Market Overview

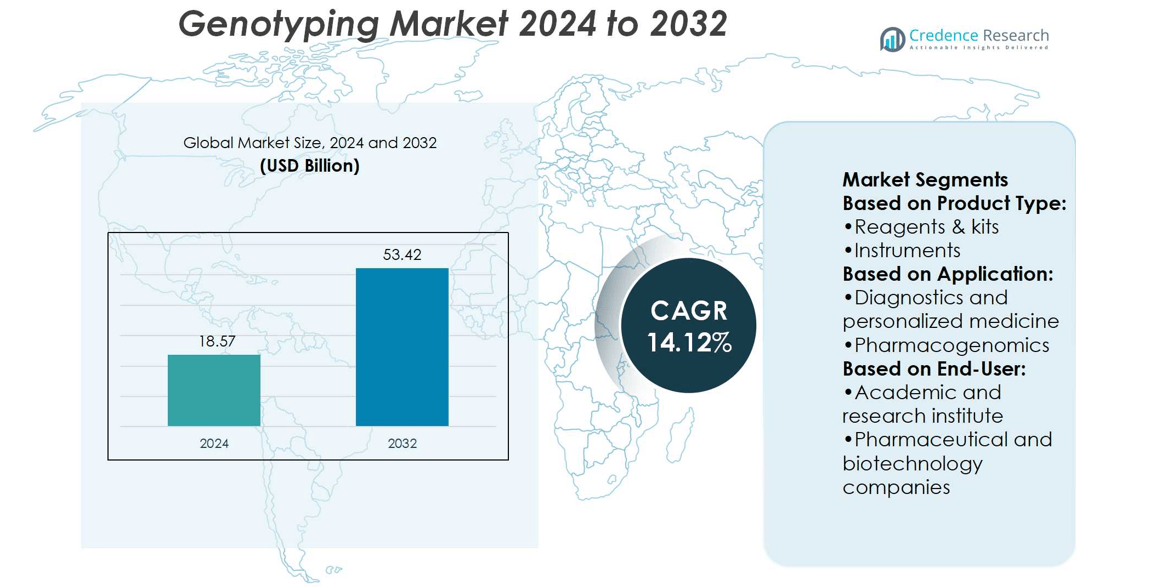

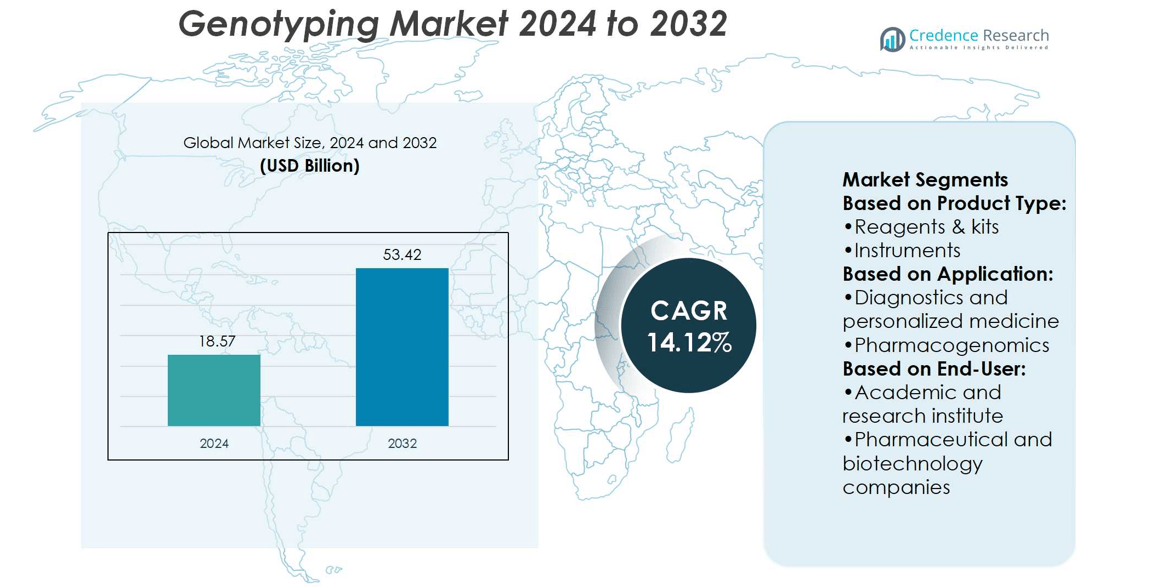

Genotyping Market size was valued at USD 18.57 billion in 2024 and is anticipated to reach USD 53.42 billion by 2032, at a CAGR of 14.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Genotyping Market Size 2024 |

USD 18.57 billion |

| Genotyping Market, CAGR |

14.12% |

| Genotyping Market Size 2032 |

USD 53.42 billion |

The Genotyping Market is driven by rising demand for personalized medicine, expanding use in pharmacogenomics, and increasing prevalence of chronic and genetic disorders that require advanced diagnostics. It gains momentum from agricultural applications, where genetic tools improve crop resilience and livestock productivity. Technological advancements in sequencing platforms, reagents, and bioinformatics strengthen adoption across research and clinical settings. The market also trends toward direct-to-consumer testing, supported by growing awareness of ancestry and wellness insights. Integration of digital platforms and data-sharing solutions enhances accessibility, while regulatory support and government funding encourage innovation and wider implementation in healthcare and agriculture.

The Genotyping Market shows strong regional presence, with North America leading due to advanced healthcare infrastructure, Europe following with supportive regulations and research funding, and Asia Pacific emerging as the fastest-growing region driven by rising clinical trials and healthcare investments. Latin America and the Middle East & Africa show gradual growth through improving infrastructure and government initiatives. Key players shaping the market include Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd., and Bio-Rad Laboratories Inc.

Market Insights

- The Genotyping Market was valued at USD 18.57 billion in 2024 and will reach USD 53.42 billion by 2032, growing at a CAGR of 14.12%.

- Rising demand for personalized medicine and growing use in pharmacogenomics drive market expansion.

- Increasing prevalence of chronic and genetic disorders strengthens adoption of advanced diagnostic tools.

- Direct-to-consumer genetic testing grows rapidly with awareness of ancestry and wellness insights.

- High costs of advanced technologies and regulatory complexities act as key restraints.

- North America leads the market, Europe follows, while Asia Pacific shows the fastest growth; Latin America and Middle East & Africa expand gradually.

- Leading companies focus on innovation, collaborations, and digital integration, with players such as Illumina, Thermo Fisher, QIAGEN, Roche, and Bio-Rad shaping competition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Need for Personalized Medicine and Precision Therapies

The Genotyping Market benefits from rising demand for personalized medicine across healthcare systems. Physicians depend on genotyping tools to identify genetic variations linked to disease risk, treatment response, and drug metabolism. This demand drives investments in research and diagnostics aimed at tailoring treatments to individuals. It enhances therapeutic efficacy and minimizes adverse drug reactions, creating measurable healthcare benefits. Pharmaceutical firms prioritize genotyping in drug development pipelines to streamline clinical trials. Strong alignment between patient outcomes and regulatory expectations further supports rapid adoption of these tools.

- For instance, Eurofins Genomics processed 40,500 samples via GWAS microarray in one year for the SIMPLER project, extracting DNA from 38,000 blood and saliva samples to support biomarker discovery. It enhances therapeutic efficacy and minimizes adverse drug reactions, creating measurable healthcare benefits.

Expanding Applications in Agricultural Biotechnology and Livestock Management

The Genotyping Market gains momentum from its use in agricultural biotechnology. Genotyping techniques help identify crop traits linked to yield, disease resistance, and stress tolerance. Agribusinesses integrate these tools to enhance seed development and accelerate breeding programs. In livestock, it supports genetic screening for superior traits, improving productivity and sustainability. This application strengthens food security by ensuring resilient and high-quality agricultural outputs. Governments and private firms continue to fund such programs to address growing global food demands.

- For instance, the Biomark X9 System processes up to 9,216 reactions per run (combining many samples and assays) using its integrated. In the plant & seed domain, the system supports simultaneous screening of up to 192 samples or markers for trait selection (such as disease resistance or growth) in one assay run.

Technological Advancements in Genotyping Platforms and Data Analysis

The Genotyping Market advances through continuous improvements in platforms, reagents, and data analysis software. High-throughput sequencing, next-generation arrays, and real-time PCR offer greater speed, precision, and affordability. These innovations allow broader adoption in research institutions, diagnostic laboratories, and clinical settings. Automated workflows reduce errors, while cloud-based platforms enable secure data sharing and interpretation. Competitive players emphasize innovation to maintain leadership and expand user adoption. It increases the scalability and accessibility of genotyping for diverse applications.

Rising Prevalence of Chronic and Genetic Disorders Driving Diagnostics Demand

The Genotyping Market experiences sustained growth due to the rising burden of chronic and genetic diseases. Early diagnosis of conditions such as cancer, diabetes, and cardiovascular disorders depends on advanced genetic tools. Genotyping supports predictive risk assessments and helps clinicians intervene earlier. It strengthens precision diagnostics by identifying mutations responsible for hereditary diseases. Demand from hospitals and diagnostic laboratories intensifies as patient awareness increases. Governments and healthcare providers invest in advanced testing programs to meet these clinical needs.

Market Trends

Integration of Genotyping with Next-Generation Sequencing and Digital Platforms

The Genotyping Market is witnessing a strong trend toward integration with next-generation sequencing (NGS). NGS platforms enable high-throughput genetic profiling at reduced costs and higher accuracy. It allows researchers and clinicians to analyze large genetic datasets with improved speed. Digital tools and cloud-based systems support real-time data storage, sharing, and interpretation. This trend accelerates clinical adoption and strengthens collaborations in research and diagnostics. Companies expand their product portfolios by merging genotyping technologies with advanced sequencing solutions.

- For instance, Bio-Rad ddPCR System partitions a DNA library into over 20,000 droplets per reaction, enabling absolute quantification of target sequences for NGS library prep.

Increasing Role of Genotyping in Pharmacogenomics and Drug Development

The Genotyping Market shows significant growth in pharmacogenomics applications, where genetic testing tailors drug therapy. Pharmaceutical companies adopt genotyping to reduce trial failures and improve drug efficacy. It identifies genetic variations affecting drug metabolism and patient response. The practice helps design safer and more effective personalized therapies. Regulators encourage pharmacogenomic integration, further reinforcing this trend. The convergence of genotyping and pharmacology reshapes the global drug development landscape.

- For instance, Thermo Fisher offers over 2,700 TaqMan® Drug Metabolism Enzyme (DME) Genotyping Assays, which cover 221 DME and drug transporter genes, enabling detection of polymorphisms relevant for drug metabolism.

Expansion of Direct-to-Consumer Genetic Testing and Personalized Health Insights

The Genotyping Market expands with the growing popularity of direct-to-consumer (DTC) testing. Consumers seek affordable tests offering insights into ancestry, wellness, and genetic predispositions. It drives higher demand for simple, user-friendly testing kits available through online platforms. Companies focus on offering faster results supported by advanced bioinformatics tools. Rising consumer awareness strengthens the link between genetic testing and preventive healthcare. The growing role of e-commerce accelerates accessibility and adoption of genotyping services.

Growing Focus on Agricultural Genotyping and Food Security Solutions

The Genotyping Market benefits from wider adoption in agriculture and food security programs. Agribusinesses employ genetic tools to improve crop resilience, yield, and quality. It also supports livestock management by enabling selection of superior genetic traits. Governments and research institutions invest heavily in genotyping to meet rising food demands. Sustainable farming practices integrate genotyping to enhance efficiency and reduce risks. This trend underlines the role of genetics in ensuring long-term agricultural sustainability.

Market Challenges Analysis

High Cost of Advanced Technologies and Limited Accessibility in Developing Regions

The Genotyping Market faces challenges due to the high cost of advanced platforms and consumables. Many laboratories struggle to adopt next-generation sequencing or high-throughput arrays due to financial constraints. It restricts access to cutting-edge technologies in low- and middle-income countries. Limited infrastructure and shortage of skilled professionals further slow adoption. Smaller research institutions and diagnostic centers remain dependent on basic techniques, reducing market penetration. Uneven distribution of resources creates gaps in global accessibility and usage.

Data Privacy Concerns and Regulatory Complexities Slowing Adoption

The Genotyping Market encounters barriers from strict regulatory frameworks and rising concerns about data privacy. Handling genetic information raises issues of confidentiality, ownership, and misuse. It creates hesitation among consumers and healthcare providers when adopting genotyping services. Inconsistent regulatory standards across countries complicate product approvals and commercialization. Companies must invest heavily in compliance, delaying innovation and market entry. Ethical debates around genetic testing further limit acceptance in certain populations.

Market Opportunities

Expanding Role of Genotyping in Precision Medicine and Preventive Healthcare

The Genotyping Market presents strong opportunities through its integration into precision medicine. Hospitals and clinics increasingly rely on genetic tools to guide treatment plans. It enables early identification of disease risks and supports preventive healthcare strategies. Demand rises for pharmacogenomics testing, which customizes therapies based on individual genetic profiles. Healthcare providers and payers recognize the value of reducing treatment failures and adverse reactions. Growing awareness among patients creates favorable conditions for widespread adoption of advanced genotyping solutions.

Rising Applications in Agriculture, Food Security, and Consumer Genomics

The Genotyping Market also benefits from expanding opportunities in agriculture and consumer-focused applications. Agribusinesses adopt genotyping to improve crop resilience, breeding efficiency, and livestock quality. It supports food security by addressing climate change challenges and increasing production sustainability. Direct-to-consumer genetic testing offers another growth avenue with rising interest in ancestry and wellness insights. Companies can leverage e-commerce platforms to reach wider populations with affordable test kits. Research funding and government initiatives further reinforce opportunities across both healthcare and agricultural domains.

Market Segmentation Analysis:

By Product Type

The Genotyping Market is segmented into reagents & kits, instruments, and software & services. Reagents & kits dominate due to their recurring use in research and clinical testing. It supports high demand for consumables required in polymerase chain reaction (PCR), sequencing, and microarray-based studies. Instruments represent a steady segment, driven by continuous technological advancements and demand for high-throughput systems. Software & services grow with the need for accurate data analysis, bioinformatics, and cloud-based platforms. Companies emphasize automation and integrated workflows to increase efficiency across laboratories.

- For instance, GE’s Omni Legend PET-CT (digital system with a 32-cm axial field-of-view) has tangential, radial, and axial spatial resolutions measured at a 1 cm radial offset of 3.76 mm, 3.73 mm, and 4.25 mm FWHM, respectively.

By Application

The Genotyping Market is categorized into diagnostics and personalized medicine, pharmacogenomics, animal genetics, and other applications. Diagnostics and personalized medicine hold the largest share, supported by rising cases of chronic and genetic diseases. It enables early detection and precision treatment, creating strong adoption in hospitals and clinics. Pharmacogenomics emerges as a vital area, guiding drug response and reducing trial failures. Animal genetics contributes significantly by supporting breeding programs and livestock improvement. Other applications, including agriculture and forensic testing, continue to expand with growing research investments.

- For instance, QIAGEN’s QIAstat-Dx Rise (FDA cleared in Sept 2025) can process up to 160 samples per day, with eight analytical modules (including two urgent-slots per run) and about <1 minute hands-on time per run.

By End-user

The Genotyping Market is further divided into academic and research institutes, pharmaceutical and biotechnology companies, and diagnostic centers. Academic and research institutes account for a major portion, driven by government funding and academic collaborations. It creates consistent demand for reagents, instruments, and software platforms. Pharmaceutical and biotechnology companies increasingly rely on genotyping to support drug discovery and clinical trials. Diagnostic centers grow rapidly due to the rising need for accurate genetic testing in clinical practice. Each end-user segment demonstrates distinct demand patterns, reinforcing the broad adoption of genotyping technologies across industries.

Segments:

Based on Product Type:

- Reagents & kits

- Instruments

Based on Application:

- Diagnostics and personalized medicine

- Pharmacogenomics

Based on End-User:

- Academic and research institute

- Pharmaceutical and biotechnology companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Genotyping Market at 39.5%. The region benefits from advanced healthcare infrastructure, strong government and private investments, and early adoption of innovative technologies. The United States leads the market with high demand for precision medicine, growing clinical trials, and significant use of genotyping in diagnostics and pharmacogenomics. Canada also contributes steadily with supportive research programs and healthcare modernization. The presence of major biotechnology and pharmaceutical companies further strengthens growth across the region.

Europe

Europe accounts for 28.0% of the global market, making it the second-largest region. The region benefits from favorable regulatory frameworks, strong research collaborations, and a rising focus on personalized healthcare solutions. Germany, the United Kingdom, and France remain the key contributors, with growing adoption of genotyping in diagnostics and drug discovery. Increasing funding from the European Union supports innovative projects and clinical applications. The emphasis on early disease detection and prevention enhances market growth across the continent.

Asia Pacific

Asia Pacific holds a 22.0% share and demonstrates the fastest growth rate among all regions. Expanding clinical trials, growing investments in biotechnology, and increasing awareness of genetic testing drive regional adoption. China and India lead the market due to their large patient base, expanding research infrastructure, and government-backed healthcare initiatives. Japan and South Korea also show steady growth with advanced research facilities and rising demand for pharmacogenomics. The region’s rapid expansion reflects a shift toward precision medicine and agricultural genotyping applications.

Latin America

Latin America represents 6.0% of the Genotyping Market, with opportunities supported by improving healthcare systems and research activities. Brazil and Mexico play leading roles due to rising demand for diagnostic tools and pharmaceutical development. Government efforts to expand access to modern healthcare technologies foster adoption in this region. Local partnerships and international collaborations further enhance growth prospects. Increasing awareness of genetic testing applications contributes to gradual expansion in the market.

Middle East & Africa

The Middle East & Africa account for 4.5% of the market, representing a smaller but steadily growing share. The region benefits from healthcare modernization programs, expanding investments in biotechnology, and gradual adoption of genetic testing services. Countries such as the United Arab Emirates and South Africa drive demand through advanced healthcare initiatives and research support. Rising focus on non-communicable disease management encourages wider use of genotyping tools. Continued infrastructure development and government support create opportunities for long-term market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eurofins Scientific

- Standard BioTools Inc.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- GE Healthcare Technologies Inc.

- QIAGEN N.V

- Danaher Corporation

- Illumina Inc.

- Agilent Technologies, Inc.

- Hoffmann-La Roche Ltd.

Competitive Analysis

The Genotyping Market players include Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd., Standard BioTools Inc., Danaher Corporation, Agilent Technologies Inc., Eurofins Scientific, GE Healthcare Technologies Inc., and Bio-Rad Laboratories Inc. The Genotyping Market remains highly competitive, characterized by continuous innovation, advanced product development, and strategic collaborations. Companies focus on expanding their portfolios across reagents, instruments, and software to meet rising demand in diagnostics, pharmacogenomics, and agricultural applications. Strong emphasis is placed on precision, scalability, and cost-efficiency to cater to both clinical and research needs. Investments in digital platforms and bioinformatics enhance data interpretation and accessibility, supporting broader adoption of genotyping solutions. The competitive environment is further shaped by mergers, acquisitions, and partnerships aimed at strengthening global reach and technological capabilities. Growing demand for personalized medicine and preventive healthcare drives sustained competition across diverse end-user segments.

Recent Developments

- In August 2024, The Kerala government is investigating the use of advanced DNA sequencing technology to help identify 52 dissociated samples from victims of the Wayanad landslides victims.

- In January 2024, Genotyping technology could detect Covid variants faster and cheaper than ever before, according to research from the University of East Anglia and the UK Health Security Agency.

- In November 2023, South Korea’s GC Genome Corporation entered into a collaboration and exclusive license agreement with MP Group in Bangkok, Thailand, to commercialise ‘Genome Health’ for genetic health checkups. Genome Health, a SNP genotyping service, utilising next-generation sequencing (NGS) to identify risk alleles associated with major cancer types and general diseases, has been developed by GC Genome.

- In September 2023, Bio-Rad Laboratories, a global leader in life sciences and analytical products, announced the PTC Tempo 48/48 and PTC Tempo 384 thermal cyclers designed to support PCR application research, basic and translational field development, and quality control.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of precision medicine across healthcare systems.

- Growing demand for pharmacogenomics will strengthen the role of genotyping in drug development.

- Integration of advanced sequencing technologies will improve accuracy and scalability of genotyping tools.

- Direct-to-consumer genetic testing will grow with increasing awareness of wellness and ancestry insights.

- Digital platforms and bioinformatics will enhance data analysis and interpretation for clinical use.

- Agricultural genotyping will expand to support food security and sustainable farming practices.

- Government funding and research investments will accelerate adoption in academic institutions.

- Diagnostic centers will increase demand for genetic testing to address chronic and genetic disorders.

- Emerging markets will show strong growth as infrastructure and awareness improve.

- Strategic collaborations and innovations will continue to shape the competitive landscape.