Market Overview

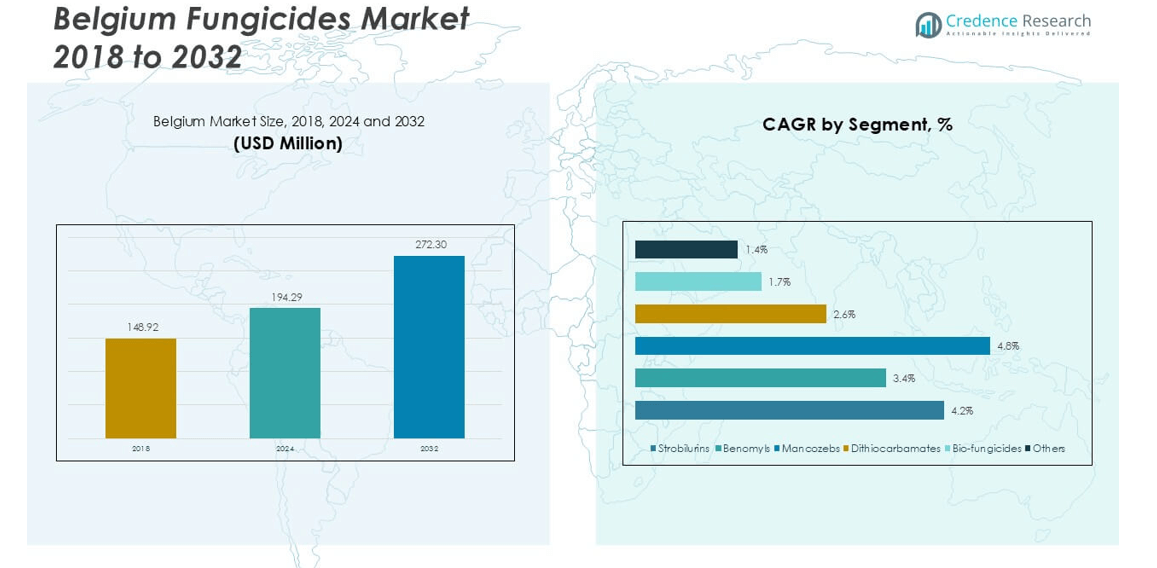

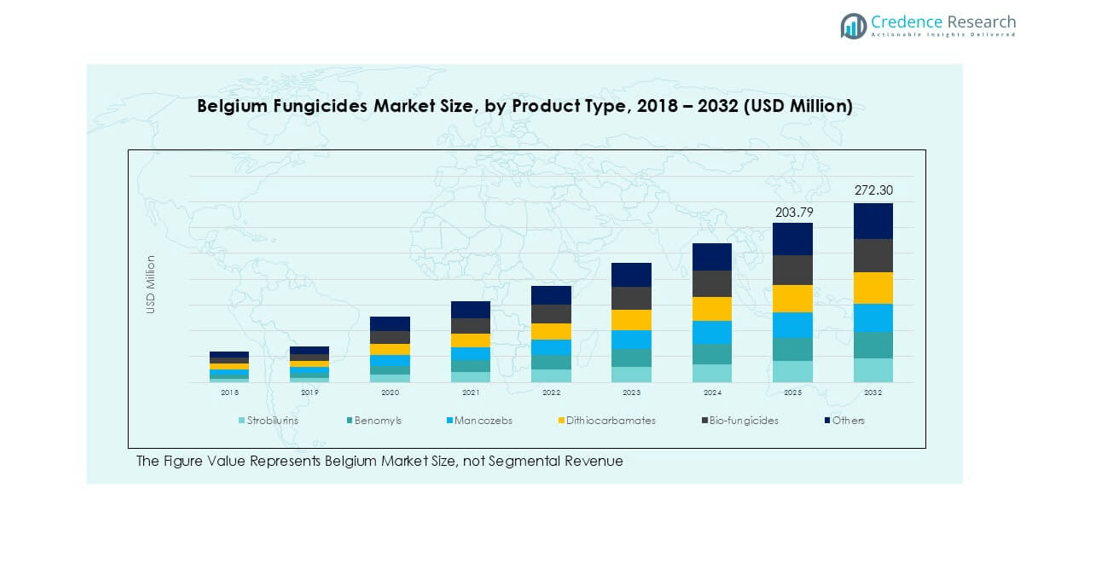

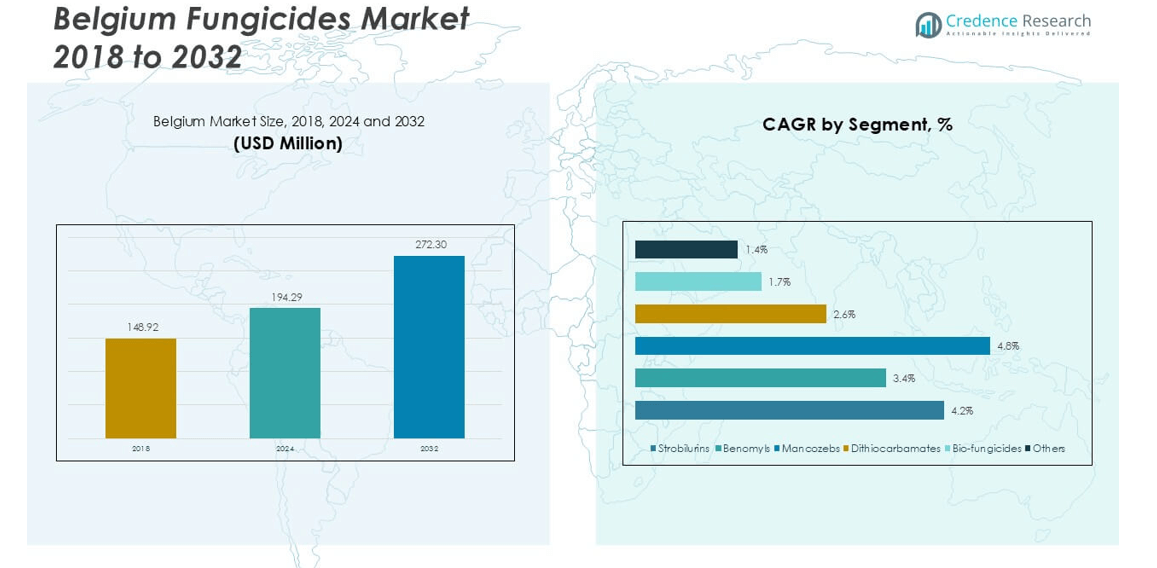

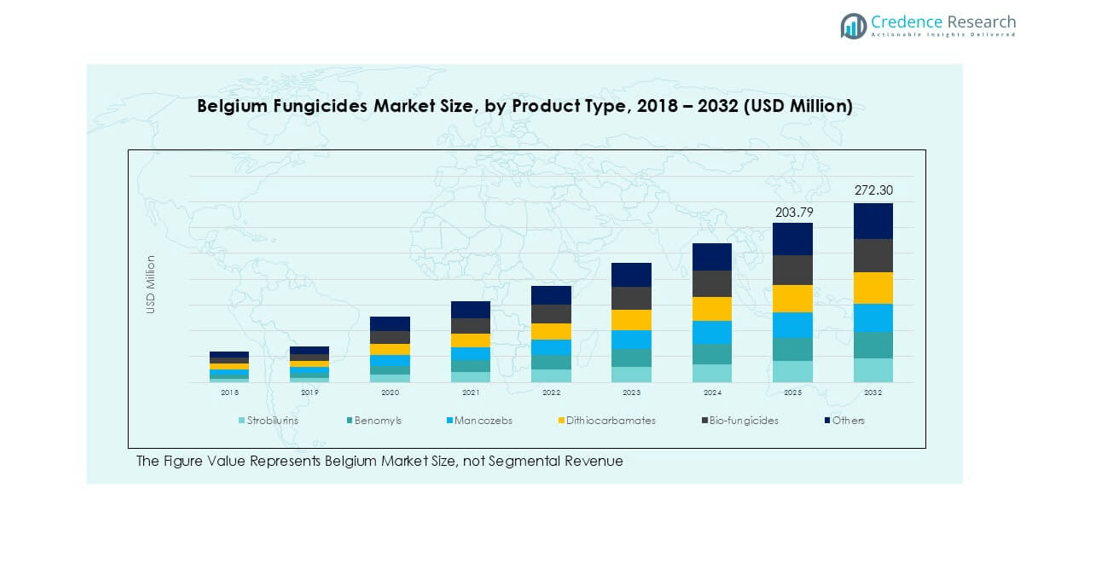

The Belgium Fungicides market size was valued at USD 148.92 million in 2018, grew to USD 194.29 million in 2024, and is anticipated to reach USD 272.30 million by 2032, at a CAGR of 4.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Belgium Fungicides Market Size 2024 |

USD 194.29 million |

| Belgium Fungicides Market, CAGR |

4.23% |

| Belgium Fungicides Market Size 2032 |

USD 272.30 million |

The Belgium fungicides market is led by major players including Bayer, BASF SE, Syngenta, Corteva Agriscience, FMC Corporation, ADAMA, UPL Limited, Nufarm, Belchim Crop Protection, and Sipcam Belgium. These companies dominate through strong product portfolios, innovation in bio-fungicides, and adherence to EU regulatory standards. Flanders emerges as the leading region, holding 55% of the market share due to its intensive horticulture and greenhouse farming. Wallonia follows with 30%, driven by cereals and oilseed cultivation, while the Brussels-Capital Region accounts for 15%, supported by ornamentals and urban farming. This regional distribution reflects both large-scale production and niche agricultural practices shaping fungicide demand.

Market Insights

- The Belgium fungicides market was valued at USD 148.92 million in 2018, reached USD 194.29 million in 2024, and is projected to attain USD 272.30 million by 2032, growing at a CAGR of 4.23%.

- Expansion of high-value crops such as apples, pears, and greenhouse vegetables drives strong demand, with farmers relying on advanced fungicides to maintain yield stability and comply with EU food safety standards.

- Bio-fungicides are a rising trend, supported by EU sustainability policies and growing consumer preference for chemical-free produce, while technological innovations in formulations enhance disease resistance management.

- The market is competitive, led by Bayer, BASF SE, Syngenta, Corteva Agriscience, FMC Corporation, and others, with local players like Belchim Crop Protection and Sipcam Belgium strengthening niche offerings.

- Regionally, Flanders dominates with 55% share due to intensive horticulture, followed by Wallonia with 30% from cereals and oilseeds, while Brussels-Capital contributes 15% through ornamentals; by product, strobilurins lead usage across crops.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Strobilurins hold the dominant share in the Belgium fungicides market, driven by their broad-spectrum activity and effectiveness in controlling fungal infections across diverse crops. Their role in preventing yield losses in cereals, fruits, and vegetables has cemented their market position. Rising adoption of advanced agricultural practices and farmer preference for reliable, high-performing products sustain growth. Bio-fungicides are gaining traction due to the push for sustainable solutions and EU regulatory frameworks. Mancozebs and dithiocarbamates maintain steady demand in conventional farming, while benomyls show limited use owing to regulatory restrictions.

- For instance, the area under pear cultivation in Belgium reached about 10,730 hectares in December 2024.

By Application

Fruits and vegetables represent the largest application segment, commanding a dominant share of Belgium’s fungicide market. The country’s strong horticultural sector and export-oriented production drive continuous demand for effective crop protection. High-value crops such as apples, pears, and greenhouse vegetables rely on fungicides for disease management and shelf-life extension. The cereals and grains segment follows, supported by Belgium’s wheat and barley production. Ornamentals also contribute significantly, reflecting the importance of floriculture. Pulses, oilseeds, and other crops form smaller segments, but rising interest in sustainable cultivation supports their gradual adoption.

- For instance, Belgium harvested about 412 million kilograms of pears in 2023, making it the top pear producer in the European Union that year. Growers in the region commonly apply multiple fungicide sprays per season to prevent pear scab and maintain high export quality, though modern integrated pest management strategies have allowed some farms to reduce the number of sprays.

Market Overview

Expansion of Horticulture and High-Value Crop Production

Belgium’s growing focus on high-value horticultural crops, including apples, pears, and greenhouse vegetables, drives fungicide demand. Farmers adopt advanced crop protection to minimize post-harvest losses and maintain export quality standards. Rising consumer preference for fresh produce with longer shelf life further supports usage. The increasing intensity of protected cultivation, especially in greenhouses, enhances dependency on fungicides. This strong horticultural base ensures steady market growth as producers seek to safeguard yields, reduce waste, and comply with stringent EU food safety requirements.

- For instance, in an IPPM case study on a 2-hectare pear orchard called “Conference,” mixed hedgerows and nesting boxes for mason bees improved fruit-quality indices over four years, with higher quality scores seen in pears located closer to pollinator habitats.

Regulatory Push for Sustainable Agricultural Practices

European Union policies encouraging integrated pest management (IPM) and reduced chemical use stimulate growth of advanced fungicides in Belgium. Demand for bio-fungicides and eco-friendly formulations increases as farmers adapt to regulatory limits on synthetic products. Incentives for adopting sustainable crop protection solutions create a favorable environment for innovation. Local producers and multinational firms expand bio-based portfolios to align with these directives. The push toward green agriculture not only meets compliance needs but also enhances Belgium’s reputation as a sustainable food producer.

- For instance, Belgium was one of 12 EU member states to decrease its total pesticide sales volume between 2011 and 2019. The overall volume of pesticides sold across the EU fluctuated during this period, but for Belgium, it was part of a broader European trend toward reduction targets.

Technological Advancements in Fungicide Formulations

Improved fungicide formulations enhance disease resistance management and application efficiency in Belgium’s farming sector. Innovations such as combination products, longer residual action, and resistance-prevention mechanisms boost farmer adoption. Precision agriculture practices also encourage demand for high-performance fungicides that can integrate with digital tools and targeted spraying systems. These advancements help reduce overall chemical load while increasing effectiveness, aligning with sustainability goals. As resistance to older active ingredients becomes a concern, technology-driven fungicides are positioned as reliable solutions for modern agricultural practices.

Key Trends & Opportunities

Rising Adoption of Bio-Fungicides

Growing awareness of environmental safety and consumer health fuels Belgium’s bio-fungicide market. Producers are shifting towards microbial-based and plant-derived formulations to address EU regulations and consumer demand for chemical-free food. This creates opportunities for companies to introduce innovative bio-products that deliver effective disease control. The trend also supports the organic farming sector, which is steadily expanding. Partnerships between research institutions and agribusinesses further strengthen product development. As demand for sustainable crop protection rises, bio-fungicides are likely to expand their market share significantly.

- For instance, in organic farming in Belgium the permitted use of copper-based fungicides is limited to 2-2.6 kg per hectare per year for most crops (excluding potatoes), prompting search for bio-alternatives.

Integration of Precision Farming Techniques

Belgium’s agricultural sector increasingly embraces digital tools such as drones, sensors, and data-driven spraying systems. Precision farming enhances fungicide application efficiency, reducing waste and optimizing input costs. This trend supports sustainable practices while ensuring effective disease management. Opportunities exist for companies to align fungicide products with precision equipment and advisory platforms. Integration of digital agriculture with crop protection is likely to expand adoption among large-scale farmers. The trend strengthens Belgium’s position as a technologically advanced agricultural hub in Europe.

- For instance, copper use surveys show that in 56% of crop-country cases (organic farming in EU including Belgium) farmers use less than half of their permitted copper amount per hectare per year, often relying on monitoring to adjust applications.

Key Challenges

Stringent EU Regulatory Compliance

Belgium’s fungicides market faces challenges due to strict EU rules limiting synthetic active ingredients. Frequent reviews and bans of popular chemicals create uncertainty for producers and farmers. Compliance with environmental and safety regulations demands significant investment in research, reformulation, and registration processes. Smaller players may find it difficult to sustain under such regulatory pressures. While compliance drives innovation, it also delays product approvals and narrows choices for farmers. These constraints can slow market growth despite rising demand for effective crop protection solutions.

Growing Fungal Resistance Issues

Continuous use of fungicides in Belgium’s intensive farming system has increased cases of fungal resistance. Pathogens such as powdery mildew and septoria adapt to widely used active ingredients, reducing product effectiveness. Farmers face higher costs as they switch to newer, more expensive formulations or combination treatments. Managing resistance requires integrated pest management and careful rotation of fungicides, adding complexity to crop protection strategies. If unchecked, resistance challenges may threaten yield stability and undermine confidence in conventional fungicides, pressuring the market toward faster innovation.

Regional Analysis

Flanders

Flanders holds the dominant share of nearly 55% in the Belgium fungicides market, supported by its intensive horticulture and greenhouse farming. The region specializes in fruit cultivation, particularly apples, pears, and berries, which require consistent fungicide application to prevent fungal infections. High-value vegetable production under controlled environments further boosts demand. Farmers in Flanders adopt advanced crop protection methods to ensure compliance with EU quality and safety standards. Strong export-oriented agriculture and investment in sustainable farming practices continue to sustain fungicide usage across the region.

Wallonia

Wallonia accounts for around 30% of the Belgium fungicides market, driven by large-scale cereal, grain, and oilseed production. Wheat and barley dominate cultivated land, requiring regular fungicide treatment for diseases like septoria and rust. The region also contributes significantly through pulses and oilseeds, where disease management is critical for yield stability. Although less intensive in horticulture than Flanders, Wallonia shows steady adoption of modern fungicides. Increasing use of bio-fungicides aligns with sustainability targets, and expanding organic farming acreage is expected to enhance future demand in the region.

Brussels-Capital Region

The Brussels-Capital Region represents nearly 15% of the Belgium fungicides market, with demand mainly concentrated in ornamentals, urban farming, and niche horticultural activities. Limited agricultural land restricts large-scale use, but the region emphasizes high-value crops and floriculture, which depend on fungicide treatments to maintain product quality. Urban greenhouses and rooftop farming also create targeted opportunities for bio-fungicides. While its share is smaller compared to Flanders and Wallonia, Brussels’ focus on sustainable and innovative farming methods ensures a steady market presence, especially for eco-friendly and specialty fungicide products.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Flanders

- Wallonia

- Brussels-Capital Region

Competitive Landscape

The Belgium fungicides market is highly competitive, with multinational players and regional companies shaping growth. Bayer, BASF SE, Syngenta, Corteva Agriscience, and FMC Corporation lead the market with strong product portfolios, advanced R&D, and broad distribution networks. These firms emphasize innovation in bio-fungicides and sustainable formulations to comply with EU regulations and meet rising demand for eco-friendly crop protection. ADAMA, UPL Limited, and Nufarm strengthen competition by offering cost-effective solutions and expanding their regional presence. Local companies such as Belchim Crop Protection and Sipcam Belgium play a vital role by addressing niche requirements and providing customized products suited to Belgian crops. Strategic partnerships, product launches, and regulatory-driven innovations define competition, with bio-based solutions and resistance management emerging as key differentiators. The overall landscape reflects a balance of global expertise and local adaptability, ensuring strong supply and innovation in Belgium’s agriculture sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer

- BASF SE

- Syngenta

- Corteva Agriscience

- ADAMA

- FMC Corporation

- Nufarm

- UPL Limited

- Sipcam Belgium

- Belchim Crop Protection

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In Septembeuse in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-fungicides will increase with stricter EU sustainability regulations.

- Strobilurins will continue to lead product demand due to broad-spectrum effectiveness.

- Fruits and vegetables will remain the largest application segment with steady expansion.

- Resistance management strategies will drive innovation in fungicide formulations.

- Precision farming adoption will enhance targeted fungicide use across Belgian farms.

- Flanders will sustain dominance, supported by intensive horticulture and greenhouse cultivation.

- Wallonia will see gradual growth from cereals, grains, and oilseed production.

- Brussels-Capital will expand niche demand from ornamentals and urban farming.

- Global players will strengthen R&D and partnerships to capture local opportunities.

- Local companies will expand specialized offerings to support sustainable farming practices.