Market Overview:

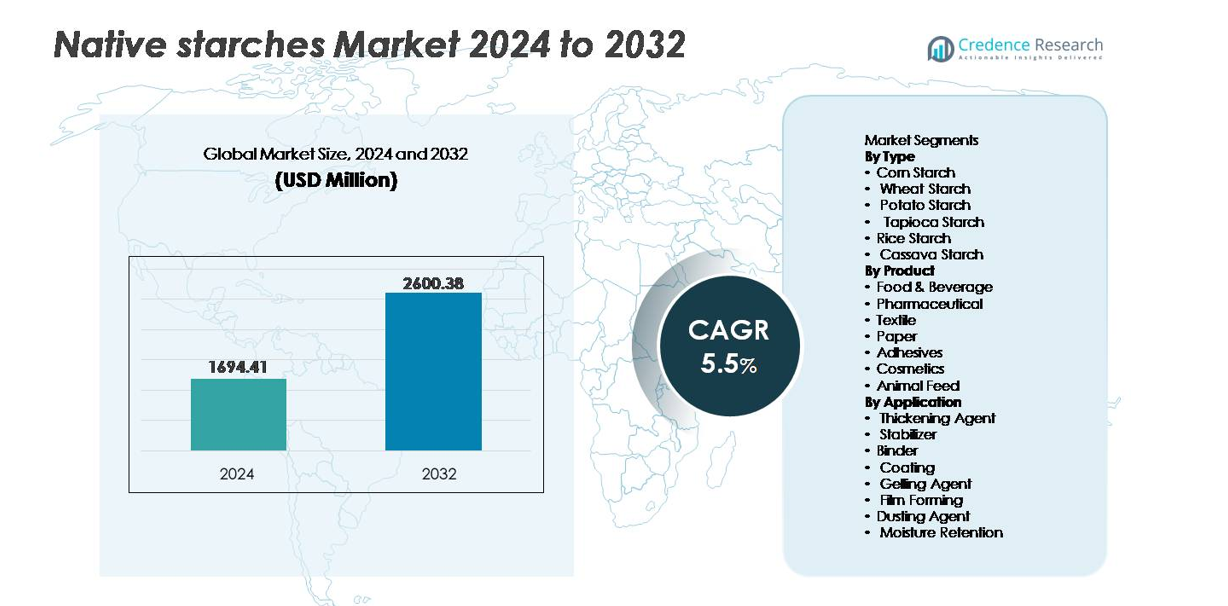

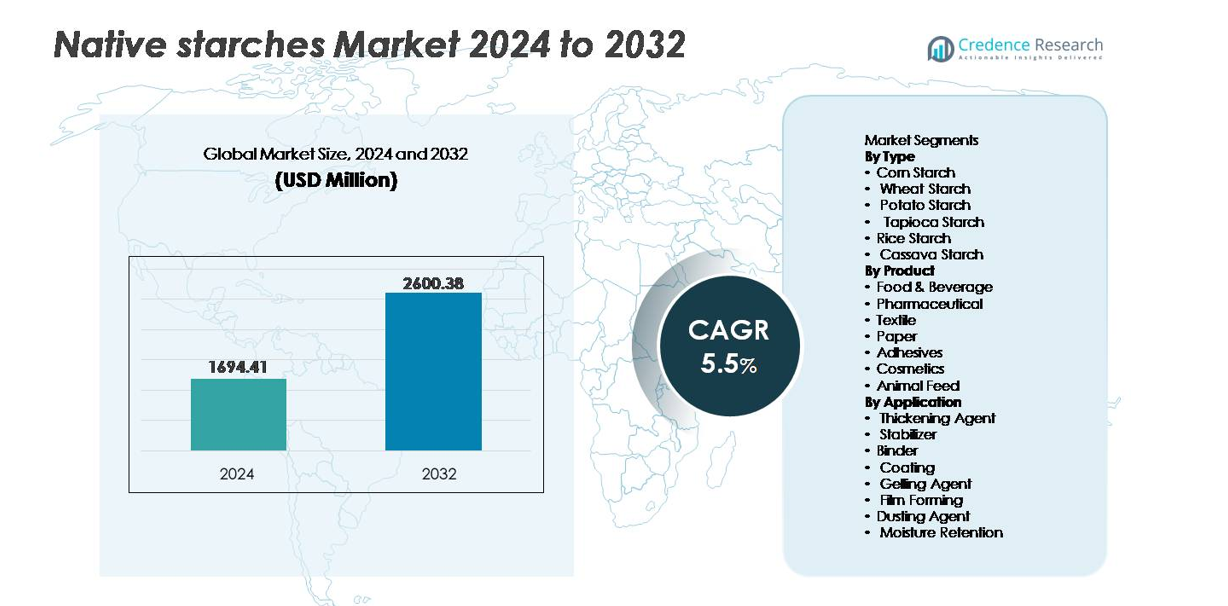

The global native starches market was valued at USD 1,694.41 million in 2024 and is projected to reach USD 2,600.38 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Native Starches Market Size 2024 |

USD 1,694.41 million |

| Native Starches Market, CAGR |

5.5% |

| Native Starches Market Size 2032 |

USD 2,600.38 million |

The native starches market is characterized by strong global participation, with leading companies such as Cargill, Tate & Lyle, Avebe, Archer Daniels Midland Company, Sudzucker Group, Emsland Group, Roquette Freres, Agrana Beteiligungs-AG, Ingredion, and Grain Processing Corporation actively expanding production capabilities and application-specific portfolios. Asia-Pacific leads the market with approximately 34% share, driven by abundant cassava and corn processing and rising consumption of convenience foods. North America follows closely, supported by advanced corn refining infrastructure and demand for clean-label formulations across food and industrial applications. Europe remains a key contributor, leveraging strong wheat and potato starch processing clusters aligned with sustainability-driven packaging and specialty ingredient development.

Market Insights:

- The global native starches market was valued at USD 1,694.41 million in 2024 and is projected to reach USD 2,600.38 million by 2032, expanding at a CAGR of 5.5% during the forecast period.

- Demand is driven by clean-label adoption, plant-based nutrition, and replacement of chemically modified additives across bakery, snacks, dairy, and ready-meal applications.

- Emerging trends include growth of starch-based biopolymers, biodegradable packaging, and functional native starches engineered for improved stability and freeze-thaw performance.

- The market remains moderately fragmented with competition focused on sourcing efficiencies, innovation in non-modified functional products, and expanding industrial applications beyond food.

- Asia-Pacific holds approximately 34% share, followed by North America at 32% and Europe at 28%, while the food and beverage segment accounts for the largest share across applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Corn starch holds the dominant share in the native starches market due to its abundant availability, cost-effective production, and preferred functionality in bakery, confectionery, and beverage formulations. Its strong gelling, sweetening, and thickening properties support extensive application across snack processing and ready-to-eat foods. Wheat starch follows as a notable contributor, driven by its rising role in plant-based meat and noodle production. Potato and tapioca starches gain traction for gluten-free, clean-label claims, while cassava and rice starch remain niche options in infant nutrition and premium specialty foods, particularly in emerging markets.

- For instance, Cargill’s joint corn-milling facility commissioned in 2025 in Madhya Pradesh operates with an initial processing capacity of 500 tonnes per day, scalable to 1,000 tonnes per day, reinforcing industrial supply consistency.

By Product

The food and beverage segment accounts for the largest share, driven by its extensive usage as a thickening, stabilizing, and texturizing ingredient across sauces, dairy desserts, soups, and bakery applications. Demand rises in natural and additive-free products, leveraging native starches as clean-label replacements for modified starches and synthetic additives. Pharmaceuticals emerge as the fastest-growing product segment owing to expanding usage in tablet binding and controlled-release excipients. Adhesives, textile, and paper industries continue to adopt native starches due to biodegradability and reduced production costs compared to petroleum-based adhesives and synthetic binders.

- For instance, The Emsland Group processes approximately 2 million tonnes of raw materials(potatoes and peas) annually across all its facilities to produce a wide range of products, including starches, proteins, and fibers for various industries like food, construction, and adhesives.

By Application

Thickening agents dominate the application landscape, supported by widespread use in gravies, sauces, dressings, soups, and dairy products requiring viscosity and mouthfeel enhancement. The stabilizer and binder categories demonstrate strong momentum across pharmaceuticals, bakery, and ready meal production as manufacturers prioritize consistent structure without chemical additives. Film-forming and coating applications gain attention for edible coatings in fruits, confectionery glazes, and biodegradable packaging solutions. Moisture retention and dusting functions remain essential in meat processing, bakery handling, and industrial molding, reflecting rising demand for natural processing aids and sustainability-driven material innovation.

Key Growth Drivers:

Rising Clean Label Adoption and Shift Toward Natural Ingredients

The preference for clean-label, non-GMO, and naturally sourced ingredients strongly accelerates demand for native starches. Consumers increasingly reject synthetic additives and chemically modified ingredients, prompting product reformulation across bakery, snacks, confectionery, beverages, and ready meals. Native starches provide desirable viscosity, texture, and mouthfeel without chemical processing, aligning with evolving health and transparency expectations. Accelerated regulatory scrutiny on modified additives in North America, Europe, and parts of Asia reinforces the advantage of native starches as compliant alternatives. Furthermore, brands in premium food segments highlight “natural starch” claims to enhance label appeal and brand differentiation. This trend extends to gluten-free and reduced-fat formulations, where native starches function effectively in structure, elasticity, and binding without artificial stabilizers. As sustainability-conscious consumers and regulatory frameworks converge, the adoption curve continues to expand into organic, plant-based, infant nutrition, and nutraceutical categories.

- For instance, Tate & Lyle’s CLARIA® line of clean-label starches demonstrated freeze-thaw stability after three full cycles and maintained consistent viscosity and texture in refrigerated dairy fillings stored at 4°C for 12 weeks, supporting performance without chemical modification.

Expanding Industrial Usage Across Packaging, Bio-Based Materials, and Adhesives

Native starches are witnessing accelerated uptake in industrial manufacturing beyond traditional food applications. They are used in paper strengthening, corrugated board adhesives, textile finishing, biopolymer production, and biodegradable packaging solutions, replacing petroleum-derived chemicals. Government-backed initiatives promoting eco-friendly packaging and single-use plastic restrictions drive adoption of starch-based films, foams, and compostable products. The growing cost advantage of bio-based feedstocks supports competitive pricing for industrial starch formulations. Native starches enhance tensile strength, thermal stability, and adhesion quality when blended with other plant-based polymers, making them suitable for bio-composites and molded packaging. Investment in starch-based bioplastics by packaging innovators and chemical companies broadens product applicability. As industries transition toward renewable materials, native starches stand positioned as a foundational component in circular manufacturing models and waste-reducing logistics.

- For instance, NatureWorks – jointly owned by Cargill – operates a biopolymer manufacturing facility with an annual production capacity of 150,000 tonnes of Ingeo™ PLA, derived from plant starch feedstocks and used in compostable films and molded packaging.

Strong Growth in Emerging Markets and Expansion of Agricultural Processing

Rapid urbanization, greater purchasing power, and evolving food consumption patterns in Asia-Pacific, Africa, and Latin America contribute substantially to native starch growth. Local governments are investing in cassava, potato, and corn-processing infrastructure to create value-added export chains and decrease reliance on imported chemicals and food additives. Indigenous crops such as cassava and rice provide cost-effective raw materials for native starch production, enhancing regional self-sufficiency. Domestic snack, dairy, and convenience food manufacturing continues to proliferate, amplifying demand for texturizing and thickening agents. Additionally, rising livestock production drives consistent demand for starch-based binders in feed pellets. As multinational food processors expand operations in emerging economies, supply chain localization strategies further accelerate adoption of native starches, benefiting growers, processors, and downstream producers alike.

Key Trends and Opportunities:

Innovation in Functional Native Starch for Clean Label Performance

A prominent trend involves developing enhanced functional native starch grades that mimic the performance of modified starch without chemical treatment. Advanced milling, enzyme treatment, and physical modification techniques improve thermal tolerance, freeze-thaw stability, and process compatibility. This enables native starches to support retortable soups, bakery fillings, frozen meals, and refrigerated beverages. Growing investment in functional and organic native starch creates new opportunities within low-allergen, vegan, and infant food categories. Manufacturers now position such advanced native starches as premium clean-label solutions capable of replacing synthetic stabilizers and modified variants in demanding food-processing environments.

- For instance, Tate & Lyle’s CLARIA® EVERLAST functional native starch demonstrated viscosity retention after three complete freeze-thaw cycles and maintained texture consistency for 12 weeks at 4°C in dairy-based applications.

Expansion of Starch-Based Biopolymer Applications

The increasing urgency for sustainable materials and carbon reduction unlocks new opportunities for starch-based polymers across packaging, agriculture, construction, and disposable consumer goods. Native starch blends are being developed for biodegradable mulch films, compostable bags, molded containers, and thermoformed trays. Collaboration between chemical producers and packaging firms accelerates commercialization of bio-based resin formulations. Starch’s availability, renewability, and low toxicity provide competitive advantages over fossil-derived polymers. As circular-economy frameworks and extended producer responsibility programs evolve, starch-based biopolymers stand to capture meaningful growth in plastic-alternative materials and recyclable product designs.

- For instance, NatureWorks – a joint venture backed by Cargill – operates a biopolymer manufacturing facility producing 150,000 tonnes of Ingeo™ PLA annually, used globally in food packaging and compostable serviceware.

Key Challenges:

Performance Limitations Compared to Modified Starches and Synthetics

While native starches offer natural labeling advantages, they face constraints in extreme processing conditions. Native starch may break down under high shear, prolonged heat exposure, or acidic environments, resulting in inconsistent texture or viscosity. Freeze-thaw instability limits use in frozen meals, while shelf-life concerns affect processed foods requiring extended stability. Modified starches and synthetic additives often outperform native starches in products requiring durability or clarity, creating adoption barriers in beverages, confectionery fillings, and industrial adhesives. Manufacturers must balance label simplicity with product performance expectations, slowing full-scale substitution.

Raw Material Volatility and Supply Chain Sensitivities

Native starch production depends heavily on agricultural output, exposing the industry to risks related to seasonal variations, climate change impacts, crop disease, and fluctuating commodity prices. Corn, wheat, and potato markets are sensitive to weather disruptions and global trade policies. Competition from alternative uses such as ethanol production or feed consumption often influences input costs. Additionally, logistics challenges and export restrictions complicate cross-border supply availability for food and industrial producers. This cost unpredictability affects contract stability, margins, and investment planning, particularly in price-sensitive markets where substitutes remain accessible.

Regional Analysis:

North America

North America holds approximately 32% market share, driven by strong demand for clean-label ingredients and mature food processing infrastructure. Native starch adoption accelerates in bakery, snacks, and dairy applications, supported by health-conscious consumption patterns and regulatory push against chemically modified additives. Expansion of bio-based adhesives and packaging technologies strengthens the industrial utilization of corn and potato starch. The United States leads production and consumption, benefiting from large-scale corn processing assets and established distribution networks. Continued R&D into functional native starches positions the region as a competitive hub for high-performance, natural formulation solutions.

Europe

Europe accounts for around 28% of the global market, fueled by strict regulatory frameworks favoring natural, non-GMO, and clean-label ingredients. Demand remains concentrated in Germany, France, and the U.K., where food manufacturers prioritize transparent ingredient sourcing and sustainability certifications. The region sees rising deployment of native starches in biodegradable films and recyclable packaging aligned with EU circular economy directives. Wheat and potato starch remain core raw materials due to agricultural abundance and well-developed processing clusters. Growing vegan, gluten-free, and plant-based diets further elevate the use of native starches in imitation dairy, meats, and specialty bakery products.

Asia-Pacific

Asia-Pacific dominates emerging growth and represents approximately 34% of market share, supported by expanding population, urbanization, and rapid growth in convenience food manufacturing. China, India, Thailand, and Vietnam drive cassava, rice, and corn starch production, facilitating cost-effective local sourcing. The region experiences rising adoption in textiles, paper manufacturing, and low-cost adhesives, benefiting from industrialization and export-driven production. Cassava-based native starch continues to gain traction due to crop scalability and local economic programs. In addition, the expansion of modern retail and frozen food categories accelerates native starch utilization as a thickening and stabilizing agent.

Latin America

Latin America holds nearly 4% market share, yet showcases rising potential due to strong agricultural output and increasing cassava and corn processing investments in Brazil and Mexico. Growth is driven by expanding snack food manufacturing and adoption of starch-based binders in animal feed production. Cost competitiveness enables local suppliers to serve export markets, particularly in cassava-derived native starch. However, limited value-added processing infrastructure and price competition from Asian markets present challenges. Sustainability-focused incentives and greater participation in global supply chains may unlock additional opportunities for industrial and food-grade native starch applications.

Middle East & Africa

The Middle East & Africa region accounts for about 2% market share, representing early-stage development driven by rising food processing activity and growing demand for affordable thickening and binding ingredients. South Africa and Egypt lead regional consumption supported by expanding bakery, dairy, and confectionery sectors. Imports dominate supply due to limited starch processing capacity and reliance on foreign agricultural raw materials. Industrial adoption remains modest but increases gradually alongside packaging and paper production. Economic diversification policies and food security initiatives present longer-term opportunities for domestic cassava and corn starch production investments.

Market Segmentations:

By Type

- Corn Starch

- Wheat Starch

- Potato Starch

- Tapioca Starch

- Rice Starch

- Cassava Starch

By Product

- Food & Beverage

- Pharmaceutical

- Textile

- Paper

- Adhesives

- Cosmetics

- Animal Feed

By Application

- Thickening Agent

- Stabilizer

- Binder

- Coating

- Gelling Agent

- Film Forming

- Dusting Agent

- Moisture Retention

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the native starches market is moderately fragmented, featuring a mix of multinational processors, regional agricultural cooperatives, and specialty starch manufacturers competing through product quality, cost efficiency, and application diversification. Leading players emphasize expanding clean-label and functional native starch portfolios to align with natural formulation trends across food, pharmaceutical, and industrial applications. Strategic priorities include crop-specific sourcing advantages-corn in North America, cassava in Southeast Asia, wheat and potato in Europe-to strengthen supply continuity and pricing competitiveness. Companies increasingly invest in physical and enzymatic modification technologies that enhance stability, viscosity, and processing performance without altering clean-label classification. Partnerships with packaging, biopolymer, and adhesive formulators further extend market penetration beyond food. Meanwhile, emerging regional suppliers gain traction by leveraging localized raw material availability, government support for agricultural processing, and cost-effective production for global export markets, intensifying competition across price-sensitive segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill

- Tate & Lyle

- Avebe

- Archer Daniels Midland Company

- Sudzucker Group

- Emsland Group

- Roquette Freres

- Agrana Beteiligungs- AG

- Ingredion

- Grain Processing Corporation

Recent Developments:

- In March 2025, Cargill inaugurated a new corn-milling plant in partnership with Saatvik Agro Processors, expanding its corn-starch supply capacity and strengthening its ability to serve increasing demand for starch and starch-derived ingredients.

- In October 2025, Südzucker reported that its starch segment revenues declined but still contributed to overall group performance, underscoring the company’s continuing reliance on starch operations even under market pressure.

- In April 2024, Tate & Lyle launched a new line of clean-label starches targeted at North American snack and dairy markets, responding to growing consumer demand for natural, label-friendly ingredients.

Report Coverage:

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Native starches will gain wider acceptance as clean-label alternatives continue to outperform modified additives in consumer preference.

- Development of functional native starches will enhance performance for frozen, refrigerated, and heat-processed applications.

- Starch-based biopolymers and packaging materials will create new opportunities in sustainable manufacturing.

- Expansion of plant-based and gluten-free categories will increase usage in bakery, snacks, and meat alternative products.

- Industrial applications will rise as manufacturers seek biodegradable and non-toxic binders, coatings, and adhesives.

- Enzyme and physical modification technologies will improve textural properties without losing natural classification.

- Local crop processing investments will strengthen domestic supply chains in emerging markets.

- Cost competitiveness will drive adoption in pharmaceuticals as excipients and binder ingredients.

- Customization of starch grades for regional cuisines and product formats will support market differentiation.

- Regulatory pressure on synthetic additives will accelerate reformulations across food and industrial sectors.