Market Overview

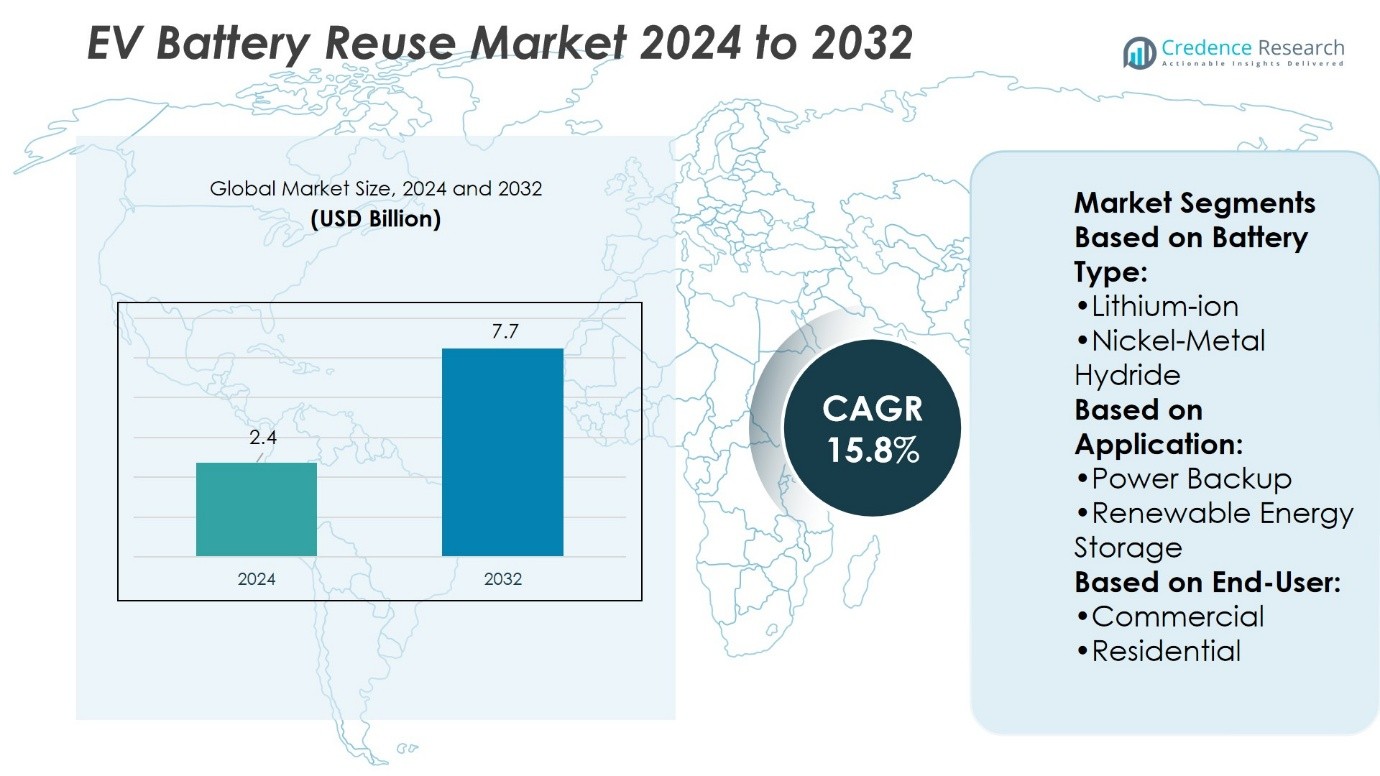

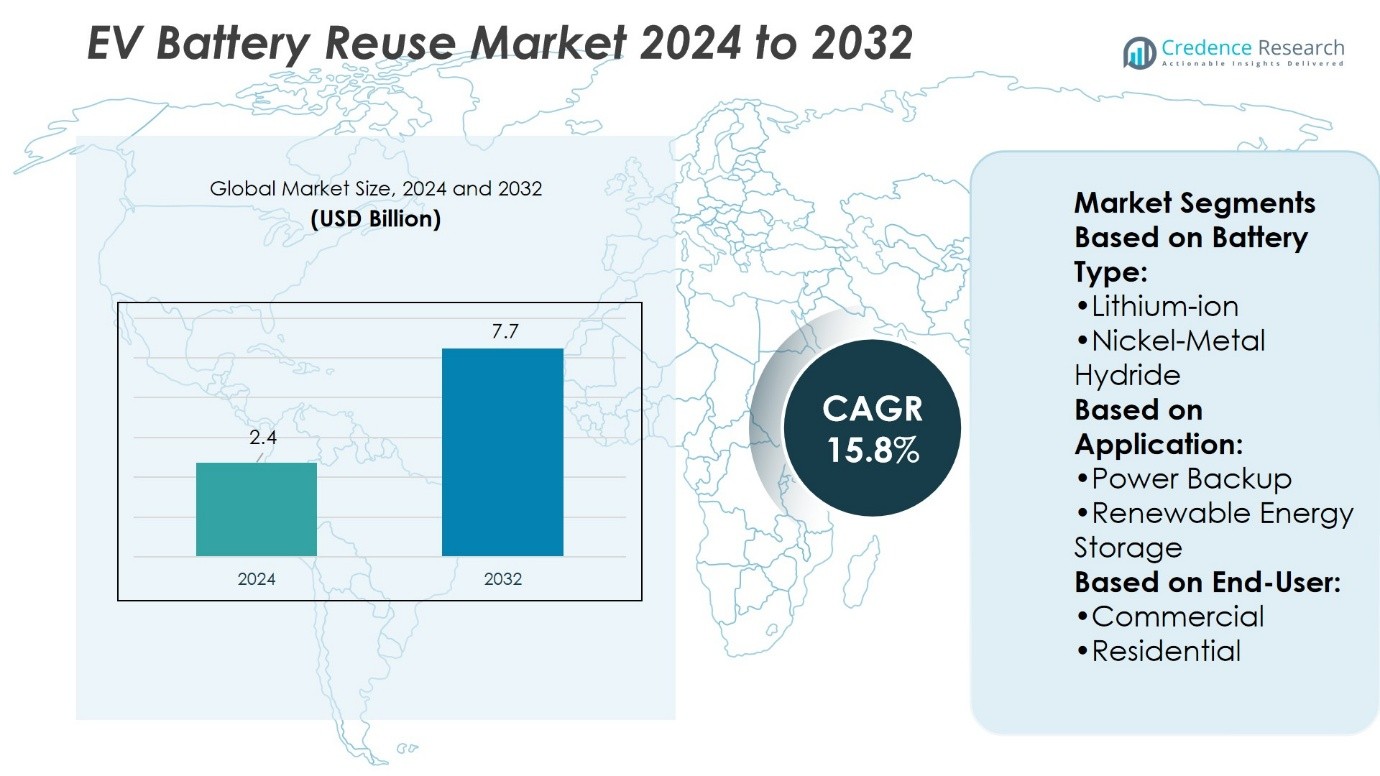

EV Battery Reuse Market size was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 7.7 billion by 2032, at a CAGR of 15.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Battery Reuse Market Size 2024 |

USD 2.4 Billion |

| EV Battery Reuse Market, CAGR |

15.8% |

| EV Battery Reuse Market Size 2032 |

USD 7.7 Billion |

The EV Battery Reuse Market grows as rising electric vehicle adoption generates a steady stream of retired batteries suitable for second-life applications. Drivers include increasing demand for affordable energy storage, supportive government regulations, and the push toward circular economy models. Reused batteries provide cost-effective solutions for renewable energy integration, backup systems, and grid stabilization. Trends highlight growing collaborations between automakers, energy companies, and technology firms to scale reuse projects. Advances in diagnostic tools, repurposing technologies, and modular storage designs further enhance efficiency. Together, these factors position battery reuse as a key enabler of sustainable energy transition.

The EV Battery Reuse Market shows strong regional growth, led by Asia-Pacific with the largest share, supported by high EV adoption and renewable energy projects. North America follows with advanced recycling infrastructure and strong policy support, while Europe benefits from strict regulations and circular economy initiatives. Latin America and the Middle East & Africa are emerging markets, driven by renewable expansion and off-grid needs. Key players driving competition include Nissan Motor Co., Ltd., Renault Group, RePurpose Energy Inc., and Connected Energy Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- EV Battery Reuse Market size was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 7.7 billion by 2032, at a CAGR of 15.8%.

- Rising electric vehicle adoption creates a continuous supply of retired batteries for second-life use.

- Increasing demand for affordable storage and supportive government regulations drive market expansion.

- Growing collaborations between automakers, energy firms, and technology providers highlight a key industry trend.

- Competition is intensifying as companies invest in diagnostics, modular solutions, and large-scale reuse projects.

- Limited collection infrastructure and fragmented standards act as restraints for global growth.

- Asia-Pacific leads the market, followed by North America and Europe, while Latin America and Middle East & Africa show emerging potential.

Market Drivers

Rising Need for Circular Economy and Resource Efficiency

The EV Battery Reuse Market grows due to the global shift toward circular economy principles. Policymakers encourage reuse to reduce raw material extraction and limit environmental impacts. Companies adopt second-life battery applications to extend value and minimize waste. Resource efficiency becomes critical as demand for lithium, cobalt, and nickel intensifies. Reusing EV batteries supports sustainability commitments and lowers dependency on volatile mining supply chains. It creates long-term cost benefits for manufacturers and energy providers seeking efficient resource use.

- For instance, Moment Energy repurposed more than 1.5 MWh of retired Nissan Leaf batteries into stationary storage systems, enabling microgrid projects that cut over 800 tons of CO₂ emissions annually.

Expanding Energy Storage Demand from Renewable Integration

The EV Battery Reuse Market benefits from rising renewable energy integration across grids. Wind and solar require stable storage to balance supply with demand. Reused EV batteries offer cost-effective backup for grid-scale storage projects. Utilities deploy them to reduce curtailment and stabilize energy flow during peak hours. Second-life storage also strengthens off-grid and community energy systems. It enables a flexible energy transition by supporting renewable adoption at scale.

- For instance, Nissan Motor Co., Ltd. has deployed second-life EV batteries from its Leaf models in various stationary storage projects. A 1.7 MWh storage system in Melilla, Spain, to provide backup power for a community of 90,000 residents.

Growing Automotive Industry Focus on Lifecycle Value

The EV Battery Reuse Market gains traction through automakers seeking to maximize product lifecycle value. Vehicle manufacturers design programs to recover used batteries and deploy them in stationary storage. These initiatives create new revenue streams beyond initial vehicle sales. It also supports corporate sustainability strategies while reducing recycling costs. Partnerships between OEMs and energy providers accelerate adoption of second-life solutions. This trend strengthens the link between transportation and energy sectors.

Supportive Regulations and Incentives Across Regions

The EV Battery Reuse Market expands with strong regulatory backing and financial incentives. Governments promote reuse to reduce landfill disposal and extend battery lifespans. Policy frameworks mandate extended producer responsibility, pushing automakers toward reuse solutions. Subsidies and tax benefits support energy storage projects that integrate second-life batteries. It creates favorable conditions for large-scale deployments in residential, commercial, and industrial sectors. Regional policies also align with climate goals, making reuse a strategic priority.

Market Trends

Increasing Integration of Second-Life Batteries in Renewable Energy Projects

The EV Battery Reuse Market shows strong momentum with second-life batteries supporting renewable energy integration. Utilities adopt these batteries for grid stabilization, peak load management, and renewable backup. It enables efficient storage for wind and solar projects while reducing costs. Community energy systems also benefit from affordable second-life storage options. Companies position reused batteries as scalable solutions for distributed energy networks. This trend highlights the growing synergy between clean energy and storage technologies.

- For instance, Evyon raised €8 million in a funding round that included a 26 MWh purchase agreement for second‑life batteries from Mercedes‑Benz Energy, aiming to deploy over 120 MWh of its energy storage systems.

Advancements in Battery Diagnostics and Repurposing Technologies

The EV Battery Reuse Market evolves with innovations in diagnostics and repurposing methods. Companies deploy advanced testing systems to assess state-of-health and performance reliability. It ensures safer second-life applications by identifying viable cells for reuse. Automated disassembly and reconfiguration systems reduce costs and improve efficiency. AI-driven predictive models optimize lifecycle management of reused batteries. This trend strengthens industry confidence in second-life adoption across diverse applications.

- For instance, OCTAVE BV deployed a second-life battery system with a 184 kW inverter in an outdoor-rated cabinet, designed to provide grid flexibility and renewable backup. The company has installed other second-life systems as well, including one with a 242 kWh capacity and 184 kW inverter for grid services and optimizing self-consumption.

Collaborations Between Automakers and Energy Providers

The EV Battery Reuse Market benefits from stronger partnerships between automotive manufacturers and energy firms. Automakers recover used EV batteries and redirect them into stationary energy projects. It creates circular business models that extend battery value beyond vehicles. Energy providers invest in pilot projects that showcase second-life potential. These collaborations generate new revenue opportunities and reduce lifecycle waste. The trend drives wider adoption by aligning industry stakeholders toward shared sustainability goals.

Rising Influence of Regulatory Frameworks and Standardization Efforts

The EV Battery Reuse Market advances with regulatory support and ongoing standardization initiatives. Governments implement policies to encourage reuse and restrict improper disposal. It drives automakers to adopt extended producer responsibility practices. Industry bodies focus on setting safety, testing, and performance standards for second-life use. Standardization improves consumer trust and market transparency. This trend establishes a structured environment for scaling reuse projects globally.

Market Challenges Analysis

Complexity of Battery Collection, Testing, and Repurposing Processes

The EV Battery Reuse Market faces hurdles linked to collection, diagnostics, and repurposing operations. Used EV batteries arrive with varying chemistries, conditions, and performance histories, complicating assessment. It requires advanced testing technologies and skilled labor, increasing operational costs. Logistics for collecting and transporting heavy batteries remain inefficient and fragmented. Automating disassembly processes helps, but investment costs deter small firms. Without streamlined systems, scaling reuse initiatives at commercial levels remains challenging for industry players.

Regulatory Uncertainty and Limited Consumer Awareness

The EV Battery Reuse Market also encounters challenges from regulatory gaps and low public awareness. Policies differ across regions, creating inconsistencies in compliance and safety requirements. It slows global standardization and adds risks for investors. Consumer trust remains limited due to concerns about safety, reliability, and performance of second-life batteries. Lack of education about benefits restricts adoption in residential and small business sectors. Companies must address regulatory clarity and build awareness to accelerate market acceptance.

Market Opportunities

Expanding Demand for Affordable Energy Storage Solutions

The EV Battery Reuse Market presents opportunities through the rising demand for cost-effective storage systems. Second-life batteries provide a competitive option for grid support, renewable integration, and backup power. It offers affordable energy access for off-grid and rural communities where new batteries remain expensive. Commercial buildings and small businesses adopt second-life storage to cut energy costs and improve resilience. Governments promote these solutions to support energy transition and carbon reduction goals. Expanding applications across residential, industrial, and community projects create strong growth potential.

Innovation in Circular Business Models and Strategic Partnerships

The EV Battery Reuse Market also benefits from opportunities in new circular business models. Automakers, recyclers, and energy providers collaborate to extend battery lifecycles and reduce waste. It allows companies to capture value across multiple stages of use, from vehicles to stationary storage. Digital platforms and AI-based diagnostics enhance efficiency, improving confidence in second-life applications. Strategic partnerships foster scalability by pooling resources and technical expertise. Growing corporate sustainability commitments amplify demand, positioning reuse as a long-term opportunity.

Market Segmentation Analysis:

By Battery Type

The EV Battery Reuse Market is primarily driven by lithium-ion batteries, which dominate due to their high energy density, longer lifespan, and wide adoption in electric vehicles. It remains the preferred chemistry for second-life applications, offering strong performance in renewable storage and backup systems. Nickel-metal hydride batteries find limited reuse potential, mainly in hybrid vehicles, where durability provides moderate extension opportunities. Lead-acid batteries also contribute to reuse, particularly in small-scale storage and low-cost backup, though shorter cycles reduce their long-term value. Each type supports distinct end-use cases, aligning with performance needs and cost structures.

- For instance, BatteryLoop integrates second-life lithium-ion battery modules from electric vehicles into modular, stackable storage units for industrial use. In a collaboration with Toyota Material Handling, the company installed a circular energy storage system (BLESS) at Stena Metall’s headquarters using 800 repurposed battery modules.

By Application

Power backup applications lead reuse adoption, with businesses and institutions deploying second-life batteries to ensure uninterrupted supply. It helps reduce operational risks and manage peak loads effectively. Renewable energy storage represents a fast-growing segment, where reused batteries stabilize solar and wind power generation. Grid-connected systems leverage these batteries for balancing demand and frequency regulation, offering utilities cost-effective options. EV charging applications also expand, using second-life storage to manage load and reduce strain on infrastructure. These diverse applications highlight the adaptability of reused batteries across energy networks.

- For instance, Renault Group has converted repurposed Kangoo Z.E. lithium-ion batteries into stationary E-STOR systems for energy storage applications. As part of its Advanced Battery Storage (ABS) program, the company also deployed an installation at its Douai plant, with a capacity of 4.7 MWh using a mix of new and repurposed batteries.

By End User

Commercial users form a major segment, adopting second-life batteries for backup, cost reduction, and sustainability goals. It supports offices, retail outlets, and institutions seeking reliable and affordable storage solutions. Residential users adopt reused batteries for renewable storage, home backup, and reduced dependency on grids. Industrial users drive demand through large-scale integration in factories and energy-intensive operations, aiming to lower costs and strengthen resilience. Each user group reflects unique requirements, yet all benefit from extended lifecycle and reduced costs. The EV Battery Reuse Market aligns these opportunities to broader energy and environmental goals.

Segments:

Based on Battery Type:

- Lithium-ion

- Nickel-Metal Hydride

Based on Application:

- Power Backup

- Renewable Energy Storage

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds nearly 35% of the EV battery reuse market. The region benefits from high EV adoption in the United States and Canada, supported by strong government incentives and sustainability policies. The presence of leading battery recycling and reuse companies, such as Redwood Materials and Li-Cycle, helps create a structured ecosystem for second-life applications. These firms invest in large facilities to recover and repurpose lithium-ion batteries for grid storage and backup systems. North America’s advanced renewable energy infrastructure also increases demand for second-life batteries, especially in solar and wind projects that require stable storage capacity. Growth is further supported by rising interest in microgrids and energy security solutions for commercial and residential users. However, the region faces challenges with logistics and collection systems for end-of-life batteries, which remain fragmented across states.

Europe

Europe accounts for close to 30% of the EV battery reuse market. Strong environmental regulations and ambitious carbon neutrality goals push the region to develop effective reuse and recycling systems. The European Union has mandated minimum recycled content in batteries, creating pressure on automakers and recyclers to expand reuse capacity. Germany, France, and the Nordic countries lead adoption with pilot projects that integrate second-life EV batteries into renewable energy storage systems. The growth of solar and wind capacity across the continent creates large opportunities for battery reuse to balance intermittent generation. Automakers and energy companies often collaborate to set up reuse programs, turning end-of-life EV batteries into affordable stationary storage products. Despite this progress, Europe struggles with limited processing capacity, which covers only a small fraction of projected needs. This gap pushes regional stakeholders to expand investments in reuse technologies and partnerships.

Asia-Pacific

Asia-Pacific leads globally with about 40% of the EV battery reuse market. China dominates the regional landscape with its massive EV fleet and well-developed supply chain for batteries. Companies across China, Japan, and South Korea actively repurpose used batteries for grid storage, backup power, and small-scale applications. India is also emerging as a strong market, driven by government initiatives promoting clean energy and EV adoption. The region benefits from a steady supply of end-of-life batteries due to rapid EV penetration, which ensures consistent input for reuse applications. Asia-Pacific also sees heavy investment in renewable energy projects, making second-life batteries attractive for balancing storage needs. However, the diversity of regulations across countries creates inconsistencies in standards and slows down regional coordination. Even so, Asia-Pacific continues to expand at the fastest pace due to demand, policy, and large-scale industrial capabilities.

Latin America

Latin America holds a small share of the EV battery reuse market, below 5%. Countries such as Brazil, Mexico, and Chile are showing interest in adopting second-life batteries for energy storage. Renewable energy expansion in solar-rich regions, especially in Chile and Brazil, supports reuse opportunities. EV penetration remains lower compared to North America, Europe, and Asia-Pacific, which limits the immediate supply of used batteries. However, regional governments are gradually implementing EV policies that will increase future demand for reuse solutions. Local companies and energy providers are exploring pilot projects where retired EV batteries power homes or act as backup storage for industries. Latin America’s growth will depend on both policy frameworks and private sector investments in the coming years.

Middle East & Africa

The Middle East & Africa contributes less than 5% to the global EV battery reuse market. The region is in the early stage of adoption but shows long-term potential due to rising renewable energy investments. Countries in the Gulf Cooperation Council, such as the UAE and Saudi Arabia, are building large solar farms that need affordable storage solutions. Second-life EV batteries can provide cost-effective backup for these renewable projects. In Africa, countries such as South Africa and Kenya are testing battery reuse for off-grid rural electrification projects, where stable energy storage is critical. The limited EV adoption in the region reduces the supply of reusable batteries today, but rapid infrastructure growth could support faster adoption over the next decade. With strong focus on energy diversification and sustainability, Middle East & Africa can emerge as a niche growth area for battery reuse.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The EV Battery Reuse Market is shaped by leading players such as Moment Energy, Nissan Motor Co., Ltd., RePurpose Energy Inc., evyon.com, RWE + Audi (AUDI AG and RWE), OCTAVE BV, Connected Energy Ltd., BatteryLoop, Renault Group, and B2U Storage. The EV Battery Reuse Market is experiencing strong competition as companies race to establish scalable reuse models and secure early advantages. Firms are investing heavily in advanced testing, sorting, and repurposing technologies to extend the life of retired EV batteries. Partnerships with utilities, renewable energy developers, and grid operators are becoming a key strategy to expand applications in energy storage and backup power. Market participants also focus on modular solutions that can serve residential, commercial, and industrial needs while keeping costs competitive. Growing regulatory support in major regions further intensifies rivalry, as companies seek to align with sustainability goals and circular economy frameworks. This competitive landscape is marked by rapid innovation, cross-industry collaborations, and an increasing emphasis on building reliable supply chains for second-life batteries.

Recent Developments

- In March 2025,the leading players Stena Recycling and Nissan came together under a strategic alliance to adopt and scale up the reuse of second-life electric vehicle batteries in Norway. Nissan has a fully developed network of value chains for batteries, which helps to reach the end of their lifespan for road use.

- In October 2024, Vision Mechatronics and JSW MG Motor entered into a collaboration and launched the India’s first high-voltage (HV) second-life battery with an indigenous active balancing battery management system.

- In June 2023, Rivian, an electric vehicle maker, will follow General Motors and Ford onto Tesla’s charging network. The new truck, SUV, and delivery van maker claims that, similar to GM and Ford, Rivian vehicles will have ports for Tesla’s connector beginning in 2025.

- In February 2023, B2U Storage Solutions, Inc., a prominent provider of large-scale energy storage systems that utilize second-life electric vehicle batteries, revealed that its SEPV Sierra hybrid solar + storage facility in Lancaster, California, has achieved 25 MWh of operational storage capacity.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising electric vehicle adoption worldwide.

- Second-life batteries will play a major role in renewable energy storage projects.

- Automotive companies will integrate reuse programs to manage end-of-life batteries effectively.

- Partnerships between battery reuse firms and utility providers will increase significantly.

- Modular storage systems will gain traction in residential and commercial applications.

- Governments will implement stricter regulations supporting circular economy and reuse practices.

- Technological advancements in testing and repurposing will improve battery efficiency and lifespan.

- Investments in large-scale reuse facilities will strengthen supply chain reliability.

- Emerging regions will adopt reuse solutions for off-grid and backup power needs.

- Growing focus on sustainability will position reuse as a core energy strategy.