Market Overview:

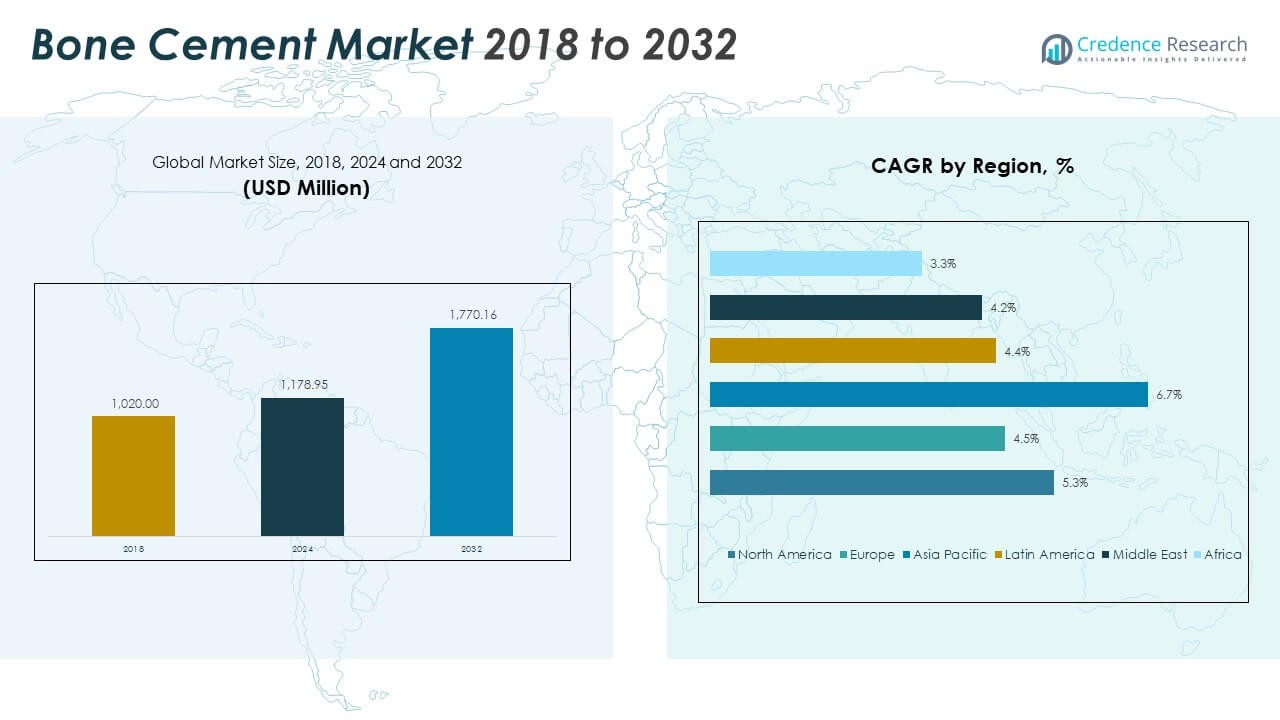

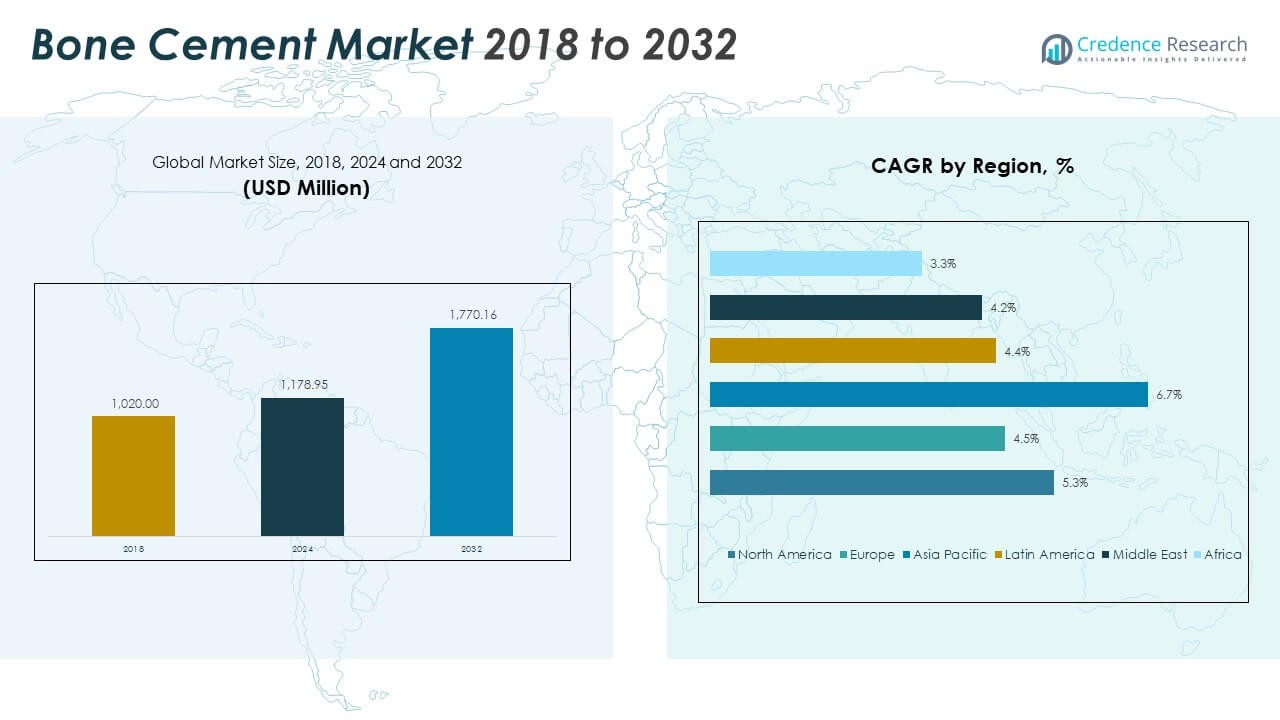

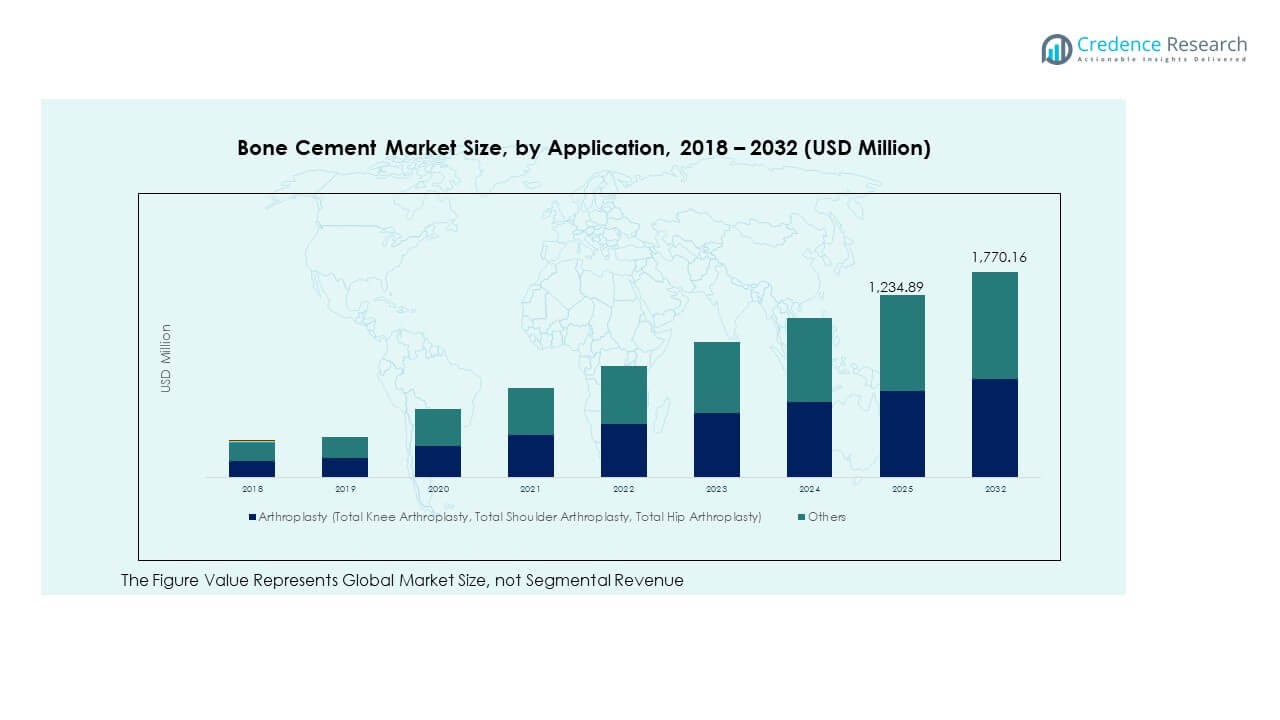

The Bone Cement Market size was valued at USD 1,020.00 million in 2018 to USD 1,178.95 million in 2024 and is anticipated to reach USD 1,770.16 million by 2032, at a CAGR of 5.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bone Cement Market Size 2024 |

USD 1,178.95 Million |

| Bone Cement Market, CAGR |

5.28% |

| Bone Cement Market Size 2032 |

USD 1,770.16 Million |

Rising volumes of orthopedic procedures, particularly hip and knee replacements, are driving market expansion. An aging population and increasing cases of osteoporosis contribute to higher demand. Advancements in cement formulations improve strength, handling, and infection control, supporting surgeon preference. Hospitals increasingly adopt these solutions for faster recovery, lower complication rates, and better implant stability. Innovation in minimally invasive surgical techniques further enhances usage across multiple applications.

North America leads the market due to advanced healthcare infrastructure and a large patient base. Europe holds a strong position supported by aging demographics and established clinical practices. Asia Pacific is emerging rapidly with rising healthcare investments and wider access to orthopedic care. Latin America, the Middle East, and Africa show steady growth as surgical capacity and awareness continue to expand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

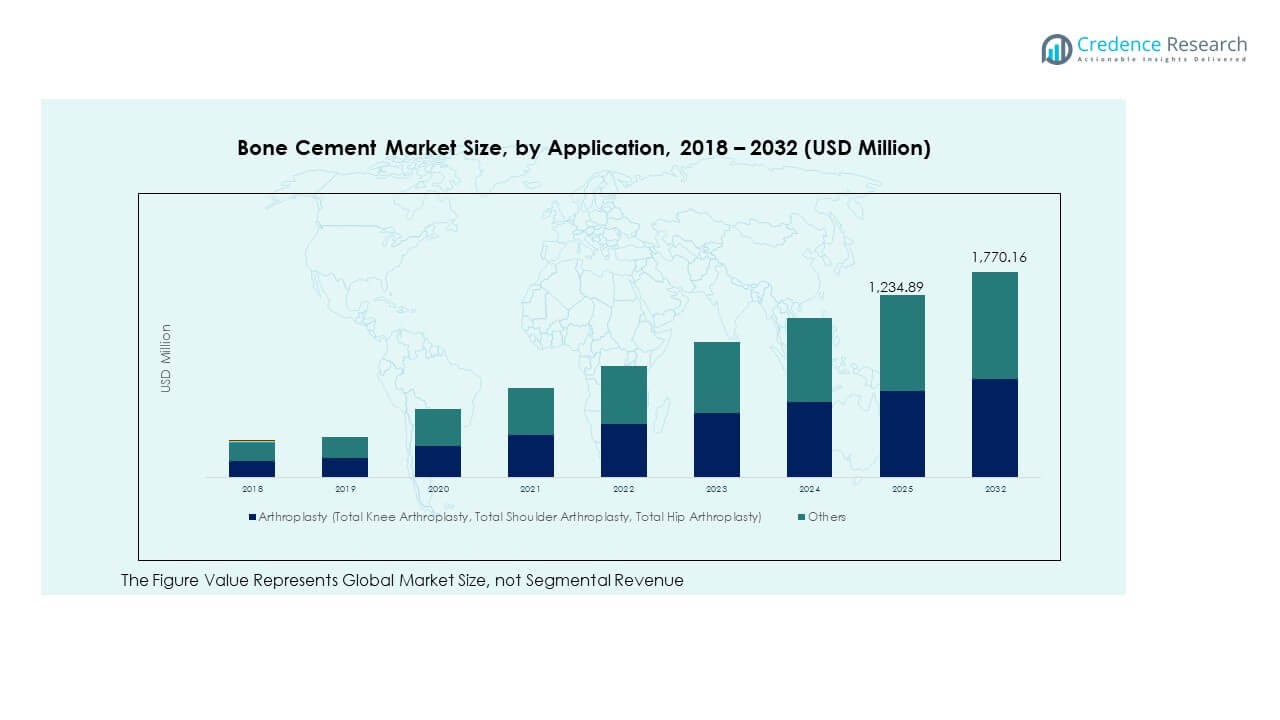

- The Bone Cement Market was valued at USD 1,020.00 million in 2018 and USD 1,178.95 million in 2024 and is projected to reach USD 1,770.16 million by 2032, growing at a CAGR of 5.28% during the forecast period.

- North America holds 38% of the market share, driven by advanced healthcare infrastructure, high procedure volumes, and early technology adoption, followed by Europe with 25% and Asia Pacific with 22%, supported by aging populations and growing procedural demand.

- Asia Pacific is the fastest-growing region with a 6.7% CAGR, fueled by rapid healthcare expansion, increased medical tourism, and wider access to joint replacement surgeries.

- Arthroplasty dominates the market with approximately 60% of the share, supported by high volumes of knee, hip, and shoulder replacements.

- Other applications account for 40% of the market, reflecting steady adoption in trauma and spine surgeries, supported by improving surgical precision and expanded clinical use.

Market Drivers

Rising Prevalence of Orthopedic Disorders Driving the Use of Bone Cement in Surgical Procedures

An aging population and increasing incidence of orthopedic diseases drive the demand for effective joint fixation solutions. Many patients face degenerative conditions that require joint replacements and fracture stabilization. The growing frequency of knee and hip arthroplasties creates a steady need for strong and reliable cement formulations. Hospitals prefer high-performance cement to ensure faster recovery and lower revision rates. It supports improved implant stability and patient mobility. Higher procedural volumes in developed economies strengthen product demand. Surgeons also rely on better handling characteristics to reduce operative time. The Bone Cement Market benefits from this strong clinical requirement and growing patient base.

Growing Adoption of Minimally Invasive Surgeries Enhancing the Application Scope

Minimally invasive surgical techniques are transforming orthopedic care and improving patient outcomes. Surgeons prefer precise fixation methods that reduce trauma and accelerate rehabilitation. It supports improved post-operative comfort and shorter hospital stays. Cement formulations designed for low-viscosity use enable controlled delivery in complex procedures. Rising procedure success rates increase physician confidence and patient preference. Hospitals integrate advanced cement application systems to optimize accuracy. The market benefits from reduced complication rates and enhanced procedural efficiency. These factors strengthen clinical trust and broaden adoption.

- For instance, Stryker’s AutoPlex M4 system automates cement mixing and transfer in under 60 seconds, delivering 11 cc of bone cement with a 0.1 cc tactile feedback precision, while reducing radiation exposure to surgeons by 29% compared to manual devices, thereby streamlining minimally invasive vertebral augmentation workflows.

Increasing Demand for High-Performance Cement Formulations with Advanced Features

Surgeons increasingly seek bone cement with enhanced mechanical and biological properties. The demand for antibiotic-loaded cement supports infection control during implant surgeries. It provides structural stability while reducing postoperative complications. High compressive strength and controlled polymerization improve fixation quality. Patients with multiple comorbidities benefit from formulations that reduce risks of implant loosening. Manufacturers invest in R&D to deliver better shelf life and predictable outcomes. Advanced formulations address surgeon preferences and regulatory expectations. This shift toward performance-oriented products accelerates product adoption.

- For instance, a 2025 Journal of Experimental Orthopaedics study using the Catalan Arthroplasty Register reported a 1.84% revision risk for PALACOS R+G antibiotic-loaded cement compared to 3.85% for other brands over 2007–2017, demonstrating lower long-term revision rates in total knee arthroplasty.

Technological Advancements Supporting Greater Efficiency in Surgical Applications

Technological progress in cement mixing, delivery, and polymerization improves surgical workflows. Modern vacuum mixing systems minimize air entrapment and enhance cement uniformity. It increases implant stability and reduces the risk of mechanical failure. Automated injectors allow surgeons to achieve accurate placement with minimal manual handling. Improved temperature control and setting time reduce intraoperative complications. Hospitals adopt these technologies to support consistency and reduce surgery duration. Better equipment integration ensures fewer postoperative revisions. These advancements drive hospital investments and market expansion.

Market Trends

Rising Development of Bioactive Cement Enhancing Clinical Integration and Healing Response

Innovation in cement formulation focuses on bioactivity and osseointegration. Manufacturers explore materials that support bone regeneration and reduce rejection risks. It helps achieve better bonding between cement and bone tissue. Bioactive additives improve healing and long-term implant stability. Surgeons prefer materials with predictable biological performance. Hospitals adopt these solutions to enhance patient satisfaction and clinical outcomes. Regulatory bodies support bioactive developments through clear approval pathways. The Bone Cement Market gains from the strong focus on biologically functional materials.

- For instance, Heraeus Medical USA launched COPAL G+V Dual Antibiotic-Loaded Bone Cement in August 2024, following FDA 510(k) clearance. Each 40 g unit contains 0.5 g gentamicin and 2 g vancomycin, demonstrating high local antibiotic elution while maintaining low systemic burden.

Increasing Integration of Robotic and Navigation Systems for Precision Application

Robotic-assisted surgery is transforming orthopedic procedures and cement application techniques. Hospitals invest in navigation platforms to enhance surgical precision and reduce errors. It allows more controlled cement delivery and optimized implant alignment. Robotic systems reduce intraoperative variability and support consistent outcomes. Surgeons benefit from improved visibility and reduced revision risks. These systems enhance reproducibility across high-volume centers. Patients experience faster recovery and improved implant longevity. This integration strengthens market demand for compatible cement systems.

Sustainability and Green Manufacturing Practices Driving Production Strategies

Manufacturers align product development with sustainable and eco-friendly processes. The shift toward low-emission production methods supports regulatory compliance. It reduces environmental impact and improves operational efficiency. Recycling and energy-efficient manufacturing equipment lower carbon footprints. Healthcare providers increasingly consider sustainability in procurement decisions. Companies build brand reputation through transparent environmental commitments. Sustainable production also supports cost optimization and process stability. The Bone Cement Market benefits from this structured approach to responsible manufacturing.

- For instance, Everox, a Netherlands-based circular materials company (formerly C2CA Technologies), partnered with Dura Vermeer in September 2024 to develop the world’s first industrial facility capable of processing 150,000 tons of concrete waste annually, reducing CO₂ emissions by approximately 30,000 tons per year. The facility converts waste into supplementary cementitious material and circular aggregates, supporting Europe’s transition to net-zero construction by 2050

Shifting Focus Toward Outpatient and Ambulatory Surgical Settings Globally

Many orthopedic procedures are moving toward outpatient and day-care settings. Shorter recovery times and lower costs make these centers attractive. It supports rapid patient turnover and better resource utilization. High-quality cement products with quick setting time match these operational requirements. Surgeons rely on user-friendly application systems for faster workflows. Healthcare systems adapt infrastructure to support efficient outpatient services. These settings expand access to joint replacement surgeries. This shift in care delivery creates new growth opportunities.

Market Challenges Analysis

Stringent Regulatory Approvals and Complex Manufacturing Requirements Restrict Market Expansion

Bone cement manufacturing requires precise control of composition and performance standards. Regulatory agencies demand extensive testing and clinical validation for approval. It creates significant entry barriers for new companies. Compliance with safety standards involves time-consuming and costly processes. Any deviation can delay launches and restrict regional expansion. Manufacturers must also meet strict biocompatibility and sterilization norms. This increases production complexity and operational costs. The Bone Cement Market faces challenges in scaling operations while meeting evolving regulatory expectations.

Risk of Postoperative Complications and Product Limitations Impacting Clinical Acceptance

Postoperative complications such as cement leakage and embolism remain major concerns for surgeons. It affects clinical confidence and may increase revision rates. Patient safety issues limit broader adoption in specific risk groups. Surgeons require precise mixing and application techniques to reduce adverse outcomes. Limited adaptability to different bone densities adds complexity in certain cases. Product formulation improvements are critical to address these challenges effectively. Hospitals also demand better evidence of long-term stability. These factors create a cautious clinical environment that can slow market penetration.

Market Opportunities

Rising Healthcare Investments and Expanding Surgical Infrastructure Creating New Growth Potential

Many countries are increasing healthcare investments and expanding orthopedic surgical infrastructure. It supports greater access to advanced surgical procedures. Rising demand in emerging markets creates new revenue streams for manufacturers. Hospitals adopt modern equipment to improve patient outcomes and procedural efficiency. Surgeons receive better training to use cement effectively. Favorable policy frameworks encourage private and public healthcare investments. The Bone Cement Market benefits from this widening treatment landscape. Strong demand in secondary cities further enhances expansion opportunities.

Growing Focus on Personalized and Patient-Specific Solutions Strengthening Innovation Strategies

Healthcare providers are moving toward more personalized treatment approaches. Customized cement formulations meet specific patient needs and improve implant integration. It supports better procedural outcomes and higher patient satisfaction. Surgeons rely on tailored delivery systems to achieve optimal precision. R&D teams explore new ways to enhance handling and mechanical properties. Companies gain a competitive edge by aligning with precision medicine trends. Hospitals favor technologies that improve procedural reliability. This personalization trend creates a clear path for long-term growth.

Market Segmentation Analysis:

By product, Polymethyl Methacrylate (PMMA) cement dominates the market due to its high mechanical strength, durability, and wide clinical acceptance. Surgeons prefer PMMA for joint fixation because it offers stable support and predictable performance during complex arthroplasty procedures. Glass polyalkenoate cement is gaining attention for its biocompatibility and lower exothermic reaction, which supports improved patient safety. Calcium phosphate cement holds strong growth potential because of its bioactive nature and ability to integrate with natural bone tissue. These product categories reflect a shift toward improved material properties and long-term implant performance.

- For instance, a 2025 Frontiers in Pharmacology article reviewed calcium phosphate–calcium sulfate composite bone cements with antimicrobial agents and reported enhanced bone regeneration and infection resistance in preclinical studies, supporting their potential for orthopedic applications.

By application, arthroplasty remains the largest segment, driven by rising volumes of total knee, shoulder, and hip replacement surgeries. Total knee arthroplasty leads due to the high prevalence of degenerative joint disorders among aging populations. Total hip arthroplasty is also expanding steadily with improved surgical outcomes and better implant fixation. Total shoulder arthroplasty shows consistent adoption supported by growing procedural efficiency. Other applications include trauma care and spine surgeries, where cement supports structural stability. The Bone Cement Market benefits from increasing procedural volumes and the growing need for reliable fixation solutions in orthopedic care.

- For instance, the American Joint Replacement Registry (AJRR) 2025 Annual Report analyzed more than 4.4 million hip and knee arthroplasty procedures and identified PALACOS R+G as one of the most commonly used PMMA cements, reflecting its strong clinical adoption across U.S. hospitals and surgical centers.

Segmentation:

By Product

- Polymethyl Methacrylate (PMMA) Cement

- Glass Polyalkenoate Cement

- Calcium Phosphate Cement

By Application

- Arthroplasty

- Total Knee Arthroplasty

- Total Shoulder Arthroplasty

- Total Hip Arthroplasty

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Bone Cement Market size was valued at USD 394.74 million in 2018 to USD 451.06 million in 2024 and is anticipated to reach USD 676.38 million by 2032, at a CAGR of 5.3% during the forecast period. North America holds the largest market share supported by advanced healthcare infrastructure and a high volume of joint replacement procedures. Strong adoption of minimally invasive orthopedic techniques boosts the use of bone cement in hospitals and surgical centers. It benefits from early access to innovative products and favorable reimbursement structures. Surgeons in the U.S. and Canada rely on well-established supply chains and strong clinical evidence for product safety. Rising cases of osteoarthritis and trauma injuries further sustain procedural demand. Strategic partnerships between manufacturers and healthcare networks strengthen product penetration. The Bone Cement Market gains a steady revenue base from this region’s strong procedural capacity and innovation focus.

Europe

The Europe Bone Cement Market size was valued at USD 265.00 million in 2018 to USD 294.23 million in 2024 and is anticipated to reach USD 416.97 million by 2032, at a CAGR of 4.5% during the forecast period. Europe represents a mature market supported by advanced orthopedic care and structured public healthcare systems. High implant adoption in countries such as Germany, the UK, and France drives stable product demand. It benefits from well-defined regulatory frameworks that encourage quality standards. Aging populations and high osteoarthritis prevalence increase the need for hip and knee arthroplasties. Hospitals across Western Europe lead in implementing advanced cement technologies. Eastern Europe shows steady growth with improved surgical capabilities. Strong clinical research and surgeon expertise sustain market competitiveness.

Asia Pacific

The Asia Pacific Bone Cement Market size was valued at USD 218.28 million in 2018 to USD 265.08 million in 2024 and is anticipated to reach USD 444.84 million by 2032, at a CAGR of 6.7% during the forecast period. Asia Pacific shows the fastest growth driven by expanding healthcare infrastructure and increasing access to joint replacement procedures. Rapid urbanization and rising disposable incomes enable more patients to seek advanced orthopedic care. It benefits from government healthcare programs and growing private sector investments. China, Japan, and India lead procedural volumes, supported by growing surgeon training and technology adoption. Demand for cost-effective cement solutions aligns with the region’s evolving healthcare models. Medical tourism in countries like India and Thailand accelerates adoption. Local manufacturing expansions also strengthen regional supply chains.

Latin America

The Latin America Bone Cement Market size was valued at USD 69.36 million in 2018 to USD 79.45 million in 2024 and is anticipated to reach USD 111.29 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America represents a developing market with rising awareness of advanced orthopedic treatments. It benefits from improving hospital infrastructure and wider access to elective surgeries. Brazil leads in procedural volume, followed by Argentina and Mexico. Increasing healthcare investments and private sector participation support broader product adoption. Orthopedic surgeons are adopting modern cement formulations to improve fixation outcomes. Regional distributors strengthen supply networks and enhance market coverage. The Bone Cement Market sees steady expansion with targeted investments in urban healthcare centers.

Middle East

The Middle East Bone Cement Market size was valued at USD 45.90 million in 2018 to USD 50.22 million in 2024 and is anticipated to reach USD 69.22 million by 2032, at a CAGR of 4.2% during the forecast period. The Middle East market benefits from expanding orthopedic services and investments in modern hospital infrastructure. GCC countries lead in adoption due to higher healthcare spending and early access to imported medical technologies. It gains from government initiatives to expand surgical capacity in public hospitals. Israel and Turkey contribute to procedural growth through strong private healthcare systems. Medical tourism adds to procedural volumes in key markets. Growing collaborations between suppliers and healthcare networks enhance regional access. Rising awareness of orthopedic solutions continues to strengthen demand.

Africa

The Africa Bone Cement Market size was valued at USD 26.72 million in 2018 to USD 38.91 million in 2024 and is anticipated to reach USD 51.46 million by 2032, at a CAGR of 3.3% during the forecast period. Africa is an emerging market with growing access to surgical care and rising awareness of joint replacement procedures. It faces infrastructure challenges but benefits from international investments in healthcare modernization. South Africa leads regional adoption with stronger clinical capabilities. Egypt and other North African countries show steady demand growth supported by urban healthcare development. It gains momentum from expanding training programs for orthopedic surgeons. Partnerships with global suppliers improve product availability. This gradual improvement positions Africa as a potential growth region for the Bone Cement Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Stryker (US)

- Merck KGaA (Germany)

- Johnson & Johnson (DePuy Synthes) (US)

- Zimmer Biomet (US)

- Smith & Nephew (UK)

- Arthrex, Inc. (US)

- Exactech (US)

- Heraeus Holding (Germany)

- Cardinal Health (US)

- Braun Melsungen AG (Germany)

- Medtronic plc (Ireland)

- Geuder AG (Germany)

- NuVasive, Inc. (US)

- Heraeus Medical GmbH (Germany)

- Curasan AG (Germany)

- Biometrix (US)

- Siora Surgicals Pvt. Ltd. (India)

- Promedics Orthopaedics (US)

- Synthes GmbH (Switzerland)

- 3M Company (US)

- OsteoMed LLC (US)

Competitive Analysis:

The Bone Cement Market features strong competition among global and regional players focused on product innovation, regulatory compliance, and market expansion. Leading companies such as Stryker, Merck KGaA, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, and Smith & Nephew dominate through established product portfolios and advanced manufacturing capabilities. It benefits from continuous R&D investments aimed at improving cement properties, handling characteristics, and antibiotic integration. Mid-tier companies strengthen their presence through regional distribution, niche product offerings, and partnerships with healthcare providers. Competitive strategies include mergers, product launches, and geographic diversification. Growing focus on clinical outcomes, regulatory alignment, and cost efficiency shapes competitive positioning. Players leverage strong relationships with hospitals and surgical centers to maintain leadership. The market environment remains dynamic, driven by technological advancements and increasing global procedural volumes.

Recent Developments:

- In October 2025, Zimmer Biomet Holdings, Inc. announced a major product showcase at the 2025 American Association of Hip and Knee Surgeons (AAHKS) Annual Meeting. The company introduced a number of innovations, including the Oxford Cementless Partial Knee System and the Persona OsseoTi Keel Tibia, both designed to improve orthopedic surgical precision and implant stability.

- In March 2025, Zimmer Biomet also launched its Tekcem 1G and Tekcem 3G antibiotic bone cements in India. These newly developed formulations are aimed at reducing infection risks during orthopedic surgeries and expanding the company’s footprint in the Asia-Pacific region. The antibiotic bone cements are part of Zimmer Biomet’s initiative to offer advanced solutions for hospital-acquired infection prevention and faster surgical recovery.

- In March 2025, Johnson & Johnson’s DePuy Synthes (US) exhibited a new generation of orthopedic materials at AAOS 2025, integrating enhanced bone cement formulations into its joint reconstruction systems. This aligns with the company’s broader innovation strategy across its MedTech division to improve bone fixation outcomes through material advancements and robotic-assisted precision.

Report Coverage:

The research report offers an in-depth analysis based on Product and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for advanced orthopedic procedures will expand product utilization across multiple applications.

- Rising adoption of minimally invasive surgical techniques will support stronger product penetration.

- Increasing use of bioactive and antibiotic-loaded formulations will enhance infection control standards.

- Continuous R&D investment will drive product differentiation and improve clinical outcomes.

- Expansion of surgical infrastructure in emerging economies will strengthen the global demand base.

- Technological improvements in mixing and delivery systems will improve procedural precision.

- Strategic collaborations between manufacturers and hospitals will boost product accessibility.

- Sustainability-focused manufacturing will gain traction in response to regulatory shifts.

- Medical tourism growth in Asia Pacific and the Middle East will create new revenue streams.

- Consolidation among major players through acquisitions will intensify competitive positioning.