Market Overview

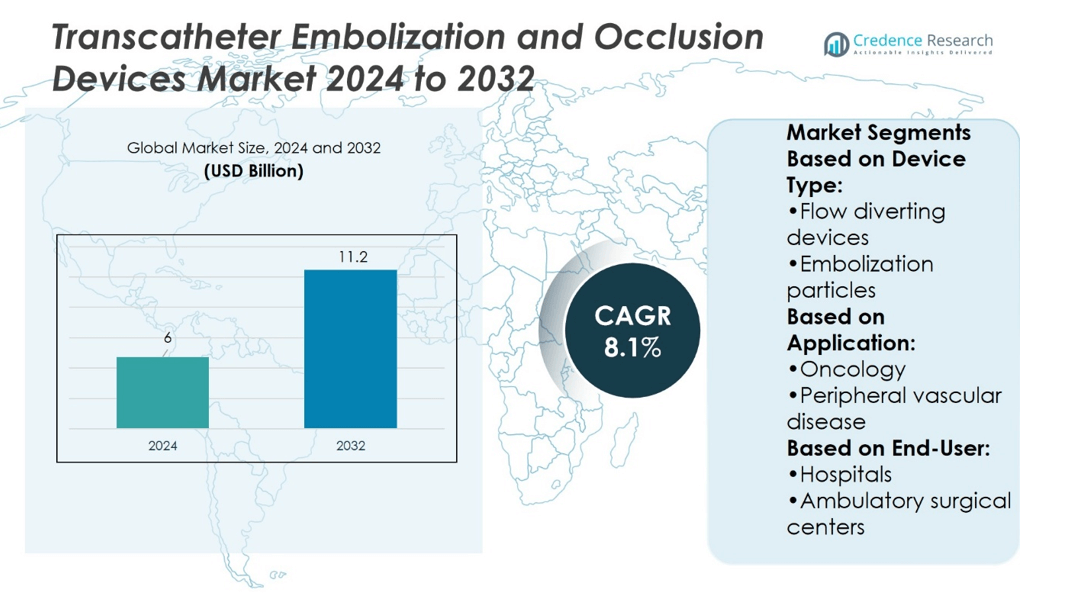

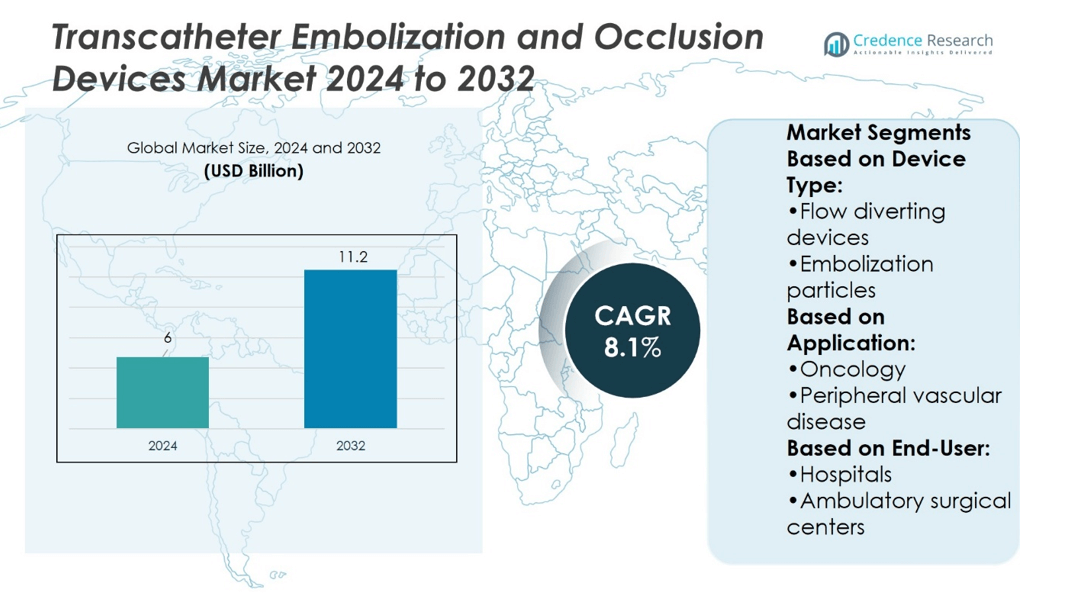

Transcatheter Embolization and Occlusion Devices Market size was valued at USD 6 billion in 2024 and is anticipated to reach USD 11.2 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transcatheter Embolization and Occlusion Devices Market Size 2024 |

USD 6 billion |

| Transcatheter Embolization and Occlusion Devices Market, CAGR |

8.1% |

| Transcatheter Embolization and Occlusion Devices Market Size 2032 |

USD 11.2 billion |

The Transcatheter Embolization and Occlusion Devices Market grows with rising prevalence of cancer, cardiovascular disorders, and neurological conditions that require targeted minimally invasive treatments. Demand strengthens as hospitals and ambulatory centers adopt advanced embolization procedures for faster recovery and reduced complications. Innovation in flow diverting devices, bio-resorbable materials, and drug-eluting technologies further accelerates market expansion. Integration of robotics, AI-based imaging, and navigation tools improves precision, supporting adoption across high-volume centers. Growing patient awareness, favorable reimbursement frameworks in developed economies, and expanding healthcare infrastructure in emerging markets together reinforce strong momentum for long-term market growth.

North America holds the largest share of the Transcatheter Embolization and Occlusion Devices Market, supported by advanced healthcare systems and strong adoption of minimally invasive procedures. Europe follows with rising demand for interventional oncology and neurovascular treatments, while Asia-Pacific emerges as the fastest-growing region due to expanding healthcare infrastructure and large patient populations. Latin America and the Middle East & Africa show steady progress with increasing investments. Key players driving competition include Abbott, Medtronic, Boston Scientific, COOK MEDICAL, and Johnson & Johnson.

Market Insights

- Transcatheter Embolization and Occlusion Devices Market size was USD 6 billion in 2024 and will reach USD 11.2 billion by 2032, at a CAGR of 8.1%.

- Rising prevalence of cancer, cardiovascular, and neurological conditions drives demand for embolization and occlusion therapies.

- Adoption of flow diverting devices, bio-resorbable materials, and drug-eluting technologies shapes strong market trends.

- Competition remains intense with companies focusing on innovation, clinical expansion, and partnerships for global reach.

- High device costs and limited reimbursement policies in some regions act as restraints.

- North America leads with advanced healthcare systems, Europe follows with interventional oncology growth, and Asia-Pacific shows fastest expansion.

- Latin America and the Middle East & Africa grow steadily with healthcare investments and improved access to interventional procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Burden of Chronic Diseases Driving Demand

The Transcatheter Embolization and Occlusion Devices Market grows with rising cases of cardiovascular and oncological diseases. Cancer treatments increasingly require embolization procedures to block blood flow to tumors. Cardiac disorders demand minimally invasive occlusion therapies to prevent complications like aneurysms and hemorrhages. It benefits from growing clinical reliance on targeted procedures over open surgery. Rising patient awareness of effective outcomes further supports device demand. This driver ensures steady adoption across hospitals and specialty clinics.

- For instance, Abbott’s Amplatzer Vascular Plug 4 ships pre-loaded on a 0.038-inch guidewire–compatible catheter with a 155 cm PTFE-coated delivery wire, allowing smooth tracking into tortuous distal vasculature.

Rising Preference for Minimally Invasive Procedures

Minimally invasive interventions drive strong adoption in the Transcatheter Embolization and Occlusion Devices Market. These devices allow faster recovery, reduced hospital stays, and lower complication risks. Patients prefer less invasive therapies, and healthcare providers align with these expectations. It strengthens market growth by replacing conventional surgical approaches. Expanded training among physicians also encourages wider clinical use. Advancements in catheter design enhance safety and precision. This driver firmly anchors market expansion across developed and emerging regions.

- For instance, Cook Medical’s Tornado® embolization microcoils provide diameters tapering from 10 mm to 5 mm (proximal to distal) and are available in lengths between 2.6 cm and 12.5 cm, enabling precise occlusion of short or tapering vessels.

Technological Advancements Enhancing Device Performance

Continuous innovation supports growth in the Transcatheter Embolization and Occlusion Devices Market. Companies introduce advanced coils, plugs, and liquid embolics with higher accuracy and durability. Improved imaging integration allows real-time guidance during complex procedures. It enables safer navigation of devices within delicate vascular structures. Rising focus on bio-compatible and drug-eluting materials boosts clinical outcomes. Integration of robotic-assisted systems also improves procedural efficiency. These advancements create strong adoption opportunities in high-tech healthcare centers.

Expanding Applications Across Multiple Therapeutic Areas

The Transcatheter Embolization and Occlusion Devices Market expands through broader therapeutic applications. Beyond oncology and cardiology, it now supports trauma care, gastrointestinal bleeding, and urology. Physicians apply these devices for pre-surgical interventions and chronic condition management. It ensures relevance across diverse clinical pathways. Rising investment in research broadens application scope with innovative trials. Growing use in pediatric and neurovascular disorders highlights its versatility. This wide application base secures sustained long-term growth.

Market Trends

Adoption of Image-Guided and Navigation-Assisted Procedures

The Transcatheter Embolization and Occlusion Devices Market demonstrates a clear trend toward image-guided interventions. Advanced imaging technologies provide precision during embolization and occlusion procedures. Real-time guidance minimizes risks and improves treatment outcomes. It helps clinicians target blood vessels with higher accuracy, reducing complications. Hybrid operating rooms support wider adoption of such advanced procedures. Integration of digital imaging platforms strengthens procedural reliability. This trend aligns with growing clinical demand for safer and more effective outcomes.

- For instance, Medtronic’s Pipeline Flex with Shield Technology flow diverter uses a braided structure made of 48 wires—specifically 36 cobalt-chromium and 12 platinum wires.

Rising Popularity of Bio-Resorbable and Drug-Eluting Devices

Manufacturers increasingly focus on bio-resorbable and drug-eluting devices in the Transcatheter Embolization and Occlusion Devices Market. Bio-resorbable products reduce long-term complications by dissolving after treatment. Drug-eluting technologies combine embolization with localized drug delivery. It enhances effectiveness while minimizing systemic side effects. Hospitals value devices that improve patient safety and long-term recovery. Clinical trials continue to support regulatory approvals for these advanced solutions. This trend accelerates innovation across both developed and emerging healthcare systems.

- For instance, Edwards Lifesciences’ Fogarty® Thru-Lumen Embolectomy Catheters offer models with an inflated balloon diameter up to 14 mm, a deflated balloon size down to 5.0 French, and liquid capacity reaching 1.7 ml.

Increasing Use in Outpatient and Ambulatory Care Settings

The Transcatheter Embolization and Occlusion Devices Market shows a strong shift toward outpatient and ambulatory care usage. Shorter recovery times encourage procedures outside traditional hospital settings. Rising demand for cost-effective solutions drives the move toward day-care treatments. It allows healthcare systems to manage resources efficiently. Patients prefer minimally invasive options that avoid extended hospital stays. Physicians also adapt to the convenience and safety of ambulatory models. This trend enhances accessibility and supports broader patient adoption.

Integration of Robotics and Artificial Intelligence in Procedures

The Transcatheter Embolization and Occlusion Devices Market benefits from robotics and AI integration. Robotic platforms enable improved navigation within complex vascular pathways. Artificial intelligence supports predictive analytics for treatment planning. It increases accuracy and reduces variability in clinical outcomes. Hospitals invest in these technologies to enhance productivity and safety. Training programs encourage physician adoption of digital tools alongside conventional techniques. This trend redefines procedural standards and raises expectations for future device innovations.

Market Challenges Analysis

High Cost of Devices and Limited Reimbursement Policies

The Transcatheter Embolization and Occlusion Devices Market faces challenges from high device costs and limited reimbursement coverage. Advanced embolic materials, bio-resorbable options, and navigation-enabled systems increase treatment expenses. Healthcare providers in developing economies struggle with budget constraints, slowing adoption rates. It limits patient access to innovative solutions despite proven clinical benefits. Inconsistent reimbursement frameworks across regions add further barriers to market penetration. Hospitals often prioritize cost-saving alternatives, reducing demand for premium technologies. These financial pressures restrict broader deployment of advanced devices in both public and private healthcare systems.

Complex Procedures and Shortage of Skilled Professionals

The Transcatheter Embolization and Occlusion Devices Market also encounters difficulties from complex procedures and workforce shortages. Embolization and occlusion require specialized training, technical expertise, and experience in advanced imaging. Many regions lack sufficient interventional radiologists and cardiovascular specialists, slowing procedural adoption. It raises risks of complications when performed by undertrained staff. Limited training programs and uneven global access to skill development intensify this issue. Healthcare institutions struggle to scale services without adequate professional capacity. These challenges highlight the need for structured training initiatives and supportive infrastructure to expand procedural availability.

Market Opportunities

Expansion Potential in Emerging Economies and Growing Healthcare Infrastructure

The Transcatheter Embolization and Occlusion Devices Market holds strong opportunities in emerging economies. Rising healthcare spending and investments in hospital infrastructure create demand for advanced interventional therapies. Rapid urbanization and growing access to modern medical facilities improve adoption potential. It gains further traction with government support for minimally invasive treatments. Expanding private healthcare networks also strengthen availability of these devices in underserved regions. Partnerships with local distributors open pathways for global players to extend market presence. This opportunity positions developing countries as significant growth engines over the next decade.

Innovation in Device Development and Expanding Clinical Applications

The Transcatheter Embolization and Occlusion Devices Market benefits from continuous innovation in materials, coatings, and delivery systems. Bio-resorbable technologies and targeted drug-eluting solutions expand clinical relevance. It allows physicians to combine occlusion with therapeutic delivery, improving patient outcomes. Expanding applications beyond oncology and cardiology, such as trauma care and gastrointestinal bleeding, further broaden adoption. Rising investments in research and clinical trials encourage product approvals in multiple regions. Hospitals show strong interest in advanced devices that reduce complications and recovery times. This innovation-driven opportunity will sustain growth momentum and diversify therapeutic use cases globally.

Market Segmentation Analysis:

By Device Type

The Transcatheter Embolization and Occlusion Devices Market demonstrates wide segmentation by device type. Non-coil devices, including flow diverting devices, embolization particles, liquid embolics, and other variations, hold significant importance due to their versatility and advanced performance. Flow diverting devices are critical in treating complex aneurysms, offering strong adoption among neurovascular specialists. Embolization particles are widely applied in oncology for tumor treatment through selective occlusion. Liquid embolics provide flexibility in addressing arteriovenous malformations and other vascular conditions. Coils remain central to the market, with pushable coils serving cost-sensitive environments and detachable coils gaining favor for precision and retrievability. It continues to witness innovation across both coil and non-coil categories, strengthening their clinical relevance.

- For instance, Merit Medical’s Maestro® Microcatheters are engineered to deploy coils up to 0.018″ and embolics up to 900 µm, featuring a swan-neck distal design that helps seat the catheter and reduces embolic recoiling.

By Application

Oncology leads application-based segmentation in the Transcatheter Embolization and Occlusion Devices Market, supported by the growing need for embolization in cancer care. Interventional oncology leverages embolization particles and liquid embolics to block tumor blood supply effectively. Peripheral vascular disease applications expand demand for coils and flow diverting devices, addressing arterial blockages and aneurysms. Neurology represents a vital segment, where advanced embolics and flow diverters are crucial for stroke and aneurysm management. Urology benefits from embolization procedures in conditions such as benign prostatic hyperplasia. Other applications, including trauma management and gastrointestinal bleeding, provide further scope for device utilization. It ensures adoption across a wide therapeutic spectrum.

- For instance, the DERIVO 2heal Embolisation Device offers a choice of 48, 52, or 64 densely woven nitinol composite wires, available in diameters from 3.5 mm to 8.0 mm, and compatible with 1.5 mm to 8.0 mm vessel diameters.

By End User

Hospitals dominate end-user segmentation in the Transcatheter Embolization and Occlusion Devices Market due to strong infrastructure, advanced imaging systems, and availability of skilled professionals. Large patient volumes in oncology and neurology further strengthen hospital reliance on these devices. Ambulatory surgical centers show rising adoption, driven by demand for cost-effective and minimally invasive procedures. Their ability to deliver faster turnaround supports wider acceptance among patients and healthcare systems. Other end users, such as specialty clinics, contribute steadily by addressing specific therapeutic areas. It reflects a balanced spread of adoption across both traditional and emerging care models, supporting sustained market growth.

Segments:

Based on Device Type:

- Flow diverting devices

- Embolization particles

Based on Application:

- Oncology

- Peripheral vascular disease

Based on End-User:

- Hospitals

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 38% share of the Transcatheter Embolization and Occlusion Devices Market, supported by advanced healthcare infrastructure and strong adoption of minimally invasive procedures. The United States drives regional dominance with a large patient base for oncology, cardiovascular, and neurological disorders. Favorable reimbursement frameworks and continuous innovation from domestic manufacturers further reinforce leadership. It benefits from early adoption of bio-resorbable and drug-eluting devices, supported by high investments in clinical research. Canada contributes steadily, supported by a growing focus on specialized interventional radiology programs. The region continues to advance adoption through regulatory approvals and training initiatives, strengthening its global role. Rising cancer prevalence and increasing use of image-guided procedures secure long-term growth prospects.

Europe

Europe holds 29% share of the Transcatheter Embolization and Occlusion Devices Market, driven by rising demand for interventional oncology and neurovascular treatments. Germany, France, and the United Kingdom represent the largest markets, benefiting from structured healthcare systems and strong regulatory support for advanced devices. It reflects growing adoption of embolization therapies in trauma care and peripheral vascular disease management. Research institutions collaborate actively with medical device companies, advancing innovation and clinical adoption. Southern and Eastern European countries show rising uptake as investments in healthcare modernization increase. Government focus on cost-effective minimally invasive procedures supports broader availability across public hospitals. Strong emphasis on evidence-based medicine ensures consistent integration of embolization and occlusion therapies into standard care pathways.

Asia-Pacific

Asia-Pacific commands 23% share of the Transcatheter Embolization and Occlusion Devices Market, representing the fastest-growing regional segment. China and India drive expansion with increasing healthcare investments, growing cancer prevalence, and rising demand for advanced vascular treatments. Japan and South Korea lead innovation, supported by technology-driven healthcare systems and robust interventional radiology expertise. It benefits from expanding training programs and adoption of imaging-guided embolization in major urban hospitals. Economic growth and rising disposable income enhance patient access to advanced procedures. Regional governments support modernization of healthcare infrastructure, boosting long-term opportunities. The combination of high patient volumes and improving access to skilled professionals positions Asia-Pacific as a critical growth hub.

Latin America

Latin America secures 6% share of the Transcatheter Embolization and Occlusion Devices Market, reflecting gradual but steady adoption. Brazil and Mexico dominate the region, supported by expanding private healthcare networks and government programs targeting cancer and cardiovascular care. It demonstrates increasing use of coils and embolization particles in tertiary hospitals. Rising medical tourism in Mexico and Brazil enhances access to advanced interventional procedures. Limited reimbursement frameworks and high device costs remain challenges but are gradually offset by partnerships with global suppliers. Training initiatives supported by international organizations strengthen physician expertise across larger urban centers. Continued investment in healthcare modernization drives regional growth prospects.

Middle East & Africa

The Middle East & Africa represents 4% share of the Transcatheter Embolization and Occlusion Devices Market, supported by rising investments in tertiary healthcare and specialized hospitals. Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the United Arab Emirates, lead adoption with high expenditure on advanced medical technologies. It benefits from government initiatives to expand interventional radiology services and attract international healthcare providers. Africa shows slower adoption due to infrastructure limitations but reflects growing interest in embolization procedures in South Africa and Nigeria. Multinational companies expand their presence through partnerships and supply agreements to strengthen accessibility. Training collaborations and technology transfer agreements gradually improve physician capacity in the region. Rising prevalence of cardiovascular and oncological diseases ensures steady demand despite structural challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LEPU MEDICAL

- Abbott

- COOK MEDICAL

- Medtronic

- Edwards Lifesciences

- Merit Medical

- acandis

- Johnson & Johnson

- Boston Scientific

- balt

Competitive Analysis

The Transcatheter Embolization and Occlusion Devices Market include Abbott, acandis, balt, Boston Scientific, COOK MEDICAL, Edwards Lifesciences, Johnson & Johnson, LEPU MEDICAL, Medtronic, and Merit Medical. The Transcatheter Embolization and Occlusion Devices Market reflects strong competition driven by innovation, product diversity, and expanding clinical applications. Companies focus on advancing embolization particles, liquid embolics, and flow diverting devices to improve safety and precision. The market benefits from growing demand for minimally invasive procedures across oncology, neurology, and cardiovascular care. It is shaped by regulatory approvals, reimbursement structures, and hospital procurement strategies that influence adoption levels. Continuous research into bio-resorbable materials and drug-eluting technologies sets new benchmarks for performance. Expanding use in ambulatory surgical centers and outpatient care strengthens accessibility, creating broader opportunities. This competitive environment ensures rapid product development and sustained global growth.

Recent Developments

- In July 2025, Teleflex completed the acquisition of BIOTRONIK’s vascular intervention business for EUR adding drug-coated balloons and the Freesolve resorbable scaffold to its portfolio.

- In June 2025, Penumbra received FDA clearance and launched the Ruby XL coil system, offering the longest and softest detachable coil for large-vessel embolization.

- In August 2024, Boston Scientific Corporation announced that it secured CE mark for the ACURATE Prime™ Aortic Valve System, the newest transcatheter aortic valve replacement (TAVR) technology.

- In October 2023, Merit Medical Systems announced that it has broadened the Maestro microcatheter line by adding a new longer length for radial embolization procedures. Maestro is also part of the company‘s portfolio of embolotherapy products, which consists of Embosphere microspheres.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for minimally invasive procedures.

- Oncology applications will remain the largest growth driver for device adoption.

- Neurology treatments will gain importance with increasing cases of stroke and aneurysm.

- Hospitals will continue leading usage due to advanced infrastructure and skilled specialists.

- Ambulatory surgical centers will grow rapidly with shorter recovery procedures.

- Technological innovation will drive development of bio-resorbable and drug-eluting devices.

- Robotics and AI integration will enhance precision in embolization and occlusion therapies.

- Emerging economies will provide strong opportunities through healthcare infrastructure expansion.

- Training programs will improve physician expertise and support higher adoption rates.

- Strategic partnerships and clinical collaborations will accelerate product approvals and innovation.