Market Overview:

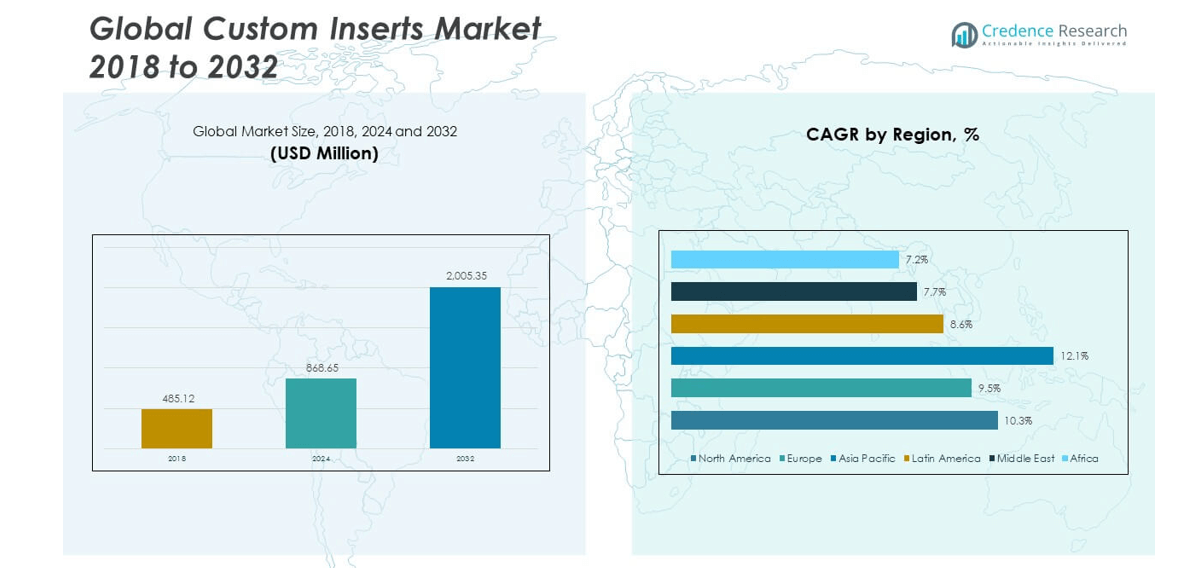

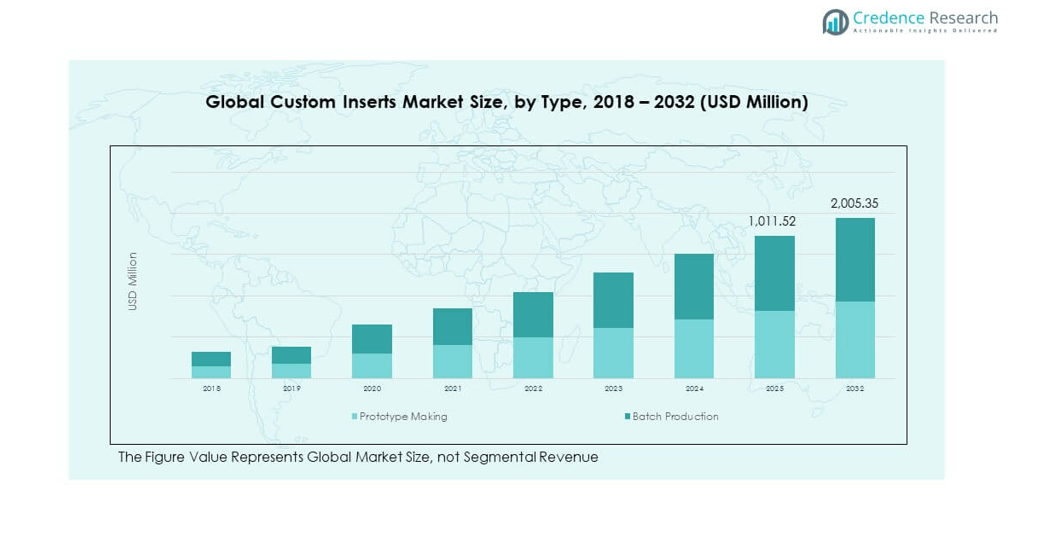

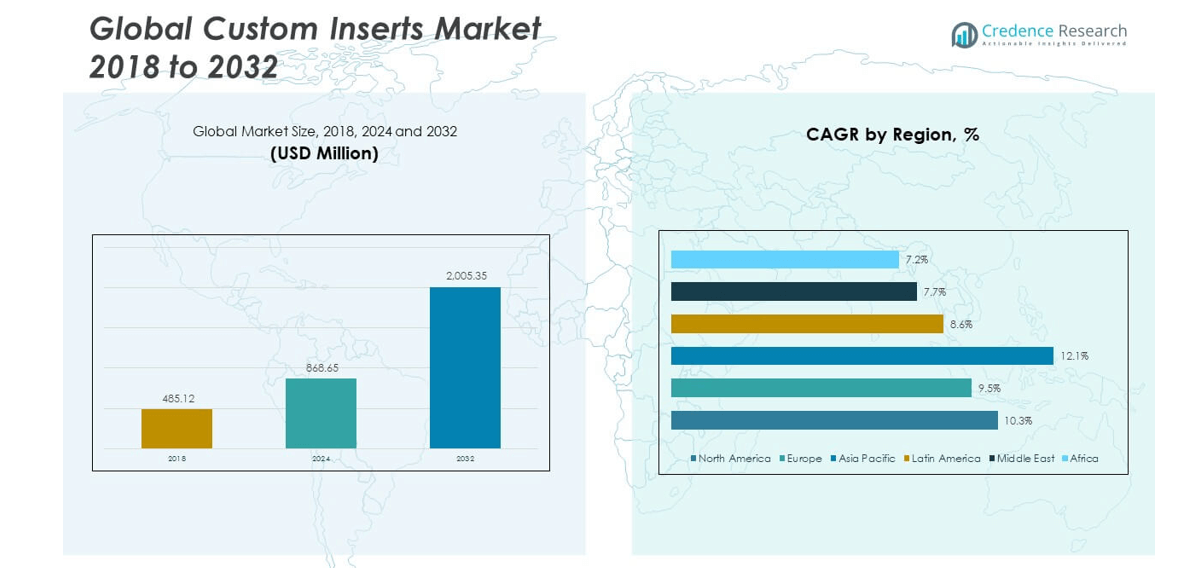

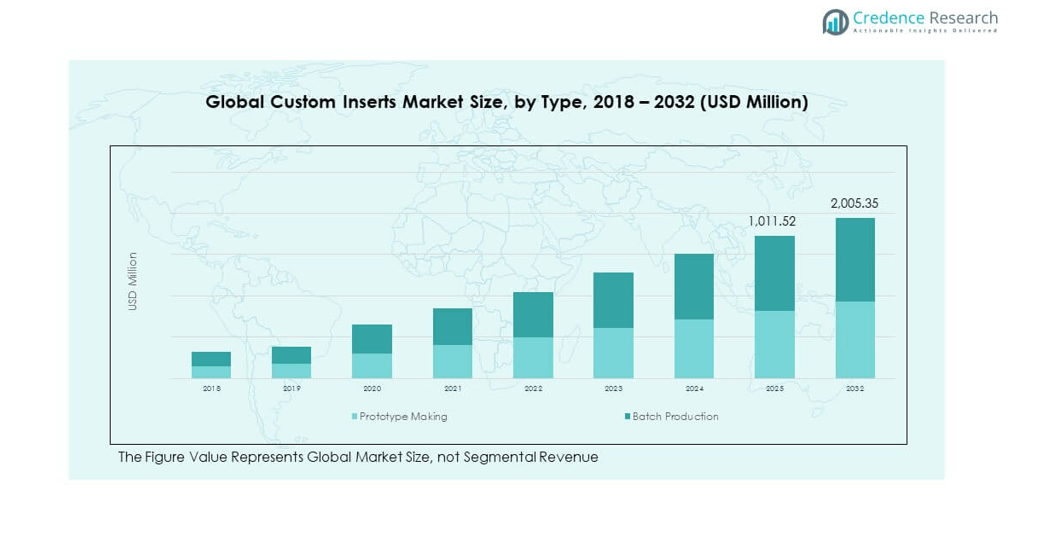

The Global Custom Inserts Market size was valued at USD 485.12 million in 2018 to USD 868.65 million in 2024 and is anticipated to reach USD 2,005.35 million by 2032, at a CAGR of 10.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Custom Inserts Market Size 2024 |

USD 868.65 million |

| Custom Inserts Market, CAGR |

10.27% |

| Custom Inserts Market Size 2032 |

USD 2,005.35 million |

The market is growing due to rising demand for personalized and protective packaging solutions across industries. E-commerce expansion and consumer preference for sustainable, custom-fit inserts fuel adoption. Companies are investing in advanced materials and 3D printing technologies to enhance durability and design flexibility. Demand for premium product presentation, coupled with increasing sustainability regulations, drives innovation in biodegradable and recyclable custom inserts, strengthening their role in diverse applications from electronics to cosmetics.

Regionally, North America leads the market due to established packaging players and high demand for premium goods. Europe follows closely, driven by strict sustainability norms and strong retail packaging demand. Asia-Pacific is emerging as the fastest-growing region, supported by booming e-commerce, expanding manufacturing, and increasing consumer spending. Countries like China and India are witnessing rapid adoption, while Latin America and the Middle East are gradually developing with rising industrialization and trade activities.

Market Insights:

- The Global Custom Inserts Market size was valued at USD 485.12 million in 2018, reached USD 868.65 million in 2024, and is projected to hit USD 2,005.35 million by 2032, growing at a CAGR of 10.27%.

- North America held the largest share at 37%, supported by strong packaging innovation and high consumer demand. Europe followed with 29%, driven by sustainability regulations, while Asia-Pacific secured 24% due to rapid industrialization and e-commerce expansion.

- Asia-Pacific is the fastest-growing region with 24% share, fueled by rising online retail, urbanization, and expanding manufacturing bases in China and India.

- Batch production dominated the market with 61% share in 2024, reflecting large-scale manufacturing demand and cost efficiency.

- Prototype making accounted for 39% share in 2024, driven by demand for design testing, customization, and low-volume applications across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Protective and Customized Packaging Solutions Across Industries:

The Global Custom Inserts Market benefits from strong demand for packaging that protects delicate items and enhances brand image. Businesses across electronics, cosmetics, and healthcare sectors prioritize packaging that reduces damage during transit. It provides tailored solutions that meet both functional and aesthetic needs. The expansion of e-commerce further drives demand for inserts that safeguard goods during shipping. Growing consumer awareness of sustainable materials increases adoption of eco-friendly custom inserts. Companies invest in biodegradable and recyclable materials to meet regulatory and consumer expectations. Innovations in 3D printing and precision cutting enable efficient production of complex insert designs. This evolution positions custom inserts as an essential element of modern packaging strategies.

- For instance, Tessy Plastics, a medical device contract manufacturer, is committed to reducing its absolute Scope 1 and 2 GHG emissions by 42% by 2030 from a 2022 base year. The company leverages advanced manufacturing techniques, such as precision injection molding and automation, to create high-tolerance components and assemblies for medical device packaging. Tessy also explores incorporating sustainable materials, like biodegradable or recycled polymers, into packaging solutions, collaborating with partners and vendors to enhance sustainability across its supply chain.

Expansion of E-Commerce and Growth of Direct-to-Consumer Business Models:

E-commerce expansion continues to drive growth for custom inserts due to rising parcel shipments. It ensures that fragile and premium goods arrive intact, enhancing customer satisfaction. Direct-to-consumer businesses use custom inserts to strengthen brand recognition and improve unboxing experiences. Demand from small and medium enterprises contributes to increased adoption of affordable and scalable insert options. Packaging suppliers offer customizable solutions to differentiate products in crowded marketplaces. Companies invest in automation to manage high-volume production while maintaining quality. This trend supports consistent demand for inserts in retail, electronics, and specialty goods. The Global Custom Inserts Market capitalizes on e-commerce growth and increasing direct customer engagement.

- For instance, following its acquisition by JBT Group in 2025, D&M Plastics (now JBT USA) enhanced its automated injection molding capacity to produce high-precision parts for medical devices and other sectors, continuing its track record of a defect rate of only 17 parts per million (PPM).

Strong Focus on Brand Differentiation and Product Presentation:

Companies across industries use custom inserts to enhance product appeal and brand identity. The Global Custom Inserts Market benefits from rising emphasis on premium unboxing experiences that influence consumer perception. It enables brands to integrate logos, color themes, and messaging into packaging. Businesses leverage inserts not only for protection but also for marketing and brand storytelling. Luxury and premium sectors rely heavily on customized inserts to elevate customer experience. This practice creates competitive advantages by improving customer loyalty and repeat purchases. The growth of social media marketing amplifies the importance of visually appealing product packaging. Custom inserts thus serve as both protective and promotional tools across global markets.

Regulatory Pressure Driving Adoption of Sustainable and Recyclable Materials:

The Global Custom Inserts Market experiences momentum from environmental regulations promoting sustainable packaging practices. It adapts by incorporating biodegradable, compostable, and recyclable materials in inserts. Governments worldwide encourage reduced use of plastics through stricter guidelines and incentives. Consumers increasingly choose eco-friendly products, pushing companies to align packaging strategies with sustainability goals. Businesses see sustainable inserts as a way to improve corporate reputation and attract environmentally conscious buyers. Investments in advanced materials like molded pulp and starch-based solutions support compliance. This shift encourages innovation and broadens product portfolios of packaging manufacturers. Sustainable custom inserts become both a regulatory requirement and a competitive advantage in global trade.

Market Trends:

Adoption of Smart Packaging Features Enhancing Customer Engagement:

The Global Custom Inserts Market is witnessing integration of smart packaging technologies into product inserts. It includes QR codes, NFC tags, and interactive elements that improve customer engagement. Brands use these features to deliver product information, loyalty rewards, and digital experiences. Retailers adopt such solutions to strengthen connections with tech-savvy consumers. Integration of smart elements transforms inserts from simple protectors to communication tools. Businesses apply these innovations in sectors like cosmetics, electronics, and luxury goods. This trend supports differentiation while aligning with evolving digital marketing strategies. Custom inserts evolve into a bridge between physical products and digital interaction.

- For instance, companies in the electronics industry are exploring the integration of NFC-enabled inserts into electronics packaging, with pilot programs aiming to provide consumers with real-time product information and access to loyalty programs.

Expansion of 3D Printing Technology in Custom Insert Production:

The Global Custom Inserts Market benefits from advancements in 3D printing for cost-effective customization. It enables rapid prototyping and efficient production of tailored designs for different industries. Manufacturers use 3D printing to reduce material waste and improve design precision. Small businesses access affordable custom packaging due to reduced setup costs. Adoption of 3D technology accelerates the creation of complex shapes and lightweight inserts. Companies integrate automation with additive manufacturing to improve scalability. This innovation expands customization options for packaging suppliers and brand owners. The trend is reshaping supply chains by cutting production times and enhancing flexibility.

- For instance, Jabil (Nypro) uses high-resolution HP Multi Jet Fusion 3D printing technology to reduce prototype production cycles from weeks to less than 48 hours, enabling faster product development and improved part integrity compared to traditional manufacturing methods.

Growth of Premium and Luxury Goods Driving Specialty Packaging Demand:

Luxury markets emphasize presentation, fueling demand for specialized custom inserts that align with brand positioning. The Global Custom Inserts Market responds by developing high-quality, visually appealing materials. It supports premium product categories such as jewellery, cosmetics, and electronics. Inserts become integral to creating distinctive customer experiences that reinforce exclusivity. Manufacturers invest in velvet-lined, rigid, or embossed inserts for high-value items. Growing influence of social media platforms amplifies the impact of luxury unboxing experiences. This trend strengthens adoption of custom inserts as part of luxury branding strategies. Demand rises globally as more consumers pursue aspirational lifestyle products.

Rising Influence of Automation and Robotics in Packaging Production:

Automation plays a central role in streamlining insert production and meeting high-volume demand. The Global Custom Inserts Market leverages robotics to enhance speed, accuracy, and efficiency in manufacturing. It ensures consistent quality across different industries requiring scalable solutions. Robotics support precision cutting, shaping, and assembly of complex insert designs. Packaging firms use automation to lower labor costs and increase throughput. Automated solutions also reduce human error and improve sustainability by minimizing waste. Integration of robotics strengthens supply chain resilience and supports mass customization. The trend highlights the role of automation in transforming modern packaging systems.

Market Challenges Analysis:

High Production Costs and Material Constraints Limiting Widespread Adoption:

The Global Custom Inserts Market faces challenges from high production costs linked to advanced materials and design complexity. It requires specialized equipment and skilled labor, which increases operational expenses for manufacturers. Smaller businesses often struggle to adopt inserts due to higher costs compared to standard packaging. Material shortages, especially in sustainable and eco-friendly options, further add to constraints. Fluctuations in raw material prices impact pricing stability across markets. Companies must balance between providing innovation and keeping packaging affordable for customers. Limited availability of scalable technologies also hinders widespread penetration. This issue remains a barrier for achieving consistent growth in diverse markets.

Environmental Regulations and Supply Chain Disruptions Affecting Market Growth:

The Global Custom Inserts Market faces pressure from evolving environmental regulations demanding sustainable alternatives. It often requires substantial investment to meet compliance standards across different regions. Some businesses encounter delays and increased costs when shifting toward biodegradable or recyclable materials. Supply chain disruptions, caused by geopolitical tensions or transportation issues, affect material sourcing. These disruptions lead to delayed deliveries and challenges in meeting customer timelines. Packaging firms also face competition from substitute solutions like flexible packaging or generic protective fillers. This challenge reduces market expansion opportunities in price-sensitive industries. The sector must innovate continually to manage evolving restrictions and external risks.

Market Opportunities:

Rising Role of Sustainable and Innovative Materials in Future Growth:

The Global Custom Inserts Market presents opportunities through rapid adoption of sustainable materials in packaging. It creates demand for biodegradable, compostable, and recyclable alternatives that meet consumer and regulatory expectations. Manufacturers innovate with molded pulp, plant-based foams, and lightweight fibers to enhance functionality. Growth in sustainable materials opens new markets in retail, food, and electronics sectors. Companies investing in eco-friendly solutions gain stronger positions in both developed and emerging economies. Demand for sustainable inserts also aligns with global corporate responsibility goals. This opportunity creates long-term growth pathways and supports strategic differentiation.

Expansion Across Emerging Economies Driven by E-Commerce and Industrial Growth:

Emerging markets provide significant opportunities for insert suppliers due to e-commerce expansion and industrialization. The Global Custom Inserts Market grows rapidly in Asia-Pacific, Latin America, and Middle East regions. It benefits from increasing consumer spending and demand for protective packaging. Growing manufacturing bases in these regions support adoption of cost-effective custom inserts. Local businesses collaborate with packaging providers to access tailored solutions. Rising urbanization and digital retail accelerate demand for efficient and customizable inserts. This opportunity strengthens global supply networks while fostering innovation at regional levels. Emerging economies thus create a vital platform for sustained market expansion.

Market Segmentation Analysis:

By Type

The Global Custom Inserts Market is classified into prototype making and batch production. Prototype making supports industries that require precision testing and design validation before full-scale production. It is particularly important in aerospace, medical devices, and high-value consumer products, where customized solutions are critical. Batch production leads the segment due to its ability to handle large orders with consistency and cost efficiency. It serves automobile, consumer product, and electronics industries where scalability and uniform quality are key competitive factors. Both segments complement each other by addressing different stages of product development and supply chain needs.

- For instance, Pro Mold & Die was acquired by Wolf Industrial Advisors in early 2023. Before the acquisition, the company specialized in manufacturing high-quality injection molds and die-cast dies for various applications, including the automotive and electronics industries. Both industry segments address different needs within the supply chain, complementing each other.

By Application

The Global Custom Inserts Market extends across aerospace, medical, automobile, consumer products, and other applications. Aerospace demands highly engineered inserts to protect sensitive parts during assembly and transit, ensuring compliance with strict safety standards. Medical applications focus on sterile and durable inserts for packaging surgical tools, diagnostic devices, and pharmaceutical products. The automobile sector relies on inserts to safeguard fragile and precision components across manufacturing and distribution chains. Consumer products form a major share as inserts enhance both protection and presentation, driven by e-commerce growth. Other applications, including electronics and industrial equipment, highlight increasing adoption of sustainable and innovative designs. Each application area demonstrates how custom inserts provide value by aligning with functional and branding needs across industries.

- For instance, Medical applications focus on sterile and durable inserts for packaging surgical tools, diagnostic devices, and pharmaceutical products. The automobile sector relies on inserts to safeguard fragile and precision components across manufacturing and distribution chains.

Segmentation:

- By Type

- Prototype Making

- Batch Production

- By Application

- Aerospace

- Medical

- Automobile

- Consumer Products

- Others

- By Region / Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Custom Inserts Market size was valued at USD 210.60 million in 2018 to USD 373.16 million in 2024 and is anticipated to reach USD 863.88 million by 2032, at a CAGR of 10.3% during the forecast period. North America accounted for 43% share of the Global Custom Inserts Market in 2024, driven by strong demand across aerospace, medical, and consumer product sectors. It benefits from advanced manufacturing capabilities, widespread adoption of automation, and established packaging players. Consumer preference for premium and sustainable packaging solutions supports higher adoption rates. Strong e-commerce penetration enhances demand for protective inserts in retail and electronics distribution. Regulations promoting eco-friendly packaging encourage investment in biodegradable and recyclable materials. Innovation in design, supported by high R&D spending, positions regional companies ahead in global competition. The region remains a hub for early adoption of advanced materials and technologies in inserts.

Europe

The Europe Custom Inserts Market size was valued at USD 142.74 million in 2018 to USD 246.70 million in 2024 and is anticipated to reach USD 537.45 million by 2032, at a CAGR of 9.5% during the forecast period. Europe held 28% share of the Global Custom Inserts Market in 2024, supported by strict sustainability regulations and consumer awareness. The region emphasizes eco-friendly materials and compliance-driven innovation in packaging. Luxury brands across France, Italy, and Germany use premium inserts to enhance product presentation. Growth in automotive and medical industries strengthens demand for durable and precision inserts. Rising online retail adoption expands opportunities in consumer goods packaging. The region continues to invest in circular economy models that encourage recyclable inserts. Design-focused innovation and adoption of high-quality materials provide a competitive advantage. It remains a leader in sustainability-focused packaging strategies.

Asia Pacific

The Asia Pacific Custom Inserts Market size was valued at USD 88.51 million in 2018 to USD 172.50 million in 2024 and is anticipated to reach USD 453.66 million by 2032, at a CAGR of 12.1% during the forecast period. Asia Pacific captured 20% share of the Global Custom Inserts Market in 2024, emerging as the fastest-growing region. Expanding e-commerce platforms and increasing consumer spending drive demand for protective and premium packaging. Countries like China and India dominate due to large-scale manufacturing and cost-efficient production bases. The region experiences rising demand in automobile and consumer goods packaging. Adoption of 3D printing and advanced materials grows in Japan and South Korea, enhancing innovation. Sustainability initiatives are gaining traction, especially in urban markets. Increasing foreign investments strengthen industrial supply chains. It continues to evolve into a global growth hub for custom inserts.

Latin America

The Latin America Custom Inserts Market size was valued at USD 22.91 million in 2018 to USD 40.52 million in 2024 and is anticipated to reach USD 82.80 million by 2032, at a CAGR of 8.6% during the forecast period. Latin America accounted for 5% share of the Global Custom Inserts Market in 2024, supported by growth in retail and automotive industries. Brazil leads the regional market due to strong manufacturing and consumer product demand. Expanding healthcare infrastructure contributes to higher adoption of custom inserts in medical packaging. E-commerce penetration, though slower compared to other regions, is steadily rising. Packaging providers explore cost-effective solutions to meet demand from price-sensitive markets. Adoption of sustainable packaging materials is growing with regulatory support. Regional players increasingly collaborate with global suppliers to strengthen capabilities. It remains an emerging market with strong potential in consumer and industrial packaging.

Middle East

The Middle East Custom Inserts Market size was valued at USD 12.73 million in 2018 to USD 20.70 million in 2024 and is anticipated to reach USD 39.76 million by 2032, at a CAGR of 7.7% during the forecast period. The Middle East represented 2% share of the Global Custom Inserts Market in 2024, driven by retail, luxury goods, and healthcare packaging. GCC countries lead demand due to expanding trade networks and investments in modern retail. Rising demand for premium packaging supports adoption of custom inserts in cosmetics and consumer products. Infrastructure development projects and industrial growth enhance opportunities in protective packaging. Limited domestic manufacturing capacity creates reliance on imports of advanced inserts. Sustainability awareness is gradually improving, influencing packaging preferences. Multinational companies expand distribution networks across the region to meet growing consumer demand. It shows steady growth supported by modernization and diversification efforts.

Africa

The Africa Custom Inserts Market size was valued at USD 7.63 million in 2018 to USD 15.07 million in 2024 and is anticipated to reach USD 27.81 million by 2032, at a CAGR of 7.2% during the forecast period. Africa held 2% share of the Global Custom Inserts Market in 2024, with demand concentrated in South Africa and Egypt. Consumer goods and healthcare packaging form the primary drivers of growth. Increasing investments in e-commerce platforms support adoption of protective packaging solutions. Local manufacturing capacity remains limited, creating reliance on imports for advanced custom inserts. Cost remains a major barrier in wider adoption across price-sensitive markets. Efforts to encourage sustainable and recyclable packaging are at an early stage. Growing urbanization creates opportunities for both consumer and industrial applications. It reflects gradual but steady market expansion in line with regional economic growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nypro (Jabil)

- Tessy Plastics

- Molex

- Pro Mold

- First American Plastic

- Natech Plastics

- D&M Plastics

- Bluestar Mould

- Carolina Precision Plastics

Competitive Analysis:

The Global Custom Inserts Market is characterized by a mix of global manufacturers and specialized regional suppliers. Leading players compete through innovation in design, adoption of sustainable materials, and investment in automation. It emphasizes scalability, with large firms focusing on batch production for automotive and consumer goods, while smaller companies strengthen niches in prototype making and high-value sectors like aerospace and medical. Competition is shaped by the ability to balance cost efficiency with customization. Strategic mergers, partnerships, and technological adoption further define the competitive dynamics, reinforcing differentiation and global presence.

Recent Developments:

- In April 2025, Tessy Plastics received the 2025 Plastics News Sustained Excellence Award, marking 25 years of growth and innovation. Tessy has expanded its global footprint with multiple facilities across New York, Pennsylvania, and China, focusing heavily on the medical device sector and pushing towards becoming a full-service finished device assembler.

- In December 2024, Molex completed its acquisition of AirBorn, a manufacturer specializing in rugged connectors and electronic components for aerospace, defense, and other mission-critical markets. This acquisition significantly expands Molex’s offerings and presence in the aerospace and defense sectors, enabling better support for evolving customer needs.

- In January 2023, Pro Mold & Die was acquired by Wolf Industrial Advisors, a company providing growth and transition services to businesses. Pro Mold specializes in manufacturing plastic injection molds and die-cast dies, and the acquisition supports the company’s founders’ retirement plans while enabling continued business evolution.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable inserts will shape product innovation.

- E-commerce growth will accelerate adoption of protective packaging.

- Aerospace and medical industries will drive premium segment demand.

- Automation and robotics will strengthen production efficiency.

- Regional suppliers will expand presence through partnerships.

- Luxury and consumer goods will boost demand for high-quality inserts.

- 3D printing will enhance customization and speed of prototyping.

- Regulations will continue to push for recyclable and eco-friendly materials.

- Emerging economies will become key contributors to future growth.

- Digital integration in inserts will improve customer engagement strategies.