Market Overview

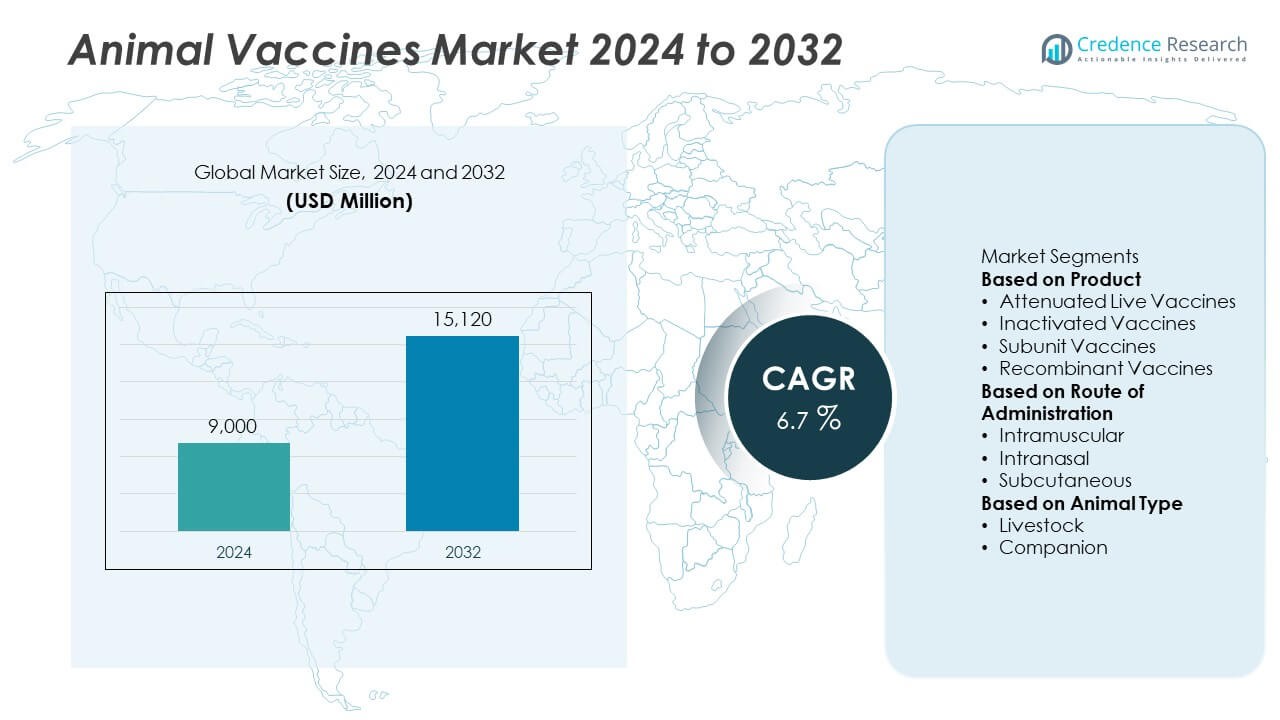

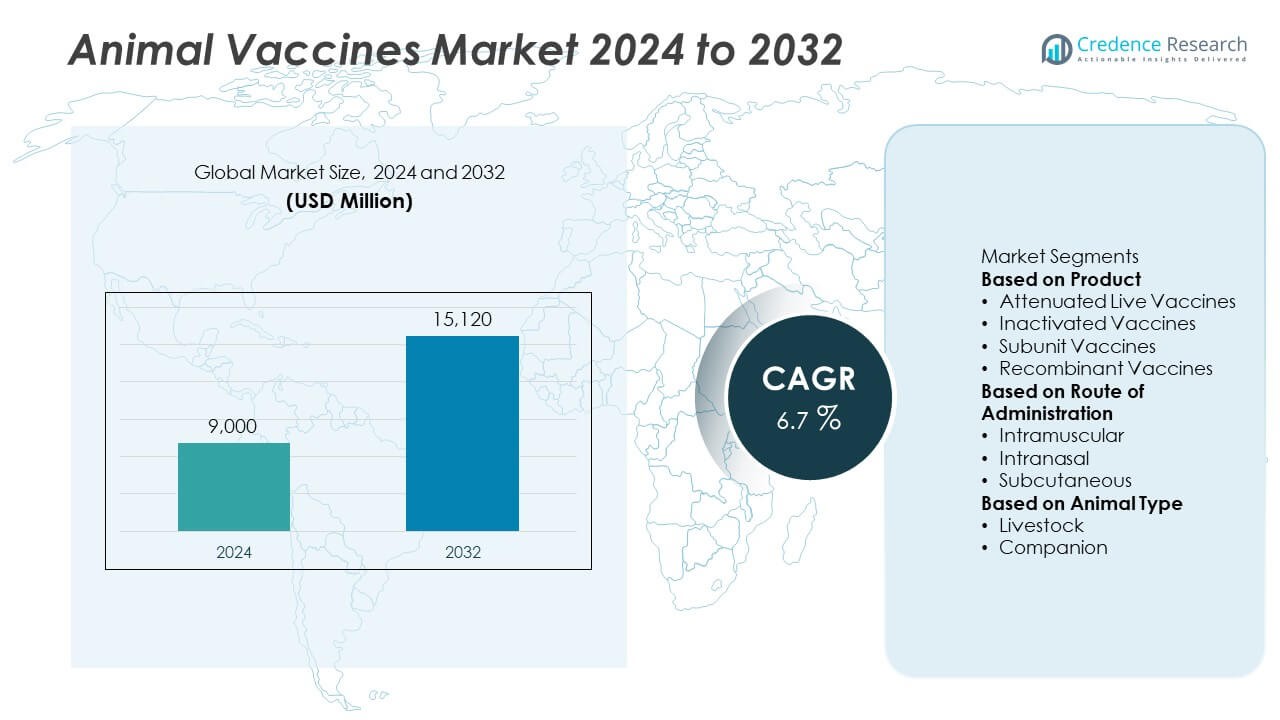

The Animal Vaccines Market was valued at USD 9,000 million in 2024 and is projected to reach USD 15,120 million by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Vaccines Market Size 2024 |

USD 9,000 Million |

| Animal Vaccines Market, CAGR |

6.7% |

| Animal Vaccines Market Size 2032 |

USD 15,120 Million |

The animal vaccines market is led by major companies including Zoetis, Merck & Co., Inc., Boehringer Ingelheim Animal Health, Elanco, and Virbac, which collectively hold a significant global presence through extensive product portfolios and advanced R&D capabilities. These players focus on developing next-generation vaccines targeting zoonotic, viral, and bacterial diseases across livestock and companion animals. Emerging participants such as Ceva, Calier, Bimeda Biologicals, Neogen Corporation, and Phibro Animal Health Corporation are expanding their footprint through regional partnerships and innovative vaccine formulations. North America dominated the global market with a 37.9% share in 2024, supported by robust veterinary infrastructure and strong government disease control initiatives.

Market Insights

- The animal vaccines market was valued at USD 9,000 million in 2024 and is projected to reach USD 15,120 million by 2032, growing at a CAGR of 6.7% during the forecast period.

- Growth is driven by rising prevalence of zoonotic diseases, expanding livestock population, and increased investment in preventive animal healthcare worldwide.

- Key trends include advancements in recombinant and DNA-based vaccines, expansion of companion animal immunization, and adoption of cold-chain technologies to improve vaccine stability.

- Leading players such as Zoetis, Merck & Co., Inc., Boehringer Ingelheim Animal Health, Elanco, and Virbac dominate the market through innovation and strategic collaborations with research institutions.

- North America led with 37.9% share, followed by Europe at 30.6% and Asia-Pacific at 22.4%; among products, attenuated live vaccines held 46.2% share, while the livestock segment accounted for 62.5% share, highlighting strong focus on large-scale farm immunization programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The attenuated live vaccines segment dominated the animal vaccines market with a 46.2% share in 2024. These vaccines provide long-lasting immunity by using weakened pathogens that stimulate strong immune responses in animals. Their effectiveness in preventing major infectious diseases in livestock and companion animals drives widespread adoption. The segment benefits from continuous R&D efforts aimed at improving safety and stability. Expanding vaccination programs targeting foot-and-mouth disease, canine distemper, and avian influenza further reinforce the dominance of attenuated live formulations in the global market.

- For instance, Merck Animal Health manufactures the NOBILIS vaccine series, including both live and inactivated attenuated strains against Newcastle disease and infectious bronchitis.

By Route of Administration

The subcutaneous segment held the largest share of 54.8% in 2024, supported by its ease of administration, reliable absorption, and minimal risk of tissue damage. Subcutaneous vaccines are commonly used for cattle, poultry, and companion animals due to their consistent immune response and cost-effectiveness. The growing availability of multi-dose formulations and automatic injection devices enhances efficiency in large-scale immunization programs. The rising emphasis on animal welfare and stress-free vaccination methods continues to drive preference for subcutaneous administration.

- For instance, Elanco offers a diverse portfolio of products and knowledge services, which it supplies to customers in more than 90 countries worldwide. The company manages 17 dedicated manufacturing sites globally and works with approximately 250 external manufacturing partners.

By Animal Type

The livestock segment accounted for a 62.5% share in 2024, driven by increasing demand for meat, milk, and poultry products worldwide. Preventive vaccination programs for cattle, poultry, and swine help minimize economic losses caused by infectious outbreaks. Governments and international organizations actively support livestock vaccination to ensure food security and export compliance. Growing investments in farm biosecurity and large-scale immunization campaigns, especially in Asia-Pacific and Latin America, further strengthen the livestock segment’s leadership in the animal vaccines market.

Key Growth Drivers

Key Growth Drivers

Rising Prevalence of Zoonotic and Infectious Diseases

Increasing cases of zoonotic diseases such as rabies, avian influenza, and foot-and-mouth disease are driving the adoption of animal vaccines globally. Governments and veterinary organizations are strengthening immunization programs to control cross-species disease transmission. The rising focus on food safety and public health protection further supports vaccination initiatives in livestock and companion animals. These efforts not only enhance animal health but also contribute to reducing economic losses associated with disease outbreaks in the livestock industry.

- For instance, Zoetis developed the Poulvac Procerta HVT-ND vaccine, which protects poultry against Newcastle disease and Marek’s disease using recombinant vector technology. The vaccine is administered either in ovo or subcutaneously at day of hatch, providing effective protection.

Expanding Livestock Population and Animal Protein Demand

Growing global demand for meat, milk, and poultry products is encouraging large-scale vaccination to maintain livestock health and productivity. Farmers and commercial producers are increasingly investing in preventive healthcare to reduce mortality and boost yield. International trade regulations also mandate vaccination compliance for livestock exports, creating additional growth opportunities. The expansion of commercial animal farming in developing regions continues to drive vaccine utilization across diverse animal species.

- For instance, Ceva Santé Animale is a global leader in the poultry vaccine market and produced 32 billion doses of new technology hatchery vaccines in 2024, including advanced vector-based formulations for avian influenza control.

Technological Advancements in Vaccine Development

Ongoing innovation in recombinant, DNA-based, and vector vaccines is improving immune response, safety, and shelf life. Advanced biotechnological methods allow faster vaccine production with high specificity against evolving pathogens. Research institutions and pharmaceutical companies are focusing on combination and thermostable vaccines to enhance efficiency in varied environments. These innovations, coupled with automation in production and advanced cold-chain management, are reshaping the global vaccine landscape and supporting market expansion.

Key Trends & Opportunities

Adoption of Recombinant and DNA-Based Vaccines

The growing preference for recombinant and DNA vaccines is transforming animal immunization practices. These vaccines provide strong and targeted protection without the risk of pathogen reversion. Pharmaceutical companies are investing in molecular biology and genetic engineering to create multi-pathogen protection solutions. The trend aligns with the industry’s shift toward safer and more effective alternatives to traditional live or inactivated vaccines.

- For instance, Virbac developed the CaniLeish recombinant vaccine using purified excreted-secreted proteins of Leishmania infantum, which demonstrated 68% efficacy in reducing parasite load and sustained cellular immune response for over 12 months in vaccinated dogs.

Expansion of Companion Animal Healthcare

Rising pet ownership and growing awareness of preventive veterinary care are boosting vaccine demand for companion animals. Dogs and cats receive routine vaccinations for rabies, parvovirus, and distemper, supported by increasing spending on pet wellness. Veterinary clinics and pet healthcare providers are adopting advanced vaccines with longer immunity duration and minimal side effects. This trend underscores the market’s expansion beyond livestock into the fast-growing companion animal segment.

- For instance, Boehringer Ingelheim offers PUREVAX RABIES vaccines for cats, which use canarypox vector technology and are available in different presentations that deliver either one-year or three-year immunity with a single dose

Government Support for Mass Immunization Programs

Public vaccination initiatives targeting livestock and poultry are gaining traction in developing countries. National veterinary departments and global organizations such as the FAO and OIE are funding mass immunization campaigns to control epidemic diseases. These initiatives improve vaccine accessibility and awareness, particularly in rural farming communities. Increased collaboration between governments and manufacturers enhances distribution networks and regulatory harmonization, promoting sustained vaccine adoption.

Key Challenges

High Cost of Vaccine Development and Storage

Developing and maintaining effective animal vaccines requires substantial investment in R&D, biosafety, and cold-chain logistics. These costs often limit availability in low-income regions where vaccination coverage remains inadequate. Smaller manufacturers face financial barriers in scaling production or meeting regulatory standards. The high cost of maintaining vaccine potency and distribution efficiency continues to challenge market expansion in cost-sensitive markets.

Regulatory and Logistical Constraints in Emerging Markets

Complex regulatory approval processes and inconsistent quality standards across countries hinder vaccine introduction and distribution. Many developing regions also lack the infrastructure for temperature-controlled storage and transport, leading to product wastage. Limited veterinary workforce and low farmer awareness further restrict vaccination rates. Overcoming these barriers requires coordinated global efforts in regulatory alignment, training, and infrastructure investment.

Regional Analysis

North America

North America held the largest share of 37.9% in 2024, driven by advanced veterinary healthcare systems, strong pet ownership rates, and high livestock vaccination coverage. The United States leads the region due to substantial R&D investments and favorable regulatory frameworks promoting preventive healthcare. Extensive government support for animal disease control programs and the presence of key players such as Zoetis and Merck Animal Health enhance regional dominance. Canada contributes through growing livestock exports and increasing awareness of zoonotic disease prevention.

Europe

Europe accounted for a 30.6% share in 2024, supported by well-established animal health infrastructure and stringent disease control regulations. Countries including Germany, France, and the United Kingdom are major contributors, emphasizing preventive immunization in livestock and companion animals. The European Medicines Agency’s regulatory oversight ensures vaccine safety and uniform standards across the region. Public health initiatives targeting rabies, foot-and-mouth disease, and avian influenza continue to drive market expansion. Increasing adoption of recombinant and subunit vaccines further strengthens Europe’s position in the global animal vaccines landscape.

Asia-Pacific

Asia-Pacific captured a 22.4% market share in 2024, fueled by rapid growth in the livestock sector and expanding government vaccination programs. Countries such as China, India, and Japan are leading markets driven by large animal populations and rising protein consumption. Government-funded disease eradication campaigns and foreign investments in animal health R&D are accelerating product adoption. Growing awareness of zoonotic diseases and the expansion of veterinary service networks across rural and urban areas are enhancing vaccination rates. The region’s evolving biopharmaceutical manufacturing capabilities further boost supply efficiency and accessibility.

Latin America

Latin America represented a 5.8% share in 2024, supported by increasing livestock production and improving veterinary infrastructure. Brazil, Mexico, and Argentina are the key markets driven by strong demand for beef, poultry, and dairy exports. Government initiatives promoting preventive healthcare and cross-border disease control contribute to steady growth. However, inconsistent vaccination coverage in rural regions and limited distribution channels present challenges. Expanding collaborations between international manufacturers and regional distributors are expected to improve accessibility and strengthen Latin America’s animal vaccine market presence.

Middle East & Africa

The Middle East & Africa region accounted for a 3.3% share in 2024, driven by expanding livestock industries and increasing government focus on animal health security. Gulf countries such as Saudi Arabia and the United Arab Emirates are investing in veterinary facilities and disease monitoring systems. In Africa, efforts by organizations like the FAO and OIE to control contagious diseases such as Rift Valley fever and foot-and-mouth disease are supporting vaccine adoption. Despite infrastructure limitations, growing awareness and regional immunization programs are driving gradual but steady market development.

Market Segmentations:

By Product

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- Recombinant Vaccines

By Route of Administration

- Intramuscular

- Intranasal

- Subcutaneous

By Animal Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The animal vaccines market is highly competitive, featuring leading players such as Ceva, Zoetis, Calier, Neogen Corporation, Bimeda Biologicals, Boehringer Ingelheim Animal Health, Elanco, Virbac, Merck & Co., Inc., and Phibro Animal Health Corporation. These companies focus on developing innovative vaccines for livestock and companion animals, emphasizing improved efficacy, safety, and longer immunity duration. Strategic initiatives such as mergers, acquisitions, and collaborations with research institutions strengthen their global market presence. Continuous R&D investments in recombinant and DNA-based vaccine technologies drive product innovation and portfolio diversification. Major manufacturers are also expanding cold-chain logistics and production facilities to enhance vaccine accessibility in developing markets. The increasing demand for preventive animal healthcare and government-backed immunization programs continue to foster strong competition across regions, encouraging technological advancement and cost-effective vaccine solutions.

Key Player Analysis

- Ceva

- Zoetis

- Calier

- Neogen Corporation

- Bimeda Biologicals

- Boehringer Ingelheim Animal Health

- Elanco

- Virbac

- Merck & Co., Inc.

- Phibro Animal Health Corporation

Recent Developments

- In March 2025, Merck Animal Health announced European approval of its NOBIVAC® MULTRIVA™ REOm vaccine for use in chickens.

- In February 2025, Medgene and Elanco agreed to jointly commercialize Elanco’s HPAI vaccine platform for dairy cattle in the U.S

- In February 2025, Zoetis Inc. received a conditional licence from the U.S. United States Department of Agriculture for its Avian Influenza (H5N2 subtype) killed virus vaccine for use in chickens.

- In November 2024, Boehringer Ingelheim Animal Health launched a next-generation poultry vaccine (in India) for Marek’s disease targeting 18-19-day-old embryonated eggs or 1-day-old chickens.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Route of Administration, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing emphasis on preventive animal healthcare worldwide.

- Development of recombinant and DNA-based vaccines will continue to drive innovation.

- Increasing livestock production will strengthen demand for large-scale vaccination programs.

- Companion animal vaccination will rise with growing pet ownership and wellness awareness.

- Governments will enhance funding for disease control and eradication initiatives.

- Manufacturers will focus on thermostable and single-dose vaccine formulations for efficiency.

- Partnerships between pharmaceutical companies and research institutes will accelerate new vaccine development.

- Digital monitoring and traceability systems will improve vaccine distribution and compliance.

- Asia-Pacific will emerge as the fastest-growing region supported by expanding veterinary infrastructure.

- Sustainability and ethical practices in vaccine production will gain greater industry importance.

Key Growth Drivers

Key Growth Drivers