Market Overview

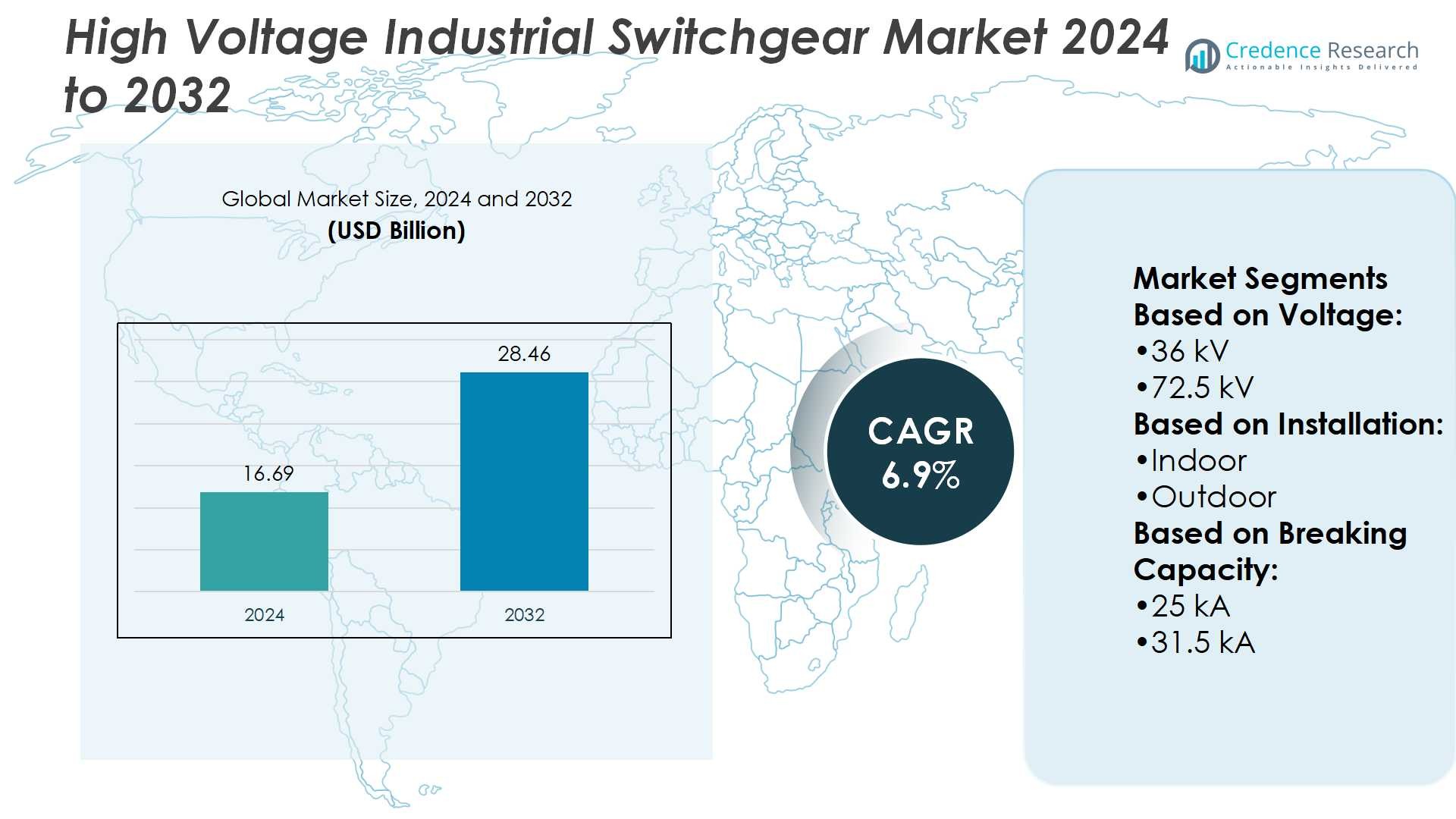

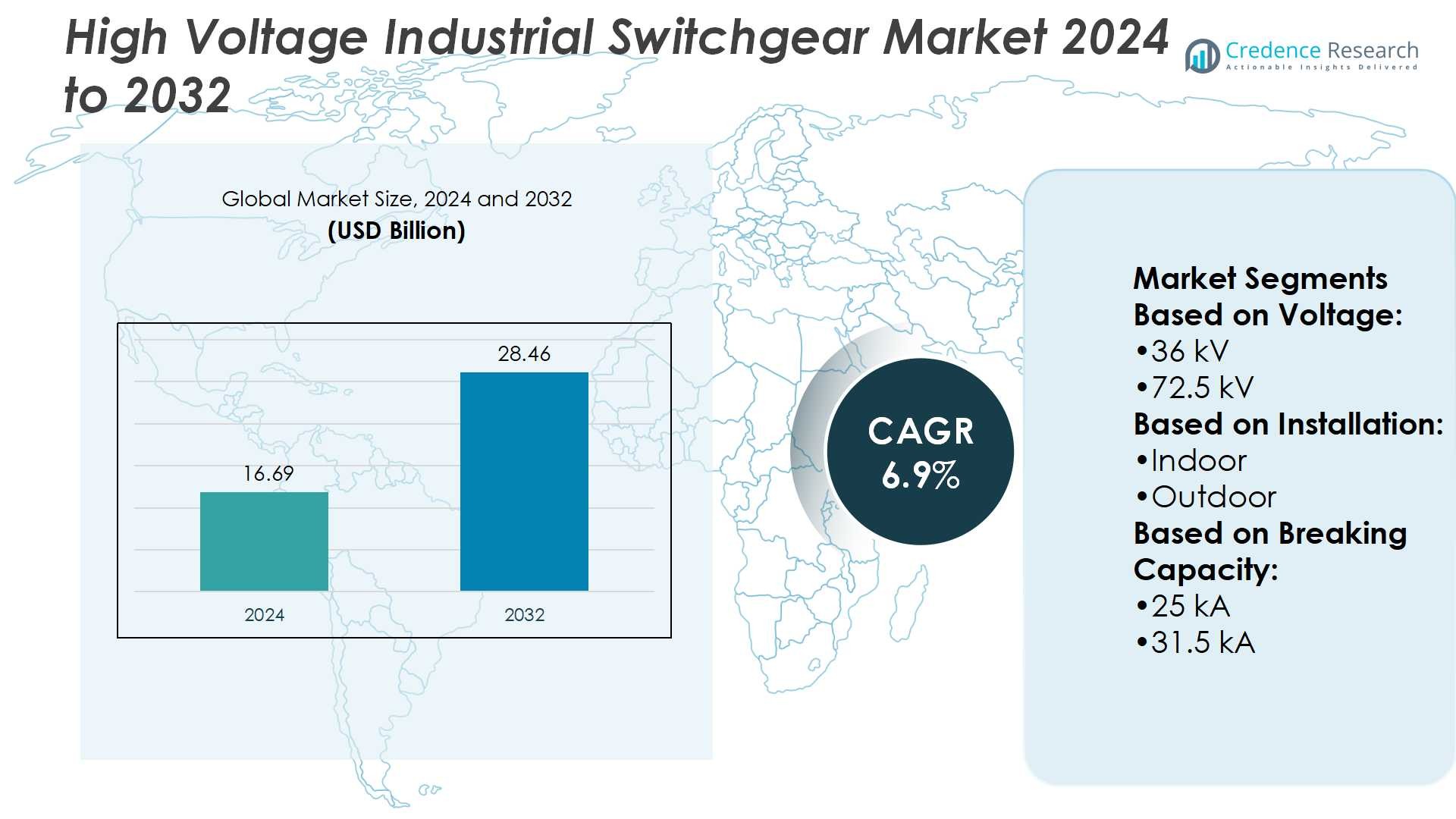

High Voltage Industrial Switchgear Market size was valued at USD 16.69 billion in 2024 and is anticipated to reach USD 28.46 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Industrial Switchgear Market Size 2024 |

USD 16.69 Billion |

| High Voltage Industrial Switchgear Market, CAGR |

6.9% |

| High Voltage Industrial Switchgear Market Size 2032 |

USD 28.46 Billion |

The High Voltage Industrial Switchgear Market is driven by increasing demand for reliable power distribution, rapid expansion of renewable energy projects, and government initiatives for grid modernization. Rising urbanization and industrial growth create strong need for efficient transmission infrastructure, while strict safety and environmental regulations accelerate adoption of advanced switchgear technologies. Trends highlight a shift toward eco-friendly insulation materials, digital monitoring systems, and modular designs that enhance flexibility and reduce maintenance costs. Growing investment in smart grids, electrification of emerging economies, and data center expansion further strengthen market growth, positioning high voltage switchgear as a critical enabler of sustainable energy systems.

The High Voltage Industrial Switchgear Market shows strong regional variation, with Asia Pacific leading due to rapid urbanization and energy infrastructure projects, while North America and Europe follow with grid modernization and renewable integration initiatives. Latin America and the Middle East & Africa display steady growth driven by electrification programs and industrial expansion. Key players, including ABB, General Electric, Eaton, Hitachi, Fuji Electric, Bharat Heavy Electricals, Hyosung Heavy Industries, HD Hyundai Electric, CG Power and Industrial Solutions, and E + I Engineering, maintain competitive dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Voltage Industrial Switchgear Market was valued at USD 16.69 billion in 2024 and is projected to reach USD 28.46 billion by 2032, growing at a CAGR of 6.9%.

- Market growth is driven by rising demand for reliable power distribution and increasing renewable energy integration.

- Government-led grid modernization initiatives and urbanization strengthen the adoption of advanced switchgear systems.

- Trends highlight the shift toward eco-friendly insulation, digital monitoring, and modular designs for efficiency and flexibility.

- Competition remains intense, with global leaders focusing on technology innovation, sustainability, and long-term contracts.

- Market restraints include high installation costs and dependency on imported components in some regions.

- Asia Pacific leads the market, followed by North America and Europe, while Latin America and the Middle East & Africa show steady growth through electrification and infrastructure expansion.

Market Drivers

Growing Need for Reliable Power Infrastructure and Expanding Industrialization

The High Voltage Industrial Switchgear Market benefits from rising investments in modern power infrastructure. Expanding urbanization and industrial projects create strong demand for equipment that ensures safe and continuous power supply. Governments prioritize reliable electricity networks to support economic development, which drives installations across power plants, manufacturing units, and utilities. Industries that operate under heavy electrical loads rely on high voltage systems to maintain performance stability. The demand extends further with increased electrification in developing regions. It supports grid modernization projects and enhances overall efficiency.

- For instance, General Electric’s g³ gas-insulated switchgear has been deployed in multiple European grid projects, achieving a 99% reduction in CO₂ equivalent emissions compared to SF₆ systems while maintaining ratings up to 420 kV and a short-circuit current withstand of 63 kA, as documented in GE Grid Solutions’ technical releases.

Rising Adoption of Renewable Energy and Grid Integration Requirements

The transition toward renewable power sources significantly drives demand in the High Voltage Industrial Switchgear Market. Solar and wind energy projects require robust switchgear solutions to manage high-capacity connections. These systems help balance variable energy flows and improve grid reliability. Expansion of distributed generation and microgrids adds to the requirement for advanced switchgear designs. Operators focus on integrating clean energy into national grids with minimal risk. It strengthens infrastructure resilience and supports energy transition goals.

- For instance, HD Hyundai Electric produces a range of gas-insulated switchgear (GIS) products, including the 800 SR GIS model rated up to 800 kV with a rated short-time withstand current of 50 kA and a lightning impulse withstand voltage up to 2,250 kVpeak.

Increasing Emphasis on Safety, Reliability, and Regulatory Compliance

Stringent regulations for safety and reliability continue to shape the High Voltage Industrial Switchgear Market. Industries must comply with international standards covering performance, fault tolerance, and environmental safety. The equipment provides protection from overloads, short circuits, and arc faults in high-risk environments. Demand grows as facility operators adopt advanced systems to safeguard workers and critical assets. Regulators encourage adoption of eco-friendly insulating mediums to reduce environmental impact. It supports both operational reliability and sustainability targets.

Technological Advancements and Smart Grid Development Fuel Market Growth

Innovation in digital monitoring, automation, and IoT-enabled solutions drives progress in the High Voltage Industrial Switchgear Market. Smart switchgear systems allow predictive maintenance and reduce downtime through real-time data insights. Manufacturers develop compact, modular, and energy-efficient designs tailored for modern infrastructure needs. Smart grid development initiatives create opportunities for integrated and connected switchgear solutions. It also helps utilities optimize load management and reduce transmission losses. Growing investments in digital infrastructure strengthen long-term market expansion.

Market Trends

Rising Deployment of Smart Switchgear with Digital Monitoring and Automation Features

The High Voltage Industrial Switchgear Market witnesses strong momentum with digital transformation in power infrastructure. Smart switchgear enables predictive maintenance, fault detection, and remote operation. Utilities and industries adopt automation-driven systems to reduce downtime and enhance operational efficiency. IoT and sensor integration help monitor performance in real time, providing data-driven insights for asset management. It increases reliability and reduces maintenance costs across large industrial facilities. The trend also aligns with the shift toward Industry 4.0.

- For instance, Fuji Electric’s F-MPC04 series power monitoring unit can handle up to 10 circuits in a 3-phase 3-wire system, measure harmonic currents (3rd, 5th, 7th), and issue two-stage leakage-current alarms (pre-alarm and relay output).

Growing Preference for Eco-Friendly and Sustainable Insulation Technologies

Environmental regulations and sustainability goals drive innovation in the High Voltage Industrial Switchgear Market. Traditional SF6 gas faces restrictions due to its high global warming potential. Manufacturers develop alternative insulation mediums such as fluoronitrile blends, vacuum-based systems, and air-insulated designs. These technologies reduce carbon emissions and support green energy transition strategies. Industries adopt eco-friendly switchgear to meet compliance and improve corporate sustainability profiles. It creates opportunities for suppliers introducing low-impact solutions.

- For instance, BHEL has developed a Bus Potential Transformer Module for 33 kV Gas Insulated Switchgear (GIS) whose panel size is reduced by 80% and weight by 80% compared to conventional PT panels; the module also yields cost savings of 57% versus traditional designs.

Increasing Integration of Renewable Energy and Distributed Generation Systems

Expanding renewable energy installations require advanced switchgear to handle high-capacity transmission and fluctuating power inputs. The High Voltage Industrial Switchgear Market supports grid stability by managing intermittent energy from wind and solar plants. Demand grows for flexible systems that allow seamless integration of distributed energy resources. Switchgear with higher efficiency ensures smooth power flow and protection under variable load conditions. Utilities invest heavily in solutions that enable energy diversification. It reinforces the role of switchgear in the renewable energy landscape.

Shift Toward Compact, Modular, and Flexible Switchgear Designs

End users seek switchgear solutions that save space while providing high reliability. The High Voltage Industrial Switchgear Market responds with modular and compact product designs. Modular units simplify installation and maintenance while reducing overall project costs. Compact systems gain demand in urban areas where space is limited. It also improves scalability, allowing utilities and industries to expand capacity with ease. Manufacturers focus on designs that combine efficiency, safety, and adaptability in diverse applications.

Market Challenges Analysis

High Costs of Installation and Maintenance Restrict Widespread Adoption

The High Voltage Industrial Switchgear Market faces challenges due to the high cost of procurement, installation, and ongoing maintenance. Large-scale infrastructure projects require significant upfront investment, which limits adoption in cost-sensitive markets. Small and medium enterprises often delay modernization plans because of financial constraints. It also demands specialized workforce training for installation and servicing, which increases overall expenses. Frequent maintenance cycles and replacement of critical components further strain operational budgets. Price competition among suppliers pressures margins, making cost management a major obstacle for long-term growth.

Regulatory Complexity and Environmental Concerns Create Operational Barriers

Complex regulatory requirements present a major hurdle in the High Voltage Industrial Switchgear Market. Manufacturers must comply with diverse safety, performance, and environmental standards across multiple regions. Stringent restrictions on the use of SF6 gas due to its environmental impact force companies to redesign technologies and adopt alternatives. It often raises production costs and extends product development timelines. Utilities and industries also face difficulties in replacing older systems while meeting evolving compliance frameworks. Regulatory uncertainty slows investment decisions, creating delays in large-scale deployment. This challenge makes innovation and compliance alignment critical for market participants.

Market Opportunities

Expansion of Renewable Energy Projects and Grid Modernization Creates Strong Growth Scope

The High Voltage Industrial Switchgear Market presents opportunities through rising renewable energy integration and modernization of power grids. Governments and utilities invest heavily in solar, wind, and hydro projects that require reliable high voltage systems. It supports efficient transmission, grid stability, and protection from variable loads. The demand for switchgear grows as countries expand distributed generation and microgrid networks. Energy transition policies encourage large-scale deployment of advanced systems with digital and automation features. This expansion positions manufacturers to supply innovative solutions tailored to renewable energy needs.

Adoption of Smart Infrastructure and Sustainable Technologies Unlocks New Potential

Urbanization and industrial growth drive opportunities for advanced switchgear with smart monitoring and eco-friendly insulation. The High Voltage Industrial Switchgear Market benefits from rising preference for digitalized infrastructure and predictive maintenance solutions. It enables reduced downtime, enhanced safety, and efficient energy management. Manufacturers introducing compact, modular, and low-emission designs gain competitive advantage. Growing replacement of legacy SF6-based units with sustainable alternatives creates new revenue streams. The trend highlights the market’s potential to align with global sustainability and smart infrastructure goals.

Market Segmentation Analysis:

By Voltage

The High Voltage Industrial Switchgear Market is segmented into 36 kV, 72.5 kV, 123 kV, and 145 kV units. Switchgear rated at 36 kV dominates applications in medium-scale industries and distribution networks where moderate load management is sufficient. Demand for 72.5 kV systems rises in urban transmission and industrial facilities requiring enhanced protection and efficiency. The 123 kV category finds strong adoption in large-scale utilities and renewable projects, offering higher resilience against faults and load fluctuations. Switchgear with 145 kV rating supports extra high-voltage operations, enabling reliable power flow across transmission lines and energy-intensive industries. It addresses complex requirements in power plants, heavy manufacturing, and smart grid projects.

- For instance, Hyosung supplies SF₆ GIS rated up to 800 kV with a short-time withstand current of 50 kA and nominal current up to 8,000 A. The company’s 145 kV class circuit breakers handle short-circuit breaking currents near 40 kA and are certified per IEC / IEEE standards, consistent with their overall product portfolio.

By Installation

This market is segmented into indoor and outdoor installations. Indoor switchgear records strong adoption in residential, commercial, and industrial settings where space efficiency and safety are priorities. Compact designs and easy integration into building systems support its demand. Outdoor switchgear dominates large transmission projects, substations, and renewable energy sites where weather resistance and high durability are critical. It ensures operational reliability under harsh conditions and supports long-distance power distribution. Rising grid expansion and utility-scale renewable projects fuel demand for advanced outdoor systems.

- For instance, Hitachi Energy’s ELK-04 C GIS rated at 145 kV offers both indoor and outdoor installation, a bay width of 800 mm, rated peak withstand current of 108 kA, and normal current rating of 3,150 A.

By Breaking Capacity

The market is further divided into 25 kA, 31.5 kA, 40 kA, 50 kA, and 63 kA categories. Switchgear with 25 kA and 31.5 kA ratings serves smaller industrial units and distribution grids where moderate fault levels are common. Systems with 40 kA and 50 kA ratings are preferred in heavy industries and utilities requiring stronger fault-clearing capacity. The 63 kA segment holds significant importance in extra high-voltage networks, ensuring stability in demanding environments. It supports critical infrastructure, including power generation plants and large substations. Demand for high breaking capacity switchgear grows with the complexity of modern grids and increasing fault current levels.

Segments:

Based on Voltage:

Based on Installation:

Based on Breaking Capacity:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 24% market share in the High Voltage Industrial Switchgear Market. The United States leads due to strong investments in modernizing its power grid and high renewable energy integration. Canada supports growth through hydroelectric projects and cross-border electricity trade. Demand rises with data center expansions and industrial automation. The region benefits from strict safety regulations and adoption of eco-friendly switchgear. However, high installation costs and reliance on imports for certain components limit faster expansion. North America remains an attractive market with steady modernization plans.

Europe

Europe accounts for 22% share of the global market. Germany, the UK, and France drive growth with emphasis on smart grids and replacement of aging infrastructure. The European Union’s carbon reduction policies accelerate demand for advanced switchgear technologies. Offshore wind projects in the North Sea create further opportunities. Companies focus on digital switchgear and sustainable materials to meet environmental rules. Slow permitting processes and higher manufacturing costs are challenges. Europe continues to hold a leading position in technological adoption and regulatory innovation.

Asia Pacific

Asia Pacific dominates with 40% market share, the highest among all regions. China, India, and Japan are central to this dominance, driven by urbanization, industrial expansion, and renewable energy integration. Rising demand for electricity in residential and commercial sectors boosts installations. Government initiatives for grid reliability and electrification in rural areas add momentum. The region also witnesses large-scale manufacturing and export of switchgear. Challenges include regulatory differences and grid stability issues in emerging economies. Despite challenges, Asia Pacific remains the largest and fastest-growing region.

Latin America

Latin America contributes 8% share to the market. Brazil leads with hydropower projects and grid upgrades. Mexico follows with renewable energy adoption and cross-border electricity integration with the U.S. The region benefits from infrastructure investments and urban electrification projects. Economic instability and heavy dependence on imports limit large-scale growth. Yet, opportunities arise from smart grid adoption in major economies. Latin America maintains steady but slower growth compared to Asia and Europe.

Middle East & Africa

The Middle East & Africa hold a 6% share of the market. Gulf countries such as Saudi Arabia and the UAE invest in transmission projects to support industrial growth. Africa’s demand rises with rural electrification and renewable energy expansion. Oil & gas sector requirements also drive installations of high voltage switchgear. Political risks, infrastructure gaps, and lower purchasing power act as hurdles. Still, projects linked to energy diversification support long-term growth. MEA is emerging as a region with future potential despite current constraints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Electric

- HD Hyundai Electric

- Fuji Electric

- Bharat Heavy Electricals

- Hyosung Heavy Industries

- Hitachi

- Eaton

- CG Power and Industrial Solutions

- ABB

- E + I Engineering

Competitive Analysis

The High Voltage Industrial Switchgear Market players such as General Electric, HD Hyundai Electric, Fuji Electric, Bharat Heavy Electricals, Hyosung Heavy Industries, Hitachi, Eaton, CG Power and Industrial Solutions, ABB, and E + I Engineering. The High Voltage Industrial Switchgear Market remains highly competitive, driven by rapid technological advancements, regulatory requirements, and increasing demand for reliable power distribution. Companies focus on innovation in digital monitoring, eco-friendly insulation, and modular switchgear to align with sustainability goals and smart grid adoption. Intense competition arises from the need to serve large utility projects, industrial expansions, and renewable energy integration. Market participants invest heavily in research, manufacturing efficiency, and global partnerships to secure long-term contracts. Emphasis on grid modernization, urban electrification, and cost optimization continues to shape strategies, with after-sales services and localized production emerging as critical differentiators in strengthening market presence.

Recent Developments

- In April 2025, Siemens Ltd. invested to expand its manufacturing operations in Goa, India. The company expressed interest in collaborating with local MSMEs to incorporate them into its supply chain. The firm already operated five factories in Goa and was actively working to increase its capacities.

- In April 2025, ABB introduced a complete switchgear solution for wind turbines to support the deployment of larger wind turbines with higher yields. The solution offers the industry’s highest power rating for a complete switchgear solution, integrating a 7200A Emax 2 air circuit breaker and a 3200A AF Contactor, to provide outstanding reliability and switching efficiency.

- In March 2025, nVent Electric plc announced to enter into a definitive agreement to acquire the enclosures, switchgear, and bus systems businesses of Avail Infrastructure Solutions for an acquisition.

- In February 2024, Schneider Electric, the global leader in the digital transformation of energy management and automation, announced the upcoming launch of its novel SureSeT Medium Voltage (MV) switchgear offering for the Canadian market.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation, Breaking Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising investments in renewable energy integration.

- Smart grid development will boost demand for digital and automated switchgear.

- Eco-friendly insulation technologies will replace traditional SF6-based systems.

- Urbanization and industrial growth will drive large-scale installations.

- Governments will support grid modernization through stricter safety regulations.

- Advanced monitoring and predictive maintenance will improve operational reliability.

- Modular and compact designs will gain preference in space-constrained projects.

- Growth in data centers will create steady demand for high voltage switchgear.

- Emerging economies will witness increased adoption through electrification programs.

- Strategic alliances and localized production will strengthen global supply chains.