Market Overview

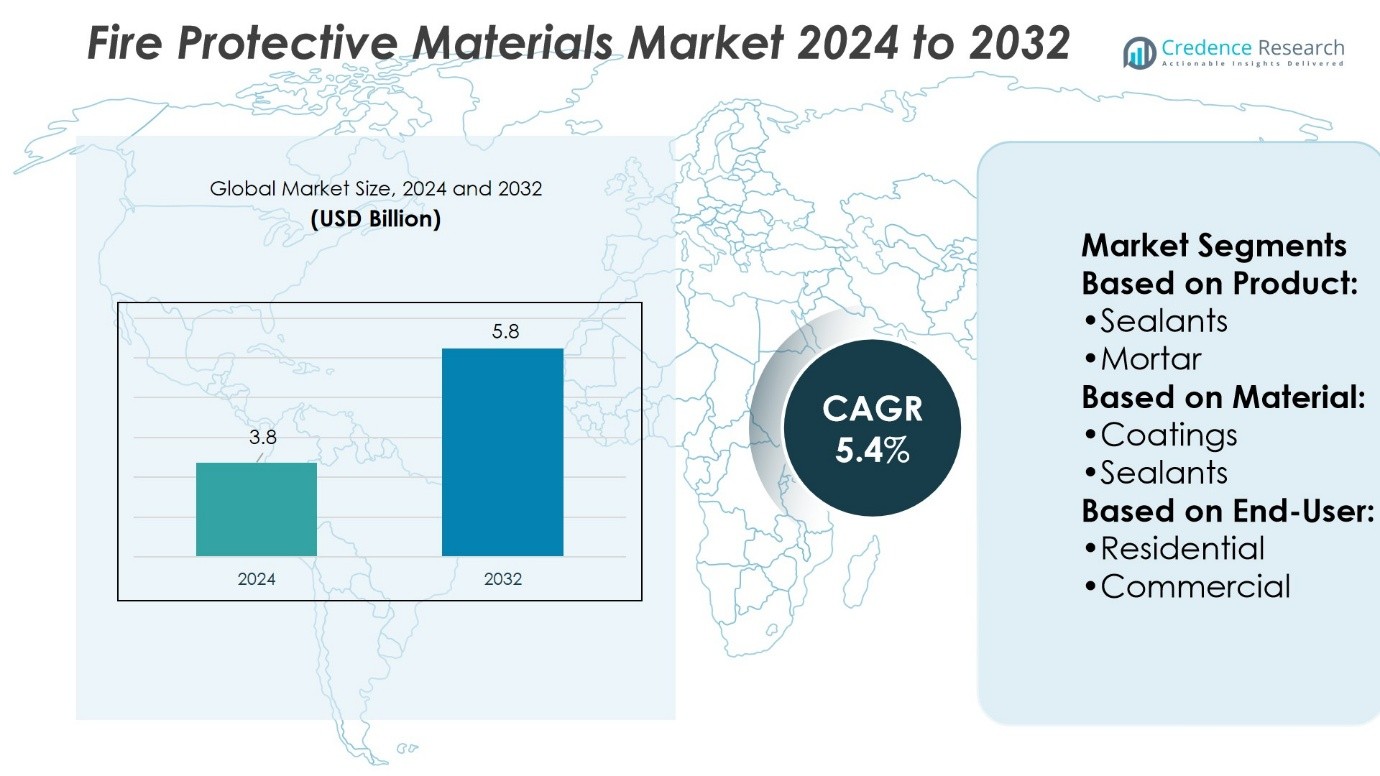

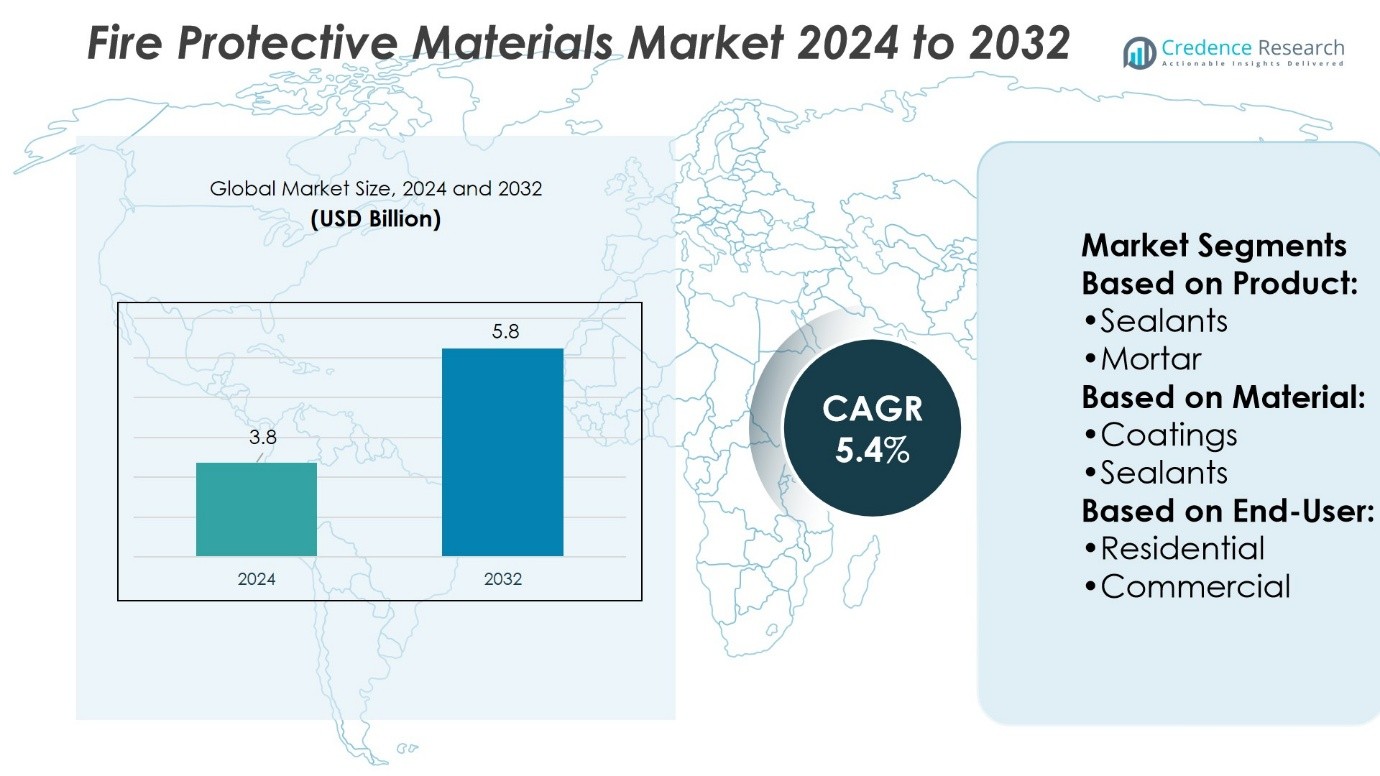

Fire Protective Materials Market size was valued at USD 3.8 billion in 2024 and is anticipated to reach USD 5.8 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Protective Materials Market Size 2024 |

USD 3.8 Billion |

| Fire Protective Materials Market, CAGR |

5.4% |

| Fire Protective Materials Market Size 2032 |

USD 5.8 Billion |

The Fire Protective Materials Market grows with rising enforcement of fire safety regulations, rapid infrastructure expansion, and increasing adoption of eco-friendly materials. Demand strengthens in commercial and residential construction, where coatings, sealants, and boards ensure compliance with strict building codes. It gains further momentum from industrial sectors, including oil, gas, and energy, where operational safety remains a priority. Trends highlight a clear shift toward halogen-free, recyclable, and low-toxicity formulations that align with sustainability goals. Integration of advanced composites, nanomaterials, and smart technologies enhances product performance, creating opportunities across transportation, aerospace, and high-rise infrastructure projects that require high durability and safety.

North America leads the Fire Protective Materials Market with strong regulatory compliance, while Europe follows with sustainability-driven adoption. Asia-Pacific shows the fastest growth supported by urbanization, industrial expansion, and smart city projects. Latin America and the Middle East & Africa contribute steadily through infrastructure upgrades and stricter safety codes. Key players strengthen the competitive landscape through innovation, eco-friendly solutions, and strategic expansions, ensuring wider availability of coatings, sealants, boards, and advanced composites across diverse construction, industrial, and transportation applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Fire Protective Materials Market size was valued at USD 3.8 billion in 2024 and is anticipated to reach USD 5.8 billion by 2032, at a CAGR of 5.4%.

- Rising enforcement of fire safety regulations drives adoption across construction, industrial, and energy sectors.

- Market trends highlight eco-friendly, halogen-free, and recyclable materials aligning with sustainability goals.

- Competitive players focus on innovation, advanced composites, and strategic global expansion to strengthen presence.

- High production costs and complex manufacturing processes remain key restraints to wider adoption.

- North America leads with strict codes, Europe follows with green initiatives, and Asia-Pacific shows fastest growth.

- Latin America and Middle East & Africa contribute steadily with infrastructure upgrades and stricter safety codes.

Market Drivers

Growing Emphasis on Fire Safety Regulations

The Fire Protective Materials Market is driven strongly by strict building and fire safety regulations worldwide. Governments and regulatory bodies enforce standards that mandate the use of flame-retardant materials across construction, transportation, and industrial sectors. It benefits from rising awareness of fire hazards and the need for structural protection. Companies invest in materials that meet international certifications to ensure compliance. This environment strengthens the demand for advanced fireproof coatings, insulation, and barriers. Expansion of urban infrastructure continues to create steady opportunities for regulated applications.

- For instance, PPG STEELGUARD 951 expands to a dry‑film thickness of 3,500 microns in one coat, offering four hours of fire protection—a clear technological achievement with a precise numerical metric.

Rising Infrastructure Development and Industrial Expansion

Rapid infrastructure growth and industrial expansion provide consistent momentum for the Fire Protective Materials Market. Large-scale projects in commercial, residential, and industrial spaces require fire-resistant walls, ceilings, and insulation. It supports the safety of workers, assets, and facilities in energy plants, factories, and warehouses. Expanding chemical and oil and gas industries also increase the demand for fireproof cladding and coatings. Developers prioritize materials that combine safety and cost-effectiveness in construction. Growing investment in smart cities further strengthens long-term demand.

- For instance, ROCKWOOL Asia manufactures stone wool insulation capable of withstanding continuous exposure above 1000 °C, a performance level tested in large-scale furnace trials, which helps delay structural collapse during fires in energy plants and high-rise buildings where steel loses half its strength at 600 °C.

Increasing Adoption in Transportation and Aerospace

Transportation industries contribute to significant growth in the Fire Protective Materials Market. Automotive and aerospace manufacturers integrate flame-retardant materials to improve passenger safety and meet safety certifications. It reduces risks linked to fire outbreaks in electric vehicles, aircraft cabins, and train compartments. Advanced polymers and composites help reduce weight while maintaining fire resistance. Manufacturers adopt fireproof adhesives and coatings to enhance performance. Rising adoption of electric mobility creates additional demand for fire protective solutions in battery housing and components.

Rising Focus on Sustainability and Advanced Materials

The Fire Protective Materials Market advances with innovations in eco-friendly and high-performance materials. Companies develop low-toxicity, halogen-free flame-retardant coatings to meet environmental standards. It aligns with sustainability goals while ensuring fire safety compliance. Advanced composites and nanomaterials improve durability, thermal stability, and cost efficiency. Research efforts focus on extending product lifespans and minimizing environmental impact. This shift toward sustainable protective materials creates new opportunities across diverse sectors.

Market Trends

Growing Use of Advanced Composites and Nanomaterials

The Fire Protective Materials Market shows a strong shift toward advanced composites and nanomaterials. Manufacturers integrate nanotechnology to improve thermal resistance and lower material weight. It enables higher efficiency in aerospace, automotive, and construction applications. Composites provide better performance compared to traditional options while reducing long-term maintenance needs. This trend aligns with the demand for lightweight structures in transportation sectors. Innovation in material science continues to accelerate adoption across safety-critical industries.

- For instance, AkzoNobel’s Interchar 2060 is an acrylic intumescent coating applied at a dry-film thickness between 350 and 750 microns (14–30 mils). This enables a theoretical coverage of 1 m² per liter at 750 microns—providing efficient fire protection on structural steelwork.

Rising Demand for Eco-Friendly and Low-Toxicity Solutions

Sustainability plays a central role in shaping the Fire Protective Materials Market. Companies focus on halogen-free, recyclable, and low-toxicity formulations to meet environmental standards. It supports safer use in indoor spaces and lowers health risks during fire events. Governments encourage the adoption of sustainable coatings and insulation through strict green building codes. Industries prefer solutions that balance performance with environmental responsibility. Growth in green construction projects reinforces demand for eco-friendly fire protective materials.

- For instance, svt’s FLAMMADUR® A 77 HF coating has a density of 1.25 g/cm³, a wet-film thickness of 770 µm, and a dry-film thickness of 450 µm—making it solvent- and halogen-free for indoor use and cable protection.

Integration with Smart and Digital Technologies

The Fire Protective Materials Market embraces integration with smart and digital technologies. Sensors, coatings, and intelligent monitoring systems work together to enhance fire detection and prevention. It creates opportunities for materials that respond actively to heat and fire exposure. Smart coatings with self-healing and thermal response capabilities gain traction in industrial and commercial use. Adoption of digital monitoring in infrastructure expands the role of advanced materials. Demand grows for innovative solutions that combine safety with technology-driven performance.

Expansion Across Emerging Economies and Urban Projects

Urbanization and industrialization in emerging economies strengthen the Fire Protective Materials Market. Large-scale residential and commercial construction projects adopt advanced fireproof solutions to meet safety regulations. It drives higher consumption of coatings, sealants, and insulation in high-rise and public structures. Rapid growth in Asia-Pacific and Latin America expands market opportunities. Governments mandate fire safety compliance in urban infrastructure, creating consistent demand. This trend reflects the importance of fire protection in shaping safer and modern urban environments.

Market Challenges Analysis

High Costs and Complex Manufacturing Processes

The Fire Protective Materials Market faces challenges linked to high production costs and complex manufacturing processes. Advanced composites, eco-friendly coatings, and nanomaterial-based solutions require significant investment in research and specialized equipment. It limits adoption in cost-sensitive industries and small-scale projects. Price-sensitive regions often prefer conventional materials, slowing penetration of advanced alternatives. The need for constant compliance with evolving safety regulations further increases operational costs. Manufacturers struggle to balance affordability with performance, creating a barrier to wider acceptance.

Limited Awareness and Integration Barriers in Emerging Markets

The Fire Protective Materials Market also encounters hurdles from limited awareness and integration barriers in emerging economies. Many construction firms and industries still rely on traditional insulation and coatings due to lack of knowledge about fire safety benefits. It restricts demand in smaller markets despite regulatory enforcement. Infrastructure projects often prioritize cost reduction over advanced safety measures. Shortage of skilled professionals in installation and inspection reduces product effectiveness. These factors slow market growth, especially in regions where fire protection awareness remains underdeveloped.

Market Opportunities

Expansion in Green Construction and Sustainable Materials

The Fire Protective Materials Market holds strong opportunities in green construction and sustainable materials. Growing demand for eco-friendly, halogen-free, and recyclable products aligns with global sustainability goals. It benefits from stricter environmental regulations that encourage the use of low-toxicity solutions. Green building certifications create steady incentives for developers to adopt advanced protective coatings and insulation. Companies investing in bio-based composites and renewable raw materials gain a competitive edge. This trend supports both safety compliance and environmental responsibility in modern construction.

Rising Adoption Across Transportation and Energy Sectors

The Fire Protective Materials Market also gains opportunities from expansion in transportation and energy sectors. Electric vehicles require flame-retardant materials for battery protection, while aerospace and railway industries adopt lightweight, fireproof composites. It creates long-term growth avenues as demand rises for high-performance and durable solutions. Energy infrastructure, including oil, gas, and renewable projects, needs advanced coatings and claddings to ensure operational safety. Governments emphasize fire safety in large-scale industrial plants, further boosting demand. These sectors provide a strong platform for innovative applications of advanced protective materials.

Market Segmentation Analysis:

By Product

The Fire Protective Materials Market is segmented by product into sealants, mortar, spray, putty, and sheets or boards. Sealants hold a strong position due to their ability to block smoke and flames in joints and openings. It ensures structural stability in high-risk areas of commercial and industrial projects. Mortar remains vital in constructing durable fire barriers for walls and floors. Spray products gain traction because they cover large surfaces quickly and provide uniform protection. Putty is widely used for flexible fire-stopping solutions in electrical and plumbing systems. Sheets and boards serve as durable options for ceilings, partitions, and walls in both residential and commercial buildings.

- For instance, Promat’s PROMATECT®‑XS boards are offered in exact thicknesses of 15 mm, 20 mm, and 25 mm, with a density of 910 kg/m³, bending strength over 12 MPa at 12.7 mm, and a compressive strength over 8 MPa—showcasing high-performance board technology.

By Material

The Fire Protective Materials Market is also segmented by material into coatings, sealants and fillers, mortar, sheets and boards, sprays, putty, preformed devices, and other material types including carbon foam. Coatings lead adoption, offering strong resistance in structural steel and large construction projects. It strengthens safety by delaying heat transfer and structural weakening during fire exposure. Sealants and fillers remain important in closing gaps and ensuring compliance with safety codes. Mortar and boards are favored in projects requiring permanent fire-resistant partitions. Preformed devices such as wraps and collars show growing use in standardized applications. Other innovative materials like carbon foam address niche needs in aerospace and high-performance industries.

- For instance, BASF’s KBS Foamcoat intumescent coating expands upon heating to form a carbon foam layer that is approximately 50 times the original coating thickness, creating a dense barrier over cable routes.

By End-user

The Fire Protective Materials Market by end-user includes residential and commercial sectors. Residential demand rises with stricter housing codes and growing awareness of fire safety. It supports use of boards, putty, and coatings in high-rise and urban projects. Commercial adoption leads the segment, with offices, malls, hospitals, and public infrastructure driving large-scale consumption. These spaces integrate coatings, sprays, and sealants to meet safety regulations and protect large populations. Industrial and institutional projects often overlap with commercial use, further strengthening demand. This segmentation highlights the wide scope of fire protection across modern infrastructure development.

Segments:

Based on Product:

Based on Material:

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 36% share of the Fire Protective Materials Market, making it the leading regional contributor. Strong building safety codes, strict fire protection regulations, and advanced construction practices drive consistent adoption. The region’s commercial infrastructure, including high-rise offices, healthcare facilities, and airports, integrates coatings, sealants, and boards as standard practice. It benefits from growing investments in industrial safety within oil, gas, and energy sectors, where fireproof claddings and mortar play critical roles. Technological innovation also supports the market, with manufacturers introducing eco-friendly, halogen-free solutions tailored to meet sustainability targets. Increasing urban redevelopment and modernization of aging structures add to demand for sprays and putty, creating a strong long-term outlook.

Europe

Europe accounts for a 29% share of the Fire Protective Materials Market, supported by strict EU fire safety directives and sustainability-focused initiatives. Demand is strong across residential, commercial, and industrial sectors where compliance with European standards remains mandatory. It reflects the region’s emphasis on eco-friendly fireproof coatings, low-toxicity sealants, and recyclable materials. Key infrastructure projects, including transportation hubs, hospitals, and energy facilities, expand the application of sprays and boards. Countries such as Germany, the UK, and France lead adoption with advanced construction practices and heavy regulatory oversight. Growth is also reinforced by the focus on green building certifications, which encourage use of environmentally responsible fire protection solutions.

Asia-Pacific

Asia-Pacific captures a 24% share of the Fire Protective Materials Market and shows the fastest growth rate. Rapid urbanization, industrialization, and infrastructure development across China, India, and Southeast Asia fuel large-scale demand. It supports massive adoption of coatings, sheets, and sprays in high-rise buildings, industrial plants, and transport networks. Government-mandated fire safety compliance across commercial and residential projects strengthens demand for durable and cost-effective solutions. Expansion of energy infrastructure, along with rising construction of smart cities, boosts usage of preformed devices and fillers. Growing investment from international players into local manufacturing also drives affordability and accelerates penetration in developing economies. The region’s strong pipeline of infrastructure projects ensures a sustained growth trajectory.

Latin America

Latin America holds a 6% share of the Fire Protective Materials Market, with steady expansion supported by infrastructure upgrades and safety reforms. Governments across Brazil, Mexico, and Chile enforce stricter building codes, increasing adoption of coatings, boards, and sprays in new projects. It reflects a growing emphasis on workplace safety in industries such as mining, oil, and gas. Commercial spaces such as malls, hospitals, and airports integrate sealants and fillers to meet regulatory demands. Economic fluctuations can limit investment, but public sector reforms in safety regulations maintain steady demand. Local adoption of eco-friendly and cost-efficient products continues to rise, supporting long-term growth potential.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share of the Fire Protective Materials Market, driven by investments in commercial and energy infrastructure. Construction of high-rise towers, airports, and industrial complexes creates consistent demand for coatings, sheets, and preformed devices. It benefits from strong government emphasis on safety in oil, gas, and petrochemical sectors. Rising urban development across Gulf countries fuels demand for fireproof claddings and insulation in large projects. Africa shows gradual adoption, supported by energy projects and residential development in emerging economies. Market growth is expected to strengthen as awareness of fire safety increases and regulations expand across key economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PPG Industries Ohio, Inc. (U.S.)

- ROCKWOOL Asia (Denmark)

- Akzo Nobel N.V (Netherland)

- svt Group of Companies (U.S.)

- Etex Group (Belgium)

- 3M (U.S.)

- Morgan Advanced Materials (U.K.)

- BASF SE (Germany)

- Trelleborg AB (publ) (Sweden)

- Technologies Inc. (U.S.)

Competitive Analysis

The Fire Protective Materials Market include PPG Industries Ohio, Inc., ROCKWOOL Asia, Akzo Nobel N.V, svt Group of Companies, Etex Group, 3M, Morgan Advanced Materials, BASF SE, Trelleborg AB (publ), and Technologies Inc. The Fire Protective Materials Market shows an intensely competitive environment driven by innovation, regulatory compliance, and sustainability. Companies prioritize the development of advanced coatings, sealants, and boards that meet strict international fire safety standards. It reflects a clear shift toward eco-friendly and low-toxicity solutions that align with green building codes. Manufacturers also expand portfolios with lightweight composites and nanomaterials designed for high-performance applications in construction, transportation, and energy sectors. Competitive strategies often focus on research investments, regional expansions, and collaboration with infrastructure developers to capture rising demand. The landscape emphasizes affordability, durability, and environmental responsibility, ensuring steady advancements in fire protection technologies.

Recent Developments

- In August 2025, ROCKWOOL Asia emphasizes the development of mineral wool insulation products offering enhanced fire resistance and thermal performance for commercial and industrial applications, capitalizing on rising infrastructure investments and fire safety awareness in the Asia-Pacific region.

- In September 2024, Kenny Pipe & Supply acquired Patco Inc., a leading provider of hydraulic and fire safety equipment. This strategic move expands Kenny Pipe’s product offerings and market reach, solidifying its position in the industry.

- In April 2024, Henkel finalized the acquisition of Seal for Life Industries LLC, a prominent global producer of advanced coating and sealing solutions. This tactical acquisition further consolidates Henkel’s presence in the coatings sector and broadens its portfolio to encompass heat-shrink sleeves, visco-elastic coatings, and fire protection solutions.

- In January 2024, Shell U.K. Limited acquired MIVOLT and MIDEL and from M&I Materials Ltd. This acquisition strengthens Shell’s position in transformer oils, offering customers improved fire protection and biodegradability through synthetic and natural ester-based fluids.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stricter global fire safety regulations across industries.

- Demand will rise in urban infrastructure projects requiring advanced protective coatings.

- Eco-friendly and halogen-free materials will gain stronger adoption worldwide.

- Growth will accelerate in Asia-Pacific with rapid industrialization and smart city projects.

- Transportation sectors will drive use of fireproof composites for vehicles and aircraft.

- Energy and petrochemical industries will continue investing in durable fire protective solutions.

- Digital integration and smart fire detection technologies will shape product innovation.

- Residential demand will grow due to stricter housing codes and safety awareness.

- Partnerships and acquisitions will expand global presence of leading manufacturers.

- Sustainable materials and recyclable solutions will remain central to long-term growth.