Market Overview:

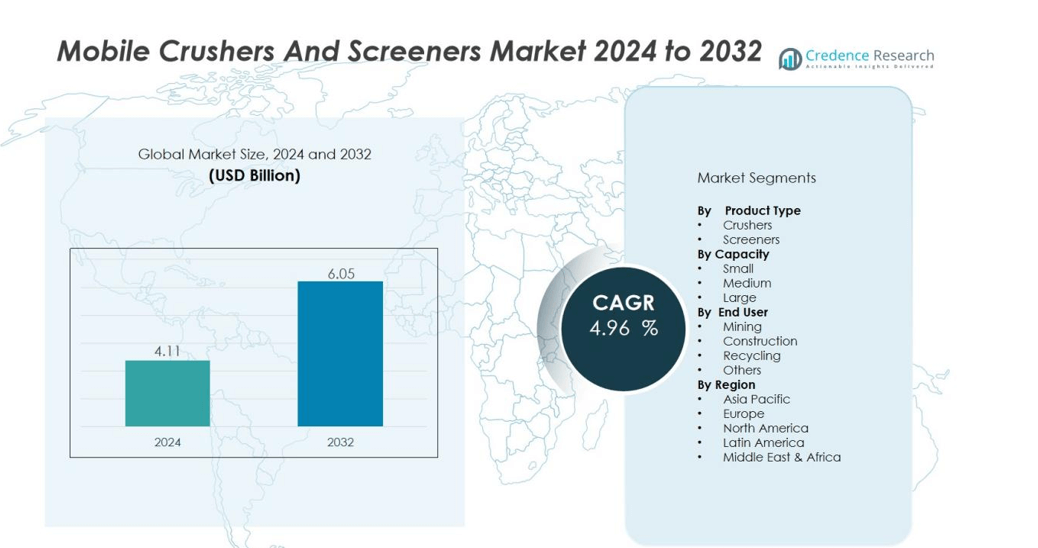

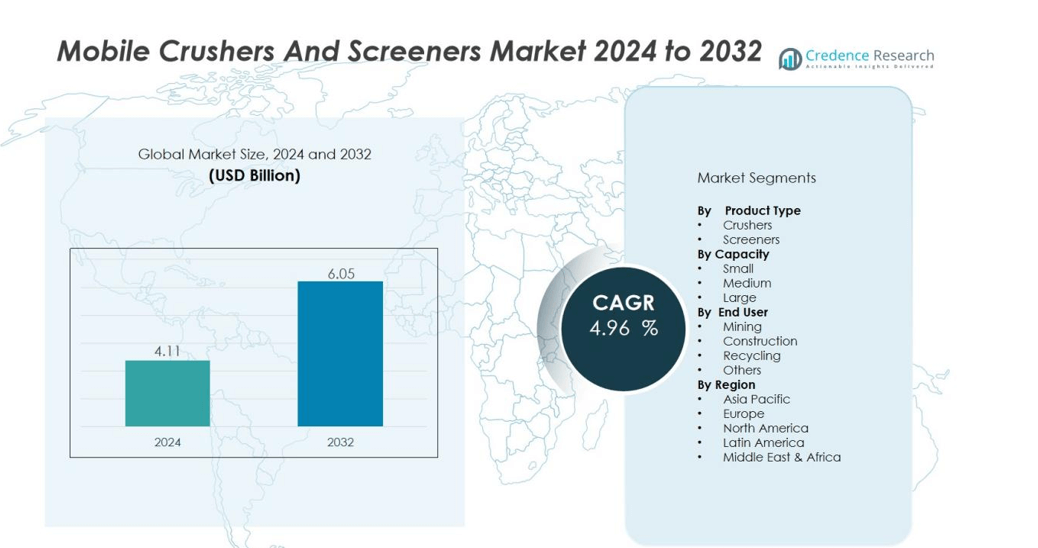

The mobile crushers and screeners market size was valued at USD 4.11 billion in 2024 and is anticipated to reach USD 6.05 billion by 2032, at a CAGR of 4.96 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Crushers and Screeners Market Size 2024 |

USD 4.11 billion |

| Mobile Crushers and Screeners Market, CAGR |

4.96% |

| Mobile Crushers and Screeners Market Size 2032 |

USD 6.05 billion |

Growth drivers include rapid construction activities, mining operations, and infrastructure projects, which require efficient material processing solutions. Mobile crushers and screeners reduce transportation costs, enable flexible site operations, and improve productivity in urban and remote areas. Advancements in automation, fuel efficiency, and hybrid-powered equipment further enhance adoption. Stringent regulations on emissions and environmental sustainability are also prompting manufacturers to develop eco-friendly and energy-efficient models.

Regionally, Asia-Pacific dominates the mobile crushers and screeners market, supported by large-scale infrastructure projects in China, India, and Southeast Asia. Europe follows, driven by quarrying and recycling applications supported by strict environmental standards. North America maintains steady demand through construction and mining activities, while Latin America and the Middle East & Africa are gradually expanding due to increasing investments in infrastructure and mining projects. This broad geographic adoption underlines the market’s long-term growth potential.

Market Insights:

- The mobile crushers and screeners market was valued at USD 4.11 billion in 2024 and is expected to reach USD 6.05 billion by 2032, growing at a CAGR of 4.96%.

- Rising demand from construction and infrastructure projects is fueling adoption, as contractors require flexible and efficient material processing solutions.

- Mining remains a key growth driver, with operators favoring mobile units for remote locations and cost efficiency.

- The market is gaining traction in recycling applications, where mobile equipment helps reduce landfill pressure and supports circular economy practices.

- Technological advancements such as automation, hybrid power, and telematics are enhancing productivity and lowering emissions.

- High operational costs and regulatory compliance pressures remain challenges, particularly for smaller operators in price-sensitive markets.

- Asia-Pacific led with 46% share in 2024, followed by Europe at 27% and North America at 18%, reflecting strong regional adoption across infrastructure, mining, and recycling applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Construction and Infrastructure Development:

The expansion of infrastructure projects and urban construction is a major driver for the mobile crushers and screeners market. Governments and private firms are investing heavily in roads, bridges, airports, and residential projects. It creates strong demand for portable equipment that can process aggregates on-site with reduced logistics costs. The mobility of these machines offers contractors efficiency and flexibility across varied terrains.

- For instance, in October 2023, Sandvik Rock Processing Solutions launched the UJ443E fully electric heavy jaw crusher, which delivers up to 400 tons per hour while reducing operational emissions through its all-electric track platform, offering significant flexibility for infrastructure projects

Increasing Mining Activities and Resource Extraction:

Growing demand for minerals, metals, and raw materials continues to fuel adoption of mobile crushers and screeners. Mining operators prefer mobile units due to their ability to operate in remote locations with limited infrastructure. It helps in reducing operational costs by eliminating the need for fixed installations. Rising global investments in mining exploration further strengthen this growth driver.

- For instance, Metso released its Remote IC control app in February 2024, letting operators wirelessly monitor and adjust Lokotrack mobile crushers and screens from the excavator cabin, increasing process productivity by enabling up to 30% higher operational output compared to manual control.

Focus on Recycling and Waste Management Solutions:

The global push toward sustainability has boosted the role of mobile crushers and screeners in recycling applications. It allows efficient processing of construction and demolition waste, reducing landfill pressure. Recycling aggregates provides cost savings and supports compliance with stricter environmental regulations. The growing adoption of circular economy practices is encouraging wider use of mobile solutions.

Technological Advancements and Equipment Innovation:

Continuous advancements in automation, fuel efficiency, and hybrid power systems are reshaping the mobile crushers and screeners market. Modern equipment delivers higher productivity, lower emissions, and improved user safety. It aligns with the demand for eco-friendly and cost-efficient solutions. The integration of telematics and digital monitoring enhances operational control, making mobile solutions more attractive for diverse industries.

Market Trends:

Growing Adoption of Eco-Friendly and Energy-Efficient Equipment:

Sustainability is shaping demand in the mobile crushers and screeners market, with companies focusing on low-emission and energy-efficient models. Hybrid and electric-powered units are gaining traction among contractors aiming to reduce fuel costs and meet regulatory standards. It reflects the industry’s shift toward greener technologies, driven by global climate policies and environmental awareness. Recycling applications are also expanding, with mobile units increasingly used for processing demolition waste and aggregates. Manufacturers are integrating advanced materials and designs to enhance durability and reduce environmental impact. These changes are positioning eco-friendly equipment as a critical trend in the market.

- For instance, Keestrack’s all-electric R3e impact crusher, unveiled in early 2024, features a closed-loop system that boosts aggregate recycling efficiency by handling up to 250 tons per hour while maintaining low carbon emissions.

Integration of Automation, Digital Monitoring, and Smart Technologies:

Technological advancement is transforming how mobile crushers and screeners operate in the field. Automated features and digital monitoring tools are now standard in modern equipment, enabling operators to track performance and predict maintenance needs. It enhances efficiency while reducing downtime and operational risks. Telematics systems allow real-time fleet management, providing data-driven insights for better decision-making. Demand for user-friendly interfaces and remote-control options is also rising across construction and mining projects. Manufacturers are responding with smart solutions that improve productivity and align with the digital transformation of industrial operations. This focus on automation marks a key trend driving long-term adoption.

- For instance, Caterpillar successfully demonstrated fully autonomous operation of its Cat 777 off-highway truck at Luck Stone’s Bull Run plant, marking the first autonomous deployment in the aggregates industry with autonomous trucks having traveled more than 325 million kilometers globally.

Market Challenges Analysis:

High Operational Costs and Maintenance Requirements:

The mobile crushers and screeners market faces challenges from high operating expenses and maintenance needs. Fuel consumption, wear and tear of components, and frequent servicing increase overall costs for contractors. It can limit adoption among small and medium-scale operators with tight budgets. Downtime during maintenance also impacts productivity and project timelines. The complexity of advanced equipment further requires skilled technicians, which raises labor costs. These factors often restrain market growth despite strong demand for mobile solutions.

Regulatory Pressures and Environmental Compliance Issues:

Strict government regulations on emissions, noise, and waste management present significant hurdles for equipment manufacturers and operators. Compliance requires investment in cleaner technologies and advanced filtration systems, which increases production costs. It creates barriers for companies competing in price-sensitive markets. Regional variations in standards make it harder for manufacturers to streamline product designs globally. Limited awareness and infrastructure in emerging economies further slow compliance adoption. These challenges continue to influence the competitive landscape and shape product innovation in the industry.

Market Opportunities:

Expansion of Recycling and Sustainable Construction Practices:

The growing emphasis on recycling and sustainable construction is creating strong opportunities for the mobile crushers and screeners market. Governments and industries are prioritizing resource recovery from demolition waste, concrete, and asphalt. It enables cost-effective production of recycled aggregates while reducing environmental impact. Contractors benefit from mobile units that can be deployed directly at sites, cutting transport costs. Rising adoption of circular economy principles in developed and emerging markets supports this opportunity. Companies investing in eco-friendly equipment are well positioned to capture growing demand.

Growth Potential in Emerging Markets and Infrastructure Development:

Emerging economies present major growth opportunities due to large-scale infrastructure investments and urbanization. Expanding road networks, housing projects, and mining operations require efficient material processing solutions. The mobile crushers and screeners market benefits from rising demand for portable, cost-effective equipment in these regions. It helps contractors improve flexibility while meeting tight project schedules. Increasing government focus on modernizing infrastructure in Asia-Pacific, Latin America, and Africa strengthens this outlook. Manufacturers that expand distribution networks and offer localized support can gain significant competitive advantages.

Market Segmentation Analysis:

By Product Type:

The mobile crushers and screeners market is segmented into crushers and screeners, each serving distinct functions in material processing. Crushers dominate demand due to their wide use in reducing large rocks and aggregates for construction and mining applications. It supports high productivity and flexibility across different terrains. Screeners are gaining momentum, driven by the need for separating and classifying materials efficiently. Growing use of mobile screeners in recycling projects further strengthens their role in the segment.

By End-User Industry:

The market caters to industries such as mining, construction, recycling, and others. Mining remains the leading segment, supported by demand for portable equipment that can operate in remote locations. It is also favored in the construction sector due to rising urban projects and road developments. Recycling applications are expanding quickly as governments and contractors adopt sustainable waste management practices. Growing demand for aggregate recycling positions this segment for strong growth.

- For instance, at LKAB’s Malmberget mine, four Epiroc Simba E6 C WL teleremote-controlled production drill rigs each surpassed 1 000 000 drill meters using Automatic Boom Control automation.

By Capacity:

Capacity-based segmentation highlights demand for small, medium, and large equipment. Medium-capacity units dominate adoption due to their versatility in both mining and construction projects. It allows contractors to balance efficiency and cost, making them a popular choice. Large-capacity machines are essential for heavy-duty mining and infrastructure projects, while small units serve niche applications in urban construction. Rising preference for scalable solutions supports growth across all capacity ranges.

- For instance, the Komatsu PC8000-6 crawler excavator, with a bucket capacity of 42 cubic meters, was commissioned in April 2025 at Barrick Gold’s Lumwana mine in Zambia, enhancing daily extraction by 18,000 tons of ore.

Segmentations:

By Product Type:

By End-User Industry:

- Mining

- Construction

- Recycling

- Others

By Capacity:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 46% share of the mobile crushers and screeners market in 2024, dominating global demand. China, India, and Southeast Asian countries are driving growth through large-scale infrastructure and mining projects. It benefits from rapid urbanization, strong government investment in construction, and expanding quarry operations. Mobile equipment is preferred in the region due to cost efficiency and flexibility across diverse terrains. Rising adoption of sustainable practices and recycling initiatives further strengthens demand. Strong manufacturing capabilities also support competitive pricing and wider adoption across the region.

Europe:

Europe accounted for 27% share of the mobile crushers and screeners market in 2024, supported by strict environmental regulations. Countries such as Germany, the UK, and France are leading adoption through quarrying, demolition recycling, and road construction. It is influenced by stringent emission norms that encourage eco-friendly and energy-efficient equipment. Demand is rising for hybrid and electric-powered crushers and screeners in line with sustainability targets. Strong government support for circular economy initiatives is accelerating market expansion. Regional players are also investing in advanced technologies to strengthen competitiveness across the continent.

North America:

North America represented 18% share of the mobile crushers and screeners market in 2024, supported by construction and mining activities. The United States leads demand through road networks, commercial projects, and aggregate processing facilities. It benefits from investments in modernizing infrastructure and rising focus on recycling. Canada is also contributing with growth in mining and urban development projects. Adoption of advanced technologies, including telematics and automation, supports efficiency and productivity in the region. Manufacturers continue to target North America with high-performance and eco-friendly models to capture steady demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sandvik AB

- Komatsu

- Metso

- Terex Corporation

- KLEEMANN

- ASTEC INDUSTRIES, INC.

- McCloskey International

- thyssenkrupp AG

- RUBBLE MASTER HMH GMBH

- Anaconda Equipment Ltd

Competitive Analysis:

The mobile crushers and screeners market is highly competitive with the presence of global and regional players. Leading companies include Sandvik AB, Komatsu, Metso, Terex Corporation, KLEEMANN, ASTEC INDUSTRIES, INC., and McCloskey International. It is shaped by continuous product innovation, strategic collaborations, and expansion into emerging markets. Players focus on developing energy-efficient, automated, and eco-friendly solutions to meet regulatory standards and customer expectations. Strong distribution networks and after-sales services provide a competitive edge in retaining long-term clients. Companies also invest in R&D to enhance equipment durability and performance. This competitive landscape highlights a market driven by technological advancement and strategic positioning.

Recent Developments:

- In June 2025, Sandvik AB introduced a new pumpable resin system for its i-series bolters designed to improve operational efficiency and safety in tunneling.

- In June 2025, Komatsu finalized a $440 million agreement with Barrick Mining Corporation for primary mining equipment deliveries for the Reko Diq copper-gold project in Pakistan starting in 2026.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, End-User Industry, Capacity and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The mobile crushers and screeners market will witness strong demand from infrastructure and mining projects worldwide.

- It will expand further with growing emphasis on recycling and sustainable construction practices.

- Manufacturers will focus on developing hybrid and electric-powered equipment to meet emission standards.

- Automation, telematics, and digital monitoring will become standard features, improving efficiency and uptime.

- Emerging economies in Asia-Pacific, Latin America, and Africa will create new opportunities through urbanization and industrialization.

- The market will see rising competition among global and regional players offering localized solutions.

- It will benefit from government policies supporting resource efficiency and circular economy adoption.

- Equipment with lower operating costs and higher durability will gain preference among contractors.

- Strategic partnerships and acquisitions will increase as companies strengthen distribution and technology portfolios.

- It will evolve toward a more technology-driven and eco-friendly industry, aligning with long-term sustainability goals.