Market Overview

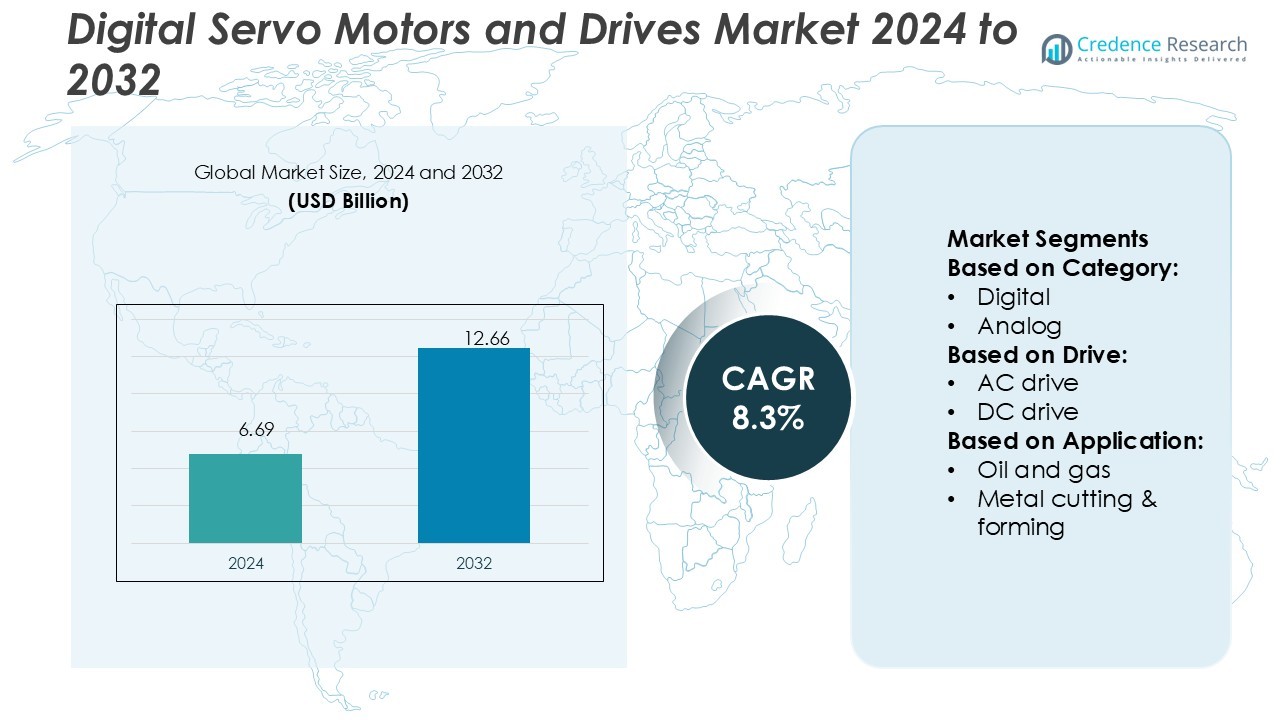

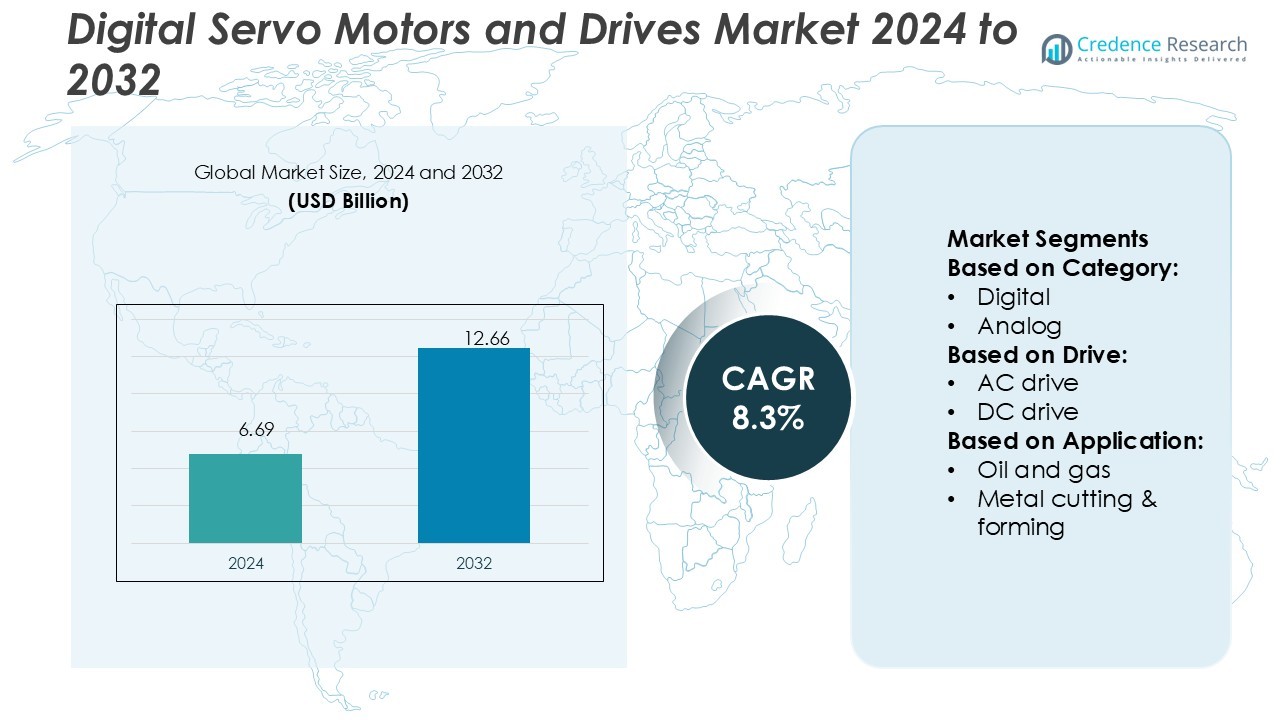

Digital Servo Motors and Drives Market size was valued USD 6.69 billion in 2024 and is anticipated to reach USD 12.66 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Servo Motors and Drives Market Size 2024 |

USD 6.69 Billion |

| Digital Servo Motors and Drives Market, CAGR |

8.3% |

| Digital Servo Motors and Drives Market Size 2032 |

USD 12.66 Billion |

The Digital Servo Motors and Drives Market is dominated by key players such as ABB, Bosch Rexroth, Beckhoff Automation, Emerson Electric, Delta Electronics, Fuji Electric, Danfoss, Hitachi, CM Robotics, and Dai-ichi Dentsu. These companies focus on advanced automation solutions, precision control, and energy-efficient technologies to strengthen their market presence. ABB and Bosch Rexroth lead in developing high-performance servo systems for smart manufacturing and robotics, while Delta Electronics and Beckhoff Automation emphasize integrated digital drive platforms. North America holds the leading regional position with a 36% market share, driven by strong industrial automation, robotics integration, and widespread adoption of Industry 4.0 technologies across the U.S. and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Servo Motors and Drives Market was valued at USD 6.69 billion in 2024 and is expected to reach USD 12.66 billion by 2032, growing at a CAGR of 8.3%.

- Rising automation in manufacturing, packaging, and robotics industries is driving strong demand for precision control and energy-efficient servo systems.

- Key players such as ABB, Bosch Rexroth, Delta Electronics, and Beckhoff Automation focus on digital integration, predictive maintenance, and high-speed motion solutions to gain a competitive edge.

- Market growth faces challenges from high installation costs and the complexity of integrating digital servo systems into existing industrial setups.

- North America leads the market with a 36% share, supported by advanced automation adoption, while the digital segment dominates product demand due to superior accuracy, efficiency, and compatibility with smart manufacturing environments.

Market Segmentation Analysis:

By Category

The digital segment dominates the Digital Servo Motors and Drives Market, accounting for nearly 72% share in 2025. This dominance arises from the growing adoption of Industry 4.0 and smart manufacturing technologies. Digital servo systems provide superior precision, real-time feedback, and programmability compared to analog units. Their integration with IoT-enabled controllers allows remote monitoring and predictive maintenance. Manufacturers in automotive, electronics, and packaging sectors increasingly prefer digital systems for improved production efficiency and reduced downtime, driving strong demand growth across industrial automation applications.

- For instance, Fuji Electric’s ALPHA7 servo system delivers a 3.2 kHz speed and frequency response and a 24-bit encoder resolution—capabilities that underpin its use in high-precision factory automation lines.

By Drive

AC drives hold the dominant position in the market, representing nearly 68% share in 2025. Their high efficiency, low maintenance requirements, and capability to handle variable torque loads make them preferred over DC drives. AC servo drives are widely deployed in robotics, CNC machinery, and conveyor systems for precise speed and torque control. The trend toward energy-efficient motion systems and the growing use of compact, brushless motors further strengthen AC drive adoption, particularly in industrial and manufacturing automation processes requiring high reliability and precision.

- For instance, The Control Techniques Unidrive M700 AC servo drive offers support for EtherCAT communication at 100 Mb/s. Specific variants of the drive can be found with a continuous current rating of 20 A and a peak current of 40 A.

By Application

The robotics segment leads the Digital Servo Motors and Drives Market, capturing nearly 31% market share in 2025. The rise of industrial robots, collaborative robots, and autonomous systems fuels this dominance. Servo systems offer high torque density, accurate positioning, and dynamic motion control essential for robotic arms and precision equipment. Expanding automation in automotive assembly, logistics, and healthcare robotics—especially medical robots for surgeries and diagnostics—drives steady growth. Investments in smart factories and human–robot collaboration technologies continue to accelerate servo drive integration across robotic applications.

Key Growth Drivers

Rising Automation Across Industrial Sectors

The growing demand for automation in manufacturing and process industries drives the adoption of digital servo motors and drives. These systems ensure high precision, energy efficiency, and reduced downtime. Automotive and electronics manufacturers increasingly deploy servo systems for robotics and CNC machinery to enhance accuracy and throughput. For instance, Mitsubishi Electric’s MELSERVO-J5 series offers real-time tuning and reduced response times by up to 50%, enabling faster production cycles and improved product quality in automated assembly lines.

- For instance, Beckhoff’s AM8064 synchronous servo motor delivers a standstill torque of 35.4 Nm, a peak torque of 148 Nm, and a rated speed of 1,500 rpm, while supporting 24-bit OCT encoder feedback.

Growing Demand for Energy Efficiency and Smart Control Systems

Industries are shifting toward energy-efficient solutions to meet global sustainability goals. Digital servo drives with integrated feedback and control algorithms reduce energy loss and improve motion accuracy. Siemens’ SINAMICS S210 system, for example, uses a synchronous servo motor and integrated safety functions, offering up to 30% energy savings in packaging and robotics. Such advancements align with government energy regulations and support smart factory initiatives under Industry 4.0, accelerating the adoption of servo technologies worldwide.

- For instance, Delta’s ASDA-B2 servo drive supports a 17-bit encoder (160,000 pulses per revolution) and a command input rate of up to 4 Mbps for high-precision positioning.

Expansion of Robotics and Advanced Manufacturing Applications

The expansion of industrial and service robotics fuels demand for high-performance servo systems. These motors provide rapid acceleration, torque stability, and precise positioning, essential in sectors like healthcare, logistics, and automotive manufacturing. Yaskawa Electric’s Sigma-7 series demonstrates this trend, offering 20-bit encoder precision and vibration suppression for improved motion accuracy in robotic arms. As automation becomes central to high-mix, low-volume production, servo motors and drives are becoming vital for flexible and adaptive manufacturing environments.

Key Trends & Opportunities

Integration of AI and IoT for Predictive Motion Control

Manufacturers are embedding artificial intelligence and IoT capabilities into servo systems to enhance predictive maintenance and real-time monitoring. ABB and Rockwell Automation, for example, integrate cloud connectivity and machine learning algorithms to predict performance degradation before failure. This trend reduces maintenance costs and boosts operational uptime. The combination of AI, digital twins, and cloud analytics represents a major opportunity for creating self-optimizing motion control systems.

- For instance, Danfoss’ VLT AutomationDrive FC 302 includes an Integrated Motion Controller (IMC) that performs high-precision positioning and synchronization tasks without requiring extra hardware (e.g. encoder modules).

Rising Adoption in Medical Robotics and Precision Equipment

Digital servo motors are gaining traction in medical robotics, surgical systems, and laboratory automation. Their high torque density and compact designs allow precise control in minimally invasive procedures. For instance, Maxon Group supplies servo systems with accuracy levels of ±0.01 mm for robotic-assisted surgery. The growing demand for precision equipment in healthcare presents strong opportunities for servo manufacturers targeting high-value medical applications.

- For instance, ABB’s E530 servo drive supports input voltages of 200 V to 240 V single/three-phase and 380 V to 480 V three-phase, and its rated power spans from 0.2 kW to 7.5 kW.

Shift Toward Compact, High-Power Density Designs

Manufacturers focus on developing lightweight, high-torque servo motors that deliver superior performance in limited spaces. Companies like Kollmorgen have introduced frameless servo kits optimized for collaborative robots, offering torque densities exceeding 10 Nm/kg. This miniaturization trend enables deployment in mobile robotics, exoskeletons, and compact machinery, broadening application potential across industries demanding high-efficiency motion systems.

Key Challenges

High Initial Cost and Integration Complexity

The integration of digital servo systems involves significant upfront investment in hardware, software, and training. Small and medium enterprises often find the cost barrier restrictive compared to conventional drives. Complex programming and compatibility issues between different automation platforms also hinder adoption. Although long-term savings exist, the need for skilled technicians and customized integration limits wider market penetration in cost-sensitive regions.

Supply Chain Disruptions and Component Shortages

Global semiconductor shortages and logistics challenges have affected servo motor and drive production. Components such as encoders, control chips, and rare-earth magnets face supply constraints, delaying project timelines. For example, manufacturers like Fanuc reported extended delivery cycles due to raw material shortages. Such disruptions highlight the vulnerability of the supply chain, prompting companies to diversify sourcing and invest in localized production strategies.

Regional Analysis

North America

North America holds the largest market share of 36% in the Digital Servo Motors and Drives Market. The region’s dominance is driven by strong automation adoption across industries such as automotive, aerospace, and packaging. The U.S. and Canada are key contributors, with widespread use of advanced motion control systems in manufacturing. Growing investments in robotics and electric vehicles further enhance regional growth. For instance, Rockwell Automation and Siemens USA have expanded digital servo solutions to support smart factory initiatives and energy-efficient operations.

Europe

Europe accounts for 28% of the Digital Servo Motors and Drives Market, led by Germany, the U.K., and Italy. The region benefits from strong industrial automation, supported by Industry 4.0 and smart manufacturing programs. Servo drive integration in robotics and CNC machines is growing rapidly across automotive and metal fabrication sectors. Siemens, Bosch Rexroth, and Schneider Electric dominate through innovations in precision control and energy optimization. The shift toward carbon-neutral production and sustainable industrial systems also supports continuous market growth in Europe.

Asia-Pacific

Asia-Pacific represents 30% of the Digital Servo Motors and Drives Market, driven by rapid industrialization in China, Japan, India, and South Korea. The region’s growth is fueled by robotics, electronics manufacturing, and factory automation investments. High adoption of CNC machines, robotics arms, and automated assembly systems drives demand. For instance, Mitsubishi Electric and Yaskawa Electric are expanding servo systems for high-speed and precision manufacturing. Government programs promoting smart manufacturing, such as China’s “Made in China 2025,” further accelerate regional market expansion.

Latin America

Latin America holds a 4% market share, supported by growing adoption of automation in Mexico and Brazil. The region is witnessing gradual integration of servo drives in packaging, automotive, and food processing industries. Expansion of industrial sectors and export-oriented manufacturing supports steady growth. Companies such as ABB and Siemens are introducing cost-efficient digital servo solutions to meet local demand. Rising foreign investments in manufacturing automation and infrastructure modernization further strengthen Latin America’s market position in this segment.

Middle East & Africa

The Middle East & Africa account for 2% of the Digital Servo Motors and Drives Market. Growth in this region is supported by industrial automation projects across oil and gas, construction, and utilities. The UAE, Saudi Arabia, and South Africa lead adoption through smart manufacturing and digital transformation initiatives. Servo drive applications in energy, water management, and logistics are expanding. For instance, Schneider Electric and Omron have partnered with regional industries to deploy energy-efficient motion control systems aligned with national industrial modernization goals.

Market Segmentations:

By Category:

By Drive:

By Application:

- Oil and gas

- Metal cutting & forming

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Servo Motors and Drives Market players such as Fuji Electric, CM Robotics, Beckhoff Automation, Emerson Electric, Bosch Rexroth, Delta Electronics, Danfoss, Hitachi, ABB, and Dai-ichi Dentsu. The Digital Servo Motors and Drives Market is highly competitive, driven by continuous advancements in automation and motion control technologies. Companies focus on enhancing precision, energy efficiency, and connectivity in servo systems to meet modern industrial requirements. The market emphasizes compact, high-torque solutions integrated with IoT and AI-based monitoring for predictive maintenance and improved productivity. Manufacturers are developing modular drive systems compatible with smart factories and Industry 4.0 standards. Strategic partnerships, mergers, and R&D investments remain key approaches to expanding global presence. Growing adoption of robotics, CNC machinery, and electric vehicles continues to intensify competition, encouraging innovation in digital servo design and control perform.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- CM Robotics

- Beckhoff Automation

- Emerson Electric

- Bosch Rexroth

- Delta Electronics

- Danfoss

- Hitachi

- ABB

- Dai-ichi Dentsu

Recent Developments

- In March 2025, Nidec Instruments added S-FLAG DYNAMIC MOTION MB Series AC servo motors to their catalog, adding to previously released S-FLAG models. These S-FLAG models were a refinement of their proprietary AC servo motors meant for transfer robots. Later, these motors were adapted for general-purpose industrial equipment.

- In January 2025, Yaskawa Electric Corporation expanded its Σ-X (Sigma-10) series of AC servo drives, showcasing their focus on motion control and industrial safety technology. The product features an addition of the Advanced Safety Modules (ASM-X), which are attached directly to the adjacent of the SERVOPACK along with a new line of servo motors with integrated functional safety.

- In June 2024, Panasonic unveiled India’s maiden servo system equipped with the AI solutions called MINAS A7, designed to slash human operational involvement by as much as 90%. Designed to deliver top-tier motion performance and automatic tuning capabilities that surpass even expert-level manual adjustments, the MINAS A7 set a new benchmark in industrial automation. Additionally, it also launched the MINAS A6SC and MINAS CZ1 Global series servo motors.

- In March 2024, Kollmorgen added additional communication protocols to the existing ones in their AKD2G servo drive. The latest version added support for Ethernet/IP and PROFINET IRT with CIP Sync, augmenting its compatibility beyond the previously available protocols. This development improves the precision in motion synchronization across several drives and various control system configurations.

Report Coverage

The research report offers an in-depth analysis based on Category, Drive, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for energy-efficient servo systems will rise with expanding industrial automation.

- Integration of IoT and AI will enhance predictive maintenance and real-time performance control.

- Robotics adoption in manufacturing and logistics will boost servo motor deployment.

- Compact and lightweight servo drives will gain popularity in portable and collaborative robots.

- Smart factories will rely more on servo-driven precision machinery and motion systems.

- Manufacturers will invest in digital twin technologies for servo performance simulation.

- Electric vehicle production growth will drive servo usage in assembly and testing lines.

- Advanced motion control software will improve synchronization and operational flexibility.

- Regional manufacturing hubs in Asia-Pacific will emerge as key growth contributors.

- Sustainability goals will push servo manufacturers to design low-power, recyclable systems.