Market Overview:

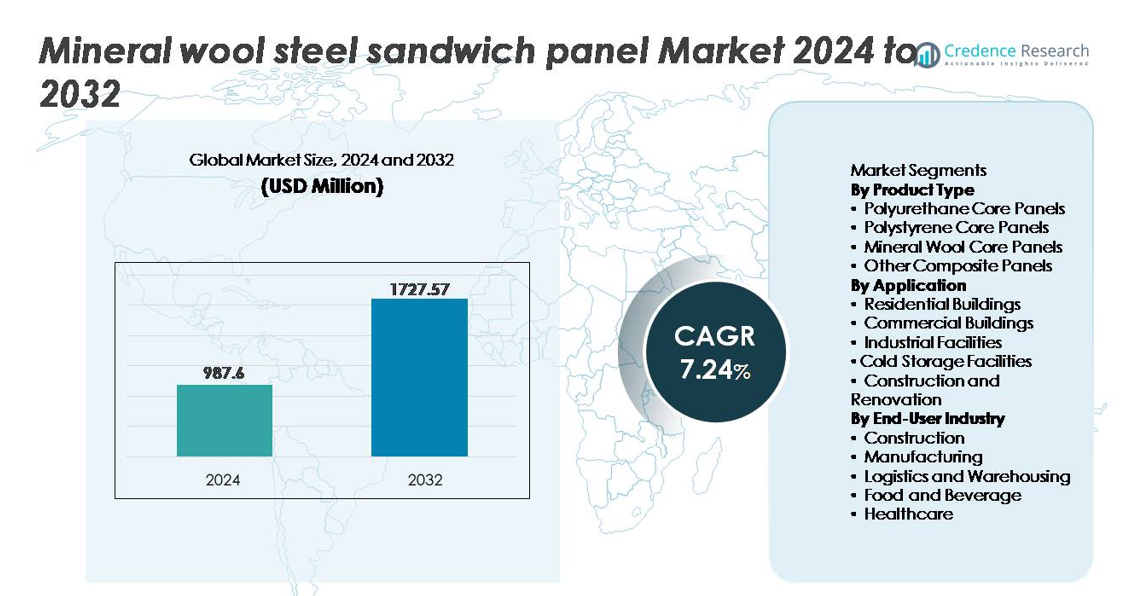

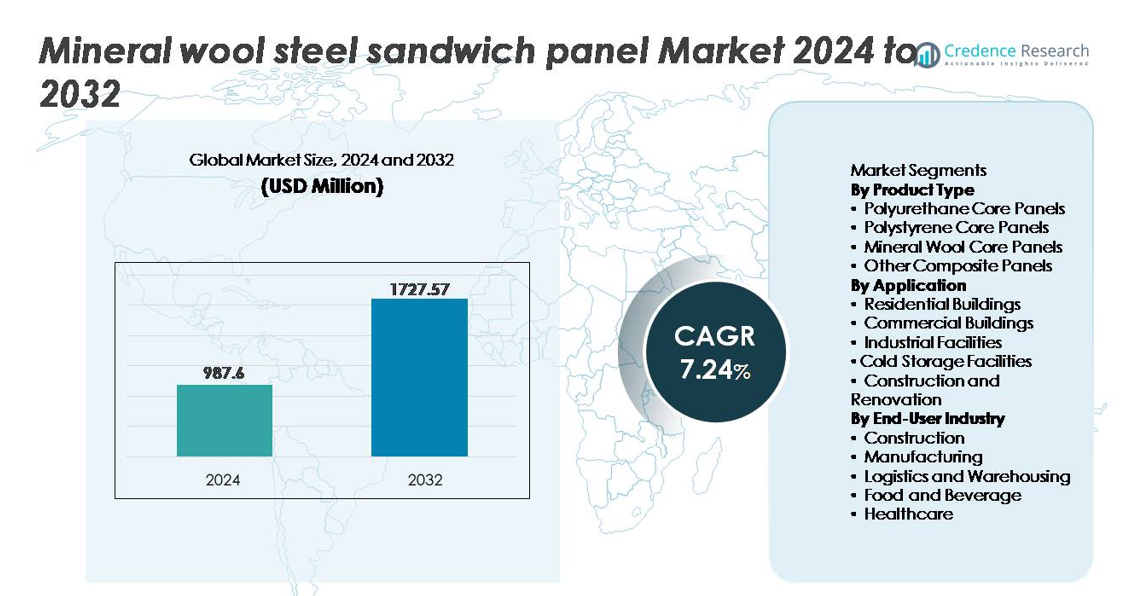

The global mineral wool steel sandwich panel market was valued at USD 987.6 million in 2024 and is projected to rise to USD 1,727.57 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.24% throughout the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mineral Wool Steel Sandwich Panel Market Size 2024 |

USD 987.6 million |

| Mineral Wool Steel Sandwich Panel Market, CAGR |

7.24% |

| Mineral Wool Steel Sandwich Panel Market Size 2032 |

USD 1,727.57 million |

The competitive landscape of the mineral wool steel sandwich panel market features a strong mix of global and regional manufacturers, including Manni Group, Knauf, Balex Metal, Paroc Group, Tata Steel Ltd, Isomec Srl, Johns Manville, ArcelorMittal, Building Component Solutions LLC, Metecno Group, and Kingspan Group. These companies compete through advancements in insulation performance, fire resistance ratings, and modular construction compatibility. Europe remains the leading regional market with approximately 34% market share, supported by stringent building safety regulations, energy-efficiency initiatives, and accelerated renovation of aging infrastructure. Market leaders leverage product certification, lifecycle value, and tailored solutions for logistics, industrial, and commercial applications to reinforce their positioning and expand regional footprints.

Market Insights:

- The mineral wool steel sandwich panel market was valued at USD 987.6 million in 2024 and is projected to reach USD 1,727.57 million by 2032, registering a CAGR of 7.24% during the forecast period.

- Market growth is driven by rising fire-safety regulations, energy-efficient building standards, and rapid expansion of warehousing, cold storage, and industrial infrastructure supporting temperature and noise control requirements.

- Key trends include widespread adoption of prefabricated and modular construction, recyclable insulation materials, and panel designs aligned with ESG goals and lifecycle performance certifications.

- Competitive activity intensifies as global and regional players enhance production capacity, optimize costs, and introduce environmentally compliant panel systems, while fluctuating steel prices and cost-sensitive procurement act as restraints.

- Europe leads with 34% market share, followed by North America at 28% and Asia-Pacific at 27%, with mineral wool core panels holding the dominant segment position due to superior fire protection and thermal insulation properties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Mineral Wool Core Panels lead the market, accounting for the largest share due to their superior fire resistance, acoustic insulation capability, and thermal performance favorable for building envelope applications. Stringent fire safety regulations in commercial and industrial construction continue to accelerate adoption, particularly in high-occupancy infrastructure. Polyurethane core panels remain a strong contender driven by lightweight properties and enhanced durability, especially for large-span structures. Polystyrene core panels retain relevance for cost-sensitive projects, while advanced composite panels gain traction as manufacturers innovate hybrid materials with improved load-bearing and energy-efficiency attributes.

- For instance, Paroc Panel System’s stone-wool panels are certified up to REI 240 fire resistance, supporting four-hour integrity and insulation in tested configurations and achieving smoke classifications Sa and S200 for smoke-tight installations.

By Application

Commercial Buildings represent the dominant application segment, capturing the highest market share owing to the growing demand for insulated façades, roofing, and internal partitioning in offices, retail centers, and hospitality structures. Developers favor mineral wool steel sandwich panels for multi-story commercial projects due to compliance with thermal codes and fire-rated performance standards. Cold storage facilities are an expanding sub-segment, fueled by rising pharmaceutical logistics, food preservation demand, and refrigerated distribution networks. Meanwhile, residential and renovation projects benefit from quick installation capabilities, reduced structural load, and long-term energy savings.

- For instance, Paroc Panel System’s non-loadbearing mineral-wool wall panels are certified up to EI 240, providing four-hour fire integrity and insulation suitable for multi-story commercial assets requiring enhanced safety compliance in fire compartmentation.

By End-User Industry

The Construction industry holds the largest share among end users, supported by urban infrastructure expansion, industrial building upgrades, and adoption of high-efficiency envelope systems in sustainable construction initiatives. Manufacturing facilities increasingly specify mineral wool core panels to improve worker safety and noise control, aligning with productivity and compliance objectives. Logistics and warehousing demonstrate rapid uptake as insulated cladding improves temperature stability for e-commerce distribution. The food and beverage and healthcare sectors further drive demand for hygienic, moisture-resistant modular panel systems suitable for controlled environments and cleanroom-grade interiors.

Key Growth Drivers:

Increasing Emphasis on Fire Safety Compliance and Building Code Regulations

Growing prioritization of fire-resistant construction materials stands as a major growth driver for mineral wool steel sandwich panels. National and regional construction codes increasingly mandate high fire ratings for building envelopes in high-density urban settings, commercial complexes, and industrial facilities. Mineral wool cores deliver superior fire resistance, low flame spread, and high thermal stability, making them a preferred solution for protection-critical environments. Insurance premiums and audit risks associated with fire incidents further push stakeholders toward non-combustible insulation panels, replacing legacy polyurethane and polystyrene alternatives. Government-backed upgrades in public infrastructure-airports, rail terminals, hospitals, and educational institutions-are also reinforcing demand. In addition, industries such as manufacturing, warehousing, and data centers rely on passive fire prevention measures to mitigate equipment loss and operational downtime. As safety compliance shapes procurement, market penetration rises through retrofit programs and replacement cycles. The resulting regulatory convergence globally solidifies the long-term adoption trajectory for mineral wool steel sandwich panels in new builds and renovations.

- For instance, Paroc Panel System’s stone-wool solutions are independently certified to REI 240, confirming up to 240 minutes of fire resistance in tested assemblies, supporting increasingly stringent commercial and industrial safety requirements.

Drive Toward Energy Efficiency and Reduction of Operational Carbon Footprints

The global shift toward net-zero construction and rising energy costs propel the adoption of mineral wool steel sandwich panels due to their superior insulation properties and ability to enhance building thermal performance. Industrial and commercial structures-particularly logistics hubs, distribution warehouses, and food processing units-seek energy savings from roofs and façades that reduce heating and cooling demands in climate-sensitive regions. Sustainability certifications such as LEED and BREEAM reward envelope insulation upgrades, improving asset value and lease attractiveness. Governments are launching tax incentives, carbon taxation models, and efficiency rebate programs that stimulate investment into high-performance construction materials. As operational emissions account for a significant share of building lifecycle carbon, energy-efficient panels offer measurable ROI in reduced utility expenditure. Rapid growth in cold chain infrastructure and temperature-controlled storage reinforces this driver, as mineral wool solutions help maintain stability across diverse temperature ranges while lowering refrigeration loads.

- For instance, Knauf Insulation’s newly announced low-carbon rock mineral wool facility in North Wales is planned to have an annual production capacity exceeding 100,000 tonnes, which will support large-scale supply for energy-efficient building envelopes once it becomes operational in late 2027.

Expansion of Industrial and Logistics Infrastructure Fueled by Manufacturing and E-Commerce Growth

The acceleration of advanced manufacturing, automation hubs, and warehousing expansion significantly contributes to rising demand for prefabricated mineral wool steel sandwich panel systems. The surge in omnichannel retailing and e-commerce has triggered a global wave of distribution center development requiring large-span structures with efficient modular envelopes. Mineral wool panels provide rapid construction timelines, structural rigidity, and low maintenance, meeting investor preferences for faster commissioning and controlled cost cycles. Industrial clusters and special economic zones continue to prioritize durable building components capable of mitigating noise, vibration, and thermal loss. In sectors handling hazardous materials or high heat-metalworking, pharmaceuticals, and chemicals-mineral wool’s fire and acoustic properties align with occupational safety initiatives. Furthermore, logistics operators favor solutions enabling future expansion or space reconfiguration, reinforcing the appeal of modular panelized construction. Combined with foreign investments in manufacturing corridors, this infrastructure boom represents a sustained market catalyst.

Key Trends & Opportunities:

Growing Adoption of Prefabricated and Modular Construction Methods

The rise of off-site manufacturing and modular project execution presents a compelling opportunity for mineral wool steel sandwich panels. Construction firms increasingly adopt prefabrication to reduce labor dependency, address skilled worker shortages, and shorten onsite build timeframes-particularly in urban markets with high installation constraints. Panels integrated into volumetric modules and hybrid structural frames enable predictable project outcomes, reduced wastage, and cleaner site operations. Government initiatives supporting industrialized construction, affordable housing, and social infrastructure further accelerate demand. Manufacturers exploring panel customization-surface textures, antimicrobial coatings, color finishes, and PV-ready integration-expand application versatility. The compatibility of mineral wool panels with modular cold storage units and retrofit building shells unlocks value in pharmaceutical, food logistics, and quick-service restaurant sectors. As developers pursue repeatable design templates and scalable construction models, the opportunity for large-volume, factory-fabricated mineral wool panels strengthens.

- For instance, Manni Group’s Isopan modular façade systems can be produced in factory-controlled lines exceeding 13 million square meters of annual panel output across its international production centres, effectively supporting high-volume modular construction pipelines.

Innovation in Sustainable Materials, Circular Design, and Recyclable Panel Systems

Sustainability-driven innovation is reshaping product development, opening new market avenues for circular mineral wool steel sandwich panel systems. Manufacturers are exploring recycled steel facings, lower-carbon binders, and reclaimed mineral fiber compositions to reduce embodied emissions. End-of-life strategies involving mechanical separation of metal and wool fibers support recyclability and align with extended producer responsibility frameworks. Corporate ESG reporting pushes companies toward transparent supply chains and sustainable procurement policies that favor non-combustible, long-life building components. Opportunities emerge in green building retrofits as governments fund carbon-neutral public facilities and incentivize envelope efficiency improvements. Additionally, façade renovation programs targeting aging commercial buildings present a large addressable market for recyclable panel solutions that enhance insulation without structural overhaul. These material and lifecycle innovations position mineral wool panels as an integral component of circular construction pathways.

- For instance, Knauf Insulation has committed to using over 65% recycled cullet (recycled glass) in its glass mineral wool production and plans to achieve zero waste to landfill from its mineral wool and wood-wool plants by 2025, feeding all production scrap back into reuse cycles.

Key Challenges:

Fluctuating Raw Material Costs and Supply Chain Pressures

Volatility in steel pricing and variations in mineral wool production costs present a major challenge to manufacturers and contractors. Since steel constitutes a significant portion of overall panel cost, disruptions caused by geopolitical tensions, energy price fluctuations, and import dependency directly impact project budgets and bidding competitive dynamics. Logistics constraints and extended lead times further complicate large-scale project planning, especially in markets distant from production hubs. Smaller contractors face difficulties in managing price escalation clauses, potentially delaying procurement decisions. Long-term contracts become difficult to negotiate without buffer pricing mechanisms, impacting margin stability for producers. Managing these cost pressures requires strategic sourcing, localizing supply chains, and capacity expansion-yet these measures demand capital-intensive investments that not all market participants can mobilize.

Intense Market Competition and Product Substitution Risks

The mineral wool steel sandwich panel market faces competitive pressure from polyurethane and polystyrene core alternatives in cost-sensitive regions and applications where fire resistance is not the primary concern. Manufacturers dealing in lower-cost panels often target price-driven procurement models, which challenges the expansion of premium mineral wool products. In markets with evolving but not yet stringent fire regulations, substitution risk remains high. Moreover, differentiated branding is limited as panel performance often appears homogenous to buyers, reducing perceived value. New entrants offering hybrid insulated panel systems also intensify competition. To mitigate these risks, industry players must invest in product testing, certification, application-specific engineering support, and education campaigns targeting architects, builders, and compliance officials to demonstrate lifecycle advantages.

Regional Analysis

North America

North America holds a significant share of the mineral wool steel sandwich panel market, accounting for approximately 28%, driven by strong adoption in commercial real estate, industrial construction, and temperature-controlled warehousing. Stringent fire codes-especially in the United States-accelerate replacement of combustible insulation systems in manufacturing and distribution facilities. Growth in e-commerce fulfillment centers and cold storage infrastructure further supports demand. Canada’s energy-efficient building mandates also encourage insulated panel use for envelope performance enhancements. Retrofit projects across retail, logistics, and educational campuses reinforce recurring consumption, supported by sustainable construction incentives and modernization initiatives across the region.

Europe

Europe leads the global market with around 34% share, underpinned by advanced building regulations, high fire protection standards, and rapid adoption of circular construction materials. The region’s focus on decarbonization and energy-efficiency retrofits drives demand for high-performance mineral wool panels in industrial and commercial façades. Germany, Italy, France, and the Nordics represent major consumption clusters due to infrastructure upgrades and prefabricated construction trends. The renovation of aging public assets and industrial facilities presents continued opportunities. EU directives on embodied carbon, recyclable materials, and life-cycle assessment influence procurement specifications, supporting long-term market stability.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional segment and accounts for approximately 27% of the market share, fueled by rapid industrialization, logistics network expansion, and increasing cold chain investments across China, India, and Southeast Asia. Urban commercial development and new manufacturing corridors stimulate consumption of fire-resistant modular panels. Rising awareness of building safety standards and the introduction of energy-efficiency norms contribute to accelerated adoption. Foreign direct investments into industrial parks, data centers, and warehouse clusters create sustained demand. Competitive pricing advantages due to regional manufacturing capacity also improve penetration across cost-sensitive markets.

Latin America

Latin America captures about 6% of the market share, with growth supported by expanding industrial and food processing facilities, particularly in Brazil, Mexico, and Chile. Adoption is accelerating in logistics infrastructure and cold storage development serving export-oriented agriculture and pharmaceuticals. Although regulatory enforcement varies, gradual tightening of workplace safety standards and fire-resistant building requirements enhances demand for mineral wool core solutions. Market growth is moderated by fluctuating currency valuations and construction investment cycles, yet opportunities persist through modernization programs, free-trade industrial zones, and rising interest in prefabricated buildings for remote or rapidly constructed projects.

Middle East & Africa

The Middle East & Africa region accounts for roughly 5% of the market share, driven by industrial construction, energy sector infrastructure, and healthcare expansion in GCC countries. Fire-resistant insulated panels are increasingly specified for oil and gas sites, warehousing, and cold storage supporting food security initiatives. Large-scale hospitality and commercial developments, especially in the UAE and Saudi Arabia, incorporate durable façade systems with thermal benefits suited for extreme climate conditions. Africa’s adoption remains gradual, limited by affordability constraints, but growing interest in modular builds and donor-funded infrastructure creates potential for future penetration.

Market Segmentations:

By Product Type

- Polyurethane Core Panels

- Polystyrene Core Panels

- Mineral Wool Core Panels

- Other Composite Panels

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Cold Storage Facilities

- Construction and Renovation

By End-User Industry

- Construction

- Manufacturing

- Logistics and Warehousing

- Food and Beverage

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mineral wool steel sandwich panel market is moderately consolidated, with a mix of global manufacturers and regional specialists competing through product performance, certification standards, and cost efficiency. Leading players focus on enhancing fire protection capabilities, thermal insulation values, and acoustic performance to comply with evolving regulatory frameworks and high-performance building envelopes. Companies invest in automated production lines, recyclable panel architectures, and customization in surface textures and coatings to differentiate within commercial and industrial applications. Strategic partnerships with contractors, modular construction firms, and logistics developers strengthen market presence, while supply chain localization becomes increasingly critical in pricing-sensitive regions. Competitors also emphasize lifecycle value propositions-longevity, low maintenance, and retrofit suitability-to appeal to end users prioritizing operational cost optimization. As substitution risks persist from lower-cost core materials, market leaders leverage certification, testing credentials, technical advisory services, and sustainability transparency to secure specification-based procurement advantages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Manni Group

- Knauf

- Balex Metal

- Paroc Group

- Tata Steel Ltd

- Isomec Srl

- Johns Manville

- ArcelorMittal

- Building Component Solutions LLC

- Metecno Group

Recent Developments:

- In January 2025, Balex Metal introduced a new product line “MW Fire” – a mineral-wool core sandwich panel aimed at improved fire safety compliance.

- In December 2024, Paroc Panel System successfully passed smoke-permeability testing for its stone-wool sandwich panels, underlining compliance with fire and safety standards.

- In May 2024, Knauf Insulation opened a new low-carbon rock-mineral-wool factory, expanding capacity and emphasizing sustainability for sandwich-panel insulation supply.

Report Coverage:

The research report offers an in-depth analysis based on Product type, Application, End-User industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption will accelerate as governments tighten fire-safety regulations and incentivize non-combustible building materials.

- Energy-efficient construction standards will drive increased demand for superior thermal insulation panel systems.

- Modular and prefabricated construction will expand market penetration across commercial, logistics, and residential sectors.

- Manufacturers will innovate lighter, stronger, and recyclable core-steel combinations to support circular construction.

- Digital configuration and BIM-integrated panel selection will streamline design and approval processes.

- Cold chain and pharmaceutical storage development will sustain demand for temperature-stable insulated panels.

- Retrofitting of aging industrial and commercial buildings will create a recurring replacement market.

- Localization of production facilities will reduce supply chain risk and enhance price competitiveness.

- Competitive differentiation will shift toward lifecycle cost, warranty, and sustainability transparency.

- New applications in data centers, cleanrooms, and controlled-environment manufacturing will offer emerging revenue streams.