Market Overview:

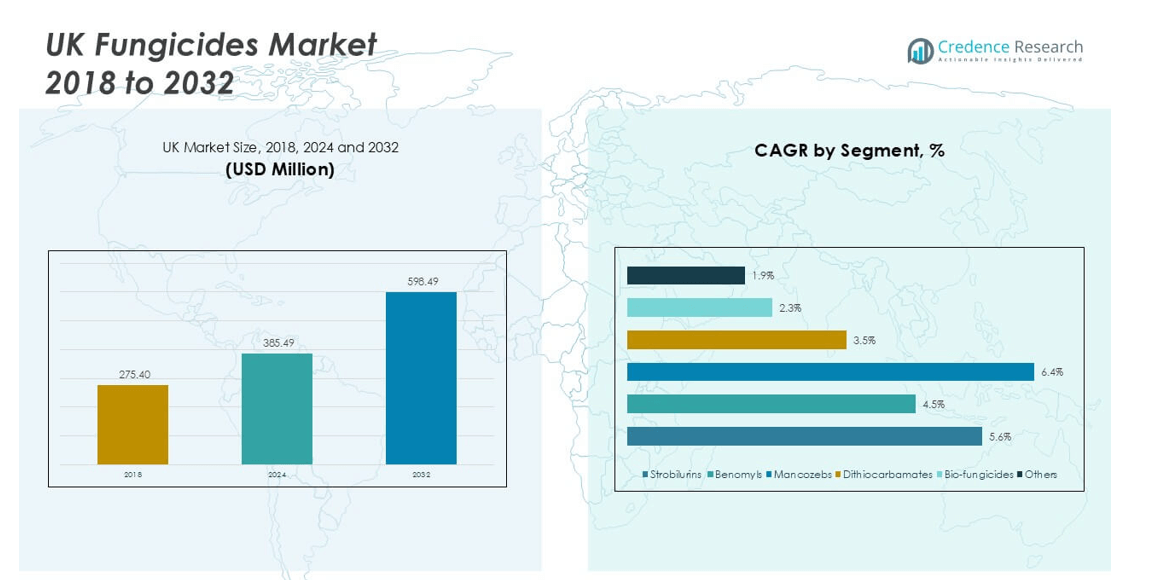

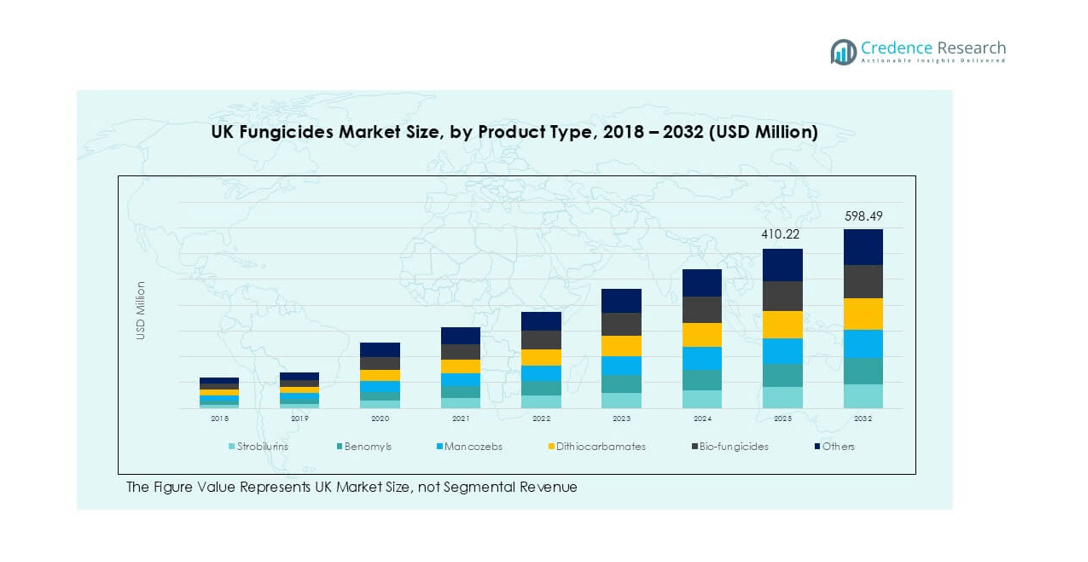

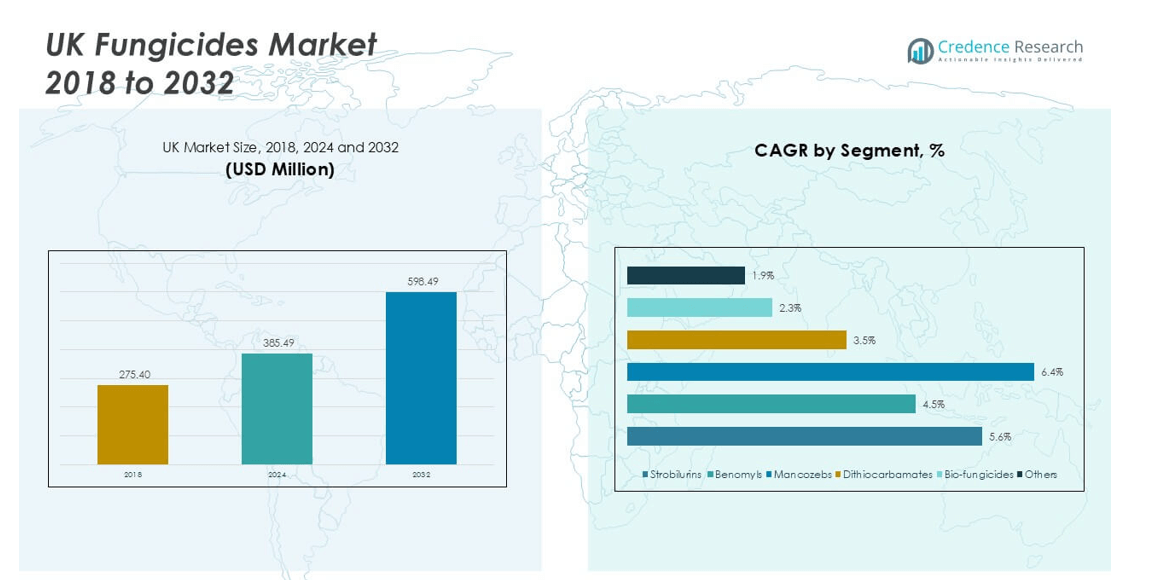

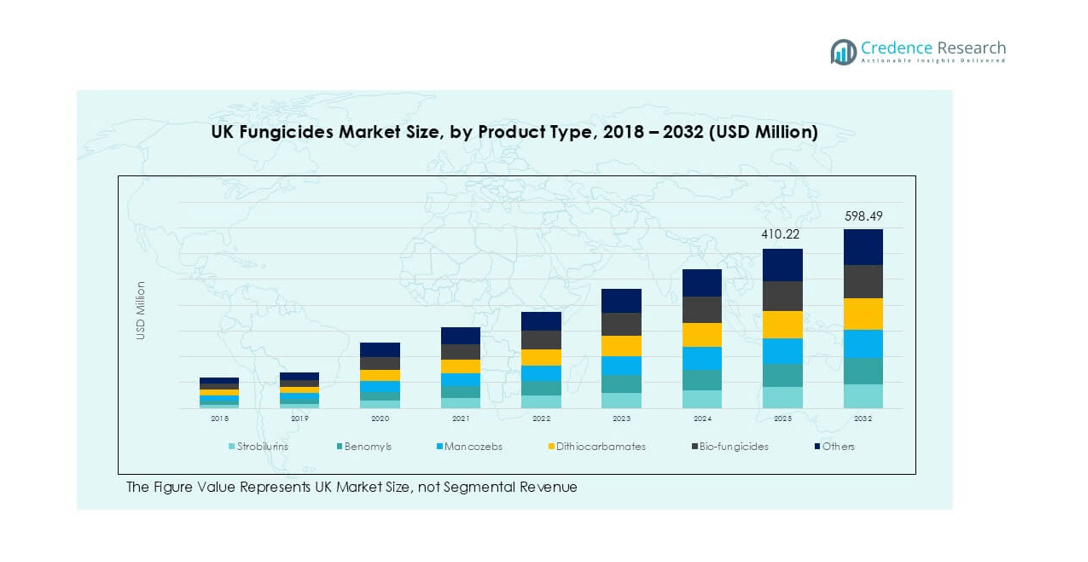

The UK Fungicides market size was valued at USD 275.40 million in 2018 to USD 385.49 million in 2024 and is anticipated to reach USD 598.49 million by 2032, at a CAGR of 5.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Fungicides Market Size 2024 |

USD 385.49 million |

| UK Fungicides Market , CAGR |

5.54% |

| UK Fungicides Market Size 2032 |

USD 598.49 million |

The UK fungicides market is led by major players including BASF SE, Bayer AG (Bayer CropScience), Syngenta Group, Corteva Agriscience, FMC Corporation, UPL Limited, ADAMA Agricultural Solutions Ltd., Nufarm Limited, Sumitomo Chemical Co., Ltd., and Cheminova A/S. These companies dominate through extensive product portfolios covering strobilurins, mancozebs, dithiocarbamates, and bio-fungicides, supported by strong distribution networks and R&D investments. England holds the largest regional share at 55%, driven by large-scale wheat, barley, and horticultural production, while Scotland, Wales, and Northern Ireland collectively account for the remaining 45%. The concentration of high-value crops and export-oriented farming in England ensures its leadership in fungicide demand, reinforcing the dominance of global players in the region.

Market Insights

- The UK Fungicides market was valued at USD 275.40 million in 2018, reached USD 385.49 million in 2024, and is projected to hit USD 598.49 million by 2032, at a CAGR of 5.54%.

- Rising crop disease incidence across wheat, barley, potatoes, and fruits drives consistent fungicide demand, with strobilurins dominating product type segments due to broad-spectrum effectiveness.

- Bio-fungicides emerge as a strong trend, supported by consumer preference for organic produce and regulatory restrictions on chemical fungicides, creating opportunities for eco-friendly solutions.

- Leading companies such as BASF SE, Bayer AG, and Syngenta Group dominate through extensive portfolios and R&D, while Nufarm and ADAMA focus on cost-effective offerings to strengthen market reach.

- England accounts for 55% of regional share, Scotland 20%, Wales 15%, and Northern Ireland 10%, with fruits and vegetables as the leading application segment supported by high-value horticulture and export demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Strobilurins hold the dominant share in the UK fungicides market, driven by their broad-spectrum activity and effectiveness against resistant fungal strains. They account for the largest market portion due to wide use in cereals, fruits, and vegetables. Strobilurins provide higher yield benefits and longer protection periods, which make them a preferred choice among growers. Rising adoption of integrated pest management practices further strengthens their position. Bio-fungicides are also gaining momentum, supported by consumer demand for organic produce and regulatory pressure on chemical residues.

- For instance, in 2022, BASF’s Agricultural Solutions segment reported a considerable increase in sales for Europe, driven primarily by higher prices and strong volume growth, particularly for fungicides and herbicides.

By Application

Fruits and vegetables represent the leading application segment, holding the highest share in the UK fungicides market. High-value crops like berries, apples, and potatoes rely heavily on fungicides to control late blight, powdery mildew, and other diseases. This dominance stems from the economic importance of horticulture in the UK and the need for quality preservation in exports. Cereals and grains also remain a key sub-segment, supported by consistent demand in wheat and barley farming. Increasing focus on food security and sustainable crop protection continues to drive growth in this category.

- For instance, Syngenta’s fungicide Revus was used for potato late blight management in the UK during 2022, a year in which the total harvested potato area was approximately 115,000 hectares.

Market Overview

Rising Incidence of Crop Diseases

The increasing prevalence of fungal infections across UK farmlands is a major driver for fungicide adoption. Crops like wheat, barley, potatoes, and fruits are vulnerable to diseases such as rusts, blights, and powdery mildew, which can significantly reduce yields. Farmers adopt strobilurins, mancozebs, and bio-fungicides to ensure crop health and productivity. Rising disease pressure due to climate fluctuations further accelerates product demand. Ensuring food security and minimizing economic losses encourages continuous use of modern and effective fungicides.

- For instance, Syngenta markets the fungicide Elatus Era, which contains SDHI and triazole chemistry, for use on UK wheat and barley to control rusts and mildew.

Shift Toward High-Value Horticultural Crops

The expansion of fruit and vegetable cultivation fuels fungicide consumption in the UK market. High-value crops, including apples, strawberries, and potatoes, demand intensive protection from fungal pathogens to maintain quality and export standards. Farmers prioritize advanced fungicide formulations to safeguard yields and reduce spoilage. The profitability of horticultural farming enhances demand for both chemical and bio-fungicides. This trend strengthens the application dominance of horticultural crops within the market, creating consistent demand for protective solutions.

- For instance, Custodia is one of a variety of fungicides used in UK apple orchards to control powdery mildew and scab. The total area of apple orchards in the UK is significantly less than 12,000 hectares.

Supportive Regulatory and Policy Framework

Government policies promoting crop protection and productivity further drive fungicide adoption in the UK. Farmers benefit from advisory programs and crop protection guidelines, which emphasize sustainable fungicide use. While regulators push for safer and eco-friendly products, they also recognize the critical role fungicides play in securing staple crops. This dual approach supports both chemical and bio-based fungicide segments. Investment in R&D for sustainable formulations aligns with policy directions, ensuring long-term market growth while complying with safety and environmental norms.

Key Trends & Opportunities

Rising Demand for Bio-Fungicides

Growing consumer preference for organic produce creates opportunities for bio-fungicides in the UK market. Farmers increasingly adopt biological solutions to reduce chemical residues while maintaining effectiveness against crop diseases. Regulatory restrictions on certain chemical fungicides further support this transition. Companies invest in microbial-based products to meet sustainability goals and market demand. The trend presents strong growth opportunities for innovative players focusing on natural and eco-friendly crop protection products.

- For instance, Bayer CropScience markets its Serenade ASO bio-fungicide, based on the microorganism Bacillus amyloliquefaciens (formerly known as Bacillus subtilis QST 713), as suitable for use in organic farming in the UK.

Integration of Precision Farming Technologies

The adoption of precision agriculture tools opens opportunities for targeted fungicide application. Farmers employ drones, smart sprayers, and digital monitoring to optimize dosage and minimize waste. This improves cost efficiency while ensuring effective crop protection. Data-driven solutions help track disease outbreaks and predict fungicide requirements, reducing environmental impact. Integration with precision farming enhances fungicide effectiveness and aligns with sustainability objectives, presenting strong growth potential for technologically advanced players.

Key Challenges

Regulatory Restrictions on Chemical Fungicides

Stringent EU and UK regulations limit the use of certain chemical fungicides, impacting product availability. Active ingredients such as benomyls and dithiocarbamates face increasing scrutiny due to environmental and health concerns. Compliance costs rise for manufacturers as they reformulate or seek approvals for safer alternatives. Farmers also face limited choices in managing resistant pathogens, which raises the risk of crop losses. These restrictions challenge market players but simultaneously open opportunities for bio-fungicide growth.

Growing Resistance Among Pathogens

Pathogen resistance to widely used fungicides presents a major challenge in the UK market. Over-reliance on strobilurins and other chemical groups leads to reduced effectiveness over time. Resistant strains of mildew, rust, and blight force farmers to rotate or combine fungicides, increasing costs. This situation threatens yield stability and complicates crop protection strategies. The industry must invest in innovation, integrated pest management, and new formulations to counteract resistance and ensure long-term effectiveness of fungicides.

Regional Analysis

England

England holds the dominant share of the UK fungicides market, accounting for over 55% of total demand. The region’s leadership stems from extensive cereal and horticultural production, particularly wheat, barley, apples, and potatoes. Farmers in England adopt advanced fungicide solutions, including strobilurins and bio-fungicides, to safeguard high-value crops from persistent fungal infections such as rusts and blights. The strong export base for fruits and vegetables further supports demand for quality-preserving crop protection solutions. Investments in precision farming technologies and sustainable crop management practices continue to enhance fungicide adoption across the region.

Scotland

Scotland represents nearly 20% of the UK fungicides market, driven by its large-scale cereal and potato cultivation. The region’s cool and wet climate makes crops highly susceptible to fungal diseases like late blight and mildew, increasing reliance on fungicide applications. Wheat and barley remain key crops, requiring consistent disease management practices to maintain yield stability. Farmers also prioritize eco-friendly products to comply with sustainability standards. Scotland’s agricultural landscape, combined with supportive policies for crop protection, reinforces the steady demand for fungicides, particularly in strobilurins and mancozeb formulations.

Wales

Wales contributes around 15% of the UK fungicides market, with its farming sector focused on cereals, horticulture, and pasture crops. Fungicide adoption is significant in fruit and vegetable cultivation, especially in protecting strawberries and apples from fungal infestations. Wet conditions in certain regions increase the vulnerability of crops, making disease prevention a priority for growers. Farmers increasingly combine chemical fungicides with bio-fungicides to ensure compliance with environmental regulations while maintaining yield quality. The regional focus on sustainable farming practices drives steady growth in fungicide usage across diverse crop applications.

Northern Ireland

Northern Ireland accounts for nearly 10% of the UK fungicides market, supported by its active horticulture and cereal cultivation. The potato sector plays a central role, requiring intensive fungicide treatments to protect against late blight and similar fungal threats. Farmers also use fungicides extensively in barley and wheat farming to ensure consistent productivity. Growing export activities in agri-food products strengthen the importance of reliable crop protection measures. Adoption of bio-fungicides is gradually increasing in response to stricter EU-aligned regulations, providing opportunities for sustainable fungicide solutions in the regional market.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK fungicides market is characterized by strong competition among global and regional agrochemical companies that focus on innovation, regulatory compliance, and product diversification. BASF SE, Bayer AG, and Syngenta Group lead the market with extensive portfolios of strobilurins, triazoles, and bio-fungicides tailored to key UK crops such as wheat, barley, potatoes, and apples. Corteva Agriscience, FMC Corporation, and UPL Limited strengthen their positions through advanced formulations and integrated crop protection services. ADAMA Agricultural Solutions and Nufarm Limited focus on cost-effective products and regional market coverage, while Sumitomo Chemical and Cheminova A/S contribute through niche fungicide offerings and UK-specific operations. Companies increasingly invest in bio-based solutions to align with strict EU and UK regulatory standards and respond to rising demand for sustainable crop protection. Strategic collaborations, digital farming integration, and targeted research remain central to maintaining competitiveness in a market driven by disease resistance challenges and sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG (Bayer CropScience)

- Syngenta Group

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- ADAMA Agricultural Solutions Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd. (UK operations)

- Cheminova A/S

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK fungicides market will grow steadily with rising demand for sustainable crop protection.

- Bio-fungicides will gain strong adoption due to stricter chemical regulations and organic farming expansion.

- Strobilurins will maintain dominance, but product diversification will increase with new active ingredients.

- Precision agriculture tools will enhance targeted fungicide application and improve efficiency.

- Resistance management strategies will drive demand for integrated pest management solutions.

- High-value crops like fruits and vegetables will continue leading fungicide consumption.

- England will retain its dominant regional share supported by large-scale cereal and horticultural production.

- Scotland and Wales will see faster growth due to increasing potato and fruit farming needs.

- Leading companies will invest in R&D for eco-friendly and advanced fungicide formulations.

- Digital platforms and farm advisory services will play a bigger role in guiding fungicide use.