Market Overview:

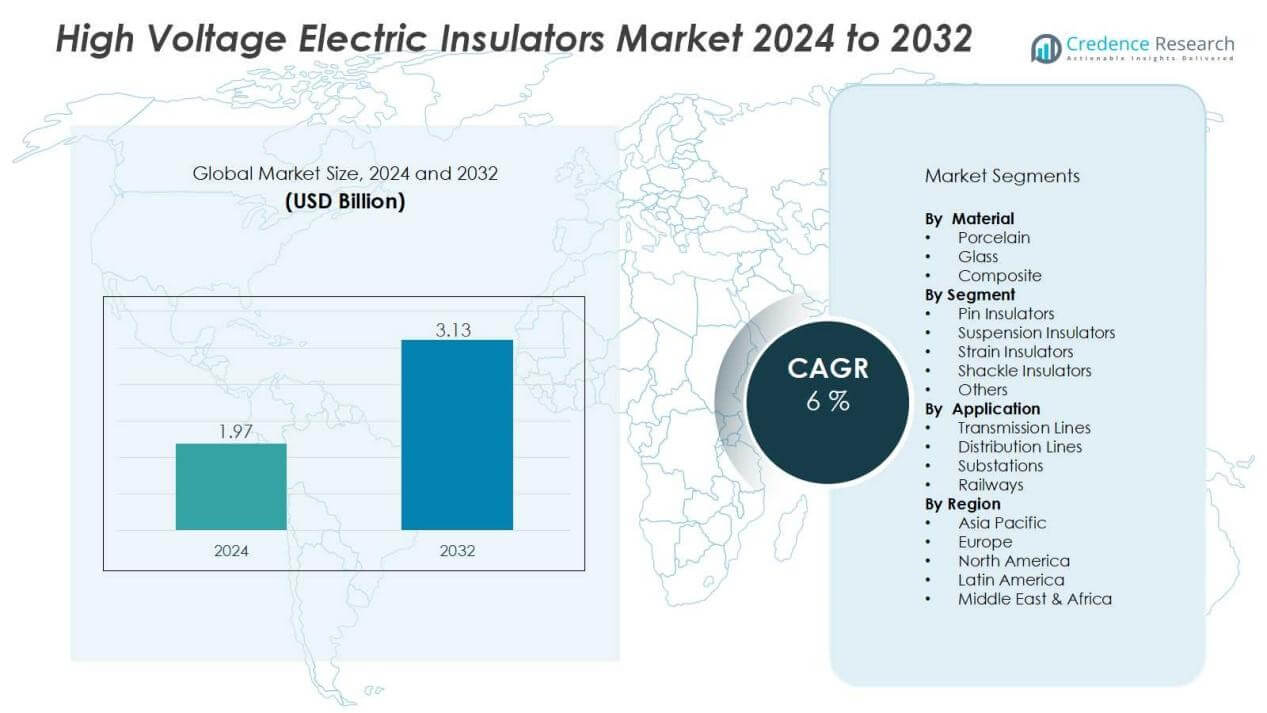

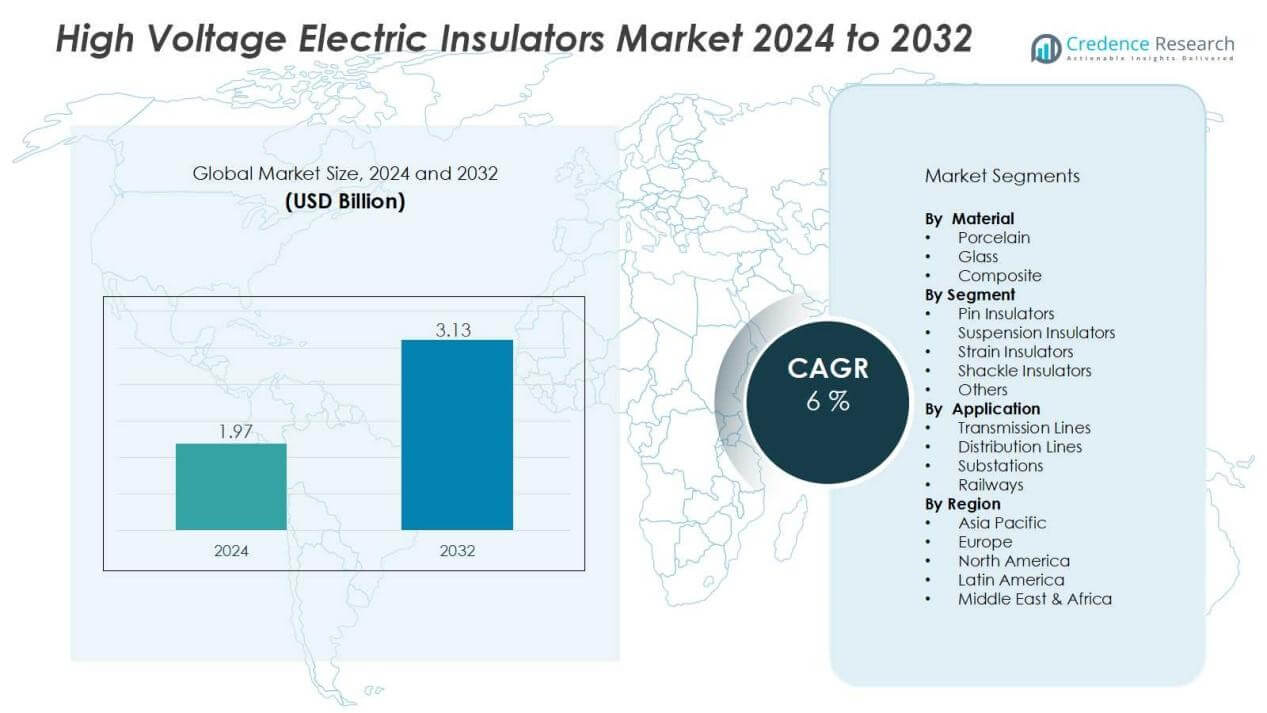

The high voltage electric insulators market size was valued at USD 1.97 billion in 2024 and is anticipated to reach USD 3.13 billion by 2032, at a CAGR of 6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Electric Insulators Market Size 2024 |

USD 1.97 Billion |

| High Voltage Electric Insulators Market, CAGR |

6% |

| High Voltage Electric Insulators Market Size 2032 |

USD 3.13 Billion |

Growth drivers include the modernization of aging power networks, expansion of high-voltage direct current (HVDC) transmission systems, and rising emphasis on energy efficiency. Governments and utilities are focusing on replacing outdated components with advanced insulators to reduce power losses and enhance system reliability. The shift toward renewable power sources such as wind and solar is also increasing the requirement for efficient grid infrastructure, thereby creating strong opportunities for manufacturers.

Regionally, Asia-Pacific dominates the high voltage electric insulators market due to large-scale electrification projects, urbanization, and the presence of major power equipment manufacturers in China and India. North America follows, supported by grid modernization initiatives and renewable energy integration. Europe shows steady demand driven by regulatory focus on energy efficiency and sustainability. Meanwhile, the Middle East & Africa and Latin America present emerging opportunities through expanding electricity access and infrastructure development.

Market Insights:

- The high voltage electric insulators market was valued at USD 1.97 billion in 2024 and is expected to reach USD 3.13 billion by 2032, growing at a CAGR of 6%.

- Rising demand for reliable transmission and distribution networks is driving the adoption of advanced insulators worldwide.

- Integration of renewable energy sources such as wind and solar is increasing the need for durable high-voltage grid components.

- Growing investments in smart grid projects and HVDC systems create significant opportunities for manufacturers of specialized insulators.

- Replacement of aging infrastructure in developed economies supports continuous demand for modern, efficient, and safe insulator solutions.

- High costs of advanced insulators and complex installation requirements remain key challenges for utilities and manufacturers.

- Asia-Pacific held 42% market share in 2024, followed by North America with 27% and Europe with 21%, reflecting strong regional demand drivers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Transmission and Distribution Networks:

The high voltage electric insulators market benefits from growing demand for efficient transmission and distribution networks. Expanding urban populations and industrial growth create higher electricity requirements, leading to grid expansions and upgrades. Utilities and governments are investing heavily in modern infrastructure to reduce outages and improve reliability. It is driving strong adoption of advanced insulators designed to withstand high voltages and environmental stress.

- For Instance, Hubbell’s Ohio Brass polymer deadend insulators, which support distribution voltages from 15 kV to 46 kV, are a market leader, with over one million units sold annually.

Integration of Renewable Energy Sources into Power Grids:

The integration of wind, solar, and other renewable sources is boosting the need for robust grid components. Renewable power plants often connect from remote areas, requiring long-distance high-voltage lines. This expansion creates a strong demand for durable insulators that can ensure stable performance under variable conditions. The high voltage electric insulators market sees consistent growth from renewable energy adoption and grid decentralization.

- For Instance, The Zhangbei-Xiong’an 1,000 kV UHV AC transmission project was completed by the State Grid Corporation of China (SGCC) in August 2020, not in 2025.

Growing Investments in Smart Grid and HVDC Projects:

Smart grid projects and the rise of high-voltage direct current (HVDC) systems create significant opportunities for insulator manufacturers. HVDC lines require specialized insulators that can handle higher electrical stress. Governments and private players are investing in such projects to improve energy efficiency and cross-border electricity trade. It is fueling continuous demand for technologically advanced insulators with high reliability and long service life.

Replacement of Aging Infrastructure and Safety Concerns:

Aging power infrastructure in many developed economies drives replacement demand for modern insulators. Older insulators often face performance issues under current load requirements, creating risks of failure. Utilities are prioritizing upgrades to improve safety, reduce transmission losses, and comply with stricter regulations. The high voltage electric insulators market benefits from this replacement cycle, supported by rising safety and reliability standards.

Market Trends:

Adoption of Composite and Polymer-Based Insulators for Enhanced Performance:

The high voltage electric insulators market is witnessing a strong shift toward composite and polymer-based products. These insulators offer advantages such as lightweight design, resistance to vandalism, and better performance in polluted environments. Utilities are increasingly replacing traditional porcelain and glass units with polymer alternatives to reduce maintenance costs and improve reliability. Rising demand for transmission lines in coastal and industrial areas with high contamination levels accelerates this adoption. The trend is supported by manufacturers focusing on innovations in hydrophobic materials and advanced coatings to extend product life. It is reinforcing the role of modern insulators in ensuring long-term grid stability and safety.

- For instance, TE Connectivity introduced its Raychem-branded high voltage insulators using silicone rubber with advanced Room Temperature Vulcanizing (RTV) coatings, achieving a water contact angle exceeding 110 degrees and extending effective service life beyond 25 years in documented outdoor field trials.

Increasing Focus on Smart Grid Integration and Digital Monitoring Solutions:

The deployment of smart grids is creating new opportunities for digital monitoring of insulator performance. Utilities are adopting sensors and IoT-enabled systems to track electrical stress, leakage current, and environmental impact in real time. This shift toward data-driven asset management helps prevent failures and reduces downtime in transmission networks. The high voltage electric insulators market benefits from this trend, with manufacturers developing insulators integrated with advanced monitoring features. Demand is rising for solutions that combine durability with predictive maintenance capabilities, especially in regions upgrading aging infrastructure. It is pushing the market toward greater adoption of intelligent, high-performance products aligned with the digitalization of power systems.

- For Instance, In August 2024, Hitachi Energy introduced SF₆-free high-voltage circuit breakers as part of its EconiQ™ portfolio, including a 420 kV live-tank breaker with advanced digital monitoring and predictive maintenance features.

Market Challenges Analysis:

High Costs of Advanced Insulators and Complex Installation Requirements:

The high voltage electric insulators market faces challenges from the high costs of advanced materials and designs. Composite and polymer-based insulators, while offering durability and better performance, require greater investment compared to conventional options. Utilities in developing regions often hesitate to adopt them due to budget constraints and limited funding for grid modernization. Installation of high voltage insulators also demands skilled labor, specialized equipment, and strict safety standards, increasing project expenses. It creates barriers for smaller utilities and emerging economies that prioritize cost efficiency over long-term performance. The financial challenge slows adoption despite clear technical advantages.

Performance Limitations in Extreme Environmental Conditions and Aging Issues:

The market is also challenged by performance issues under extreme environmental conditions such as heavy pollution, high humidity, and intense UV exposure. Even advanced insulators can degrade faster under such conditions, requiring frequent maintenance and replacements. Utilities face rising costs in regions where environmental stress reduces product life cycles. The high voltage electric insulators market must address these issues through innovations in coatings, material improvements, and predictive monitoring solutions. It is also affected by aging infrastructure in developed economies, where replacement demand is high but often delayed by budgetary or regulatory constraints. These challenges create pressure on manufacturers to balance performance, affordability, and sustainability.

Market Opportunities:

Market Opportunities:

Expansion of Renewable Energy Projects and Grid Modernization Efforts:

The high voltage electric insulators market has strong opportunities from expanding renewable energy projects worldwide. Wind and solar farms located in remote areas require new transmission lines to connect with urban and industrial centers. This expansion increases demand for high-performance insulators that can handle variable loads and harsh environments. Governments are investing in grid modernization to integrate clean energy sources, creating a favorable market environment. It benefits manufacturers that develop durable, lightweight, and cost-efficient insulators suitable for long-distance power transmission. The focus on sustainability and energy efficiency further enhances these growth opportunities.

Adoption of Smart Technologies and Emerging Regional Markets:

Digitalization of power systems opens opportunities for smart insulators with monitoring and diagnostic capabilities. Utilities seek predictive maintenance solutions to improve reliability, reduce outages, and extend asset life. Manufacturers offering IoT-enabled insulators can gain a competitive edge in modern power networks. The high voltage electric insulators market also sees prospects in emerging regions such as Africa, Southeast Asia, and Latin America, where electrification initiatives are expanding. It creates significant potential for cost-effective, innovative insulators that support large-scale infrastructure projects. Growing demand from these regions ensures steady long-term opportunities for global market players.

Market Segmentation Analysis:

By Material:

The high voltage electric insulators market is segmented into porcelain, glass, and composite materials. Porcelain insulators maintain strong usage due to durability and cost efficiency in traditional networks. Glass insulators offer high mechanical strength and visual transparency for inspection but face declining preference. Composite insulators gain traction for their lightweight properties, resistance to vandalism, and superior performance in polluted or coastal environments. It is expected that composite materials will continue to expand their share with ongoing advancements in polymer technology.

- For instance, Sediver’s toughened glass disc insulators are manufactured with a compressive pre-stress technique that enables a shatter rate of less than 1 in 10,000 units per year, validated by routine automated inspections across its global production lines.

By Product Segment:

Product segmentation includes pin insulators, suspension insulators, strain insulators, shackle insulators, and others. Suspension insulators dominate due to their wide application in high-voltage transmission lines. Pin insulators remain common in lower voltage applications but are gradually losing ground in higher voltage ranges. Strain insulators are widely used in tension zones to handle mechanical stress effectively. The market favors advanced designs that ensure efficiency, reliability, and reduced maintenance in complex grid operations.

- For Instance, Siemens Energy supplies advanced composite insulators, such as their long-rod insulator series, for overhead line applications up to 800 kV.

By Application:

Applications cover transmission lines, distribution lines, substations, and railways. Transmission lines account for the largest share due to global investments in cross-border and long-distance electricity projects. Distribution lines see steady demand supported by urban expansion and rural electrification initiatives. Substations adopt high-performance insulators to enhance operational safety and reliability. Railways also create demand, especially in regions investing in high-speed and electrified rail infrastructure. It is anticipated that transmission will remain the most dominant application segment.

Segmentations:

By Material:

- Porcelain

- Glass

- Composite

By Segment:

- Pin Insulators

- Suspension Insulators

- Strain Insulators

- Shackle Insulators

- Others

By Application:

- Transmission Lines

- Distribution Lines

- Substations

- Railways

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 42% market share in 2024 and continues to lead the global demand. China, India, and Japan dominate the region due to rapid urbanization, industrialization, and large-scale electrification programs. The high voltage electric insulators market benefits from significant investments in high-voltage transmission projects and renewable integration. Governments are expanding grid infrastructure to support clean energy and growing electricity consumption. It is also supported by the presence of leading manufacturers that invest in research and development. Rising adoption of polymer-based insulators strengthens the region’s technological advancements and ensures long-term growth.

North America:

North America held 27% market share in 2024 and shows steady growth in advanced grid solutions. The United States leads with heavy investments in renewable power and grid modernization initiatives. The high voltage electric insulators market grows in this region due to increasing replacement demand for aging infrastructure. Utilities are focusing on smart grids and HVDC transmission systems to improve efficiency and reliability. It is also supported by strict regulatory standards promoting energy efficiency and safety compliance. Canada and Mexico contribute with ongoing electrification projects and cross-border energy trade.

Europe:

Europe recorded 21% market share in 2024 and remains a key market for advanced solutions. Countries like Germany, France, and the United Kingdom emphasize energy efficiency and sustainable grid development. The high voltage electric insulators market in this region is shaped by strong policies on renewable energy adoption. Investments in offshore wind projects and interconnection of European grids drive consistent demand. It is supported by replacement of older porcelain insulators with advanced polymer-based units. Southern and Eastern Europe also present growth opportunities through ongoing electrification and infrastructure upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Electric

- Siemens Energy

- LAPP Insulators GmbH

- Sediver

- GIPRO GmbH

- Olectra Greentech Limited

- PFISTERER Holding SE

- Hubbell

- Hitachi Energy Ltd.

- Newell Porcelain

Competitive Analysis:

The high voltage electric insulators market is highly competitive with global and regional players focusing on innovation, quality, and reliability. Key companies include General Electric, Siemens Energy, LAPP Insulators GmbH, Sediver, GIPRO GmbH, Olectra Greentech Limited, and PFISTERER Holding SE. Competition is shaped by investments in advanced materials, such as composites and polymers, that improve performance in harsh environments. It is also driven by the demand for insulators capable of supporting smart grid and HVDC projects worldwide. Leading manufacturers strengthen their market presence through partnerships, product launches, and expansion into emerging regions. Regional players compete by offering cost-effective solutions tailored to local grid requirements. The competitive landscape reflects a balance between established global brands setting high technology standards and regional companies addressing niche market opportunities.

Recent Developments:

- In September 2025, GE Vernova, General Electric’s energy business, agreed to sell its Proficy industrial software unit to private equity firm TPG for $600 million, with the proceeds set to be reinvested into grid software and AI platforms.

- In September 2025, Siemens Energy signed a strategic Memorandum of Understanding with Wison New Energies at Gastech 2025 in Milan to cooperate on novel offshore energy solutions and expand their presence in floating LNG projects.

Report Coverage:

The research report offers an in-depth analysis based on Material, Segment, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage electric insulators market will see rising demand from renewable energy integration projects worldwide.

- Growing investments in HVDC transmission lines will create consistent opportunities for advanced insulator solutions.

- Smart grid development will encourage adoption of digital monitoring and IoT-enabled insulators across utilities.

- Manufacturers will focus on lightweight composite and polymer-based designs to improve efficiency and reduce maintenance.

- Emerging markets in Africa, Southeast Asia, and Latin America will drive strong infrastructure-related demand.

- Replacement of aging insulators in developed economies will remain a steady source of revenue.

- Environmental challenges will accelerate innovation in hydrophobic coatings and weather-resistant materials for longer product life.

- Cross-border electricity trade will increase reliance on reliable high-voltage insulators to maintain grid stability.

- Sustainability concerns will push manufacturers to adopt eco-friendly materials and manufacturing processes.

- Collaboration between utilities, governments, and technology providers will shape the future direction of the high voltage electric insulators market.

Market Opportunities:

Market Opportunities: