Market Overview

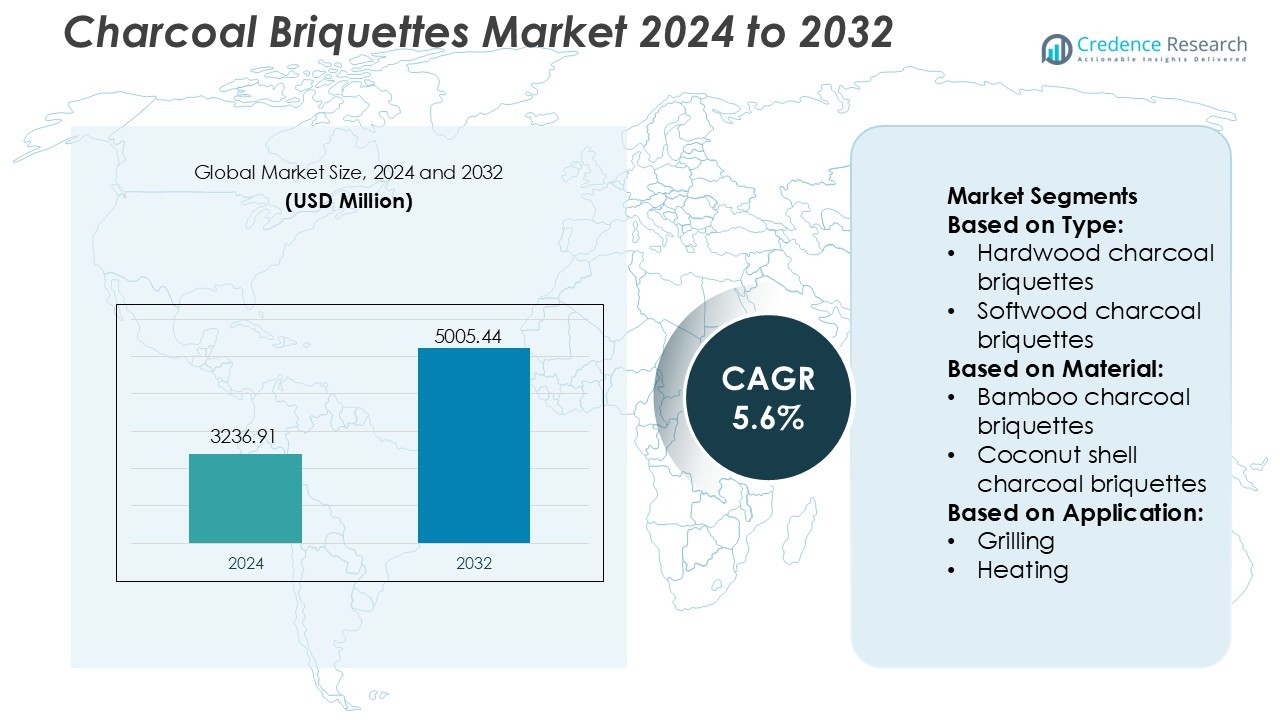

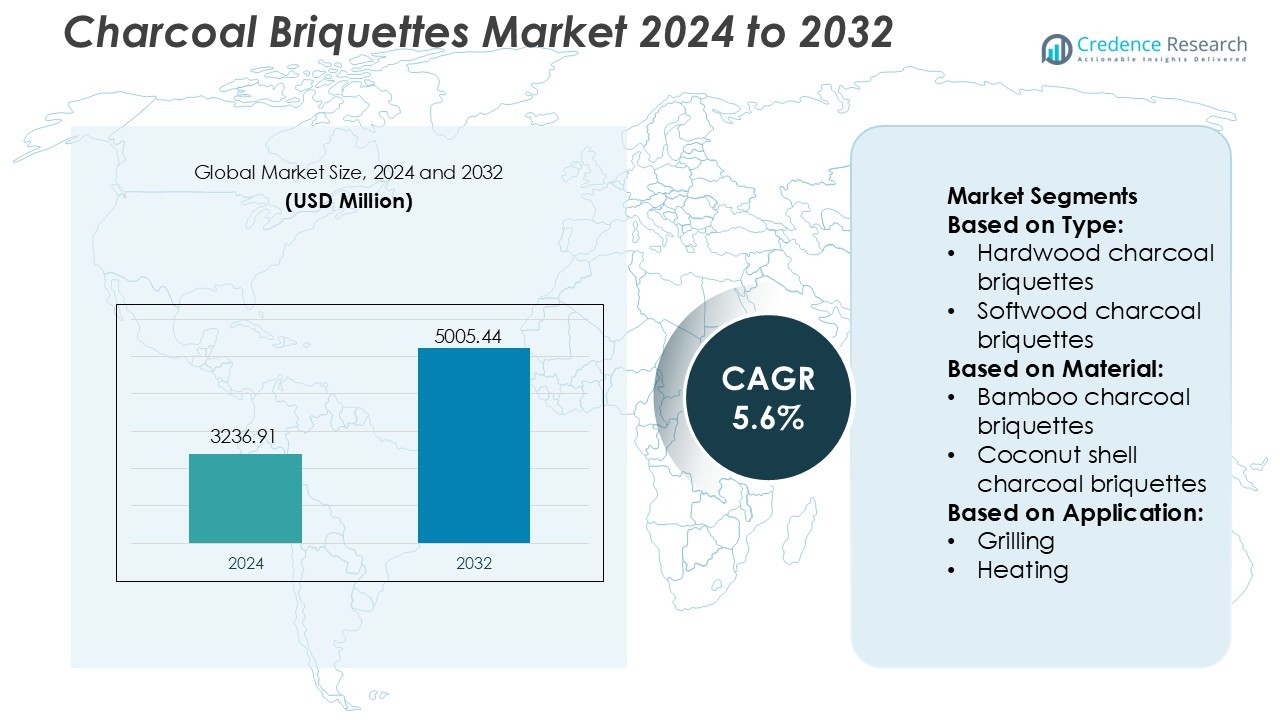

Charcoal Briquettes Market size was valued USD 3236.91 million in 2024 and is anticipated to reach USD 5005.44 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Charcoal Briquettes Market Size 2024 |

USD 3236.91 Million |

| Charcoal Briquettes Market, CAGR |

5.6% |

| Charcoal Briquettes Market Size 2032 |

USD 5005.44 Million |

The Charcoal Briquettes Market includes several established and emerging manufacturers focusing on high-efficiency, low-smoke, and sustainable briquette production. Top players strengthen their competitiveness through product innovation, large retail distribution, and export capacity. Asia-Pacific leads the global market with 36% share, supported by abundant raw materials and strong manufacturing networks in countries such as Indonesia, China, and Vietnam. The region also drives global exports of coconut-shell briquettes to Europe and North America, where premium grilling fuels are in high demand. Companies continue to diversify product lines, invest in cleaner production technologies, and expand digital sales channels to increase global reach and customer visibility.

Market Insights

- The Charcoal Briquettes Market reached USD 3,236.91 million in 2024 and is projected to hit USD 5,005.44 million by 2032 at a 5.6% CAGR, driven by rising demand for clean and efficient cooking fuel.

- Growing preference for low-smoke and odor-free briquettes supports market growth, as households and commercial users shift from traditional wood charcoal to sustainable alternatives.

- Asia-Pacific holds 36% share and remains the leading region due to strong production capacity and high export volumes, led by Indonesia, China, and Vietnam.

- Premium briquettes used in restaurants, catering, and outdoor grilling continue to expand, giving the BBQ segment the highest revenue contribution in the market.

- Competition intensifies as manufacturers invest in eco-friendly binders, advanced carbonization technologies, digital retail channels, and global distribution partnerships, while market restraints include raw material price fluctuations and strict emission regulations in developed regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Hardwood charcoal briquettes hold the dominant share of the Charcoal Briquettes Market. Manufacturers favor hardwood briquettes because they burn longer, generate higher heat output, and create less smoke than softwood variants. This benefit supports demand from outdoor cooking brands and household users. The stable combustion rate also reduces fuel consumption, making them appealing for commercial barbeque restaurants and catering services. Softwood briquettes follow due to fast ignition properties, but lower heat density limits their scale. Growing consumer interest in clean-burning and long-lasting fuel continues to strengthen hardwood demand across residential and commercial sectors.

- For instance, Weber documents that its Hardwood Briquettes maintain a steady burn for up to 3 hours per grilling session and reach combustion temperatures exceeding 600°C, giving restaurants longer heat cycles without frequent refueling.

By Material

Coconut shell charcoal briquettes lead this segment with a significant share, driven by high calorific value and low ash residue. Food chains and grilling equipment suppliers adopt these briquettes because they offer consistent heat and generate minimal smoke or odor. Bamboo and sawdust briquettes also see rising adoption as eco-friendly options, supported by waste recycling initiatives. Coal dust briquettes remain present in heavy-duty heating use despite concerns about emissions. Coconut shell products continue to gain traction as hotels, resorts, and export markets prefer sustainable, high-performance alternatives.

- For instance, Weber’s Coconut Shell Briquettes are laboratory-tested to burn for up to 3 hours per grilling cycle and contain ash levels typically under 5 grams per 100 grams of fuel (less than 5% ash content), according to product information.

By Application

Grilling represents the largest application share in the Charcoal Briquettes Market, supported by strong usage in household barbeques, restaurants, and outdoor events. Consumers choose briquettes for uniform heat distribution and longer burn time compared to lump charcoal. Barbequing and heating follow due to seasonal demand and rural household energy needs. Industrial processes and metallurgy segments use briquettes as cost-efficient carbon sources, but their market size remains smaller and application-specific. The growth of fast-casual barbeque dining and rising exports of premium grilling briquettes support the dominant position of this segment.

Key Growth Drivers

Rising Outdoor Cooking and Barbeque Culture

Outdoor cooking activity continues to grow in residential and commercial spaces. Restaurants, resorts, and catering businesses shift to smokeless charcoal briquettes due to clean combustion and longer burn times. Consumers value consistent heat for barbeque and grilling. Tourism growth also increases barbeque events in resorts and holiday destinations. The improved availability of packaged briquettes through supermarkets and online platforms strengthens adoption. Product variants made from coconut shell and hardwood offer low ash and strong calorific value. These advantages help charcoal briquettes replace traditional wood and lump charcoal in many regions.

- For instance, Kingsford confirms that its Professional Hardwood Briquettes are its lowest-ash formula and generate significantly less ash by weight than its Original formula, with independent tests showing levels around 10% to 11% (approx. 10 to 11 grams of ash per 100 grams of fuel).

Shift Toward Sustainable and Eco-Friendly Fuels

Governments promote eco-friendly heating and cooking fuels to reduce deforestation and carbon emissions. Charcoal briquettes use agricultural waste like sawdust, rice husk, coconut shells, and bamboo, turning waste into valuable energy products. The clean-burning nature of briquettes supports reduced smoke and indoor air pollution. Urban households prefer them for easy storage and faster ignition. Industrial users adopt briquettes to meet emission standards and sustainability targets. Supportive policies, rising awareness about clean fuels, and bans on illegal wood charcoal production accelerate demand. These factors drive briquettes as a preferred green alternative.

- For instance, Baccar Indo Resources reports that its coconut-shell charcoal briquettes deliver 7,200 to 7,500 kcal/kg calorific value, achieve a fixed carbon content of approximately 80%, and record ash content between 1.5 % and 2.5%, while moisture remains at 5% or less.

Growth of Small-Scale Energy and Industrial Applications

Charcoal briquettes find growing use in metal processing, ceramics, and small furnaces due to stable heat and high carbon content. Factories in Africa, Asia, and Latin America switch to briquettes because they are cheaper and easier to transport than traditional coal or wood. Heating applications in brick kilns, smokehouses, and small manufacturing units support steady consumption. The expansion of briquette production facilities increases product availability in rural and urban markets. Many startups and community-based units adopt low-cost briquetting machines, leading to local economic gains. Industrial diversification strengthens long-term market potential.

Key Trends & Opportunities

Demand for Low-Smoke, Odor-Free, and High-Performance Briquettes

Consumers prefer briquettes with faster ignition, reduced sparks, and longer combustion. Companies develop uniform-sized, odor-free, and moisture-resistant products for premium barbeque experiences. Activated carbon briquettes and additive-free products gain preference in international markets. Eco-certifications open export opportunities in Europe and North America. Growing packaging innovations such as waterproof bags and instant-light coatings improve convenience. Manufacturers focus on clean indoor heating briquettes for cold regions. These performance-driven innovations help brands gain a competitive edge and expand into premium retail channels.

- For instance, Mitsui & Co. has invested in a large-scale alternative fuel initiative with LanzaJet that will produce approximately 150,000 kiloliters of sustainable aviation fuel (SAF) and 17,000 kiloliters of renewable diesel annually at the Sakaide Logistics Base, scheduled for completion in 2029.

Expansion of Organized Retail and E-Commerce Channels

Large supermarkets, barbeque equipment stores, and e-commerce platforms provide wider product visibility. Online retail allows customers to compare features like calorific value, burning time, and materials. Subscription-based delivery of briquettes for restaurants and food trucks creates a steady revenue model. Partnerships between briquette makers and grill manufacturers promote bundled sales. Exporters benefit from digital trade platforms that support cross-border shipments. The shift from informal sellers to branded packaging builds trust and enhances market price stability. This trend supports branded players and increases consumer adoption.

- For instance, Royal Oak’s Classic Premium Hardwood Charcoal Briquets feature a patented ridge design that “lights fast, and is ready to cook within 15 minutes.”

Rising Usage of Agricultural Waste and Renewable Inputs

Producers utilize coconut shells, sugarcane bagasse, sawdust, coffee husk, and rice husk as feedstock. These waste-based briquettes reduce landfill pressure and create rural income sources. Governments encourage briquetting units under renewable energy programs. Technology upgrades improve density and carbonization, resulting in higher energy efficiency. International buyers prefer waste-derived products due to their sustainability credentials. This trend helps emerging manufacturers enter export markets with low production costs. The focus on renewable feedstocks promotes circular economy benefits and reduces wood dependency.

Key Challenges

Price Competition from Traditional Charcoal and Fossil Fuels

Many rural and low-income households still rely on inexpensive wood and lump charcoal. In some regions, illegal charcoal production reduces market prices and creates unfair competition for organized briquette makers. The price of raw materials varies seasonally, affecting small producers. Transportation costs remain high due to bulky packaging. Industrial buyers often demand lower pricing, which pressures profit margins. Without awareness programs and subsidy support, briquettes struggle to attract cost-sensitive customers. These price-driven constraints limit faster market penetration.

Quality and Standardization Issues in Unorganized Production

A large share of briquettes comes from small-scale or home-based producers. Many lack proper carbonization and binding technologies, leading to inferior products with high ash content and low calorific value. Poor packaging causes moisture absorption and crumbling during transport. Absence of standardized labeling makes it hard for customers to compare quality. Importing nations require strict emission and chemical standards, which small producers fail to meet. Inconsistent quality reduces consumer trust and affects brand reputation. Standardization and certification are essential to support international trade and large-scale sales.

Regional Analysis

North America

North America holds 27% of the charcoal briquettes market. Strong demand comes from household grilling and outdoor cooking, supported by a well-established barbecue culture in the United States and Canada. Consumers prefer low-smoke, high-heat briquettes with uniform burning time, boosting sales of premium and natural products. Retail chains, hypermarkets, and online platforms expand brand visibility and distribution. Environment-friendly briquettes made from coconut shells and wood waste gain traction due to rising sustainability awareness. Commercial food outlets and catering services also increase consumption, while brand promotions and holiday-season sales further strengthen market growth across the region.

Europe

Europe accounts for 24% of global charcoal briquettes sales. The region shows strong adoption of eco-friendly briquettes, driven by strict emission norms and a preference for sustainable fuel sources. Countries such as Germany, the U.K., and France are key markets due to high outdoor cooking activities in summer and growing demand from restaurants and campgrounds. Manufacturers invest in low-ash, odor-free products that meet safety and environmental regulations. The rising popularity of outdoor leisure, tourism, and camping maintains steady consumption. Import of coconut-shell briquettes from Asia also supports market availability across European retail shelves.

Asia-Pacific

Asia-Pacific dominates the market with 36% share, driven by large production capacity and cost-efficient raw materials. Countries like Indonesia, China, and Vietnam are major exporters of coconut-shell briquettes, supplying both domestic and global markets. Growing household cooking needs, street-food vendors, and small commercial outlets increase usage. Affordable pricing, wide availability, and strong manufacturing networks strengthen regional leadership. Urban households prefer clean-burning briquettes over traditional wood charcoal due to lower smoke and faster ignition. International demand for Asian briquettes supports strong export revenue, making the region the largest manufacturing hub in the industry.

Latin America

Latin America represents 8% of the market. The region benefits from wide availability of biomass sources like coconut shells, sawdust, and wood waste. Outdoor cooking, tourism, and camping activities in Brazil, Mexico, and Argentina support market growth. Premium briquettes gain adoption among restaurants and grilling enthusiasts seeking longer burn times and consistent heat. Local producers focus on natural binding materials and reduced carbon emissions to align with sustainability trends. Export opportunities are rising, especially to the U.S. and Europe, creating new revenue streams for regional manufacturers.

Middle East & Africa

Middle East & Africa hold 5% of global share, led by demand from hospitality, tourism, and household cooking. Hotels, cafes, and catering services use briquettes for barbequing and grilling, particularly in Gulf countries. Africa has strong raw material availability, encouraging local briquette production from agricultural waste and wood residues. Rural households adopt briquettes as cleaner cooking fuel compared to traditional firewood. Awareness of low-smoke and long-burning briquettes is rising, while international partnerships help local producers scale exports. Market penetration remains moderate, but growth prospects are strong due to expanding tourism and rising urban consumption.

Market Segmentations:

By Type:

- Hardwood charcoal briquettes

- Softwood charcoal briquettes

By Material:

- Bamboo charcoal briquettes

- Coconut shell charcoal briquettes

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the charcoal briquettes market includes Ferrocycle, Ash Briquettes LTD, Namchar, Kingsford Products Company, Green Carb Technologies, Baccar Indo Resources, E & C, B&B Charcoal, Mitsui & Co, and Duraflame. The charcoal briquettes market features a mix of global manufacturers, regional producers, and emerging eco-friendly brands. Companies prioritize longer burn times, low ash content, and uniform heat distribution to meet consumer expectations in household and commercial cooking. Many players are shifting toward biomass-based and coconut-shell briquettes to reduce environmental impact and comply with sustainability standards. Strong distribution networks, including supermarkets, retail chains, and online platforms, help expand market reach. Producers also invest in advanced carbonization technologies and natural binders to enhance product quality. As consumer preference moves toward clean-burning and smoke-free fuels, the market becomes more innovation-driven, with branding and packaging strategies further shaping competition.

Key Player Analysis

- Ferrocycle

- Ash Briquettes LTD

- Namchar

- Kingsford Products Company

- Green Carb Technologies

- Baccar Indo Resources

- E & C

- B&B Charcoal

- Mitsui & Co

- Duraflame

Recent Developments

- In June 2025, U.S. EPA issued the proposed Renewable Fuel Standard Set 2 Rule, lifting 2026-2027 biomass-based diesel volumes and prioritizing domestic feedstocks.

- In August 2024, INVISTA completed an expansion of its nylon 6,6 polymer facility at the Shanghai Chemical Industry Park, effectively doubling its annual output to 400,000 metric tons.

- In May 2024, Nylon Corporation of America (NYCOA) launched NY-Clear, a next-generation amorphous 6I/6T nylon developed for packaging and precision-molded uses. This transparent material delivers outstanding clarity and enhanced barrier performance, offering up to 30% greater resistance to oxygen, carbon dioxide, and water vapor transmission than alternative materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for eco-friendly briquettes made from coconut shells, sawdust, and agricultural waste.

- Manufacturers will shift toward low-smoke and odor-free products to meet clean-fuel demand.

- Outdoor cooking, tourism, and commercial grilling will continue to support steady consumption.

- Companies will expand exports to Europe and North America due to strong barbecue culture.

- Advanced carbonization technologies will improve burn efficiency and reduce production emissions.

- E-commerce platforms will boost brand visibility and expand direct-to-consumer sales.

- Sustainability certifications will become key for market entry in regulated regions.

- Premium briquettes with longer burning time will gain preference in restaurants and catering.

- Partnerships between local producers and international distributors will strengthen supply chains.

- Growing urbanization in developing regions will increase household adoption of briquettes.