Market Overview

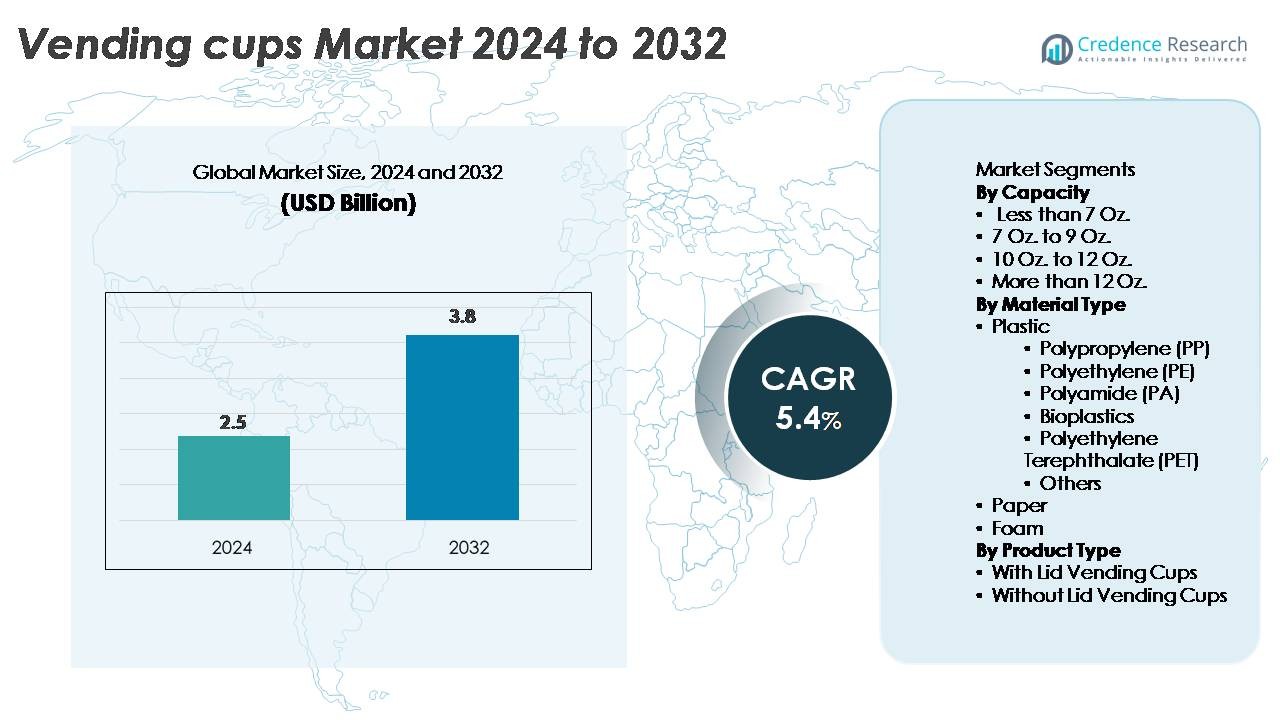

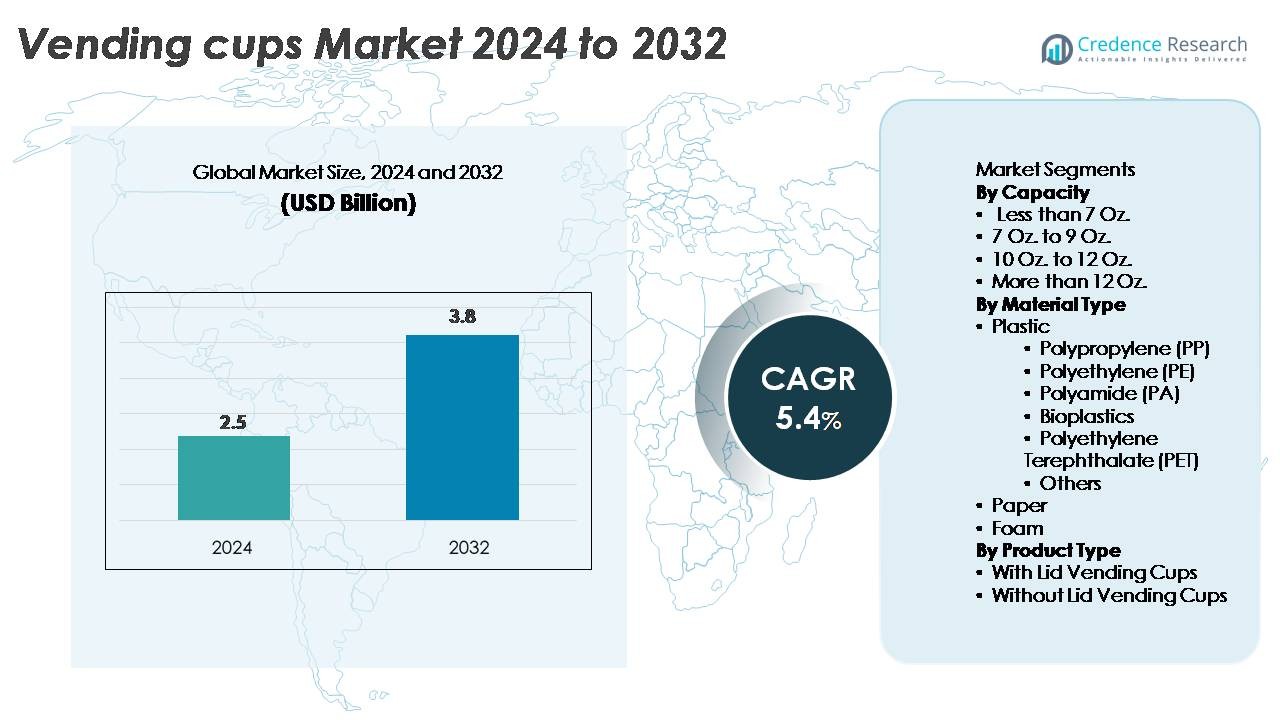

The global vending cups market was valued at USD 2.5 billion in 2024 and is anticipated to reach USD 3.8 billion by 2032, reflecting a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vending Cups Market Size 2024 |

USD 2.5 Billion |

| Vending Cups Market, CAGR |

5.4% |

| Vending Cups Market Size 2032 |

USD 3.8 Billion |

The vending cups market is shaped by a mix of global and regional leaders, with companies such as Dispo International Ltd., SwissPrime Pack AG, New WinCup Holdings Inc., RPC Tedeco-Gizeh Ltd., Graphic Packaging International LLC, Hosti GmbH, MPM Marketing Services Pty Ltd., Nupik-Flo UK Ltd., Huhtamaki Oyj, and Benders Paper Cups driving product innovation, sustainable material development, and high-volume manufacturing efficiency. These players focus on recyclable PP, coated paper, and emerging bioplastic solutions to meet vending machine compatibility and environmental standards. Asia-Pacific leads the market with a 38% share, supported by rapid urbanization and smart vending adoption, followed by Europe and North America, where sustainability-driven innovation strengthens competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global vending cups market was valued at USD 2.5 billion in 2024 and is projected to reach USD 3.8 billion by 2032, expanding at a 5.4% CAGR, supported by rising beverage vending installations across commercial environments.

- Market growth is driven by increasing adoption of automated coffee and cold-drink vending systems in offices, transport hubs, and institutional facilities, boosting demand for PP, PET, and paper-based vending cups.

- Key trends include a shift toward recyclable and compostable materials, precision-engineered cup designs for anti-jam dispensing, and upgraded vending ecosystems integrating smart, touchless technologies.

- Competitive activity intensifies as players like Huhtamaki Oyj, New WinCup Holdings Inc., and Graphic Packaging International LLC invest in sustainable materials and high-speed molding capabilities, though raw material price volatility remains a restraint.

- Asia-Pacific leads with 38% share, followed by Europe at 27% and North America at 24%; among segments, 7–9 Oz. cups dominate due to their suitability for hot beverage vending formats.

Market Segmentation Analysis:

By Capacity

The 7 Oz. to 9 Oz. segment holds the largest market share, driven by its widespread use in hot beverage vending machines across offices, transport hubs, quick-service restaurants, and institutional facilities. This size range balances portion control with cost efficiency, making it the preferred choice for tea, coffee, and specialty drink dispensers. Less than 7 Oz. cups continue to support economy vending formats, while 10 Oz. to 12 Oz. and more than 12 Oz. categories are gaining traction as vending operators expand offerings to include premium beverages, cold drinks, and value-added refreshment services.

- For instance, Selecta Group Europe’s largest unattended coffee and vending operator services more than 460,000 vending points of sale and delivers beverages to over 12 million consumers per day, with the majority of its hot-drink vending machines calibrated for 7–9 Oz. cup formats due to optimal dispense volume and machine compatibility.

By Material Type

Plastic-based vending cups particularly Polypropylene (PP) dominate the market, owing to their heat resistance, durability, and compatibility with automated dispensing systems. PP cups also benefit from low production costs and consistent machinability, making them the preferred choice for high-volume commercial vending operations. Paper cups are gaining momentum as sustainability regulations tighten, while PET and bioplastics are emerging in regions prioritizing recyclability and compostability. Foam cups continue to serve niche hot beverage applications but face declining demand due to environmental restrictions, pushing manufacturers toward recyclable and lightweight polymer alternatives.

- For instance, NatureWorks’ Ingeo PLA (polylactic acid) used in select vending-cup variants is produced at a capacity of 150,000 tons per year at its Blair, Nebraska facility, enabling large-scale supply of bio-resin for durable and transparent beverage cups.

By Product Type

The without-lid vending cups segment holds the dominant market share, supported by its suitability for automated dispensing machines that serve beverages directly without requiring manual closure. These cups streamline vending operations, reduce material costs, and enhance dispensing speed key factors for high-traffic environments. With-lid vending cups are expanding in cold drink and specialty vending formats, particularly where spill prevention and mobility are required. Growing demand for vending machines in workplaces, public facilities, and retail environments continues to reinforce the strong adoption of standard open-top cups across global vending ecosystems.

Key Growth Drivers

Expansion of Automated Beverage Vending Infrastructure

The rapid expansion of automated beverage vending infrastructure across corporate offices, transit stations, educational institutions, and quick-service retail locations remains a primary driver for the vending cups market. As organizations modernize refreshment services, hot and cold drink vending machines are being deployed to enhance convenience, reduce labor dependencies, and ensure consistent beverage quality. This shift encourages higher consumption of single-use cups designed for automated dispensing systems. Additionally, rising adoption of smart vending machines equipped with touchless dispensing, cashless payment systems, and IoT-enabled monitoring increases beverage throughput, thereby accelerating cup demand. Growth in self-service food and beverage ecosystems particularly in airports, hospitals, and co-working spaces further boosts usage volumes. The market benefits from manufacturers improving cup machinability, heat insulation, and stacking precision to ensure uninterrupted vending performance. As consumer expectations for quick, hygienic, and on-the-go beverage access continue to rise, vending cups gain sustained traction.

Rising Consumption of On-the-Go Beverages

Changing consumer lifestyles and increased preference for on-the-go consumption significantly support demand for vending cups. Busy work environments, growing urban mobility, and longer commute times have amplified reliance on quick-serve beverage points, including coffee vending machines placed in office corridors, shopping complexes, and service stations. Hot beverages such as tea, espresso, and specialty coffee drive steady weekday usage, while cold beverages and flavored drinks contribute to higher off-peak and weekend demand. The increasing penetration of micro-markets and unattended retail outlets further reinforces the trend, as these setups depend on single-serve, ready-to-consume formats. As beverage vendors introduce premium offerings such as organic coffee, energy drinks, and health-focused beverages, vending cups become an integral part of product delivery. This shift toward convenience-driven consumption continues to position vending cups as an essential packaging format in evolving retail and workplace beverage ecosystems.

- For example, Costa Coffee’s Express smart kiosks operate more than 12,000 installations worldwide and deliver barista-style beverages using automated grinding, extraction, and milk-frothing systems. The platform uses standardized cup formats in the 9–12 oz range to maintain consistent drink dosing across all deployed units.

Growing Shift Toward Hygienic and Single-Use Dispensing Solutions

Heightened hygiene awareness is driving greater reliance on single-use vending cups, particularly in shared and high-traffic environments. Corporations, transportation hubs, and healthcare facilities prioritize hygienic beverage delivery solutions that minimize contamination risks and eliminate the need for reusable shared cups. Vending cups meet these expectations by offering standardized, tamper-resistant, and contact-free dispensing compatibility. This shift is further supported by advancements in manufacturing technologies such as improved polymer sterilization, food-safe paper coatings, and dust-free packaging lines that ensure cleanliness from production to machine loading. The trend is notably strong in regions with strict public health protocols and in sectors where beverage vending complements large workforce operations. As consumers increasingly associate single-use cups with safety, convenience, and assurance of food-grade quality, demand continues to grow across both hot and cold beverage vending setups.

- For example, Huhtamaki’s ShieldPlus technology uses a water-based barrier coating that delivers strong moisture and oxygen resistance without a polyethylene layer. The coating is validated for food-safe protection and supports hygienic single-use dispensing in high-traffic vending locations.

Key Trends & Opportunities

Growing Demand for Sustainable and Eco-Friendly Cup Materials

Sustainability is emerging as a transformative trend, generating major commercial opportunities for manufacturers. With regulatory pressure intensifying on single-use plastics, companies are investing in recyclable PP, eco-friendly paper cups, bioplastic blends, and lightweight PET alternatives that reduce environmental impact. Vending operators are also transitioning toward cups designed for efficient recycling streams, supported by corporate sustainability mandates in workplaces and public facilities. Biodegradable and compostable vending cup formats are gaining interest from commercial establishments looking to enhance their environmental footprint without compromising performance. This trend encourages innovation in advanced barrier coatings, heat-resistant paper substrates, and plant-based polymers tailored for automated vending machines. Manufacturers that can deliver sustainable materials while preserving cup durability, stacking precision, and temperature resistance stand to benefit significantly.

- For example, Stora Enso’s Cupforma Natura Aqua+ uses a water-based dispersion barrier with plastic content below 5%, allowing the board to achieve full fiber recovery in CEPI-aligned recyclability tests. Its design supports high-volume cup converting for vending and foodservice applications.

Advancements in Cup Design and Functional Performance

Innovations in vending cup design such as improved insulation, ribbed exterior textures, reinforced rims, and anti-jam stacking technologies create new growth opportunities for vendors and manufacturers. As beverage vending machines increasingly handle diverse hot and cold beverages, demand rises for cups with enhanced temperature tolerance, superior grip, and reduced deformation. Lightweight material engineering enables cost savings without compromising structural integrity, while new surface treatments improve printing quality and brand visibility. Automated dispensing compatibility remains central, prompting manufacturers to refine uniformity in cup dimensions, cup wall thickness, and nesting properties. The integration of smart branding features such as QR codes, promotional prints, or loyalty-enabled labeling also opens avenues for marketing-driven vending formats. These advancements position vending cups as premium, value-enhancing components in modern beverage service environments.

- For instance, Dart Container’s ThermoGuard® insulated paper cups use a double-wall structure with an internal air gap that delivers up to 40% better heat insulation than standard single-wall paper cups, based on Dart’s comparative performance tests. The design keeps beverages hot while keeping the outer surface cool enough to hold, removing the need for sleeves or double-cupping.

Increasing Penetration of Unattended Retail and Smart Vending Ecosystems

The shift toward smart vending ecosystems supported by IoT connectivity, AI-enabled demand forecasting, and contactless interfaces presents considerable opportunities for cup manufacturers. As unattended retail expands across workplaces, schools, residential complexes, and hospitality settings, beverage vending becomes more efficient, reliable, and accessible. This growth boosts cup consumption, especially in locations operating 24/7. The integration of cloud-managed beverage dispensing, automated refill alerts, and dynamic beverage programming accelerates machine uptime, increasing daily drink throughput. These environments require vending cups with superior compatibility, reduced defect rates, and consistent dimensional precision. Manufacturers supplying high-quality, machine-optimized cups stand to gain competitive advantage as smart retail networks scale globally.

Key Challenges

Environmental Regulations and Recycling Limitations

Stringent regulations on single-use plastics pose a significant challenge for vending cup manufacturers, particularly those relying heavily on PP and foam materials. Many regions are implementing restrictions, extended producer responsibility (EPR) rules, and penalties targeting non-recyclable cup formats. Even where recycling infrastructure exists, contamination and sorting limitations often prevent vending cups from being effectively recycled, reducing material recovery rates. This regulatory pressure forces manufacturers to transition toward sustainable materials, which often require higher production costs and additional testing for vending machine compatibility. Balancing performance, cost, and compliance becomes a complex operational challenge, especially for suppliers serving multiple regions with differing regulatory frameworks.

Volatile Raw Material Prices and Supply Chain Constraints

Fluctuations in raw material prices particularly polymers, paper pulp, and specialty coatings create substantial cost pressures for vending cup producers. Polypropylene and PET markets often experience price volatility due to crude oil fluctuations, geopolitical uncertainties, and refinery output variations. Meanwhile, global paper supply chains remain sensitive to fiber shortages, transportation bottlenecks, and seasonal production constraints. These factors directly impact manufacturing margins and force companies to frequently adjust pricing for vending operators. Additionally, maintaining consistent material quality amid fluctuations becomes challenging, as even slight variations can disrupt vending machine performance. Managing supply chain risks while ensuring uninterrupted product availability remains a core challenge for industry stakeholders.

Regional Analysis

North America

North America accounts for 24% of the vending cups market, driven by strong adoption of automated beverage vending systems across corporate offices, universities, transportation hubs, and healthcare facilities. The U.S. leads consumption due to high penetration of coffee vending machines and expanding micro-market formats in workplaces. Demand for insulated PP and recyclable paper cups continues to rise as operators modernize machine fleets and prioritize hygienic, single-serve beverage dispensing. Sustainability regulations particularly in several U.S. states and Canada are accelerating the shift toward recyclable and compostable cup formats, supporting innovation in advanced material solutions.

Europe

Europe represents 27% of global market share, supported by mature vending machine networks and strict environmental regulations that promote rapid adoption of recyclable paper and bioplastic vending cups. Countries such as Germany, Italy, France, and the U.K. maintain strong institutional vending demand across offices, public buildings, and transportation systems. The region’s emphasis on circular economy policies is encouraging manufacturers to transition from traditional plastics to sustainable materials optimized for automated dispensing. Expansion of workplace coffee culture, along with technological upgrades in vending infrastructure, continues to strengthen cup consumption across both hot and cold beverage segments.

Asia-Pacific

Asia-Pacific leads the market with 38% share, driven by large-scale urbanization, expanding commercial infrastructure, and increasing installation of beverage vending machines in malls, metro stations, airports, and corporate parks. China, Japan, and South Korea dominate demand, supported by high consumer preference for automated beverage services and strong adoption of smart vending ecosystems. The region’s growing quick-service retail sector contributes to rising consumption of PP and PET cups, while sustainability policies in Japan and Australia encourage uptake of recyclable paper and bioplastic alternatives. Rapid expansion of unattended retail formats further accelerates volume growth.

Latin America

Latin America holds 6% of the market, supported by growing adoption of vending solutions in corporate workplaces, universities, and hospitality environments. Brazil, Mexico, and Chile lead demand as beverage vending becomes integrated into modern retail and transportation facilities. The region increasingly prefers cost-efficient plastic vending cups, though interest in paper and recyclable formats is rising in response to emerging environmental regulations. Expanding coffee culture and rising consumption of ready-to-drink beverages strengthen vending cup usage, while improved supply chain access to imported vending equipment supports market expansion across urban commercial zones.

Middle East & Africa

The Middle East & Africa region accounts for 5% of global share, driven by expanding commercial development in the Gulf states and increasing installation of beverage vending machines in airports, business centers, universities, and hospitality venues. The UAE and Saudi Arabia dominate consumption, supported by strong café culture and high demand for on-the-go beverages. Plastic cups remain the primary choice due to cost efficiency and heat resistance for tea and coffee vending. However, sustainability initiatives in the UAE, South Africa, and Qatar are gradually creating opportunities for recyclable paper and bioplastic vending cup formats.

Market Segmentations:

By Capacity

- Less than 7 Oz.

- 7 Oz. to 9 Oz.

- 10 Oz. to 12 Oz.

- More than 12 Oz.

By Material Type

- Plastic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyamide (PA)

- Bioplastics

- Polyethylene Terephthalate (PET)

- Others

- Paper

- Foam

By Product Type

- With Lid Vending Cups

- Without Lid Vending Cups

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vending cups market is characterized by a mix of global packaging manufacturers, regional converters, and specialized vending cup suppliers competing on material innovation, product consistency, and compatibility with automated dispensing systems. Leading companies focus on enhancing cup durability, heat resistance, and dimensional precision to minimize jamming issues in vending machines. Sustainability has become a key differentiator, with major players investing in recyclable PP, coated paper, and emerging bioplastic formulations to meet regulatory expectations across Europe and North America. Manufacturers increasingly leverage lightweight engineering and high-speed molding technologies to optimize production efficiency and reduce material usage. Strategic partnerships with vending machine OEMs, office coffee service providers, and foodservice distributors strengthen market presence and ensure long-term supply contracts. In emerging markets, local producers gain traction by offering cost-effective plastic and paper alternatives tailored to regional vending requirements. As environmental policies tighten, innovation in eco-friendly materials is expected to intensify competitive rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dispo International Ltd.

- SwissPrime Pack AG

- New WinCup Holdings Inc.

- RPC Tedeco-Gizeh Ltd.

- Graphic Packaging International LLC

- Hosti GmbH

- MPM Marketing Services Pty Ltd.

- Nupik-Flo UK Ltd.

- Huhtamaki Oyj

- Benders Paper Cups

Recent Developments

- In November 2025, Graphic Packaging inaugurated a new recycled-paperboard production facility in Waco, Texas, described as “the most advanced, efficient and high-quality recycled paperboard platform in North America.” This strengthens its capacity to supply paper-based vending hot and cold cups that meet sustainability standards.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Material type, Product type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for vending cups will rise as workplaces, transport hubs, and public facilities expand automated beverage vending networks.

- Manufacturers will increase adoption of recyclable PP, coated paper, and bioplastic materials to meet tightening sustainability regulations.

- Precision-engineered cup designs with improved stackability and anti-jam performance will become standard for next-generation vending machines.

- Smart vending ecosystems with touchless dispensing and IoT connectivity will drive higher consumption of single-serve cups.

- Lightweight material engineering will accelerate to reduce production costs while maintaining structural integrity.

- Paper-based vending cups will grow rapidly as brands and operators pursue low-carbon packaging goals.

- Greater customization opportunities will emerge through branded prints, QR codes, and promotional cup designs.

- Regional suppliers will strengthen their presence by offering cost-effective, machine-compatible cup formats.

- Innovation in heat-resistant coatings and multi-layer paper structures will enhance performance for hot beverages.

- Partnerships between vending machine OEMs and cup manufacturers will intensify to ensure compatibility and reliable dispensing.