Market Overview

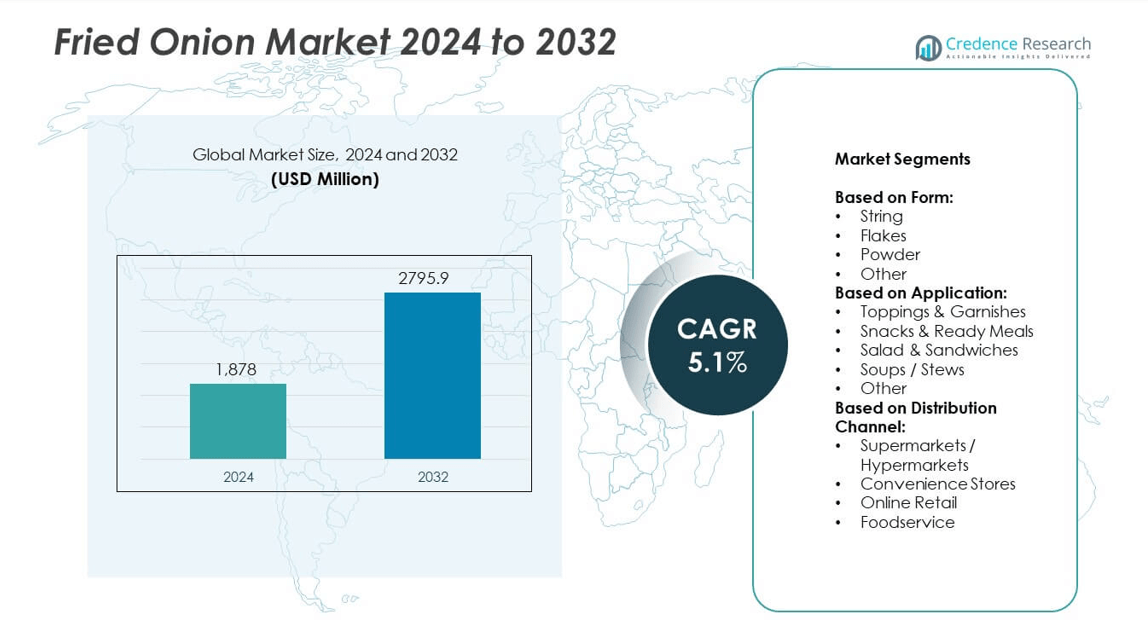

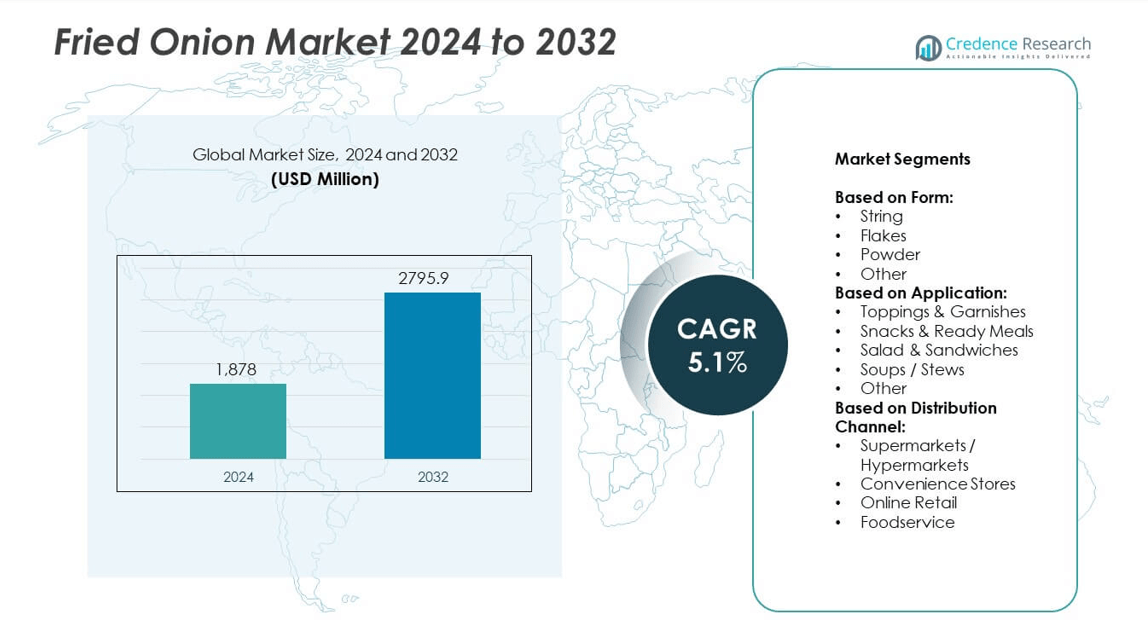

The fried onion market size was valued at USD 1,878 million in 2024 and is expected to reach USD 2,795.9 million by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fried Onion Market Size 2024 |

USD 1,878 million |

| Fried Onion Market, CAGR |

5.1% |

| Fried Onion Market Size 2032 |

USD 2,795.9 million |

The fried onion market grows due to rising demand for convenient and ready-to-use food ingredients. Busy lifestyles drive strong consumption in households and foodservice sectors. It gains traction in snacks, ready meals, and meal kits for flavor and texture enhancement. Expansion of supermarkets and online retail improves product accessibility. Manufacturers innovate with low-oil and organic variants to meet health-conscious preferences. Globalization of cuisines and rising quick-service restaurant penetration further strengthen adoption across regions, ensuring steady and long-term market growth.

North America leads the fried onion market, supported by strong demand from households and foodservice chains. Europe follows with high adoption in packaged meals and gourmet recipes. Asia-Pacific shows rapid growth driven by urbanization and rising consumption of convenience foods. Key players include Beevis, Ajinomoto Co. Inc, Pik-Nik Foods, and Roland Foods, who focus on product innovation, regional expansion, and strategic partnerships. Their efforts strengthen distribution networks and ensure consistent availability across retail and online channels worldwide.

Market Insights

- The fried onion market was valued at USD 1,878 million in 2024 and is projected to reach USD 2,795.9 million by 2032, growing at a CAGR of 5.1%.

- Rising demand for convenience food and ready-to-use ingredients drives market expansion in households and foodservice.

- Innovation in flavors, textures, and low-oil variants attracts health-conscious and gourmet consumers across regions.

- Leading players such as Beevis, Ajinomoto Co. Inc, Pik-Nik Foods, and Roland Foods invest in R&D and expand distribution to strengthen their market presence.

- Volatile onion prices, supply chain disruptions, and health concerns regarding fried foods act as key restraints for producers.

- North America leads demand supported by strong retail penetration, while Asia-Pacific shows the fastest growth due to urbanization and growing packaged food adoption.

- Expanding online retail and foodservice channels provide significant opportunities for manufacturers to reach new customer segments and improve brand visibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Convenient and Ready-to-Use Food Products

The fried onion market benefits from rising demand for convenience foods. Consumers prefer pre-prepared ingredients that reduce cooking time and effort. It is widely used in ready meals, instant noodles, and quick-service restaurants. Busy lifestyles in urban areas drive strong uptake in households and foodservice. Food companies include fried onion in packaged snacks to improve flavor and appeal. Growing sales of frozen and ready-to-eat meals support market expansion across regions.

- For instance, Kings Dehydrated Foods Pvt. Ltd. offers “Golden Fried Onion” flakes in various packaging sizes, including commercial options of 1, 5, 15, and 25 kg. The product has a stated moisture content of 3% and a distinctive golden brown color, and is packaged using food-grade materials to ensure a long shelf life.

Expanding Applications Across Diverse Culinary Segments

he fried onion market sees wider use in toppings, snacks, soups, and salads. Food manufacturers use it to enhance texture and taste in packaged products. It supports consistent quality in recipes across large-scale production. Restaurants adopt fried onion to maintain flavor uniformity and save kitchen time. It is popular in both traditional and modern recipes, boosting its global appeal. Expanding application range strengthens market penetration in multiple cuisines and regions.

- For instance, Pinaka Global Agri Services Pvt. Ltd. sells Fried Red Onion Flakes and Fried White Onion Flakes in 500 g plastic packs, with minimum order quantity of 100 kg.

Rising Influence of Globalization and Fusion Cuisine

The fried onion market grows with increased exposure to global cuisines. International food chains and fusion restaurants adopt it to attract diverse customers. It enables chefs to deliver authentic taste profiles in regional dishes. Social media trends promote recipes using crispy onions, driving home consumption. It benefits from growing cultural exchange and migration that spread culinary habits. Rising awareness of new flavors supports continuous adoption in emerging markets.

Supportive Retail Expansion and E-Commerce Growth

The fried onion market gains from rising availability in supermarkets and online channels. Retailers stock multiple variants, including flakes, powder, and ready-to-use packs. It becomes more accessible to consumers through aggressive promotions and private labels. Online grocery platforms expand reach to remote and semi-urban areas. E-commerce allows customers to compare quality and choose preferred brands easily. Growing organized retail sector supports steady and long-term market growth.

Market Trends

Rising Popularity of Packaged and Ready-to-Use Ingredients

The fried onion market experiences growth from rising preference for packaged food solutions. Consumers seek products that save time while offering consistent quality. It caters to busy households and commercial kitchens with ready-to-use formats. Pre-packaged onions in string, flakes, and powder forms gain strong traction. Manufacturers focus on packaging innovation to extend shelf life and retain freshness. Rising demand for convenient products drives consistent market expansion.

- For instance, Agramasala Udyog manufactures Fried Onion Flakes in 25 kg plastic bag packaging.

Innovation in Product Formats and Flavor Profiles

The fried onion market witnesses new product launches with unique flavors and textures. Manufacturers introduce spiced, caramelized, and seasoned variants to attract diverse consumers. It helps food producers differentiate offerings in competitive retail environments. Product developers focus on creating healthier, low-oil alternatives to meet wellness trends. Innovative frying techniques maintain crispness while reducing fat content. Flavor and texture innovation boosts adoption in snacks and gourmet applications.

- For instance, Fitaky Food of China offers crispy fried onion flakes with moisture content up to 7%, shelf life 24 months, packed in 20 kg cartons or 1-25 kg bag sizes.

Shift Toward Premium and Clean-Label Offerings

The fried onion market benefits from growing demand for premium and natural products. Clean-label claims such as non-GMO and preservative-free attract health-conscious buyers. It supports transparency by including clear ingredient information on packaging. Producers adopt sustainable sourcing practices to appeal to environmentally aware consumers. Organic fried onions see rising shelf presence in retail and e-commerce. The trend strengthens brand loyalty and consumer trust in product quality.

Growth of Online Distribution and Direct-to-Consumer Models

The fried onion market expands through online grocery platforms and D2C channels. E-commerce provides consumers with easy access to multiple brands and formats. It enables companies to offer subscription services for regular home delivery. Online marketing campaigns increase product visibility and engagement with target customers. Retailers invest in digital platforms to capture tech-savvy shoppers. The trend enhances market reach and supports steady revenue growth.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Issues

The fried onion market faces pressure from volatile onion prices and seasonal supply gaps. Crop failures due to weather changes disrupt consistent availability of quality onions. It creates cost fluctuations for producers and impacts profit margins. Supply chain delays increase transportation costs and affect timely deliveries to retailers. Global trade restrictions and export bans in major onion-producing countries add risk. Companies invest in storage and procurement planning to manage these uncertainties effectively.

Quality Consistency and Rising Health Concerns

The fried onion market must address challenges linked to quality control and oil usage. Consumers demand uniform taste, crispness, and freshness across every batch. It requires producers to maintain strict manufacturing and hygiene standards. Concerns about high oil content and fried food health risks limit adoption among certain buyers. Regulatory norms on food safety and labeling create compliance costs for manufacturers. Companies innovate with healthier frying methods and better packaging to regain consumer confidence.

Market Opportunities

Expansion into Emerging Economies and Untapped Regions

The fried onion market holds strong potential in Asia-Pacific, Latin America, and Africa. Rising disposable incomes and urbanization increase demand for packaged and convenient foods. It allows producers to target growing middle-class consumers seeking quick meal solutions. Foodservice expansion in these regions creates steady demand from restaurants and catering services. Local production facilities can reduce costs and improve market penetration. Strategic partnerships with regional distributors help brands gain early mover advantage.

Product Diversification and Health-Focused Innovations

The fried onion market can grow through development of healthier, value-added products. Low-oil, organic, and air-fried variants appeal to health-conscious buyers. It gives brands a competitive edge in retail shelves and online platforms. Manufacturers can experiment with new seasonings and premium packaging to attract gourmet consumers. Collaboration with snack makers and meal kit companies opens new sales channels. Investment in R&D supports consistent innovation and long-term revenue growth.

Market Segmentation Analysis:

By Form:

The fried onion market is segmented into string, flakes, powder, and other forms. String form dominates due to its strong use in toppings for biryani, burgers, and fast foods. It is preferred by restaurants for visual appeal and crunch. Flakes see high demand in packaged snacks and instant meals. Powder form is widely used in sauces, gravies, and seasoning mixes. Other niche formats include caramelized or spiced versions targeting gourmet and premium applications.

- For instance, Sky Agri Export provides dehydrated onion flakes in flakes form with a size of 8-15 mm, offering variants made from white, red, and pink onions. The company states a shelf life of “2 Years” for its dehydrated onion flakes.

By Application:

The fried onion market covers toppings & garnishes, snacks & ready meals, salad & sandwiches, soups/stews, and other uses. Toppings and garnishes lead demand, driven by their role in traditional recipes and QSR menus. It enhances flavor and presentation, making it popular across global cuisines. Snacks and ready meals segment grows with rising sales of frozen food and instant noodles. Salads and sandwiches use fried onions to add crunch and taste variety. Soups and stews benefit from their use as a base flavoring and finishing touch. Other uses include meal kits and bakery products that integrate onions for flavor innovation.

- For instance, Roland Foods sells Crispy Fried Onions (SKU 87530) in a 35.2-oz unit size, packaged 6 units per case, with shelf life of 365 days (unopened).

By Distribution Channel:

The fried onion market is segmented into supermarkets/hypermarkets, convenience stores, online retail, and foodservice. Supermarkets and hypermarkets hold the largest share due to easy access and variety. It allows consumers to choose among private labels and premium brands. Convenience stores cater to quick purchases in urban and semi-urban regions. Online retail grows rapidly, supported by e-commerce platforms and home delivery services. Foodservice distribution remains crucial, supplying bulk volumes to restaurants, caterers, and hotels.

Segments:

Based on Form:

- String

- Flakes

- Powder

- Other

Based on Application:

- Toppings & Garnishes

- Snacks & Ready Meals

- Salad & Sandwiches

- Soups / Stews

- Other

Based on Distribution Channel:

- Supermarkets / Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the fried onion market, driven by strong demand for packaged food products and ready-to-use ingredients. Consumers in the United States and Canada actively purchase fried onions for home cooking, fast food, and quick-service restaurants. It is commonly used in popular dishes such as burgers, salads, hot dogs, and casseroles, supporting consistent sales throughout the year. The rise of plant-based and vegan product innovation further increases the use of fried onion as a flavor enhancer in meat alternatives and snack categories. Major retailers, including Walmart and Kroger, continue to expand private-label offerings and shelf space for this product segment. Online grocery delivery services also gain traction, making fried onion more accessible to consumers across metropolitan areas. Strategic partnerships between producers and foodservice distributors strengthen supply to restaurants, cafes, and caterers.

Europe

Europe accounts for 28% of the fried onion market, supported by high consumption of convenience foods and culinary diversity. Countries such as Germany, the United Kingdom, and France lead in demand due to the popularity of fried onions in sandwiches, burgers, and traditional recipes. It benefits from growing interest in ready-to-cook meal kits and gourmet snacks that use crispy onion as a texture enhancer. European consumers value clean-label and preservative-free products, prompting manufacturers to focus on natural ingredients and sustainable sourcing. Retail chains such as Tesco, Carrefour, and Aldi actively promote premium and organic variants to attract health-conscious buyers. The presence of established food processing companies in the region helps maintain consistent supply and innovation. Seasonal demand during holidays and festive periods further boosts sales in retail and foodservice channels.

Asia-Pacific

Asia-Pacific holds a market share of 25%, driven by high onion consumption and expanding food processing industries. Countries like India, China, and Japan use fried onion extensively in traditional and modern dishes. It is a key ingredient in biryani, stir-fries, soups, and instant noodle seasonings. Rapid urbanization and a growing middle-class population support higher adoption of packaged food products. E-commerce platforms such as Flipkart, JD.com, and Rakuten expand the reach of packaged fried onions to smaller cities. Local manufacturers invest in automated production facilities to meet rising demand and maintain quality consistency. Foodservice players in this region adopt fried onion to save preparation time and maintain flavor standardization across large-scale operations.

Latin America

Latin America contributes 9% of the fried onion market, supported by the increasing popularity of fast food and snacks. Countries like Brazil, Mexico, and Argentina use fried onions in burgers, sandwiches, and ready-to-eat meals. It is also gaining use in fusion cuisine influenced by North American and European food trends. Retail distribution networks expand rapidly, offering consumers better access to packaged products. Supermarkets and convenience stores feature multiple product formats, including locally produced options. Foodservice growth, driven by quick-service restaurant expansion, further supports demand in urban centers. Producers focus on cost-efficient supply chain models to keep prices competitive in price-sensitive markets.

Middle East & Africa

Middle East & Africa represent 6% of the fried onion market, with demand led by countries such as Saudi Arabia, UAE, and South Africa. It is widely used in Middle Eastern rice dishes, kebabs, and festive meals, making it an important ingredient in home cooking and catering services. Rising tourism and hospitality sectors create opportunities for higher usage in hotels and restaurants. Packaged fried onion sales grow in supermarkets and hypermarkets across the Gulf region, supported by increased consumer awareness. Online retail channels expand reach to remote markets and offer bulk purchase options for catering businesses. Regional producers emphasize product freshness and high-quality packaging to meet consumer expectations. Strategic imports from major onion-producing countries help maintain stable supply during low-production periods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Beevis

- Ajinomoto Co. Inc

- Pik-Nik Foods

- Roland Foods

- Kings Crispy Onion

- Olam International

- Verstegen Spices & Sauces Uk Ltd.

- Lion Foods B.V.

- Pereg Gourmet Spices

- Fresh Gourmet Company

- B&G Foods Inc.

- The Onion Group

- McCormick & Company

- Kissan International

- Sadaf

Competitive Analysis

The fried onion market is characterized by strong competition among leading players such as Beevis, Ajinomoto Co. Inc, Pik-Nik Foods, Roland Foods, Kings Crispy Onion, Olam International, Verstegen Spices & Sauces Uk Ltd., Lion Foods B.V., Pereg Gourmet Spices, Fresh Gourmet Company, B&G Foods Inc., The Onion Group, McCormick & Company, Kissan International, and Sadaf. These companies focus on product quality, flavor innovation, and packaging advancements to differentiate their offerings. They invest in research and development to create healthier and low-oil variants that appeal to health-conscious consumers. Competition is also shaped by distribution strength, with major players leveraging supermarkets, hypermarkets, and online platforms to expand reach. Many companies maintain partnerships with foodservice providers and restaurant chains to secure bulk orders and consistent demand. Regional players focus on cost efficiency and localized flavors to capture price-sensitive customers, while global players emphasize premium quality and clean-label claims to build brand loyalty. Marketing campaigns and promotional pricing are used to strengthen visibility in competitive retail environments. Continuous innovation and geographic expansion remain crucial strategies for maintaining market share and meeting the rising demand for convenient and ready-to-use food ingredients.

Recent Developments

- In 2025, McCormick launched a seasoning mix called French’s Crispy Fried Onions Seasoned Coatings Mix (5 oz), which uses crispy fried onions with garlic

- In 2024, Roland Foods completed a recapitalization under Vestar Capital Partners to support its growth strategy, including expansion of specialty food ingredients.

- In 2022, McCain Foods completed the acquisition of Scelta Products in Kruiningen, Netherlands

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fried onion market will grow steadily with rising demand for convenient meal solutions.

- Urbanization and busy lifestyles will keep driving preference for ready-to-use food products.

- Manufacturers will focus on launching healthier, low-oil, and organic fried onion variants.

- E-commerce and direct-to-consumer models will expand product reach to new customers.

- Innovation in flavors and textures will attract gourmet and premium food buyers.

- Foodservice adoption will rise as restaurants seek consistency and time-saving ingredients.

- Emerging economies will offer high growth potential with expanding middle-class populations.

- Retailers will promote private-label fried onion products to capture price-sensitive buyers.

- Companies will invest in sustainable sourcing and eco-friendly packaging to meet regulations.

- Strategic partnerships and acquisitions will help brands strengthen distribution networks globally.