Market Overview:

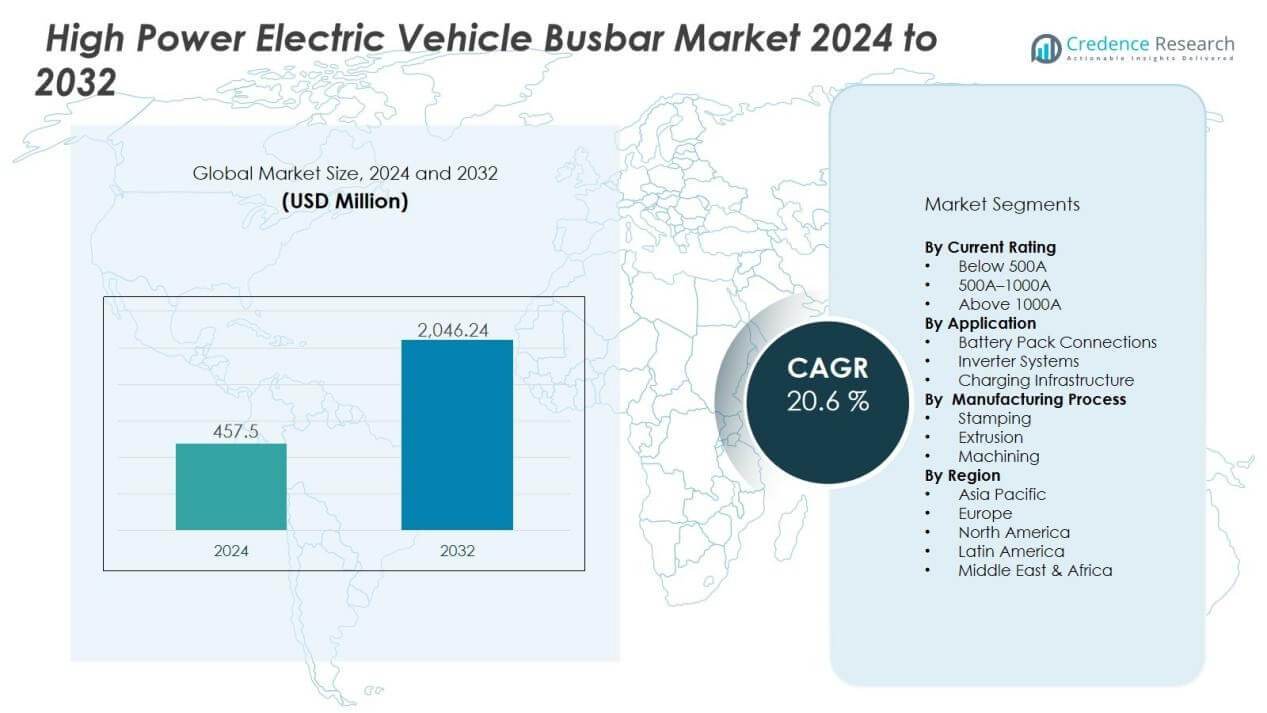

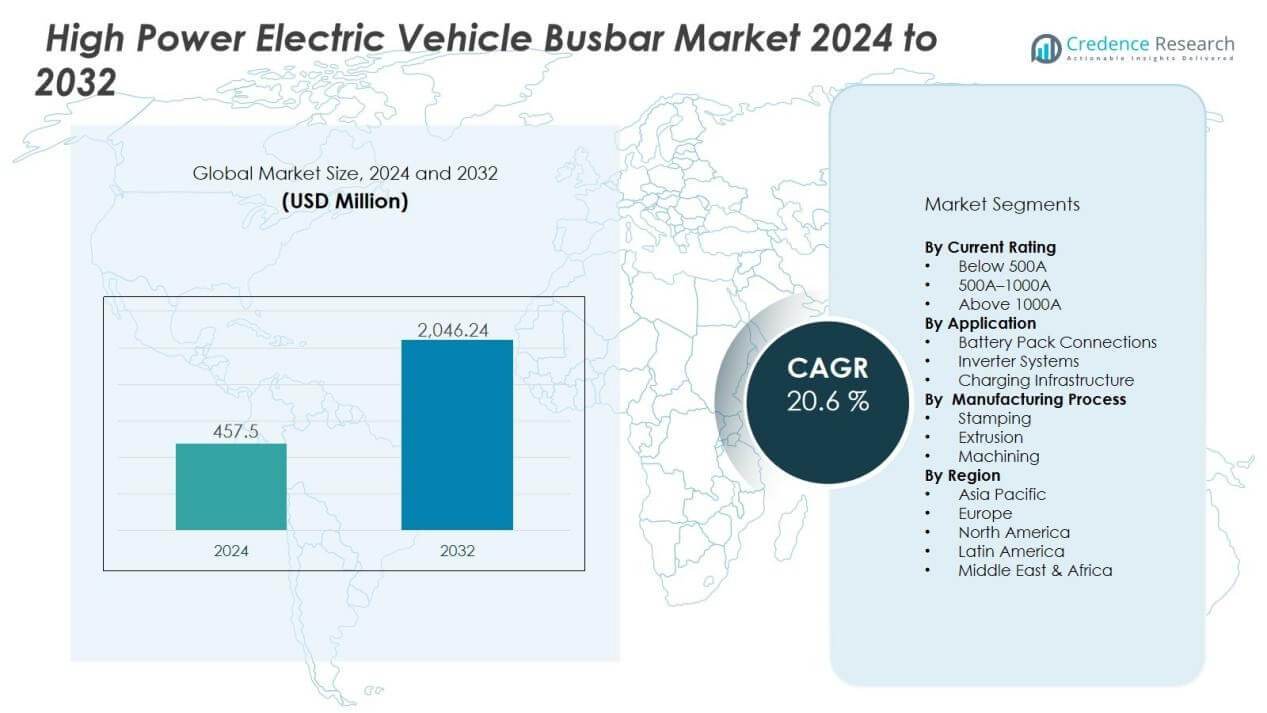

The high power electric vehicle busbar market size was valued at USD 457.5 million in 2024 and is anticipated to reach USD 2,046.24 million by 2032, at a CAGR of 20.6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Power Electric Vehicle Busbar Market Size 2024 |

USD 457.5 Million |

| High Power Electric Vehicle Busbar Market, CAGR |

20.6% |

| High Power Electric Vehicle Busbar Market Size 2032 |

USD 2,046.24 Million |

Key drivers shaping the market include the global shift toward electrification, stricter emission regulations, and rising demand for fast-charging infrastructure. Busbars offer superior electrical conductivity, compact design, and durability compared to conventional cabling, making them essential in high-power EV architectures. Continuous innovation in materials, including copper and aluminum alloys, further supports performance efficiency, weight reduction, and thermal stability, driving widespread adoption across OEMs.

Regionally, Asia Pacific dominates the market due to strong EV production in China, Japan, and South Korea. Europe follows with robust regulatory frameworks and automaker commitments to carbon neutrality. North America also contributes significantly, driven by government incentives and investments in charging infrastructure. Emerging markets in Latin America and the Middle East are gradually adopting electric mobility, offering additional opportunities for busbar suppliers.

Market Insights:

- The high power electric vehicle busbar market was valued at USD 457.5 million in 2024 and is projected to reach USD 2,046.24 million by 2032, growing at a CAGR of 20.6%.

- Rising adoption of electric vehicles and government incentives drive strong demand for high-performance busbars that ensure reliable current flow and efficient power management.

- Growing need for fast-charging and high-voltage architectures accelerates the use of busbars capable of handling higher capacity, enabling the development of ultra-fast charging networks.

- Advances in copper, aluminum, and composite materials support lightweight, durable, and thermally stable busbar designs that improve efficiency and vehicle range.

- Expansion of commercial electric fleets, including buses and trucks, creates new opportunities, with infrastructure investment further boosting adoption across global markets.

- High production costs and complex manufacturing processes, combined with thermal management issues and supply chain constraints, remain key challenges for industry players.

- Asia Pacific led with 45% share in 2024, followed by Europe with 28% and North America with 20%, highlighting strong regional demand and government-backed electrification initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Electric Vehicles and Government Incentives:

The high power electric vehicle busbar market benefits from strong EV adoption worldwide. Governments implement stricter emission norms and offer subsidies to accelerate the transition from internal combustion engines to electric mobility. Automakers invest heavily in expanding EV production, which increases the demand for high-performance busbars. It ensures reliable current flow and efficient power management, making it vital to large-scale EV deployment.

- For instance, Siemens’ SIVACON 8PS BD2 busbar trunking system supports direct current transmission at 2,165 amperes.

Growing Demand for Fast-Charging and High-Voltage Architectures:

The increasing need for fast-charging systems drives demand for busbars with higher capacity. Consumers expect reduced charging times, which requires robust current handling and efficient thermal performance. The high power electric vehicle busbar market addresses these challenges by enabling higher voltage designs in EV platforms. It plays a central role in supporting the global shift toward ultra-fast charging networks.

- For Instance, Microvast pioneered ultra-fast charging technology for electric buses at a station in Chongqing, China, featuring a total power capacity of 3,200 kW, enabling full recharges in 5 to 10 minutes.

Advances in Materials and Design for Enhanced Efficiency :

Busbar manufacturers focus on material innovations, including copper, aluminum, and composites, to reduce weight while maintaining conductivity. These advancements help improve vehicle range and reduce energy losses during power transfer. The high power electric vehicle busbar market leverages such designs to provide compact, durable, and thermally stable solutions. It strengthens OEM adoption by aligning with efficiency and sustainability targets.

Expansion of Commercial Electric Fleets and Infrastructure Investment:

The deployment of electric buses, trucks, and logistics fleets expands steadily across developed and emerging economies. Large commercial vehicles require busbars capable of handling greater loads under demanding operating conditions. The high power electric vehicle busbar market grows as fleet operators seek cost-efficient and reliable solutions. It also gains support from rising investments in charging infrastructure, which further strengthens market momentum.

Market Trends:

Market Trends:

Increasing Shift Toward Lightweight and Modular Busbar Designs:

The high power electric vehicle busbar market is witnessing a strong shift toward lightweight and modular solutions. Automakers demand components that reduce overall vehicle weight without compromising conductivity or durability. Manufacturers are adopting advanced aluminum alloys and hybrid composite materials to balance strength, efficiency, and cost. Modular busbar systems are also gaining traction because they simplify assembly, support flexible designs, and reduce manufacturing time. It enables OEMs to achieve scalability across different vehicle models while maintaining consistent performance. This trend aligns with broader industry goals of improving energy efficiency and extending driving range.

- For Instance,SHOGO Vietnam manufactures customized aluminum busbars for EV battery packs, which can achieve significant weight reductions compared to copper, with some designs capable of maintaining a current capacity of up to 1000A.

Integration of Smart Features and Growing Focus on Sustainability:

The integration of smart sensors and monitoring capabilities into busbars is becoming a key trend. These features enable real-time tracking of voltage, current, and temperature, improving safety and predictive maintenance. The high power electric vehicle busbar market is also influenced by the industry’s emphasis on sustainable materials and eco-friendly production processes. Manufacturers explore recyclable and low-carbon options to meet environmental standards and appeal to eco-conscious consumers. It reflects the rising importance of aligning with circular economy principles in the automotive sector. At the same time, partnerships between OEMs and busbar producers are expanding to co-develop advanced systems tailored for high-voltage EV architectures. This convergence of smart functionality and sustainability continues to define the competitive landscape.

For instance, Schneider Electric and Micropelt’s Qnode wireless sensor harvests energy from a 5 °C temperature differential on low-voltage busbars to power itself and transmit real-time temperature readings every second.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes:

The high power electric vehicle busbar market faces challenges due to high material and production costs. Copper and advanced alloys provide excellent conductivity but increase overall expenses for OEMs. Manufacturers also deal with complex machining, plating, and insulation processes that add to production time and cost. It raises barriers for smaller players trying to enter the market with competitive offerings. Stringent quality standards and the need for precise customization further complicate manufacturing. These factors often limit large-scale adoption in cost-sensitive regions.

Thermal Management Issues and Supply Chain Constraints:

Thermal management remains a critical challenge, particularly in high-voltage applications where overheating risks are higher. The high power electric vehicle busbar market must address these performance issues through advanced designs and materials. It requires consistent innovation to ensure safety and reliability under demanding conditions. At the same time, supply chain disruptions for metals and insulation materials create uncertainty for manufacturers. Fluctuating raw material prices and global shortages strain profitability and production planning. Limited standardization across OEM requirements also increases design complexity, making it harder to achieve economies of scale.

Market Opportunities:

Expansion of Electric Commercial Vehicles and Public Transportation Fleets :

The high power electric vehicle busbar market holds significant opportunity in commercial fleet electrification. Growing adoption of electric buses, trucks, and delivery vehicles creates demand for high-capacity busbars capable of handling heavy loads. Governments worldwide invest in sustainable public transport systems, further boosting demand for reliable power distribution components. It positions busbars as critical enablers for efficient fleet performance and reduced operating costs. Rising commitments from logistics companies and municipal authorities also expand the customer base. This trend strengthens the long-term growth prospects for manufacturers targeting high-volume commercial applications.

Rising Demand for Advanced Charging Infrastructure and Smart Technologies:

The global rollout of fast-charging and ultra-fast-charging stations creates a promising avenue for busbar suppliers. The high power electric vehicle busbar market benefits from the need for components that support higher voltages and currents in next-generation charging networks. It also gains from integration opportunities with smart monitoring systems, which improve safety and predictive maintenance. Manufacturers focusing on sustainable and recyclable materials can further capture demand from eco-conscious OEMs. Strategic collaborations with automakers and energy providers will enhance market penetration. This opens the door for innovation-driven companies to secure strong positions in a rapidly evolving ecosystem.

Market Segmentation Analysis:

By Current Rating:

The high power electric vehicle busbar market is segmented by current rating into below 500A, 500A–1000A, and above 1000A. Busbars rated above 1000A hold significant demand due to their role in commercial vehicles, electric buses, and heavy-duty trucks. It ensures stable performance under high load conditions, where reliability and safety are critical. The 500A–1000A segment supports passenger EVs, offering a balance of efficiency and compact design. Below 500A ratings cater to smaller EV models where space and cost efficiency drive adoption.

- For Instance,Blue Sea Systems manufactures 1000A rated PowerBar busbars designed for industrial and marine applications.

By Application:

Applications include battery pack connections, inverter systems, and charging infrastructure. Battery pack connections account for a major share, as they require high precision and consistent current flow. It drives demand for advanced busbars that improve energy efficiency and reduce losses. Inverter systems also adopt busbars to support smooth power conversion and thermal stability. Charging infrastructure integration is expanding with ultra-fast chargers that depend on high-capacity busbars to enable rapid power transfer.

- For instance, ABB’s Terra HP 350 kW DC fast charger provides 160 kW continuous output at 375 A per power cabinet, enabling up to 350 kW peak power delivery when two cabinets are combined.

By Manufacturing Process:

Manufacturing processes include stamping, extrusion, and machining. Stamping dominates due to its cost efficiency and ability to deliver high-volume production. It allows precise shaping, which supports complex designs for compact EV platforms. Extrusion is preferred for larger and thicker busbars used in heavy-duty EVs. Machining caters to custom applications where precision and durability are prioritized. Each process supports diverse needs, strengthening the adaptability of the high power electric vehicle busbar market.

Segmentations:

By Current Rating

- Below 500A

- 500A–1000A

- Above 1000A

By Application

- Battery Pack Connections

- Inverter Systems

- Charging Infrastructure

By Manufacturing Process

- Stamping

- Extrusion

- Machining

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific :

Asia Pacific accounted for 45% market share in the high power electric vehicle busbar market in 2024. China, Japan, and South Korea dominate due to their strong EV manufacturing ecosystems and government-backed electrification policies. It benefits from large-scale EV adoption, advanced battery technologies, and rising investments in charging networks. Strong support from government subsidies and incentives further accelerates market penetration. Regional manufacturers continue to focus on lightweight and high-capacity busbars that meet global standards. Rapid urbanization and growing demand for electric buses also reinforce Asia Pacific’s leadership.

Europe:

Europe held 28% market share in the high power electric vehicle busbar market in 2024. The region benefits from strict carbon reduction policies and automakers’ commitments to electrify product portfolios. It leverages strong demand for premium EVs, along with extensive charging infrastructure investments supported by the European Union. Germany, France, and the Nordic countries are at the forefront, driving innovation in advanced busbar designs. OEM partnerships with material suppliers further enhance product quality and sustainability. Growing consumer awareness of eco-friendly vehicles also supports wider adoption. Europe’s focus on carbon neutrality targets ensures continued demand growth.

North America:

North America accounted for 20% market share in the high power electric vehicle busbar market in 2024. The region benefits from federal incentives, state-level programs, and investments in EV charging infrastructure. It has strong contributions from the United States, supported by commitments from leading automakers and technology suppliers. Expanding adoption of electric trucks and commercial fleets further strengthens demand for high-capacity busbars. Canada also contributes through policies that promote EV adoption and clean energy integration. The region’s growing ecosystem of EV startups and established manufacturers reinforces long-term opportunities. North America continues to gain momentum as infrastructure and consumer adoption accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ametek

- Nexans

- Hitachi

- Mitsubishi Electric

- Wieland Electric

- Eaton

- Honeywell

- Alstom

- General Electric

- ABB

- Cummins

- Siemens

- Rittal

Competitive Analysis:

The high power electric vehicle busbar market is highly competitive, with global and regional players focusing on innovation, cost efficiency, and partnerships. Key companies include Ametek, Nexans, Hitachi, Mitsubishi Electric, Wieland Electric, Eaton, Honeywell, and Alstom, each contributing through diverse product portfolios and strategic initiatives. It reflects a strong push toward lightweight materials, thermal stability, and integration of smart monitoring features. Manufacturers emphasize collaborations with OEMs to develop customized solutions for high-voltage EV platforms. Strategic investments in advanced manufacturing processes such as stamping and extrusion strengthen production capabilities and scalability. Companies also prioritize sustainability by adopting recyclable materials and eco-friendly practices, which align with automaker goals. The market remains dynamic, where continuous technological improvements and regional expansion strategies define competitive positioning.

Recent Developments:

- In July 2025, Ametek completed its acquisition of FARO Technologies, enhancing its Ultra Precision Technologies division with FARO’s 3D metrology and digital reality solutions.

- In June 2025, Nexans completed the acquisition of 100% of the share capital of Cables RCT, strengthening its electrification portfolio in Southern Europe with focus on fire safety and innovation.

- In June 2025, Hitachi Energy launched its Compact Line Voltage Regulator to improve controllability of distribution grids.

Report Coverage:

The research report offers an in-depth analysis based on Current Rating, Application, Manufacturing Process and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high power electric vehicle busbar market will expand with growing EV adoption across passenger and commercial segments.

- It will see stronger demand from fast-charging infrastructure that requires high-capacity power distribution solutions.

- Advancements in copper and aluminum alloys will drive innovation in lightweight and thermally efficient busbar designs.

- Integration of smart monitoring features will enhance safety, predictive maintenance, and overall system reliability.

- Collaboration between OEMs and busbar manufacturers will accelerate development of customized high-voltage architectures.

- It will gain traction in public transportation fleets as governments push for electric buses and green mobility.

- Sustainability initiatives will promote recyclable materials and eco-friendly production processes in busbar manufacturing.

- The market will expand in emerging regions with rising investments in EV infrastructure and local assembly plants.

- Growing electrification of heavy-duty vehicles such as trucks and logistics fleets will strengthen long-term demand.

- It will remain competitive as global players focus on product differentiation, cost efficiency, and strategic partnerships.

Market Trends:

Market Trends: