Market Overview

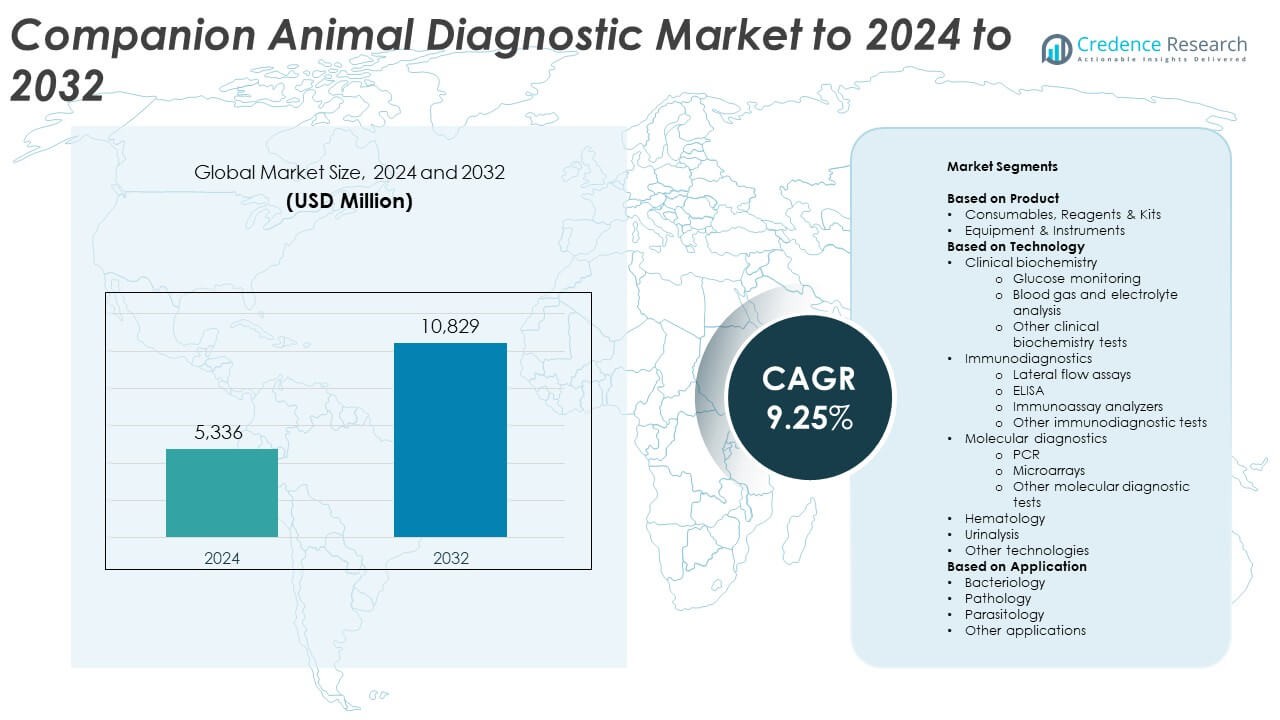

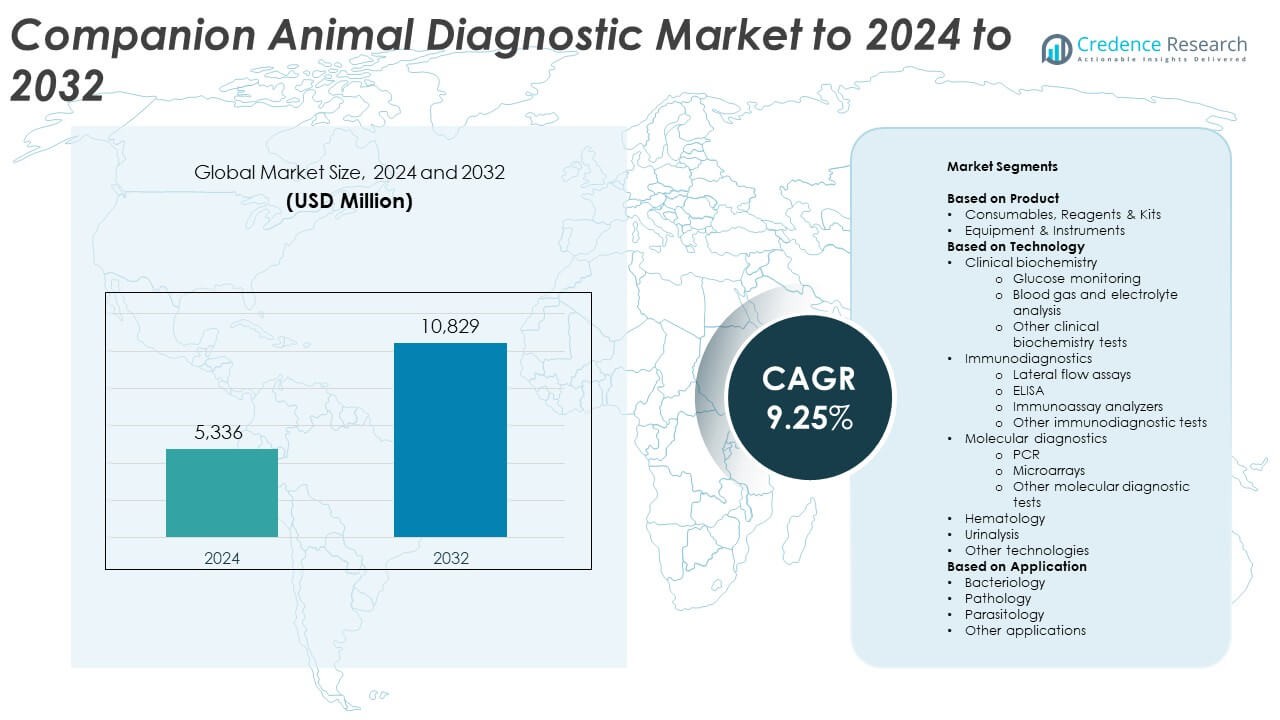

The Companion Animal Diagnostic Market size was valued at USD 5,336 Million in 2024 and is anticipated to reach USD 10,829 Million by 2032, at a CAGR of 9.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Diagnostic Market Size 2024 |

USD 5,336 Million |

| Companion Animal Diagnostic Market, CAGR |

9.25% |

| Companion Animal Diagnostic Market Size 2032 |

USD 10,829 Million |

The Companion Animal Diagnostic Market is led by major players such as IDEXX Laboratories, Zoetis, Thermo Fisher Scientific, Bio-Rad Laboratories, bioMérieux, Virbac, Heska Corporation (Mars), Qiagen, and Neogen Corporation. These companies dominate through strong product portfolios, advanced diagnostic technologies, and extensive global distribution networks. They emphasize innovation in molecular diagnostics, immunoassays, and digital pathology to enhance clinical accuracy and efficiency. North America remains the leading region, accounting for 42.7% of the global market share in 2024, supported by high pet ownership, strong veterinary infrastructure, and growing adoption of preventive health diagnostics across the United States and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Companion Animal Diagnostic Market was valued at USD 5,336 million in 2024 and is projected to reach USD 10,829 million by 2032, expanding at a CAGR of 9.25%.

• Rising pet ownership and growing awareness of preventive animal healthcare are major drivers accelerating market growth across veterinary clinics and hospitals.

• Increasing adoption of molecular and immunodiagnostic technologies represents a key trend, as digital pathology and AI integration enhance diagnostic precision and speed.

• The competitive landscape is characterized by continuous innovation, strategic collaborations, and the expansion of diagnostic portfolios focusing on consumables and point-of-care testing.

• Regionally, North America leads with a 42.7% share, followed by Europe with 28.9%, and Asia Pacific with 17.5%, while consumables, reagents, and kits dominate product segments with over 60% contribution to global market revenues.

Market Segmentation Analysis:

By Product

Consumables, reagents, and kits held the largest share of the Companion Animal Diagnostic Market in 2024, accounting for 62.4%. Their recurring use in daily diagnostic workflows drives demand across veterinary clinics and reference laboratories. High test frequency for infectious, metabolic, and genetic diseases sustains steady sales. The introduction of ready-to-use assay kits and rapid test strips enhances convenience and turnaround time. Increasing adoption of advanced molecular and immunodiagnostic reagents further supports this segment’s dominance, driven by the need for accuracy and time efficiency in veterinary testing.

- For instance, Heska Corporation’s Element i+ immunodiagnostic analyzer delivers results in as little as 4 to 5 minutes using a 100 µL sample of serum or lithium heparin plasma, which improves testing throughput and efficiency in small animal clinics

By Technology

Immunodiagnostics dominated the market with a 38.7% share in 2024, supported by its accuracy and versatility. Techniques such as ELISA and lateral flow assays are widely used for detecting infectious and parasitic diseases in dogs and cats. The growing demand for point-of-care immunoassay analyzers enhances early diagnosis and clinical efficiency. Continuous innovation in multiplex assay technology and microfluidic platforms improves sensitivity and cost-effectiveness. Expanding adoption of rapid diagnostic test kits in home and clinic settings strengthens this segment’s leadership across veterinary diagnostics.

- For instance, Zoetis expanded its VETSCAN Imagyst platform in 2024 to include AI-driven urine sediment analysis, which was the 5th application added to the platform at that time.

By Application

Pathology accounted for the largest share of 41.2% in 2024, driven by its central role in disease identification and treatment monitoring. Rising cases of chronic conditions such as arthritis, cancer, and diabetes in companion animals increase demand for histopathological and cytological evaluations. Advanced imaging and molecular pathology tools allow precise diagnosis and better clinical outcomes. Growing integration of digital pathology platforms and AI-assisted image analysis enhances diagnostic accuracy and workflow speed, reinforcing the dominance of this application segment in veterinary diagnostic practices.

Key Growth Drivers

Increasing Pet Ownership and Health Awareness

Rising pet adoption rates and heightened awareness of animal health are fueling the demand for diagnostics. Pet owners are investing more in preventive healthcare and early disease detection. This trend is supported by higher spending on veterinary services and advanced testing. Growing human-animal bonding drives routine health checkups and diagnostic screenings, expanding clinic-based testing volumes across developed markets.

- For instance, Banfield Pet Hospital manages more than 1,000 clinics across 42 states, Washington D.C., Puerto Rico, and Mexico, serving over 3 million pets annually, indicating rapid expansion of veterinary diagnostic access in developed regions.

Advancements in Veterinary Diagnostic Technologies

Continuous innovations in molecular diagnostics, immunoassays, and imaging tools are transforming veterinary testing efficiency. Automated analyzers and point-of-care devices provide faster and more accurate results. Integration of digital systems supports real-time data sharing between clinics and laboratories. These technological advancements enable early detection of infectious and chronic diseases, improving clinical outcomes for companion animals.

- For instance, IDEXX Laboratories’ ProCyte One analyzer uses 5-dimensional laser flow cytometry and AI to detect anomalies in seconds, minimizing manual review in veterinary hematology.

Expansion of Veterinary Healthcare Infrastructure

The growing number of veterinary hospitals and diagnostic centers enhances access to specialized testing services. Governments and private sectors are investing in modern animal healthcare infrastructure. Reference laboratories are expanding testing capabilities, including molecular and genetic diagnostics. This infrastructure growth supports consistent service delivery, enabling faster turnaround and improved accuracy in pet diagnostics.

Key Trends & Opportunities

Rising Adoption of Point-of-Care Testing (POCT)

The shift toward rapid, on-site diagnostic testing is a major market opportunity. POCT devices enable veterinarians to perform real-time blood, urine, and biochemistry tests. These tools minimize sample handling and delay, allowing immediate clinical decisions. Their use is increasing in small clinics and home-based pet healthcare, improving accessibility and convenience for pet owners.

- For instance, Heska Corporation’s Element RC analyzer performs biochemistry tests in approximately 12 minutes, enabling rapid treatment decisions in veterinary clinics.

Integration of Artificial Intelligence and Digital Pathology

Artificial intelligence and digital imaging are enhancing diagnostic accuracy in pathology and hematology. AI-driven systems support early identification of diseases through pattern recognition and predictive analytics. Cloud-based pathology platforms also enable remote consultations and second opinions. The use of AI technologies in veterinary diagnostics improves efficiency, standardization, and diagnostic confidence across facilities.

- For instance, IDEXX launched its inVue Dx cellular analyzer in January 2024, using deep learning algorithms trained by board-certified pathologists to interpret cytology images and blood morphology. The analyzer delivers reference laboratory-level results within 10 minutes for canine and feline (companion animal) ear and blood samples.

Key Challenges

High Cost of Advanced Diagnostic Equipment

The expensive nature of advanced diagnostic instruments limits adoption in small and mid-sized veterinary clinics. Many clinics face budget constraints that hinder investment in molecular or digital imaging tools. Maintenance and calibration costs further increase financial pressure. This challenge often leads to outsourcing of testing to reference laboratories, affecting in-clinic diagnostic capabilities.

Lack of Skilled Veterinary Professionals

A shortage of trained veterinarians and technicians affects diagnostic quality and efficiency. Many developing regions struggle to maintain consistent training programs in advanced diagnostic techniques. Inadequate expertise in molecular and genetic testing restricts full utilization of modern systems. This gap limits diagnostic reach, especially in rural or underdeveloped veterinary care networks.

Regional Analysis

North America

North America dominated the Companion Animal Diagnostic Market with a 42.7% share in 2024, supported by a well-established veterinary healthcare system and high pet ownership rates. Strong spending on preventive care and early disease screening drives market growth. The United States leads with widespread adoption of advanced diagnostic technologies such as PCR and ELISA-based tests. Major veterinary diagnostic laboratories and manufacturers continue expanding their service networks and R&D efforts. Continuous innovation and robust distribution channels further strengthen the region’s position as the leading contributor to global companion animal diagnostics revenue.

Europe

Europe accounted for 28.9% of the market share in 2024, driven by advanced veterinary practices and regulatory emphasis on animal health monitoring. Countries like Germany, the United Kingdom, and France lead in diagnostic testing adoption. Growing awareness of zoonotic disease prevention and companion animal wellness supports steady demand. Expanding access to veterinary insurance and increasing diagnostic investments enhance the market presence. Technological collaboration among diagnostic firms and universities fosters innovation in molecular and imaging-based veterinary diagnostics across the region.

Asia Pacific

Asia Pacific held a 17.5% market share in 2024, emerging as the fastest-growing regional market. Rising pet adoption in urban centers of China, Japan, and India drives diagnostic demand. Expanding veterinary clinics and reference laboratories enhance accessibility to advanced testing services. Increasing awareness of preventive healthcare and zoonotic risk control supports regional growth. Local players are investing in cost-effective diagnostic tools to serve price-sensitive markets. The region’s growing middle-class population and expanding pet insurance coverage further contribute to its accelerating market development.

Latin America

Latin America captured a 6.8% share of the global market in 2024, supported by increasing pet ownership and urbanization. Brazil and Mexico represent major markets, driven by growing awareness of animal welfare and preventive healthcare. Diagnostic adoption is rising as veterinary facilities modernize testing capabilities. Collaborations between global manufacturers and local distributors are improving access to diagnostic reagents and instruments. Government-led initiatives to control zoonotic diseases also boost clinical testing rates. Despite slower infrastructure development, expanding private veterinary clinics continue to create strong market opportunities.

Middle East & Africa

The Middle East & Africa region accounted for a 4.1% share in 2024, driven by gradual improvement in veterinary infrastructure. Growing pet ownership in Gulf countries and awareness of pet health management are key contributors. Investments in veterinary laboratories and training programs enhance diagnostic service quality. South Africa and the United Arab Emirates lead regional adoption, supported by government efforts to promote animal health standards. However, limited access to advanced diagnostic technologies and high equipment costs continue to challenge broader market penetration.

Market Segmentations:

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Technology

- Clinical biochemistry

- Glucose monitoring

- Blood gas and electrolyte analysis

- Other clinical biochemistry tests

- Immunodiagnostics

- Lateral flow assays

- ELISA

- Immunoassay analyzers

- Other immunodiagnostic tests

- Molecular diagnostics

- PCR

- Microarrays

- Other molecular diagnostic tests

- Hematology

- Urinalysis

- Other technologies

By Application

- Bacteriology

- Pathology

- Parasitology

- Other applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Companion Animal Diagnostic Market features leading players such as IDEXX Laboratories, Zoetis, Thermo Fisher Scientific, Bio-Rad Laboratories, bioMérieux, Virbac, Heska Corporation (Mars), Qiagen, Neogen Corporation, Boehringer Ingelheim International, Randox, Median Diagnostics, BioNote, VetAll Laboratories, Kogene Biotech, and Mars. The competitive landscape is marked by continuous innovation in diagnostic technologies and expansion of veterinary testing portfolios. Companies are focusing on developing molecular and immunodiagnostic platforms that deliver faster, more accurate results. Strategic collaborations with veterinary clinics and hospitals strengthen product accessibility and customer loyalty. Investments in AI-driven tools and digital pathology are enhancing diagnostic precision and workflow efficiency. Market participants are also expanding geographic presence through acquisitions and partnerships, particularly in emerging economies. The emphasis on consumables, reagents, and rapid point-of-care kits supports recurring revenue models, while ongoing R&D in genetic and biomarker-based testing ensures technological advancement and sustained competitive differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IDEXX Laboratories

- Zoetis

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- bioMérieux

- Virbac

- Heska Corporation (Mars)

- Qiagen

- Neogen Corporation

- Boehringer Ingelheim International

- Randox

- Median Diagnostics

- BioNote

- VetAll Laboratories

- Kogene Biotech

- Mars

Recent Developments

- In 2024, Zoetis announced the introduction of the Vetscan OptiCell, an AI-powered, cartridge-based hematology analyzer designed for point-of-care use.

- In 2024, IDEXX Laboratories: Launched the Catalyst Pancreatic Lipase Test to provide rapid, quantitative results for diagnosing pancreatitis in dogs and cats.

- In 2023, Mars, Incorporated: Completed the acquisition of Heska Corporation, a global provider of advanced veterinary diagnostic and specialty solutions, integrating it into the Mars Petcare Science & Diagnostics division.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with rising pet adoption and preventive healthcare awareness.

- Point-of-care testing will gain higher adoption due to faster results and convenience.

- AI-enabled diagnostic tools will improve accuracy and clinical decision-making.

- Molecular diagnostics will grow as genetic testing becomes more accessible in veterinary care.

- Veterinary clinics will increasingly integrate digital platforms for remote diagnostic support.

- Partnerships between diagnostic firms and veterinary hospitals will enhance service reach.

- Expansion of insurance coverage for pets will support higher diagnostic spending.

- Emerging economies will experience rapid growth with improving veterinary infrastructure.

- Technological innovation in reagents and consumables will strengthen recurring revenue streams.

- Sustainability and eco-friendly manufacturing practices will become key differentiators for diagnostic suppliers.