Market Overview

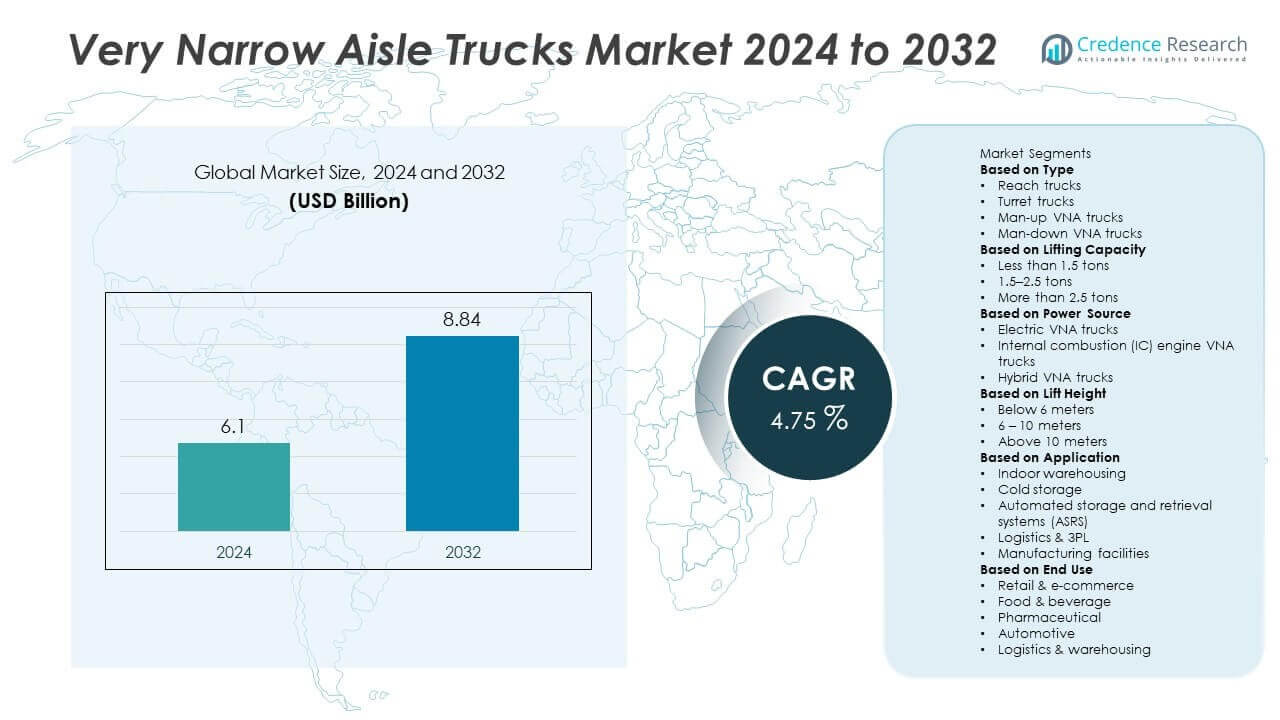

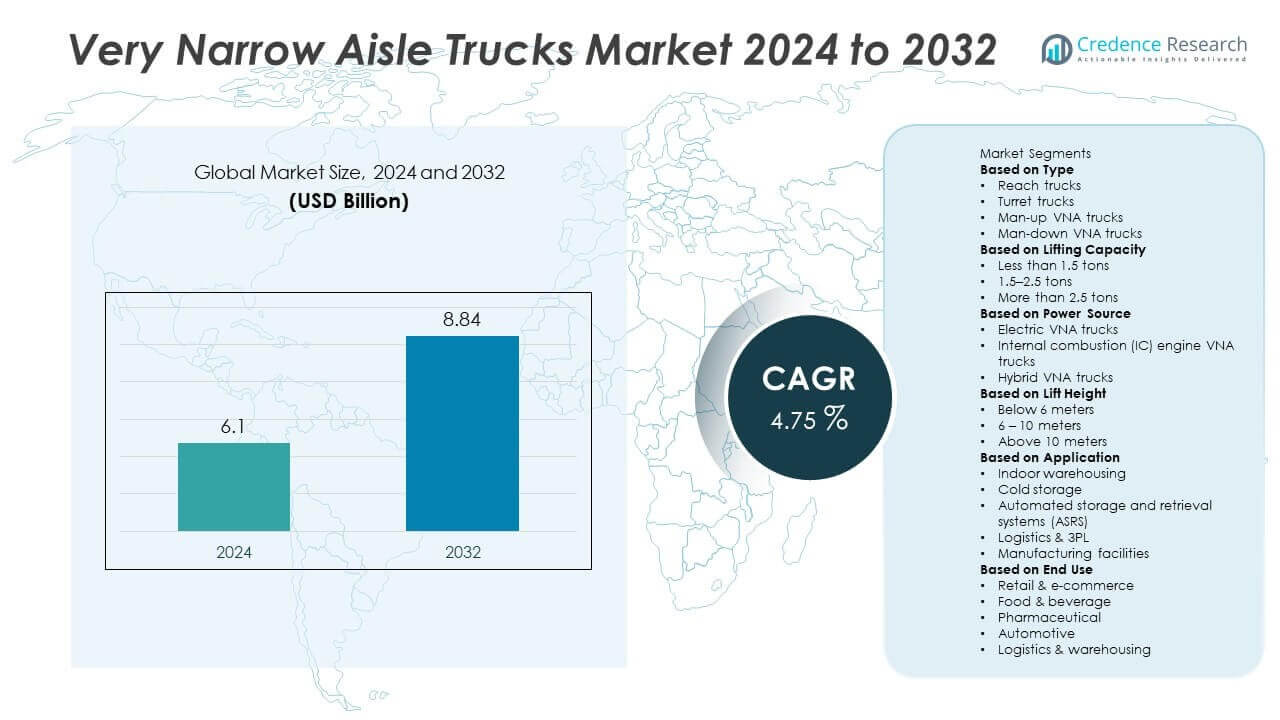

The Very Narrow Aisle Trucks Market size was valued at USD 6.1 billion in 2024 and is anticipated to reach USD 8.84 billion by 2032, growing at a CAGR of 4.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Very Narrow Aisle Trucks Market Size 2024 |

USD 6.1 Billion |

| Very Narrow Aisle Trucks Market, CAGR |

4.75% |

| Very Narrow Aisle Trucks Market Size 2032 |

USD 8.84 Billion |

The Very Narrow Aisle Trucks Market grows steadily, supported by strong drivers and evolving trends in warehousing and logistics. Rising demand for space optimization in high-density storage facilities accelerates adoption across retail, e-commerce, and manufacturing sectors. It improves inventory handling efficiency and reduces operational costs for distribution centers

The Very Narrow Aisle Trucks Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region contributing uniquely to growth. North America leads adoption through e-commerce fulfillment centers, retail warehouses, and logistics hubs supported by advanced automation. Europe focuses on green warehousing and Industry 4.0 initiatives, driving demand for electric-powered and high-capacity trucks. Asia-Pacific expands rapidly with large-scale investments in logistics, retail, and manufacturing, particularly in China, Japan, and India. Latin America and the Middle East & Africa present steady opportunities through modernization of warehousing infrastructure and growing retail distribution networks. Key players shaping this market include Toyota Material Handling, KION Group, Jungheinrich, and Raymond Corporation, who compete by offering innovative, energy-efficient, and automation-integrated solutions. Their strategies focus on sustainability, safety, and operational efficiency, ensuring widespread adoption across diverse industries and reinforcing competitiveness in global markets.

Market Insights

- The Very Narrow Aisle Trucks Market was valued at USD 6.1 billion in 2024 and is projected to reach USD 8.84 billion by 2032, growing at a CAGR of 4.75%.

- Rising demand for space optimization in warehouses drives adoption of narrow aisle trucks for high-density storage.

- E-commerce growth accelerates investments in fulfillment centers that rely on efficient material handling equipment.

- Leading players such as Toyota Material Handling, KION Group, Jungheinrich, and Raymond Corporation compete through innovation, automation, and sustainable solutions.

- High capital investment and maintenance costs act as restraints, limiting adoption among small and medium-sized operators.

- North America leads with advanced warehousing and logistics infrastructure, while Europe emphasizes sustainability and automation in material handling practices.

- Asia-Pacific shows the fastest growth with rising adoption in China, Japan, and India, supported by retail expansion and logistics modernization, while Latin America and the Middle East & Africa present emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Space Optimization in Warehousing

The Very Narrow Aisle Trucks Market is driven by the growing need to maximize warehouse storage capacity. Companies seek solutions that allow higher racking systems and tighter aisle layouts without reducing efficiency. It enables businesses to increase storage density and improve space utilization. Retailers and logistics providers benefit from reduced real estate costs by adopting narrow aisle systems. Rising e-commerce volumes further strengthen the need for efficient space management. It positions very narrow aisle trucks as essential tools for modern high-density warehouses.

- For instance, Linde Material Handling’s VNA turret trucks can process up to 30 pallets per hour at a rack height of seven meters, thanks to their ability to move and lift simultaneously.

Growth of E-Commerce and Expanding Logistics Networks

The Very Narrow Aisle Trucks Market gains momentum from the rapid growth of e-commerce and expanding distribution networks. Online retailers demand quick, accurate, and large-scale inventory handling in their warehouses. It ensures faster picking cycles, better order fulfillment, and reduced downtime. Logistics companies adopt these trucks to meet rising expectations for same-day and next-day delivery. Growing investments in new fulfillment centers across urban and semi-urban regions fuel adoption. It highlights the importance of narrow aisle trucks in scaling e-commerce operations efficiently.

- For instance, Raymond’s 9800 Swing-Reach articulated VNA truck can lift 3,300 lb to 30 ft, or 2,500 lb to nearly 50 ft, and operate in aisles as narrow as 60 in.

Increasing Focus on Automation and Advanced Material Handling

The Very Narrow Aisle Trucks Market benefits from rising demand for automation and advanced material handling solutions. Integration of sensors, telematics, and semi-automation features enhances productivity and reduces operator fatigue. It supports precise maneuverability in high racks and tight aisles, where accuracy is critical. Manufacturers are introducing electric-powered models with energy-efficient systems to align with sustainability goals. Companies adopt these technologies to improve operational safety and reduce labor dependency. It strengthens the market’s role in modernizing warehouse infrastructure.

Rising Adoption Across Retail, Manufacturing, and Third-Party Logistics

The Very Narrow Aisle Trucks Market experiences strong adoption across diverse industries including retail, manufacturing, and third-party logistics. Retailers use these trucks to manage growing product assortments in compact spaces. It provides efficiency for manufacturing plants handling large volumes of raw materials and finished goods. Third-party logistics operators invest in very narrow aisle trucks to support multi-client operations and flexible storage needs. The demand for cost efficiency and operational flexibility drives consistent adoption. It reinforces the versatility of narrow aisle trucks as a key solution across industry verticals.

Market Trends

Adoption of Electric-Powered and Eco-Friendly Models

The Very Narrow Aisle Trucks Market is witnessing strong demand for electric-powered and eco-friendly models. Companies focus on reducing emissions and improving energy efficiency in material handling. It aligns with sustainability goals and regulatory pressure for greener warehouse operations. Lithium-ion battery technology enhances runtime, reduces charging downtime, and lowers maintenance costs. Businesses adopt electric trucks to improve safety and reduce reliance on fossil fuels. It positions eco-friendly narrow aisle trucks as the preferred choice for future-ready warehouses.

- For instance, Raymond’s lithium-ion battery for its reach trucks offers 6–8 hours of runtime with a 156 Ah, 24 V pack, and fully recharges in 6 hours.

Integration of Automation and Smart Technologies

The Very Narrow Aisle Trucks Market benefits from the growing integration of automation and digital systems. Advanced trucks are equipped with telematics, fleet management tools, and semi-automated navigation. It enables operators to track performance, optimize routes, and reduce handling errors. Smart sensors and collision-avoidance systems improve safety in high-density environments. Warehouses adopting Industry 4.0 practices prefer trucks that support data-driven decisions. It highlights the trend toward intelligent and connected material handling equipment.

- For instance, Linde’s K-series VNA turret truck offers an optional Personal Protection System using laser scanners to detect people within a 9-meter safety zone, triggering an automatic stop.

Rising Use in High-Bay and Automated Warehousing Systems

The Very Narrow Aisle Trucks Market shows growth in high-bay warehouse applications. Increasing demand for vertical storage pushes adoption of trucks designed for extreme heights and narrow pathways. It supports efficient pallet handling in automated storage and retrieval systems. Manufacturers focus on compact designs with high stability to enhance performance in tall racking systems. Growing adoption of automated warehouses in retail and logistics accelerates this trend. It underscores the importance of narrow aisle trucks in advanced warehouse layouts.

Focus on Operator Safety and Ergonomic Enhancements

The Very Narrow Aisle Trucks Market emphasizes safety and ergonomics to improve operator productivity. New models include enhanced visibility cabins, intuitive controls, and adjustable seating. It reduces operator fatigue during long shifts in demanding warehouse operations. Safety systems such as automatic braking, speed control, and anti-collision features are increasingly common. Employers prioritize equipment that minimizes risk while maintaining efficiency. It strengthens the market’s commitment to workforce safety alongside performance improvements.

Market Challenges Analysis

High Capital Investment and Maintenance Costs

The Very Narrow Aisle Trucks Market faces challenges due to the high upfront cost of acquisition. Advanced models with electric powertrains, automation features, and safety systems require significant investment. It limits adoption among small and medium-sized warehouse operators with budget constraints. Maintenance and repair costs further add to the financial burden over the equipment lifecycle. Frequent need for skilled technicians and specialized parts raises operational expenses. It creates hesitation among businesses in price-sensitive markets, slowing overall growth.

Operational Limitations and Skilled Workforce Shortage

The Very Narrow Aisle Trucks Market also encounters barriers from operational and workforce constraints. Maneuvering trucks in narrow aisles requires trained operators to ensure safety and efficiency. It becomes a challenge in regions facing labor shortages or inadequate training infrastructure. Performance is also affected in uneven floors or warehouses with limited racking compatibility. Dependence on manual input in non-automated facilities increases the risk of accidents and inefficiency. It highlights the importance of workforce development and infrastructure upgrades to maximize adoption.

Market Opportunities

Rising Demand from E-Commerce and Retail Expansion

The Very Narrow Aisle Trucks Market presents strong opportunities through the rapid expansion of e-commerce and organized retail. Growing online sales drive the need for high-density warehouses with efficient space utilization. It supports faster order picking, streamlined inventory management, and reduced delivery timelines. Retailers and logistics providers increasingly invest in modern warehouse infrastructure where narrow aisle trucks play a central role. Global expansion of fulfillment centers in urban and semi-urban areas further boosts demand. It establishes a solid opportunity for manufacturers to align solutions with the evolving retail landscape.

Adoption of Automation and Green Warehousing Practices

The Very Narrow Aisle Trucks Market benefits from opportunities linked to automation and sustainability initiatives. Companies seek advanced trucks integrated with telematics, semi-automation, and fleet management tools to improve efficiency. It aligns with Industry 4.0 strategies and the push for digital warehouses. Growing preference for electric-powered and lithium-ion battery models creates prospects in eco-friendly operations. Governments and corporations emphasize green warehousing to meet carbon reduction goals, fueling adoption. It highlights a long-term growth path where innovation and sustainability define competitive advantage.

Market Segmentation Analysis:

By Type

The Very Narrow Aisle Trucks Market by type is segmented into turret trucks, order pickers, and reach trucks. Turret trucks hold a strong position due to their ability to rotate forks and operate efficiently in the narrowest aisles. It allows warehouses to maximize vertical storage and streamline pallet handling. Order pickers are increasingly adopted in retail and e-commerce for precise picking of smaller packages. Reach trucks continue to find demand in facilities balancing height capability with affordability. It highlights the flexibility of narrow aisle truck types in addressing distinct operational needs.

- For instance, a Linde K-series turret truck can achieve a maximum lift height of 15,650 mm (about 51 ft). However, the minimum operating aisle width varies by model, with the narrowest K-series model operating in aisles as small as 1,645 mm (about 5.4 ft).

By Lifting Capacity

The Very Narrow Aisle Trucks Market by lifting capacity includes less than 1.5 tons, 1.5 to 2.5 tons, and above 2.5 tons. Trucks in the 1.5 to 2.5 tons segment dominate as they suit the requirements of most warehouses and distribution centers. It provides an ideal balance between load management and maneuverability. Trucks with capacities above 2.5 tons are adopted in heavy-duty industrial warehouses and large-scale manufacturing operations. The segment below 1.5 tons serves small facilities and retail outlets with lighter load needs. It reflects the ability of the market to cater to both small-scale and high-capacity warehousing demands.

- For instance, Linde’s K 1.1 turret truck is rated for 1.1 t nominal load at center of gravity and can lift up to 7.2 m (about 23.6 ft).

By Power Source

The Very Narrow Aisle Trucks Market by power source divides into electric-powered and internal combustion models. Electric-powered trucks lead adoption as companies prioritize sustainability, efficiency, and lower emissions. It aligns with global shifts toward green warehousing and energy-efficient logistics. Lithium-ion battery systems improve runtime, reduce charging downtime, and minimize maintenance costs. Internal combustion models remain relevant for operations requiring continuous heavy-duty performance, particularly in regions with limited charging infrastructure. It shows the growing preference for electrification while retaining flexibility in power options for specialized applications.

Segments:

Based on Type

- Reach trucks

- Turret trucks

- Man-up VNA trucks

- Man-down VNA trucks

Based on Lifting Capacity

- Less than 1.5 tons

- 1.5–2.5 tons

- More than 2.5 tons

Based on Power Source

- Electric VNA trucks

- Internal combustion (IC) engine VNA trucks

- Hybrid VNA trucks

Based on Lift Height

- Below 6 meters

- 6 – 10 meters

- Above 10 meters

Based on Application

- Indoor warehousing

- Cold storage

- Automated storage and retrieval systems (ASRS)

- Logistics & 3PL

- Manufacturing facilities

Based on End Use

- Retail & e-commerce

- Food & beverage

- Pharmaceutical

- Automotive

- Logistics & warehousing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 33% share of the Very Narrow Aisle Trucks Market, supported by advanced warehousing practices and a strong logistics network. The United States leads adoption with a high concentration of e-commerce fulfillment centers, retail warehouses, and third-party logistics providers. It benefits from rapid growth in online shopping and rising demand for faster delivery times, which require high-density storage solutions. Canada contributes through steady adoption in manufacturing and retail sectors, while Mexico supports growth with expanding automotive and industrial facilities. Investments in automation and electric-powered trucks further enhance adoption in the region. It positions North America as a leading market, shaped by innovation, efficiency, and sustainability.

Europe

Europe accounts for a 29% share of the Very Narrow Aisle Trucks Market, driven by strict warehouse efficiency standards and a mature logistics sector. Germany, the UK, and France lead with strong adoption across retail chains, automotive production, and industrial warehouses. It benefits from the region’s focus on green warehousing and widespread shift toward electric-powered and energy-efficient trucks. Warehousing automation initiatives across Western Europe strengthen demand for narrow aisle solutions that maximize space and streamline material handling. Eastern Europe also shows rising adoption due to expanding logistics and retail distribution hubs. It underlines Europe’s balanced growth, supported by sustainability goals and technological innovation.

Asia-Pacific

Asia-Pacific commands a 26% share of the Very Narrow Aisle Trucks Market, making it one of the fastest-growing regions. China dominates adoption with large-scale manufacturing, e-commerce growth, and rapid warehouse expansion. It benefits from rising investments in logistics infrastructure and the push for efficient storage solutions in densely populated urban areas. Japan and South Korea focus on advanced automated warehouses with strong integration of narrow aisle trucks in logistics and industrial facilities. India shows increasing adoption, driven by the growth of organized retail, food distribution, and e-commerce operations. Southeast Asian countries also contribute through modernization of logistics networks. It highlights Asia-Pacific as a dynamic region with strong long-term potential.

Latin America

Latin America contributes a 7% share of the Very Narrow Aisle Trucks Market, reflecting gradual adoption supported by industrial and retail expansion. Brazil leads the region, with strong demand from food and beverage warehouses, automotive plants, and growing e-commerce networks. Mexico follows with adoption in automotive, logistics, and retail distribution sectors. Chile and Argentina show potential through modernization of warehousing infrastructure. Limited access to high-capital equipment and training slows faster adoption, but international partnerships and investments are improving accessibility. It positions Latin America as a developing market with steady opportunities in logistics and industrial growth.

Middle East & Africa

The Middle East & Africa hold a 5% share of the Very Narrow Aisle Trucks Market, supported by rising investments in logistics hubs and retail infrastructure. The UAE and Saudi Arabia lead adoption with their growing warehousing sectors tied to global trade and e-commerce expansion. It benefits from regional strategies to diversify economies and strengthen supply chain efficiency. Africa, led by South Africa and Nigeria, shows adoption in food distribution and retail supply chains. Limited local manufacturing capacity and high equipment costs remain challenges for broader penetration. It reflects an emerging region with long-term opportunities linked to urbanization, retail growth, and logistics modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Very Narrow Aisle Trucks Market features leading players such as Toyota Material Handling, KION Group, Jungheinrich, Raymond Corporation, Mitsubishi Logisnext, Doosan Industrial Vehicle, Manitou Group, Hyundai Construction Equipment, Godrej Material Handling, and Anhui Heli. These companies compete by focusing on innovation, automation, and sustainability to meet the evolving demands of global warehousing and logistics. They invest heavily in developing electric-powered models with lithium-ion battery systems to improve energy efficiency and reduce emissions. Advanced features such as telematics, smart navigation, and fleet management tools are integrated to enhance operator safety and warehouse productivity. Strategic partnerships with retailers, e-commerce companies, and logistics providers allow them to expand their customer base and strengthen global presence. Companies also focus on compact, high-capacity designs that support efficient operations in high-density storage environments. Growing emphasis on Industry 4.0 and automated warehouses drives innovation, ensuring these players maintain leadership through technological excellence, product diversification, and global service networks.

Recent Developments

- In May 2025, Raymond Corporation opened an advanced energy storage solutions development, prototyping, and test center in Henrietta, Monroe County, New York.

- In March 2025, Jungheinrich showcased a new VNA truck design that enhances efficiency in warehouses with high stacking heights and narrow aisles.

- In July 2024, Crown Equipment Corporation introduced the TSP 1000/1500 series of VNA turret trucks, featuring the new Gena operating system. This system provides a customizable interactive display with real‑time data, enhancing safety and operator performance in dense, high‑rise storage environments.

- In April 2023, Toyota Material Handling Europe, unveiled two new VNA models in its BT Vector VCE-series: VCE100A and VCE120A, alongside an updated VCE150A variant with improved ergonomics and a touchscreen interface.

Report Coverage

The research report offers an in-depth analysis based on Type, Lifting Capacity, Power Source, Lift Height, Application, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for space-efficient warehousing solutions.

- E-commerce growth will continue to drive investments in modern storage facilities.

- Electric-powered and lithium-ion battery trucks will see stronger adoption.

- Automation and telematics integration will enhance productivity and safety.

- High-capacity turret trucks will gain traction in high-bay warehouses.

- Compact and modular designs will support urban and small-scale warehouses.

- Retail and third-party logistics providers will remain major end users.

- Manufacturing and food sectors will increase adoption for bulk handling.

- Emerging markets will invest in warehouse modernization and efficient logistics.

- Sustainability goals will reinforce the shift toward energy-efficient narrow aisle trucks.