscape in transport systems. Roadways, vehicles, and transit hubs integrate sensors that generate continuous data streams. The Transportation Analytics market evolves with this influx, offering platforms that translate sensor data into actionable insights. It enables better visibility into asset utilization, vehicle diagnostics, and infrastructure conditions. Governments and logistics firms use IoT-integrated analytics to improve maintenance scheduling and reduce service disruptions. This trend accelerates the shift toward real-time, data-centric transport operations.

- For instance, Inrix Inc. collects data from over 500 million connected vehicles, road sensors, and mobile devices globally.

Growing Use of Cloud-Based Analytics Platforms

Organizations seek scalable and accessible solutions for managing transport data. Cloud platforms offer flexibility, reduced infrastructure costs, and faster deployment for analytics applications. The Transportation Analytics market embraces cloud models to support cross-location data access and seamless integration with enterprise systems. It facilitates collaboration between government agencies, urban planners, and private operators. Vendors focus on offering modular and API-enabled platforms to accommodate varied analytics needs. This shift improves system agility and promotes continuous innovation in transport management.

Integration of Multimodal Transportation Data for Unified Planning

The complexity of modern urban mobility requires integrated data from multiple transport modes. Authorities and service providers rely on analytics to coordinate traffic, rail, air, and maritime systems. The Transportation Analytics market addresses this need by supporting multimodal data aggregation and unified dashboards. It assists in planning seamless transitions across modes and reducing operational silos. Planners use such systems to improve scheduling, capacity planning, and commuter satisfaction. This trend strengthens the foundation for smart, connected, and inclusive mobility ecosystems.

Market Challenges Analysis

Data Privacy, Security, and Integration Complexities Limit Market Penetration

The growing dependence on real-time data raises serious concerns around privacy, cybersecurity, and data governance. Transport analytics platforms handle sensitive information related to vehicle movement, commuter behavior, and infrastructure usage. Failure to secure this data exposes operators and governments to regulatory penalties and public distrust. The Transportation Analytics market faces obstacles in unifying data from fragmented sources, legacy systems, and disconnected platforms. It must also navigate varying data protection laws across regions, complicating multinational deployments. These challenges hinder full-scale implementation and delay decision-making in data-sensitive environments.

High Implementation Costs and Technical Skill Gaps Affect Adoption

Deployment of transportation analytics systems requires advanced hardware, high-speed connectivity, and continuous technical support. Public sector entities and small logistics operators often struggle to allocate budgets for such large-scale digital infrastructure. The Transportation Analytics market must also contend with a shortage of skilled professionals capable of interpreting complex datasets and configuring predictive models. It faces resistance from traditional operators unfamiliar with data-centric approaches. High upfront investment and long return cycles reduce the appeal of analytics tools for cost-conscious stakeholders. These barriers restrict growth in low- and middle-income regions and slow the pace of digital transformation. Top of Form Bottom of Form

Market Opportunities

Rising Demand for Sustainable Urban Mobility Solutions Creates Expansion Potential

Global efforts to decarbonize transport systems create opportunities for data-driven mobility planning. Cities prioritize emissions reduction, energy efficiency, and modal shift to public and non-motorized transport. The Transportation Analytics market plays a central role by offering tools that measure environmental impact, optimize transit schedules, and support low-emission zones. It enables policymakers to monitor sustainability metrics and implement evidence-based strategies. Analytics platforms also help design efficient charging infrastructure for electric vehicles. These capabilities align with national climate goals and drive new investments in analytics integration.

Emergence of Autonomous and Connected Mobility Platforms Boosts Market Scope

Advances in autonomous driving and connected vehicle systems generate a growing need for high-frequency data interpretation. OEMs and mobility service providers depend on analytics to evaluate system performance, ensure safety, and personalize transport services. The Transportation Analytics market benefits from this evolution by enabling real-time vehicle-to-everything communication and predictive diagnostics. It supports deployment of intelligent routing, adaptive traffic control, and incident prevention mechanisms. Demand rises for platforms that integrate telematics, edge analytics, and AI-based decision systems. These developments open long-term growth avenues in next-generation mobility ecosystems.

Market Segmentation Analysis:

By Type:

Descriptive analytics holds strong demand due to its ability to summarize historical transportation data and provide insights into patterns and inefficiencies. It supports public agencies and private operators in identifying congestion trends, peak-hour volumes, and route utilization. Predictive analytics sees rapid adoption as organizations seek to forecast traffic incidents, demand fluctuations, and maintenance needs. It enables proactive decision-making using AI and machine learning algorithms. Prescriptive analytics gains traction for its role in suggesting actionable solutions based on real-time and predictive inputs. The Transportation Analytics market adopts all three types to meet different operational and strategic planning needs across various stakeholders.

- For instance, SAS Institute Inc. deployed its analytics platform for the North Carolina Department of Transportation, analyzing over 2 billion data points monthly to predict traffic disruptions and optimize response strategies.

By Component:

The solutions segment dominates in deployment volume, driven by high demand for integrated software platforms that analyze, visualize, and automate transport-related data. It includes tools for route optimization, fleet monitoring, and multimodal traffic coordination. Enterprises and governments prioritize scalable analytics solutions to support dynamic operations and data-driven infrastructure planning. The services segment grows steadily, providing consulting, integration, and maintenance support for analytics systems. It plays a critical role in ensuring successful deployment and user training, especially for complex transportation environments. The Transportation Analytics market leverages both components to deliver value across the lifecycle of transport analytics initiatives.

- For instance, LA’s Automated Traffic Surveillance and Control (ATSAC) System reduced travel time by 10 % using 40,000 loop detectors across 4,500.

By Application:

Traffic management emerges as a primary application area due to rising urban congestion and the need for efficient flow control. Authorities deploy analytics to adjust signal timings, detect incidents, and monitor road usage in real time. Logistic management follows, as supply chains increasingly rely on route optimization, vehicle tracking, and delivery performance analysis. Safety and risk management applications address accident prevention, compliance monitoring, and infrastructure vulnerability assessments. The “Others” category includes parking analytics, toll collection optimization, and transit planning. The Transportation Analytics market uses these applications to support smarter, safer, and more efficient mobility systems.

Segments:

Based on Type:

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

Based on Component:

Based on Application:

- Traffic Management

- Logistic Management

- Safety and Risk Management

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Transportation Analytics market, accounting for 38.2% of the global revenue in 2024. The region benefits from early adoption of intelligent transportation systems, strong government support, and extensive infrastructure investments. The United States leads in deploying predictive analytics for traffic monitoring, logistics planning, and autonomous mobility development. Smart city initiatives across cities like New York, Los Angeles, and Toronto integrate analytics tools to improve commuter experience and environmental performance. Public agencies collaborate with private firms to utilize cloud-based and AI-driven platforms for traffic congestion reduction and real-time incident detection. The presence of key players and technology providers further strengthens North America’s leadership in this market.

Europe

Europe contributes 27.4% of the global Transportation Analytics market, driven by strict regulatory frameworks, sustainability goals, and the growing demand for multimodal mobility solutions. The region emphasizes reducing carbon emissions, improving public transport reliability, and optimizing urban logistics. Countries such as Germany, the United Kingdom, and France lead in integrating analytics into rail, road, and air traffic management systems. EU-funded programs support the adoption of smart mobility platforms that incorporate descriptive and prescriptive analytics. European cities deploy predictive tools to manage traffic congestion, enable electric vehicle integration, and enhance safety outcomes. Cross-border logistics optimization across the EU also promotes consistent investment in transport analytics infrastructure.

Asia-Pacific

Asia-Pacific holds a market share of 22.9%, supported by rapid urbanization, rising vehicle populations, and expanding e-commerce logistics. China, Japan, South Korea, and India invest heavily in smart city projects and digital traffic control systems. The Transportation Analytics market in Asia-Pacific gains momentum through government-backed digitalization programs and private sector innovations. Japan focuses on integrating analytics into autonomous public transit, while China scales predictive tools for urban logistics and safety management. Southeast Asian economies adopt cost-effective cloud-based platforms for real-time traffic surveillance and fleet optimization. The region’s growing urban density creates long-term demand for scalable and adaptable analytics solutions.

Latin America

Latin America represents 6.5% of the Transportation Analytics market, with growth driven by improvements in public transportation systems and logistics management. Brazil and Mexico lead in adopting traffic analytics tools to address chronic congestion and improve road safety. Governments explore partnerships with international firms to enhance data infrastructure and support real-time monitoring. The region shows rising demand for fleet analytics in logistics and last-mile delivery services. Despite challenges such as limited digital infrastructure and budget constraints, public agencies pursue analytics-driven solutions to improve mobility and reduce emissions in dense urban centers.

Middle East & Africa

The Middle East & Africa account for 5.0% of the global market, with steady adoption of analytics in urban mobility and infrastructure development. The UAE and Saudi Arabia invest in smart transport systems as part of national transformation plans. Projects such as Riyadh Metro and Dubai Smart City integrate transportation analytics to optimize system performance and passenger flow. African cities begin deploying basic analytics for public bus networks and informal transit regulation. While market maturity is still developing, infrastructure modernization efforts and international funding support gradual expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PTV Group

- TomTom NV

- Inrix Inc.

- SAP SE

- Siemens Mobility

- Conduent Incorporated

- Trimble Inc.

- SAS Institute Inc.

- IBM Corporation

- Cubic Corporation (Veritas Capital Fund Management, L.L.C.)

Competitive Analysis

The Transportation Analytics market features prominent players such as PTV Group, TomTom NV, Inrix Inc., SAP SE, Siemens Mobility, Conduent Incorporated, Trimble Inc., SAS Institute Inc., IBM Corporation, and Cubic Corporation (Veritas Capital Fund Management, L.L.C.). These companies focus on advanced data analytics, real-time traffic intelligence, and predictive modeling to serve urban planning, logistics optimization, and smart mobility applications. They compete by offering scalable platforms that integrate AI, machine learning, and IoT capabilities to enhance transport efficiency. Leading firms emphasize end-to-end visibility, cloud deployment, and multimodal data integration to meet the evolving needs of governments and logistics operators. Strategic collaborations with municipalities and transportation agencies strengthen their global footprint and allow access to large-scale infrastructure projects. Innovation in edge analytics, API integration, and adaptive traffic control solutions supports their product differentiation. Players also invest in R&D to expand capabilities in sustainability metrics, autonomous vehicle analytics, and connected transport systems. The competitive landscape reflects strong emphasis on performance reliability, security compliance, and real-time insight delivery. Market leaders sustain growth through mergers, partnerships, and vertical-specific solution portfolios across freight, passenger, and public transport networks.

Recent Developments

- In 2025, Siemens Mobility showcased its “Smart Asset Suite powered by Railigent X,” alongside the Vectron AC with battery power module, at the Transport Logistic 2025 trade fair in Munich

- In June 2025, TomTom initiated a reorganization by cutting around 300 jobs (approximately 8–10% of its workforce) to realign with a product-led strategy and incorporate artificial intelligence

- In September 2023, 3SC Solutions launched intelligent transport management solution. iTMS is an integrated transportation management solution that uses artificial intelligence and data analytics.

Market Concentration & Characteristics

The Transportation Analytics market shows moderate concentration, with a mix of established technology providers and specialized mobility solution firms competing across global regions. It features a blend of software developers, infrastructure integrators, and data intelligence companies that serve public agencies, logistics operators, and urban planners. Leading players differentiate themselves through proprietary platforms, AI-enabled analytics, and multimodal data integration. The market favors firms with strong capabilities in real-time traffic monitoring, predictive modeling, and cloud-based deployment. It responds to demand for customized solutions that address region-specific challenges in congestion, emissions, and logistics efficiency. Entry barriers include high initial investment, complex regulatory compliance, and the need for advanced technical expertise. The Transportation Analytics market supports long-term contracts and platform licensing models, encouraging continuous upgrades and system expansion. It aligns with smart city programs, sustainability mandates, and mobility-as-a-service frameworks, reinforcing demand for scalable, data-driven transport infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of AI and machine learning to enhance predictive traffic and logistics analytics.

- Governments will continue integrating analytics platforms into smart city infrastructure and public transit systems.

- Demand for cloud-based transportation analytics solutions will rise due to their scalability and remote accessibility.

- Real-time analytics will become essential for managing urban congestion and improving emergency response.

- Connected and autonomous vehicles will drive the need for high-frequency data processing and analytics integration.

- Logistics and e-commerce companies will rely more on transportation analytics to optimize last-mile delivery and supply chain efficiency.

- Electric vehicle infrastructure planning will use analytics tools to manage charging station deployment and usage patterns.

- The market will expand across emerging economies as digital transport initiatives receive public and private investment.

- Partnerships between analytics providers and urban planning agencies will grow to support sustainable mobility policies.

- Data privacy, cybersecurity, and compliance management will remain critical as analytics platforms scale globally.