Market Overview:

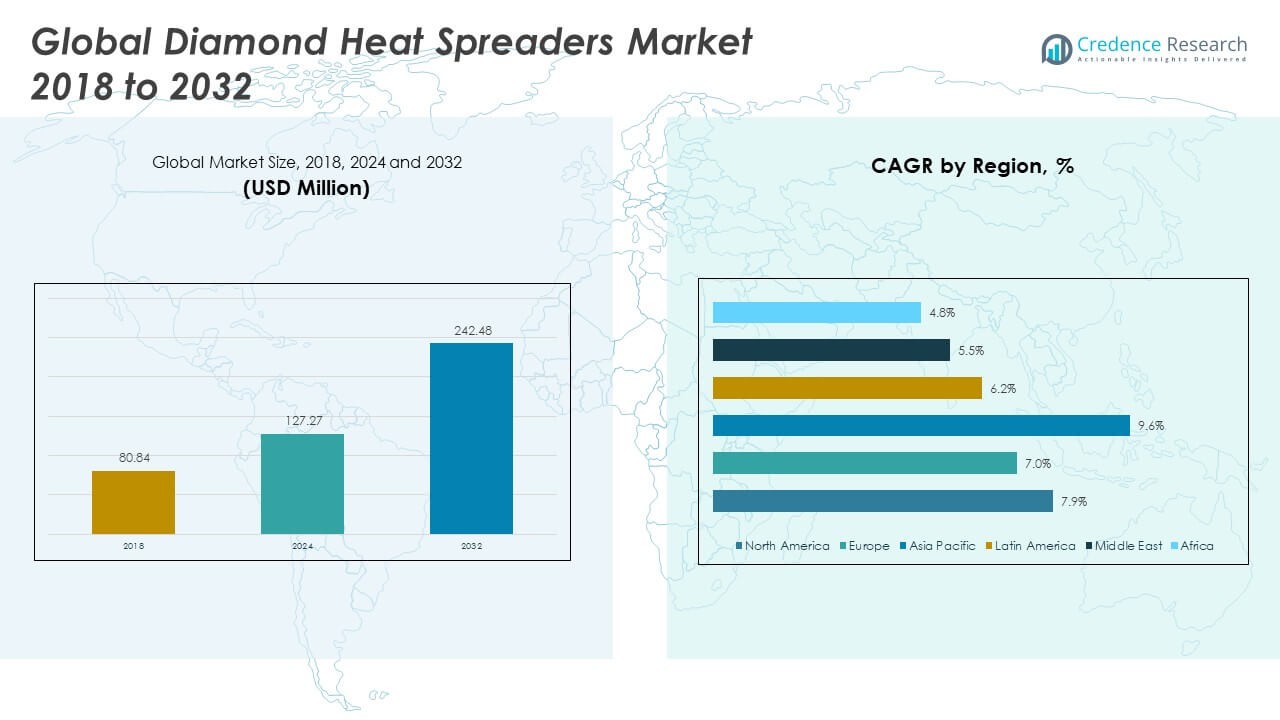

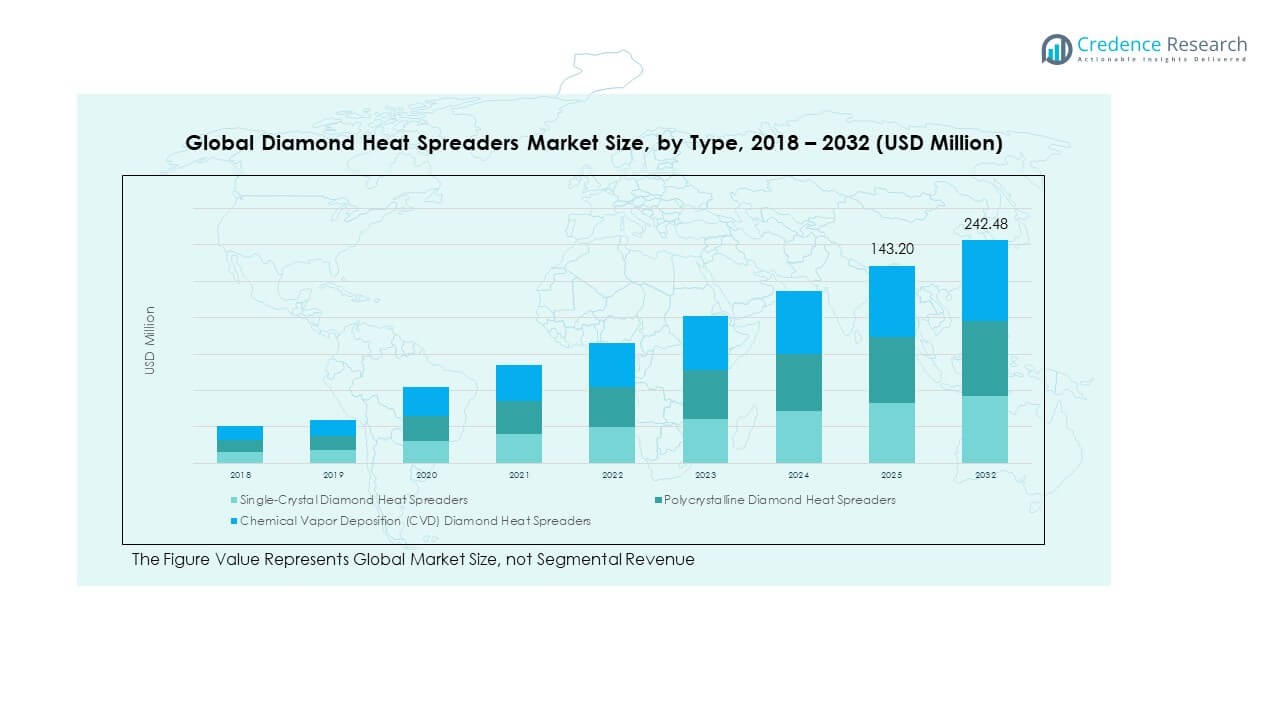

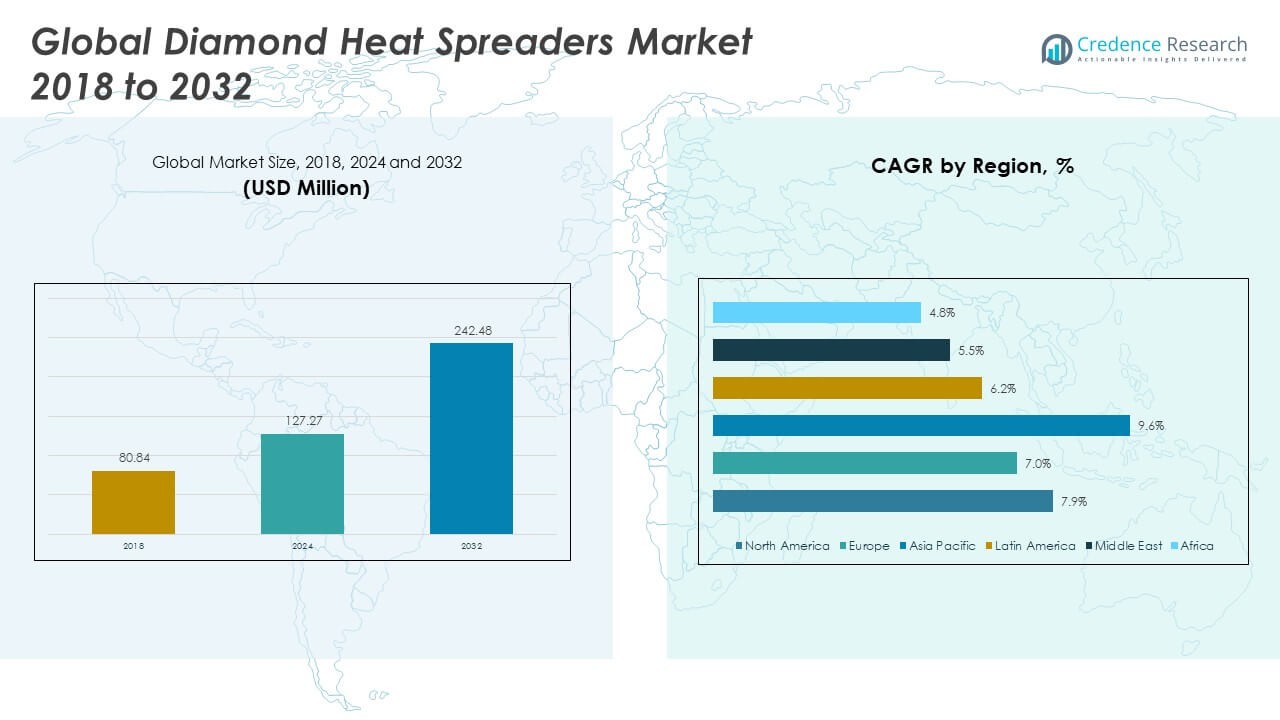

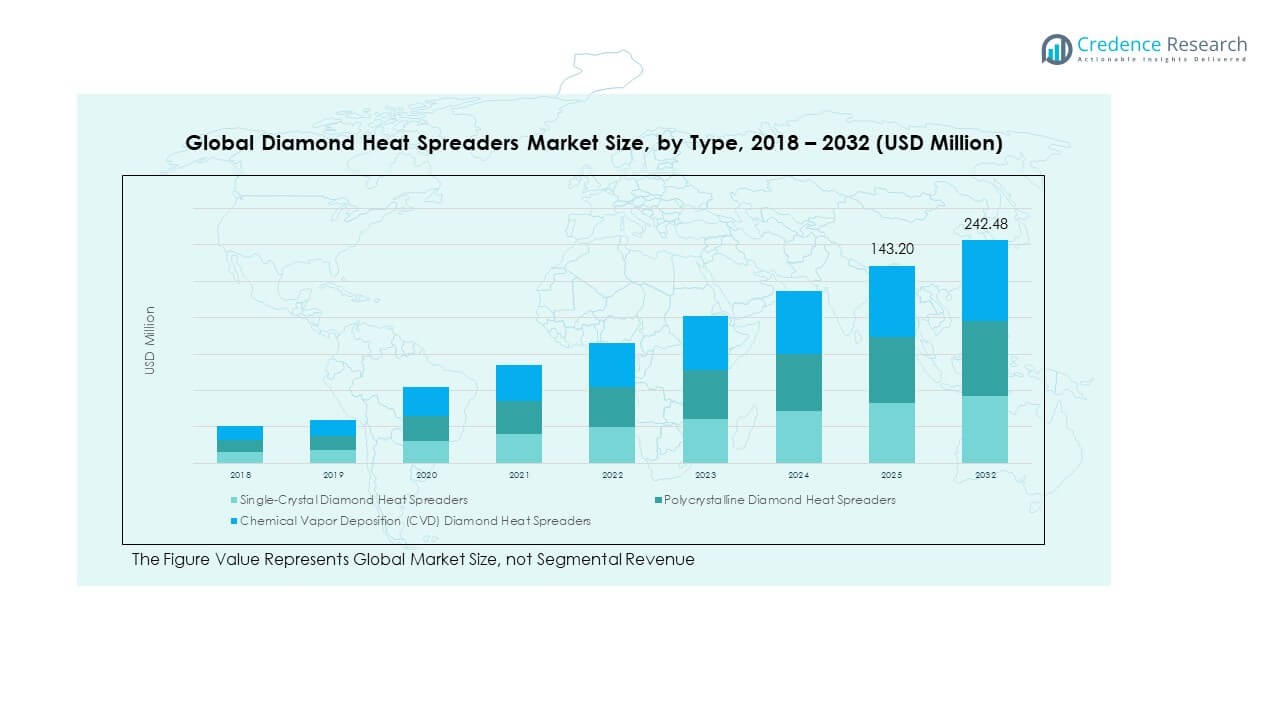

The Global Diamond Heat Spreaders Market size was valued at USD 80.84 million in 2018 to USD 127.27 million in 2024 and is anticipated to reach USD 242.48 million by 2032, at a CAGR of 7.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diamond Heat Spreaders Market Size 2024 |

USD 127.27 Million |

| Diamond Heat Spreaders Market, CAGR |

7.81% |

| Diamond Heat Spreaders Market Size 2032 |

USD 242.48 Million |

The market growth is driven by rising demand for advanced thermal management solutions in electronics, aerospace, and defense industries. Diamond heat spreaders offer exceptional thermal conductivity, enabling efficient dissipation of heat in high-power devices. Expanding adoption of miniaturized electronics, high-performance computing systems, and 5G infrastructure is strengthening demand. Manufacturers are investing in research to enhance synthetic diamond production and reduce costs, which is improving accessibility for industrial applications. The market benefits from collaborations between material suppliers and semiconductor companies to integrate advanced cooling solutions.

Geographically, North America leads the market due to strong semiconductor and aerospace industries. Asia-Pacific is emerging as a high-growth region, supported by rapid expansion in consumer electronics, telecommunications, and automotive electronics. Countries like China, Japan, and South Korea are investing in high-power electronics and 5G deployment, fueling demand for diamond-based thermal solutions. Europe maintains steady adoption, driven by advanced automotive and defense sectors. The Middle East and Latin America are also gradually adopting diamond heat spreaders, supported by infrastructure modernization and industrialization trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Diamond Heat Spreaders Market was valued at USD 80.84 million in 2018, reached USD 127.27 million in 2024, and is projected to hit USD 242.48 million by 2032, registering a CAGR of 7.81%.

- North America holds 34% share, driven by strong semiconductor and aerospace industries. Asia-Pacific captures 31% share, supported by consumer electronics and telecom expansion, while Europe accounts for 24%, led by automotive and defense demand.

- Asia-Pacific is the fastest-growing region, with rising adoption in 5G, automotive electronics, and renewable energy applications fueling growth momentum.

- Polycrystalline diamond heat spreaders dominate with about 48% share, due to wide use in electronics and cost advantages compared to single-crystal variants.

- Chemical Vapor Deposition (CVD) diamond heat spreaders account for 32% share, benefiting from scalability and integration in advanced computing and telecommunication systems.

Market Drivers:

Rising Importance of Thermal Management in High-Performance Electronics:

The Global Diamond Heat Spreaders Market is driven by rising demand for thermal management solutions in advanced electronics. High-performance devices generate intense heat, which requires efficient dissipation to maintain reliability and lifespan. Diamond heat spreaders, with their superior thermal conductivity, enable effective cooling of compact semiconductors. Growing adoption of miniaturized consumer electronics and high-performance computing creates continuous need for advanced cooling. The shift toward 5G networks and cloud-based infrastructure adds further demand. Manufacturers are responding with research to enhance synthetic diamond quality. Partnerships between electronic component makers and material producers support adoption. The market shows consistent growth due to integration across critical applications.

- For instance, Element Six launched a copper diamond composite in January 2025 with thermal conductivity optimized at 800 W/mK, tailored for AI and high-performance computing devices to reduce cooling costs and improve reliability. The market shows consistent growth due to integration across critical applications.

Expanding Role in Aerospace and Defense Applications Globally:

Aerospace and defense industries fuel growth for diamond heat spreaders through adoption in advanced systems. Satellites, radars, and avionics demand superior thermal regulation to sustain mission performance. The Global Diamond Heat Spreaders Market benefits from investment in these sectors, where reliability is vital. Defense modernization initiatives create strong procurement for high-performance materials. Governments prioritize advanced cooling technologies to meet operational safety and efficiency. Suppliers develop specialized diamond solutions tailored for harsh environments. Strong collaboration with aerospace companies supports innovation. This driver strengthens the market’s position in mission-critical applications worldwide.

- For instance, Smiths Interconnect secured a significant contract in August 2025 to supply patented DaVinci Gen V test sockets used in high-performance AI semiconductor chips for data centers, demonstrating trusted reliability and superior performance in mission-critical environments.

Increasing Penetration into High-Power Automotive Electronics:

Automotive electrification contributes strongly to demand for diamond heat spreaders. Electric vehicles and hybrid models rely on power electronics that generate significant heat. The Global Diamond Heat Spreaders Market gains from integration into battery management systems, inverters, and charging units. Rising global sales of EVs create opportunities for thermal control solutions. Automakers seek reliable materials to enhance efficiency and durability of electronic systems. Suppliers target cost reduction to make diamond components more accessible. Regulatory support for clean energy vehicles drives further adoption. The market expands with automotive innovation and investments in smart mobility.

Growing Adoption in Medical Devices and Optoelectronics:

Medical devices and optoelectronics contribute to the expansion of diamond heat spreaders. Lasers, diagnostic equipment, and imaging systems require effective thermal dissipation. The Global Diamond Heat Spreaders Market benefits from demand in healthcare where precision and safety are priorities. Rising need for advanced optical communication devices supports adoption. Telecommunications companies integrate diamond materials in devices to enhance reliability. Growing use in LED lighting systems reinforces market presence. Suppliers work on scalable production methods to serve these diverse applications. Continuous investment in medical and optical industries sustains demand for diamond heat spreaders.

Market Trends:

Integration of Synthetic Diamond in Emerging 5G and AI Technologies:

The Global Diamond Heat Spreaders Market shows a clear trend toward integration into 5G and AI-driven devices. High-frequency communication systems require advanced cooling solutions for stable performance. Diamond materials provide unmatched thermal conductivity and mechanical strength. AI accelerators and data centers increasingly deploy these components for reliability. The expansion of smart cities and IoT further accelerates this adoption. Telecom providers invest heavily in cooling infrastructure to sustain rapid growth. Diamond spreaders emerge as premium solutions for high-frequency environments. The trend reinforces market potential in future technologies.

- For instance, Smiths Interconnect DaVinci Gen V sockets are adopted for testing next-generation AI GPUs driving machine learning and high-performance computing. While Smiths Interconnect does use diamond-based technology in some specialized products, the DaVinci Gen V sockets achieve ultra-reliable test performance through patented insulated metal technology and an optimized coaxial design, not through diamond-related technologies.

Transition Toward Eco-Friendly and Sustainable Diamond Production:

Sustainability shapes the future of diamond heat spreaders with rising focus on eco-friendly production. Manufacturers explore cleaner synthesis processes to reduce carbon footprints. The Global Diamond Heat Spreaders Market evolves through initiatives in green technologies and responsible sourcing. Synthetic diamond production shifts toward renewable energy inputs. Industry players highlight sustainability commitments to attract environmentally conscious customers. Research continues on recycling and reuse of diamond materials. This trend aligns with broader sustainability mandates across industries. Companies adopting sustainable practices strengthen their long-term competitive advantage.

- For instance, Element Six emphasizes scalable, cost-effective production of copper diamond composites with durability that supports less frequent replacements and energy savings in thermal management, reflecting their sustainability strategy within advanced material manufacturing.

Expansion of Diamond Applications into Photonics and Quantum Computing:

Photonics and quantum computing emerge as new frontiers for diamond heat spreaders. Advanced computing systems require reliable cooling to function effectively. The Global Diamond Heat Spreaders Market adapts by serving these specialized industries. Diamond’s optical transparency and thermal capacity make it ideal for photonic devices. Quantum systems depend on extreme stability where diamond heat spreaders add value. Research labs and technology firms invest in early-stage deployment. These applications highlight diamond’s versatility beyond traditional uses. This trend drives diversification of market demand into futuristic technologies.

Strong Regional Manufacturing Expansion Across Asia-Pacific:

Asia-Pacific shows a clear trend of strengthening manufacturing capabilities in diamond technologies. China, Japan, and South Korea expand investments in diamond-based thermal materials. The Global Diamond Heat Spreaders Market benefits from regional adoption in consumer electronics. Domestic suppliers scale up operations to meet local and export demand. Supportive government policies encourage technological advancement. Rapid urbanization and growing electronics consumption fuel adoption further. Collaboration between research institutes and manufacturers accelerates innovation. This trend positions Asia-Pacific as a critical growth hub for diamond heat spreaders.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes:

The Global Diamond Heat Spreaders Market faces challenges from high production costs and complex processes. Synthetic diamond creation requires advanced equipment and precision, which increases expenses. These costs limit wider adoption in cost-sensitive sectors like consumer electronics. Manufacturers struggle to balance performance benefits with affordability. Small and mid-scale companies face barriers in entering the industry. Dependence on specialized production expertise further restricts scalability. Research into alternative processes aims to reduce costs but remains under development. The challenge slows overall market penetration compared to traditional thermal management solutions.

Supply Chain Constraints and Limited Awareness Across Industries:

Another challenge arises from supply chain constraints and limited awareness in emerging markets. The Global Diamond Heat Spreaders Market depends on specialized raw materials and technologies. Global supply disruptions impact pricing stability and availability. Industries in developing regions lack knowledge about the advantages of diamond spreaders. Competing materials like copper and aluminum dominate due to lower costs. Awareness campaigns and education remain insufficient in many sectors. Manufacturers invest in marketing to overcome misconceptions and highlight performance benefits. Until broader recognition grows, adoption rates remain uneven globally.

Market Opportunities:

Expansion into Emerging Automotive and Renewable Energy Applications:

The Global Diamond Heat Spreaders Market presents strong opportunities in automotive and renewable energy sectors. Electric vehicles and solar inverters increasingly demand efficient thermal control. Diamond heat spreaders deliver superior performance in these high-power environments. Automakers seek long-lasting solutions for next-generation vehicle electronics. Renewable energy projects also integrate advanced cooling systems for enhanced reliability. Suppliers can target these industries with tailored offerings. Growing government incentives for clean energy adoption strengthen demand. The opportunity expands as these sectors continue global growth.

Rising Role of Miniaturization and Advanced Healthcare Devices:

Miniaturization in electronics and advancements in healthcare devices create new opportunities. Compact devices require efficient cooling to maintain performance. The Global Diamond Heat Spreaders Market benefits from their integration into medical lasers and diagnostic tools. Healthcare industry growth ensures consistent demand for high-precision solutions. Consumer preference for smaller, faster, and durable electronics reinforces adoption. Suppliers can innovate scalable solutions to capture market share. Research partnerships support introduction of cost-effective diamond spreaders. These opportunities extend market reach across both consumer and specialized applications.

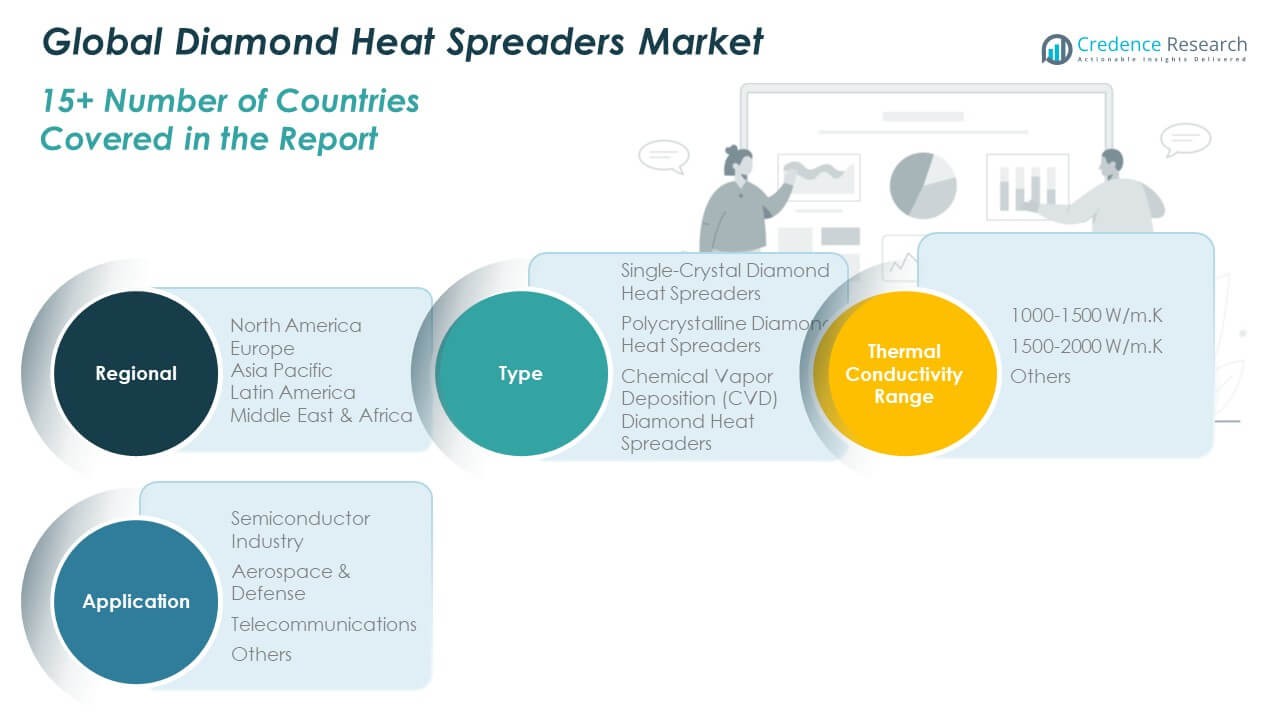

Market Segmentation Analysis:

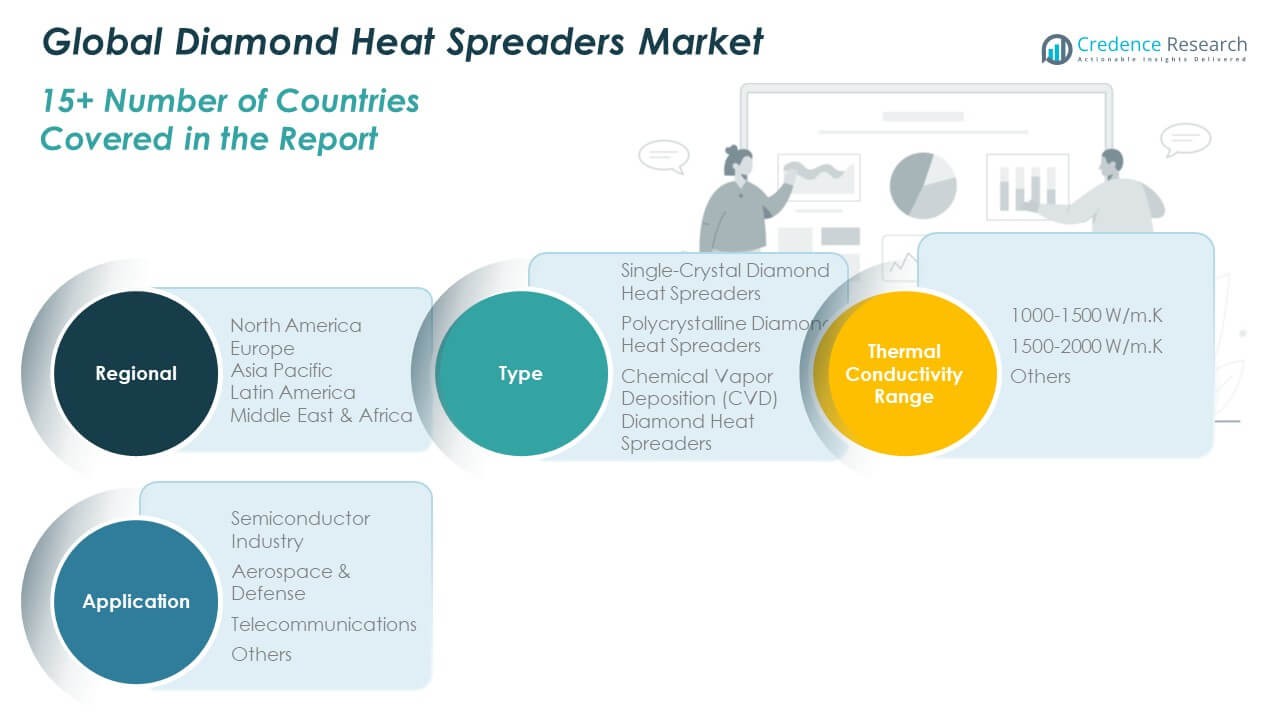

By Type

The Global Diamond Heat Spreaders Market shows diverse demand across product categories. Single-crystal diamond heat spreaders are used in semiconductors and aerospace where unmatched conductivity is critical. Polycrystalline variants dominate share due to cost efficiency and widespread adoption in electronics and telecom. Chemical Vapor Deposition (CVD) heat spreaders expand with scalable production methods, supporting integration into computing and optoelectronics.

- For instance, Element Six’s new composite material is produced with scalable manufacturing processes that allow integration into advanced 2.5D and 3D packaging for semiconductor devices, facilitating adoption across multiple industries.

By Thermal Conductivity Range

Products in the 1500–2000 W/m.K segment lead adoption, serving mission-critical aerospace, defense, and advanced semiconductor applications. The 1000–1500 W/m.K category balances affordability with efficiency, making it suitable for automotive electronics and industrial equipment. Other ranges fulfill specialized performance needs where unique thermal stability is required.

- For instance, the copper diamond composite launched by Element Six delivers around 800 W/mK conductivity, representing a high-performance yet cost-effective option, optimized for AI and high-frequency GaN RF devices, while Smiths Interconnect’s technologies support thermal management through reliable test sockets critical for devices in these conductivity segments.

By Application

The semiconductor industry generates the largest demand, driven by miniaturization and next-generation chip designs. Aerospace and defense secure strong adoption, with applications in satellites, radar, and avionics. Telecommunications represent a rising segment, fueled by 5G expansion and data center growth. Other applications such as medical devices, optoelectronics, and LED systems add consistent incremental demand.

Segmentation:

By Type

- Single-Crystal Diamond Heat Spreaders

- Polycrystalline Diamond Heat Spreaders

- Chemical Vapor Deposition (CVD) Diamond Heat Spreaders

By Thermal Conductivity Range

- 1000–1500 W/m.K

- 1500–2000 W/m.K

- Others

By Application

- Semiconductor Industry

- Aerospace & Defense

- Telecommunications

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Diamond Heat Spreaders Market size was valued at USD 35.99 million in 2018 to USD 56.08 million in 2024 and is anticipated to reach USD 107.13 million by 2032, at a CAGR of 7.9% during the forecast period. North America holds around 44% share of the global market, making it the largest regional contributor. The Global Diamond Heat Spreaders Market benefits here from strong demand in semiconductors, aerospace, and defense. The region’s advanced R&D ecosystem supports continuous innovation in diamond-based thermal solutions. U.S. manufacturers lead adoption through collaborations with aerospace and electronic component companies. Expansion of high-performance computing systems drives steady integration of diamond spreaders. Military modernization programs also boost adoption in avionics and radar systems. Canada and Mexico contribute through their growing electronics and automotive sectors.

Europe

The Europe Diamond Heat Spreaders Market size was valued at USD 23.14 million in 2018 to USD 35.13 million in 2024 and is anticipated to reach USD 63.05 million by 2032, at a CAGR of 7.0% during the forecast period. Europe accounts for about 22% share of the global market. The Global Diamond Heat Spreaders Market here benefits from advanced automotive electronics, defense applications, and optoelectronic industries. Germany, the UK, and France are the main hubs for adoption due to strong technology bases. Investments in next-generation automotive electronics strengthen regional demand. The European defense sector integrates diamond spreaders into satellites, avionics, and radar technologies. Steady growth in renewable energy projects adds further potential for heat management applications. Research institutions collaborate with manufacturers to enhance production scalability. Southern and Eastern Europe show growing interest, led by industrial and defense modernization initiatives.

Asia Pacific

The Asia Pacific Diamond Heat Spreaders Market size was valued at USD 14.34 million in 2018 to USD 24.62 million in 2024 and is anticipated to reach USD 53.62 million by 2032, at a CAGR of 9.6% during the forecast period. Asia Pacific holds about 18% share of the global market, but it records the fastest growth rate among all regions. The Global Diamond Heat Spreaders Market benefits from rapid expansion in consumer electronics, 5G infrastructure, and automotive electrification. China, Japan, and South Korea dominate regional adoption, supported by large-scale semiconductor production. India emerges as a promising hub due to its growing electronics and telecom sectors. Regional governments promote advanced material adoption through policy support and R&D funding. Demand rises from both consumer-driven applications and industrial sectors. Local players invest in scalable diamond synthesis processes. Asia Pacific is positioned to narrow the gap with North America and Europe in the coming years.

Latin America

The Latin America Diamond Heat Spreaders Market size was valued at USD 3.90 million in 2018 to USD 6.06 million in 2024 and is anticipated to reach USD 10.25 million by 2032, at a CAGR of 6.2% during the forecast period. Latin America represents about 5% share of the global market. The Global Diamond Heat Spreaders Market gains momentum here through emerging adoption in automotive and industrial electronics. Brazil leads demand with its growing electric vehicle and energy sectors. Mexico contributes due to its electronics assembly and manufacturing industries. Limited awareness and high costs restrict broader penetration, but multinational companies are targeting opportunities in renewable energy and smart grid technologies. Government initiatives to strengthen digital infrastructure support gradual adoption. The region relies heavily on imports, creating opportunities for partnerships with global suppliers.

Middle East

The Middle East Diamond Heat Spreaders Market size was valued at USD 2.21 million in 2018 to USD 3.17 million in 2024 and is anticipated to reach USD 5.08 million by 2032, at a CAGR of 5.5% during the forecast period. The region accounts for about 3% share of the global market. The Global Diamond Heat Spreaders Market in the Middle East is driven by investments in defense modernization and infrastructure projects. Countries such as Israel and GCC nations adopt advanced electronics in defense and aerospace systems. The rise of smart city projects boosts demand for high-performance telecommunications infrastructure. Regional players are exploring diamond-based solutions for niche applications. Limited local manufacturing capacity keeps the market import-dependent. Strategic collaborations with global suppliers remain essential for market expansion.

Africa

The Africa Diamond Heat Spreaders Market size was valued at USD 1.27 million in 2018 to USD 2.21 million in 2024 and is anticipated to reach USD 3.36 million by 2032, at a CAGR of 4.8% during the forecast period. Africa holds around 2% share of the global market, making it the smallest regional contributor. The Global Diamond Heat Spreaders Market here remains at an early stage of development. Demand emerges from South Africa’s industrial and defense electronics sectors. Egypt and Nigeria show gradual growth with infrastructure modernization projects. Limited technological capacity and high costs restrict widespread adoption. The region depends on imports to meet demand for advanced electronic materials. International partnerships are expected to drive entry into the African market. Growth potential exists in telecommunications and renewable energy systems, but awareness levels remain low.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Diamond Heat Spreaders Market is moderately consolidated with a mix of established players and emerging innovators. Leading companies such as Element Six, II-VI Incorporated, A.L.M.T. Corp., and Applied Diamond, Inc. invest heavily in R&D to advance synthetic diamond technologies and scalable production methods. It remains competitive due to strong applications in semiconductors, aerospace, and telecommunications. Companies pursue mergers, partnerships, and regional expansions to strengthen supply chains and reach diverse industries. Cost reduction strategies and performance innovation are central to maintaining an edge. New entrants face high entry barriers due to capital intensity and technical expertise requirements. Continuous focus on disruptive applications in photonics, 5G, and automotive electronics shapes rivalry. The market structure reflects a balance between technological leadership and cost competitiveness across global regions.

Recent Developments:

- In January 2025, Element Six unveiled an innovative copper diamond composite material at Photonics West 2025 in Santa Clara, California. This copper-plated diamond composite, notable for its high thermal and electrical conductivity, is designed to address thermal management challenges in advanced semiconductor devices. The product aims to enhance performance and reliability for applications such as AI, high-performance computing, and gallium arsenide RF devices, offering a scalable and cost-effective thermal management solution.

- Smiths Interconnect launched new high-speed data transmission modules and next-generation test sockets such as the ‘DaVinci Gen V’ in 2025. These products address industry challenges related to impedance tuning and signal integrity, vital for improving electronic circuit performance. The company also announced expansions in its US manufacturing facilities, enhancing production for chip testers.

- In September 2024, A.L.M.T. Corp. completed the acquisition of Esteves Group, a move announced by Torqx Capital. The merger aims to create a global leader with advanced technological capabilities and expanded market reach, particularly focusing on EMEA and the Americas. This union leverages shared corporate values and a long-standing business relationship between the companies.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Thermal Conductivity Range, and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise with the expansion of semiconductor and high-performance computing industries.

- Aerospace and defense will continue adopting diamond heat spreaders for mission-critical systems.

- Automotive electrification will create strong opportunities for thermal management integration.

- Telecommunications growth with 5G will accelerate adoption of diamond solutions.

- Medical devices and optoelectronics will expand as emerging application areas.

- Asia-Pacific will strengthen its role as the fastest-growing regional hub.

- Research into cost-effective diamond synthesis will enhance accessibility.

- Strategic collaborations between suppliers and OEMs will shape the competitive landscape.

- Sustainability in diamond production will gain importance for market positioning.

- Continuous R&D will unlock opportunities in quantum computing and photonics.