Market Overview:

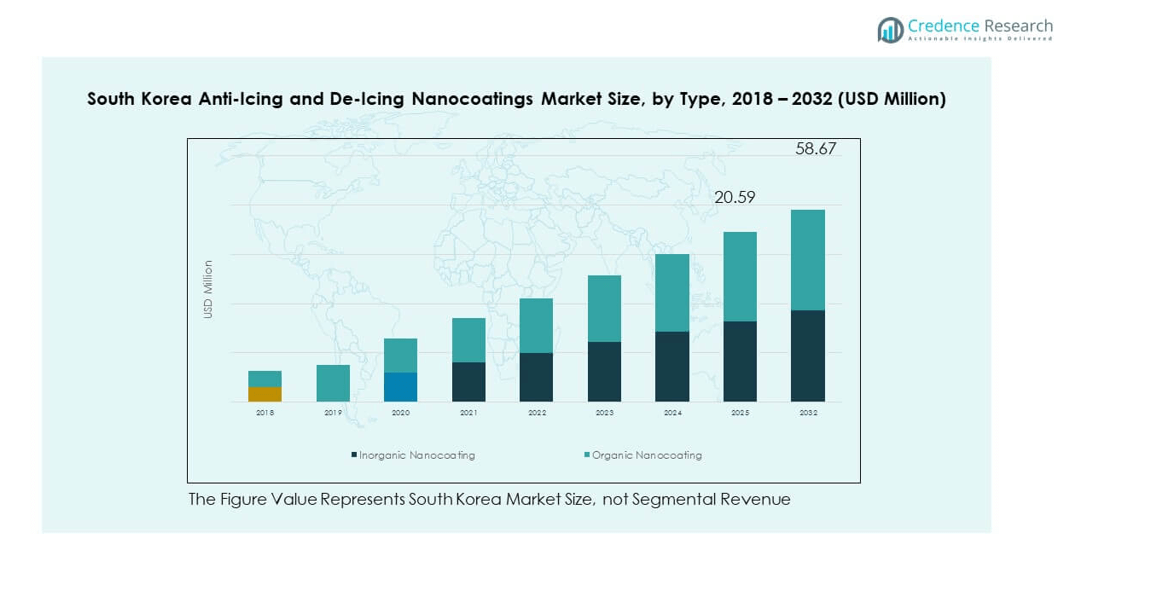

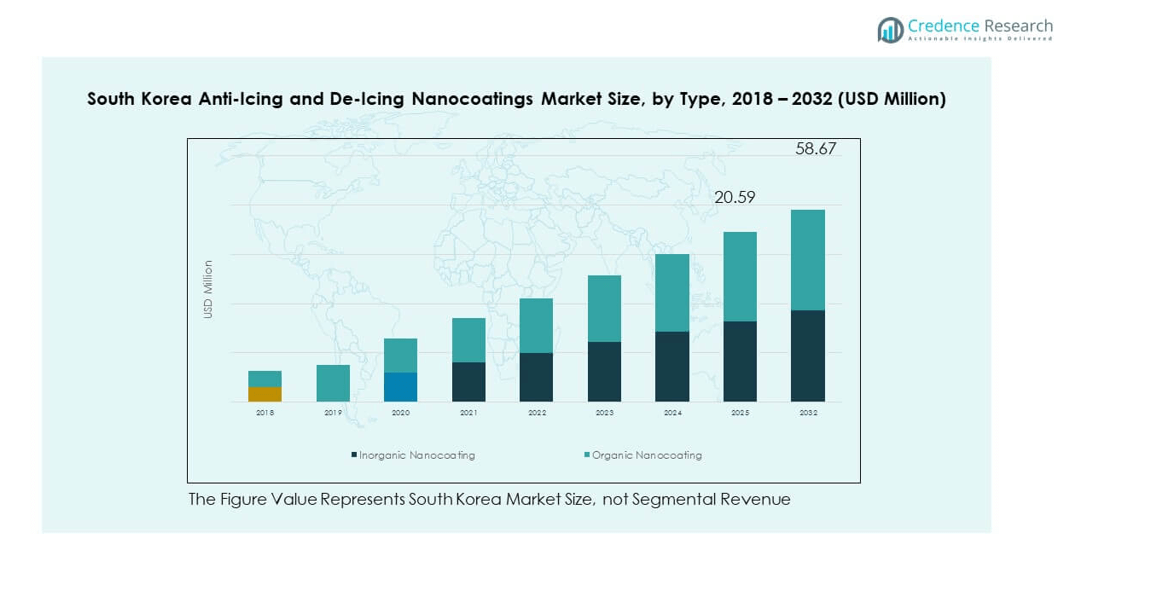

The South Korea Anti-Icing and De-Icing Nanocoatings Market size was valued at USD 7.24 million in 2018 to USD 17.84 million in 2024 and is anticipated to reach USD 58.67 million by 2032, at a CAGR of 16.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Anti-Icing and De-Icing Nanocoatings Market Size 2024 |

USD 17.84 million |

| South Korea Anti-Icing and De-Icing Nanocoatings Market, CAGR |

16.05% |

| South Korea Anti-Icing and De-Icing Nanocoatings Market Size 2032 |

USD 58.67 million |

Demand grows across aviation, wind energy, and transport. Winters cause icing on aircraft, blades. Operators want lower downtime and safer operations. Government pushes safety and energy reliability. Offshore wind projects expand in Jeju and southern coasts. Utilities seek coatings for power lines and substations. Automakers test ice-repellent layers for sensors and cameras. Drone adoption adds new surfaces needing protection. Materials progress improves durability and adhesion on metals and composites. Research institutes partner with OEMs for pilots. Coatings that cut de-icing chemicals also support sustainability goals. Buyers prefer long-life, low-maintenance solutions.

Gyeonggi-do leads with automotive and materials clusters. Ulsan and Geoje lead through shipbuilding and offshore equipment demand. Busan supports marine coatings and infrastructure trials. Incheon adds aviation MRO and weather resilience projects. Daejeon advances research with labs and university partners. Chungcheong grows through chemicals suppliers. Jeju emerges on offshore wind parks needing blade protection. Gangwon emerges for cold-weather testing mountainous sites. Gwangju builds capacity in sensors and smart factories. Daegu develops logistics coatings pilots. North Gyeongsang supports steel substrates and heavy industry. Regional buyers favour proven durability and fast application.

Market Insights:

- The South Korea Anti-Icing and De-Icing Nanocoatings Market was valued at USD 7.24 million in 2018, reached USD 17.84 million in 2024, and is projected to hit USD 58.67 million by 2032, registering a CAGR of 16.05% between 2024 and 2032.

- The capital region (Seoul and Gyeonggi-do) holds the largest share at 32%, supported by strong industrial bases in automotive, electronics, and R&D ecosystems that foster advanced material innovations.

- The southeastern region (Ulsan, Busan, and Geoje) captures 27% of the market, driven by shipbuilding, marine engineering, and offshore energy industries that require durable coatings for harsh marine and freezing environments.

- Emerging hubs like Daejeon, Jeju, and Gangwon represent 21%, with Jeju gaining traction from offshore wind energy expansion and Gangwon benefitting from colder climate testing, making this subregion the fastest-growing market.

- By type segmentation, inorganic nanocoatings account for nearly 65% of the market due to their high durability, while organic nanocoatings contribute 35%, focusing on lightweight and eco-friendly applications across textiles, packaging, and electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Safety compliance and weather resilience across aviation, energy, and transport

Airlines seek safer winter operations and fewer delays. Wind farms want higher turbine uptime and fewer blade repairs. Rail and road operators need better visibility and safer movement. Power utilities aim for grid reliability during freeze events. Regulators set stricter safety norms for ice hazards. It reduces chemical de-icers and helps sustainability targets. Budgets shift toward coatings with long service life. The South Korea Anti-Icing and De-Icing Nanocoatings Market aligns with these goals. Procurement teams seek standards alignment across fleets. Local trials validate performance in severe frost. Government incentives strengthen regional deployment. Industry forums highlight safety-driven adoption.

- For instance, Korea Electric Power Corporation (KEPCO) has been researching advanced anti-icing and superhydrophobic coating technologies for high-voltage power lines, particularly in cold regions such as Gangwon Province, where heavy ice accretion impacts grid stability. These efforts focus on improving grid reliability and reducing outage risks by testing new surface treatments and materials under severe winter conditions.

Total cost reduction across maintenance, labor, and downtime

Asset owners focus on lifetime cost, not unit price. Fewer de-icing cycles cut labor and equipment wear. Lower ice load reduces energy use on moving parts. OEMs push solutions that lower warranty claims. Fleet managers value fast cure times and easy touch-ups. It enables longer service intervals at harsh sites. Buyers prefer coatings that suit multiple substrates. The South Korea Anti-Icing and De-Icing Nanocoatings Market benefits from this shift. Lifecycle models capture fewer emergency callouts. Stakeholders expect measurable ROI within winter seasons. Benchmarking shows cost parity with traditional methods. Industry adoption widens where margins remain tight.

- For instance, Hyundai Heavy Industries has explored advanced coating technologies for LNG carriers and marine infrastructure at its Ulsan Shipyard, where anti-icing and surface protection are critical for safe and efficient operations in winter conditions. These developments align with industry priorities to improve durability, reduce manual de-icing requirements, and enhance operational efficiency in cold-climate shipping.

Rapid material innovation and stronger field performance

Suppliers advance hydrophobic and icephobic surface designs. Nano textures boost water roll-off and delay ice nucleation. Binders deliver better UV and salt-spray resistance. Primers improve adhesion on composites and metals. Lab methods now mirror wet freeze–thaw cycles. It shortens qualification cycles with clear pass criteria. Pilots expand with airside, marine, and wind partners. The South Korea Anti-Icing and De-Icing Nanocoatings Market absorbs these gains. Field data now flows into design updates. Collaborations speed path from lab to runway. Testing programs scale across multiple subregions. Certification bodies refine approval standards faster.

Infrastructure growth and climate risk adaptation momentum

Offshore wind capacity rises near Jeju and the south. Airports expand cold-weather readiness and MRO capacity. ADAS sensors need clear surfaces for reliable vision. Drones and eVTOL craft require ice control on rotors. Power lines need lower ice loads to protect towers. It supports smart-city optics on cameras and signs. Insurers reward strong risk controls with better terms. The South Korea Anti-Icing and De-Icing Nanocoatings Market tracks these investments. Municipal buyers plan multi-year resilience budgets. Vendors expand service hubs near coastal assets. Cold-climate pilots guide long-term strategies. Collaboration grows between public and private sectors.

Market Trends

Shift to PFAS-free chemistries and greener formulations

Buyers demand fluorine-free systems with strong ice release. Suppliers replace legacy agents with safer molecules. Labels highlight low VOC and low toxicity claims. Compliance teams prefer widely accepted ingredient lists. Eco metrics enter tenders and vendor scorecards. It elevates R&D on non-fluorinated slip layers. Third-party eco labels gain weight in selection. The South Korea Anti-Icing and De-Icing Nanocoatings Market reflects this shift. Customers request full material disclosures. Auditors check cradle-to-grave impacts. Investor pressure accelerates sustainable product rollouts. Local firms align with green export markets.

Integration with sensors, analytics, and control systems

Coatings pair with ice detection for timely action. Airports link alerts to ground crew workflows. Wind operators trigger pitch or yaw strategies. Data feeds train models for icing hotspots. Dashboards rank assets by risk and urgency. It strengthens predictive maintenance and planning. Vendors bundle software with surface treatments. The South Korea Anti-Icing and De-Icing Nanocoatings Market adopts such bundles. APIs support vendor-neutral deployments. Cyber teams require secure data handling. Interoperability drives wider adoption. Real-time updates cut system downtime.

- For instance, Liebherr-Aerospace has been advancing ice-detection and protection systems for next-generation aircraft, including solutions tested on Airbus platforms. The company has developed electronic control units and software-based systems to monitor ice accretion in real time, supporting safer and more efficient de-icing strategies when integrated with advanced coating technologies.

Movement toward factory application and OEM specifications

OEM lines define primers, film builds, and cure windows. Consistent processes deliver repeatable performance across fleets. Approved-process lists guide maintenance depots nationwide. Kits include cleaners, pads, and mixing ratios. Training modules certify applicators in short cycles. It reduces rework and cure-time errors. Audits verify adhesion and water contact angles. The South Korea Anti-Icing and De-Icing Nanocoatings Market standardizes around OEM routes. Robotic sprayers improve line throughput. Traceability tags support warranty claims. Stronger OEM mandates influence supplier competition. Certification harmonization supports exports.

- For instance, Boeing has worked with Henkel on advanced coating technologies, including polyurethane-based systems such as Aerofilm, which are designed to improve durability and surface performance in aerospace applications. These coatings are applied using automated processes in manufacturing lines and are evaluated through rigorous adhesion and surface property testing to meet aviation safety and reliability standards.

Service-led models and outcome guarantees

Vendors offer seasonal performance warranties with clear metrics. Contracts tie payment to uptime and safety goals. Mobile crews handle inspections and rapid repairs. Drones map ice zones for targeted action. Digital twins simulate freeze scenarios by site. It enables budgeting based on outcomes, not inputs. Partners co-create site-specific playbooks. The South Korea Anti-Icing and De-Icing Nanocoatings Market embraces service models. Shared dashboards align vendor and client. Season reviews refine contract terms. Subscription-based models attract mid-sized clients. Long-term data strengthens customer loyalty.

Market Challenges Analysis

Harsh-environment durability, verification, and cross-industry certification barriers

Coatings face salt spray, UV, and abrasion stress. Erosion on blades and rotors limits service life. Cold shock tests expose brittle failure risks. Certification paths differ across air, marine, and rail. Standards evolve faster than test capacity grows. It delays approvals and extends pilot timelines. Heat tracing and active systems keep budget share. The South Korea Anti-Icing and De-Icing Nanocoatings Market must prove reliability. Repair cycles remain shorter than targets. Budget holders demand independent field evidence.

Application complexity, cost hurdles, and supply continuity risks

Field work needs tight humidity and temperature control. Weak surface prep causes early adhesion loss. Rework adds downtime and cost overruns. Price pressure slows adoption on low-margin assets. Skill gaps persist among regional applicators. It depends on stable supply of key resins. Logistics shocks can disrupt project schedules. The South Korea Anti-Icing and De-Icing Nanocoatings Market needs robust support. Cold storage of materials complicates logistics. Exchange-rate swings pressure import costs.

Market Opportunities

Offshore wind retrofits, aviation MRO, and ADAS sensor protection at scale

Aging turbines need upgrades for winter reliability. Blade retrofit programs unlock large repeat orders. Airports seek faster turnarounds with durable films. ADAS cameras require clear vision in snow and sleet. Drone fleets expand inspection and delivery use cases. It opens cross-sell paths across shared platforms. Local partners can scale nationwide deployment. The South Korea Anti-Icing and De-Icing Nanocoatings Market can lead here. Local composites shops can co-develop solutions. Export partners seek turnkey retrofit packages.

Grid hardening, smart-city assets, and export-ready solutions

Transmission lines benefit from lower ice loads. Catenary systems gain stability during storms. Traffic cameras and signs need clear optics. Ports require safer surfaces on cranes and decks. Defense assets value low-visibility ice control. It supports regional exports to cold-climate neighbors. Service bundles create sticky client relationships. The South Korea Anti-Icing and De-Icing Nanocoatings Market can capture these wins. Universities assist with test protocols. Pilot corridors create fast adoption paths.

Market Segmentation Analysis:

The South Korea Anti-Icing and De-Icing Nanocoatings Market demonstrates steady growth across type and application categories.

By type, inorganic nanocoatings hold a strong share due to their durability, resistance to harsh weather, and suitability for high-performance applications in aviation, automotive, and energy industries. Their ability to withstand extreme temperatures and provide long-term protection makes them a preferred option for infrastructure and heavy-duty assets. Organic nanocoatings, while gaining adoption, focus on lightweight applications where flexibility and eco-friendly formulations are valued. It expands in sectors like textiles, packaging, and electronics, where cost-effectiveness and tailored properties are prioritized.

- For instance, PPG Industries supplies its Desothane® topcoats to major aerospace OEMs including Airbus. These polyurethane-based coatings are certified for long-term durability, strong resistance to UV and weathering, and performance across the extreme temperature ranges experienced in aviation environments.

By application, transportation leads the demand with coatings deployed in automotive, aerospace, marine, and rail sectors. The need for improved safety and reduced maintenance costs drives higher adoption. Energy emerges as another major segment, with offshore wind turbines and power transmission lines requiring protection from ice accumulation. Electronics contribute through coating solutions for sensors, cameras, and advanced driver-assistance systems. Food and packaging industries use coatings to ensure safe storage and maintain product integrity under cold-chain logistics. Textiles represent a niche but growing segment, particularly for outdoor apparel and protective fabrics. Other applications include infrastructure, defense, and smart-city assets, where coatings support safety, resilience, and operational continuity.

- For example, Siemens Gamesa has developed and implemented anti-icing technologies for wind turbine blades, including advanced coatings and surface treatments. The company uses SCADA-based analytics to monitor icing and optimize turbine availability in wind farms located in cold climates, including in Asia.

Segmentation:

By Type

- Inorganic Nanocoating

- Organic Nanocoating

By Application

- Transportation

- Textiles

- Energy

- Electronics

- Food & Packaging

- Others

Regional Analysis:

Capital Region – Seoul and Gyeonggi-do

The South Korea Anti-Icing and De-Icing Nanocoatings Market records its highest share in the capital region, with Seoul and Gyeonggi-do accounting for 32% of the market. Strong demand arises from automotive, electronics, and advanced materials industries concentrated in this subregion. It benefits from large-scale R&D investments, strong industrial clusters, and a high density of manufacturing facilities. Aviation MRO hubs and logistics networks in Incheon also contribute to rising adoption. High infrastructure resilience programs support coatings in smart-city and transport projects. Buyers in this subregion value advanced, eco-friendly coatings with proven durability for diverse applications.

Southeastern Region – Ulsan, Busan, and Geoje

The southeastern belt holds 27% of the market share, driven by shipbuilding, marine engineering, and offshore energy sectors. Ulsan and Geoje focus on large vessel construction, offshore wind equipment, and heavy machinery, creating consistent demand for durable nanocoatings. Busan, a key port city, supports coating applications in marine infrastructure, cranes, and logistics facilities. It serves as a vital hub for export-driven industries, reinforcing international supply chains. Local companies prioritize coatings that improve operational efficiency in saline and freezing environments. The market here shows strong preference for inorganic coatings due to their resilience in marine and offshore conditions.

Emerging Industrial and Energy Hubs – Daejeon, Jeju, and Gangwon

Emerging regions such as Daejeon, Jeju, and Gangwon account for 21% of the market. Daejeon strengthens the ecosystem with academic research and innovation partnerships. Jeju gains importance with offshore wind expansion and renewable energy initiatives requiring blade and grid protection. Gangwon, with its mountainous terrain and colder climate, provides ideal conditions for testing and deploying coatings in transport and infrastructure. It is also attracting projects in drone and sensor technologies requiring anti-icing properties. The South Korea Anti-Icing and De-Icing Nanocoatings Market in these hubs grows steadily as industries align with energy transition and climate resilience goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Battelle

- PPG

- Fraunhofer

- Hygratek

- Nanosonic

- Luna Innovations

- Nanovere Technologies

- NEI Corporation

- Cytonix

- Other Key Players

Competitive Analysis:

The South Korea Anti-Icing and De-Icing Nanocoatings Market features a mix of global leaders and specialized innovators competing across diverse applications. Companies such as Battelle, PPG, and Fraunhofer hold strong positions through advanced R&D, proven product performance, and partnerships with industrial sectors. Hygratek, Nanosonic, and Luna Innovations focus on delivering customized solutions for aerospace, defense, and energy clients. Nanovere Technologies, NEI Corporation, and Cytonix strengthen competitiveness with patented formulations and eco-friendly alternatives. It is shaped by ongoing investments in durability, sustainability, and integration with smart technologies. Competitive dynamics emphasize innovation, service differentiation, and regional expansion. Firms with established OEM relationships secure long-term contracts, especially in automotive and aviation. Marine and offshore segments create opportunities for players offering robust inorganic coatings, while electronics and packaging segments attract companies advancing organic solutions. Strategic mergers, product launches, and partnerships with South Korean universities and research centers enhance competitiveness. Local collaborations improve adaptability to unique climatic challenges and regulatory frameworks.

Recent Developments:

- In April 2024, Fraunhofer expanded its collaboration with South Korea by signing a comprehensive international partnership funded by the Korean Ministry of Trade, Industry and Energy (MOTIE). The new partnership, sealed with a letter of agreement and the inauguration of a coordination office in Germany, aims to expedite technological innovations, including nanocoating and materials research, through closer ties between eight Fraunhofer institutes and South Korean research and industrial entities.

- In January 2024, KAIST announced the development of a new anti-icing and de-icing film coating technology by its research team led by Professor Hyoungsoo Kim and Professor Dong Ki Yoon. The breakthrough focuses on the photothermal effect of gold nanorods patterned with cellulose nanocrystals to create a film that prevents ice formation and enables efficient de-icing when exposed to visible light, without the need for external heating or chemical sprays.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The South Korea Anti-Icing and De-Icing Nanocoatings Market will expand with higher adoption in aviation, automotive, and wind energy sectors.

- Demand for PFAS-free and eco-friendly formulations will intensify as regulations favor sustainable alternatives.

- Transportation will remain a core application, with increasing use in autonomous and electric vehicles.

- Offshore wind projects in coastal regions will drive coatings demand for turbine protection and grid reliability.

- Electronics and sensor applications will grow rapidly as smart infrastructure and ADAS technologies scale nationwide.

- R&D collaborations between universities, labs, and industry leaders will strengthen product innovation pipelines.

- Service-driven business models, including warranties and bundled maintenance contracts, will gain preference.

- Regional players will expand partnerships with global leaders to improve competitiveness and export reach.

- Energy and infrastructure investments will enhance opportunities for long-term deployment across diverse sectors.

- The South Korea Anti-Icing and De-Icing Nanocoatings Market will evolve as a critical enabler of safety, cost efficiency, and climate resilience.