Market Overview

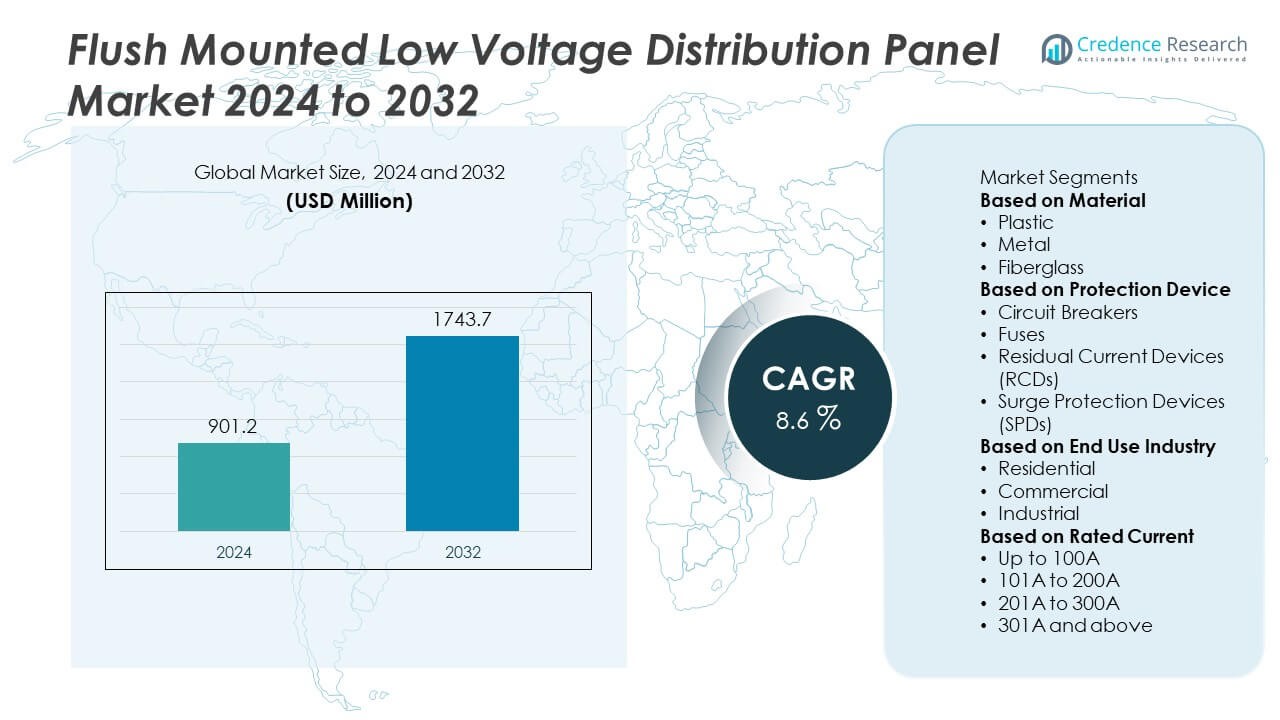

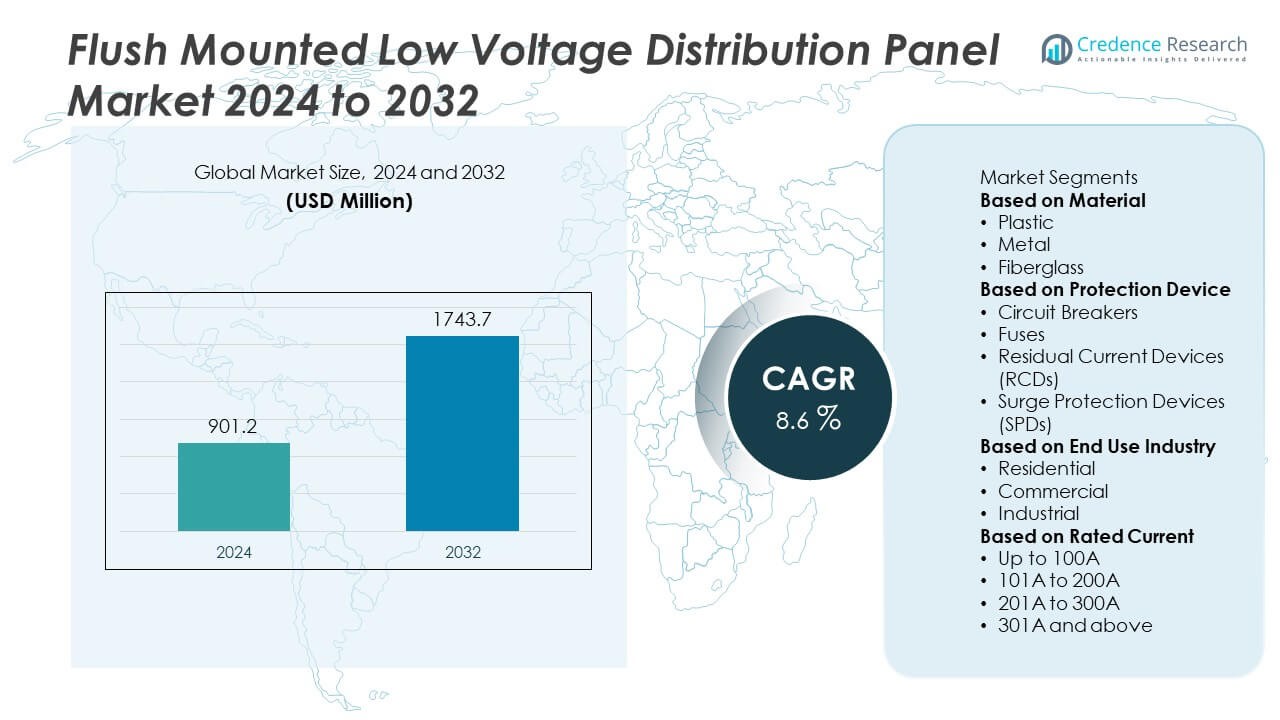

Flush Mounted Low Voltage Distribution Panel Market size was valued at USD 901.2 million in 2024 and is projected to reach USD 1,743.7 million by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flush Mounted Low Voltage Distribution Panel Market Size 2024 |

USD 901.2 Million |

| Flush Mounted Low Voltage Distribution Panel Market, CAGR |

8.6% |

| Flush Mounted Low Voltage Distribution Panel Market Size 2032 |

USD 1,743.7 Million |

The Flush Mounted Low Voltage Distribution Panel Market grows through rising demand for compact and reliable power distribution in residential, commercial, and industrial spaces. Urbanization, modernization of infrastructure, and stricter safety regulations drive adoption of flush-mounted systems that blend functionality with design appeal.

The Flush Mounted Low Voltage Distribution Panel Market demonstrates strong geographical spread, with North America leading adoption through advanced building codes, retrofitting projects, and demand for smart, energy-efficient systems in residential and commercial spaces. Europe emphasizes sustainability and strict regulatory frameworks, with countries like Germany, France, and the United Kingdom driving adoption in both premium and mid-segment construction projects. Asia-Pacific records rapid growth supported by urbanization, large-scale housing demand, and government-backed smart city initiatives across China, India, Japan, and Southeast Asia. Latin America and the Middle East & Africa gradually expand adoption, fueled by real estate investments and infrastructure modernization programs. Key players shaping the market include Siemens AG, ABB Ltd., Eaton Corporation, and Legrand S.A., each focusing on advanced designs, IoT-enabled monitoring features, and global expansion strategies to strengthen competitiveness across diverse applications. These factors collectively reinforce the market’s long-term relevance in modern power distribution systems.

Market Insights

- The Flush Mounted Low Voltage Distribution Panel Market was valued at USD 901.2 million in 2024 and is projected to reach USD 1743.7 million by 2032, growing at a CAGR of 8.6%.

- Rising demand for compact and reliable power distribution in residential, commercial, and industrial buildings drives steady adoption of flush-mounted panels.

- Increasing integration of IoT-enabled features, digital monitoring, and sustainable materials reflects a strong trend toward smart, energy-efficient systems.

- The competitive landscape features Siemens AG, ABB Ltd., Eaton Corporation, and Legrand S.A., which invest in innovation, smart connectivity, and expanding presence in emerging markets.

- High installation costs and limited retrofit flexibility in older buildings restrain widespread adoption, particularly in cost-sensitive regions.

- North America leads adoption due to advanced construction standards and retrofitting projects, while Europe emphasizes sustainability and regulatory compliance across modern infrastructure.

- Asia-Pacific shows the fastest growth with large-scale housing demand, industrial expansion, and government-backed smart city initiatives, while Latin America and the Middle East & Africa record gradual adoption through real estate and infrastructure investments.

Market Drivers

Rising Demand for Reliable Power Distribution in Urban Infrastructure

The Flush Mounted Low Voltage Distribution Panel Market grows steadily due to expanding urban infrastructure and rising demand for efficient electrical systems. Modern residential and commercial spaces require compact solutions that ensure safe power distribution. Flush-mounted panels offer space optimization, aligning with architectural preferences in apartments, offices, and retail complexes. It provides secure circuit segregation, supporting uninterrupted power supply across multiple applications. Growing construction activities and real estate development reinforce adoption across urban projects. The shift toward reliable and compact electrical systems strengthens demand globally.

- For instance, Siemens markets its SIVACON S4 low-voltage switchboard, a system designed for safe and efficient power distribution in residential and commercial buildings. The SIVACON S4 is part of a modular system that provides reliable performance with standard current ratings up to 4,000 A and is used for self-standing or wall-mounted installations.

Expansion in Industrial and Commercial Applications

Industrial facilities and commercial establishments drive adoption of advanced low voltage distribution solutions. The Flush Mounted Low Voltage Distribution Panel Market benefits from panels that handle heavy power loads while maintaining safety and operational efficiency. It protects against overload, short circuits, and equipment failures, ensuring smooth operations in malls, hospitals, and factories. Commercial demand rises with modernization projects across retail and educational institutions. Industrial expansion in emerging economies further supports growth, requiring durable panels for high-performance environments. These applications reinforce the importance of flush-mounted designs in critical infrastructure.

- For instance, Mitsubishi Electric received an order in July 2024 for its 84 kV dry-air insulated switchgear—an eco-friendly alternative to SF₆ gas switchgear—to be installed in substations. This technology supports vacuum interrupters and dry-air insulation for improved safety and efficient maintenance.

Integration of Smart and Digital Features

The shift toward smart buildings and IoT-based infrastructure drives technological innovation in distribution systems. The Flush Mounted Low Voltage Distribution Panel Market leverages smart panels that integrate sensors and digital monitoring features. It allows real-time diagnostics, energy consumption tracking, and predictive maintenance. Building owners adopt these advanced solutions to improve efficiency and reduce downtime. Smart integration aligns with sustainability goals by optimizing energy management. The demand for intelligent systems ensures continued growth of flush-mounted panels in modern construction projects.

Supportive Regulations and Focus on Safety Standards

Government regulations and safety standards play a key role in driving adoption. The Flush Mounted Low Voltage Distribution Panel Market aligns with strict compliance frameworks that enforce safe electrical installations in residential, commercial, and industrial spaces. It ensures adherence to fire safety norms and reduces risks of electrical hazards. Consumers and developers increasingly prefer certified panels that meet international standards. Regulatory emphasis on energy efficiency and safe distribution systems boosts long-term demand. These frameworks create favorable conditions for adoption across both developed and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Integration of Smart Monitoring and IoT Solutions

The Flush Mounted Low Voltage Distribution Panel Market reflects a strong trend toward digital integration. Manufacturers introduce panels with IoT-enabled monitoring to track energy usage and detect faults in real time. It supports predictive maintenance by sending alerts on abnormal conditions, reducing operational risks. Smart panels also provide remote access, allowing facility managers to control systems more effectively. The growing emphasis on digital transformation in infrastructure supports this adoption. This trend highlights the shift from conventional designs to connected, intelligent systems.

- For instance, ABB’s ReliaHome Smart Panel (2025) supports monitoring of up to 16 individual circuits via its mobile app. It detects grid outages, coordinates temporary power supply, and enables circuit-level load control during disruptions.

Focus on Compact and Aesthetic Panel Designs

Modern construction projects prioritize space efficiency and clean interior layouts. The Flush Mounted Low Voltage Distribution Panel Market addresses this with sleek, compact panels that integrate seamlessly into walls. It aligns with architectural requirements in residential and commercial spaces, maintaining both function and design appeal. Builders prefer panels that save space without compromising safety. Consumer demand for minimalistic solutions further supports this trend. The preference for aesthetic yet reliable systems reinforces adoption across urban housing and office projects.

- For instance, the Legrand XL³ S 160 flush-mount cabinet (cat. no. 3 372 23) accommodates 72 modular units across three rows. It has a depth of 135 mm and weighs approximately 13.56 kg. This model is designed for a flush-mounting installation.

Sustainability and Energy Efficiency in Panel Manufacturing

The global focus on sustainable construction practices influences product design and development. The Flush Mounted Low Voltage Distribution Panel Market incorporates eco-friendly materials and energy-efficient components to reduce environmental impact. It aligns with green building standards such as LEED, which encourage adoption of certified solutions. Manufacturers use recyclable materials and low-VOC coatings to enhance compliance. Energy-efficient panels also contribute to reduced operational costs for end users. This trend strengthens the alignment between electrical infrastructure and environmental goals.

Rising Adoption Across Emerging Economies

Growing infrastructure investments in emerging markets create opportunities for widespread use of flush-mounted panels. The Flush Mounted Low Voltage Distribution Panel Market expands with smart city projects, residential developments, and industrial growth in Asia-Pacific, Latin America, and Africa. It delivers safe and reliable power distribution in high-density urban environments. Governments in these regions promote modernization of electrical networks, boosting adoption. Rising disposable incomes and demand for modern housing support this expansion. This trend positions flush-mounted panels as critical components in new infrastructure projects worldwide.

Market Challenges Analysis

High Installation Costs and Retrofit Limitations

The Flush Mounted Low Voltage Distribution Panel Market faces challenges due to high installation costs and limited flexibility in existing buildings. Flush-mounted systems often require structural modifications, increasing expenses compared to surface-mounted alternatives. It restricts adoption in cost-sensitive markets where developers prioritize budget-friendly options. Retrofitting older infrastructures is particularly complex, as adjustments to wiring and wall structures add labor and material costs. Small contractors and developers hesitate to invest in flush-mounted systems for low-margin projects. These financial and structural barriers limit widespread adoption in certain regions.

Competition from Alternative Solutions and Safety Concerns

The Flush Mounted Low Voltage Distribution Panel Market also contends with competition from surface-mounted panels, which offer easier installation and maintenance. In industrial and rural settings, surface-mounted systems remain preferred due to their practicality. It further faces concerns related to improper installations, where poor sealing or insufficient clearances may create risks of overheating or electrical hazards. Limited awareness about the long-term benefits of flush-mounted solutions slows consumer preference. Builders and electricians often default to conventional systems unless regulations mandate advanced options. This competitive and safety-related pressure challenges market expansion.

Market Opportunities

Growth in Smart Homes and Connected Infrastructure

The Flush Mounted Low Voltage Distribution Panel Market holds strong opportunities with the rise of smart homes and connected buildings. Consumers demand compact systems that integrate seamlessly with IoT-enabled devices and building automation platforms. It allows real-time monitoring, predictive maintenance, and efficient energy management. Builders adopt smart panels to enhance property value and meet modern safety standards. The integration of intelligent distribution systems aligns with growing urbanization and digital infrastructure projects. This trend positions flush-mounted panels as essential components in smart city and residential developments.

Expansion in Emerging Economies and Infrastructure Projects

Rising infrastructure investments in Asia-Pacific, Latin America, and Africa create favorable conditions for market growth. The Flush Mounted Low Voltage Distribution Panel Market benefits from government initiatives promoting energy efficiency, sustainable construction, and modernization of electrical networks. It delivers safe and space-efficient solutions for large-scale residential and commercial projects in urban centers. Industrialization across developing economies further strengthens demand for reliable low voltage panels. Affordable product designs tailored to regional needs open new opportunities for manufacturers. These conditions ensure steady expansion across both established and emerging construction sectors.

Market Segmentation Analysis:

By Material

The Flush Mounted Low Voltage Distribution Panel Market segments by material into metallic, non-metallic, and hybrid panels. Metallic panels dominate due to their durability, fire resistance, and suitability for both residential and commercial projects. It offers strong protection for wiring and circuit systems, ensuring compliance with safety standards. Non-metallic panels gain traction in residential applications where lightweight designs and corrosion resistance are prioritized. Hybrid panels, combining metal and polymer materials, provide a balance of strength, safety, and cost efficiency. This diversity in material selection enables adoption across a wide range of infrastructure projects.

- For instance, Eaton’s Pow-R-Line Xpert switchboards support metallic enclosures with continuous current ratings up to 6,000 A and interrupting ratings up to 200 kAIC, suitable for demanding commercial and industrial installations.

By Protection Device

Segmentation by protection device includes circuit breakers, residual current devices (RCDs), surge protection devices, and others. Circuit breakers hold the largest share as they are essential for preventing overloads and short circuits in modern buildings. It provides reliable protection in residential, commercial, and industrial environments. RCDs record steady growth, driven by stricter safety regulations and increasing awareness of electrical shock prevention. Surge protection devices gain importance with rising integration of sensitive electronics and smart systems in infrastructure. Other devices, such as fuses and isolators, continue to support niche applications where basic or additional safety measures are required.

By End Use Industry

The Flush Mounted Low Voltage Distribution Panel Market also segments by end use into residential, commercial, and industrial sectors. The residential sector dominates, driven by growing urbanization, smart home development, and rising demand for space-efficient designs. It ensures safe power distribution while blending with modern interior layouts. The commercial sector, including offices, malls, and healthcare facilities, shows strong adoption due to compact design and compliance with strict building codes. Industrial facilities also adopt flush-mounted systems, particularly in control rooms and precision-driven operations where reliability and safety are crucial. These varied end uses highlight the adaptability of flush-mounted panels across diverse infrastructure needs.

- For instance, Schneider Electric offers its Wiser home automation solution, which can manage a single home’s energy consumption by displaying data in real-time, helping to make the electrical installation safer and more efficient.

Segments:

Based on Material

Based on Protection Device

- Circuit Breakers

- Fuses

- Residual Current Devices (RCDs)

- Surge Protection Devices (SPDs)

Based on End Use Industry

- Residential

- Commercial

- Industrial

Based on Rated Current

- Up to 100A

- 101A to 200A

- 201A to 300A

- 301A and above

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Flush Mounted Low Voltage Distribution Panel Market at 33% in 2024. The region benefits from advanced construction practices, strong adoption of smart home technologies, and a focus on energy-efficient electrical systems. The United States drives growth with high demand across residential, commercial, and industrial sectors, supported by strict building codes and retrofitting projects in older infrastructure. Canada contributes through investments in housing and commercial real estate, while Mexico shows progress in modern infrastructure development. It gains further momentum from rising adoption of IoT-enabled panels that align with the region’s digital infrastructure goals. The region’s emphasis on safety standards and regulatory compliance ensures continued leadership in the market.

Europe

Europe accounts for 29% of the Flush Mounted Low Voltage Distribution Panel Market in 2024. The region emphasizes sustainable construction practices, strict energy efficiency regulations, and high adoption of advanced electrical systems. Germany, France, and the United Kingdom lead demand, driven by residential housing projects and commercial complexes requiring compact and aesthetic solutions. Eastern Europe shows rising adoption with modernization of building infrastructure and increasing smart city initiatives. It also benefits from the European Union’s policies that encourage low-voltage energy management systems. The integration of flush-mounted panels in both premium and mid-segment projects strengthens the region’s role as a hub for innovation and compliance-driven growth.

Asia-Pacific

Asia-Pacific secures 25% of the global market share in 2024, reflecting its rapid urbanization and large-scale infrastructure projects. China dominates with strong investments in housing, commercial facilities, and industrial plants, where space-efficient solutions are essential. India follows with robust demand supported by urban housing programs, government-backed electrification projects, and smart city initiatives. Japan and South Korea adopt advanced flush-mounted systems in both residential and industrial facilities, emphasizing energy efficiency and compact design. Southeast Asian countries such as Indonesia, Vietnam, and Thailand contribute through growing real estate development and industrialization. It is projected to be the fastest-growing region, supported by rising disposable incomes, expanding urban populations, and government policies promoting modern electrical infrastructure.

Latin America

Latin America holds an 8% share of the Flush Mounted Low Voltage Distribution Panel Market in 2024. Brazil and Mexico dominate demand, supported by urban housing expansion, commercial construction, and modernization of public infrastructure. Argentina, Chile, and Colombia also contribute with ongoing real estate projects and rising consumer awareness about electrical safety. It faces challenges such as limited budgets and high costs of advanced panels, which slow adoption in smaller markets. Governments encourage modernization through energy efficiency programs and stricter building codes. These developments create opportunities for wider use of flush-mounted systems across both residential and commercial applications.

Middle East & Africa

The Middle East & Africa represent a 5% share of the global market in 2024, reflecting gradual adoption with emerging opportunities. Gulf nations, including Saudi Arabia and the United Arab Emirates, lead demand through large-scale infrastructure and smart city projects. South Africa and Nigeria contribute through modernization of housing and commercial facilities. It faces barriers from high installation costs and limited awareness of advanced electrical systems, especially in rural areas. Government diversification programs and investments in sustainable infrastructure strengthen prospects for adoption. The region shows long-term potential as urbanization and smart housing projects gain traction across key economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Flush Mounted Low Voltage Distribution Panel Market features leading players such as Honeywell International Inc., ABB Ltd., Chint Group Corporation, Eaton Corporation, Mitsubishi Electric Corporation, Havells India Ltd., Legrand S.A., Siemens AG, Rockwell Automation, and Zest Electric. These companies focus on delivering advanced, compact, and energy-efficient panel solutions that meet the rising demand for modern electrical infrastructure across residential, commercial, and industrial sectors. They invest heavily in research and development to integrate IoT-enabled monitoring, smart connectivity, and digital control features that support real-time diagnostics and predictive maintenance. Strategic expansion into emerging economies through partnerships, acquisitions, and localized manufacturing strengthens their global reach and competitiveness. Compliance with international safety and energy efficiency standards remains a key priority, ensuring reliable and secure operations. Differentiation is achieved through innovation in design aesthetics, modularity, and sustainable materials, aligning with green building practices and smart city initiatives. Competition remains strong as players target both premium and cost-sensitive segments with tailored solutions, reinforcing their long-term growth in the evolving market for flush-mounted low voltage distribution panels.

Recent Developments

- In August 2025, Schneider Electric continues to lead innovation in smart panel design with its flush-mounted systems incorporating digital monitoring and modular flexibility.

- In November 2024, Eaton Corporation debuted the xEnergy series panelboards, noted in product coverage for low-voltage applications.

- In June 2024, Mitsubishi Electric Corporation introduced a 84 kV dry-air insulated switchgear, using vacuum interrupters instead of SF₆ gas—an eco-friendly solution relevant for flush-mounted distribution setups.

- In May 2024, ABB Ltd. opened a new factory in Evergem, Belgium, equipped with a photovoltaic plant expected to save 9,400 MWh annually—supporting production of smart building parts including flush-mounted panels.

Report Coverage

The research report offers an in-depth analysis based on Material, Protection Device, End Use Industry, Rated Current and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for compact and space-efficient power distribution systems.

- Smart panels with IoT-enabled monitoring will gain traction in residential and commercial applications.

- Energy-efficient designs using sustainable materials will become a core focus for manufacturers.

- Integration with smart city projects will drive adoption in large-scale infrastructure development.

- Advanced safety regulations will push demand for certified and reliable low voltage distribution panels.

- Retrofitting opportunities will expand as older buildings modernize their electrical infrastructure.

- Asia-Pacific will record the fastest growth supported by urbanization and large housing projects.

- Partnerships between panel manufacturers and construction firms will strengthen market penetration.

- Modular and cost-optimized designs will improve accessibility in mid-range and small-scale projects.

- Predictive maintenance and digital control features will enhance long-term system reliability and adoption.