Market Overview

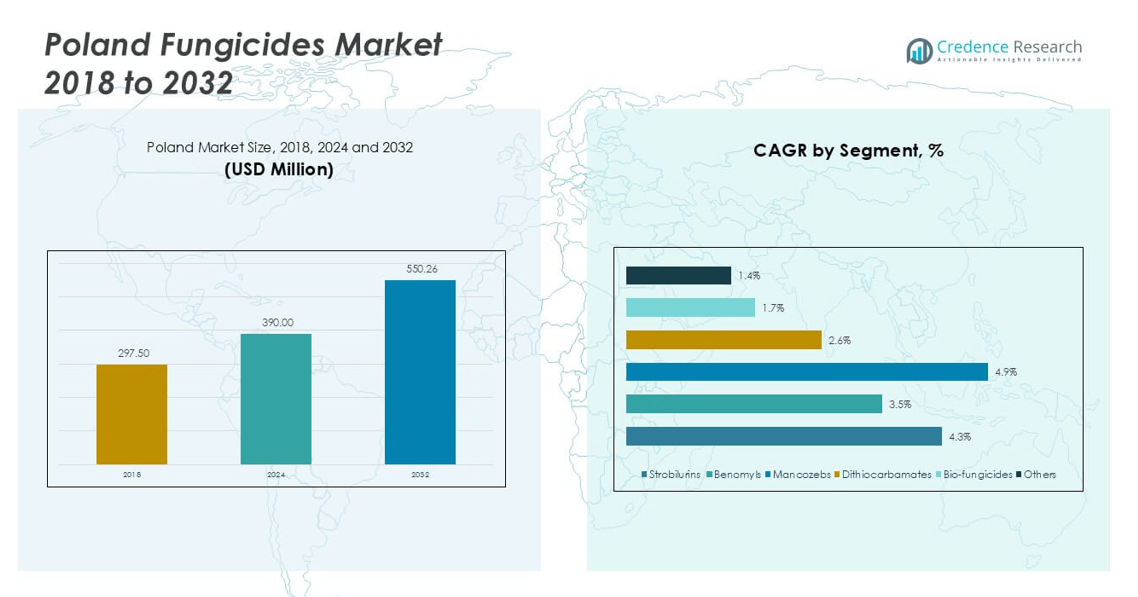

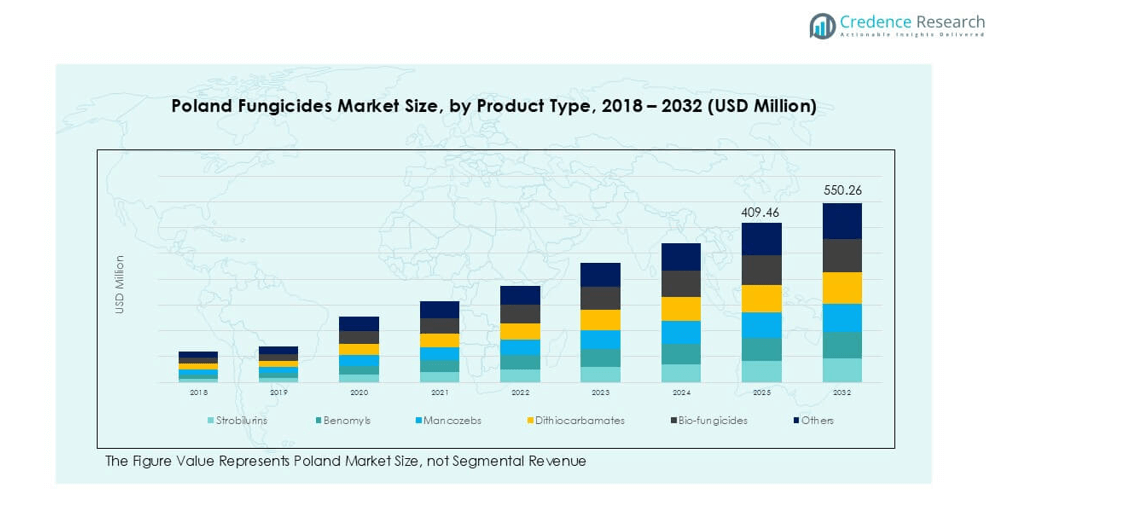

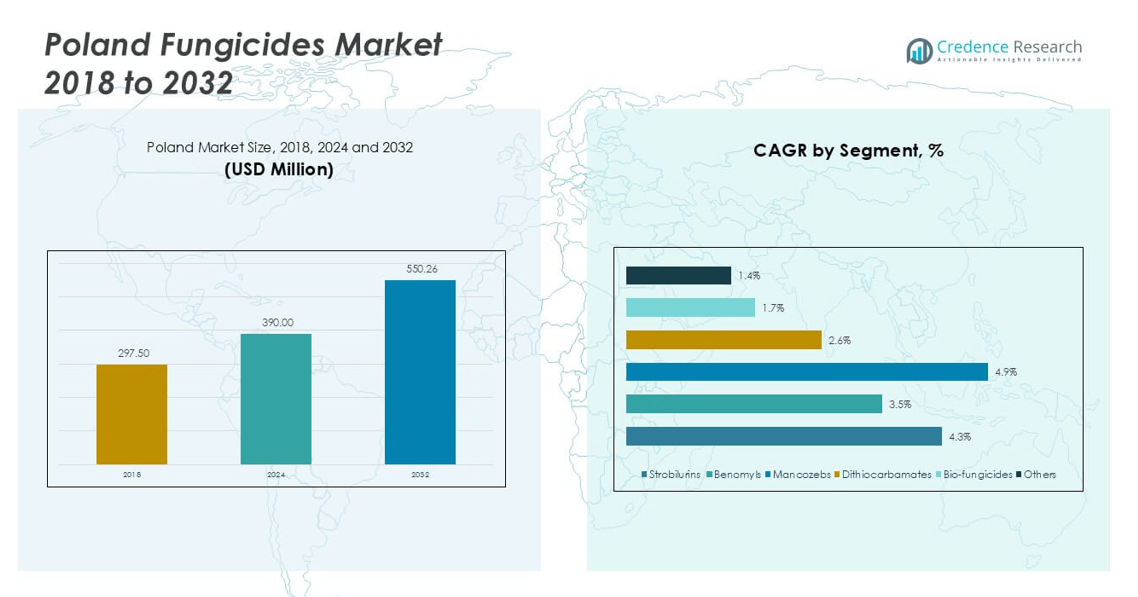

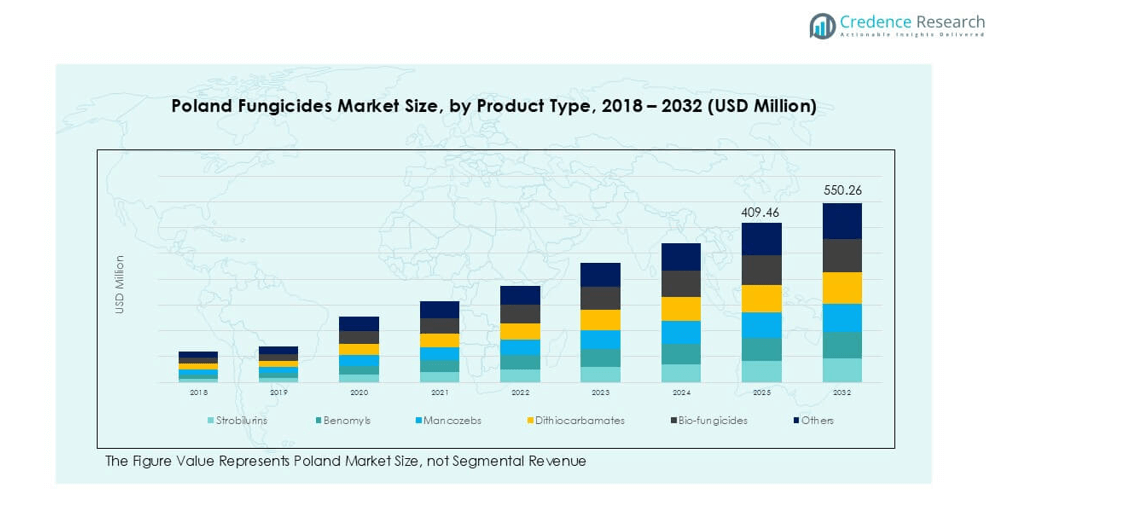

Poland Fungicides market size was valued at USD 297.50 million in 2018, grew to USD 390.00 million in 2024, and is anticipated to reach USD 550.26 million by 2032, at a CAGR of 4.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poland Fungicides Market Size 2024 |

USD 390.00 million |

| Poland Fungicides Market, CAGR |

4.31% |

| Poland Fungicides Market Size 2032 |

USD 550.26 million |

The Poland fungicides market is led by global and domestic players including Bayer Crop Science, Syngenta, BASF Polska, FMC Corporation, Adama Agricultural Solutions, UPL Limited, Nufarm, Grupa Azoty, KWS Polska, and Koppert Biological Systems. These companies compete through broad chemical portfolios, bio-fungicide innovations, and strong distribution networks. Bayer Crop Science and Syngenta maintain leadership through advanced formulations for cereals and horticulture, while BASF Polska and FMC focus on resistance management solutions. UPL and Nufarm emphasize cost-effective alternatives, and Koppert drives growth in biological crop protection. Regionally, North Poland holds the largest market share at 28%, supported by its dominant fruit and vegetable production. Central Poland follows with 25%, led by extensive cereal and grain cultivation. These regions remain key growth centers as companies target high-value crops and compliance with EU sustainability regulations.

Market Insights

- The Poland fungicides market was valued at USD 390.00 million in 2024 and is projected to reach USD 550.26 million by 2032, expanding at a CAGR of 4.31%.

- Rising demand for high-value crops such as apples, berries, and cereals drives fungicide adoption, with strobilurins dominating product type segments due to their broad-spectrum efficacy.

- Bio-fungicides are gaining traction as sustainability trends and EU regulations push farmers toward eco-friendly solutions, supported by precision agriculture adoption for efficient application.

- The market is competitive, led by Bayer Crop Science, Syngenta, BASF Polska, FMC Corporation, Adama Agricultural Solutions, and UPL Limited, while local players like Grupa Azoty and Koppert Biological Systems strengthen regional supply.

- Regionally, North Poland leads with 28% market share due to fruit production, followed by Central Poland with 25% driven by cereal cultivation, while South Poland contributes 22%, East 15%, and West 10%, ensuring balanced national growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Poland fungicides market shows strong adoption of strobilurins, which hold the dominant share due to their broad-spectrum activity and effectiveness in protecting cereals and horticultural crops. This sub-segment benefits from consistent demand as farmers prioritize yield security and disease management across key crops. The growth of strobilurins is driven by their role in combating fungal resistance and extending crop protection. While mancozebs and dithiocarbamates remain widely used for cost-effective solutions, bio-fungicides are gaining traction as sustainable alternatives under regulatory pressure and consumer demand for eco-friendly produce.

- For instance, Azoxystrobin is a major agricultural fungicide that generated an estimated $1.2 billion in market revenue in 2024 and is projected to exceed $2 billion by 2031. It is widely used on cereals like wheat and barley and is sold by key manufacturers such as Syngenta and Suli Chemical.

By Application

Fruits and vegetables represent the leading application segment, accounting for the largest share of fungicide use in Poland. The dominance comes from the country’s significant production of apples, berries, and other high-value horticultural crops that require intensive disease control. Demand is driven by export standards, quality assurance needs, and strict regulations on residue levels. Cereals and grains also contribute strongly, supported by extensive wheat and barley cultivation. Rising use in ornamentals and pulses highlights diversification, but fruits and vegetables remain the growth engine due to high disease pressure and profitability.

- For instance, Poland is Europe’s largest apple producer, with commercial orchards covering approximately 150,000 to 160,000 hectares. Due to the humid climate and prevalence of fungal diseases like apple scab, conventional apple farming in Poland typically requires multiple fungicide sprays per season.

Market Overview

Rising Demand for High-Value Crops

Poland’s fungicides market grows with the expanding cultivation of fruits and vegetables, particularly apples and berries, which are vital for exports. Farmers rely on fungicides to safeguard crop quality and meet stringent international standards on appearance and safety. Increasing consumer preference for fresh and residue-free produce boosts demand for advanced formulations. The need to secure higher yields per hectare intensifies fungicide adoption across regions. This driver remains central as producers prioritize profitability through consistent protection against fungal infestations that threaten high-value agricultural output.

- For instance, in a recent orchard trial, protective fungicides were applied at specific rates and with a sufficient pre-harvest interval between mid-July and mid-August. This was done to ensure the crops complied with the importing country’s strict Maximum Residue Limits (MRLs) for export.

Government Support and Regulatory Frameworks

Supportive agricultural policies and EU-funded initiatives encourage the use of crop protection solutions, including fungicides. Farmers benefit from subsidies that enhance access to modern formulations designed to improve efficiency and reduce environmental risks. Regulations under EU frameworks such as the Common Agricultural Policy ensure the adoption of safer and compliant products. These rules accelerate the shift toward bio-fungicides and low-residue chemicals in the Polish market. By aligning crop protection practices with environmental standards, government backing sustains long-term demand for sustainable fungicide options.

- For instance, National and regional guidelines for pre-harvest fungicide applications vary significantly depending on the specific chemical used, the target disease, and the location.

Expanding Agricultural Exports

Poland strengthens its position in global agricultural trade, driving higher demand for fungicides to meet export requirements. Export-focused crops such as cereals, apples, and berries face strict quality and phytosanitary checks, increasing the importance of disease management. Fungicides help ensure uniform quality and longer shelf life for exported produce. Rising export partnerships with European and non-European markets create opportunities for continuous fungicide use. This driver supports market expansion as Polish farmers adopt advanced crop protection practices to remain competitive in the international marketplace.

Key Trends & Opportunities

Shift Toward Bio-Fungicides

Sustainability trends drive rising adoption of bio-fungicides in Poland, reflecting consumer and regulatory preferences for eco-friendly products. Farmers increasingly explore biological solutions to reduce chemical residues and combat resistance challenges. Advances in microbial-based fungicides provide effective disease management with lower environmental impact. This trend creates opportunities for manufacturers to expand bio-based product portfolios and capture growing market share. The shift also aligns with Poland’s agricultural sustainability goals, enabling farmers to balance productivity with compliance while appealing to export markets demanding residue-free produce.

- For instance, in 2022, Poland’s crop protection chemical usage included approximately 7.0 thousand metric tons of fungicides, and regulatory pressure is pushing biological alternatives as synthetic chemical use faces stricter scrutiny.

Precision Agriculture Adoption

The integration of digital farming technologies supports targeted fungicide applications, reducing waste and improving efficiency. Precision agriculture tools, including drones and satellite monitoring, help farmers identify early disease outbreaks and optimize spraying schedules. This trend lowers input costs and enhances yield outcomes by improving disease control accuracy. Opportunities emerge for fungicide manufacturers to offer smart-compatible solutions tailored to precision systems. Adoption accelerates in Poland as farmers modernize practices and align with EU-funded innovation programs, reinforcing the market’s move toward technology-driven disease management.

- For instance, research has shown that Polish farmers are using GPS systems, soil sensors, and drones to improve productivity, especially in Western provinces where pesticide consumption has been recorded at about 2.12 kilograms per hectare on average.

Key Challenges

Stringent EU Regulations

The fungicides market in Poland faces challenges from strict EU regulatory frameworks that restrict chemical approvals and enforce low maximum residue levels. Compliance with these rules often raises production costs and limits farmer access to conventional fungicides. The push for safer and eco-friendly alternatives forces companies to invest in reformulation and innovation. While beneficial in the long run, these measures strain small-scale farmers who rely on affordable solutions. Regulatory stringency creates barriers to market expansion, particularly for synthetic fungicide producers.

Rising Incidence of Resistance

Fungal pathogens increasingly develop resistance to widely used chemical classes such as strobilurins and triazoles, reducing treatment effectiveness. This challenge compels farmers to rotate products, adopt mixtures, or switch to newer, often costlier, solutions. The cycle of resistance escalates demand for innovation but simultaneously raises financial burdens for growers. Resistance also threatens yield stability, especially in high-value crops that depend on consistent disease control. Managing resistance remains a critical challenge for sustaining fungicide efficacy and ensuring long-term market growth in Pola

Regional Analysis

North Poland

North Poland holds nearly 28% market share in the fungicides market, driven by extensive fruit cultivation, especially apples and berries. The region’s strong horticultural base depends heavily on fungicide use to maintain yield and meet export standards. Local growers adopt advanced strobilurins and bio-fungicides to manage high disease pressure from humid climatic conditions. Support from EU programs accelerates the shift toward eco-friendly solutions. Export orientation in northern provinces further strengthens demand, as producers must comply with strict residue limits. The region continues to expand its market role by focusing on sustainable and high-value crop protection practices.

Central Poland

Central Poland accounts for about 25% market share, supported by large-scale cereal and grain production, including wheat and barley. Farmers here rely on fungicides to secure yield consistency against widespread fungal threats like rust and blight. The region benefits from established distribution networks and access to both chemical and bio-fungicides. Increasing adoption of precision agriculture technologies enhances fungicide efficiency, reducing costs and improving disease management. Central Poland’s role as a grain-producing hub drives continuous demand, with sustainability policies gradually influencing product selection. Strong integration into national and export supply chains further sustains this region’s significant market contribution.

South Poland

South Poland captures around 22% market share, led by its diverse agricultural base covering cereals, vegetables, and ornamentals. The region faces rising disease pressures due to varied climatic conditions, encouraging higher fungicide consumption. Local farmers adopt both conventional fungicides and growing volumes of bio-based alternatives to balance productivity and compliance. EU-supported rural development schemes enhance access to modern crop protection solutions. Demand is further reinforced by the presence of small and medium-sized farms that collectively contribute to high fungicide uptake. South Poland’s diversified cropping patterns ensure steady growth and make it a critical segment of the national market.

East Poland

East Poland holds nearly 15% market share, driven by pulses, oilseeds, and cereal cultivation. This region’s market is expanding as farmers adopt fungicides to protect yields in crops ractices. Bio-fungicides are gaining attention due to their compatibility with regional organic farming initiatives. Disease outbreaks in oilseed crops further fuel fungicide demand. East Poland’s market share is expected to grow steadily as infrastructure improves, and farmers adopt modern solutions to meet local consumption and regional trade requirements.

West Poland

West Poland contributes about 10% market share, with a focus on mixed farming systems covering cereals, vegetables, and ornamentals. The region has smaller agricultural areas compared to central and northern provinces, which limits overall fungicide consumption. However, farmers increasingly invest in efficient fungicide solutions to improve productivity in niche horticultural and ornamental crops. Proximity to export channels within the EU supports compliance with stringent residue regulations, driving adoption of advanced formulations. Government incentives for sustainable farming practices further encourage bio-fungicide use. Although smaller in scale, West Poland remains an important growth area with rising demand for eco-friendly solutions.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- North Poland

- Central Poland

- South Poland

- East Poland

- West Poland

Competitive Landscape

The competitive landscape of the Poland fungicides market is shaped by the presence of multinational corporations and strong domestic players offering diverse product portfolios. Leading companies such as Bayer Crop Science, Syngenta, BASF Polska, FMC Corporation, and Adama Agricultural Solutions dominate with broad-spectrum chemical fungicides and advanced formulations tailored to cereals, fruits, and vegetables. UPL Limited and Nufarm strengthen competition by delivering cost-effective solutions with increasing focus on bio-fungicides. Local firms like Grupa Azoty and KWS Polska enhance the market with region-specific offerings, while Koppert Biological Systems emphasizes biological crop protection aligned with EU sustainability goals. Companies invest in R&D to address resistance management and regulatory compliance, while also expanding distribution networks to reach small and medium-sized farms. Strategic collaborations, product launches, and sustainability-driven innovations remain key approaches for growth. The market’s competitive environment is defined by balancing affordability with innovation, ensuring farmers gain access to effective and compliant solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for fruits and vegetables.

- Bio-fungicides will gain more adoption as sustainability and EU compliance intensify.

- Precision agriculture will enhance targeted fungicide applications and reduce wastage.

- Resistance management will drive innovation in advanced chemical formulations.

- Export-focused crops will continue to create higher demand for quality crop protection.

- Government support and EU funding will accelerate adoption of modern fungicides.

- Regional growth will remain strongest in North and Central Poland.

- Domestic players will strengthen presence alongside multinational corporations.

- Research and development will focus on eco-friendly and residue-free solutions.

- Farmers will increasingly adopt integrated crop protection strategies for long-term yield security.