Market Overview:

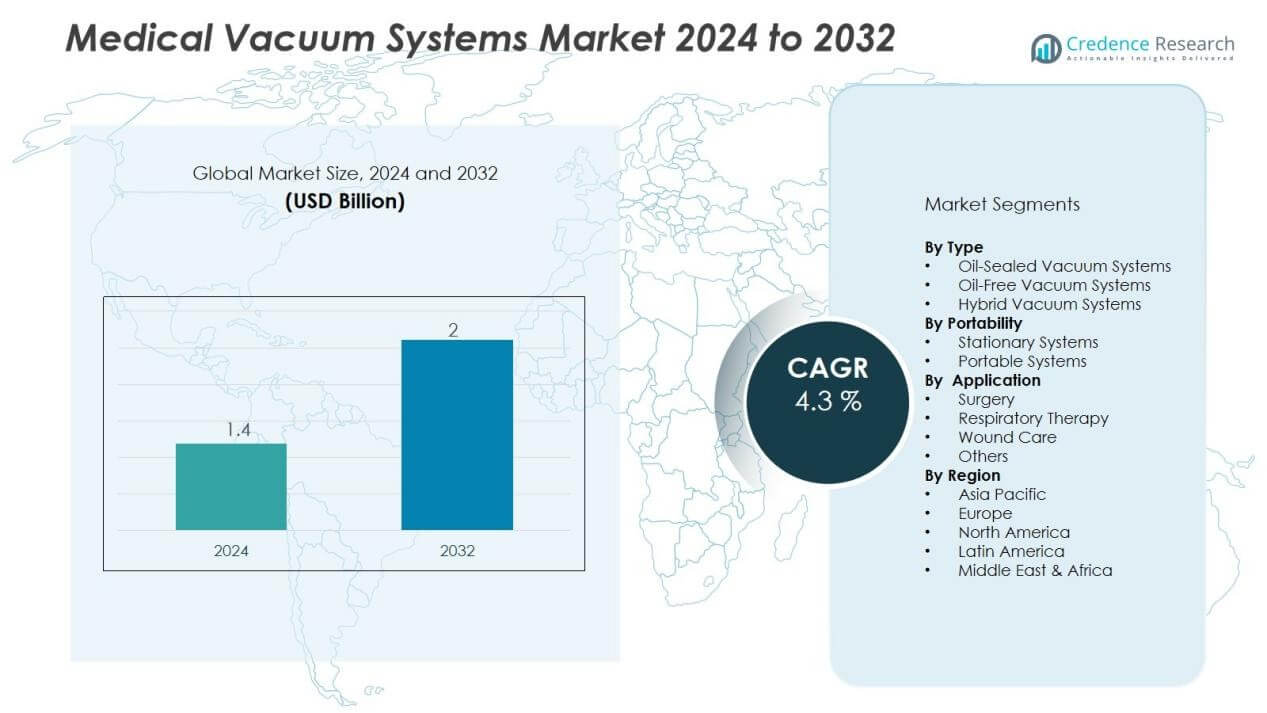

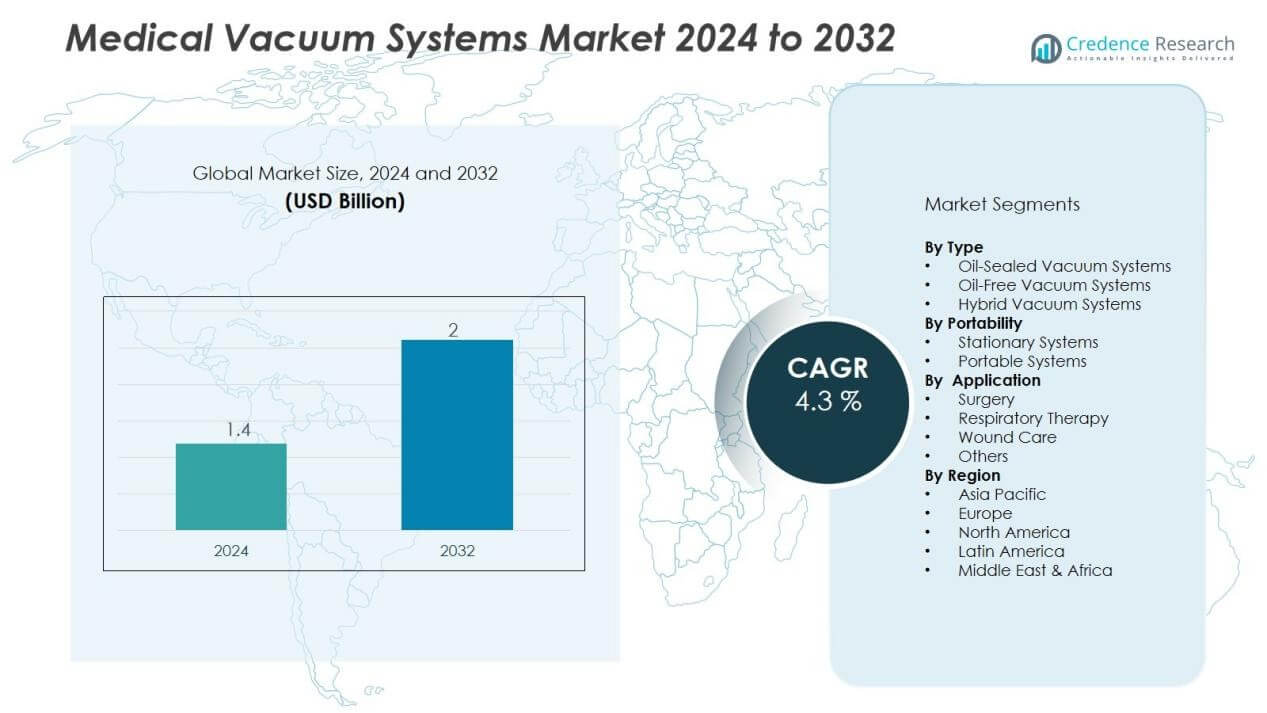

The medical vacuum systems market size was valued at USD 1.4 billion in 2024 and is anticipated to reach USD 2 billion by 2032, at a CAGR of 4.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Vacuum Systems Market Size 2024 |

USD 1.4 Billion |

| Medical Vacuum Systems Market, CAGR |

4.3% |

| Medical Vacuum Systems Market Size 2032 |

USD 2 Billion |

Key drivers include rising surgical procedures worldwide, increasing cases of respiratory diseases, and stricter infection control standards in healthcare facilities. Technological advancements such as oil-free vacuum pumps, energy-efficient systems, and centralized vacuum networks enhance operational efficiency and patient safety. Growing investments in healthcare infrastructure, particularly in developing regions, further support market expansion.

Regionally, North America dominates the market due to advanced healthcare facilities, high procedural volumes, and strong regulatory compliance. Europe follows with significant adoption driven by modern hospital networks and patient safety initiatives. The Asia-Pacific region is expected to register the fastest growth, supported by expanding healthcare infrastructure in China, India, and Southeast Asia, coupled with rising medical tourism. Latin America and the Middle East & Africa present emerging opportunities, backed by growing hospital construction projects and rising government focus on healthcare quality improvements.

Market Insights:

- The medical vacuum systems market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2 billion by 2032, growing at a CAGR of 4.3%.

- Rising surgical procedures and critical care demand continue to drive adoption in hospitals and clinics, where vacuum systems remain essential for operating rooms and intensive care units.

- Increasing prevalence of respiratory disorders such as COPD and asthma strengthens demand for airway clearance and secretion management solutions, reinforcing the importance of vacuum systems.

- Stricter infection control standards and regulatory compliance requirements push hospitals to adopt oil-free and energy-efficient vacuum pumps that ensure safe and reliable operation.

- Expanding healthcare infrastructure across Asia-Pacific, Latin America, and the Middle East boosts adoption, with governments and private investors prioritizing vacuum systems in hospital construction projects.

- High installation and maintenance costs remain a challenge, particularly in smaller facilities and developing economies where budget limitations restrict modernization efforts.

- North America and Europe dominate with 35% and 28% market share respectively in 2024, while Asia-Pacific grows fastest at 25%, and Latin America along with the Middle East & Africa represent 7% and 5%, supported by modernization and government initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Surgical Procedures and Critical Care Demand :

The medical vacuum systems market is strongly driven by the increase in surgical procedures and critical care needs worldwide. Hospitals and clinics rely on vacuum systems for effective suction during surgeries, ensuring clean operative fields and enhanced patient safety. Growing cases of trauma, chronic illnesses, and emergency admissions continue to expand the demand for dependable suction systems. It remains essential equipment for intensive care units and operating rooms.

- For instance, NOVAIR’s medical vacuum systems, widely used in ICUs and operating theaters, deliver capacities up to 2×250 m3/h, supporting diverse healthcare facility needs with high efficiency and compliance with European and US medical standards.

Increasing Prevalence of Respiratory Disorders:

The rising incidence of respiratory conditions such as COPD, asthma, and lung infections directly influences the demand for advanced vacuum systems. These systems play a vital role in airway clearance, secretion management, and oxygen therapy support. With aging populations and environmental pollution, respiratory cases are expected to climb further. The medical vacuum systems market benefits from this growing clinical reliance.

- For instance, Atlas Copco’s mVAC medical vacuum systems maintain vacuum levels as low as -600 mbar (-450 mmHg), providing reliable suction for secretion management in respiratory care units, which supports critical airway clearance for patients with COPD and asthma.

Stringent Infection Control and Regulatory Compliance :

Healthcare facilities face strict regulations for infection prevention and hygiene maintenance. Medical vacuum systems provide reliable waste gas removal, surgical fluid suction, and contamination control. Their integration ensures compliance with healthcare safety standards while supporting accreditation processes. It drives hospitals to adopt energy-efficient and oil-free vacuum pumps to meet environmental and safety guidelines.

Expanding Healthcare Infrastructure in Emerging Economies :

Rapid growth in healthcare infrastructure across Asia-Pacific, Latin America, and the Middle East increases the need for advanced medical equipment. Governments and private investors are funding new hospitals, clinics, and specialty centers. Vacuum systems are part of core infrastructure planning due to their role in surgical and emergency care. The medical vacuum systems market gains significant momentum from these large-scale investments.

Market Trends:

Adoption of Energy-Efficient and Oil-Free Vacuum Technologies:

The medical vacuum systems market is witnessing a clear shift toward energy-efficient and oil-free technologies. Hospitals and clinics are moving away from traditional oil-sealed pumps due to maintenance costs, contamination risks, and sustainability concerns. Oil-free vacuum pumps reduce energy consumption, improve reliability, and lower environmental impact. Demand is rising for centralized vacuum systems that support multiple departments while minimizing operational expenses. Integration of smart monitoring features also enhances system efficiency by predicting maintenance needs and reducing downtime. It positions energy-efficient solutions as a priority for healthcare providers aiming to align with sustainability targets.

- For instance, the Becker Series 5 Central Medical Vacuum Control Panel supports up to six vacuum pumps with automated lead/lag sequencing, extending pump lifespan and reliability, while integrating smart monitoring to minimize downtime.

Growing Integration of Smart and Digital Solutions:

The integration of IoT-enabled monitoring and digital controls is emerging as a dominant trend in healthcare infrastructure. Vacuum systems now feature remote diagnostics, automated pressure regulation, and predictive analytics for improved performance. Hospitals adopt these systems to ensure uninterrupted operation and meet compliance with strict patient safety standards. The medical vacuum systems market benefits from this trend, as smart solutions enhance operational transparency and reduce manual intervention. Vendors are also introducing modular designs to support flexible healthcare facilities, including outpatient centers and ambulatory surgical units. It reinforces the shift toward digitalization and ensures that medical vacuum systems remain aligned with modern healthcare needs.

- For instance, Festo’s PGVA-1 pressure and vacuum generator integrated with remote monitoring capabilities processes 320 patient samples per hour in MolGen’s PurePrep TTR system, demonstrating precise pressure control for automated fluid handling.

Market Challenges Analysis:

High Installation and Maintenance Costs:

The medical vacuum systems market faces a key challenge in high installation and maintenance expenses. Setting up centralized vacuum infrastructure requires significant capital investment, which limits adoption in smaller hospitals and clinics. Regular servicing, replacement of filters, and energy costs further increase the financial burden on healthcare providers. Budget constraints in developing economies slow the pace of modern equipment adoption. It forces many facilities to continue relying on outdated or less efficient systems. Cost sensitivity among healthcare operators remains a barrier to faster market penetration.

Compliance with Stringent Regulatory Standards:

Strict regulatory frameworks also present challenges for manufacturers and healthcare providers. Medical vacuum systems must comply with standards related to safety, infection control, and environmental performance. Meeting these requirements often increases product development costs and prolongs approval timelines. Smaller players find it difficult to compete with established companies that have resources to manage compliance. The medical vacuum systems market must constantly adapt to evolving regulations in multiple regions. It places continuous pressure on manufacturers to innovate while keeping systems affordable and accessible.

Market Opportunities:

Expansion of Healthcare Infrastructure in Emerging Regions:

The medical vacuum systems market holds strong opportunities from rapid healthcare infrastructure expansion in emerging economies. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in new hospitals, clinics, and specialty care centers. Rising medical tourism in India, Thailand, and Mexico further increases the need for modern surgical and critical care facilities. Governments are prioritizing advanced medical equipment to improve healthcare accessibility and patient safety. It creates sustained demand for efficient and cost-effective vacuum solutions. International players have an opportunity to expand their presence through partnerships and localized production.

Technological Innovation and Smart System Integration:

Ongoing innovation in vacuum pump design, digital integration, and modular system development opens new growth avenues. IoT-enabled monitoring, predictive analytics, and energy-efficient models enhance system reliability and reduce operational costs. Healthcare providers are seeking flexible solutions that can adapt to growing outpatient and ambulatory care facilities. The medical vacuum systems market benefits from rising demand for oil-free and eco-friendly technologies that meet sustainability goals. It allows manufacturers to differentiate their products by focusing on advanced features and compliance readiness. Continuous innovation positions the industry to address evolving healthcare needs while expanding its customer base.

Market Segmentation Analysis:

By Type:

The medical vacuum systems market is segmented into oil-sealed, oil-free, and hybrid systems. Oil-free vacuum systems dominate due to their energy efficiency, low maintenance, and reduced contamination risk. Hospitals prefer these systems to meet strict hygiene and environmental standards. Oil-sealed systems retain demand in smaller facilities due to lower upfront costs. Hybrid systems are gaining traction where reliability and cost efficiency must balance. It ensures diverse adoption across healthcare settings.

- For instance, AmcareMed’s oil-free rotary vane medical vacuum system, compliant with ISO 13485 and ISO 7396 standards, features 2 to 4 vacuum pumps and offers a compact, lightweight design requiring minimal maintenance with no oil vapor contamination during use

By Portability:

Based on portability, the market includes portable and stationary systems. Stationary vacuum systems hold a larger share due to their use in hospitals, surgical centers, and ICUs. They provide centralized suction solutions for multiple departments and support continuous operation. Portable systems are expanding their presence in ambulatory care and emergency units. Their flexibility makes them essential for home healthcare and field applications. It highlights strong growth potential in outpatient care expansion.

- For instance, the central medical vacuum system installed at a large hospital expansion in Calgary is designed to deliver a vacuum capacity of approximately 90 SCFM at 300 mbar pressure, ensuring uninterrupted multi-departmental suction needs in critical care areas.

By Application:

By application, the medical vacuum systems market covers surgery, respiratory therapy, wound care, and others. Surgical applications remain the largest segment due to the critical role of vacuum systems in maintaining clear operative fields. Respiratory therapy applications are growing with rising cases of COPD, asthma, and other pulmonary conditions. Wound care and specialty treatments create further demand for reliable suction equipment. It supports a wide range of procedures across healthcare facilities.

Segmentations:

By Type:

- Oil-Sealed Vacuum Systems

- Oil-Free Vacuum Systems

- Hybrid Vacuum Systems

By Portability:

- Stationary Systems

- Portable Systems

By Application:

- Surgery

- Respiratory Therapy

- Wound Care

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America accounted for 35% market share in 2024, while Europe held 28% during the same year. The medical vacuum systems market in these regions benefits from advanced healthcare infrastructure, high surgical volumes, and strict infection control regulations. Strong regulatory frameworks such as NFPA standards in the U.S. and EN standards in Europe support the adoption of modern systems. Hospitals in these regions are investing in oil-free and energy-efficient vacuum technologies to meet sustainability goals. It is further strengthened by government funding for healthcare modernization and technological innovation. Established players dominate these regions with strong distribution networks and service capabilities.

Asia-Pacific:

Asia-Pacific represented 25% market share in 2024, supported by rapid healthcare expansion and large patient populations. The medical vacuum systems market in this region is driven by increasing hospital construction in China, India, and Southeast Asia. Governments are prioritizing healthcare investments and medical tourism growth is fueling infrastructure upgrades. Adoption of smart healthcare solutions and energy-efficient vacuum systems is accelerating. It is supported by rising demand in urban centers and specialized medical facilities. Local manufacturers are entering the market with cost-effective systems to serve mid-tier hospitals and clinics.

Latin America and Middle East & Africa:

Latin America accounted for 7% market share in 2024, while the Middle East & Africa held 5%. The medical vacuum systems market in these regions is influenced by ongoing investments in healthcare infrastructure and hospital modernization projects. Governments are introducing initiatives to improve patient care and expand medical access. Demand for critical care facilities, surgical centers, and infection control systems is increasing steadily. It creates opportunities for international players to expand through partnerships and distributor networks. Economic development and urbanization trends are expected to further support adoption across these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Precision Medical Inc

- Olympus Corporation

- Allied Healthcare Products Inc

- Drive Medical

- ATMOS MedizinTechnik GmbH & Co KG

- Medicop

- Integra Biosciences AG

- Laerdal Medical

- Welch Vacuum

- Labcoco Corporation and Amsino International, Inc

- ZOLL Medical Corporation

Competitive Analysis:

The medical vacuum systems market is highly competitive with several global and regional players shaping industry dynamics. Key companies include Precision Medical Inc, Olympus Corporation, Allied Healthcare Products Inc, Drive Medical, ATMOS MedizinTechnik GmbH & Co KG, Medicop, Integra Biosciences AG, and Laerdal Medical. Leading manufacturers focus on technological innovation, offering oil-free and energy-efficient systems that align with sustainability and infection control standards. Companies are expanding portfolios with smart, IoT-enabled solutions to strengthen their competitive edge. Strategic partnerships, mergers, and acquisitions remain central to market consolidation and global reach. It faces intense rivalry as firms compete on performance, reliability, and cost efficiency while targeting both advanced and emerging healthcare markets.

Recent Developments:

- In September 2025, Olympus Corporation launched the VISERA™ S OTV-S500 imaging platform in the U.S., designed for ENT and urological applications with advanced diagnostic imaging and Narrow Band Imaging (NBI) technology.

- In October 2024, Drive Medical launched the PulmO2 Oxygen Concentrator in partnership with Sanrai International to improve access to oxygen therapy globally.

Report Coverage:

The research report offers an in-depth analysis based on Type, Portability, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for medical vacuum systems will rise with increasing surgical procedures and critical care needs.

- Oil-free and energy-efficient vacuum technologies will gain higher adoption due to sustainability goals.

- Integration of IoT-enabled monitoring and predictive maintenance will drive digital transformation in hospitals.

- Healthcare providers will prioritize modular and scalable systems for outpatient and ambulatory facilities.

- Regulatory compliance and infection control standards will continue to shape product innovation and design.

- Asia-Pacific will remain the fastest-growing region due to large-scale healthcare infrastructure investments.

- North America and Europe will sustain demand with modernization of existing hospitals and strict safety mandates.

- Manufacturers will expand through partnerships, joint ventures, and localized production to meet regional demand.

- Emerging economies in Latin America and the Middle East & Africa will create new growth opportunities.

- Focus on patient safety, cost efficiency, and operational reliability will define long-term market strategies.