Market Overview

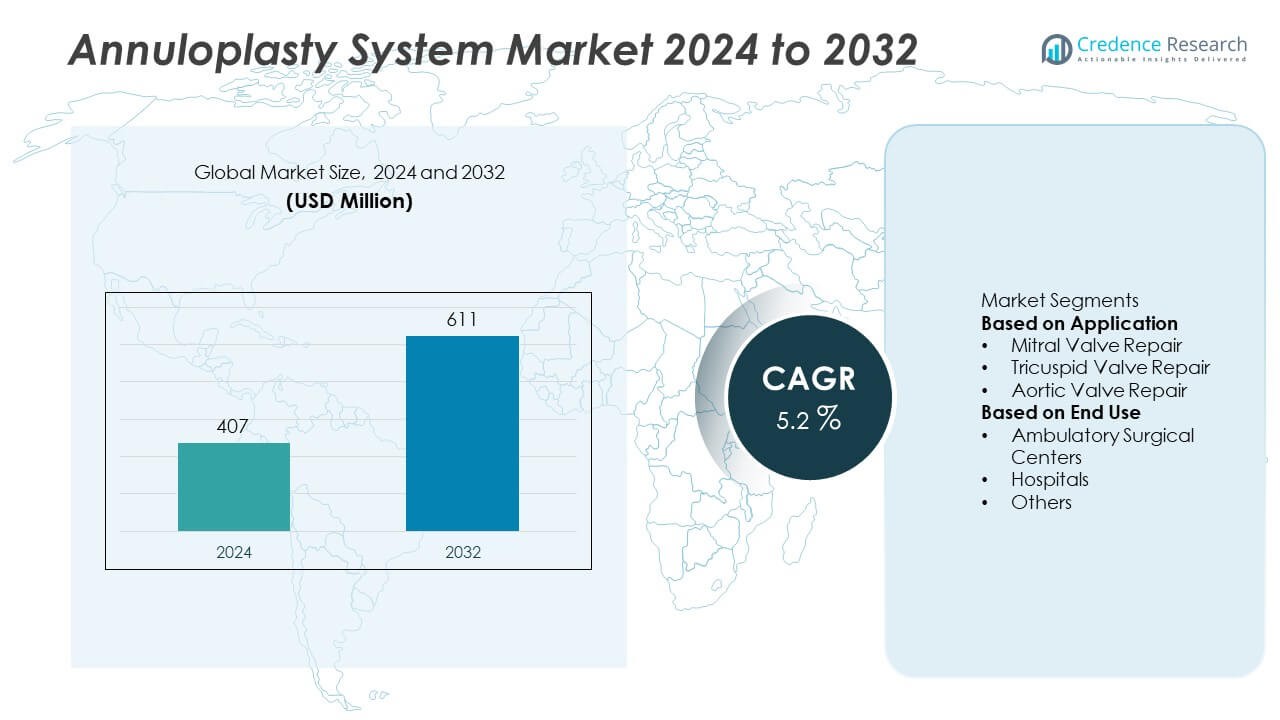

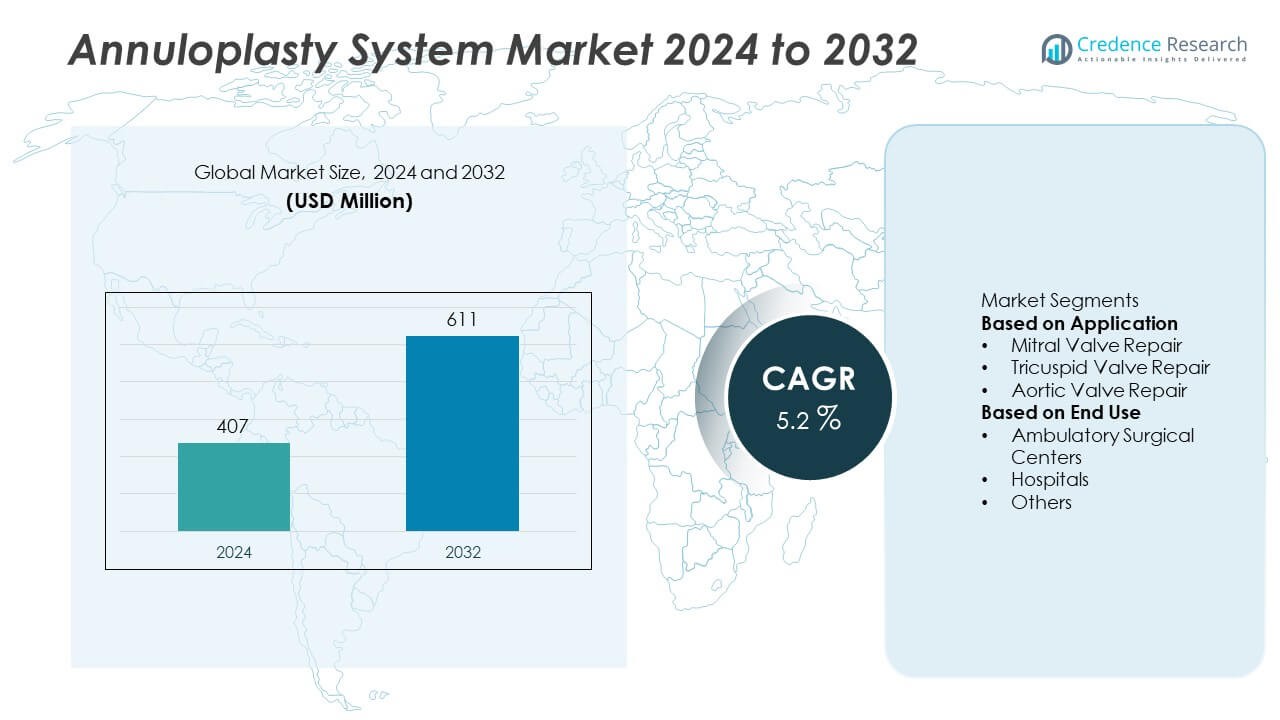

The Annuloplasty System Market was valued at USD 407 million in 2024 and is projected to reach USD 611 million by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Annuloplasty System Market Size 2024 |

USD 407 Million |

| Annuloplasty System Market, CAGR |

5.2% |

| Annuloplasty System Market Size 2032 |

USD 611 Million |

The annuloplasty system market is dominated by major players such as Edwards Lifesciences Corporation, Abbott Laboratories, Medtronic plc, LivaNova PLC, and CryoLife Inc., which hold significant shares through strong product portfolios and advanced cardiac repair technologies. These companies focus on developing minimally invasive and transcatheter systems that improve procedural accuracy and patient outcomes. Emerging participants, including Valcare Medical, Micro Interventional Devices Inc., Cardiac Dimensions Inc., Sorin Group, and Neovasc Inc., are enhancing competitiveness through innovative and biocompatible ring designs. North America led the global annuloplasty system market with a 39.6% share in 2024, supported by advanced healthcare infrastructure and high adoption of minimally invasive cardiac procedures.

Market Insights

- The annuloplasty system market was valued at USD 407 million in 2024 and is projected to reach USD 611 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Market growth is driven by the increasing prevalence of valvular heart diseases, rising geriatric population, and technological advancements in minimally invasive cardiac repair procedures.

- Key trends include the adoption of transcatheter and robotic-assisted annuloplasty systems, integration of 3D imaging technologies, and growing demand for personalized and biocompatible repair rings.

- Leading players such as Edwards Lifesciences, Abbott Laboratories, Medtronic, LivaNova, and CryoLife dominate the market through product innovation, strong clinical collaborations, and global distribution networks.

- North America led with 39.6% share, followed by Europe at 30.2% and Asia-Pacific at 21.8%; among applications, mitral valve repair accounted for 63.4% share, while hospitals represented 72.1% share, reflecting their dominance in advanced cardiac care procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The mitral valve repair segment dominated the annuloplasty system market with a 63.4% share in 2024, driven by the high prevalence of mitral regurgitation and the growing preference for valve-preserving procedures. Annuloplasty rings and bands are widely used to restore normal valve function and improve durability post-surgery. The segment benefits from advancements in minimally invasive and transcatheter repair techniques that reduce hospital stays and recovery time. Increasing adoption of technologically advanced mitral repair systems and rising awareness of early cardiac interventions continue to strengthen this segment’s leadership.

- For instance, Abbott Laboratories developed the Tendyne Transcatheter Mitral Valve System, which has been used in hundreds of patients across multiple global clinical studies and demonstrated sustained elimination or reduction of mitral regurgitation to trace or mild in over 98% of patients after one year, which was associated with significant symptomatic improvement in most surviving patients.

By End Use

The hospitals segment held the largest share of 72.1% in 2024, supported by the availability of advanced cardiac surgical infrastructure and skilled cardiovascular surgeons. Hospitals remain the primary setting for both open and minimally invasive annuloplasty procedures due to comprehensive postoperative care and diagnostic support. Rising patient admissions for valvular disease management and growing adoption of 3D imaging-assisted repair systems drive this segment’s growth. Meanwhile, ambulatory surgical centers are gaining traction as outpatient cardiac procedures expand with enhanced recovery and cost-efficiency advantages.

- For instance, Medtronic plc offers the SimuPlus™ Annuloplasty Ring, which is a flexible annuloplasty ring made of braided polyester designed to provide flexible annular support and allow for natural annular motion during mitral or tricuspid valve repair.

Key Growth Drivers

Rising Prevalence of Valvular Heart Diseases

The growing incidence of mitral and tricuspid valve disorders is a key factor driving the annuloplasty system market. Aging populations and lifestyle-related cardiovascular risks have led to higher rates of valve regurgitation and insufficiency. Increasing awareness of early diagnosis and the benefits of surgical repair over replacement supports procedural demand. Hospitals and cardiac centers are adopting advanced annuloplasty systems to enhance precision, improve long-term outcomes, and reduce complications, fueling consistent market growth globally.

- For instance, Edwards Lifesciences introduced the Carpentier-Edwards Physio II Annuloplasty Ring, designed for mitral valve repair, which in a single-center study demonstrated a four-year freedom from reoperation rate exceeding 94% in clinical follow-ups.

Advancements in Minimally Invasive and Transcatheter Techniques

Technological innovation in cardiac repair is accelerating the shift toward minimally invasive annuloplasty procedures. Modern transcatheter systems offer shorter recovery times, reduced hospital stays, and lower surgical risks, making them ideal for high-risk and elderly patients. The integration of 3D imaging and robotic-assisted tools improves procedural accuracy and device placement. These advancements are expanding the adoption of annuloplasty systems across both developed and emerging healthcare markets.

- For instance, Cardiac Dimensions developed the Carillon Mitral Contour System, a transcatheter indirect annuloplasty device implanted via the jugular vein, which in various clinical trials has shown significant improvements in functional mitral regurgitation and quality of life.

Growing Preference for Valve Repair over Replacement

Valve repair procedures, supported by annuloplasty systems, are increasingly favored over replacements due to their ability to preserve native valve function and reduce long-term complications. Surgeons prefer annuloplasty for its durability, lower thrombosis risk, and better postoperative outcomes. Favorable clinical results, combined with advancements in customized ring and band designs, drive adoption across leading cardiac institutions. This shift in clinical preference continues to boost market penetration globally.

Key Trends & Opportunities

Integration of 3D Imaging and Robotic Assistance

The use of advanced imaging and robotic technology is transforming annuloplasty procedures. Real-time 3D visualization and navigation systems enhance surgical precision, leading to improved patient safety and outcomes. Robotic-assisted platforms allow surgeons to perform complex valve repairs with higher accuracy and minimal invasiveness. These technologies create opportunities for procedural standardization, training advancements, and improved device development in the global market.

- For instance, the Intuitive Surgical da Vinci system, which has undergone several iterations including the da Vinci Xi, has been utilized in over 14 million procedures globally across various specialties, including a growing number of cardiac procedures such as mitral valve repair and coronary artery bypass grafting.

Rising Adoption of Biocompatible and Customized Rings

Manufacturers are focusing on developing flexible, biocompatible, and patient-specific annuloplasty rings that optimize anatomical fit and reduce postoperative complications. Customization through 3D modeling and advanced biomaterials enhances valve durability and patient comfort. This trend supports better clinical outcomes and long-term repair success rates. The growing demand for personalized cardiac devices presents new opportunities for innovation and differentiation among key market players.

- For instance, LivaNova PLC developed the Memo 4D semirigid annuloplasty ring with a 3D curvature design made from titanium alloy and medical-grade polyester, used in over 60,000 mitral valve repairs, showing improved annular stability and reduced suture line stress during long-term evaluations.

Expansion in Emerging Healthcare Markets

Emerging economies in Asia-Pacific and Latin America are witnessing rapid growth in cardiac procedures due to improving healthcare infrastructure and rising disease prevalence. Governments are investing in advanced surgical technologies and expanding cardiac specialty centers. The increasing affordability of cardiac care and the presence of skilled cardiac surgeons create opportunities for global manufacturers to expand their market footprint through partnerships and localized production.

Key Challenges

High Cost of Annuloplasty Procedures and Devices

Annuloplasty surgeries are costly due to advanced device materials, imaging technologies, and the expertise required. High procedural and hospitalization costs often limit access in low- and middle-income countries. Even in developed regions, reimbursement limitations pose challenges for patient affordability. Manufacturers face pressure to reduce pricing while maintaining safety and efficacy, making cost optimization and local manufacturing crucial for broader market accessibility.

Limited Skilled Professionals and Complex Surgical Techniques

Annuloplasty procedures require advanced surgical expertise and specialized training, which limits adoption in regions with fewer cardiac specialists. Complex surgical techniques and a steep learning curve hinder the widespread implementation of minimally invasive and transcatheter systems. Insufficient training infrastructure and limited awareness among healthcare providers in emerging markets further restrict market growth. Expanding training programs and simulation-based education remains vital to address this challenge.

Regional Analysis

North America

North America held the largest share of 39.6% in 2024, driven by a high prevalence of cardiovascular diseases and strong adoption of advanced cardiac repair technologies. The region benefits from robust healthcare infrastructure, skilled cardiac surgeons, and favorable reimbursement frameworks. The United States leads the market due to the widespread availability of transcatheter and minimally invasive annuloplasty systems. Continuous product innovation, coupled with growing demand for early diagnosis and treatment of mitral and tricuspid valve disorders, further supports regional growth. Canada’s expanding cardiac care facilities also contribute to overall market advancement.

Europe

Europe accounted for a 30.2% share in 2024, supported by the region’s strong focus on cardiac health and extensive investments in clinical research. Countries such as Germany, France, and the United Kingdom dominate due to the presence of leading cardiovascular device manufacturers and advanced hospital networks. Favorable healthcare policies promoting early intervention and the growing adoption of minimally invasive repair systems are driving market expansion. Collaborative research programs and a high rate of mitral valve repair procedures strengthen Europe’s position as a key market for annuloplasty systems.

Asia-Pacific

Asia-Pacific captured a 21.8% market share in 2024, propelled by rising incidences of heart valve diseases and improving access to cardiac care. Countries such as China, Japan, and India are investing in advanced healthcare technologies and expanding cardiac surgery programs. Increasing awareness of minimally invasive repair procedures and the availability of skilled surgeons are boosting market adoption. Government initiatives promoting early detection and treatment of cardiovascular conditions further enhance growth. The region’s growing elderly population and rapid healthcare modernization continue to position Asia-Pacific as the fastest-growing market.

Latin America

Latin America represented a 5.1% share in 2024, supported by increasing prevalence of heart valve diseases and gradual improvements in cardiac treatment infrastructure. Brazil and Mexico are leading contributors due to expanding hospital networks and growing investments in healthcare modernization. The rising adoption of advanced surgical techniques and greater access to specialized care are strengthening market growth. However, high treatment costs and limited awareness among patients remain challenges. Ongoing collaborations between international manufacturers and regional healthcare providers are expected to improve availability of annuloplasty systems across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3.3% share in 2024, driven by improving healthcare infrastructure and growing investment in cardiac care. Gulf nations such as Saudi Arabia and the United Arab Emirates are prioritizing cardiovascular health through advanced hospital facilities and government-funded initiatives. In Africa, the rising burden of valvular disorders and the expansion of private healthcare systems are creating growth opportunities. Despite limitations in specialized cardiac expertise and access to high-end devices, increasing awareness and medical training programs are gradually supporting market development across the region.

Market Segmentations:

By Application

- Mitral Valve Repair

- Tricuspid Valve Repair

- Aortic Valve Repair

By End Use

- Ambulatory Surgical Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The annuloplasty system market is highly competitive, featuring leading players such as Edwards Lifesciences Corporation, Abbott Laboratories, Medtronic plc, LivaNova PLC, CryoLife Inc., Valcare Medical, Micro Interventional Devices Inc., Cardiac Dimensions Inc., Sorin Group, and Neovasc Inc. These companies focus on technological innovation, product diversification, and strategic collaborations to strengthen their market presence. Continuous advancements in minimally invasive and transcatheter valve repair technologies have enhanced product efficiency and procedural safety. Major players are expanding their portfolios with flexible and biocompatible annuloplasty rings to improve clinical outcomes. Strategic mergers, acquisitions, and partnerships with hospitals and research institutions are driving competitive differentiation. Additionally, investments in 3D imaging, robotic assistance, and customized device development are shaping the next phase of innovation. The competitive landscape is defined by high R&D spending and increasing emphasis on patient-specific solutions to enhance precision and long-term procedural success.

Key Player Analysis

- Edwards Lifesciences Corporation

- Abbott Laboratories

- Medtronic plc

- LivaNova PLC

- CryoLife Inc.

- Valcare Medical

- Micro Interventional Devices Inc.

- Cardiac Dimensions Inc.

- Sorin Group

- Neovasc Inc.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In October 2025, Micro Interventional Devices, Inc. announced that its MIA‑T Percutaneous Tricuspid Annuloplasty System acquired U.S. FDA approval for its pivotal IDE trial.

- In March 2025, Valcare Medical announced that the AMEND™ Trans‑Septal System, a D-shaped semi-rigid annuloplasty ring for mitral repair, received U.S. FDA investigational device exemption (IDE) approval to begin its Early Feasibility Study (EFS).

- In July 2024, Valcare Medical expanded its EU pilot study of the AMEND system to Italy after Italian Ministry of Health approval, initiating enrolment of multiple Italian centres.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for minimally invasive cardiac repair procedures.

- Advancements in transcatheter and robotic-assisted annuloplasty systems will enhance procedural precision.

- Rising prevalence of mitral and tricuspid valve diseases will sustain long-term market growth.

- Development of patient-specific and biocompatible annuloplasty rings will improve clinical outcomes.

- Integration of 3D imaging and digital navigation tools will optimize surgical accuracy.

- Hospitals will continue to dominate due to advanced cardiac infrastructure and specialized expertise.

- Asia-Pacific will witness the fastest growth with expanding cardiovascular treatment facilities.

- Strategic collaborations between manufacturers and research institutes will drive product innovation.

- Increasing geriatric population will boost demand for safe and durable valve repair systems.

- Focus on cost-effective and efficient solutions will encourage adoption in emerging healthcare markets.