Market Overview

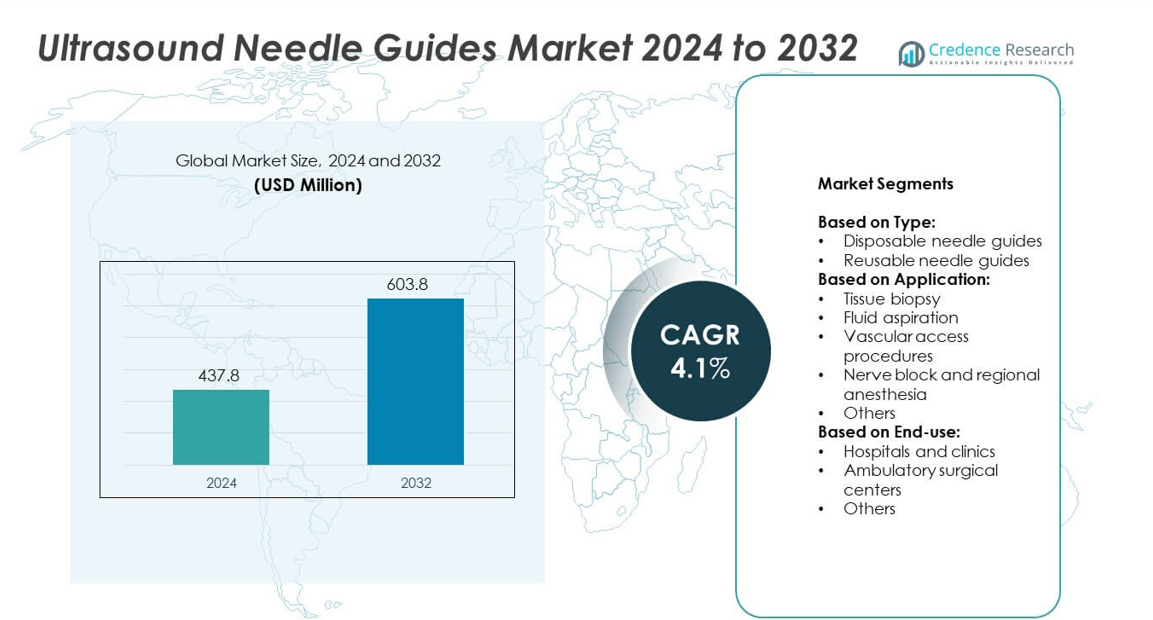

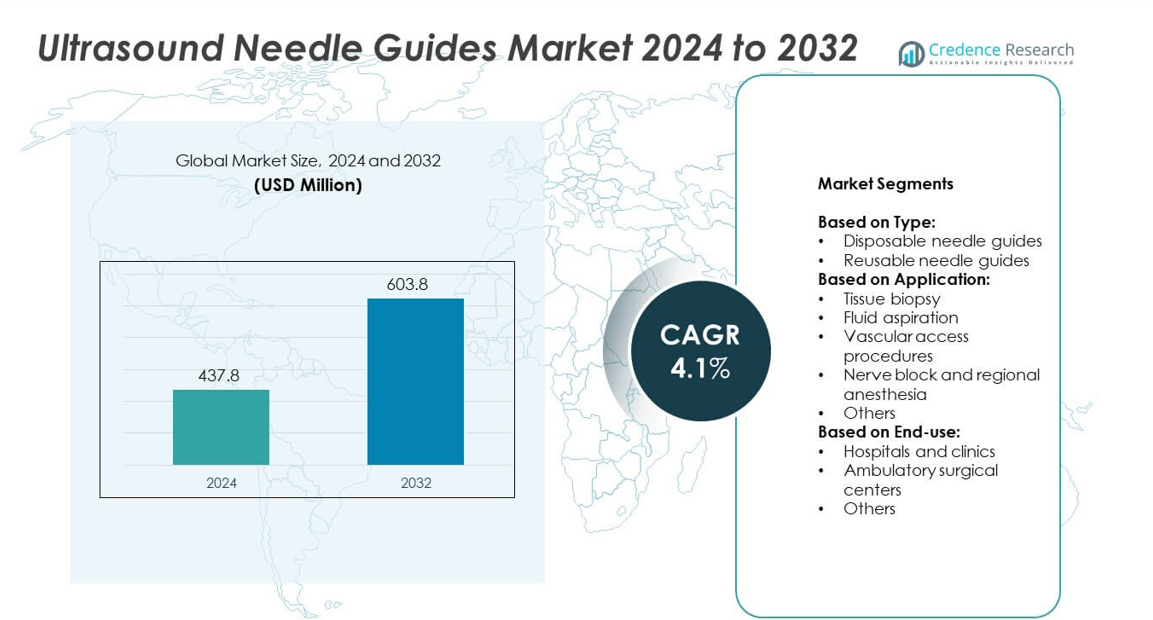

Ultrasound Needle Guides Market size was valued at USD 437.8 million in 2024 and is anticipated to reach USD 603.8 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasound Needle Guides Market Size 2024 |

USD 437.8 million |

| Ultrasound Needle Guides Market, CAGR |

4.1% |

| Ultrasound Needle Guides Market Market Size 2032 |

USD 603.8 million |

The Ultrasound Needle Guides market grows through rising demand for image-guided procedures across hospitals and outpatient settings. Increased adoption of minimally invasive techniques in oncology, anesthesia, and vascular access supports steady product uptake. Hospitals prefer disposable guides for infection control, while cost-sensitive facilities opt for reusable variants. Advancements in ultrasound systems and guide compatibility enhance procedural accuracy. Point-of-care and portable ultrasound expansion further boosts guide usage in emergency and remote care. These drivers and trends together shape consistent market growth.

North America leads the Ultrasound Needle Guides market due to advanced healthcare infrastructure and strong adoption of ultrasound-guided procedures. Europe follows with increased use in oncology, anesthesiology, and urology across public hospitals. Asia-Pacific shows rapid growth supported by rising healthcare investments and expanding access to diagnostic technologies. Latin America and the Middle East & Africa witness gradual adoption driven by infrastructure upgrades. Key players include Siemens Healthineers, Cook Medical, Veran Medical Technologies, and CIVCO Medical Solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ultrasound Needle Guides market was valued at USD 437.8 million in 2024 and is projected to reach USD 603.8 million by 2032, growing at a CAGR of 4.1%.

- Rising preference for image-guided procedures in oncology, anesthesia, and vascular access drives market expansion.

- Hospitals adopt disposable guides to meet infection control standards, while clinics continue using reusable systems for cost efficiency.

- Key players such as Siemens Healthineers, Cook Medical, Veran Medical Technologies, and CIVCO Medical Solutions compete by offering device compatibility, multi-angle options, and clinical support.

- High device cost and lack of standardization across ultrasound systems challenge adoption, especially in budget-constrained regions.

- North America leads due to advanced infrastructure and clinical volume, while Europe sees steady uptake across specialty care and training programs.

- Asia-Pacific shows strong growth through increasing healthcare investments, equipment availability, and expanding access in rural and urban hospitals.

Market Drivers

Rising Preference for Image-Guided Minimally Invasive Procedures Across Clinical Settings

Growing demand for minimally invasive techniques continues to drive the use of ultrasound-guided procedures. Surgeons and interventional radiologists rely on needle guides for enhanced needle precision and faster access to target tissues. Ultrasound needle guides reduce procedural time and improve first-attempt success rates. This efficiency directly supports their adoption in emergency and outpatient care. Clinicians benefit from reduced complications and improved patient safety. The Ultrasound Needle Guides market benefits from this ongoing shift toward guided interventions across hospitals and surgical centers.

- For instance, GE Healthcare’s LOGIQ E10 ultrasound platform includes needle guidance software, such as B-Steer+ and Volume Navigation, and was initially launched around 2018. It processes data with a 48x higher throughput than its predecessor, the LOGIQ E9

Expanding Use in Biopsies, Anesthesia, and Vascular Access Drives Growth

Broadening clinical applications increase demand for needle guides across departments. These devices support accurate needle placement in tissue biopsies, fluid aspirations, and regional anesthesia. Vascular access procedures in critical care and oncology also rely on ultrasound-guided devices. Integration with real-time imaging helps clinicians avoid major blood vessels and nerves. It boosts safety across both routine and high-risk procedures. The Ultrasound Needle Guides market continues expanding with rising cases of cancer, cardiovascular diseases, and chronic kidney disorders.

- For instance, Siemens Healthineers’ ACUSON Sequoia ultrasound system includes integrated guide support for procedures like biopsies, which enhances targeting efficiency. The system has features that provide twice the sensitivity for detecting contrast agents and allows for needle insertions up to 40 cm deep with the DAX transducer

Global Healthcare Infrastructure Upgrades Support Higher Adoption in Developing Economies

Investments in healthcare infrastructure improve access to diagnostic and interventional tools in emerging regions. Governments and private hospitals invest in ultrasound systems and accessories to improve service quality. Affordable and portable ultrasound machines enhance point-of-care imaging, especially in rural and semi-urban areas. Needle guide adoption rises in regions with growing awareness of procedural safety and clinical outcomes. It becomes part of standardized practice protocols in many mid-tier hospitals. The Ultrasound Needle Guides market grows as access to technology improves across Latin America, Southeast Asia, and Africa.

Technological Advancements in Ultrasound Platforms and Guide Designs Improve Usability

Continuous innovation in ultrasound systems enhances compatibility with disposable and reusable needle guides. Manufacturers introduce guides with adjustable angles, better material composition, and multi-probe compatibility. These features support use in complex procedures while maintaining sterility and ease of handling. It encourages adoption in high-volume centers and specialized outpatient facilities. Compact, ergonomic designs support clinician comfort and precision. The Ultrasound Needle Guides market evolves alongside technological upgrades in imaging and interventional care tools.

Market Trends

Increased Shift Toward Disposable Needle Guides for Infection Control Compliance

Healthcare providers increasingly prefer disposable needle guides to reduce cross-contamination risk. These single-use devices meet strict hygiene protocols in high-throughput clinical environments. Hospitals prioritize infection prevention measures, particularly in ICUs, surgical units, and oncology departments. Disposable guides eliminate the need for sterilization and simplify logistics. It ensures procedural consistency and reduces turnaround time between patients. The Ultrasound Needle Guides market aligns with this demand through growing supply of sterile, ready-to-use options.

- For instance, Mindray, a provider of medical equipment, offers portable ultrasound units that can be equipped with needle guides and has a presence in the Indian market. Its Indian subsidiary, Mindray Medical India, reported operating revenue of over INR 500 cr for the financial year ending March 31, 2024

Integration of Needle Guides with Point-of-Care and Handheld Ultrasound Devices

Demand for compact and mobile ultrasound units drives need for compatible needle guide systems. Physicians in emergency, primary care, and field settings rely on portable ultrasound platforms. Integration of needle guides supports precise interventions in time-critical or resource-limited conditions. Point-of-care ultrasound expands across trauma care, sports medicine, and military healthcare. It drives manufacturers to develop universal and clip-on needle guide attachments. The Ultrasound Needle Guides market benefits from rising use of mobile imaging solutions in clinical and remote locations.

- For instance, CIVCO Medical Solutions provides single-use ultrasound needle guides used in various procedures, including those within oncology. As of 2021, CIVCO held over 50% of the U.S. market share for needle guides and ultrasound probe covers.

Customization and Multi-Angle Design Features Gain Attention in Advanced Clinical Applications

Manufacturers introduce customizable guides with adjustable angles to support complex procedures. Multi-angle flexibility enhances targeting in deep tissue biopsies, nerve blocks, and musculoskeletal interventions. Custom-fit guides improve workflow efficiency and reduce needle redirection attempts. It helps specialists achieve better patient outcomes in orthopedics, cardiology, and pain management. The trend also supports training programs by improving visual guidance for medical residents. The Ultrasound Needle Guides market shifts toward design innovation to meet specialty-specific needs.

Growing Demand from Ambulatory Surgical Centers and Specialty Clinics

Ambulatory surgical centers adopt ultrasound-guided systems to perform procedures with minimal recovery time. Needle guides help clinicians perform safe, accurate, and faster interventions in outpatient settings. Cost-conscious facilities choose reusable or hybrid systems to reduce per-procedure expenses. It expands device utilization in orthopedic, urology, and ENT clinics. Fast-growing outpatient care models across the U.S., Europe, and Asia-Pacific support this trend. The Ultrasound Needle Guides market gains traction outside traditional hospital environments.

Market Challenges Analysis

Limited Standardization Across Ultrasound Systems Creates Compatibility Issues for Needle Guides

Needle guide designs often vary based on probe type, brand, and clinical application. Lack of standardization limits universal compatibility across ultrasound platforms. Healthcare facilities face procurement challenges when dealing with mixed imaging systems from different vendors. It increases inventory complexity and training requirements for staff. Compatibility issues can delay procedures and reduce operational efficiency. The Ultrasound Needle Guides market faces hurdles due to these fragmentation issues in probe-guide integration.

High Cost of Advanced Imaging Systems Restricts Adoption in Resource-Limited Settings

Initial investment in ultrasound platforms and accessories remains high for small clinics and rural facilities. Many low- and middle-income regions struggle to adopt imaging-guided tools due to budget constraints. It reduces access to needle guides, even where procedural benefits are clear. Disposable variants further increase per-use costs, limiting their uptake in high-volume centers with limited reimbursements. The Ultrasound Needle Guides market encounters slower growth in price-sensitive markets with underdeveloped diagnostic infrastructure. Cost-effective solutions are essential to unlock wider adoption in emerging economies.

Market Opportunities

Rising Demand for Ultrasound-Guided Interventions in Oncology and Pain Management

Oncology and pain care procedures increasingly rely on ultrasound guidance for safe and precise needle placement. Growing use of regional nerve blocks, tumor biopsies, and fluid drainage procedures supports device demand. Needle guides help reduce complications and improve targeting in deep or hard-to-reach areas. It enhances procedure safety in complex oncology and pain treatment plans. Clinics and hospitals expand ultrasound infrastructure to meet rising procedure volumes. The Ultrasound Needle Guides market benefits from this clinical shift toward image-assisted, localized treatments.

Expanding Access to Training and Simulation Programs for Interventional Procedures

Medical education centers integrate simulation-based training for ultrasound-guided techniques across specialties. Needle guides play a key role in skill development for residents and nurses. Availability of realistic practice models and devices supports faster learning curves and procedural confidence. It promotes early adoption of guides in both academic and private care settings. The trend encourages OEMs to offer training-compatible kits and bundles with educational tools. The Ultrasound Needle Guides market gains new growth avenues through its role in clinical education and upskilling.

Market Segmentation Analysis:

By Type:

Disposable needle guides lead the segment due to their convenience and infection control benefits. Hospitals prefer single-use guides to reduce contamination risks and comply with hygiene standards. These guides eliminate the need for sterilization, supporting faster patient turnover. Reusable needle guides hold steady demand in cost-sensitive facilities. Clinics and teaching hospitals often adopt them to reduce long-term procurement costs. The Ultrasound Needle Guides market sees a shift toward hybrid models that offer both safety and affordability.

- For instance, Butterfly Network’s handheld iQ+ ultrasound device was launched in 2020 and is compatible with clip-on needle guide attachments. By January 2024, the company had more than 145,000 customers for its ultrasound devices, and it introduced the next-generation iQ3 model in 2024

By Application:

Tissue biopsy dominates application share, driven by the rising number of cancer screening procedures. Precise needle guidance is critical to reach deep or irregular tumor sites with minimal risk. Vascular access procedures follow, with strong use in ICUs, dialysis centers, and oncology departments. Nerve block and regional anesthesia gain popularity in orthopedic and pain management practices. Fluid aspiration maintains steady demand across diagnostic and emergency care units. The Ultrasound Needle Guides market supports all these applications with improved accuracy and procedural efficiency.

- For instance, FUJIFILM SonoSite supplies needle guide-compatible point-of-care ultrasound systems to various facilities, including ambulatory surgical centers, across North America. As of a 2016 company report, the installed base of Sonosite ultrasound systems had already exceeded 25,000 units worldwide

By End-Use:

Hospitals and clinics represent the largest end-use segment, backed by high patient volume and infrastructure investments. These facilities widely adopt both reusable and disposable guides for various interventions. Ambulatory surgical centers expand usage due to demand for minimally invasive outpatient procedures. These centers prioritize fast, safe workflows, making needle guides essential for efficiency. The others segment includes specialty practices and mobile units, where portable ultrasound and guide compatibility play key roles. The Ultrasound Needle Guides market responds to growing end-user diversity with flexible and adaptable product lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Type:

- Disposable needle guides

- Reusable needle guides

Based on Application:

- Tissue biopsy

- Fluid aspiration

- Vascular access procedures

- Nerve block and regional anesthesia

- Others

Based on End-use:

- Hospitals and clinics

- Ambulatory surgical centers

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Ultrasound Needle Guides market, accounting for 37.6% of the global revenue in 2024. The region benefits from advanced healthcare infrastructure, high procedural volumes, and strong adoption of ultrasound-guided interventions in hospitals and clinics. A well-established reimbursement framework in the U.S. encourages clinicians to adopt imaging-guided biopsies, nerve blocks, and vascular access procedures. Most hospitals use disposable needle guides to meet infection control standards. Large teaching hospitals and tertiary care centers adopt reusable guides for internal training and research purposes. The presence of key manufacturers and strong distribution channels supports continuous product availability. North America’s leadership in oncology care, critical care interventions, and outpatient anesthesia procedures drives consistent product demand.

Europe

Europe represents the second-largest share in the Ultrasound Needle Guides market with 27.4% in 2024. Regional growth is supported by high awareness of clinical safety, strong public healthcare systems, and growing adoption of minimally invasive diagnostic and therapeutic techniques. Countries like Germany, France, and the U.K. lead in integrating ultrasound-guided solutions across departments such as anesthesiology, oncology, and urology. Many public hospitals prefer reusable needle guides to reduce procedural costs over time. Infection prevention regulations support slow but steady uptake of disposable guides, particularly in high-risk units. Europe also invests in clinical training and simulation centers where needle guides are used in resident training. It creates a long-term growth base for needle guide manufacturers targeting both clinical and educational segments.

Asia-Pacific

Asia-Pacific contributes 21.3% of the global Ultrasound Needle Guides market share in 2024. The region shows strong growth momentum, supported by rising healthcare investments and rapid hospital expansion in China, India, South Korea, and Southeast Asian countries. Urban hospitals adopt ultrasound-guided tools for vascular access, fluid drainage, and tumor biopsies. Governments and private providers increasingly adopt disposable guides in high-volume hospitals to meet patient safety goals. In mid-tier and smaller facilities, reusable guides remain preferred due to budget constraints. Regional growth is also supported by rising awareness of safe procedural practices and a growing base of ultrasound equipment manufacturers. The availability of affordable and portable ultrasound systems enables broader deployment of guides in outpatient and rural settings. Market players benefit from high patient volumes and increasing training needs in emerging economies.

Latin America

Latin America holds a smaller but notable share of 7.1% in the global Ultrasound Needle Guides market in 2024. Brazil, Mexico, Argentina, and Chile lead in regional adoption of imaging-guided procedures. The market is driven by the need to improve procedural safety in public healthcare systems and private hospitals. Most facilities use reusable guides to maintain affordability, while leading hospitals in metropolitan cities begin adopting disposable variants in oncology and anesthesiology. Regional players also import guides from North America and Europe to meet growing demand. Though reimbursement coverage varies, institutional upgrades and government spending on diagnostic infrastructure create growth opportunities. Latin American growth remains gradual, with future gains expected from local distribution partnerships and training programs.

Middle East & Africa

The Middle East & Africa accounts for 6.6% of the global market share in 2024. Growth remains modest but consistent, supported by rising investments in healthcare modernization in countries like the UAE, Saudi Arabia, and South Africa. Specialty hospitals adopt ultrasound-guided tools to improve procedural outcomes in anesthesiology and critical care. Disposable guides see limited adoption, mainly in private hospitals with better budget allocations. Public sector hospitals rely on reusable devices due to procurement limitations. Market expansion depends on international partnerships, equipment donations, and regional medical education initiatives. As more hospitals acquire portable ultrasound units, demand for compatible guides is expected to rise. The Ultrasound Needle Guides market in this region remains in an early development stage, with increasing awareness driving long-term potential.

Key Player Analysis

- Veran Medical Technologies

- Aspen Surgical

- Cook Medical

- PBN Medicals

- Siemens Healthineers

- CIVCO AIROS

- Innovative Trauma Care

- Besmed

- CIVCO Medical Solutions

- Biopsy Sciences

- Bard Access Systems (now part of BD)

Competitive Analysis

The Ultrasound Needle Guides market features strong competition among established medical device manufacturers focused on imaging-guided procedures. Key players include Veran Medical Technologies, Siemens Healthineers, Cook Medical, CIVCO AIROS, Aspen Surgical, PBN Medicals, Innovative Trauma Care, Besmed, CIVCO Medical Solutions, Biopsy Sciences, and Bard Access Systems (now part of BD). These companies focus on delivering precision, compatibility, and workflow efficiency through disposable and reusable guide systems. They target hospitals, ambulatory centers, and specialty clinics by offering products compatible with a wide range of ultrasound probes. Innovation in design—such as multi-angle needle channels, ergonomic attachments, and sterile packaging—remains a core strategy to capture user demand. Market leaders invest in expanding product portfolios to support tissue biopsy, vascular access, anesthesia, and fluid aspiration. Larger firms leverage their global distribution networks and technical support to strengthen hospital relationships and clinical training. Emerging players gain ground by introducing cost-effective solutions tailored for mid-tier and price-sensitive healthcare facilities. Mergers and strategic partnerships support expansion into new geographic markets, especially in Asia-Pacific and Latin America. Competitive intensity remains high, driven by clinical demand for accuracy, infection control, and ease of use in ultrasound-guided procedures. Companies that align product design with evolving procedural needs and hospital protocols are better positioned for sustained growth.

Recent Developments

- In January 2025, Mermaid Medical Group received UKCA approval for the TP Pivot Pro disposable needle guide developed by CIVCO, featuring 20-degree needle angulation for enhanced access and precision.

- In September 2024, RIVANNA secured a patent for an advanced ultrasound-guided needle insertion system aimed at significantly improving the accuracy and safety of needle-based medical procedures by integrating advanced ultrasound imaging and guidance technology with enhanced precision features.

- In 2023, BD introduced the SiteRite 9 Ultrasound System featuring Cue needle-tracking, improving catheter placement efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to increasing use of ultrasound-guided procedures in hospitals.

- Demand for disposable needle guides will rise with stricter infection control protocols worldwide.

- Portable and point-of-care ultrasound systems will expand usage in remote and emergency settings.

- Manufacturers will develop multi-angle and probe-specific guides for complex procedures.

- Asia-Pacific will show strong growth with rising healthcare access and hospital investments.

- Ambulatory surgical centers will drive adoption with focus on fast, safe outpatient procedures.

- Simulation-based training programs will boost early exposure and usage among medical staff.

- Reusable needle guides will remain in use across cost-sensitive and mid-tier healthcare markets.

- Integration of AI in ultrasound imaging may support automated targeting and guide alignment.

- Global OEMs will expand through partnerships with regional distributors and local suppliers.