Market Overview

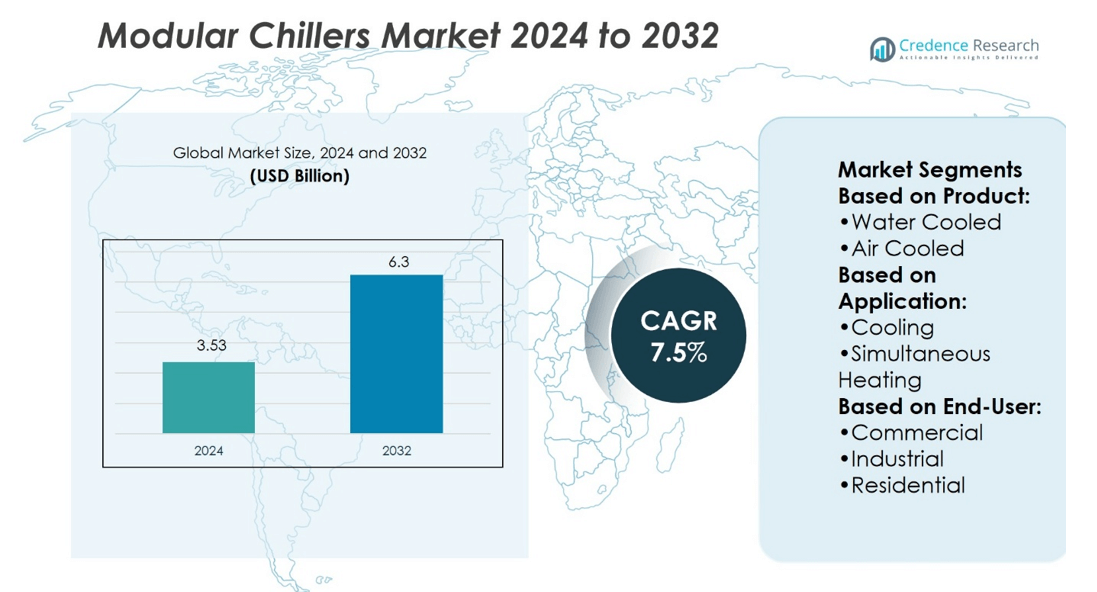

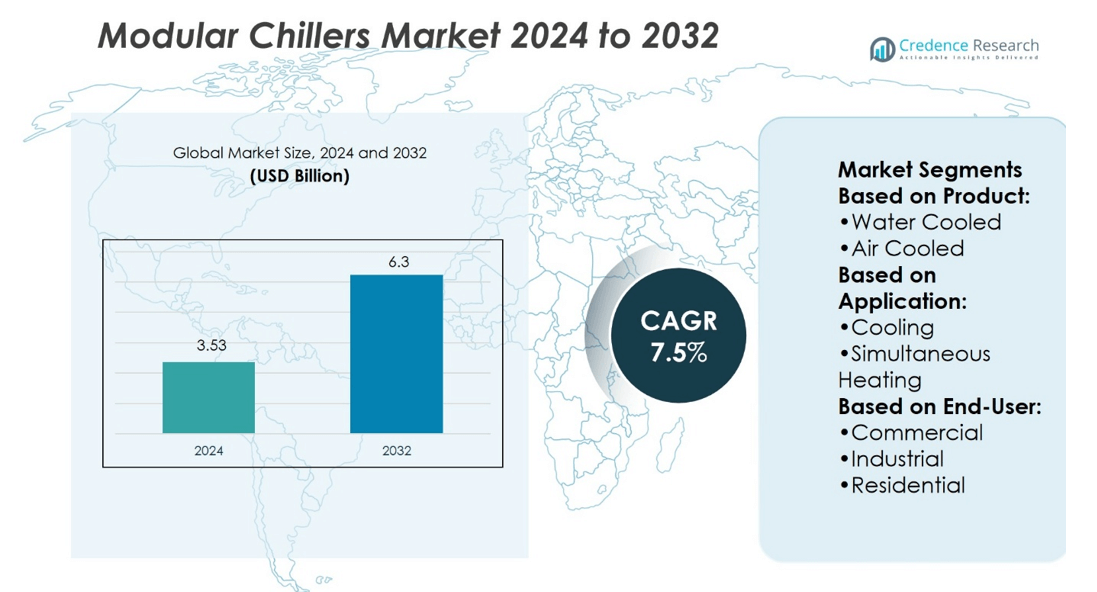

Modular Chillers Market size was valued at USD 3.53 billion in 2024 and is anticipated to reach USD 6.3 billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Chillers Market Size 2024 |

USD 3.53 billion |

| Modular Chillers Market, CAGR |

7.5% |

| Modular Chillers Market Size 2032 |

SD 6.3 billion |

The Modular Chillers Market grows through strong drivers and evolving trends focused on energy efficiency, sustainability, and digital integration. Rising demand from commercial, industrial, and residential sectors accelerates adoption, supported by regulatory pressure for low-GWP refrigerants and high-performance systems. Scalability and flexibility position modular chillers as preferred solutions for projects with dynamic cooling and heating requirements. Smart features, including IoT-enabled monitoring and predictive maintenance, enhance reliability and optimize energy use. Expanding construction activity, particularly in emerging economies, strengthens market potential. Continuous innovation in compressor technologies and integration with green building practices shape the long-term outlook for modular chiller adoption.

North America holds a strong share of the Modular Chillers Market, driven by advanced infrastructure and strict energy efficiency regulations. Europe follows with robust adoption supported by green building initiatives and low-GWP refrigerant mandates. Asia-Pacific leads in growth due to rapid urbanization and rising demand from data centers and healthcare facilities. Latin America and the Middle East & Africa show steady expansion with infrastructure upgrades. Key players include Mitsubishi Electric Corporation, Daikin Industries Ltd., Trane, Carrier Corporation, and LG Electronics.

Market Insights

- Modular Chillers Market size was valued at USD 3.53 billion in 2024 and is projected to reach USD 6.3 billion by 2032, at a CAGR of 7.5%.

- Rising demand for energy-efficient and sustainable cooling systems drives adoption across multiple sectors.

- Trends focus on digital integration, IoT-enabled monitoring, and predictive maintenance for improved reliability.

- Competition intensifies as global and regional players invest in innovation and strategic partnerships.

- High initial investment and complex maintenance requirements act as restraints for smaller enterprises.

- North America shows strong adoption supported by advanced infrastructure and regulatory pressure.

- Asia-Pacific leads growth with urbanization, data center expansion, and healthcare demand, while Europe, Latin America, and the Middle East & Africa show steady progress.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy-Efficient Cooling Solutions

Energy efficiency remains a central driver for the Modular Chillers Market. Commercial and industrial users demand systems that lower energy consumption without reducing performance. Regulatory frameworks in multiple regions mandate higher efficiency standards in HVAC equipment. It encourages adoption of modular units that integrate advanced variable-speed compressors and smart controls. Growing electricity costs push facility managers to replace conventional systems with modular alternatives. Adoption of these units directly reduces operational expenses while aligning with sustainability goals.

- For instance, Carrier’s 30RAM modular air-cooled chiller series covers capacities from 66 kW to 2,080 kW, fitting everything from mid-size installations to large-scale infrastructure requirements.

Expanding Construction and Infrastructure Development

Rapid growth in construction projects contributes significantly to market demand. Large-scale residential, commercial, and industrial developments require reliable climate control systems. The Modular Chillers Market benefits from urbanization trends across emerging economies. It supports deployment in high-rise buildings, hospitals, and data centers where cooling demand is continuous. Modular systems offer easy scalability, making them well suited for phased construction projects. Infrastructure expansion in Asia-Pacific and the Middle East strengthens the long-term outlook for manufacturers.

- For instance, the RCD Microgel dual-zone unit offers cooling capacities from 7.3 kW to 89.1 kW (depending on model) plus synchronized digital readings for temperature, flow, and pressure on both inlet and outlet lines.

Increasing Adoption of Sustainable Building Practices

Sustainability commitments by corporations and governments accelerate the need for eco-friendly HVAC systems. Green building certifications such as LEED and BREEAM highlight the role of efficient chillers in reducing carbon footprints. The Modular Chillers Market responds with units compatible with low-GWP refrigerants and energy recovery technologies. It ensures compliance with international environmental agreements and emission standards. Building owners prioritize equipment that supports long-term climate goals. This shift drives replacement of aging infrastructure with modern modular units.

Technological Advancements and Smart Integration

Advances in digital monitoring and IoT integration enhance the value proposition of modular chillers. Intelligent sensors provide real-time performance data, enabling predictive maintenance and improved reliability. It reduces downtime and extends the lifecycle of equipment. Remote connectivity features allow centralized control across multiple facilities. Manufacturers invest in R&D to integrate automation and AI-based optimization tools. These innovations make modular chillers an essential component in smart building ecosystems.

Market Trends

Growing Preference for Flexible and Scalable Cooling Systems

End-users demand cooling systems that adapt to dynamic requirements in commercial and industrial settings. Modular chillers provide scalability by allowing facilities to expand capacity without full system replacement. The Modular Chillers Market reflects this shift as businesses focus on flexible solutions. It offers cost savings through staged investments in capacity rather than upfront spending. High-rise offices, hospitals, and universities value the ability to add modules incrementally. This trend makes modular chillers attractive for projects with evolving cooling loads.

- For instance, Daikin’s EWYK‑QZ modular air‑to‑water heat pump includes modules rated at 100 kW or 125 kW each. Up to four modules combine into an array of 500 kW; four arrays—meaning sixteen modules—can scale up to 2000 kW, all controlled centrally via the Intelligent Chiller Manager (iCM).

Rising Integration of Smart and Connected Technologies

Digital transformation in building management strengthens the role of smart chillers. IoT-enabled sensors and cloud platforms allow real-time monitoring and predictive maintenance. The Modular Chillers Market incorporates advanced connectivity features to align with smart city initiatives. It enables operators to track energy use, optimize loads, and prevent downtime. Integration with building automation systems ensures efficient performance across facilities. The demand for intelligent, connected equipment continues to grow among modern infrastructure projects.

- For instance, in its data‑center cooling lineup, LG offers models covering 200 to 5,000 RT, integrated with the BECON DC control system that unifies server cooling and chiller plant management on one platform.

Increasing Use of Low-GWP Refrigerants

Environmental regulations drive adoption of refrigerants with lower global warming potential. Manufacturers redesign modular chillers to meet compliance with standards such as F-Gas and Kigali Amendment. The Modular Chillers Market advances with models that use eco-friendly refrigerants like R-32 and R-1234ze. It supports sustainability goals while maintaining high performance. Building owners and operators prioritize compliance to avoid regulatory penalties. This trend ensures strong uptake of environmentally responsible modular solutions.

Expanding Adoption in Data Centers and Healthcare Facilities

Critical industries require reliable and efficient cooling systems for continuous operations. Data centers demand stable cooling to support rising server density. The Modular Chillers Market benefits from growing investment in healthcare facilities that prioritize precise temperature control. It ensures patient safety in hospitals and supports sensitive equipment in labs. Modular units allow redundancy by adding modules for backup during maintenance. These sectors continue to represent key growth areas for manufacturers.

Market Challenges Analysis

High Initial Investment and Maintenance Complexity

The upfront cost of modular chillers remains a significant challenge for wider adoption. Small and medium enterprises often hesitate to replace traditional systems due to high capital requirements. The Modular Chillers Market faces resistance from budget-conscious buyers despite long-term efficiency benefits. It demands specialized installation and skilled technicians, which increases initial project costs. Maintenance also becomes complex when integrating advanced digital controls and IoT platforms. Limited availability of trained personnel in emerging economies further slows adoption.

Regulatory Compliance and Environmental Concerns

Strict environmental standards create challenges for manufacturers in this sector. Modular chillers must align with evolving regulations on refrigerants and energy performance. The Modular Chillers Market experiences pressure to redesign systems around low-GWP refrigerants without compromising efficiency. It forces continuous investment in research and development, which raises operational costs. Rapid changes in compliance frameworks across regions add uncertainty for producers. Meeting sustainability expectations while ensuring affordability remains a persistent challenge for industry stakeholders.

Market Opportunities

Expansion Across Emerging Economies

Rapid industrialization and urban growth in emerging economies create significant opportunities for manufacturers. Commercial complexes, healthcare facilities, and data centers in Asia-Pacific, Latin America, and the Middle East drive strong demand. The Modular Chillers Market benefits from rising investments in smart cities and infrastructure upgrades. It offers scalable solutions that suit regions with phased construction projects. Government incentives for energy-efficient equipment encourage adoption of modular systems. This expansion creates a favorable environment for international and regional suppliers to strengthen their presence.

Advancements in Green Building Technologies

Growing emphasis on sustainability and green certifications presents long-term prospects for modular chiller adoption. Green building standards encourage developers to integrate equipment that lowers emissions and supports renewable energy use. The Modular Chillers Market aligns with these goals through models designed for low-GWP refrigerants and high-efficiency performance. It provides opportunities for suppliers to target projects pursuing LEED and BREEAM certifications. Integration with renewable-powered HVAC systems further increases relevance in eco-conscious markets. The shift toward sustainable building practices ensures strong future demand for innovative modular chillers.

Market Segmentation Analysis:

By Product

The market divides into water-cooled and air-cooled modular chillers. Water-cooled units dominate large-scale projects where efficiency and continuous operation are priorities. These systems often serve commercial complexes, data centers, and healthcare facilities requiring stable load management. Air-cooled units gain preference in locations with water scarcity or limited infrastructure. The Modular Chillers Market reflects rising use of air-cooled models due to easier installation and lower maintenance needs. It positions water-cooled systems as the choice for high-capacity environments while air-cooled models expand in mid-scale applications.

- For instance, Gree’s MSA Series modular water-cooled chiller offers unit modules from 38 kW to 316 kW, which can be combined to match varying load demands across infrastructure sites.

By Application

Applications include cooling, simultaneous heating and cooling, and heat pump functions. Cooling remains the largest segment, supported by growing demand from commercial offices, retail complexes, and industrial facilities. Simultaneous heating and cooling units grow steadily due to their ability to manage fluctuating loads in mixed-use buildings. The Modular Chillers Market benefits from the increasing adoption of heat pump systems in regions prioritizing energy-efficient HVAC solutions. It offers flexibility to building operators by reducing dependence on separate systems. This diversity in applications strengthens the role of modular chillers across industries.

- For instance, Mitsubishi Electric’s R32 e-Series modular chiller range includes modules with cooling capacity of 150 kW or 180 kW. Up to six units can link to form systems with total capacity from 150 kW to 1,080 kW. These units support both cooling-only and heat pump configurations.

By End-User

End-user segmentation includes commercial, industrial, and residential sectors. Commercial use leads adoption, driven by offices, hospitals, universities, and shopping malls requiring scalable climate control. Industrial facilities follow closely, supported by demand from manufacturing, food processing, and pharmaceuticals. The Modular Chillers Market gains traction in residential projects, particularly high-rise apartments and luxury housing developments. It allows developers to meet regulatory efficiency standards while ensuring comfort. The combination of reliability, scalability, and reduced lifecycle costs positions modular chillers as a preferred choice across all end-user groups.

Segments:

Based on Product:

Based on Application:

- Cooling

- Simultaneous Heating

Based on End-User:

- Commercial

- Industrial

- Residential

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of around 32% in the Modular Chillers Market. Strong demand comes from commercial buildings, data centers, and healthcare facilities that require reliable and efficient cooling. It benefits from strict regulatory frameworks that emphasize energy efficiency and carbon footprint reduction. Adoption grows in urban projects where space-saving and scalable systems are valued. U.S. construction investments, especially in smart buildings and digital infrastructure, sustain demand. Canada follows with strong adoption in institutional facilities and green-certified projects. It reinforces North America’s role as a leading contributor to global revenues.

Europe

Europe accounts for nearly 27% of the market share supported by sustainability goals and green building regulations. The region adopts modular chillers in commercial spaces, airports, and educational institutions. Countries such as Germany, the UK, and France drive significant adoption with strict energy efficiency policies. It benefits from widespread commitment to low-GWP refrigerants and smart energy solutions. Retrofits in aging infrastructure expand opportunities for water-cooled systems, while air-cooled units find application in space-limited projects. Government incentives for renewable energy integration also support modular chiller uptake. Europe maintains its position as a highly regulated yet lucrative market.

Asia-Pacific

Asia-Pacific represents the largest share at 34%, driven by rapid urbanization and infrastructure expansion. Countries such as China, India, Japan, and South Korea invest heavily in commercial, residential, and industrial construction. The Modular Chillers Market thrives on high demand for data centers, hospitals, and retail complexes across the region. It reflects rising adoption of air-cooled systems where space and water resources are constrained. Strong government initiatives promoting energy-efficient equipment strengthen adoption. Manufacturers focus on expanding production capacity in Asia-Pacific to serve growing regional demand. Its large population and economic growth ensure Asia-Pacific retains leadership during the forecast period.

Latin America

Latin America contributes about 4% of the market share, with adoption concentrated in Brazil, Mexico, and Chile. The market grows steadily as construction activity expands in commercial and hospitality sectors. It supports demand from healthcare facilities and high-rise residential projects in urban centers. Local governments promote energy-efficient HVAC systems through updated standards. The Modular Chillers Market sees gradual adoption in data centers and industrial projects across the region. Infrastructure investment, though limited compared to developed economies, provides opportunities for scalable chiller systems. Latin America positions itself as an emerging contributor with long-term growth potential.

Middle East & Africa

The Middle East & Africa hold nearly 3% of the market share, primarily driven by demand from Gulf countries. Commercial complexes, luxury hotels, and airports create significant opportunities for modular chillers. It benefits from extreme climatic conditions where cooling is essential throughout the year. Large-scale urban projects such as smart cities in the UAE and Saudi Arabia increase adoption. Africa shows slower growth but gains traction in urban centers with expanding residential and commercial projects. Modular chillers align with the region’s demand for energy-efficient and space-optimized systems. The market in this region remains small but strategically important.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Haier Group (Shandong, China)

- Carrier Corporation (Florida, U.S.)

- Frigel Firenze S.p.A. (Tuscany, Italy)

- Daikin Industries, Ltd. (Osaka, Japan)

- LG Electronics (Seoul, Korea)

- Gree Electric Appliances, Inc. of Zhuhai (Guangdong, China)

- Mitsubishi Electric Corporation (Tokyo, Japan)

- Midea Group (Guangdong, China)

- Trane (Dublin, Ireland)

- Nanjing tica climate solutions co., ltd (Nanjing, China)

Competitive Analysis

The Modular Chillers Market features including Mitsubishi Electric Corporation, Trane, Carrier Corporation, LG Electronics, Daikin Industries Ltd., Nanjing TICA Climate Solutions Co. Ltd., Midea Group, Gree Electric Appliances Inc. of Zhuhai, Haier Group, and Frigel Firenze S.p.A. The Modular Chillers Market is highly competitive, shaped by global manufacturers and regional suppliers that emphasize energy efficiency, flexible design, and digital integration. Companies focus on expanding product portfolios with models that use low-GWP refrigerants and advanced compressor technologies. Strong investment in smart features, including IoT-enabled monitoring and predictive maintenance, enhances reliability and lifecycle performance. Manufacturers compete by targeting diverse applications in commercial, industrial, and residential projects, ensuring scalability to meet evolving cooling and heating demands. The competitive landscape is also defined by regional specialization, with firms leveraging local production capacity and service networks to address market needs effectively. Strategic partnerships, mergers, and product launches strengthen market presence, while compliance with strict regulatory frameworks drives continuous innovation. Price competitiveness and long-term service support remain critical factors in customer decision-making, especially in emerging economies where adoption rates are rising. Companies that combine sustainable design, cost-effectiveness, and advanced technology integration secure stronger positioning in this fragmented but rapidly evolving industry.

Recent Developments

- In July 2025, LG Electronics enhanced their modular chiller portfolios through partnerships with building automation firms, focusing on smart control systems, IoT-based monitoring, predictive maintenance, and ecofriendly refrigerants. Carrier rolled out modular solutions targeting commercial and healthcare facilities to meet stricter global energy regulations.

- In May 2025, Smardt launched the ECO AeroMod, a high-efficiency modular air-cooled chiller platform designed for scalable performance, energy savings, and operational flexibility across various commercial and industrial cooling applications.

- In March 2025, Daikin Applied, a part of DAIKIN INDUSTRIES Ltd, acquired Modular Comfort Systems, a New York-based company that specializes in modular HVAC solutions. This acquisition strengthens Daikin’s presence in the modular HVAC market and enhances its ability to deliver advanced, energy-efficient solutions to commercial customers in the region.

- In May 2024, Carrier India introduced the 30RB Air-Cooled Modular Scroll Chiller, manufactured in India to meet the specific demands of the local market. Engineered for enhanced cooling efficiency and operational reliability.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for modular chillers will grow with rising investments in smart buildings.

- Adoption of low-GWP refrigerants will strengthen compliance with environmental regulations.

- Integration of IoT and AI will enhance system performance and predictive maintenance.

- Data centers will remain a major growth sector due to high cooling needs.

- Healthcare facilities will increase reliance on modular systems for reliable climate control.

- Urbanization in emerging economies will drive adoption in residential and commercial projects.

- Manufacturers will focus on scalable designs to meet diverse project requirements.

- Energy efficiency will remain a primary factor influencing customer purchasing decisions.

- Strategic partnerships and acquisitions will accelerate global market expansion.

- Growing focus on sustainable construction will boost demand for eco-friendly chillers.