Market Overview

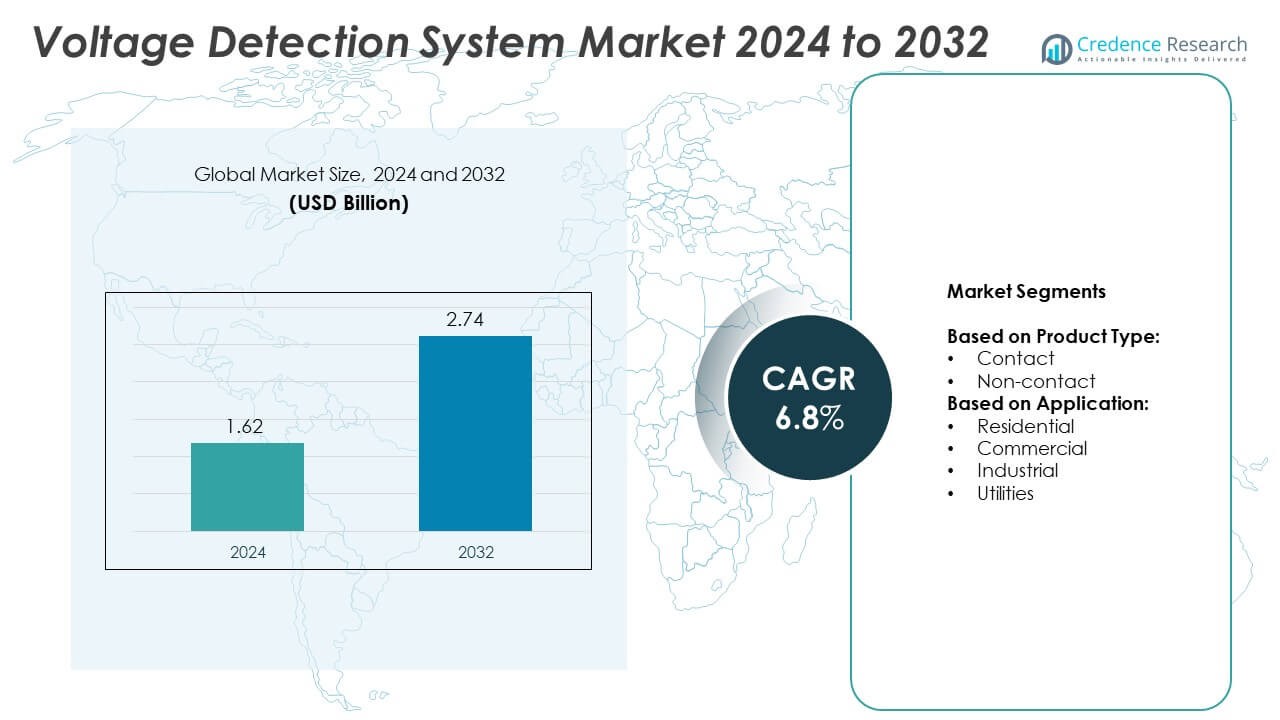

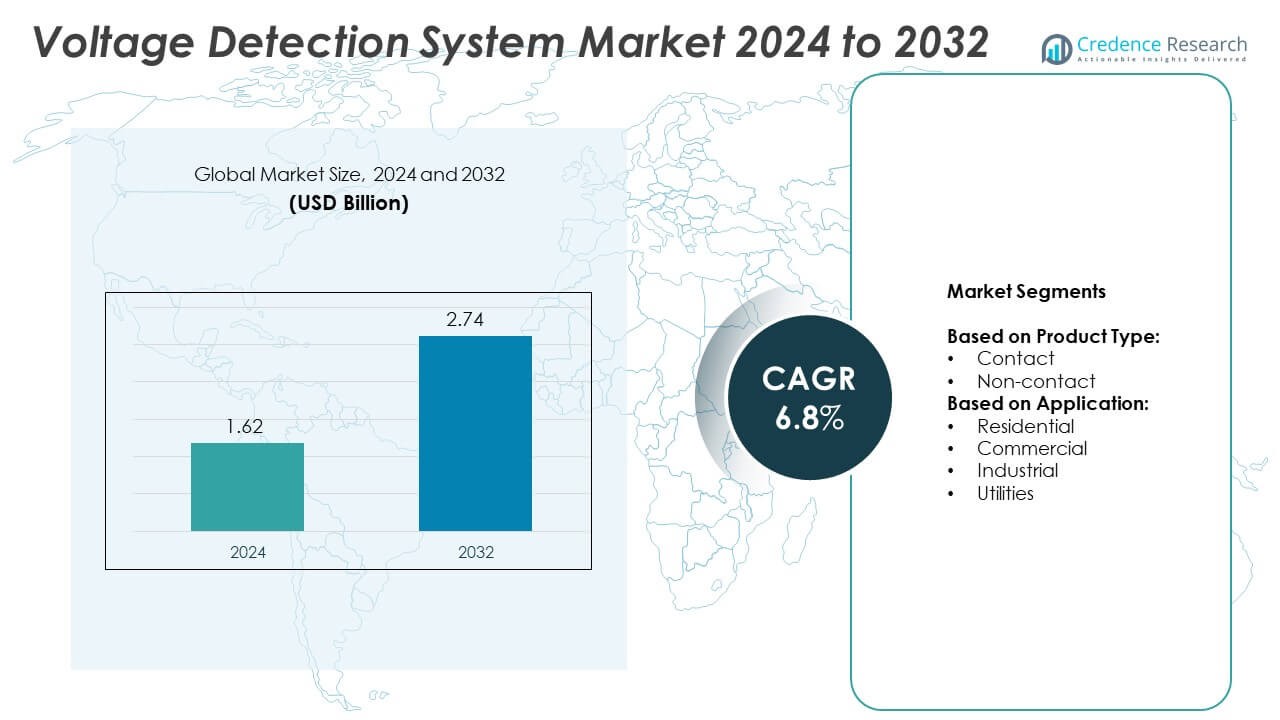

Voltage Detection System Market size was valued at USD 1.62 billion in 2024 and is anticipated to reach USD 2.74 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Voltage Detection System Market Size 2024 |

USD 1.62 Billion |

| Voltage Detection System Market, CAGR |

6.8% |

| Voltage Detection System Market Size 2032 |

USD 2.74 Billion |

The Voltage Detection System market grows due to increasing industrial automation, strict safety regulations, and rising adoption of smart grids. It supports real-time monitoring, reduces electrical hazards, and enhances operational efficiency across residential, commercial, industrial, and utility sectors. Technological advancements, including non-contact detection and IoT integration, drive innovation and user convenience. Growing awareness of workplace safety and the expansion of renewable energy projects further boost demand. It remains essential for accurate voltage monitoring and reliable electrical system management.

The Voltage Detection System market shows strong presence in North America, Europe, and Asia-Pacific, driven by industrial growth, infrastructure development, and safety regulations. North America leads with advanced electrical networks, while Europe emphasizes compliance and renewable integration. Asia-Pacific experiences rapid adoption due to urbanization and expanding industrial sectors. Key players including ARCUS ELEKTROTECHNIK, Chauvin Arnoux, DEHN SE, and C&S Electric focus on product innovation, IoT-enabled solutions, and portable devices to meet diverse application needs across residential, commercial, industrial, and utility sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Voltage Detection System market was valued at USD 1.62 billion in 2024 and is projected to reach USD 2.74 billion by 2032, growing at a CAGR of 6.8%.

- Rising industrial automation and smart grid adoption drive demand for accurate voltage detection systems.

- Increasing awareness of electrical safety and compliance with strict regulations boosts market growth across residential, commercial, and industrial sectors.

- Non-contact detection devices and IoT integration enhance operational efficiency and user safety, shaping current market trends.

- Key players including ARCUS ELEKTROTECHNIK, Chauvin Arnoux, DEHN SE, and C&S Electric focus on product innovation, portability, and multifunctional solutions to strengthen market presence.

- High initial costs and complex installation requirements restrain market expansion, particularly in emerging economies with limited infrastructure.

- North America, Europe, and Asia-Pacific lead market adoption, supported by advanced electrical networks, regulatory frameworks, and rapid urbanization, while Latin America and the Middle East & Africa show gradual growth opportunities.

Market Drivers

Rising Adoption of Safety Regulations and Standards Driving Market Demand

Stringent safety regulations in electrical utilities, manufacturing, and construction sectors increase the adoption of voltage detection systems. Companies face strict compliance requirements to prevent electrical accidents and equipment damage. It ensures worker safety by alerting operators to live circuits before maintenance or repairs. Industrial and commercial facilities increasingly integrate voltage detection solutions to meet OSHA, IEC, and IEEE standards. Growing awareness of electrical hazards among employees encourages proactive safety measures. Regulatory incentives and penalties support investment in reliable detection tools. The demand for advanced, non-contact, and handheld systems rises across multiple regions.

- For instance, Seaward Group manufactures a range of voltage detectors, including non-contact models, engineered to comply with relevant IEC safety standards. A specific model, the AGL-5, a two-pole detector, is designed for systems up to 5kV.

Expansion of Renewable Energy Infrastructure Boosting Requirement for Accurate Monitoring

Deployment of solar farms, wind turbines, and microgrids drives the need for precise voltage monitoring. Voltage detection systems help maintain stability and prevent downtime in renewable energy networks. It supports grid integration by detecting abnormal voltages and ensuring reliable energy distribution. Utilities adopt advanced solutions to manage variable energy outputs efficiently. Rising investments in clean energy projects increase opportunities for manufacturers of detection devices. Technological advancements in sensors improve accuracy and response times. Market players focus on providing scalable solutions compatible with both traditional and renewable grids.

- For instance, Northern Power Systems’ NPS-100 turbine logs, The company had an installed base of over 900 NPS-100 units worldwide.

Increasing Industrial Automation and Smart Grid Implementations Supporting Market Growth

Industries adopt automated and smart systems to optimize performance and reduce manual intervention. Voltage detection systems enable remote monitoring and rapid response to electrical faults. It integrates with IoT-enabled devices and SCADA systems to enhance operational efficiency. Automation reduces human error while ensuring energy reliability in factories and distribution networks. Demand rises for real-time data collection and predictive maintenance solutions. Integration with advanced analytics helps minimize downtime and prevent equipment damage. Manufacturers invest in compact, portable, and wireless voltage detection tools for industrial applications.

Growing Awareness of Electrical Safety in Residential and Commercial Buildings Enhancing Adoption

Awareness campaigns highlight the importance of preventing electrical hazards in homes and offices. Voltage detection systems help identify faulty wiring and live circuits before interventions. It increases user confidence in handling electrical appliances safely. Rising urbanization and smart building initiatives boost adoption in commercial complexes. Homeowners and facility managers prioritize reliable, user-friendly detection solutions. Educational programs and certification requirements further support market penetration. Companies offer solutions combining affordability with high accuracy to meet diverse consumer needs.

Market Trends

Integration of Smart Technologies and IoT Enabling Advanced Electrical Monitoring

The Voltage Detection System market increasingly integrates smart technologies and IoT-enabled devices for enhanced monitoring. It allows real-time detection of voltage fluctuations and automated alerts for abnormal conditions. Utilities and industrial facilities adopt these systems to improve operational efficiency and reduce downtime. Data analytics integration helps predict electrical faults before they cause damage. Cloud-based platforms enable remote access and centralized monitoring across multiple sites. Manufacturers focus on compact, wireless, and energy-efficient solutions to support smart infrastructure. The trend drives the development of multifunctional devices that combine safety and data reporting capabilities.

- For instance, FNET/GridEye collects over 4 GB of phasor data daily from 300+ FDR units. Utilities use this real-time voltage and frequency data for automated fault detection.

Rising Demand for Non-Contact and Portable Detection Solutions in Industrial Environments

Industries prefer non-contact voltage detection systems to enhance worker safety while reducing equipment downtime. It offers quick identification of live wires without requiring direct contact. Portable devices gain traction due to their ease of use and suitability for field inspections. Companies invest in rugged and durable designs to withstand harsh operational conditions. Growing adoption occurs in construction, manufacturing, and electrical maintenance sectors. Advanced sensor technologies improve detection accuracy across various voltage ranges. Market players develop user-friendly interfaces to support rapid deployment and training.

- For instance, Monnit’s 0–500 VAC wireless meters deploy in under 15 minutes, cover distances beyond 1200 feet, and last up to 12 years on AA batteries.

Adoption of Renewable Energy and Microgrid Systems Influencing Market Innovation

Expansion of solar, wind, and hybrid energy systems increases reliance on accurate voltage monitoring solutions. Voltage detection systems ensure stable energy distribution and protect critical equipment from electrical surges. It enables integration with microgrids, smart meters, and energy storage systems. Rising investment in decentralized energy networks encourages innovation in sensor precision and portability. Developers focus on cost-effective solutions for residential, commercial, and industrial applications. Compliance with renewable energy standards drives adoption of specialized detection tools. The trend promotes modular and scalable systems adaptable to evolving energy infrastructures.

Focus on Enhanced Safety Awareness and Training in Commercial and Residential Sectors

Growing concern for electrical safety drives adoption in commercial complexes and residential buildings. Voltage detection systems help prevent accidents by identifying live circuits and faulty wiring. It increases user confidence and reduces risks during electrical maintenance. Educational campaigns and safety certification programs emphasize the importance of reliable detection devices. Homeowners and facility managers prioritize compact, intuitive solutions for daily use. Manufacturers offer devices with clear indicators, audible alarms, and enhanced durability. The trend encourages broader market penetration across developed and emerging regions.

Market Challenges Analysis

High Initial Costs and Complexity of Advanced Detection Systems Limiting Adoption

The Voltage Detection System market faces challenges due to the high initial investment required for advanced solutions. It deters small and medium enterprises from upgrading legacy equipment. Complex installation and calibration processes require skilled personnel, increasing operational expenses. Maintenance and periodic testing add to total cost of ownership, affecting adoption in budget-constrained projects. Companies must balance performance, accuracy, and affordability to attract wider customer segments. Limited awareness of cost-effective alternatives further slows market penetration. Manufacturers focus on simplifying designs, but high-end solutions remain expensive for widespread deployment.

Technical Limitations and Environmental Factors Affecting Device Performance

Environmental conditions and operational constraints impact the reliability of voltage detection systems. It may produce inaccurate readings in extreme temperatures, high humidity, or areas with electromagnetic interference. Non-contact and portable devices face limitations in long-distance or high-voltage applications. Users require frequent recalibration to maintain precision, increasing downtime and labor costs. Integration with legacy infrastructure often presents compatibility issues, limiting seamless adoption. Market growth depends on improving sensor durability, accuracy, and adaptability across diverse environments. Companies invest in research to overcome technical limitations while meeting safety and performance standards.

Market Opportunities

Expansion of Smart Grid and Renewable Energy Projects Offering Significant Growth Potential

The Voltage Detection System market benefits from the rapid deployment of smart grids and renewable energy infrastructure. It supports real-time monitoring and protection of distributed energy resources, improving grid reliability. Rising investments in solar, wind, and hybrid energy systems increase demand for accurate voltage detection solutions. Utilities and independent power producers require scalable devices to manage variable energy outputs efficiently. Integration with IoT platforms and automated monitoring systems enhances operational insights. Manufacturers can develop modular and wireless solutions to cater to evolving energy networks. Growing government incentives for clean energy projects further create favorable market conditions.

Development of Compact, User-Friendly, and Portable Detection Devices Driving Market Expansion

Increasing focus on safety in industrial, commercial, and residential sectors creates opportunities for innovative detection tools. Voltage detection systems with compact and portable designs appeal to technicians, facility managers, and homeowners. It allows rapid identification of live circuits, improving safety and reducing maintenance time. Advanced sensor technologies and intuitive interfaces enhance device usability across diverse environments. Companies can introduce multifunctional products combining detection, data reporting, and connectivity features. Rising awareness of electrical hazards drives adoption in emerging regions with expanding urban infrastructure. The trend encourages development of cost-effective, reliable, and high-accuracy solutions to reach broader customer segments.

Market Segmentation Analysis:

By Product Type:

The Voltage Detection System market divides into contact and non-contact product types. Contact devices provide direct measurement of electrical potential, offering high accuracy and suitability for industrial and utility applications. It ensures precise readings for maintenance tasks and supports compliance with safety regulations. Non-contact solutions gain traction due to ease of use, portability, and enhanced safety for field technicians. It allows quick detection of live wires without requiring physical contact, reducing the risk of electric shock. Non-contact devices serve residential, commercial, and industrial users, offering versatility across multiple voltage ranges. Market players focus on improving sensitivity, response time, and battery efficiency in both categories.

- For instance, Klein Tools’ NCVT1XT non-contact voltage tester detects 70–1000 V AC, survives 9.8-foot drops, and offers IP67 ingress protection

By Application:

The Voltage Detection System market serves residential, commercial, industrial, and utility applications, each with distinct requirements. Residential users adopt compact and user-friendly devices to identify live circuits and faulty wiring safely. It increases safety in homes while supporting integration with smart home systems. Commercial buildings, including offices, malls, and healthcare facilities, rely on detection systems to comply with electrical safety regulations and prevent downtime. Industrial applications require robust and precise tools to monitor high-voltage operations, machinery, and automated production lines. Utilities use advanced, long-range, and rugged devices to maintain grid reliability, detect voltage fluctuations, and support smart grid and renewable energy integration. Market players focus on multifunctional, IoT-enabled, and portable solutions to meet diverse operational needs across all applications.

- For instance, the Fluke 1AC II non-contact voltage tester senses AC voltages from 90 V to 1000 V, beeps and glows red at the tip, and works over 1 year on AAA batteries

Segments:

Based on Product Type:

Based on Application:

- Residential

- Commercial

- Industrial

- Utilities

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 38% share of the Voltage Detection System market, driven by strict safety regulations and advanced electrical infrastructure. Utilities, industrial facilities, and commercial buildings in the U.S. and Canada invest heavily in voltage detection solutions to prevent accidents and ensure operational reliability. It supports compliance with OSHA and IEEE standards while reducing downtime in high-voltage operations. Growing adoption of smart grids, IoT-enabled monitoring, and renewable energy projects fuels demand for advanced systems. Non-contact and portable devices gain traction due to user safety and field inspection efficiency. The presence of major market players, including FLIR Systems, Megger, and Extech Instruments, strengthens product availability and innovation. Rising awareness of workplace safety and government incentives further encourage adoption across residential, commercial, and industrial applications.

Europe

Europe accounts for a 26% share of the Voltage Detection System market, supported by stringent EU safety directives and widespread electrification. Countries such as Germany, France, and the UK prioritize workplace safety in industrial and commercial sectors, driving adoption of high-accuracy detection systems. It enables efficient monitoring of live circuits and integration with building management systems. The growth of renewable energy projects and microgrids across the region increases demand for reliable voltage detection solutions. Manufacturers emphasize compact, energy-efficient, and IoT-enabled products tailored to European standards. Commercial and residential applications benefit from awareness campaigns highlighting electrical safety and accident prevention. Rising investments in industrial automation and smart infrastructure further propel market growth across the region.

Asia-Pacific

Asia-Pacific represents a 22% share of the Voltage Detection System market, fueled by rapid urbanization, industrial expansion, and increasing electricity demand. Countries like China, India, Japan, and South Korea invest in grid modernization, smart manufacturing, and renewable energy projects. It supports industrial and utility applications by detecting voltage fluctuations and preventing equipment damage. Non-contact and portable devices gain popularity among technicians and field operators for safe, quick inspections. Rising infrastructure development, coupled with government initiatives promoting safety standards, boosts residential and commercial adoption. Market players focus on affordable, high-performance solutions to cater to emerging economies with growing electrification needs. Rising awareness of electrical hazards and increased investments in energy management further strengthen market growth.

Latin America

Latin America holds a 9% share of the Voltage Detection System market, driven by industrial modernization and energy infrastructure development. Countries such as Brazil and Mexico increasingly adopt voltage detection solutions to enhance workplace safety and grid reliability. It helps utilities and industrial operators manage electrical networks efficiently while ensuring compliance with regional safety standards. Growing urbanization and expansion of commercial complexes create additional opportunities for residential and commercial applications. Portable and user-friendly devices gain preference due to limited availability of skilled personnel in some areas. Market players focus on cost-effective and durable solutions to meet local operational challenges. Initiatives to integrate renewable energy and smart grid technologies further encourage adoption across the region.

Middle East & Africa

Middle East & Africa represents a 5% share of the Voltage Detection System market, supported by growing industrial activities and energy sector expansion in countries like UAE, Saudi Arabia, and South Africa. It ensures safe maintenance of high-voltage transmission and distribution networks in harsh operational environments. Utilities and industrial facilities increasingly adopt portable, rugged, and IoT-compatible detection devices for real-time monitoring. The rise of large-scale construction projects and commercial infrastructure drives demand for residential and commercial applications. Market players emphasize durable and high-accuracy solutions suitable for extreme temperatures and remote locations. Government initiatives promoting electrical safety and renewable energy integration create additional growth opportunities. Rising awareness of workplace safety standards enhances market penetration in both established and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- Arshon Technology

- C&S Electric Limited

- CATU SAS

- Chauvin Arnoux

- Cole-Parmer Instrument Company

- DEHN SE

- -Ing. H. Horstmann GmbH

- Electrisium International

- ELECTRONSYSTEM MD srl

Competitive Analysis

Key players in the Voltage Detection System market include ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH, Arshon Technology, C&S Electric Limited, CATU SAS, Chauvin Arnoux, Cole-Parmer Instrument Company, DEHN SE, Dipl.-Ing. H. Horstmann GmbH, Electrisium International, and ELECTRONSYSTEM MD srl. These companies focus on innovation, safety, and precision to strengthen their market presence. It drives product differentiation through advanced sensor technologies, non-contact detection, and IoT integration. Companies invest in research and development to improve device accuracy, response time, and durability under varied environmental conditions. Strategic collaborations and partnerships enable expansion into new geographic regions and industrial sectors. Market leaders emphasize user-friendly interfaces, portable designs, and multifunctional solutions to address diverse customer needs. It maintains competitiveness through continuous upgrades and compliance with global electrical safety standards. Firms also focus on after-sales support, calibration services, and technical training to retain customers and enhance brand loyalty. Regional presence and tailored solutions for industrial, commercial, residential, and utility applications further boost adoption. The competitive landscape remains dynamic, with companies leveraging technology, product innovation, and strategic alliances to capture larger market shares. Rising demand for reliable voltage detection across emerging and developed markets intensifies rivalry among leading players, encouraging continuous advancement and differentiation.

Recent Developments

- In 2024, Chauvin Arnoux did release new and updated power and energy loggers with wireless capabilities for energy consumption monitoring

- In 2024, Arshon Technology continued marketing its Wireless Stray Voltage Detection System, aiming to enhance grid safety and portable detection capabilities, though no new product releases were noted in public sources during this period

- In 2023, C&S Electric held a Business Partners Conference in Kolkata, targeting the Eastern Region. The event focused on strengthening partnerships and exploring market opportunities.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart grid infrastructure will drive demand for advanced voltage detection systems.

- Integration with IoT and cloud-based monitoring will improve real-time fault detection.

- Growth in renewable energy projects will increase need for accurate voltage monitoring.

- Development of compact and portable devices will enhance usability across sectors.

- Rising industrial automation will support adoption in manufacturing and utility applications.

- Enhanced safety regulations will encourage deployment in residential and commercial buildings.

- Non-contact detection solutions will gain popularity due to improved worker safety.

- Expansion in emerging markets will create opportunities for cost-effective detection tools.

- Manufacturers will focus on energy-efficient and multifunctional products to meet market demand.

- Increased awareness of electrical hazards will boost adoption across all application segments.