Market Overview

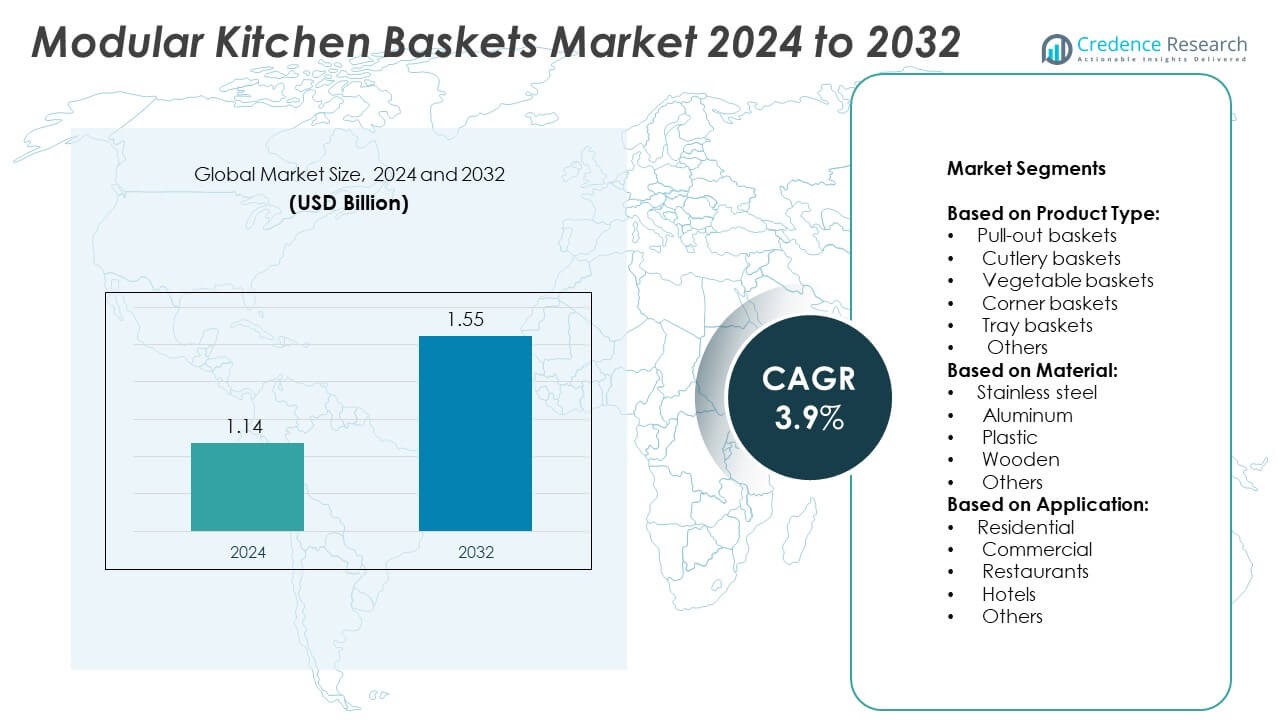

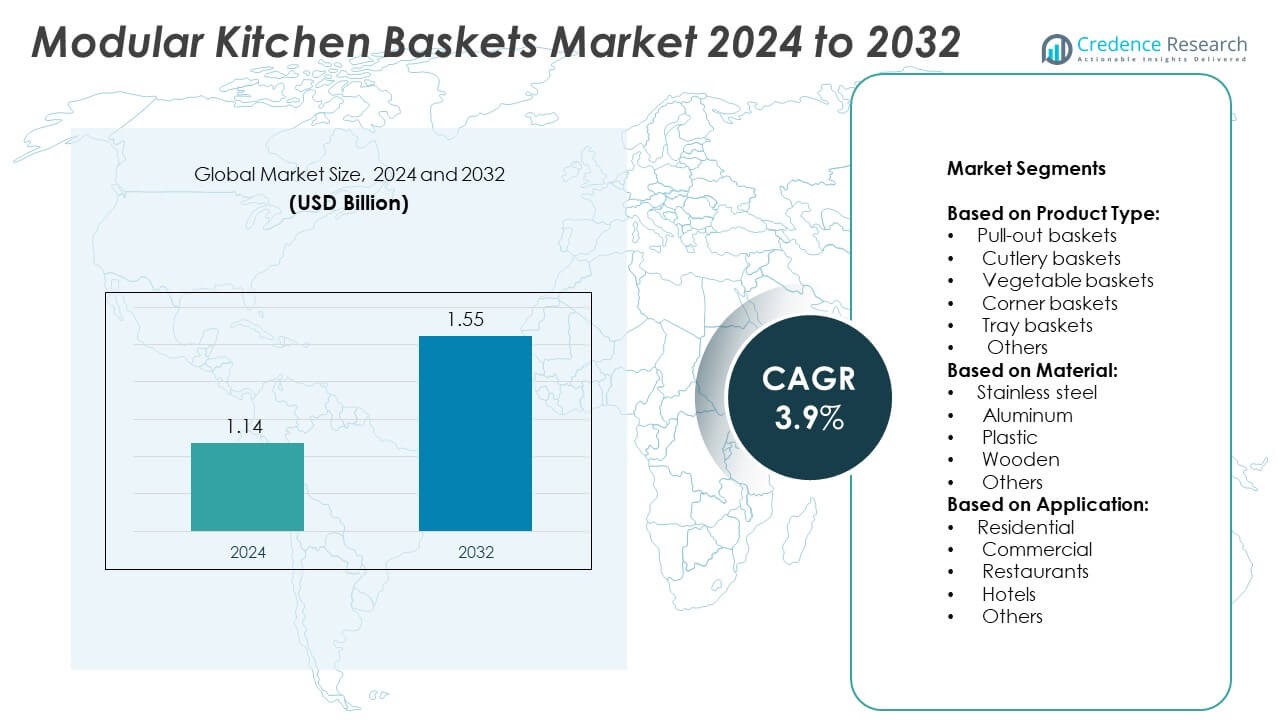

Modular Kitchen Baskets Market size was valued at USD 1.14 billion in 2024 and is anticipated to reach USD 1.55 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Kitchen Baskets Market Size 2024 |

USD 1.14 Billion |

| Modular Kitchen Baskets Market, CAGR |

3.9% |

| Modular Kitchen Baskets Market Size 2032 |

USD 1.55 Billion |

The Modular Kitchen Baskets market grows with rising demand for organized, space-efficient kitchen solutions. Consumers prefer customizable baskets that improve storage access and match modern kitchen aesthetics. Increased residential construction, renovation activity, and adoption of modular interiors drive product demand. Stainless steel and aluminum baskets gain popularity for their durability and low maintenance. Brands introduce innovations like soft-close mechanisms and anti-rust coatings. Urbanization, nuclear families, and smart kitchen trends further support market expansion across residential and commercial segments.

North America leads the Modular Kitchen Baskets market due to strong remodeling activity and high demand for premium storage solutions. Europe follows with growing adoption of compact, eco-friendly kitchen designs. Asia-Pacific shows rapid growth supported by urban housing developments and rising middle-class income. Latin America and the Middle East & Africa experience steady demand through expanding retail presence. Key players active across these regions include Hettich, Hafele India, Godrej Interio, and Livsmart Modular Kitchen Accessories, each offering diverse and innovative product portfolios.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Modular Kitchen Baskets market was valued at USD 1.14 billion in 2024 and is projected to reach USD 1.55 billion by 2032, growing at a CAGR of 3.9%.

- Rising urbanization and preference for modular kitchen setups are key drivers boosting demand across residential and commercial sectors.

- Consumers increasingly choose pull-out, corner, and cutlery baskets for space optimization and modern functionality.

- Leading companies focus on product variety, smart features, and strong retail distribution to strengthen market presence.

- High costs of premium materials and lack of skilled labor in emerging regions act as growth barriers.

- North America leads the market due to strong adoption of modular designs in homes and commercial kitchens, followed by Europe and Asia-Pacific.

- Customization, durable materials, and integration with modular cabinetry remain central to product innovation and regional expansion strategies.

Market Drivers

Rising Demand for Organized and Space-Efficient Storage Solutions

Rapid urbanization and shrinking residential spaces are driving demand for organized storage systems. Consumers prioritize functionality, compactness, and accessibility in modern kitchens. Pull-out, corner, and multi-level baskets help optimize space without compromising on design. It supports efficient storage of utensils, groceries, and kitchen accessories. The Modular Kitchen Baskets market benefits from the growing shift toward ergonomic and decluttered kitchen layouts. Rising adoption in apartments and condominiums strengthens the need for customized storage components.

- For instance, Häfele India has made public its goal to become the Häfele Group’s largest global market by 2030. To achieve this, the company announced in late 2024 its plans to significantly increase local sourcing in India from less than 10% to 50% in the mid-term.

Growth in Residential Renovations and Modular Kitchen Installations

Renovation trends fuel demand for modular kitchen upgrades in both urban and semi-urban regions. Homeowners seek premium kitchen interiors with high utility and aesthetic appeal. It creates a market for modular baskets that integrate seamlessly with other fittings. Increasing disposable incomes support investment in luxury kitchen elements, including stainless-steel and wooden baskets. The Modular Kitchen Baskets market gains traction as consumers replace traditional storage with more adaptable solutions. Organized retail and rising home improvement projects support this segment’s growth.

- For instance, In September 2023, Hettich India held a groundbreaking ceremony for a new plant in Indore, marking a significant step in its expansion plans. As part of this expansion, Hettich announced plans to invest a substantial ₹700 crore. This investment is projected to create nearly 1,000 new jobs.

Shifting Consumer Preferences Toward Customization and Design Variety

Consumers increasingly seek tailored basket configurations based on kitchen size and usage patterns. Manufacturers offer a wide range of material choices including plastic, aluminum, and stainless steel. It allows buyers to match baskets with cabinet finishes and design themes. Functional innovations like soft-close rails and modular dividers enhance user experience. The Modular Kitchen Baskets market sees product differentiation through innovation and aesthetic appeal. Smart customization options improve market penetration in developed and emerging economies.

Expansion of Online and Organized Retail Channels

E-commerce platforms and specialty home improvement stores improve product accessibility. Organized retail supports greater visibility of brands offering modular kitchen accessories. It enables comparison shopping, bulk purchases, and personalized selection. Online reviews and influencer marketing influence buyer decisions in tier-1 and tier-2 cities. The Modular Kitchen Baskets market benefits from bundled offerings and discounts available online. Distribution networks and brand positioning play a key role in expanding customer reach.

Market Trends

Integration of Smart Storage Features and Modular Design Elements

Consumers prefer kitchen baskets that support ease of access, mobility, and organization. Features like soft-close runners, adjustable dividers, and modular tray systems gain popularity. It supports faster meal prep, better categorization, and clean interiors. The Modular Kitchen Baskets market evolves through intelligent layouts designed to reduce clutter. Custom-fit components help homeowners maximize storage in small kitchens. Smart storage systems increasingly align with modern lifestyle needs.

- For instance, The Blum Group reported a turnover of €2,297.16 million for the 2023/2024 financial year and €2,441.48 million for the 2024/2025 financial year, focusing on overall market conditions rather than single product sales figures

Increased Use of Premium and Sustainable Materials

Rising awareness about material quality drives preference for rust-proof and durable products. Stainless steel, powder-coated aluminum, and engineered wood gain momentum in premium segments. It aligns with consumer interest in long-lasting and hygienic kitchen solutions. Eco-friendly materials and recyclable components also influence purchase decisions. The Modular Kitchen Baskets market tracks growing demand for materials that resist moisture and wear. Aesthetic appeal plays a strong role in product selection.

- For instance, Ebco provides a wide range of products for the furniture fittings market. The company, founded in 1963, has an extensive distribution network of over 5,500 retail touchpoints and three manufacturing plants in Maharashtra. As of January 31, 2025, Ebco had 811 employees. Its product portfolio includes over 4,500 SKUs, and the company has consistently invested in its manufacturing capabilities and product development

Shift Toward Ready-to-Install and Customizable Kitchen Modules

Time-saving installation drives popularity of pre-engineered modular units. Ready-to-install baskets reduce on-site labor and support faster kitchen setups. It appeals to both contractors and DIY consumers in urban regions. Custom basket layouts help match kitchen flow and user preferences. The Modular Kitchen Baskets market expands with brands offering full customization in layout and design. Personalization improves satisfaction and drives repeat purchases.

Growth in Demand from Tier 2 and Tier 3 Cities

Affordable modular furniture and rising homeownership fuel adoption in semi-urban regions. Consumers seek modern kitchen designs without high remodeling costs. It leads to increased use of functional basket systems in low- to mid-range housing. Organized retailers and online platforms enable product access in remote areas. The Modular Kitchen Baskets market benefits from aspirational buyers in growing housing clusters. Local carpenters and fitters also influence product selection trends.

Market Challenges Analysis

High Cost of Premium Materials and Installation Services

Rising demand for stainless steel and custom-designed kitchen baskets increases overall kitchen setup costs. Consumers in price-sensitive regions hesitate to invest in premium modular storage. It creates a challenge for market penetration in low-income households. Professional installation and branded accessories often raise total expenses beyond basic kitchen budgets. The Modular Kitchen Baskets market faces slow adoption in rural and semi-urban areas where traditional wooden shelves remain dominant. Cost-effective alternatives continue to influence buying behavior.

Lack of Standardization and Skilled Labor Availability

Wide variation in kitchen sizes and layout standards affects uniform product design. Manufacturers struggle to offer one-size-fits-all solutions for diverse housing segments. It increases the need for tailored production and installation services, adding to operational complexity. Limited availability of trained fitters and carpenters affects the quality of basket installation in emerging regions. The Modular Kitchen Baskets market finds it difficult to scale in areas lacking skilled workforce and awareness. Gaps in service delivery reduce customer satisfaction and brand loyalty.

Market Opportunities

Expanding Urban Housing and Modular Construction Projects

Rising investments in urban housing drive demand for modular kitchen setups across new projects. Builders and developers increasingly offer pre-fitted modular kitchens in compact apartments. It opens strong sales channels for kitchen basket manufacturers through B2B partnerships. Growth in nuclear families and working households boosts the need for efficient kitchen storage. The Modular Kitchen Baskets market can capitalize on this shift by offering scalable and ready-to-install units. Integration with real estate and interior design firms enhances long-term supply potential.

Rising Adoption of E-Commerce and DIY Home Improvement

Online platforms create access to a wider customer base across tier-2 and tier-3 cities. Consumers explore modular kitchen accessories through digital catalogs, videos, and virtual design tools. It reduces dependency on in-store visits and increases direct-to-consumer sales. The rise in DIY culture supports demand for easy-to-fit baskets and adjustable components. The Modular Kitchen Baskets market has an opportunity to bundle products with online kitchen planning tools. Growth in influencer marketing and home décor content also strengthens product visibility.

Market Segmentation Analysis:

By Product Type:

Pull-out baskets hold the leading share due to their versatility in storing utensils, jars, and packaged goods. They fit seamlessly into narrow cabinets, making them ideal for compact kitchens. Cutlery baskets follow with strong demand in both residential and commercial spaces, offering organized storage for knives, spoons, and forks. Vegetable baskets grow steadily as consumers prefer dedicated, ventilated sections for perishables. Corner baskets gain popularity for utilizing unused blind corners and improving accessibility. Tray baskets serve niche functions and support flat storage for plates or lids. The Modular Kitchen Baskets market also includes other customized basket types that cater to unique design needs.

- For instance, Century Ply is widely known for supplying durable engineered wooden modules, manufactured using materials like its moisture-resistant Sainik 710 plywood, for use in modular kitchens. These products are integrated into premium residential kitchen installations across major Indian cities.

By Material:

Stainless steel dominates due to its durability, corrosion resistance, and hygienic properties. It suits both modern and traditional kitchens, making it a preferred material across regions. Aluminum baskets offer a lightweight, rust-proof alternative, especially for budget-conscious consumers. Plastic baskets maintain traction in low-cost housing and temporary setups, though concerns over strength limit premium adoption. Wooden baskets appeal to luxury interiors, offering a natural look that blends with wood cabinetry. Other materials, including coated metal and composites, find selective use in designer kitchens with unique configurations.

- For instance, Enox Hardware, a brand now part of the ASSA ABLOY Group, supplies a range of aluminum and coated-metal basket systems for modular kitchens to its dealer networks in India and beyond. The legal entity associated with the brand, ASSA ABLOY Opening Solutions India Private Limited, had a workforce of 358 employees as of September 30, 2024 for ASSA ABLOY Opening Solutions India Private Limited based on market tracking profiles.

By Application:

The residential segment leads in volume, driven by rising demand for modular kitchens in apartments and independent homes. Homeowners seek smart storage that supports daily cooking efficiency and space use. Commercial applications grow with expanding office canteens and institutional kitchens seeking organized storage. Restaurants invest in heavy-duty modular baskets to support quick access and hygiene compliance. Hotels adopt multi-functional basket systems to match customized kitchen layouts in suites and service areas. The Modular Kitchen Baskets market finds further application in builder projects and semi-commercial food preparation spaces under the “Others” category.

Segments:

Based on Product Type:

- Pull-out baskets

- Cutlery baskets

- Vegetable baskets

- Corner baskets

- Tray baskets

- Others

Based on Material:

- Stainless steel

- Aluminum

- Plastic

- Wooden

- Others

Based on Application:

- Residential

- Commercial

- Restaurants

- Hotels

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 32.6% share of the Modular Kitchen Baskets market in 2024. Strong demand for modern kitchen solutions across the United States and Canada supports steady growth in the region. High-income households, premium housing developments, and remodeling projects drive sales of stainless-steel and pull-out baskets. Consumers prioritize aesthetic appeal and organization, which creates preference for branded and customized solutions. Growing popularity of open kitchen layouts and island units increases adoption of tray and cutlery baskets. The presence of well-established modular kitchen brands and online retail platforms makes product access easier for homeowners and contractors. Demand remains strong across urban areas and continues to expand into suburban developments supported by housing upgrades and kitchen renovations.

Europe

Europe held a market share of 27.8% in the Modular Kitchen Baskets market in 2024. The region benefits from strong adoption of modular kitchen systems driven by space optimization needs in compact homes. Germany, the UK, France, and Italy lead consumption, with homeowners seeking integrated and minimalistic storage solutions. Demand for eco-friendly and recyclable basket materials like aluminum and engineered wood supports product innovation. Rising adoption of multifunctional corner baskets and custom-built storage systems reflects changing lifestyle needs. Organized retail chains and DIY improvement platforms like IKEA and Leroy Merlin expand access across countries. Product compliance with design and safety regulations in the EU ensures premium product quality and customer satisfaction across residential and hospitality applications.

Asia-Pacific

Asia-Pacific contributed 23.4% to the Modular Kitchen Baskets market in 2024, with rapid growth across China, India, Japan, and Southeast Asia. Rising urbanization and middle-class income expansion support demand for modular kitchen solutions in both apartments and standalone homes. India sees strong traction in tier-1 and tier-2 cities with the rise of compact housing and real estate-led kitchen upgrades. China drives volume with ready-to-install basket systems in new residential construction. The region experiences a shift from traditional wooden cabinetry to stainless-steel and aluminum modular components. Online and offline retail expansion, along with government-supported housing projects, increases product availability. Manufacturers benefit from scalable production and cost-effective labor, enabling competitive pricing across emerging markets.

Latin America

Latin America held 9.1% share of the Modular Kitchen Baskets market in 2024. Growth remains steady in Brazil, Mexico, Argentina, and Chile, driven by demand for organized kitchen storage in urban housing. Rising disposable incomes and interest in modern kitchen interiors create opportunities for brands offering pull-out, vegetable, and tray baskets. The market is supported by retail chains and local kitchen installers introducing modular basket components in residential renovation projects. Plastic and aluminum baskets maintain strong presence due to affordability and ease of maintenance. Commercial establishments, such as restaurants and hotels, slowly adopt modular setups to meet food safety standards and efficiency goals. Limited product awareness in rural areas restricts expansion, but ongoing promotional efforts aim to bridge the gap.

Middle East & Africa

Middle East & Africa represented 7.1% of the Modular Kitchen Baskets market in 2024. Gulf countries, including the UAE, Saudi Arabia, and Qatar, witness growing demand for high-end kitchen designs in luxury apartments and villas. Stainless-steel and soft-close basket systems see strong adoption across urban developments and hospitality sectors. In South Africa and other African nations, product awareness is increasing through organized retail and home improvement channels. The market faces challenges with pricing and skilled installation, but demand continues to build in premium housing and hotel kitchens. Basket suppliers partner with modular cabinet manufacturers to deliver integrated solutions. Preference for European and Asian imports remains high in upscale projects, while local brands expand their footprint in mid-tier markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hettich

- Livsmart Modular Kitchen Accessories

- Hafele India

- Ebco

- Godrej Interio

- Sleek International

- Century Ply

- Kesseböhmer

- Enox Hardware

- Rinox India

- Tallsen Hardware

- Blum

- Jindal Steel Kitchen Accessories

- Sleek by Asian Paints

- Häfele

Competitive Analysis

The Modular Kitchen Baskets market features strong competition among key players including Hettich, Livsmart Modular Kitchen Accessories, Hafele India, Ebco, Godrej Interio, Sleek International, Century Ply, Kesseböhmer, Enox Hardware, Rinox India, Tallsen Hardware, Blum, Jindal Steel Kitchen Accessories, Sleek by Asian Paints, and Häfele. These companies compete on parameters such as material quality, product design, customization options, and distribution reach. Many of them offer a wide range of basket types including pull-out, cutlery, corner, and tray baskets to cater to varied customer needs. Global and regional players focus on expanding their retail presence through both offline and online channels. Brand strength, after-sales service, and pricing remain important factors influencing buyer choice. Companies invest in product innovation, such as anti-rust coatings and soft-close mechanisms, to enhance user experience. Several players maintain long-term partnerships with modular kitchen cabinet manufacturers and real estate developers. Manufacturing efficiency and supply chain control help leading brands meet bulk demand across urban and semi-urban areas. While global brands emphasize premium quality, regional manufacturers target volume through cost-effective offerings. The competition is intensifying as new entrants adopt digital marketing and e-commerce strategies to capture market share in untapped regions.

Recent Developments

- In 2025, Enox launched a new premium range of architectural hardware in a matte black finish, catering to the trend of bold minimalism in interior design.

- In March 2025, Ebco exhibited its existing range of plain kitchen baskets designed for modular kitchens at the IndiaWood trade fair.

- In December 2024, Hettich expanded its manufacturing investment in India, reinforcing its commitment to its established portfolio of kitchen storage systems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for modular kitchens in urban housing projects.

- Manufacturers will focus on offering customized and space-saving basket designs.

- Demand for stainless steel and aluminum baskets will grow due to durability and low maintenance.

- E-commerce platforms will play a key role in product visibility and sales growth.

- DIY-friendly and easy-to-install basket systems will attract younger homeowners.

- Tier 2 and Tier 3 cities will emerge as strong demand centers for mid-range basket solutions.

- Strategic tie-ups with real estate developers will support large-scale installations.

- Smart features like soft-close and anti-rust coating will drive premium product adoption.

- Sustainability will influence material choices, boosting demand for recyclable options.

- Brands will expand their product portfolios to cater to both residential and commercial users.