Market Overview

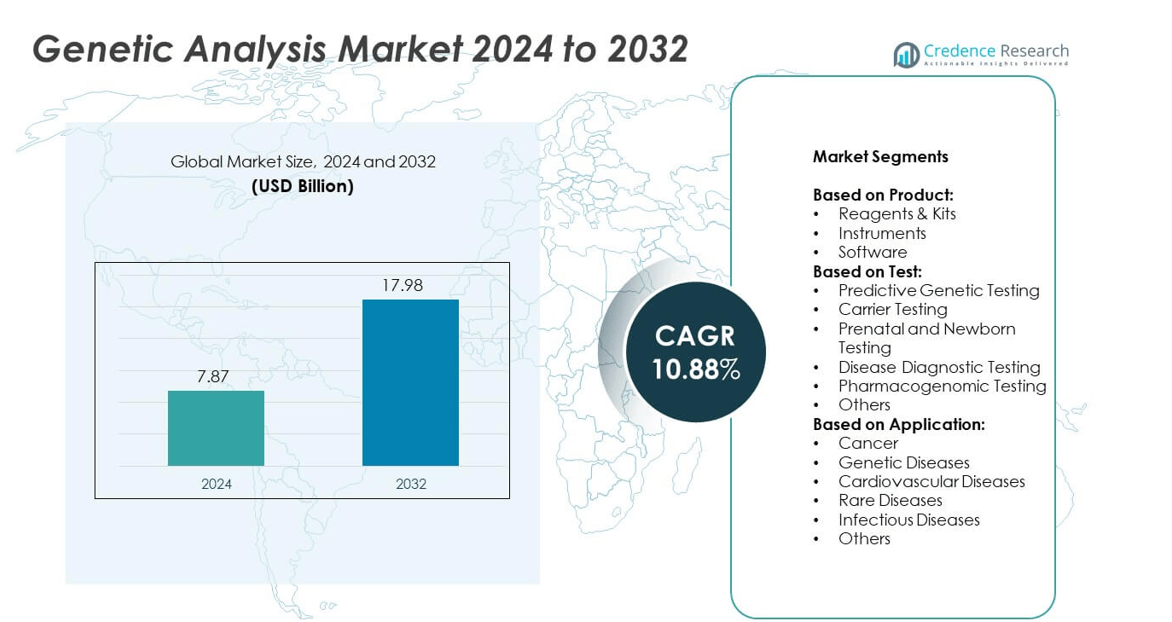

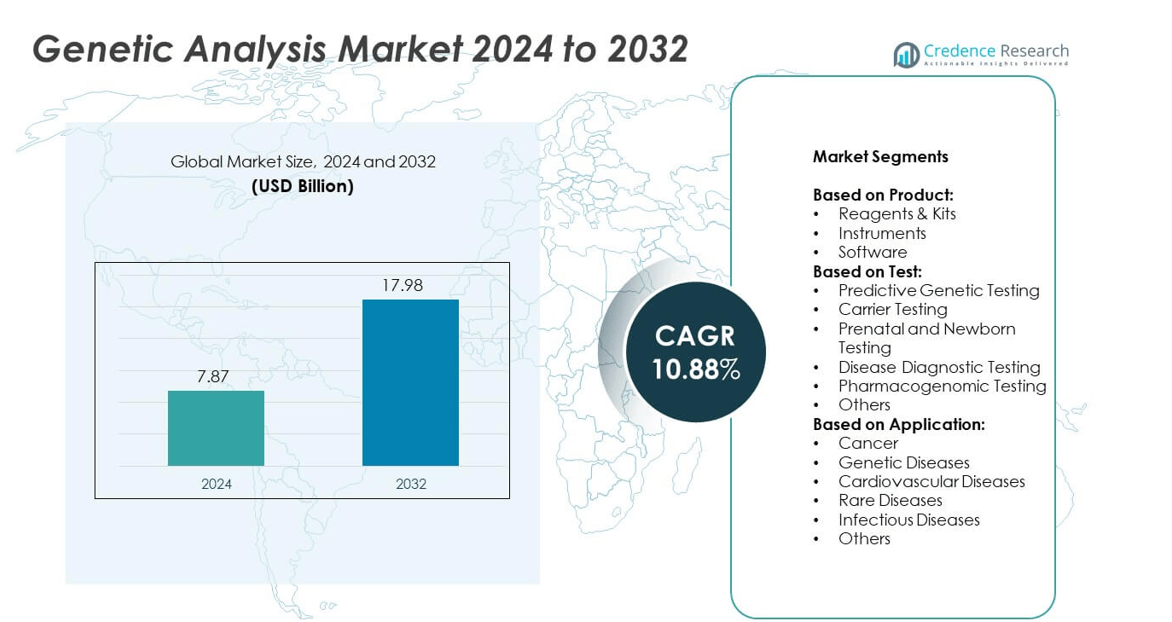

The genetic analysis market size was valued at USD 7.87 billion in 2024 and is projected to reach USD 17.98 billion by 2032, registering a CAGR of 10.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Genetic Analysis Market Size 2024 |

USD 7.87 billion |

| Genetic Analysis Market, CAGR |

10.88% |

| Genetic Analysis Market Size 2032 |

USD 17.98 billion |

The genetic analysis market grows with rising demand for precision medicine and early disease detection. Technological advances in next-generation sequencing and AI-driven analytics improve accuracy and speed of results. Government initiatives and funding for population-scale genomics projects support adoption. It benefits from growing awareness of preventive healthcare and availability of direct-to-consumer genetic testing kits. Expanding use in drug discovery and companion diagnostics further strengthens market potential. The trend toward personalized medicine drives continuous investment in research and development.

North America leads the genetic analysis market due to advanced healthcare infrastructure and strong adoption of genomic technologies. Europe follows with robust government initiatives supporting precision medicine and population-wide screening programs. Asia-Pacific shows rapid growth driven by improving healthcare access and large-scale genome mapping projects. Key players driving the market include Quest Diagnostics Inc., Qiagen, Hoffmann-La Roche AG, and Thermo Fisher Scientific, focusing on innovation, partnerships, and expanded product offerings to strengthen their presence across developed and emerging markets.

Market Insights

- The genetic analysis market was valued at USD 7.87 billion in 2024 and is projected to reach USD 17.98 billion by 2032, growing at a CAGR of 10.88%.

- Rising demand for precision medicine and early disease diagnosis drives adoption of genetic testing solutions.

- Advancements in next-generation sequencing, AI-powered analytics, and cloud platforms improve accuracy and reduce turnaround time.

- The market is competitive with major players focusing on innovation, partnerships, and expansion into emerging markets.

- High testing costs and limited reimbursement policies remain key challenges for broader adoption, especially in developing regions.

- North America leads with strong infrastructure and research funding, followed by Europe with robust genomics initiatives and Asia-Pacific showing fastest growth.

- Growing government support for population-scale genomics projects and rising use of pharmacogenomics in drug development create long-term opportunities for market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Precision Medicine and Personalized Healthcare

The genetic analysis market benefits from the rapid adoption of precision medicine approaches. Healthcare providers rely on genetic testing to tailor treatments for cancer, cardiovascular, and rare diseases. Growing awareness among patients drives early diagnostic adoption. Pharmaceutical companies use genetic data to design targeted therapies and reduce trial failures. It supports the shift toward predictive and preventive healthcare models. The trend enhances clinical outcomes and reduces overall treatment costs.

- For instance, GeneDx reported 74,547 exome and genome test results in 2024, an increase of 51% compared to the prior year.

Technological Advancements in Genetic Testing Tools and Platforms

Innovations in next-generation sequencing and microarray technologies strengthen the genetic analysis market. Automated workflows and AI-driven data interpretation improve speed and accuracy of results. Cost reductions make genetic testing more accessible for hospitals and diagnostic labs. It encourages integration into routine clinical practice. Cloud-based platforms support large-scale genomic data storage and analysis. Advancements allow deeper insights into complex genetic disorders.

- For instance, Genetic Analysis AS’ core product, the GA-map Dysbiosis Test, achieved 37% growth year-to-date December 2024 compared to 2023 and reached NOK 13.2 million in revenue for that product alone.

Supportive Regulatory Frameworks and Government Initiatives

Favorable policies promote genetic testing adoption across developed and emerging economies. Governments fund population-scale genomic programs to advance research and precision medicine. Public health agencies encourage screening for hereditary conditions. It creates strong demand for genetic testing services in national health programs. Partnerships between public and private sectors accelerate research translation into clinical use. Clear regulatory pathways build trust and standardization in test quality.

Growing Role of Genetic Testing in Drug Development and Clinical Trials

Pharmaceutical companies integrate genetic analysis to identify drug responders and improve safety. Companion diagnostics gain traction for targeted therapies in oncology and rare diseases. The genetic analysis market supports biomarker discovery and patient stratification. It helps reduce trial duration and improves approval success rates. Collaboration between biotech firms and CROs expands genetic testing capacity for global studies. Rising investment in pharmacogenomics fuels long-term market expansion.

Market Trends

Expansion of Direct-to-Consumer Genetic Testing Services

The genetic analysis market observes strong growth in direct-to-consumer testing. Companies offer at-home kits for ancestry, health risk, and trait analysis. Rising consumer awareness supports demand for convenient genetic insights. It improves access to genetic data without clinical visits. Digital platforms enable secure data sharing with healthcare providers. The trend encourages proactive health management among consumers.

- For instance, As of April 2025, the Emirati Genome Programme has sequenced the genetic data of more than 800,000 Emiratis. This places the UAE on track to sequence the entire Emirati population of approximately 1 million citizens. M42, a technology-enabled healthcare company, is a partner in the project.

Integration of Artificial Intelligence and Big Data in Genomics

AI tools transform how genomic data is processed and interpreted. The genetic analysis market leverages machine learning for faster variant classification. Big data analytics uncovers links between genes and diseases with higher precision. It supports drug discovery and personalized treatment planning. Cloud-based AI platforms enable real-time collaboration among researchers. The approach reduces errors and improves diagnostic accuracy.

- For instance, Natera, Inc. processed approximately 188,800 oncology tests in the second quarter of 2025, an increase from the approximately 125,400 tests performed in the second quarter of 2024. This represents an increase of 50.6% year-over-year.

Shift Toward Population-Scale Genomics and Screening Programs

Governments and research institutions invest in large-scale genome mapping projects. The genetic analysis market benefits from national initiatives focused on public health. These programs identify genetic risk factors across populations. It improves disease prevention strategies and guides policy decisions. Partnerships between genomic labs and healthcare systems expand access to testing. Such efforts strengthen global genetic databases for future research.

Growing Adoption of Multi-Omics and Integrated Diagnostics

Multi-omics combines genomics, proteomics, and metabolomics for comprehensive insights. The genetic analysis market sees demand for integrated platforms in research and clinics. It enhances understanding of complex diseases and treatment response. Researchers use combined data to uncover novel biomarkers. Pharmaceutical firms adopt multi-omics to optimize drug pipelines. The trend supports precision medicine and personalized care models.

Market Challenges Analysis

High Cost of Genetic Testing and Limited Reimbursement Policies

The genetic analysis market faces barriers due to high testing costs. Many advanced sequencing technologies remain expensive for routine use. Limited insurance coverage reduces patient access to genetic testing in several regions. It slows adoption in low- and middle-income countries. Hospitals and clinics often hesitate to integrate tests without financial support. Cost pressure also affects smaller laboratories and research institutions. Wider reimbursement frameworks are needed to accelerate adoption.

Data Privacy Concerns and Regulatory Complexity

Growing volumes of genomic data create privacy and security challenges. The genetic analysis market must comply with strict regulations such as GDPR and HIPAA. It requires secure storage and sharing systems to protect patient information. Data breaches can reduce public trust in genetic testing. Complex approval processes delay launch of new tests in some countries. Companies invest in compliance and cybersecurity, which raises operational costs. Strong governance is vital for sustained market growth.

Market Opportunities

Emerging Demand in Developing Regions and Expanding Healthcare Access

The genetic analysis market has strong opportunities in Asia-Pacific, Latin America, and Africa. Rising healthcare spending and improving diagnostic infrastructure support market penetration. Governments invest in population screening programs to detect genetic disorders early. It creates a wider customer base for testing service providers. Growing awareness of preventive healthcare encourages adoption in urban areas. Partnerships with local labs and clinics help global companies enter new markets. These regions offer long-term growth potential due to large patient populations.

Advancement of Personalized Medicine and Companion Diagnostics

Pharmaceutical and biotech companies expand research in pharmacogenomics and biomarker-driven therapies. The genetic analysis market plays a central role in enabling targeted drug development. It allows identification of responders and non-responders, improving clinical outcomes. Demand for companion diagnostics grows with approvals of precision therapies in oncology and rare diseases. Integration of genetic testing into routine care supports more efficient treatment planning. Collaborations between diagnostic firms and drug developers create new revenue streams. Rising investment in R&D strengthens innovation across the industry.

Market Segmentation Analysis:

By Product:

Reagents and kits hold the largest share in the genetic analysis market due to their recurring demand and essential role in testing workflows. These consumables are critical for PCR, sequencing, and genotyping procedures. Instruments, including sequencers and analyzers, contribute significantly with rising installation in clinical and research laboratories. It benefits from automation and improved throughput that reduce turnaround times. Software solutions gain momentum as genomic data interpretation becomes more complex. AI-powered platforms enable fast analysis and support clinical decision-making.

- For instance, Myriad Genetics saw hereditary cancer testing volume in oncology rise about 14% year-over-year in Q2 2025, especially through its MyRisk with RiskScore tests.

By Test:

Disease diagnostic testing dominates the market with high use in oncology, infectious disease detection, and genetic screening. Predictive genetic testing grows steadily with rising focus on risk assessment for hereditary cancers and chronic disorders. Carrier testing remains crucial for couples planning pregnancies, helping reduce the risk of passing on genetic conditions. It supports early interventions and family planning decisions. Prenatal and newborn testing is widely adopted under national health programs to identify disorders at birth. Pharmacogenomic testing expands with the approval of targeted therapies that require companion diagnostics. Other tests cover lifestyle and ancestry segments appealing to consumer health markets.

- For instance, Grail, Inc. sold more than 137,000 Galleri® multi-cancer early detection tests in 2024, growing its U.S. test volume significantly

By Application:

Cancer leads the segment due to the critical need for early diagnosis and targeted therapy selection. Genetic diseases account for significant demand driven by rare disease research initiatives. It helps clinicians develop personalized treatment plans and improve outcomes. Cardiovascular disease testing supports detection of inherited conditions such as cardiomyopathies. Rare disease testing gains importance with expanding orphan drug development efforts. Infectious disease testing integrates with molecular diagnostics for rapid pathogen identification. Other applications include neurological and metabolic disorders, broadening the overall adoption of genetic testing solutions.

Segments:

Based on Product:

- Reagents & Kits

- Instruments

- Software

Based on Test:

- Predictive Genetic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Disease Diagnostic Testing

- Pharmacogenomic Testing

- Others

Based on Application:

- Cancer

- Genetic Diseases

- Cardiovascular Diseases

- Rare Diseases

- Infectious Diseases

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the genetic analysis market, accounting for 39% in 2024. The region benefits from advanced healthcare infrastructure, strong research funding, and early adoption of innovative testing technologies. High prevalence of chronic diseases such as cancer and cardiovascular disorders drives demand for genetic testing solutions. It also supports large-scale genomic projects like the All of Us Research Program, which fuels data collection and personalized medicine initiatives. The presence of leading companies and well-established diagnostic laboratories further strengthens the market. Favorable reimbursement policies for genetic tests encourage hospitals and clinics to integrate them into routine care. Rising awareness among patients and physicians continues to expand the adoption of predictive and preventive genetic testing services across the region.

Europe

Europe represents a significant share of the market, contributing 28% in 2024. The region shows strong focus on precision medicine through EU-backed programs and national genomics initiatives. Countries such as the UK, Germany, and France invest heavily in next-generation sequencing infrastructure to support cancer and rare disease diagnostics. It benefits from strict regulatory frameworks that ensure high-quality standards for genetic testing. Growing collaboration between academic institutes and biotechnology companies drives innovation in genomic data analysis. Population-wide screening programs expand access to early disease detection and prevention. Rising healthcare spending and public awareness encourage broader use of genetic counseling services across the region.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions, holding 22% of the global share in 2024. Rapidly developing healthcare systems in China, India, and Japan create strong opportunities for market growth. Government initiatives, such as genome mapping projects, support research and precision medicine development. It experiences increasing demand for prenatal, carrier, and disease diagnostic testing due to a large population base and rising birth rates. Expanding medical tourism also contributes to adoption of advanced diagnostics. Local companies invest in cost-effective testing solutions to meet the needs of price-sensitive markets. Growing partnerships with global players accelerate technology transfer and improve access to high-quality genetic testing services.

Latin America

Latin America captures 7% of the genetic analysis market in 2024, with steady growth potential. Brazil and Mexico lead regional adoption supported by public health programs and investments in molecular diagnostics. Rising burden of infectious diseases and genetic disorders creates demand for advanced screening solutions. It benefits from improving healthcare infrastructure and growing awareness of preventive medicine. Partnerships between regional laboratories and multinational companies enhance testing capacity and service availability. Increasing government focus on expanding access to diagnostic tools supports long-term growth. The region continues to adopt cost-effective solutions tailored to local needs.

Middle East and Africa

The Middle East and Africa account for 4% of the total market in 2024, representing a nascent but growing segment. Demand is rising due to higher prevalence of genetic disorders in certain populations and growing interest in prenatal and carrier screening. It faces challenges from limited infrastructure and high cost of advanced testing, yet investments in healthcare modernization are improving access. Countries such as the UAE and Saudi Arabia lead adoption through national genomics programs. International collaborations are helping to build local capacity for genetic counseling and sequencing. Awareness campaigns and private sector investments are gradually expanding market reach in underserved areas. The region holds long-term potential with increasing focus on precision medicine initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Quest Diagnostics Inc.

- Qiagen

- AutoGenomics Inc.

- Hoffmann-La Roche AG

- Danaher (Cepheid)

- BioRad Laboratories

- Celera Group

- IntegraGen

- Thermo Fisher Scientific

- ELITech Group

- Abbott Laboratories

- PerkinElmer, Inc.

Competitive Analysis

The genetic analysis market is highly competitive, with key players including Quest Diagnostics Inc., Qiagen, AutoGenomics Inc., Hoffmann-La Roche AG, Danaher (Cepheid), BioRad Laboratories, Celera Group, IntegraGen, Thermo Fisher Scientific, ELITech Group, Abbott Laboratories, and PerkinElmer, Inc. These companies focus on innovation, strategic partnerships, and expanding their product portfolios to strengthen market presence. Many invest heavily in next-generation sequencing, PCR solutions, and advanced diagnostic kits to meet growing demand for precision medicine. They emphasize automation and digital platforms to enhance testing speed, accuracy, and scalability. Competition is driven by continuous research and development efforts targeting improved diagnostic accuracy and cost efficiency. Companies actively pursue mergers, acquisitions, and collaborations with research institutes to expand global reach and access new technologies. The market also sees growing emphasis on companion diagnostics and pharmacogenomics, aligning solutions with drug development pipelines. Firms expand into emerging markets by partnering with local laboratories and healthcare providers to increase accessibility. Continuous focus on regulatory compliance and quality standards helps maintain trust and market credibility. The competitive landscape remains dynamic, with players seeking differentiation through specialized assays, software integration, and value-added services that support personalized healthcare and clinical decision-making.

Recent Developments

- In 2025, Cepheid (Danaher) and Oxford Nanopore Technologies formed a collaboration to develop a sample and library preparation workflow using GeneXpert and Nanopore sequencing for infectious disease analysis.

- In 2025, Thermo Fisher opened its first US Advanced Therapies Collaboration Center (ATxCC) in Carlsbad, California, to support cell therapy development and commercialization.

- In 2024, QIAGEN launched IPA Interpret, an AI-extension of its Ingenuity Pathway Analysis tool for automatic interpretation of complex biological data.

Report Coverage

The research report offers an in-depth analysis based on Product, Test, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of precision medicine worldwide.

- Rising demand for early disease detection will drive genetic testing volumes.

- Advances in next-generation sequencing will lower costs and improve accessibility.

- AI-based analytics will enhance accuracy and speed of genetic data interpretation.

- Population-scale genomics programs will generate valuable datasets for research.

- Pharmaceutical companies will increase use of pharmacogenomics in drug development.

- Direct-to-consumer genetic testing will see higher adoption for health insights.

- Emerging economies will witness faster uptake with improved healthcare infrastructure.

- Integration of multi-omics will support personalized treatment planning.

- Collaborations between diagnostics firms and research institutes will boost innovation.