Market Overview

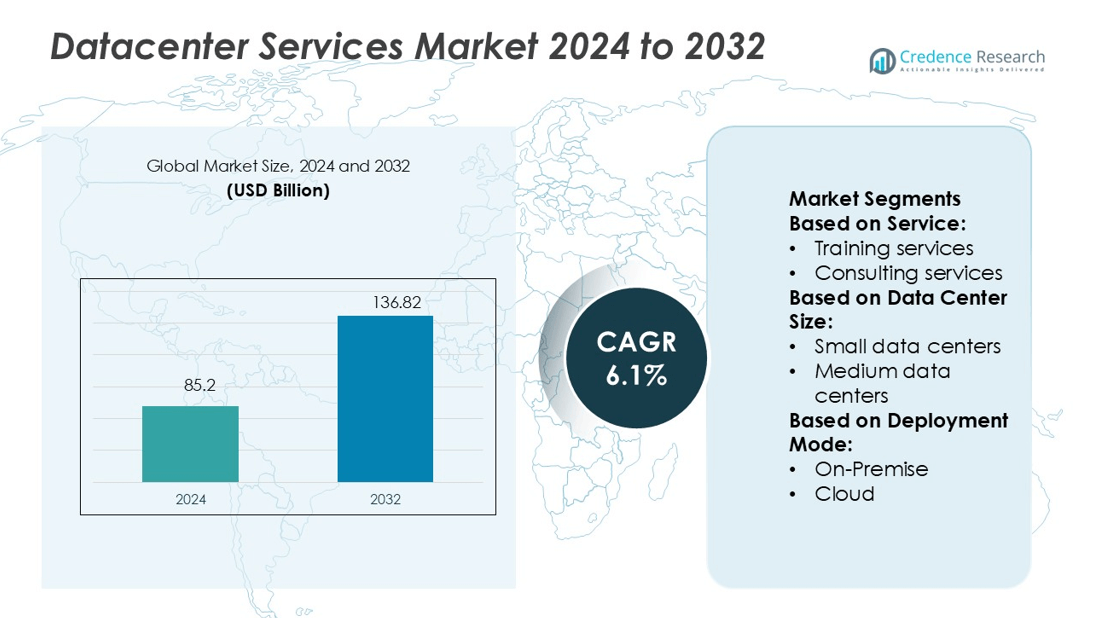

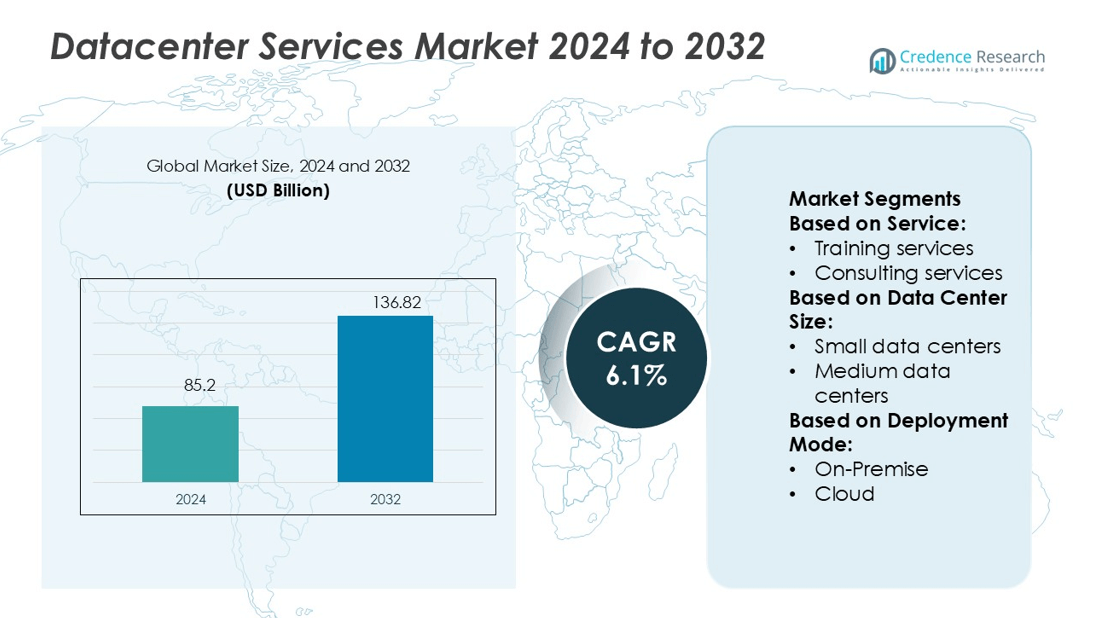

Data Center Services Market size was valued USD 85.2 billion in 2024 and is anticipated to reach USD 136.82 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Services Market Size 2024 |

USD 85.2 billion |

| Data Center Services Market , CAGR |

6.1% |

| Data Center Services Market Size 2032 |

USD 136.82 billion |

The datacenter services market is shaped by leading companies such as Siemens, Equinix, Eaton, IBM, Cisco Systems, Schneider Electric, Dell Inc, ABB, Digital Realty, and NTT Data. These players drive market expansion through advanced infrastructure solutions, energy-efficient technologies, and strategic partnerships. Their focus on automation, hybrid cloud integration, and sustainable operations strengthens their competitive edge. North America leads the global market with a 37.4% share, supported by strong cloud adoption, high data center density, and significant investments from hyperscale operators. The region’s advanced digital ecosystem and regulatory readiness make it a hub for global service expansion.

Market Insights

- The datacenter services market was valued at USD 85.2 billion in 2024 and is projected to reach USD 136.82 billion by 2032, growing at a CAGR of 6.1%.

- Rising demand for cloud migration, automation, and AI integration is driving strong service adoption across multiple industries.

- Sustainability, edge computing, and hybrid cloud strategies are key market trends shaping long-term growth opportunities.

- North America leads with a 37.4% market share, supported by strong cloud adoption, while large data centers account for 47.9% of the segment share.

- Intense competition among major players and high infrastructure costs remain key restraints, while strategic partnerships and digital transformation initiatives continue to strengthen market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Installation & integration services dominate the datacenter services market with a 41.7% share in 2024. This segment leads due to the rising adoption of advanced infrastructure, modular racks, and high-density computing systems. Enterprises prioritize expert deployment to minimize downtime and optimize energy use. Demand grows across hyperscale and edge facilities, where precision installation supports faster go-live cycles. Integration of automation and software-defined infrastructure also drives this segment. Maintenance and support services hold the second-largest share, supported by long-term contracts for performance and uptime assurance.

- For instance, Equinix and its joint venture partner GIC developed the SL2x and SL3x xScale data centers in Seoul, which together will have over 45 MW of power capacity.

By Data Center Size

Large data centers account for the largest market share at 47.9% in 2024. Hyperscale operators and colocation providers drive this segment through aggressive capacity expansions. These facilities require complex integration, structured cabling, and scalable power systems to support growing workloads. Enterprises adopt large data centers to handle AI, edge computing, and hybrid cloud strategies. Investments in advanced cooling and redundant power systems also boost this segment. Medium data centers show steady growth, supported by demand from regional service providers and enterprises pursuing cost efficiency.

- For instance, Eaton is helping lead the shift to 800 V high-voltage direct current (HVDC) infrastructure to support 1 megawatt racks in AI data centers, collaborating with NVIDIA on reference architectures.

By Deployment Mode

Cloud deployment mode dominates with a 53.4% market share in 2024. Businesses prefer cloud deployment for scalability, lower capital expenditure, and fast provisioning. The rise of hybrid IT strategies also boosts demand for cloud-first models. Hyperscalers like AWS, Microsoft Azure, and Google Cloud are expanding global footprints, driving growth. Industries such as BFSI, healthcare, and manufacturing accelerate migration to support AI and big data workloads. Hybrid deployment mode is the second fastest-growing segment, supported by firms balancing on-premise control with cloud flexibility.

Key Growth Drivers

Rising Data Traffic and Cloud Adoption

The rapid growth in global data traffic and cloud computing adoption is driving datacenter service demand. Enterprises are expanding IT infrastructure to support AI, IoT, and 5G applications. Cloud migration strategies boost the need for managed hosting, integration, and maintenance services. Hyperscale operators are investing heavily in capacity expansion to meet enterprise requirements. Colocation facilities also benefit from businesses seeking flexible and cost-efficient solutions. This increasing reliance on digital platforms fuels steady growth for datacenter service providers worldwide.

- For instance, IBM introduced its Power11 server lineup, engineered to maintain just 30 seconds of unplanned downtime per year, and equipped with AI-driven security that detects ransomware in under 60 seconds.

Expansion of Hyperscale and Edge Infrastructure

Rising investment in hyperscale and edge infrastructure is a major growth catalyst. Hyperscale operators are constructing large, energy-efficient facilities to support AI workloads and advanced analytics. Edge data centers enable low-latency processing for autonomous systems, smart cities, and industrial automation. This distributed architecture enhances speed and resilience, driving service demand. Service providers are expanding integration and maintenance offerings to align with these advanced deployments. The growing number of hybrid and multi-cloud environments further supports this expansion.

- For instance, Cisco’s new P200 AI networking chip consolidates 92 traditional chips into one, reducing power consumption in data center routers by 65 %. Cisco 8223 router system supports 51.2 Tbps throughput over a single ASIC platform to carry AI traffic across distributed facilities.

Regulatory Compliance and Security Demands

Strict regulatory frameworks and rising cybersecurity risks increase the need for secure, compliant datacenter services. Enterprises must follow GDPR, HIPAA, and regional data protection laws. This drives demand for advanced monitoring, encryption, and disaster recovery solutions. Service providers are enhancing managed security and compliance support to attract regulated industries such as healthcare, BFSI, and government. Security certifications and automation capabilities strengthen their competitive position. The emphasis on regulatory readiness fuels steady market expansion.

Key Trends & Opportunities

Shift Toward Sustainable and Green Data Centers

Sustainability initiatives are reshaping the datacenter services market. Operators are investing in renewable energy, advanced cooling systems, and energy-efficient hardware. Enterprises seek service providers that support carbon reduction goals and green certifications. Technologies like liquid cooling and AI-driven energy management reduce power usage and improve operational efficiency. This trend creates opportunities for specialized service providers to deliver eco-friendly installation, monitoring, and optimization solutions. Green data centers are becoming a key differentiator in competitive bids.

- For instance, Schneider’s liquid cooling portfolio includes direct-to-chip and immersion options, supporting rack densities up to 100 kW per rack, with coolant distribution units (CDUs) and manifold systems tuned for high heat loads.

Integration of AI and Automation in Operations

AI and automation adoption is transforming datacenter operations. Predictive analytics, autonomous infrastructure management, and intelligent workload distribution improve performance and reduce downtime. Service providers are embedding AI tools to enhance real-time monitoring, fault detection, and energy management. These technologies support faster deployment, reduced maintenance costs, and improved service quality. The integration of AI creates opportunities for providers to offer advanced, value-added services that align with enterprise digital transformation goals.

- For instance, Dell’s Integrated Rack 7000 (IR7000) supports liquid cooling density up to 480 kW per rack, capturing nearly 100 % of generated heat via its internal airflow system.

Rising Demand for Edge Computing Services

The growing use of IoT and real-time applications is increasing demand for edge computing. Enterprises are deploying localized data centers to reduce latency and improve user experiences. This shift supports new service opportunities in installation, configuration, and security management for edge infrastructure. Service providers are expanding portfolios to include modular and scalable edge solutions. Edge deployments also create synergies with cloud and hybrid environments, enabling flexible data strategies for industries like manufacturing, telecom, and logistics.

Key Challenges

High Capital and Operational Expenditure

Datacenter services require significant investment in infrastructure, skilled labor, and energy resources. High capital costs for building and maintaining large-scale facilities create entry barriers for new players. Operational expenses related to power, cooling, and network management also remain high. These factors can limit profitability and slow expansion for small and mid-sized service providers. Companies must optimize resource use and adopt energy-efficient solutions to remain competitive while maintaining service quality and uptime.

Complex Regulatory and Data Sovereignty Issues

Evolving data protection regulations and sovereignty laws create operational complexity for service providers. Different countries enforce strict rules on data storage, transfer, and security. Service providers must continuously adapt infrastructure and policies to ensure compliance. Non-compliance risks penalties, reputational damage, and customer loss. This regulatory diversity increases operational costs and slows service deployment in new markets. Providers with strong compliance capabilities and flexible infrastructure strategies are better positioned to manage this challenge.

Regional Analysis

North America

North America holds the largest share of the datacenter services market at 37.4% in 2024. Strong cloud adoption, hyperscale expansion, and advanced IT infrastructure drive regional growth. The U.S. leads with major investments from AWS, Microsoft, and Google. Enterprises in BFSI, healthcare, and retail are rapidly modernizing infrastructure to support AI and 5G applications. High data center density and strong connectivity also support the demand for integration and maintenance services. Regulatory focus on data security and green energy initiatives further boosts the service market. Canada shows steady growth through investments in sustainable data center development.

Europe

Europe accounts for 28.6% of the global datacenter services market in 2024. Countries such as Germany, the Netherlands, and the UK drive growth through investments in hyperscale and colocation facilities. The region’s strict data protection laws, including GDPR, create strong demand for compliance-focused services. Renewable energy integration and sustainable design are key priorities, supporting service opportunities in energy optimization. Enterprises adopt hybrid and cloud-first strategies, increasing demand for managed and consulting services. Edge deployments are growing in response to digital transformation programs across industries, further strengthening the service ecosystem.

Asia Pacific

Asia Pacific captures 24.1% of the datacenter services market in 2024 and is the fastest-growing region. China, India, Japan, and Singapore are leading investment hubs due to rapid digitization and cloud expansion. Strong growth in e-commerce, manufacturing, and telecom sectors boosts demand for scalable and secure infrastructure. Hyperscalers are expanding capacity to meet rising AI and IoT workloads. Governments are supporting domestic data center development through tax incentives and regulatory reforms. This growth fuels strong demand for installation, integration, and maintenance services. High population density and increasing mobile connectivity amplify regional service adoption.

Latin America

Latin America represents 5.2% of the global datacenter services market in 2024. Brazil and Mexico lead regional expansion, supported by growing cloud adoption and enterprise digitalization. Increasing demand for low-latency networks drives new edge and colocation deployments. Service providers are focusing on infrastructure modernization and energy-efficient solutions to meet evolving enterprise needs. Regulatory developments in data protection are strengthening trust in local hosting services. International hyperscalers are expanding their regional footprints, creating opportunities for local service providers. Economic reforms and improved connectivity are further accelerating market growth across key industries.

Middle East & Africa

The Middle East & Africa holds a 4.7% share of the datacenter services market in 2024. The UAE, Saudi Arabia, and South Africa drive regional demand through smart city projects and cloud adoption initiatives. Government programs supporting digital transformation are accelerating infrastructure investments. The region is witnessing strong growth in colocation and managed service demand from BFSI, telecom, and public sector organizations. International players are partnering with local firms to establish large-scale facilities. Limited skilled workforce and infrastructure gaps remain challenges, but ongoing investments in energy and connectivity are improving service delivery capabilities.

Market Segmentations:

By Service:

- Training services

- Consulting services

By Data Center Size:

- Small data centers

- Medium data centers

By Deployment Mode:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The datacenter services market features strong competition among key players including Siemens, Equinix, Eaton, IBM, Cisco Systems, Schneider Electric, Dell Inc, ABB, Digital Realty, and NTT Data. The datacenter services market is highly competitive, driven by rapid technological advancements and increasing enterprise demand for scalable infrastructure. Companies focus on expanding service portfolios that include cloud migration, integration, colocation, and managed services to strengthen their market position. Investments in hyperscale and edge facilities are rising as organizations adopt hybrid and multi-cloud strategies. Automation, AI integration, and energy-efficient infrastructure are becoming core differentiators among providers. Strategic collaborations and mergers are reshaping the competitive environment, enabling faster service delivery and broader global reach. Sustainability and regulatory compliance are also key factors shaping market strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Equinix

- Eaton

- IBM

- Cisco Systems

- Schneider Electric

- Dell Inc

- ABB

- Digital Realty

- NTT Data

Recent Developments

- In November 2024, Cologix, a leading network-neutral interconnection and hyperscale edge data center provider in North America, launched its fourth and largest data center in Columbus, Ohio. This milestone reinforces Cologix’s commitment to meeting the surging demand for colocation and interconnection services in the region.

- In November 2024, Nokia signed a five-year agreement to supply Microsoft Azure with data center switches and routers, enhancing the scalability and reliability of Azure’s global data centers. This partnership will extend Nokia’s reach to more than 30 countries, strengthening its role as a crucial supplier for Microsoft’s worldwide cloud infrastructure.

- In July 2024, Microsoft unveiled its first-ever data center region in Mexico, named the Mexico Central region. The launch provides global organizations with local access to scalable, resilient, and highly available cloud services. It underscores Microsoft’s commitment to driving digital transformation and sustainable innovation in Mexico, supporting companies such as Binaria ID and DocSolutions.

- In May 2024, Cisco expanded its security footprint with the launch of the first security cloud data centers in Jakarta, Indonesia. This launch marks a new milestone in Cisco’s commitment to supporting businesses’ cyber security readiness in the country

Report Coverage

The research report offers an in-depth analysis based on Service, Data Center Size, Deployment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising cloud adoption across industries.

- Edge data centers will expand rapidly to support low-latency applications.

- Sustainability will become a central focus for infrastructure development.

- AI and automation will optimize operations and reduce downtime.

- Hybrid and multi-cloud strategies will dominate enterprise deployments.

- Energy-efficient power and cooling solutions will see higher adoption.

- Security and regulatory compliance services will gain stronger demand.

- Colocation facilities will expand to serve growing enterprise requirements.

- Strategic partnerships and M&A activities will accelerate market consolidation.

- Advanced monitoring and predictive maintenance will enhance service quality.