Market Overview:

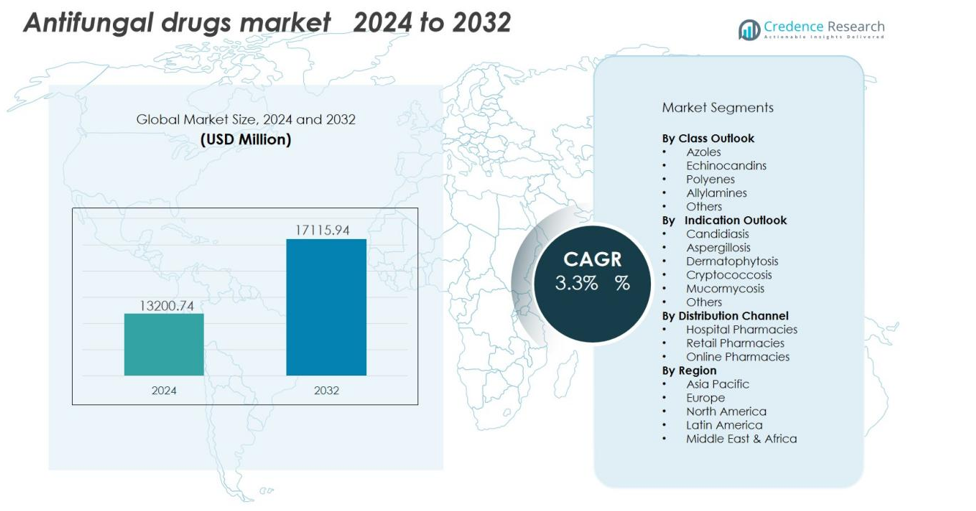

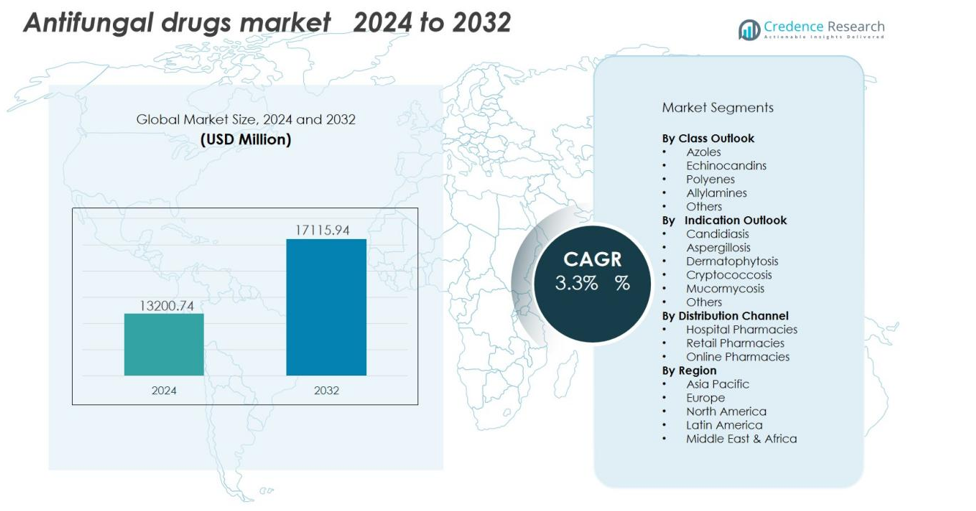

The Antifungal drugs market size was valued at USD 13200.74 million in 2024 and is anticipated to reach USD 17115.94 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antifungal drugs market Size 2024 |

USD 13200.74 million |

| Antifungal drugs market, CAGR |

3.3% |

| Antifungal drugs market Size 2032 |

USD 17115.94 million |

Growth is primarily supported by the rising prevalence of immunocompromised patients, an aging global population, and higher adoption of invasive medical procedures. Increased awareness of fungal infections and the availability of over-the-counter antifungal medications have also accelerated market growth. Pharmaceutical companies are investing in research and development to create next-generation drugs addressing resistance issues and emerging fungal strains.

Regionally, North America dominated the antifungal drugs market in 2024, holding over 40% of the total share, supported by advanced healthcare systems and strong demand for prescription drugs. Europe follows closely with a mature pharmaceutical landscape and stringent infection control practices. The Asia Pacific region is expected to experience the fastest growth, driven by expanding healthcare access, rising awareness, and a growing at-risk population across China, India, and Southeast Asia.

Market Insights:

- The Antifungal Drugs Market size was valued at USD 13,200.74 million in 2024 and is anticipated to reach USD 17,115.94 million by 2032, expanding at a CAGR of 3.3% during the forecast period.

- North America held 40% of the market share in 2024 due to advanced healthcare infrastructure, high treatment awareness, and early adoption of innovative antifungal therapies.

- Europe accounted for 28% of the total market share, supported by strong diagnostic capabilities, government funding, and a well-established pharmaceutical base.

- Asia Pacific captured 22% of the market share and is projected to record the fastest growth through 2032, driven by expanding healthcare access, higher infection rates, and growing e-pharmacy networks.

- By class, azoles led the segment with 38% share due to broad-spectrum activity, while echinocandins followed with 25% share, supported by rising use in resistant fungal infections.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Fungal Infections Among Immunocompromised Populations

The Antifungal Drugs Market is driven by the growing prevalence of fungal infections among patients with weakened immune systems. Individuals undergoing chemotherapy, organ transplants, or long-term corticosteroid therapy are at higher risk of invasive fungal diseases. The spread of hospital-acquired infections has further increased the demand for effective antifungal treatments. It benefits from heightened awareness of conditions such as candidiasis, aspergillosis, and cryptococcosis that require targeted drug therapies. Expanding diagnostic capabilities have improved early detection, encouraging timely antifungal intervention.

- For instance, Pfizer Inc.’s antifungal drug Vfend (voriconazole) was studied in randomized, controlled trials for primary treatment of invasive aspergillosis in immunocompromised patients. In a landmark study (Study 307/602), voriconazole demonstrated superior survival rates compared to the older standard therapy, conventional amphotericin B.

Expanding Geriatric Population and Increased Healthcare Spending

Global aging trends significantly influence demand for antifungal treatments. Elderly populations are more prone to chronic diseases, which compromise immunity and heighten vulnerability to fungal infections. Rising healthcare expenditure across both developed and emerging economies supports broader drug access and availability. It also drives hospital and retail pharmacy sales, strengthening prescription and over-the-counter product demand. The focus on preventive care and early treatment among older adults continues to propel this market forward.

- For instance, during 2021, Medicare Part D beneficiaries filled 6.5 million topical antifungal prescriptions at a total cost of $231 million, with ketoconazole representing 36.6% of prescriptions (2.4 million), nystatin 29.0% (1.9 million), and clotrimazole-betamethasone dipropionate 14.7% (0.9 million), highlighting substantial healthcare system investment in geriatric antifungal therapy.

Advancements in Drug Formulations and Novel Delivery Systems

Innovation in antifungal drug formulations is improving treatment outcomes and patient compliance. Pharmaceutical firms are developing drugs with extended-release profiles, topical solutions, and novel administration routes. It addresses issues of drug resistance and minimizes toxicity linked to older formulations. Liposomal and nanotechnology-based delivery systems are enhancing bioavailability and targeting efficiency. Such advancements expand clinical use in both hospital and outpatient settings.

Rising Awareness and Improved Diagnostic Infrastructure in Emerging Economies

Improved healthcare infrastructure in Asia Pacific, Latin America, and the Middle East has expanded access to antifungal therapies. Governments and health agencies are promoting awareness programs for fungal infections and hygiene standards. It is supported by better laboratory diagnostics that enable faster identification of fungal strains. Growing health insurance coverage and urbanization contribute to greater adoption of prescribed antifungal medications. The market continues to benefit from these structural healthcare improvements.

Market Trends:

Growing Focus on Novel Antifungal Agents and Drug Resistance Management

The Antifungal Drugs Market is experiencing a shift toward developing innovative agents to combat drug-resistant fungal strains. Pharmaceutical companies are investing in next-generation compounds that target new fungal pathways and exhibit broader spectra of activity. Resistance to existing azoles and echinocandins has intensified research for alternative mechanisms of action. It reflects a strategic focus on safer drugs with reduced hepatotoxicity and improved patient tolerance. The pipeline includes agents with dual mechanisms that address both surface and systemic infections. Combination therapies are also gaining traction, enhancing efficacy and minimizing resistance development. These innovations are expanding therapeutic options in both hospital and community care settings.

- For instance, F2G Ltd. announced the publication of successful Phase IIb trial results in June 2025 for olorofim, a novel orotomide antifungal. The data, from a study of 203 patients with life-threatening invasive fungal infections, demonstrated a positive risk-benefit profile.

Rising Adoption of Topical and Over-the-Counter Formulations for Mild Infections

Consumer preference for self-medication and convenience has driven strong growth in topical antifungal formulations. Creams, gels, and sprays are increasingly used to treat superficial infections such as athlete’s foot, ringworm, and yeast infections. It has encouraged pharmaceutical companies to expand over-the-counter portfolios targeting dermatophyte infections. Enhanced awareness of hygiene and dermatological health supports this trend in both urban and rural markets. Digital retail and e-pharmacy platforms are further increasing product accessibility and visibility. Patients favor non-invasive products that deliver quick relief with fewer side effects. This growing inclination toward topical and OTC solutions complements prescription drug sales and broadens overall market reach.

- For Instance, Cipla Health sells a range of popular consumer healthcare products through various e-pharmacy platforms, including Tata 1mg, with key brands like Clocip (an anti-fungal powder), Omnigel, and Nicotex holding strong positions in their respective market categories.

Market Challenges Analysis:

Rising Drug Resistance and Limited Availability of Novel Therapies

The Antifungal Drugs Market faces growing challenges from drug-resistant fungal strains that reduce treatment effectiveness. Long-term use of azoles and echinocandins has led to reduced sensitivity among common pathogens. It limits therapeutic options and increases the need for alternative drug classes. The slow pace of innovation and limited approval of new antifungal molecules create supply gaps in critical care. Pharmaceutical pipelines remain underdeveloped compared to antibacterial research. Hospitals are forced to rely on older, less effective drugs, leading to prolonged infections and higher mortality risks. Addressing this resistance requires stronger investment in research and clinical trials.

Adverse Side Effects and High Treatment Costs Impact Patient Compliance

Antifungal drugs often cause toxicity, including liver and kidney complications, which affect patient adherence. It discourages long-term therapy and complicates disease management. The high cost of systemic antifungal treatments creates access barriers in low- and middle-income regions. Many healthcare systems struggle to subsidize these essential medicines, limiting widespread use. Poor awareness of fungal infections further delays diagnosis and worsens outcomes. Stringent regulatory approval timelines also slow the introduction of safer alternatives. These factors collectively restrain market growth and limit treatment success rates.

Market Opportunities:

Expanding Research and Development for Next-Generation Antifungal Agents

The Antifungal Drugs Market holds significant opportunity through advanced research aimed at developing safer and more potent agents. Pharmaceutical companies are focusing on novel molecular targets and antifungal peptides to overcome resistance challenges. It opens possibilities for drugs with improved pharmacokinetics and fewer side effects. Collaborations between biotech firms and research institutions are accelerating discovery pipelines and clinical trials. The growing use of artificial intelligence in drug design enhances molecule screening and formulation efficiency. Rising government and private funding for infectious disease research further supports innovation in antifungal therapy. These efforts are expected to create a new generation of broad-spectrum and precision-targeted antifungal drugs.

Emerging Demand Across Developing Regions with Rising Healthcare Access

Expanding healthcare infrastructure and increasing disease awareness in emerging economies present major growth opportunities. It benefits from rising income levels, improved insurance coverage, and stronger distribution networks across Asia Pacific, Latin America, and Africa. Hospitals and retail pharmacies are expanding their antifungal product portfolios to meet rising infection rates. Governments are emphasizing infection control and preventive care, driving institutional purchases of antifungal medications. Local manufacturing initiatives are helping reduce costs and improve drug availability. E-commerce channels are also broadening access to OTC and prescription products. These factors collectively create a strong foundation for future market expansion.

Market Segmentation Analysis:

By Class Outlook

The Antifungal Drugs Market is segmented into azoles, echinocandins, polyenes, and allylamines. Azoles dominate the market due to their broad-spectrum activity and established use in treating systemic and superficial infections. It continues to see strong adoption in both hospital and retail settings for conditions like candidiasis and aspergillosis. Echinocandins are growing rapidly because of their effectiveness against resistant fungal strains and favorable safety profile. Polyenes remain vital for severe systemic infections, while allylamines are preferred for dermatophytic infections due to their topical efficacy.

- For Instance, Fujifilm Toyama Chemical’s Amphotericin B Liposomal (AmBisome) is used in Japan for the treatment of severe systemic fungal infections, particularly in acute care settings and for immunocompromised patients, such as those with hematologic malignancies or who have undergone stem cell transplantation. The actual number of such documented cases nationwide annually is substantially lower than 95,000, with national studies on specific severe infections like mucormycosis or disseminated cryptococcosis typically identifying only hundreds of cases per year.

By Indication Outlook

Key indications include aspergillosis, candidiasis, dermatophytosis, and others such as cryptococcosis and mucormycosis. Candidiasis represents the largest share due to its high occurrence among hospitalized and immunocompromised patients. It benefits from the growing number of invasive fungal infections requiring prescription treatments. Dermatophytosis treatments continue to expand with increased awareness of skin and nail infections. Rising cases of rare fungal diseases have also created new demand for specialized antifungal therapies.

- For instance, Scynexis developed Brexafemme (ibrexafungerp), the first novel non-azole oral antifungal that achieved 65.4% clinical success rate in preventing recurrence of vulvovaginal candidiasis over 24 weeks in the Phase 3 CANDLE trial, compared to 53.1% with placebo, demonstrating superior technological innovation in chronic yeast infection management.

By Distribution Channel

Distribution channels include hospital pharmacies, retail pharmacies, and online platforms. Hospital pharmacies dominate due to the high volume of prescriptions for systemic antifungal drugs. Retail pharmacies maintain steady growth with expanding over-the-counter options for topical treatments. It is further supported by online pharmacies that improve accessibility and offer convenient purchasing options. Growing digital health adoption continues to reshape distribution trends across both developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Class Outlook

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

By Indication Outlook

- Candidiasis

- Aspergillosis

- Dermatophytosis

- Cryptococcosis

- Mucormycosis

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America held 40% of the global market share in 2024, making it the largest regional segment. The region benefits from advanced healthcare infrastructure, high treatment awareness, and early adoption of innovative antifungal drugs. It continues to witness rising fungal infection cases among immunocompromised populations, driving hospital-based drug demand. Pharmaceutical companies based in the United States are actively developing novel formulations with improved efficacy and safety. Canada supports growth through expanding infection control programs and strong regulatory frameworks. Robust insurance coverage and widespread access to prescription medications reinforce North America’s leadership position in the global market.

Europe

Europe accounted for 28% of the total market share in 2024, supported by a well-established healthcare system and consistent government funding. The region exhibits strong demand for prescription-based antifungal medications, especially in Germany, the United Kingdom, and France. It benefits from high awareness of fungal infections and the availability of advanced diagnostic technologies. Increasing cases of resistant fungal strains have accelerated the need for new antifungal agents. Pharmaceutical collaborations across European nations are improving research pipelines and access to essential therapies. Regulatory bodies continue to enforce stringent drug safety standards that enhance consumer confidence.

Asia Pacific

Asia Pacific captured 22% of the market share in 2024 and is projected to record the fastest growth through 2032. Rising population density, expanding healthcare infrastructure, and increasing awareness of fungal infections support this growth. It gains momentum from higher incidences of dermatophytosis, candidiasis, and hospital-acquired infections. Countries such as China, India, and Japan are investing in healthcare modernization and local drug production. Growing e-pharmacy networks and government health initiatives are widening treatment accessibility. Strengthened diagnostic capacity and demand for affordable antifungal formulations continue to drive regional expansion.

Key Player Analysis:

- Novartis AG

- Pfizer, Inc.

- Bayer AG

- Sanofi

- Merck & Co., Inc.

- GSK plc

- Abbott

- Glenmark

- Enzon Pharmaceuticals, Inc.

- Astellas Pharma, Inc.

Competitive Analysis:

The Antifungal Drugs Market is characterized by intense competition among global pharmaceutical leaders focused on product innovation and strategic expansion. Key players include Novartis AG, Pfizer Inc., Bayer AG, Sanofi, Merck & Co., Inc., GSK plc, and Abbott. These companies maintain strong portfolios of prescription and over-the-counter antifungal therapies targeting systemic and superficial infections. It continues to advance through ongoing R&D investments aimed at developing broad-spectrum and resistance-targeted drugs. Market participants are strengthening distribution networks and partnerships to expand their reach across emerging regions. Continuous reformulation of existing drugs and the introduction of improved delivery systems enhance therapeutic outcomes. Strategic acquisitions and collaborations with research institutions further support competitive differentiation and pipeline growth.

Recent Developments:

- In April 2025, Novartis entered into a definitive agreement to acquire Regulus Therapeutics Inc., focusing on microRNA-based medicines, with an initial payment of $0.8 billion and milestones up to $1.7 billion.

- In September 2025, Bayer launched its Co.Lab AdVenture platform connecting biotech startups in Shanghai with global venture capital partners, including SIIC and Legend Capital.

Report Coverage:

The research report offers an in-depth analysis based on Class Outlook, Indication Outlook, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Antifungal Drugs Market will experience sustained growth driven by rising global infection rates.

- Pharmaceutical innovation will focus on next-generation antifungal agents with improved safety and efficacy.

- Rising awareness of fungal infections will strengthen demand across both developed and emerging economies.

- Healthcare digitalization and telemedicine expansion will increase prescription and over-the-counter drug accessibility.

- Biotech partnerships will accelerate research on novel antifungal molecules and advanced formulations.

- Topical and OTC segments will grow rapidly due to patient preference for self-care and quick relief.

- Improved diagnostics and rapid testing technologies will support earlier detection and timely treatment.

- Government initiatives promoting infection prevention and hospital hygiene will enhance drug adoption.

- Expansion of e-pharmacy platforms will make antifungal treatments more accessible to rural populations.

- The market will continue to consolidate, with leading companies pursuing acquisitions and new product launches to strengthen global presence.