Market Overview:

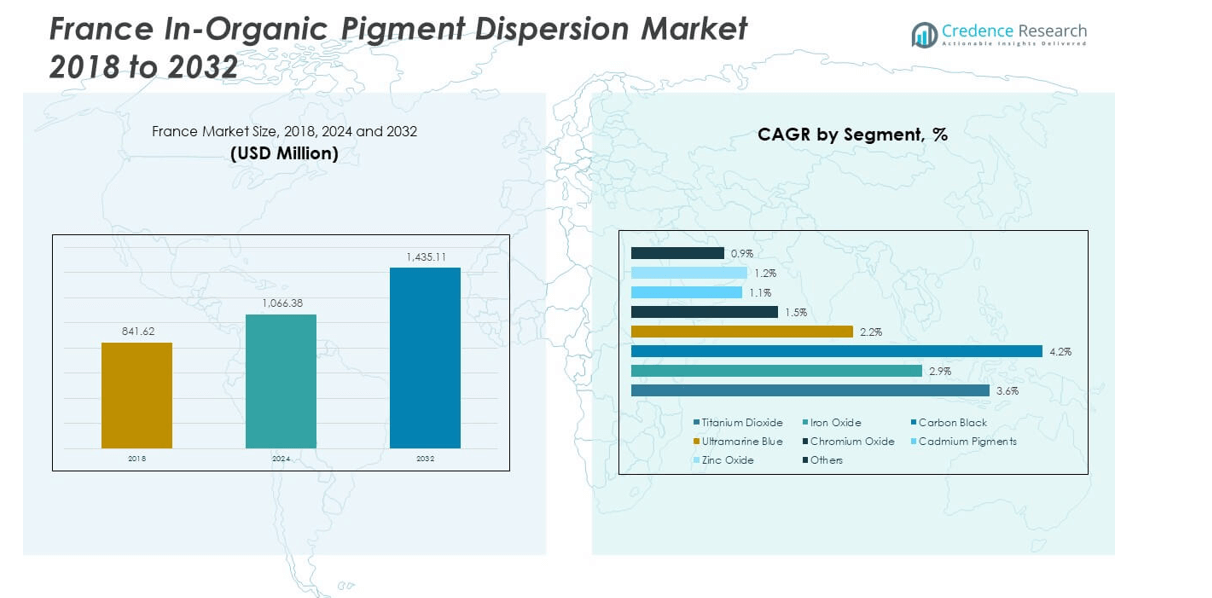

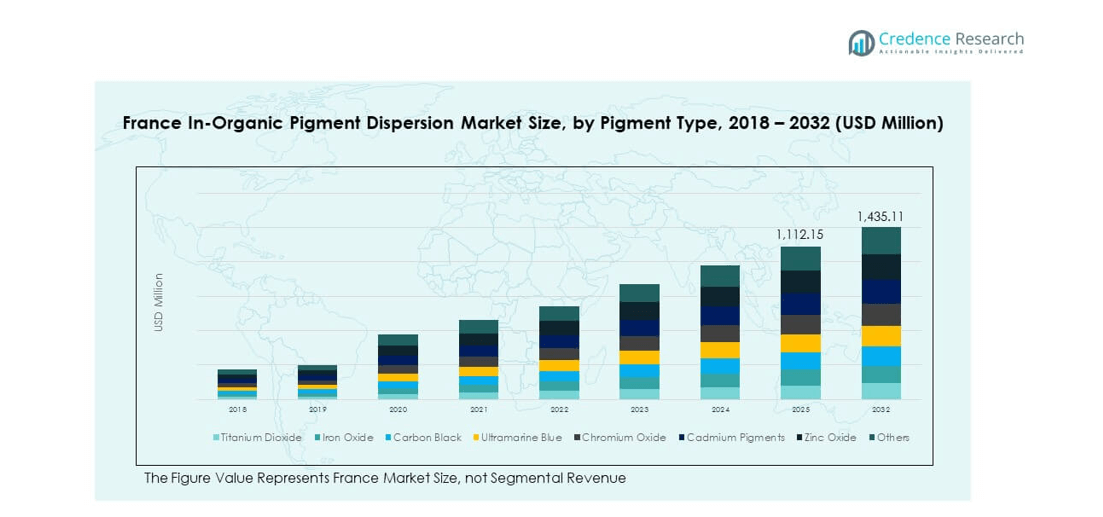

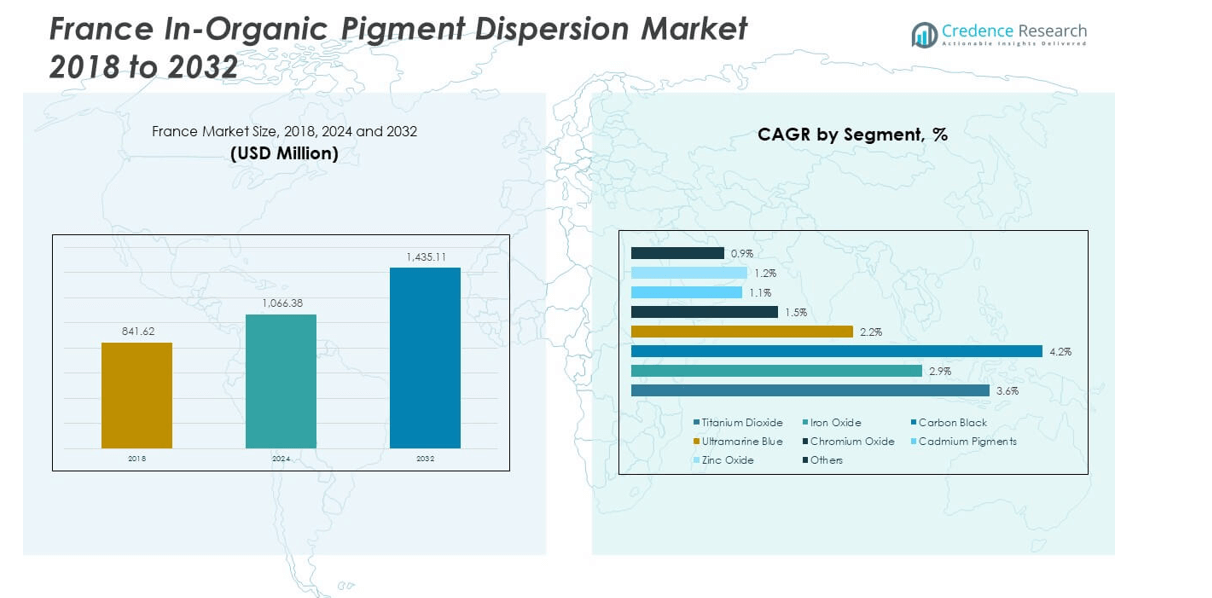

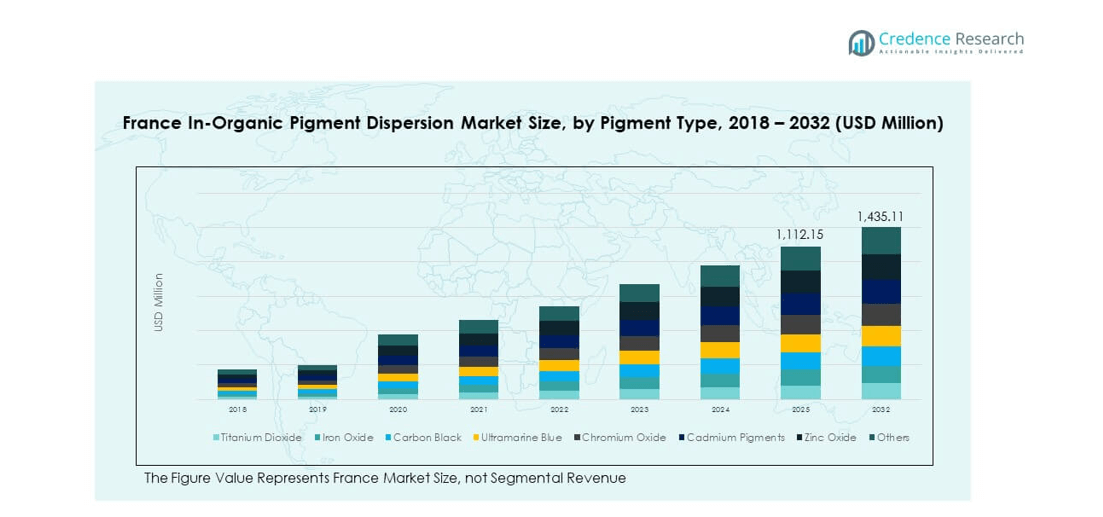

The France In-Organic Pigment Dispersion Market size was valued at USD 841.62 million in 2018 to USD 1,066.38 million in 2024 and is anticipated to reach USD 1,435.11 million by 2032, at a CAGR of 3.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France In-Organic Pigment Dispersion Market Size 2024 |

USD 1,066.38 million |

| France In-Organic Pigment Dispersion Market, CAGR |

3.71% |

| France In-Organic Pigment Dispersion Market Size 2032 |

USD 1,435.11 million |

The market growth is driven by rising demand across industries such as construction, automotive, packaging, and paints and coatings. Increasing use of in-organic pigment dispersions in architectural paints and automotive coatings enhances durability, weather resistance, and color consistency. France’s focus on sustainability is encouraging the adoption of eco-friendly pigments that comply with environmental regulations. Advancements in dispersion technologies further improve pigment performance, offering high opacity, better dispersion stability, and long-lasting color strength, which supports widespread adoption. Growing investments in infrastructure and industrial activities also strengthen demand for high-performance pigments across the market.

Regionally, the France In-Organic Pigment Dispersion Market shows clear subregional dynamics, with Northern France holding the largest share at 38% due to its strong industrial clusters and automotive production hubs. Central France follows with 34%, supported by demand from construction, architectural coatings, and cultural infrastructure projects. Southern France contributes 28%, fueled by packaging, cosmetics, and port-driven trade activities that enhance supply chains. Each subregion demonstrates unique drivers, yet together they reinforce France’s position as a vital European market supported by sustainability goals and regulatory compliance.

Market Insights

- The France In-Organic Pigment Dispersion Market was valued at USD 841.62 million in 2018, reached USD 1,066.38 million in 2024, and is projected to hit USD 1,435.11 million by 2032, at a CAGR of 3.71%.

- Northern France led with 38% share due to strong industrial and automotive bases, followed by Central France with 34% supported by construction and architectural coatings, and Southern France with 28% driven by packaging and cosmetics.

- The fastest-growing subregion is Southern France, where expansion in packaging, cosmetics, and port-driven trade networks fuels strong demand for dispersions despite holding a smaller share compared to the north and center.

- Titanium dioxide holds the largest share of 42% in the France In-Organic Pigment Dispersion Market, offering opacity and brightness for coatings, plastics, and packaging.

- Iron oxide accounts for 27% share, supported by applications in construction materials, ceramics, and decorative coatings requiring durability and performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Demand From Construction And Infrastructure Projects Enhancing Market Growth

The France In-Organic Pigment Dispersion Market benefits from growing demand in construction and infrastructure. Pigments deliver high durability and resistance, making them essential for architectural coatings. It supports projects requiring long-lasting weather resistance and stable color performance. Growing renovation activities in urban areas push the use of advanced pigments. France’s commitment to sustainable building practices increases adoption of eco-friendly dispersions. Manufacturers prioritize high-quality formulations to align with energy-efficient construction. Strong regulations on product safety strengthen reliance on compliant pigments. This ensures the segment’s growth across both public and private infrastructure development.

- For example, Arkema’s Kynar Aquatec® FMA-12 is a hybrid fluoropolymer–acrylic latex dispersion engineered for field-applied architectural coatings. Independent accelerated weathering tests confirm it provides superior durability compared to premium acrylics, delivering enhanced UV and chalk resistance and long-term performance.

Rising Automotive Production Creating Need For Durable Pigment Dispersions

Automotive coatings contribute significantly to the France In-Organic Pigment Dispersion Market. Pigments offer improved gloss, resistance to corrosion, and strong color retention. It addresses the demand for protective and aesthetic qualities in vehicles. French automotive manufacturers emphasize sustainability, creating opportunities for low-toxicity pigments. High-performance dispersions improve production efficiency and surface finish. Increased consumer preference for stylish vehicles boosts pigment adoption. Local suppliers focus on product innovation to meet evolving design standards. Growing automotive exports enhance opportunities for high-value pigment applications.

Growing Packaging Industry Driving Pigment Dispersion Usage Across End-Products

The packaging sector holds a strong role in the France In-Organic Pigment Dispersion Market. Pigments provide visual appeal, opacity, and stability across multiple packaging formats. It supports industries like food, beverage, and consumer goods with branding consistency. Demand for recyclable and biodegradable packaging drives adoption of sustainable pigment dispersions. Companies innovate to create vibrant and durable finishes for flexible packaging. Advanced dispersion technologies improve printability and performance in packaging materials. Rising consumer awareness encourages adoption of safe, eco-friendly pigments. Packaging brands rely on color differentiation, ensuring strong demand for dispersions.

- For example, BASF’s Lumogen® F pigments deliver high lightfastness, heat stability, and brilliant fluorescence, making them well-suited for packaging applications that demand long-lasting color. Fastness to light and heat is evaluated using recognized standards like DIN EN ISO 105-B and DIN EN ISO 4892-2, confirming the reliable performance of these pigments under prolonged exposure to light and elevated temperatures.

Government Regulations And Sustainability Standards Supporting Market Expansion

Government regulations influence the growth of the France In-Organic Pigment Dispersion Market. Strict European standards on chemical safety encourage manufacturers to design compliant formulations. It ensures lower environmental impact while maintaining superior performance. Regulatory frameworks such as REACH strengthen reliance on safe dispersions. Sustainability goals push industries to use pigments with minimal toxicity. Producers invest in R&D to align with government-driven policies. Demand from sectors seeking compliance increases adoption of regulated pigments. This alignment of innovation with policy ensures strong growth in the French market.

Market Trends

Integration Of Smart Dispersion Technologies For Performance Improvement

The France In-Organic Pigment Dispersion Market shows a shift toward advanced dispersion technologies. Smart systems enhance stability and uniform distribution of pigments. It reduces waste and improves end-product quality. Automation in dispersion processes ensures consistency and efficiency. Companies invest in technology to meet strict quality standards. Improved dispersion reduces energy use in production facilities. The trend supports both cost control and sustainability. Producers see innovation in dispersion processes as a key market differentiator.

Increasing Focus On Eco-Friendly Formulations Within Industrial Applications

Environmental awareness influences trends in the France In-Organic Pigment Dispersion Market. Manufacturers prioritize low-VOC and recyclable formulations to meet green standards. It helps reduce environmental footprint while serving industrial demand. Eco-friendly pigment dispersions find applications in paints, plastics, and packaging. French industries actively adopt bio-based solutions to meet consumer expectations. This trend reflects both corporate responsibility and regulatory compliance. Companies seek certifications that highlight safe product use. Market competitiveness depends on sustainable formulation development across industries.

- For example, Eagle Specialty Products provides H2LOW-VOC pigment dispersions, a water-based line formulated with VOC levels below 50 g/L. Using 100% prime pigments, the range offers high color strength, excellent lightfastness, and strong heat and bleed resistance, supporting eco-friendly uses such as LEED-compliant and green-certified architectural coatings.

Digital Printing Expansion Encouraging Use Of High-Quality Pigment Dispersions

Digital printing growth creates new trends in the France In-Organic Pigment Dispersion Market. High-quality pigments improve sharpness and color vibrancy in digital formats. It ensures long-lasting results across labels and flexible packaging. Digital printing demand grows in food, pharmaceutical, and retail industries. Companies require pigments that deliver stable performance in advanced printing systems. Dispersions compatible with digital platforms attract strong interest. This trend links to rising consumer preference for personalized packaging. High-definition printing needs are reshaping pigment dispersion demand in France.

Product Customization And Innovation To Meet Industry-Specific Applications

Customization trends shape the France In-Organic Pigment Dispersion Market. Industries seek pigment dispersions designed for unique applications. It ensures compatibility with coatings, plastics, and specialty materials. Companies introduce formulations with tailored color strength and stability. Innovation drives growth in industrial and consumer applications. Collaboration between suppliers and manufacturers creates specialized solutions. Custom pigments serve industries like automotive, electronics, and healthcare. This approach increases market opportunities through targeted product innovation.

- For example, Achitex Minerva Group offers Minerprint® pigment dispersions—water-based, finely homogeneous formulations ideal for textile printing. Certain products, including Minerprint® Prime Lacquer NFO and Minerprint® White SBN, carry top-tier sustainability certifications: ZDHC Confidence Level 3, bluesign® approval, and GOTS 6.0 for advanced environmental compliance and safety in industrial applications.

Market Challenges Analysis

High Raw Material Costs And Supply Chain Limitations Affecting Stability

The France In-Organic Pigment Dispersion Market faces challenges due to volatile raw material prices. Fluctuations in supply of minerals and chemicals impact production costs. It reduces profit margins for manufacturers while increasing pressure on pricing. Dependence on global supply chains makes companies vulnerable to disruptions. Trade policies and logistical delays worsen material shortages. Rising costs create difficulties for small and mid-sized suppliers. Companies struggle to maintain affordability without compromising quality. Competitive pricing remains difficult in such fluctuating conditions.

Regulatory Pressures And Competition From Organic Alternatives Influencing Growth

Strict regulations challenge the France In-Organic Pigment Dispersion Market. European policies require compliance with safety and environmental standards. It forces producers to redesign formulations and invest in certifications. Compliance increases operational costs, limiting smaller competitors. Growing popularity of organic pigments creates direct competition. Organic alternatives appeal to industries prioritizing sustainability. Innovation and compliance demand significant investment from manufacturers. This challenge tests the ability of companies to balance performance, cost, and regulation.

Market Opportunities

Emerging Adoption In Advanced Coatings And Specialty Applications Offering New Potential

The France In-Organic Pigment Dispersion Market shows opportunities in advanced coatings. Specialty coatings for aerospace, marine, and industrial equipment drive adoption. It supports demand for pigments with high durability and resistance. French industries explore dispersions for electronics and renewable energy applications. Growth of these sectors creates new end-user opportunities. High-performance pigments meet specialized requirements across demanding environments. Companies with innovation capacity capture growth from these evolving applications. Opportunities expand through diversification into advanced material solutions.

Sustainability-Driven Innovations Creating Demand For Green Pigment Dispersions

Sustainability opens opportunities for the France In-Organic Pigment Dispersion Market. Green pigment formulations attract industries aiming for eco-certifications. It helps companies align with consumer preference for safe and recyclable products. Research in bio-based pigments enables new product lines for packaging and coatings. France’s environmental focus encourages adoption of low-impact dispersions. Manufacturers investing in sustainable R&D strengthen their competitive edge. Opportunities arise from alignment with global sustainability targets. This focus positions France as a leader in sustainable pigment adoption.

Market Segmentation Analysis

By pigment type, the France In-Organic Pigment Dispersion Market is dominated by titanium dioxide, which provides opacity and brightness across coatings and plastics. Iron oxide follows with strong use in construction materials, ceramics, and paints requiring durability. Carbon black remains essential in plastics and inks due to its color strength and conductivity. Ultramarine blue and chromium oxide serve niche demand in decorative coatings and ceramics. Cadmium pigments are restricted but still used in specialized applications. Zinc oxide plays a growing role in cosmetics and protective coatings. Other pigments address customized industrial needs with tailored properties.

- For instance, Tronox markets the TiONA® range of titanium dioxide pigments with advanced chloride process technology, creating products such as TiONA® 233 designed for plastics offering excellent color stability and UV resistance, ensuring durable brightness retention in automotive and architectural coatings.

By application, paints and coatings hold the largest share in the France In-Organic Pigment Dispersion Market due to strong demand from construction and automotive sectors. Printing inks utilize dispersions for packaging, labeling, and digital printing growth. Plastics applications expand with packaging innovations and industrial material use. Construction materials continue to require durable pigments for decorative and protective purposes. Ceramics and glass benefit from color-stable dispersions in tiles, sanitary ware, and specialty glass. Cosmetics applications are supported by safe, regulated pigments offering vibrant shades. Other uses span across electronics and niche industrial processes where dispersions deliver performance and consistency.

- For example, Novacentrix’s water-based HPR-059 conductive carbon black ink demonstrates resistivity of 0.7 to 0.9 ohm-cm (curing at minimum 100°C), applied in flexible packaging and printed electronics requiring water cleanup and good adhesion.

Segmentation

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

Regional Analysis

Northern France

Northern France holds 38% share of the France In-Organic Pigment Dispersion Market, supported by strong industrial bases and established automotive production hubs. The region benefits from advanced manufacturing clusters, where pigments serve coatings and plastics. It is driven by demand from urban infrastructure and export-focused industries. Local suppliers focus on innovation in titanium dioxide and iron oxide formulations. Strong logistics and trade routes enhance access to European markets. Northern France remains a critical subregion for high-value pigment adoption.

Central France

Central France accounts for 34% share of the France In-Organic Pigment Dispersion Market, driven by its diverse applications in construction, paints, and ceramics. The region supports demand from commercial infrastructure and cultural preservation projects. It shows steady growth with rising use of eco-friendly dispersions in architectural coatings. Local manufacturers adapt product lines to meet strict sustainability standards. It benefits from institutional investment in green technologies. Strong demand from the building and decorative sectors maintains Central France’s competitive role in the market.

Southern France

Southern France contributes 28% share of the France In-Organic Pigment Dispersion Market, reflecting its growing reliance on packaging, cosmetics, and specialty coatings. The region benefits from vibrant consumer markets and active use in personal care industries. It shows expansion in pigments for flexible packaging and food-contact materials. The cosmetics sector boosts adoption of safe and color-stable dispersions. Southern France also leverages its ports for import-export activities, strengthening supply networks. It continues to position itself as a growth-oriented subregion with diversified applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Huntsman Corporation

- Chromaflo

Competitive Analysis

The France In-Organic Pigment Dispersion Market demonstrates a highly competitive landscape with strong presence of global and regional players. BASF SE and Clariant AG lead the market with extensive product portfolios in titanium dioxide and iron oxide dispersions. It benefits from their innovation in eco-friendly and low-toxicity formulations, catering to regulatory standards. Heubach GmbH and Lanxess AG focus on specialty pigments for coatings and plastics, strengthening their positions in industrial applications. Venator Materials PLC and Cabot Corporation expand through technological advancements in carbon black and ultramarine pigments. Huntsman Corporation and Sudarshan Chemical Industries target growth through diversified pigment offerings and strategic partnerships. Chromaflo and Ferro Corporation build market presence by serving niche demand in ceramics and packaging. The competitive environment remains shaped by innovation, regulatory compliance, and product differentiation, ensuring strong rivalry across the French pigment dispersion market.

Recent Developments

- In May 2025, BASF SE announced the successful startup of a new world-scale hexamethylenediamine (HMD) plant in Chalampé, France, which strengthens their position as a leading supplier in the polyamide 6.6 value chain for various high-performance coatings and composites relevant to the in-organic pigment dispersion market. In the same month, BASF also signed an agreement to acquire DOMO Chemicals’ 49% stake in their French Alsachimie joint venture, aiming for 100% ownership to further optimize production and supply of polyamide precursors vital for the regional pigment industry.

- In March 2025, Venator introduced the TIOXIDE® TR81 pigment, a TMP- and TME-free titanium dioxide (TiO₂) product, marking a notable advancement in sustainable inorganic pigment technology for the French market.

- In June 2025, Clariant AG launched HOSTAPHAT OPS 100, a dispersing agent specifically developed for metal-containing pigments and their dispersions, supporting advanced pigment preparations in industrial coatings and related markets.

- In May 2025, BASF SE introduced Pluriol® A 2400 I, a new reactive polyethylene glycol designed for polycarboxylate ethers used in construction, which also serves as a dispersant for inorganic pigments, helping deliver higher performance and improved sustainability for pigment dispersion applications in Europe.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth in architectural coatings will remain a leading driver supported by urban renovation projects.

- Expanding automotive production will strengthen demand for dispersions with durability and aesthetic appeal.

- Eco-friendly pigment innovations will gain traction under strict European environmental standards.

- Digital printing applications will open new opportunities in packaging and labeling sectors.

- Cosmetics and personal care will drive niche demand for safe, color-stable dispersions.

- Infrastructure development will push adoption of pigments in construction materials and ceramics.

- Specialty coatings for aerospace and marine industries will support high-performance pigment use.

- Strategic investments in R&D will differentiate leading players in the competitive landscape.

- Supply chain improvements will enhance access to raw materials and stabilize production.

- Sustainable manufacturing practices will guide long-term growth of the France In-Organic Pigment Dispersion Market.