Market Overview

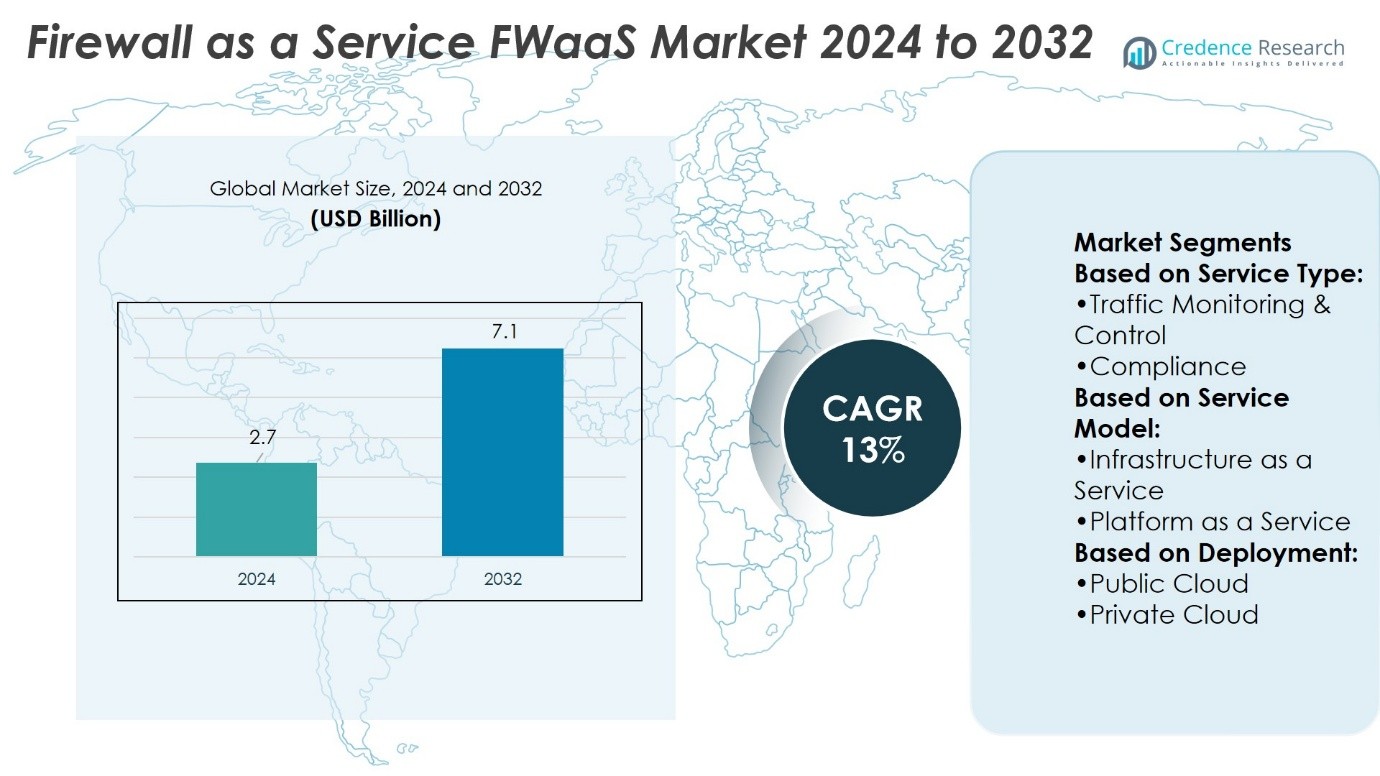

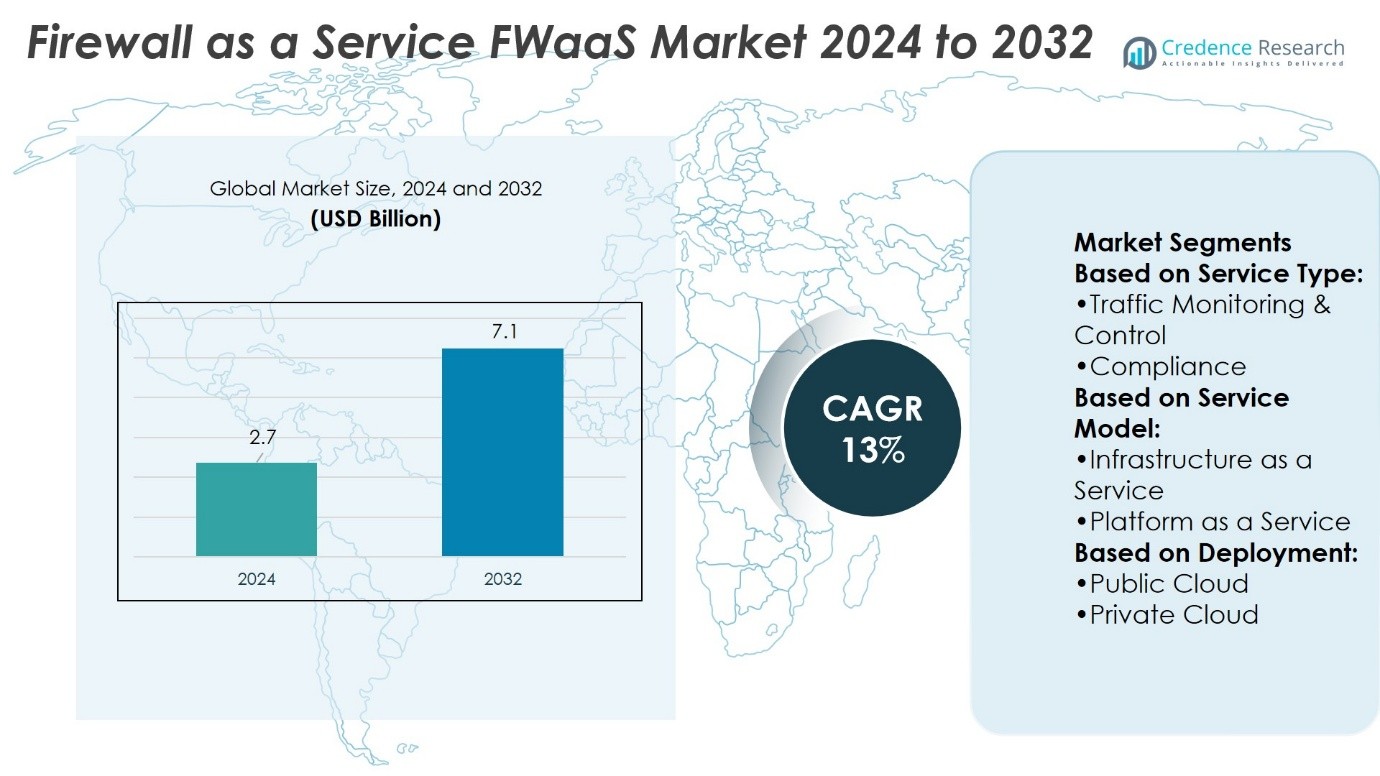

Firewall as a Service (FWaaS) Market size was valued at USD 2.7 billion in 2024 and is anticipated to reach USD 7.1 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Firewall as a Service Market Size 2024 |

USD 2.7 Billion |

| Firewall as a Service Market, CAGR |

13% |

| Firewall as a Service Market Size 2032 |

USD 7.1 Billion |

The Firewall as a Service (FWaaS) Market grows with rising cloud adoption, increasing cyber threats, and the demand for secure remote access. Enterprises rely on FWaaS to deliver scalable protection, centralized visibility, and compliance with strict data regulations. It enables organizations to secure hybrid and multi-cloud environments without heavy infrastructure costs. Key trends include the integration of artificial intelligence for real-time threat detection, the expansion of zero-trust security models, and the adoption of secure access service edge frameworks. These factors position FWaaS as a critical component in modern cybersecurity strategies, supporting digital transformation across industries.

North America leads the Firewall as a Service FWaaS Market with the largest share, driven by advanced cloud adoption and strong cybersecurity regulations, followed by Europe with strict data privacy frameworks and rising zero-trust deployments. Asia-Pacific shows the fastest growth due to digital transformation and increasing cyber risks across China, India, and Japan. Latin America and the Middle East & Africa steadily expand with growing investments in security modernization. Key players include Cisco, Fortinet, Palo Alto Networks, Zscaler, and Sophos.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Firewall as a Service FWaaS Market size was valued at USD 2.7 billion in 2024 and is expected to reach USD 7.1 billion by 2032, at a CAGR of 13%.

- Market growth is driven by rising cloud adoption, increasing cyber threats, and demand for secure remote access.

- Key trends include AI-powered threat detection, expansion of zero-trust frameworks, and adoption of secure access service edge models.

- Competition remains strong as vendors focus on scalable, cloud-native solutions with managed service offerings.

- Market restraints include integration challenges with legacy systems and concerns over vendor reliability.

- North America leads the market with the largest share, followed by Europe with strong compliance-driven adoption.

- Asia-Pacific records the fastest growth, while Latin America and Middle East & Africa expand steadily with digital security investments.

Market Drivers

Rising Cybersecurity Threats Driving the Demand for Advanced Cloud-Based Solutions

The Firewall as a Service (FWaaS) Market gains momentum from escalating cyber threats that target businesses across industries. Organizations seek cloud-based defenses that scale quickly and adapt to evolving risks. FWaaS enables firms to consolidate security functions under a unified platform, reducing reliance on on-premises hardware. It enhances protection against malware, phishing, and distributed denial-of-service attacks. Growing digital transformation pushes firms to secure networks for remote and mobile users. It positions FWaaS as a reliable solution to safeguard business continuity and sensitive information.

- For instance, Fortinet’s EDR solution blocked all 51 advanced persistent threat scenarios in the latest SE Labs Advanced Security Test—achieving a perfect 100% in protection accuracy (816 of 816 points), legitimate accuracy (742 of 742 points), and total accuracy (1,558 of 1,558 points).

Increasing Cloud Adoption and Remote Workforce Expansion Fueling Growth

The Firewall as a Service FWaaS Market benefits from rapid cloud adoption and rising demand for secure remote connectivity. Enterprises migrate applications, data, and infrastructure to public and hybrid cloud environments, requiring flexible security frameworks. FWaaS delivers centralized visibility, policy enforcement, and threat detection for distributed systems. Organizations prioritize solutions that secure endpoints across multiple locations without heavy infrastructure investments. It empowers businesses to manage hybrid workforces while maintaining compliance standards. Cloud-native architectures strengthen the market’s role in digital transformation strategies.

- For instance, Zscaler processes more than 500 trillion security signals daily through its Zero Trust Exchange platform data fabric, bolstering AI-powered threat detection and automated defenses.

Regulatory Compliance and Data Privacy Requirements Creating Strong Demand

The Firewall as a Service FWaaS Market is reinforced by strict data protection rules and industry regulations. Businesses must comply with standards like GDPR, HIPAA, and PCI DSS while securing global operations. FWaaS platforms offer continuous monitoring and automated reporting that simplify compliance management. It ensures data handling practices meet legal expectations while reducing audit complexity. Companies adopt FWaaS to align security strategies with regulatory frameworks. Growing awareness of privacy risks supports adoption in finance, healthcare, and government sectors.

Cost Efficiency and Scalability Encouraging Widespread Adoption

The Firewall as a Service FWaaS Market expands with demand for cost-efficient and scalable cybersecurity models. Traditional firewall systems require expensive hardware, frequent updates, and specialized staff. FWaaS reduces capital expenditure by shifting protection to subscription-based models. It allows organizations to scale resources up or down depending on network requirements. Predictable pricing structures support budgeting while minimizing operational complexity. Businesses recognize FWaaS as a flexible investment that delivers enterprise-grade protection without infrastructure burdens. This balance of security and efficiency accelerates long-term adoption.

Market Trends

Integration of Artificial Intelligence and Machine Learning into Threat Detection

The Firewall as a Service FWaaS Market demonstrates a clear trend toward AI and machine learning integration. Vendors embed intelligent algorithms to identify and block threats with greater speed and accuracy. It supports automated anomaly detection and reduces reliance on manual monitoring. Machine learning models adapt to evolving attack vectors, strengthening proactive defense. Enterprises adopt these tools to limit downtime and reduce false positives. The focus on predictive security capabilities ensures continuous protection across diverse environments.

- For instance, Barracuda Managed XDR logged 11 trillion IT events identifying just over 1 million potential risks. Of those, 16,812 high-severity threats were identified as confirmed malicious instances requiring immediate action via automated defense. The 11 trillion logged events equate to an average of about 350,000 events per second.

Expansion of Zero-Trust Network Security Architecture Across Industries

The Firewall as a Service FWaaS Market aligns with the growing adoption of zero-trust frameworks. Organizations prioritize identity-based authentication and micro-segmentation to secure critical assets. It emphasizes verifying every access request, regardless of location or user. FWaaS platforms support zero-trust policies with centralized visibility and flexible controls. Enterprises adopt these practices to address hybrid work environments and remote operations. The trend strengthens the role of FWaaS in modern network security strategies.

- For instance, Cisco’s Secure Firewall 3105 achieved a real-world TLS throughput of 4.17 Gbps in NetSecOPEN testing, exceeding its 3.2 Gbps datasheet value by 30%. The firewall also delivered 100% detection of evasive threats while maintaining performance under heavy load conditions.

Growing Demand for Multi-Cloud and Hybrid Cloud Security Integration

The Firewall as a Service FWaaS Market evolves with rising adoption of multi-cloud and hybrid architectures. Companies require unified security policies across different cloud providers and on-premises systems. It enables consistent monitoring, policy enforcement, and data protection across fragmented infrastructures. FWaaS supports seamless integration with leading platforms like AWS, Azure, and Google Cloud. Businesses value these capabilities to avoid security gaps during migration or workload distribution. This trend positions FWaaS as a central tool for cloud security orchestration.

Rising Focus on Managed Security Services and Subscription Models

The Firewall as a Service FWaaS Market shows a steady shift toward managed services and flexible pricing. Enterprises prefer subscription-based models that reduce upfront costs and streamline upgrades. It provides continuous support from specialized providers, addressing skill shortages in cybersecurity. Managed offerings deliver real-time monitoring, compliance reporting, and faster incident response. Organizations value predictable costs while gaining access to advanced threat intelligence. This trend reinforces FWaaS as a scalable and service-driven security solution.

Market Challenges Analysis

Complexity of Integration with Legacy Infrastructure and Diverse IT Environments

The Firewall as a Service FWaaS Market faces significant challenges in integrating with existing legacy infrastructure. Many enterprises operate on hybrid networks that combine outdated systems with modern cloud environments. It creates compatibility issues that delay adoption and require extensive customization. FWaaS solutions must adapt to varying architectures while maintaining seamless security controls. Organizations often struggle to align centralized policies across different endpoints and platforms. This complexity increases deployment costs and slows large-scale implementation, limiting the pace of adoption.

Rising Concerns Over Data Privacy, Vendor Dependence, and Service Reliability

The Firewall as a Service FWaaS Market encounters growing concerns around data privacy and vendor reliability. Companies depend heavily on external providers for managing critical security functions. It raises questions about control, transparency, and long-term service continuity. Outages or service disruptions may compromise protection and expose sensitive data. Enterprises also face risks from varying regional compliance requirements that FWaaS providers must address. Balancing reliance on third-party services with the need for regulatory compliance and operational resilience remains a persistent challenge.

Market Opportunities

Expanding Role in Securing Remote Workforces and Cloud-Centric Enterprises

The Firewall as a Service FWaaS Market presents opportunities through the rapid expansion of remote workforces and cloud-driven businesses. Organizations seek scalable and cloud-native solutions that secure users across multiple devices and geographies. It supports centralized policy enforcement while reducing infrastructure costs, making it attractive for mid-sized and large enterprises. The shift toward hybrid and multi-cloud adoption further strengthens demand for FWaaS platforms. Companies value its ability to deliver consistent protection across public and private environments. This creates a strong pathway for providers to expand market presence and service portfolios.

Rising Demand in Emerging Economies and Regulated Industries

The Firewall as a Service FWaaS Market gains opportunities in emerging economies where digital transformation is accelerating. Enterprises in Asia-Pacific, Latin America, and the Middle East invest heavily in advanced cybersecurity to protect growing digital ecosystems. It enables businesses in finance, healthcare, and government sectors to meet strict compliance and privacy regulations. Service providers that tailor FWaaS offerings to regional needs stand to capture significant growth. Organizations in regulated industries prioritize advanced monitoring and reporting tools offered by FWaaS. This creates long-term opportunities for expanding adoption across industries and geographies.

Market Segmentation Analysis:

By Service Type

The Firewall as a Service FWaaS Market segments into traffic monitoring & control, compliance & audit management, reporting & log management, automation & orchestration, security management, managed services, professional services, and others. Traffic monitoring & control holds strong relevance due to its role in detecting anomalies and preventing network breaches. Compliance & audit management gains importance in industries bound by strict regulatory frameworks. Reporting & log management provides visibility into threats and user activity, strengthening real-time response. Automation & orchestration streamline workflows and improve operational efficiency. Managed services and professional services attract enterprises that lack in-house expertise, offering end-to-end security support. It ensures businesses of varying sizes access specialized protection aligned with their operational needs.

- For instance, WatchGuard’s Threat Lab reported a 323% increase in AI-powered IntelligentAV detections in Q1 2025, alongside a 712% surge in new malware threats on endpoints, reinforcing the need for real-time AI-based defense against evasive threats.

By Service Model

The Firewall as a Service FWaaS Market divides by service model into infrastructure as a service, platform as a service, and software as a service. Software as a service dominates due to its scalability, ease of deployment, and centralized control. It allows enterprises to secure networks without maintaining hardware or complex infrastructure. Infrastructure as a service supports organizations that prefer flexible, cloud-hosted resources with strong customization. Platform as a service integrates security functions within application development frameworks, enabling built-in defense mechanisms. Businesses choose models depending on their cloud strategy and cost structure. The availability of multiple models ensures FWaaS aligns with varied enterprise requirements.

- For instance, Forcepoint’s Cloud Network Firewall independently blocked 977 exploits and 35 evasion techniques, maintaining a throughput of 943 Mbps during tests—demonstrating consistent performance under realistic loads.

By Deployment

The Firewall as a Service FWaaS Market further classifies deployment into public cloud, private cloud, and hybrid cloud. Public cloud deployment gains traction among small and medium enterprises due to affordability and ease of access. Private cloud appeals to organizations that prioritize data sovereignty and strict control over sensitive assets. Hybrid cloud emerges as a preferred model for large enterprises managing workloads across diverse environments. It combines flexibility with advanced security features, ensuring continuity of operations. Growing reliance on multi-cloud strategies strengthens the hybrid approach, making it a long-term growth driver. This diversity in deployment models ensures FWaaS meets security needs across industries and geographies.

Segments:

Based on Service Type:

- Traffic Monitoring & Control

- Compliance

Based on Service Model:

- Infrastructure as a Service

- Platform as a Service

Based on Deployment:

- Public Cloud

- Private Cloud

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for the largest share of the Firewall as a Service FWaaS Market, with around 35 % in 2024. The region benefits from a well-established digital economy, advanced cloud adoption, and strong awareness of cybersecurity risks. Enterprises across industries such as banking, healthcare, retail, and manufacturing continue to prioritize FWaaS solutions for securing their expanding digital footprints. It provides centralized visibility, compliance management, and advanced threat detection, which remain critical for organizations handling sensitive data. The United States leads the regional market, supported by investments from both private enterprises and government agencies that aim to strengthen cybersecurity readiness. Canada contributes steadily with its focus on data privacy and compliance, particularly in financial and public sectors. The overall dominance of North America is expected to continue as enterprises expand hybrid work models and increase spending on managed security services.

Europe

Europe holds a significant share of the Firewall as a Service FWaaS Market, estimated at 28 % in 2024. The region’s strength is linked closely to its strict regulatory environment, including GDPR and sector-specific data protection laws. Companies in Europe adopt FWaaS not only to secure their cloud-based operations but also to ensure compliance with legal frameworks that require continuous monitoring and detailed reporting. It plays an essential role in financial services, government institutions, and healthcare providers, where data sensitivity is high. Leading economies such as Germany, the United Kingdom, and France drive adoption by integrating FWaaS into broader digital transformation strategies. The market also benefits from the growing demand for zero-trust security frameworks that emphasize identity and access control. With cloud expansion continuing across Europe, FWaaS adoption is likely to accelerate, reinforcing the region’s role as one of the largest contributors to global market growth.

Asia-Pacific

Asia-Pacific captures about 25 % of the Firewall as a Service FWaaS Market in 2024 and demonstrates the fastest growth rate globally. The region is experiencing rapid digitalization, large-scale cloud adoption, and rising awareness of cybersecurity risks. Countries like China, India, Japan, and Singapore are at the forefront of investment in FWaaS platforms. It enables organizations to secure remote users, manage hybrid environments, and comply with evolving regional data protection rules. Small and medium enterprises, alongside large corporations, are increasingly shifting to subscription-based security models to reduce capital costs. Governments across Asia-Pacific are also investing in cybersecurity frameworks to counter rising cyberattacks that target public and private sectors. The increasing establishment of new data centers and the expansion of multi-cloud deployments create additional demand for FWaaS solutions. With strong growth momentum, Asia-Pacific is expected to steadily increase its market share over the coming years.

Latin America

Latin America holds about 7 % of the Firewall as a Service FWaaS Market in 2024, with adoption driven by enterprises in Brazil, Mexico, and Argentina. Organizations in these countries are becoming more aware of the importance of cloud-based security solutions to safeguard digital infrastructure. It offers affordable and scalable protection, making FWaaS appealing for enterprises with limited resources for traditional hardware-based systems. The financial sector in particular seeks FWaaS to meet compliance standards while securing sensitive customer information. Governments are also showing interest in strengthening public sector cybersecurity, which opens opportunities for service providers. While the pace of adoption is slower compared to North America, Europe, and Asia-Pacific, the market potential in Latin America remains strong. Rising internet penetration, growth in e-commerce, and digital transformation initiatives are expected to increase demand over the next decade.

Middle East & Africa

The Middle East & Africa region contributes around 5 % of the Firewall as a Service FWaaS Market in 2024. Although smaller compared to other regions, MEA is seeing steady growth driven by industries such as energy, telecom, and government services. Many organizations in the region face high exposure to cyber risks due to expanding digital ecosystems. It provides them with cost-effective, flexible, and scalable security solutions. Countries like the United Arab Emirates and Saudi Arabia lead adoption in the Middle East, focusing on compliance and modernization. In Africa, South Africa remains a growing market due to its strong banking and telecom sectors. Challenges such as limited digital infrastructure and lower awareness of advanced cybersecurity solutions restrict current adoption levels. However, with ongoing infrastructure development and growing cloud penetration, the region holds strong long-term potential for FWaaS expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sophos Ltd. (U.K.)

- Fortinet, Inc. (U.S.)

- Check Point Solution Technologies Ltd. (Israel)

- Forcepoint LLC (U.S.)

- Zscaler, Inc. (U.S.)

- Cato Networks Ltd. (Israel)

- Barracuda Networks, Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Palo Alto Networks (U.S.)

Competitive Analysis

The Firewall as a Service FWaaS Market players such as Sophos Ltd. (U.K.), Fortinet, Inc. (U.S.), Check Point Solution Technologies Ltd. (Israel), Forcepoint LLC (U.S.), Zscaler, Inc. (U.S.), Cato Networks Ltd. (Israel), Barracuda Networks, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Cisco Systems Inc. (U.S.), and Palo Alto Networks (U.S.). The Firewall as a Service FWaaS Market is becoming increasingly competitive as enterprises demand advanced, flexible, and cost-effective security solutions. Vendors are focusing on developing platforms that combine cloud-native design with features such as AI-driven threat detection, automated policy enforcement, and real-time analytics. The adoption of zero-trust security models and secure access service edge frameworks highlights the market’s shift toward identity-centric and application-aware approaches. Companies operating in diverse industries, from banking to healthcare, prioritize FWaaS to maintain compliance with strict data protection regulations while supporting remote and mobile workforces. The market’s competitiveness is reinforced by constant technological upgrades, integration with hybrid cloud strategies, and increasing awareness of data privacy risks across global regions.

Recent Developments

- In May 2024, Palo Alto Networks launched Prisma SASE 3.0, which provides both managed and unmanaged devices with enhanced Zero Trust security. The release features the first natively integrated enterprise browser in the industry, AI-driven data security, and enhanced application performance, all designed to future-proof and revolutionize workforce security.

- In April 2024, Sonrai Security, a leader in cloud security solutions, unveiled the launch of the industry’s first Cloud Permissions Firewall for AWS, Azure, and Google Cloud. This groundbreaking technology revolutionizes cloud access and permissions security, offering a seamless one-click least privilege solution with zero disruption for cloud operations and development teams.

- In April 2024, Zscaler revealed it agreed to buy Airgap Networks with the goal of advancing Zero Trust Segmentation for IoT/OT devices and sensitive infrastructure. The acquisition will revolutionize enterprise security across campuses, branches, factories, and data centers by doing away with the requirement for traditional firewall-based segmentation.

- In December 2023, Thales acquired Imperva, a U.S. cybersecurity firm focused on application and data security. The acquisition enhances the cybersecurity capability of Thales by the integration of FWaaS capabilities from Imperva.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Service Model, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Firewall as a Service FWaaS Market will expand with rising cloud adoption across industries.

- Demand will grow as enterprises strengthen zero-trust and identity-driven security models.

- It will gain importance in securing remote and hybrid workforces.

- Vendors will integrate AI and automation to improve real-time threat detection.

- Multi-cloud and hybrid cloud environments will drive adoption of flexible FWaaS solutions.

- Regulatory compliance and data privacy requirements will remain strong growth drivers.

- Managed services and subscription-based models will increase customer reliance on providers.

- Emerging economies will contribute significantly as digital transformation accelerates.

- Integration with secure access service edge platforms will shape the market’s evolution.

- Investments in scalable, service-driven architectures will reinforce long-term market leadership.