Market Overview

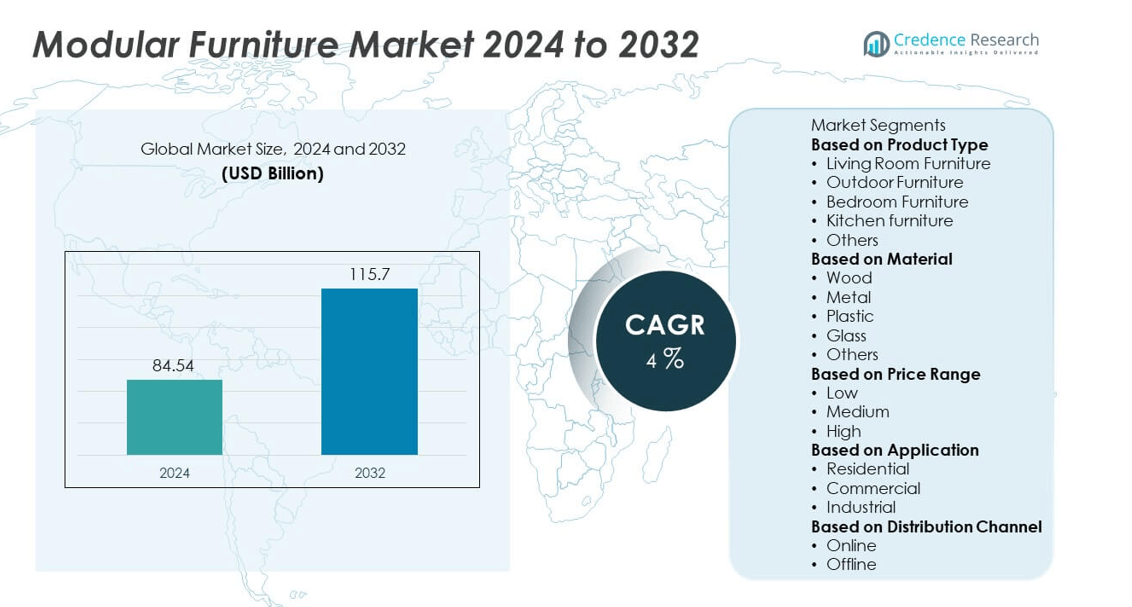

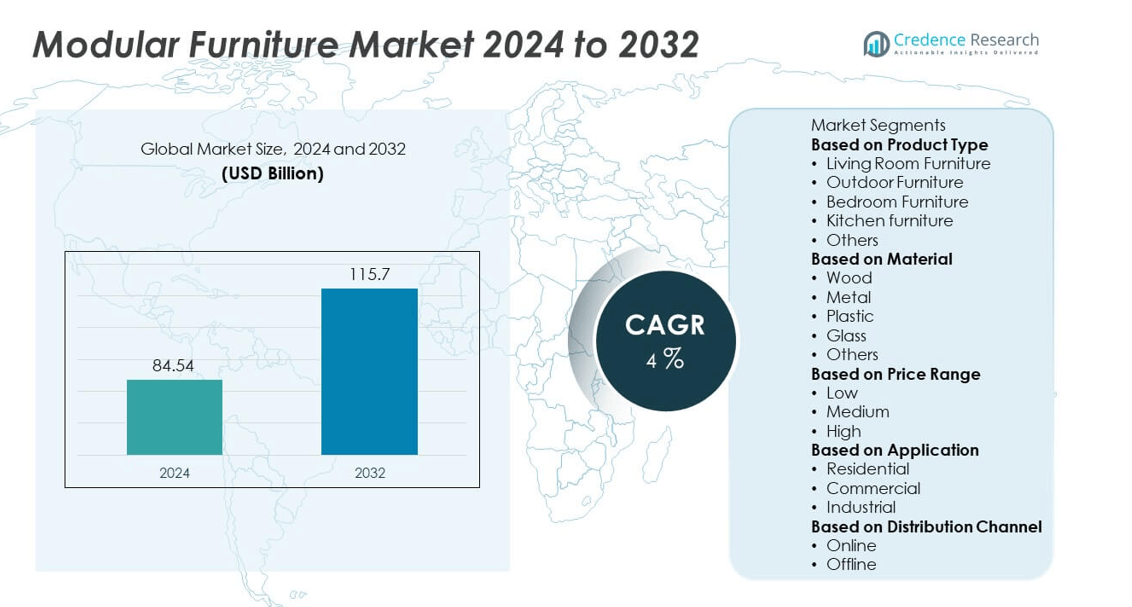

The Modular Furniture Market was valued at USD 84.54 billion in 2024 and is projected to reach USD 115.7 billion by 2032, expanding at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Furniture Market Size 2024 |

USD 84.54 billion |

| Modular Furniture Market, CAGR |

4% |

| Modular Furniture Market Size 2032 |

USD 115.7 billion |

The Modular Furniture Market grows with rising demand for flexible and space-efficient designs across residential and commercial spaces. Urbanization and smaller living areas push consumers to adopt modular solutions that maximize utility and enhance aesthetics. Companies invest in ergonomic designs and customizable options to meet evolving consumer needs.

The Modular Furniture Market shows strong growth potential across key global regions, driven by shifting lifestyles, urbanization, and rising demand for flexible interior solutions. North America leads adoption with a focus on innovative office designs and ergonomic products, while Europe emphasizes sustainability and eco-friendly materials in modular systems. Asia Pacific emerges as the fastest-growing region, supported by expanding urban populations, housing projects, and increasing consumer spending on home improvement. Latin America and the Middle East & Africa gradually expand through infrastructure development and growing awareness of modern furnishing solutions. Prominent players driving this market include IKEA Systems, Herman Miller, Haworth, and HNI Corporation, each focusing on customization, design innovation, and sustainable production. These companies strengthen their global footprint through technological integration, recyclable materials, and partnerships that cater to both residential and commercial applications. This geographical diversity highlights the market’s dynamic nature and long-term growth opportunities worldwide.

Market Insights

- The Modular Furniture Market was valued at USD 84.54 billion in 2024 and is projected to reach USD 115.7 billion by 2032, growing at a CAGR of 4%.

- Rising demand for space-saving, flexible, and cost-efficient furniture drives strong adoption across residential and commercial sectors.

- The Modular Furniture Market shows increasing preference for eco-friendly materials, smart furniture integration, and customizable designs that suit modern lifestyles.

- Competitive dynamics remain strong with key players such as IKEA Systems, Herman Miller, Haworth, and HNI Corporation investing in sustainability, product innovation, and global distribution networks.

- High initial costs and limited awareness in emerging regions act as restraints, making affordability a key challenge for mass adoption.

- North America leads with advanced product innovation and demand for ergonomic office furniture, while Europe emphasizes sustainable designs aligned with environmental standards.

- Asia Pacific records the fastest growth, supported by rapid urbanization, rising disposable incomes, and government-backed housing projects, while Latin America and the Middle East & Africa steadily expand through growing infrastructure and consumer awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Urbanization and Demand for Space-Saving Solutions

The Modular Furniture Market benefits strongly from rapid urbanization and shrinking residential spaces. Consumers in metropolitan areas increasingly prioritize furniture that optimizes available space while maintaining style. Modular units provide versatility, offering customizable layouts that suit apartments and compact homes. It supports rising demand for smart storage and multifunctional designs that enhance comfort. Flexible arrangements, such as foldable tables and modular sofas, appeal to urban dwellers. This driver continues to expand adoption in both developed and emerging economies.

- For instance, IKEA’s BILLY bookcase system surpassed 140 million units sold worldwide by 2023, demonstrating significant success of modular storage designs globally.

Growing Popularity in Commercial and Office Spaces

The Modular Furniture Market gains traction in corporate and commercial environments that require adaptable layouts. Modern offices adopt modular desks, partitions, and seating to support hybrid work models. It enables businesses to reconfigure spaces quickly for collaboration or privacy without incurring high costs. Commercial buyers prefer modular options for scalability, ensuring furniture adapts to changing workforce needs. Schools, hospitals, and co-working spaces also incorporate modular systems to improve efficiency. This trend reinforces modular furniture’s role in the business sector.

- For instance, Herman Miller creates modular office systems, including the Atlas Office Landscape. The company designs and markets these products for flexible and collaborative work environments. The Atlas system, is height-adjustable and flexible for different layouts.

Increased Focus on Sustainability and Eco-Friendly Materials

The Modular Furniture Market benefits from global emphasis on sustainable practices and eco-friendly production. Manufacturers adopt recycled wood, metal, and eco-certified fabrics to align with green building standards. It reduces environmental impact while meeting consumer demand for ethical products. Furniture with replaceable components extends product life and minimizes waste generation. Green certifications drive stronger adoption among environmentally conscious buyers. This sustainability-driven demand shapes future design and material choices in the industry.

Advancements in Design, Technology, and Customization

The Modular Furniture Market experiences growth through innovations in design and technology. Companies leverage digital tools, such as 3D visualization and augmented reality, to offer personalized solutions. It allows customers to preview layouts and customize products according to preferences. Modular systems with integrated smart features, including charging ports and adjustable settings, gain popularity. E-commerce platforms further support customization by offering virtual design assistance. This driver highlights the importance of innovation in attracting diverse consumer groups and expanding market potential.

Market Trends

Expansion of E-commerce and Online Customization Platforms

The Modular Furniture Market reflects strong growth through e-commerce platforms offering customizable solutions. Consumers use online tools to design layouts and select finishes before purchase. It improves convenience and accessibility, driving wider adoption among younger buyers. Retailers integrate augmented reality to let customers visualize furniture in real spaces. Online channels also expand brand reach across urban and semi-urban markets. This trend reinforces the digital transformation of modular furniture sales globally.

- For instance, IKEA’s total retail sales for FY2023 were indeed €47.6 billion, and the online sales share was 23%. The company uses AR tools, with the newer IKEA Kreativ app replacing the older IKEA Place.

Integration of Smart Features into Modular Systems

The Modular Furniture Market benefits from growing demand for smart, technology-enabled designs. Furniture with built-in charging ports, wireless connectivity, and ergonomic adjustments gains appeal in modern households. It addresses the need for multifunctional products in connected living environments. Offices also adopt smart modular desks with adjustable heights and power access points. Integration of these features enhances user experience and long-term value. This trend highlights how technology shapes modular furniture’s next phase of growth.

- For instance, Herman Miller’s Ratio sit-stand desk is available in multiple configurations, including a dual-stage electric version that offers a seamless height adjustment between 650 mm and 1250 mm. It comes with options for programmable electric controls that allow users to save preferred height settings for one-touch adjustments.

Shift Toward Sustainable and Eco-Certified Products

The Modular Furniture Market shows a rising trend toward sustainability-driven choices. Consumers prefer furniture made with recycled, renewable, and eco-certified materials. It aligns with broader environmental concerns and green building practices. Modular designs that allow replacement of single components further reduce waste. Brands increasingly highlight certifications such as FSC and LEED to attract eco-conscious buyers. This trend strengthens the connection between sustainability and modular furniture adoption.

Rising Demand for Flexible and Multifunctional Designs

The Modular Furniture Market records increasing preference for flexible layouts that adapt to changing lifestyles. Consumers favor modular sofas, wardrobes, and shelving units that can be rearranged easily. It supports households in urban settings where space efficiency is critical. Multifunctional designs, such as sofa beds or extendable tables, gain traction across residential markets. Offices also adopt modular systems that shift seamlessly between collaborative and private spaces. This trend underscores modular furniture’s role in offering adaptable solutions for modern needs.

Market Challenges Analysis

High Costs of Quality Materials and Advanced Designs

The Modular Furniture Market faces challenges from high costs linked to premium raw materials and modern designs. Quality components such as engineered wood, metal, and eco-friendly laminates increase production expenses. It creates affordability barriers for price-sensitive consumers in developing economies. Advanced modular systems that integrate smart features or custom designs require higher investment. Small manufacturers often struggle to match large players in terms of pricing and innovation. This cost pressure slows down adoption among middle-income households and smaller businesses.

Logistics, Standardization, and Assembly Concerns

The Modular Furniture Market also encounters difficulties with logistics, assembly, and product standardization. Transporting modular parts across regions requires efficient packaging and reliable distribution channels. It often leads to damage risks, higher shipping costs, and delays in delivery. Consumers also face challenges with self-assembly, which reduces satisfaction when instructions lack clarity. Variations in sizing and compatibility across different brands limit the interchangeability of components. These issues restrict smooth adoption and create long-term reliability concerns in competitive markets.

Market Opportunities

Rising Demand for Customizable and Space-Saving Solutions

The Modular Furniture Market benefits from increasing demand for flexible, space-saving solutions across urban households and offices. Compact living spaces in metropolitan areas encourage adoption of furniture that maximizes utility and adapts to changing needs. It allows consumers to customize layouts, colors, and finishes to match personal preferences. Growing popularity of home offices further boosts demand for modular desks, storage units, and ergonomic seating. Companies offering tailored solutions strengthen their appeal among both residential and commercial buyers. Expanding urbanization and lifestyle changes continue to create new opportunities for modular innovation.

Sustainability and Growth in Emerging Markets

The Modular Furniture Market gains opportunities from rising interest in sustainable and eco-friendly products. Manufacturers introduce recyclable materials, low-emission finishes, and energy-efficient production techniques to meet green building standards. It aligns with consumer preferences for environmentally responsible products and supports corporate sustainability commitments. Emerging markets in Asia Pacific, Latin America, and Africa provide strong growth potential due to rising disposable incomes and rapid urban development. Public infrastructure projects and expanding real estate markets further encourage modular adoption. Global players investing in sustainable practices and regional expansion position themselves to capture these opportunities.

Market Segmentation Analysis:

By Product Type

The Modular Furniture Market divides into categories such as storage units, seating, beds, tables, and workstations. Storage units lead demand as consumers seek efficient space utilization in both residential and commercial spaces. It supports better organization and flexibility, making modular wardrobes and cabinets popular choices. Seating, including sofas and chairs, also shows strong growth due to demand for customizable and ergonomic options. Workstations record rising adoption in offices and home setups, driven by hybrid work practices. Beds and tables with modular features gain traction in compact homes where multipurpose furniture is valued. Each category highlights versatility and the ability to adapt designs to evolving needs.

- For instance, Haworth’s Zody ergonomic chair has sold more than 3 million units worldwide, demonstrating strong demand for modular seating in corporate setups.

By Material

The Modular Furniture Market includes wood, metal, plastic, and engineered materials. Wood dominates, supported by its aesthetic appeal and durability in both premium and mid-range categories. It remains preferred in residential projects where design and finish hold priority. Metal segments grow steadily due to higher usage in office furniture, particularly modular workstations and shelving. Plastic and engineered materials offer cost advantages and lightweight solutions, making them suitable for mass-market demand. It expands adoption in budget-conscious regions while supporting modern, customizable designs. Innovation in composites and laminates also enhances durability and appeal, driving wider application across end-user segments.

- For instance, Kimball International did introduce its EverySpace platform in 2021, and the modular system is noted for its adaptable architecture and durable construction. Kimball does emphasize sustainability and minimizing waste in its manufacturing processes, which aligns with using materials efficiently.

By Price Range

The Modular Furniture Market divides into premium, mid-range, and budget segments. Premium furniture caters to high-income consumers and corporates seeking luxury, design, and long-term durability. It often incorporates sustainable materials and smart features, appealing to environmentally conscious and technologically inclined buyers. Mid-range furniture records the largest demand as it balances quality, affordability, and customization, making it suitable for growing middle-class populations. Budget furniture caters to cost-sensitive consumers in developing regions where affordability drives purchase decisions. This segment expands with rising urbanization and smaller living spaces that require functional yet low-cost solutions. Manufacturers strategically diversify offerings across these ranges to capture diverse customer bases and regional markets.

Segments:

Based on Product Type

- Living Room Furniture

- Outdoor Furniture

- Bedroom Furniture

- Kitchen furniture

- Others

Based on Material

- Wood

- Metal

- Plastic

- Glass

- Others

Based on Price Range

Based on Application

- Residential

- Commercial

- Industrial

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 30% share of the Modular Furniture Market, driven by high demand for flexible and modern interior solutions. The United States leads with strong adoption in residential and commercial spaces, supported by urban households seeking space-saving designs. It benefits from the hybrid work culture, which increases demand for modular workstations and ergonomic home-office furniture. Canada also contributes significantly, focusing on eco-friendly modular solutions that align with sustainability goals. Mexico shows rising adoption due to expanding middle-class income and increasing urban housing projects. The region benefits from established players and continuous investments in premium designs and smart furniture technologies.

Europe

Europe accounts for nearly 28% share of the Modular Furniture Market, reflecting its focus on sustainability, design innovation, and high-quality materials. Germany, the UK, France, and Italy dominate demand due to well-established furniture industries and strong consumer awareness of eco-friendly options. It benefits from strict European Union regulations promoting sustainable production and recyclable materials. Scandinavian countries further lead with wood-based modular designs, reflecting regional preferences for minimalism and renewable resources. Commercial demand strengthens in countries such as the Netherlands and Spain, where businesses prioritize modular office setups for flexibility. Europe’s emphasis on customization and environmentally conscious designs ensures steady growth in the market.

Asia Pacific

Asia Pacific captures about 27% share of the Modular Furniture Market and remains the fastest-growing regional segment. China drives the region with large-scale manufacturing capacity and rising adoption in both urban residential and office spaces. It benefits from rapid urbanization, where compact apartments demand space-efficient and multifunctional furniture. India shows strong growth potential through government-backed housing projects and increasing middle-class spending power. Japan and South Korea focus on technology-integrated modular solutions that combine smart features with efficient designs. Southeast Asian countries, including Indonesia and Vietnam, also contribute through expanding residential construction and rising disposable incomes. Asia Pacific’s role as both a production hub and a demand center strengthens its global importance.

Latin America

Latin America represents nearly 8% share of the Modular Furniture Market, with Brazil and Mexico leading adoption. Growing urban populations and expanding housing sectors drive demand for cost-effective and customizable modular solutions. It benefits from increasing investment in residential and commercial construction, particularly in metropolitan cities. Brazil remains the largest market, with modular furniture widely used in urban apartments and office spaces. Mexico supports growth through cross-border trade with North America and expanding retail distribution networks. Other countries such as Chile, Argentina, and Colombia also show steady demand, supported by rising middle-class income and a preference for affordable furniture options.

Middle East & Africa

The Middle East and Africa together account for about 7% share of the Modular Furniture Market, supported by growing infrastructure and housing investments. The United Arab Emirates and Saudi Arabia dominate demand, with modular furniture gaining traction in commercial projects such as hotels, offices, and retail centers. It benefits from large-scale real estate developments that incorporate modern interior designs. South Africa leads in Africa, with rising adoption in residential and office markets, while Nigeria shows growing demand fueled by urbanization. Regional expansion is also supported by government-backed housing projects and international collaborations. The increasing popularity of modular designs in high-density urban centers strengthens long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kinnarps

- Herman Miller

- Hay

- IKEA Systems

- Knoll

- Flexsteel Industries

- Kimball International

- HNI Corporation

- Bene

- Haworth

Competitive Analysis

The competitive landscape of the Modular Furniture Market features leading players such as IKEA Systems, Herman Miller, Haworth, HNI Corporation, Knoll, Kimball International, Flexsteel Industries, Bene, Kinnarps, and Hay. Competition is defined by innovation in design, sustainability practices, and the ability to deliver flexible solutions for residential, commercial, and institutional spaces. Global leaders focus on scaling operations through efficient supply chains, advanced manufacturing, and extensive retail networks, while premium-focused companies emphasize ergonomic designs and workplace adaptability. Regional players enhance their positions with localized production, strong customer engagement, and tailored product offerings. Sustainability and eco-friendly materials play a crucial role in product differentiation, supported by investments in recyclable inputs and energy-efficient processes. Strategic collaborations, acquisitions, and continuous product development further strengthen competitive advantage. The market remains highly dynamic, with companies balancing affordability, customization, and design innovation to capture evolving consumer preferences worldwide.

Recent Developments

- In June 2025, Kinnarps joined the UN’s Science Based Targets initiative and the UN Global Compact, committing to measurable sustainability goals tied to climate and corporate responsibility.

- In June 2025, MillerKnoll (supporting Herman Miller, Knoll, Hay, and others) opened its expansive Chicago flagship, spanning nearly 70,000 square feet across two connected buildings in Fulton Market, showcasing integrated modular environments across eight floors.

- In June 2025, Knoll introduced the Dividends Skyline holistic workstation system with 18 new veneers, a fresh ultra-matte laminate palette, and flexible configurations designed for varied workplace roles; the line will launch in winter 2025 through MillerKnoll dealers.

- In October 2024, Kinnarps unveiled its “Everything’s connected” workplace ergonomics concept at Orgatec in Cologne, featuring holistic design solutions inspired by Swedish nature to improve wellbeing in modern offices.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Price Range, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Urban lifestyle trends will drive continued demand for space-saving, multifunctional modular furniture solutions.

- Increasingly, customers will expect eco-friendly materials and recyclable design features integrated into modular products.

- Smart furniture with built-in technology, such as wireless charging or adjustable settings, will gain popularity.

- Online customization platforms and augmented reality tools will simplify design choices and improve customer satisfaction.

- Hybrid work models will sustain demand for modular office systems that support flexible workspace configurations.

- Manufacturers will emphasize circular economy models, encouraging modular refurbishing rather than full replacement.

- Expansion in emerging markets will unlock new sales opportunities as urban populations grow and incomes rise.

- Partnerships between furniture brands and e-commerce platforms will enhance reach and delivery efficiencies.

- Modular furniture will increasingly serve hospitality and educational sectors that demand rapid reconfiguration and durability.

- Innovations in lightweight, high-strength materials will increase portability and ease of assembly, expanding modular usage.