Market Overview:

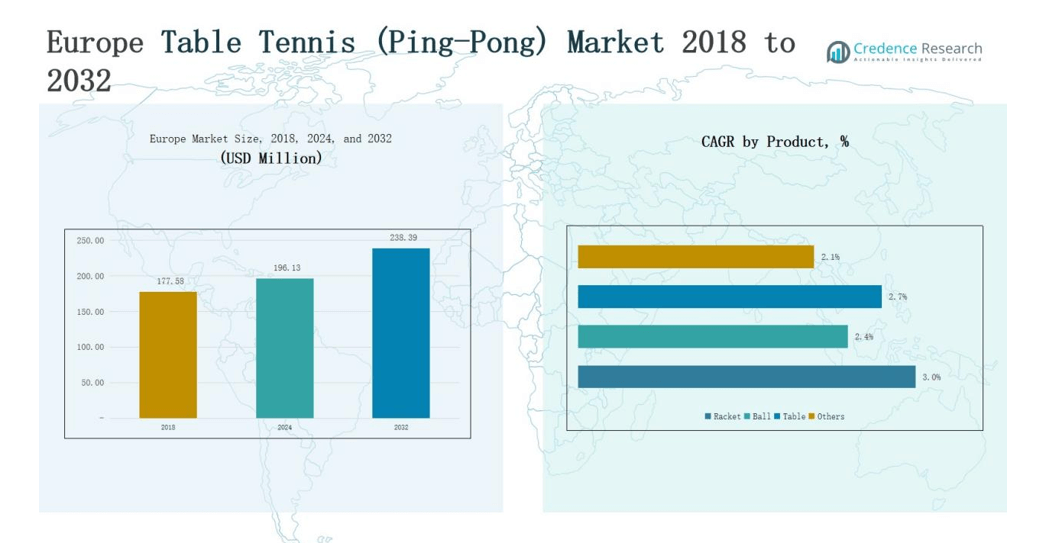

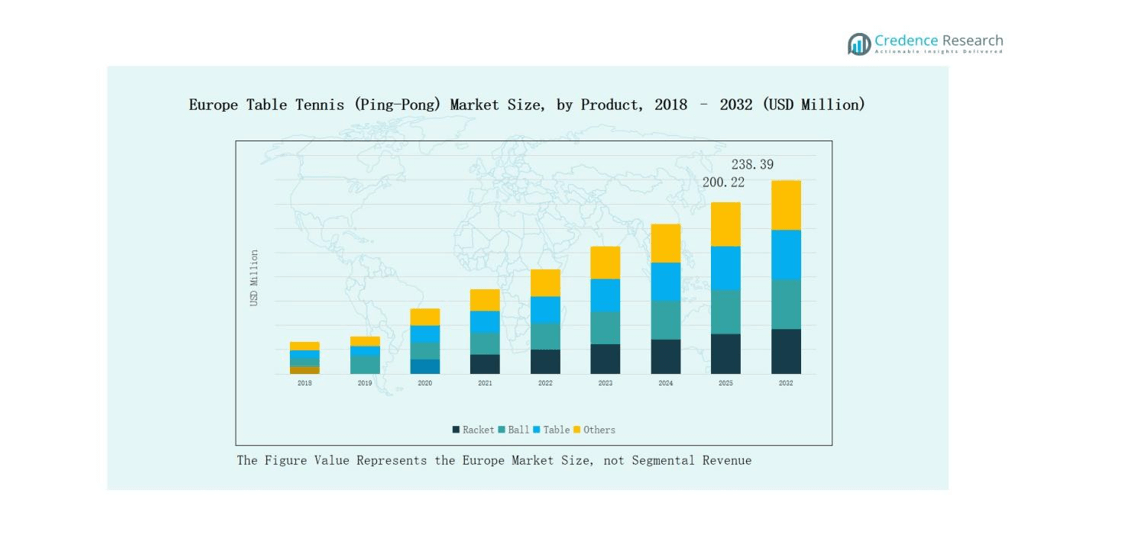

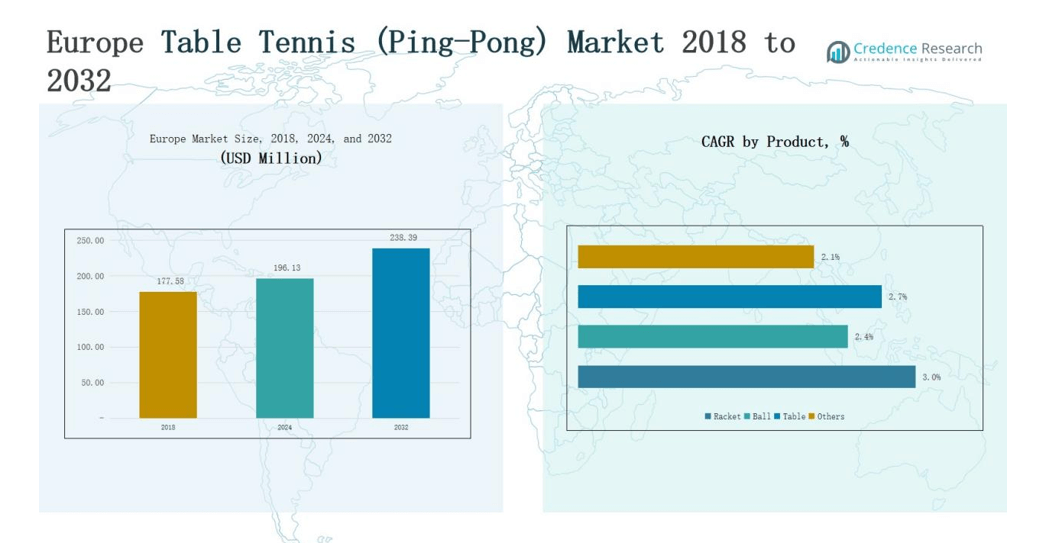

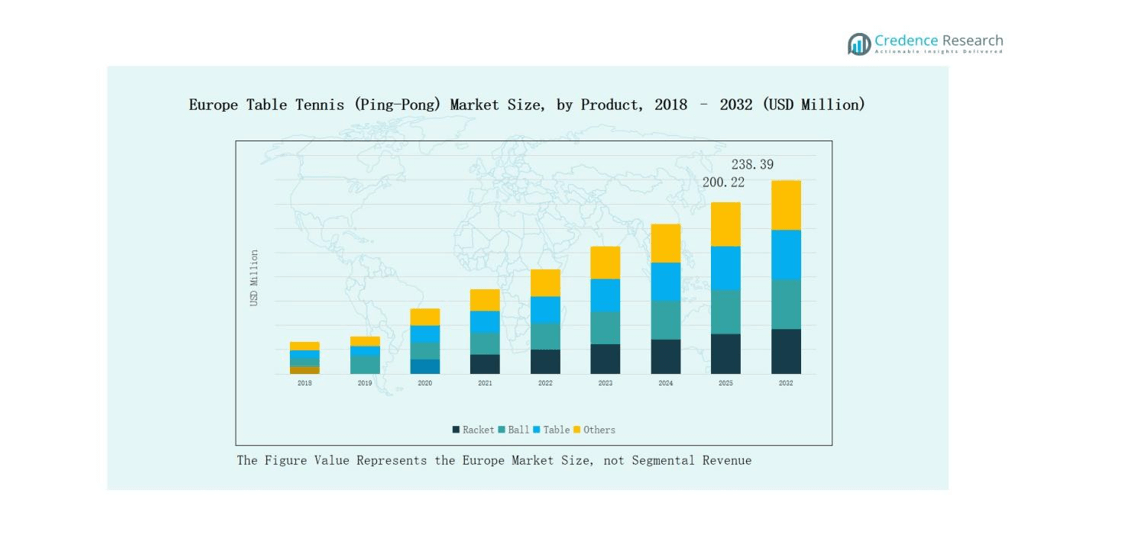

Europe Table Tennis (Ping-Pong) Market size was valued at USD 177.58 million in 2018 to USD 196.13 million in 2024 and is anticipated to reach USD 238.39million by 2032, at a CAGR of 2.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Table Tennis (Ping-Pong) Market Size 2024 |

USD 196.13 million |

| Europe Table Tennis (Ping-Pong) Market, CAGR |

2.13% |

| Europe Table Tennis (Ping-Pong) Market Size 2032 |

USD 238.39 million |

The Europe Table Tennis (Ping-Pong) Market is led by prominent players such as JOOLA, Butterfly, Sponeta GmbH, Nittaku, Double Happiness Co. Ltd., DONIC, STIGA, C&C, TELAMON, and KETTLER. These companies maintain strong positions through diverse product portfolios, including rackets, balls, tables, and accessories, while leveraging technological innovation, ITTF certification, and premium material usage. Strategic initiatives, including partnerships, sponsorships, and e-commerce expansion, enhance brand visibility and market penetration. Germany emerges as the leading region, commanding 22% of the market in 2024, supported by robust recreational participation, established club networks, school programs, and high consumer demand for quality and certified equipment.

Market Insights

- The Europe Table Tennis (Ping-Pong) Market is projected to grow steadily, driven by rising recreational and professional participation.

- Rackets dominated with a 42% share in 2024, fueled by innovation in materials, grip design, and ITTF approvals.

- Recreational players led end-user demand with a 48% share, supported by clubs, schools, and fitness initiatives.

- Online stores captured 38% of distribution in 2024, reflecting strong e-commerce adoption and consumer preference for convenience.

- Germany held the largest market share at 22% in 2024, supported by robust infrastructure, club networks, and high-quality equipment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Rackets dominated the Europe Table Tennis (Ping-Pong) Market in 2024 with a 42% share. Their leadership is driven by continuous innovation in blade materials, ergonomic grip designs, and ITTF approvals. Professional and recreational players demand premium rackets tailored for speed, spin, and control. Balls followed with a steady share, supported by mandatory use in competitive tournaments and training programs. Tables also contributed notably, with rising adoption in educational institutions and sports clubs. The “Others” category, including accessories and nets, remained a niche segment but supported market breadth.

- For instance, Butterfly’s Viscaria blade series, used by Olympic champion Ma Long, is known for its arylate-carbon composition that balances speed and stability.

By End User

Recreational players held the largest share of 48% in 2024, making them the key growth driver. Rising participation in clubs, fitness centers, and casual setups across Europe boosts this segment. Educational institutions followed with strong adoption, backed by sports curriculum integration and school-level tournaments. Professional players contributed a smaller but premium-driven share, as they prefer high-end equipment from global brands. The “Others” category, which includes community centers and corporate events, adds incremental demand. Recreational growth is also supported by increasing online content and awareness campaigns promoting table tennis as a health-friendly sport.

- For instance, Butterfly’s Tenergy and Dignics rubber lines remain the preferred choice among ITTF-ranked athletes, with the company officially supplying equipment for multiple international tournaments.

By Distribution Channel

Online stores led the distribution channel in 2024 with a 38% share, reflecting Europe’s strong e-commerce penetration. Consumers prefer online platforms for wide product availability, competitive pricing, and fast delivery. Specialty sports stores maintained a significant share, catering to buyers seeking expert guidance and premium equipment. Supermarkets and hypermarkets held a moderate portion, attracting casual and price-sensitive consumers. The “Others” segment, including local sports shops and direct sales from clubs, supported accessibility in smaller regions. Growth in online sales is further driven by digital promotions and partnerships with leading e-commerce platforms.

Market Overview

Rising Recreational Participation Across Europe

Increasing interest in table tennis as a recreational sport drives market expansion. Community clubs, fitness centers, and local tournaments encourage amateur engagement, boosting equipment sales. Schools and universities also integrate table tennis into physical education programs, further expanding user base. Recreational players seek affordable yet quality rackets, balls, and tables, creating demand for mid-range and premium products. Growing health awareness, low space requirement, and suitability for all age groups sustain consistent participation. This widespread adoption fuels overall revenue growth in the European market.

- For instance, STIGA Sports partnered with the Swedish Table Tennis Association in 2022 to supply schools and recreational centers with beginner-friendly rackets and indoor tables, making the sport more accessible to youth and families.

Technological Innovation in Equipment

Continuous innovation in materials, design, and manufacturing of rackets, balls, and tables supports market growth. Advanced composite blades, high-spin rubber surfaces, and ergonomic grips enhance player performance. Manufacturers focus on durable, lightweight, and eco-friendly products to meet evolving consumer preferences. Integration of ITTF-certified standards ensures acceptance in professional competitions, further boosting credibility. These innovations attract both professional athletes and recreational users. Enhanced product performance and customization options drive repeat purchases and strengthen brand loyalty across Europe.

Expansion of Online and Specialty Distribution Channels

E-commerce platforms and specialty sports stores drive market accessibility and visibility. Online channels offer convenience, wide product variety, and competitive pricing, appealing to tech-savvy consumers. Specialty stores provide expert guidance and premium equipment, enhancing purchase confidence. Retail expansion across urban and semi-urban areas improves availability, while digital marketing campaigns boost brand awareness. Partnerships with online marketplaces and clubs amplify reach. This multi-channel presence ensures consistent product supply, broadens customer base, and accelerates adoption, supporting sustainable revenue growth in Europe.

- For instance, Decathlon expanded its digital platform in Europe by integrating real-time inventory visibility across its 1,817 global stores, ensuring faster delivery and product availability for customers.

Key Trends & Opportunities

Integration of Table Tennis in Schools and Community Programs

Educational institutions increasingly adopt table tennis for physical education and extracurricular activities. School-level competitions, inter-school tournaments, and recreational clubs enhance student participation. Governments and local sports authorities promote sports infrastructure, creating procurement opportunities for manufacturers. This trend generates steady demand for tables, balls, and training equipment. Additionally, collaboration with coaches and sports academies presents avenues for branded products and training kits. Expanding youth engagement fosters long-term growth potential while establishing brand recognition among future professional and recreational players.

- For instance, table tennis clubs in the UK actively collaborate with schools through after-school programs, school visits, and local tournaments, boosting student participation and community engagement.

Premiumization and Customization of Equipment

Consumers increasingly prefer high-quality, performance-oriented equipment tailored to skill levels. Professional and semi-professional players seek customized rackets and accessories for competitive advantage. Manufacturers capitalize on premium offerings with advanced rubber sheets, specialized blades, and ergonomic designs. Limited-edition products, branded collaborations, and eco-friendly options attract niche buyers. This trend encourages higher spending per customer and strengthens market differentiation. Growing awareness of product benefits, combined with rising disposable incomes, offers manufacturers a strategic opportunity to capture high-margin segments and expand market share.

- For instance, Butterfly’s “Zhang Jike Super ZLC” racket, priced above $350, is engineered with carbon-fiber reinforcement and is widely adopted by international players for speed and control.

Key Challenges

High Price Sensitivity Among Recreational Users

While demand is rising, many recreational players prioritize affordability over premium quality. High costs of professional-grade rackets, tables, and ITTF-certified balls limit adoption in price-sensitive regions. Competition from local, low-cost manufacturers creates pricing pressure. Brands must balance quality and cost to retain market share. Failure to address this sensitivity may reduce penetration in emerging markets and smaller European towns. Additionally, excessive reliance on mid-to-high-end segments can restrict growth among casual players seeking entry-level equipment.

Fragmented Market with Numerous Players

The European table tennis market features many global and regional players, creating intense competition. Small manufacturers and local brands challenge established companies ith competitive pricing and regional familiarity. Differentiating products becomes difficult, particularly for mid-range offerings. Market fragmentation complicates distribution, marketing, and brand recognition strategies. Companies must invest in R&D, promotions, and partnerships to maintain competitiveness. Fragmentation may also lead to inconsistent quality standards, affecting consumer trust and slowing adoption, especially among newer recreational players.

Limited Awareness in Emerging Regions

Despite urban popularity, table tennis remains underdeveloped in smaller towns and rural areas. Lack of awareness and limited access to equipment and clubs restrict market growth. Promotional initiatives, training programs, and government-supported events are less frequent in these regions. This disparity limits potential recreational and professional player base, constraining overall revenue. Companies must invest in marketing, grassroots campaigns, and distribution infrastructure to expand reach. Without strategic initiatives, untapped markets may remain inaccessible, slowing the growth trajectory of the European table tennis sector.

Regional Analysis

Germany

Germany holds the largest share of the Europe Table Tennis (Ping-Pong) Market with 22% in 2024. It benefits from a strong sports culture, high disposable incomes, and extensive recreational infrastructure. Clubs and schools actively promote table tennis, boosting demand for rackets, balls, and tables. Professional tournaments and local leagues drive sales of premium equipment. Online and specialty stores dominate distribution, ensuring widespread product availability. Consumer preference for high-quality and ITTF-certified equipment strengthens market revenue. Germany continues to attract investments from leading European and global manufacturers.

United Kingdom

The United Kingdom accounts for 18% of the market in 2024. Its market expansion is supported by growing recreational participation and increasing integration of table tennis in educational institutions. Specialty stores and online platforms provide easy access to diverse product ranges. Recreational players dominate demand, but professional players contribute to premium segment sales. Government initiatives and local associations encourage youth involvement. Rising awareness about fitness and indoor sports supports steady revenue growth. The UK market shows potential for further expansion through club and school partnerships.

France

France represents 16% of the Europe Table Tennis (Ping-Pong) Market in 2024. It features active professional and recreational segments, with strong club networks in urban areas. Educational institutions contribute significantly to equipment demand. Consumers prefer mid-range to premium products for training and competition. E-commerce channels support accessibility and variety. Manufacturers leverage partnerships with local clubs and associations to increase visibility. France demonstrates steady growth due to rising participation and professional events across the country.

Italy

Italy holds 12% of the market in 2024. Recreational players dominate, while professional participation supports high-end equipment sales. Schools and sports academies promote table tennis through competitions and programs. Online stores provide convenient access to products, complementing specialty retail. Regional clubs increase adoption and brand awareness. Consumer interest in health and indoor sports drives consistent demand. Italy remains an important market for European and global manufacturers targeting both recreational and professional segments.

Spain

Spain contributes 10% of the market in 2024. It experiences growth from recreational and youth segments, supported by schools and local clubs. Demand for tables and rackets increases due to competitions and community programs. E-commerce and sports stores expand distribution reach. Premium and mid-range products attract professional and amateur players. Consumer preference for indoor fitness activities reinforces market expansion. Spain presents opportunities for targeted promotional campaigns and product customization.

Russia

Russia captures 14% of the Europe Table Tennis (Ping-Pong) Market in 2024. It benefits from strong recreational engagement and growing interest in competitive table tennis. Schools and clubs drive demand for beginner and intermediate equipment. Online stores support accessibility across urban and remote areas. Professional events increase demand for high-quality products. Rising disposable income enhances purchases in the premium segment. Russia remains a key market for European and global equipment manufacturers.

Rest of Europe

The Rest of Europe accounts for 8% of the market in 2024. It includes smaller markets with emerging recreational and professional segments. Participation in schools and clubs drives equipment demand. Online sales and specialty stores ensure availability. Consumers increasingly prefer quality products over price in developed areas. Market growth remains steady due to rising awareness and gradual adoption. Opportunities exist in underdeveloped regions for education-based promotions and retail expansion.

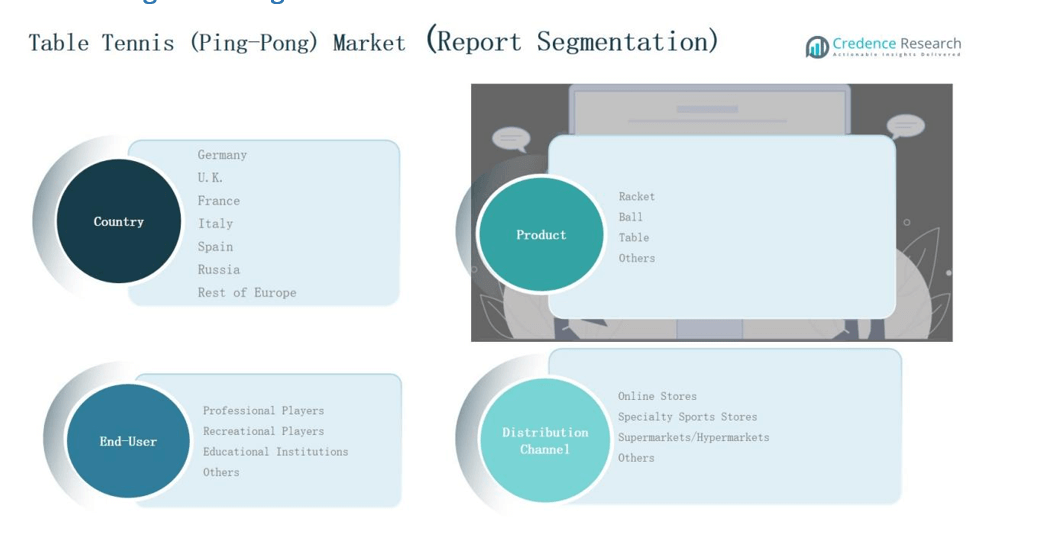

Market Segmentations:

By Product

By End User

- Professional Players

- Recreational Players

- Educational Institutions

- Others

By Distribution Channel

- Online Stores

- Specialty Sports Stores

- Supermarkets/Hypermarkets

- Others

By Country (Europe)

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Table Tennis (Ping-Pong) Market features a highly competitive landscape with several established and emerging players driving innovation and market growth. Leading companies such as JOOLA, Butterfly, Nittaku, Double Happiness Co. Ltd., STIGA, DONIC, Sponeta GmbH, C&C, TELAMON, and KETTLER maintain strong market positions through diversified product portfolios, including rackets, balls, tables, and accessories. These players leverage technological advancements, high-quality materials, and ITTF certification to meet professional and recreational demands. Strategic initiatives such as mergers, partnerships, sponsorship of tournaments, and expansion of e-commerce and retail distribution strengthen market presence. Companies focus on customer engagement through training programs, promotional events, and collaborations with clubs and educational institutions. Product differentiation through premium offerings, affordable options, and customized solutions enhances competitiveness. The market’s fragmented nature allows emerging local manufacturers to capture niche segments. Continuous innovation, brand recognition, and extensive distribution networks remain crucial for sustaining leadership and expanding market share across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- JOOLA

- Butterfly

- Sponeta GmbH

- Nittaku

- Double Happiness Co. Ltd.

- DONIC

- STIGA

- C&C

- TELAMON

- KETTLER

- Others

Recent Developments

- In 2025, JOOLA Table Tennis GmbH partnered with Pingpod, becoming its exclusive supplier for table tennis equipment and performance apparel.

- In May 2025, the International Table Tennis Federation (ITTF) launched the Sustainability Pledge during the World Championships in Qatar, aimed at promoting responsible and eco-friendly equipment practices.

- In March 2025, the European Table Tennis Union (ETTU) partnered with JOOLA. JOOLA will be the title sponsor of the ETTU Europe Youth Series for 2025 and 2026. The deal includes JOOLA sponsoring Development Camps and supplying equipment like balls to support young talent across Europe.

- In May 2025, Liebherr became an Official Event Partner for WTT Champions events in Europe. The company backed the Montpellier 2025 stop and returned as Official Event Partner for WTT Champions Frankfurt, marking expanded presence in Europe.

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising interest in recreational table tennis will expand consumer base across Europe.

- Professional tournaments and league activities will boost demand for premium equipment.

- E-commerce growth will increase accessibility and sales of table tennis products.

- Educational institutions will integrate table tennis programs, driving consistent demand.

- Technological advancements in racket and ball materials will enhance product performance.

- Manufacturers will focus on eco-friendly and sustainable materials to meet regulatory standards.

- Strategic partnerships and sponsorships will strengthen brand presence and market penetration.

- Emerging local players will target niche segments and regional markets.

- Multi-channel distribution strategies will improve market reach and customer engagement.

- Innovation in compact and home-use tables will attract casual players and urban consumers.