Market Overview:

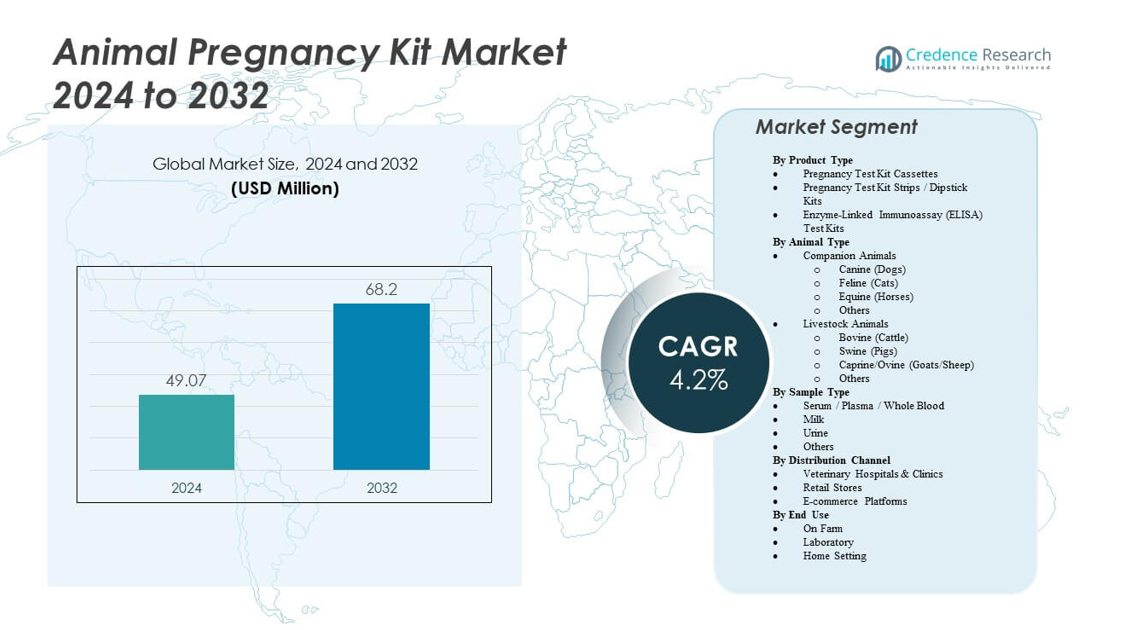

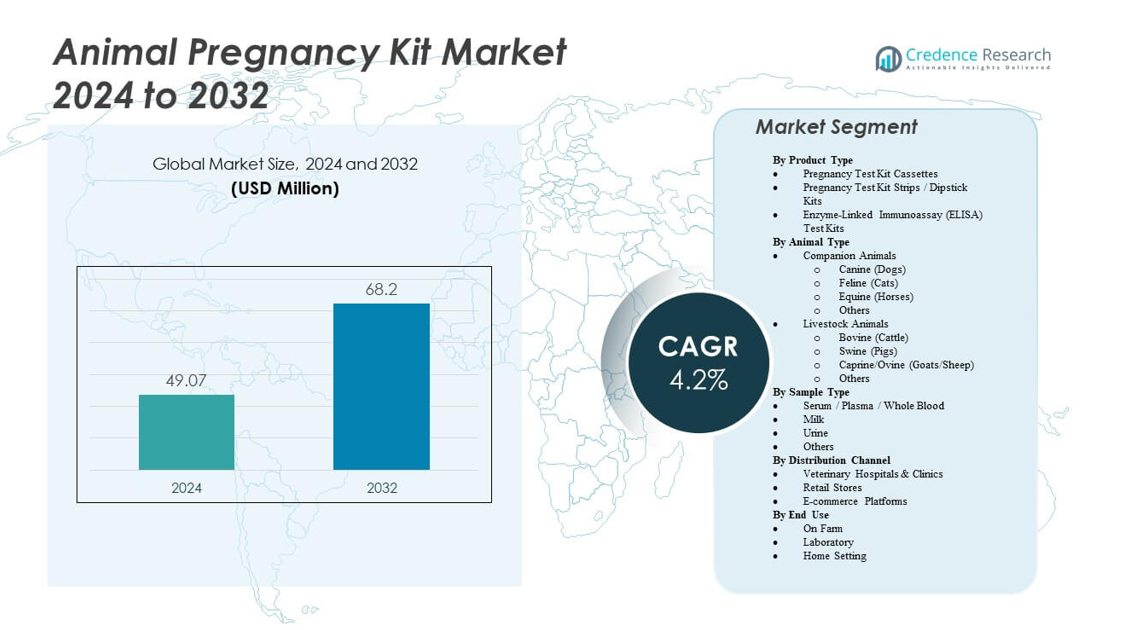

The Animal Pregnancy Kit Market is projected to grow from USD 49.07 million in 2024 to an estimated USD 68.2 million by 2032, with a compound annual growth rate (CAGR) of 4.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Pregnancy Kit Market Size 2024 |

USD 49.07 Million |

| Animal Pregnancy Kit Market, CAGR |

4.2% |

| Animal Pregnancy Kit Market Size 2032 |

USD 68.2 Million |

Increasing awareness of animal health management and advancements in veterinary diagnostics are key growth drivers. Rapid testing technologies, such as ELISA and immunoassay kits, enhance accuracy and ease of use across both farms and veterinary clinics. Growing demand for dairy and meat products encourages adoption of these kits among farmers aiming to boost herd fertility. Government-led livestock health programs and veterinary support networks further strengthen market expansion across rural and commercial farms.

North America leads the market due to advanced veterinary infrastructure and early adoption of diagnostic technologies in livestock farming. Europe follows closely, driven by strong animal welfare regulations and integration of digital monitoring systems. Asia-Pacific is emerging as a high-growth region supported by expanding livestock populations and increasing awareness among small and medium-scale farmers. Latin America and the Middle East & Africa are also gaining momentum, supported by government initiatives promoting modern reproductive management practices in agriculture.

Market Insights:

- The Animal Pregnancy Kit Market is projected to grow from USD 49.07 million in 2024 to USD 68.2 million by 2032, registering a CAGR of 4.2%.

- Rising focus on livestock reproductive efficiency and early pregnancy detection drives steady market adoption.

- Increasing demand for dairy and meat products supports the use of reliable diagnostic kits among farmers.

- Advancements in ELISA and immunoassay testing technologies enhance result accuracy and convenience.

- Limited awareness in rural regions and uneven veterinary access act as key restraints on market growth.

- North America leads the market due to strong veterinary infrastructure and advanced diagnostic practices.

- Asia-Pacific shows the fastest growth, supported by expanding livestock populations and government-backed animal health initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Livestock Reproduction and Farm Productivity

The Animal Pregnancy Kit Market is driven by the growing emphasis on livestock fertility management. Farmers are adopting diagnostic tools to detect pregnancies early, reducing losses from missed breeding cycles. Accurate results help optimize feeding and breeding schedules, improving animal productivity. Dairy and meat producers are using these kits to ensure consistent supply and quality. Rural veterinary programs promote awareness of reproductive health, increasing product acceptance. Growing global demand for animal-based food further encourages kit usage. Companies continue developing rapid tests for field applications. Governments support programs to enhance livestock reproductive efficiency.

- For instance, the IDEXX Alertys Rapid Visual Pregnancy Test is widely used across U.S. cattle farms and can detect pregnancy-associated glycoproteins as early as 28 days post-breeding, with sensitivity rates of 98.4% and specificity of 96.5%—validated by laboratory and field trials.

Growing Awareness and Veterinary Support for Early Pregnancy Detection

Increasing education among livestock owners about early diagnosis benefits encourages adoption of these kits. Veterinarians recommend rapid testing to avoid unnecessary insemination and maintain herd health. Awareness campaigns by animal health organizations highlight early detection’s economic value. Easy-to-use devices allow farmers to test on-site without expert help. High accuracy rates build user trust and promote repeat purchases. Veterinary hospitals integrate such diagnostics into breeding management plans. The shift toward preventive veterinary practices strengthens market penetration. The Animal Pregnancy Kit Market benefits from collaboration between veterinary suppliers and farming cooperatives.

Technological Advancement in Immunoassay and ELISA-Based Testing Kits

Innovation in diagnostic technologies drives the adoption of more accurate and portable testing tools. Companies are introducing ELISA and immunoassay-based kits offering reliable results within minutes. Automation reduces human error and improves data accuracy in field use. Portable devices with simple workflows appeal to small-scale farmers. Manufacturers focus on reducing testing costs without compromising performance. Integration of digital tracking systems helps record and monitor reproductive data. Continuous research in biosensors enhances kit sensitivity for multiple animal species. It encourages investment in advanced veterinary diagnostics by global health companies.

Government Initiatives and Supportive Livestock Health Programs

Public sector initiatives to improve animal breeding efficiency positively influence market growth. Subsidies and veterinary extension programs promote kit distribution in rural areas. Agencies focus on disease prevention and fertility management, creating awareness among farmers. Collaborations with agricultural institutions ensure product accessibility. Health ministries in developing nations emphasize livestock productivity through diagnostic tools. Growing investments in veterinary infrastructure expand market outreach. Public-private partnerships enable bulk procurement and training for rural communities. It contributes to higher adoption rates and improved herd management outcomes.

- For instance, India’s Rashtriya Gokul Mission, under the Ministry of Animal Husbandry and Dairying, has subsidized pregnancy detection and artificial insemination programs, targeting 2 lakh IVF pregnancies to be established in five years. This initiative is detailed in official government releases and parliamentary documents, with subsidies of INR 5,000 per assured pregnancy to improve breed quality and rural livestock productivity.

Market Trends

Adoption of Portable and On-Site Diagnostic Tools for Field Application

Technological innovation encourages the shift toward portable and easy-to-use diagnostic kits. The Animal Pregnancy Kit Market observes rising preference for compact tools providing instant results. Field-based devices help farmers perform tests without laboratory support. These kits reduce diagnosis time and operational cost for livestock farms. Companies invest in lightweight, durable designs suitable for harsh environments. Demand grows for kits compatible with multiple species. Manufacturers integrate colorimetric and digital reading systems for improved usability. It reflects the broader trend of precision livestock farming worldwide.

Integration of Digital Platforms and Data Analytics in Reproductive Monitoring

Digital technology integration is transforming pregnancy detection accuracy and data management. Cloud-based applications allow veterinarians to track reproductive health remotely. Farmers access reports through mobile dashboards for real-time decision-making. The Animal Pregnancy Kit Market leverages IoT and data analytics to forecast breeding cycles. Automation of data entry reduces manual errors and saves time. Companies design Bluetooth-enabled kits connecting directly with smartphones. Predictive analytics enhance breeding efficiency by identifying fertility patterns. It strengthens the link between diagnostics and herd management analytics.

Expansion of Rapid Lateral Flow and Immunochromatographic Testing

Rapid testing kits using lateral flow technology are gaining industry traction. Farmers prefer these kits for their simplicity and speed in field conditions. The Animal Pregnancy Kit Market benefits from innovations ensuring higher specificity and stability. Lateral flow tests provide visual confirmation in minutes without additional tools. Companies enhance reagents to improve storage life and test sensitivity. The technology supports both professional veterinarians and small farmers. User-friendly design increases accessibility in remote regions. It supports faster breeding decisions and reduces unproductive intervals.

- For instance, BioTracking’s BioPRYN ELISA blood test for ruminant pregnancy achieved a total sensitivity of 91.4% and specificity of 100% in published research on American bison and similar metrics in cattle. The practical testing approach using a single blood sample at 62 days post-mating minimizes handling and stress, providing results consistent with conventional methods.

Rising Focus on Sustainable and Animal-Friendly Diagnostic Practices

Sustainability is shaping new product development strategies among leading manufacturers. Producers use biodegradable materials for kit components to reduce waste. The Animal Pregnancy Kit Market experiences increased demand for non-invasive testing. Bio-based reagents replace chemical-intensive formulations in test development. Companies prioritize ethical testing aligned with animal welfare standards. Regulatory bodies encourage sustainable diagnostic practices across veterinary applications. Manufacturers adapt packaging to minimize environmental impact. It supports the industry’s alignment with global sustainability goals.

- For instance, Zoetis produces diagnostic kits such as WITNESS® and SERELISA®, which are simple to use and minimize sample requirements, thus reducing animal distress. Zoetis is publicly committed to sustainable packaging and improved point-of-care diagnostic design to further lower environmental impact in veterinary practice.

Market Challenges Analysis

Limited Awareness and Inconsistent Product Accessibility in Developing Regions

Low awareness among small-scale farmers restricts broader adoption across emerging markets. Many rural users remain unfamiliar with available pregnancy detection tools. The Animal Pregnancy Kit Market faces barriers due to uneven distribution networks and training gaps. Limited access to veterinary infrastructure reduces testing reliability. Farmers in remote areas depend on traditional observation methods, affecting accuracy. Import costs and logistical constraints increase retail pricing. Lack of government support in some nations hinders affordability. It slows the transition toward advanced reproductive management systems.

Regulatory and Accuracy Concerns Impacting User Confidence

Regulatory variation across countries leads to product approval delays and market entry issues. Certification requirements for diagnostic tools differ among regional authorities. The Animal Pregnancy Kit Market contends with inconsistent standards for sensitivity and precision. Variations in animal species physiology also affect result reliability. Inadequate quality control by smaller producers lowers confidence among users. Manufacturers must invest in validation studies to meet global benchmarks. Distributors face challenges ensuring temperature-stable storage during transport. It creates hurdles in achieving consistent test performance across markets.

Market Opportunities

Growing Demand for Precision Livestock Management and Data-Driven Breeding

Advancement in precision livestock management opens new opportunities for diagnostic manufacturers. The Animal Pregnancy Kit Market benefits from integration with smart farming technologies. Farmers seek data-driven methods to track reproductive health in real time. IoT-enabled kits allow automatic updates on conception success rates. Veterinary service providers can analyze aggregated data to improve breeding outcomes. Companies offering combined analytics and testing solutions gain competitive advantage. Demand rises for multi-species kits catering to mixed-farm operations. It presents scope for partnerships between technology firms and agricultural agencies.

Expansion Potential Across Emerging Economies with Growing Livestock Populations

Emerging nations in Asia-Pacific, Latin America, and Africa hold strong market potential. Rising livestock populations increase the need for efficient reproductive tools. The Animal Pregnancy Kit Market stands to benefit from expanding veterinary networks. Governments are investing in agricultural modernization programs and farmer education. Distributors target rural markets with low-cost yet reliable products. Local manufacturing partnerships reduce dependency on imports. Expansion of e-commerce channels improves product reach and availability. It creates long-term opportunities for sustained growth in underpenetrated regions.

Market Segmentation Analysis:

By Product Type

The Animal Pregnancy Kit Market is segmented into pregnancy test kit cassettes, strips or dipstick kits, and ELISA test kits. Pregnancy test kit cassettes dominate due to their accuracy, ease of use, and suitability for both field and laboratory testing. Strips or dipstick kits are gaining traction among small-scale farmers for quick, cost-effective testing. ELISA test kits hold importance in veterinary laboratories for their high precision and ability to process multiple samples simultaneously. Each product type caters to distinct end-user needs across livestock and companion animal sectors.

By Animal Type

The market is divided into companion animals and livestock animals, including subcategories such as canine, feline, equine, bovine, swine, and caprine/ovine. Livestock animals account for the largest demand due to the focus on improving dairy and meat productivity. Companion animal testing is increasing with rising pet healthcare awareness and veterinary visits. The Animal Pregnancy Kit Market benefits from growing veterinary infrastructure supporting both livestock and companion diagnostics. It continues to expand as breeders adopt efficient reproductive monitoring systems.

- For instance, BioPRYN by BioTracking Inc. has processed over 6 million blood samples from cattle, sheep, goats, bison, deer, elk, and moose since 2002. The test demonstrates over 99% accuracy in identifying open (non-pregnant) cows, with a false-open rate of 1% and a false-pregnant rate of around 5%, primarily linked to early embryonic loss or sample handling variability.

By Sample Type

Sample types include serum, plasma, whole blood, milk, urine, and others. Serum and plasma samples remain the most widely used due to their high reliability in detecting pregnancy hormones. Milk-based testing is popular among dairy farmers for its non-invasive nature and accessibility. Urine-based kits appeal to small-scale farmers for quick and field-friendly use. It supports varied user preferences, ensuring adaptability across animal species and testing environments.

By Distribution Channel

Distribution occurs through veterinary hospitals and clinics, retail stores, and e-commerce platforms. Veterinary hospitals remain the primary channel for professional-grade testing solutions. Retail stores support sales in rural areas where farmers prefer physical access. The Animal Pregnancy Kit Market is witnessing rapid growth in online distribution, providing easy availability and brand comparison. It enables smallholders and veterinarians to procure diagnostic kits conveniently and cost-effectively.

By End Use

End-use segments include on-farm, laboratory, and home settings. On-farm applications lead due to growing demand for point-of-care testing among livestock owners. Laboratory testing retains importance in confirming results through advanced methods. Home setting use is expanding among companion animal owners seeking quick and private results. It reflects an evolving balance between professional and user-driven testing practices across the animal health ecosystem.

- For instance, IDEXX’s Rapid Visual Pregnancy Test enables on-farm detection of pregnancy-associated glycoproteins in cattle and other ruminants as early as 28 days post-breeding, while BioTracking’s BioPRYN ELISA test provides laboratory-confirmed results through standardized protocols integrated with herd management software for efficient reproductive monitoring.

Segmentation:

By Product Type

- Pregnancy Test Kit Cassettes

- Pregnancy Test Kit Strips / Dipstick Kits

- Enzyme-Linked Immunoassay (ELISA) Test Kits

By Animal Type

- Companion Animals

- Canine (Dogs)

- Feline (Cats)

- Equine (Horses)

- Others

- Livestock Animals

- Bovine (Cattle)

- Swine (Pigs)

- Caprine/Ovine (Goats/Sheep)

- Others

By Sample Type

- Serum / Plasma / Whole Blood

- Milk

- Urine

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Stores

- E-commerce Platforms

By End Use

- On Farm

- Laboratory

- Home Setting

By Region or Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading position in the Animal Pregnancy Kit Market with a 36.5% share. Strong veterinary infrastructure, advanced diagnostic technologies, and widespread livestock management programs support its dominance. The United States drives demand through extensive dairy and beef industries that prioritize early pregnancy detection for productivity gains. Canada contributes with growing awareness among small and medium-scale farmers adopting rapid testing kits. The region’s regulatory emphasis on animal welfare and data-driven livestock monitoring encourages consistent innovation. It continues to witness strong investments from key manufacturers developing portable and high-accuracy testing solutions.

Europe

Europe accounts for 28.7% of the global share, driven by a mature veterinary network and well-established animal healthcare systems. The UK, Germany, and France lead regional growth with advanced farm automation and digital diagnostic adoption. Growing emphasis on sustainable livestock management enhances kit adoption across dairy and swine operations. The Animal Pregnancy Kit Market benefits from the region’s strict regulatory standards promoting reliable and validated diagnostic tools. It shows steady demand among both large-scale and family-run farms maintaining reproductive efficiency. Manufacturers in Europe focus on eco-friendly and reusable test designs aligning with regional sustainability goals.

Asia-Pacific, Latin America, and Middle East & Africa

Asia-Pacific holds a 24.1% share and is the fastest-growing regional market due to expanding livestock populations and improved veterinary access. China, India, and Japan lead the region with strong government support for modern animal healthcare. Latin America represents 6.2% of the global market, supported by dairy expansion in Brazil, Argentina, and Mexico. The Middle East & Africa account for 4.5%, with rising adoption in countries such as South Africa and Saudi Arabia. It benefits from improving farm management practices and growing awareness of reproductive health diagnostics. Increasing rural outreach and local manufacturing investments are expected to further accelerate market growth across these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IDEXX Laboratories, Inc.

- Zoetis Services LLC

- Ring Biotechnology Co. Ltd.

- Hangzhou Testsea Biotechnology Co. Ltd.

- BioTracking, Inc.

- J&G Biotech Ltd.

- Fassisi (Germany)

- BioNote Inc.

- Randox Laboratories Ltd.

- Bellylabs Oy

- EMLAB Genetics LLC

- Secure Diagnostics Pvt. Ltd.

- Neogen Corporation

- Thermo Fisher Scientific, Inc.

- Eurolyser Diagnostica

- Mitra Industries (India) Pvt. Ltd.

- Vetlab (Diamond Diagnostics)

- Ourofino Saude Animal (Brazil)

- Agener Uniao Saude Animal (Brazil)

- VetECG (Israel)

Competitive Analysis:

The Animal Pregnancy Kit Market is highly competitive, featuring established veterinary diagnostic companies and emerging biotechnology firms. IDEXX Laboratories, Zoetis, and Neogen Corporation lead through extensive product portfolios and strong distribution networks. Thermo Fisher Scientific and Randox Laboratories invest in advanced immunoassay technologies to enhance test accuracy and efficiency. It witnesses continuous innovation in portable and rapid diagnostic formats designed for on-farm use. Regional players such as Mitra Industries, Hangzhou Testsea Biotechnology, and Bellylabs Oy strengthen their presence through cost-effective and user-friendly products. Partnerships between manufacturers and veterinary institutions support new product validation and wider adoption. Companies focus on expanding reach in developing regions through e-commerce and local manufacturing alliances.

Recent Developments:

- In July 2025, Ringbio unveiled its Pig Pregnancy Rapid Test Kit at the AVIANA Expo in Nigeria, showcasing a urine-based, on-farm pregnancy diagnostic tool. This product is engineered to deliver fast and accurate pregnancy results, specifically tailored to enhance the efficiency and sustainability of swine farming operations, enabling farmers to improve herd management practices on-site.

Report Coverage:

- The research report offers an in-depth analysis based on Product Type, Animal Type, Sample Type, Distribution Channel and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for rapid and portable diagnostic kits will strengthen field-based testing adoption.

- Rising awareness of animal fertility management will drive increased use across livestock farms.

- Technological advancement in immunoassay and ELISA platforms will enhance test accuracy and reliability.

- Integration of digital tools and IoT-enabled diagnostics will support precision livestock monitoring.

- Expansion of e-commerce platforms will improve accessibility for farmers and small veterinary clinics.

- Increasing government programs on animal health and reproductive efficiency will boost rural adoption.

- Sustainable and non-invasive testing solutions will gain traction among animal welfare-focused producers.

- Strategic collaborations between biotech firms and veterinary networks will accelerate product innovation.

- Emerging economies in Asia-Pacific and Latin America will present high-growth opportunities.

- Rising investment in veterinary infrastructure and farmer education will ensure long-term market stability.