Market Overview

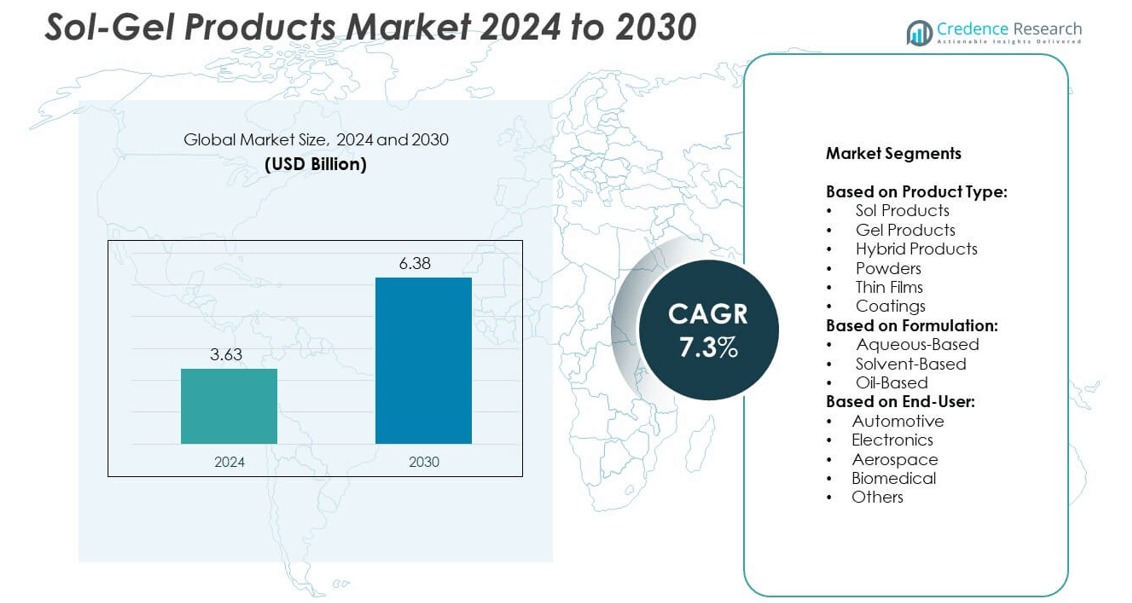

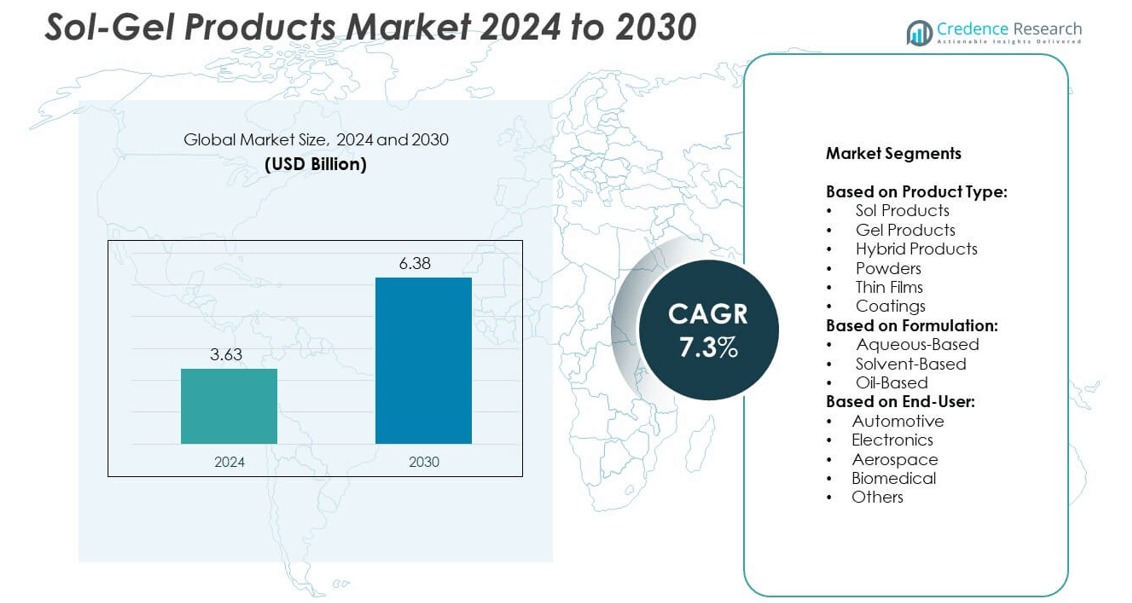

The Sol-Gel Products Market size was valued at USD 3.63 billion in 2024 and is projected to reach USD 6.38 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sol-Gel Products Market Size 2024 |

USD 3.63 billion |

| Sol-Gel Products Market, CAGR |

7.3% |

| Sol-Gel Products Market Size 2032 |

USD 6.38 billion |

The Sol-Gel Products market grows due to rising demand for high-performance coatings in automotive, aerospace, and electronics industries. Manufacturers adopt sol-gel solutions for corrosion protection, surface durability, and improved adhesion. The market benefits from expanding use in solar panels, smart glass, and energy-efficient construction projects. Growing preference for water-based, low-VOC formulations supports compliance with strict environmental regulations. Advances in nanotechnology and hybrid materials drive innovation, enabling multifunctional coatings that combine anti-corrosion, UV resistance, and enhanced mechanical strength for diverse applications.

North America leads the Sol-Gel Products market due to strong demand from automotive, aerospace, and electronics sectors. Europe follows with high adoption in sustainable construction and solar energy projects. Asia-Pacific shows fastest growth driven by semiconductor manufacturing and infrastructure development. Key players driving the market include PPG Industries, BASF SE, Dow, and Akzo Nobel N.V. These companies focus on R&D, advanced formulations, and eco-friendly coatings to meet rising global demand and support compliance with strict environmental regulations.

Market Insights

- The Sol-Gel Products market was valued at USD 3.63 billion in 2024 and is projected to reach USD 6.38 billion by 2032, growing at a CAGR of 7.3%.

- Rising demand from automotive, aerospace, and electronics industries drives adoption of sol-gel coatings for corrosion protection and durability.

- Integration of nanotechnology and development of hybrid materials enhance performance, creating multifunctional solutions with anti-corrosion, anti-scratch, and UV resistance properties.

- Leading players such as PPG Industries, BASF SE, Dow, Akzo Nobel N.V., and 3M focus on innovation, sustainability, and capacity expansion in growth regions.

- High production costs and complexity of sol-gel synthesis remain key restraints, limiting adoption in price-sensitive markets and small-scale manufacturers.

- North America leads demand with advanced manufacturing capacity, while Europe drives growth through stringent environmental regulations and focus on energy-efficient glass solutions.

- Asia-Pacific shows the fastest growth supported by electronics production, semiconductor fabs, solar energy installations, and rapid urban infrastructure development

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Performance Coatings in Automotive and Aerospace Industries

The Sol-Gel Products market benefits from growing use in automotive and aerospace coatings. These products deliver superior corrosion protection and enhanced adhesion for metal and composite surfaces. Manufacturers prefer sol-gel technology to replace heavy primer layers, helping reduce overall weight. It supports compliance with strict performance standards required in high-stress environments. OEMs adopt sol-gel coatings for paint durability and lower maintenance cycles. Expanding production of electric vehicles and rising air traffic fuel demand for advanced surface solutions.

- For instance, in a 2023 study, Macera et al. demonstrated that sol-gel silica coatings applied to aluminum produced by Selective Laser Melting (SLM) yielded a coating thickness of about 1-2 μm that improved corrosion resistance even on as-built (rough) surfaces.

Growing Adoption in Electronics and Semiconductor Applications

Electronics manufacturers use sol-gel products to improve surface hardness and scratch resistance on displays. It enables anti-reflective and conductive coatings essential for smartphones, tablets, and smart wearables. Semiconductor producers integrate sol-gel layers in wafer cleaning and protective processes. Demand rises with rapid miniaturization of chips and high-performance computing devices. The Sol-Gel Products market grows with the expansion of fabs in Asia-Pacific and the U.S. Suppliers align solutions with ISO and SEMI purity standards to meet industry requirements.

- For instance, research by Domínguez-Martínez et al. (2024) on AZ61 (magnesium-aluminum) alloy showed sol-gel coatings with organic corrosion inhibitors achieved thicknesses between 150 and 300 nm and retained strong transmission in visible light (~410 nm for the MB inhibitor sample).

Expanding Use in Glass, Solar, and Architectural Applications

The Sol-Gel Products market gains traction from increasing demand for functional glass solutions. Glassmakers apply sol-gel coatings to create self-cleaning, anti-fog, and anti-reflective surfaces. It improves light transmission and durability in solar panels, raising energy conversion efficiency. Construction projects integrate sol-gel treated glass for improved aesthetics and easier maintenance. Smart window adoption in commercial buildings drives further consumption. Growth of renewable energy installations and green building initiatives strengthens market uptake.

Focus on Sustainable and Environment-Friendly Product Development

The Sol-Gel Products market sees innovation in eco-friendly formulations that reduce VOC emissions. Manufacturers develop water-based sol-gel solutions to meet tightening global regulations. It supports lower environmental footprint and safer workplace conditions for applicators. Companies invest in nanotechnology-based hybrids to enhance durability and chemical resistance. Sustainable solutions appeal to industries aiming for greener supply chains and certifications. Rising regulatory pressure in Europe, North America, and Asia-Pacific accelerates adoption of compliant sol-gel products.

Market Trends

Integration of Nanotechnology to Enhance Functional Properties

The Sol-Gel Products market advances with integration of nanotechnology for improved performance. Nanostructured sol-gel coatings offer better hardness, thermal stability, and chemical resistance. It enables superior anti-corrosion and anti-scratch characteristics for critical components. Automotive and aerospace manufacturers use these solutions to extend product lifespan. Electronics companies adopt nanocomposite coatings to ensure reliable surface protection in compact devices. Growing investment in nanomaterial research supports the development of next-generation sol-gel formulations.

- For instance, A study published in Materials (April 2023) by Zhang, B. et al. details a highly transparent and zirconia-enhanced sol-gel hybrid coating on polycarbonate substrates. The study confirmed that the coatings, which were formed by dip-coating a mixture of zirconium dioxide (ZrO₂) sol and methyltriethoxysilane (MTES)-modified silica (SiO₂) sol-gel, exhibited high transparency. The average transmittance reached up to 93.9% (400–800 nm), and the peak transmittance was up to 95.1% at 700 nm.

Shift Toward Water-Based and Low-VOC Formulations

Environmental regulations drive a shift toward sustainable sol-gel solutions with lower emissions. The Sol-Gel Products market benefits from adoption of water-based coatings that reduce VOC levels. It aligns with green building certifications and workplace safety standards. Manufacturers focus on creating eco-friendly products to meet customer sustainability targets. Regulatory agencies in Europe and North America encourage compliance with stricter emission limits. Rising demand from industries seeking greener production processes fuels market growth.

- For instance, in nanoporous silica AR films on glass, Nielsen et al. evaluated abrasion resistance via image analysis; those films made from 5–6 wt % aqueous solutions had measurable areal loss of AR function after certain abrasion cycles, and the denser films showed significantly slower degradation.

Growing Use in Smart Glass and Functional Surface Applications

Smart glass applications create new opportunities for sol-gel technology suppliers. The Sol-Gel Products market gains from demand for self-cleaning, anti-reflective, and energy-efficient glass. It improves performance of windows used in commercial, residential, and automotive segments. Architects prefer sol-gel treated glass for modern facades and daylight optimization. Rising installation of solar control glazing in smart buildings boosts adoption. Expanding construction of energy-efficient infrastructure accelerates use of sol-gel coatings worldwide.

Increasing Collaboration Between Industry and Research Institutes

Collaboration between material science institutes and manufacturers drives innovation in sol-gel products. The Sol-Gel Products market benefits from joint R&D projects focusing on hybrid materials. It helps create multifunctional coatings for diverse industrial applications. Universities partner with companies to accelerate commercialization of advanced formulations. Government-funded research programs support the development of high-performance and sustainable solutions. Growing partnerships improve product scalability and shorten time to market for innovative technologies.

Market Challenges Analysis

High Production Cost and Complex Manufacturing Process

The Sol-Gel Products market faces challenges from high production costs and process complexity. Sol-gel synthesis requires controlled conditions and precise formulations, which raise operational expenses. It demands specialized equipment and skilled labor to maintain product consistency. Small and mid-sized manufacturers find it difficult to scale production economically. Variability in raw material quality impacts final product performance. High manufacturing costs limit adoption in price-sensitive industries, slowing market penetration in emerging regions.

Limited Awareness and Slow Rate of Commercialization

The Sol-Gel Products market struggles with limited awareness among end-users in traditional sectors. Many industries rely on conventional coatings due to familiarity and lower cost. It delays transition to advanced sol-gel solutions despite performance benefits. Commercialization of new formulations often takes years because of testing and certification requirements. Slow adoption in construction and automotive aftermarket restricts demand growth. Educating stakeholders about long-term cost savings and environmental benefits remains a major challenge.

Market Opportunities

Expansion into Renewable Energy and Green Construction Applications

The Sol-Gel Products market has strong growth potential in renewable energy and green building sectors. Sol-gel coatings enhance light transmission in solar panels, improving power output. It also supports anti-soiling properties, reducing cleaning frequency and maintenance costs. Green construction projects use sol-gel treated glass for energy-efficient windows and facades. Governments promote adoption through energy efficiency incentives and sustainable building standards. Rising investment in solar power installations and eco-friendly infrastructure increases demand for advanced sol-gel solutions.

Development of Multifunctional and Hybrid Formulations

The Sol-Gel Products market benefits from opportunities in multifunctional and hybrid materials. Manufacturers create coatings that combine anti-corrosion, anti-fog, and UV protection in a single layer. It reduces application time and lowers overall costs for end-users. Hybrid sol-gel formulations meet performance requirements of aerospace, electronics, and healthcare industries. Growing focus on miniaturized devices and precision components expands use in microelectronics. Investment in R&D accelerates commercialization of next-generation solutions with higher durability and sustainability benefits.

Market Segmentation Analysis:

By Product Type

The Sol-Gel Products market is segmented into sol products, gel products, hybrid products, powders, thin films, and coatings. Sol products hold a strong position due to their use in surface treatment and protective layers. Gel products gain demand in biomedical and catalytic applications for their tunable porosity. Hybrid products grow rapidly due to their ability to combine organic and inorganic properties, offering superior performance. It finds application in electronics, optics, and high-performance coatings. Thin films and coatings contribute significantly to demand from automotive and aerospace sectors where durability and corrosion resistance are critical. Powders are used for producing ceramic and glass materials with high thermal stability.

- For instance, 3M AC-130-2 sol-gel plus grit-blast achieved ASTM D3762 wedge-test durability comparable to PAA on aluminum; testing ran at 60 °C and 95–100% RH.”

By Formulation

The Sol-Gel Products market includes aqueous-based, solvent-based, and oil-based formulations. Aqueous-based formulations dominate due to low toxicity and compliance with environmental regulations. It is preferred for industrial and architectural coatings where safety and sustainability are priorities. Solvent-based formulations remain important for high-performance applications requiring superior adhesion and fast drying. Oil-based formulations cater to niche applications in specialty coatings and high-temperature environments. Growing demand for eco-friendly products supports research on waterborne formulations with enhanced durability. Manufacturers focus on optimizing formulation processes to balance cost and performance.

- For instance, Solvent-based,ORGANOSILICASOL™ IPA-ST provides 10–15 nm silica at 30–31 wt% SiO₂ in isopropanol”

By End-User

The Sol-Gel Products market serves automotive, electronics, aerospace, biomedical, and other industries. Automotive applications use sol-gel coatings for corrosion protection and improved paint adhesion. Electronics manufacturers rely on it for anti-reflective, conductive, and scratch-resistant coatings on displays. Aerospace companies adopt sol-gel technology for weight reduction and protection of metal surfaces. Biomedical applications include drug delivery, dental coatings, and bioactive glass production. Other end-users include energy, construction, and optics, where functional coatings and surface modification solutions are in demand. Growing adoption across multiple sectors drives consistent market expansion.

Segments:

Based on Product Type:

- Sol Products

- Gel Products

- Hybrid Products

- Powders

- Thin Films

- Coatings

Based on Formulation:

- Aqueous-Based

- Solvent-Based

- Oil-Based

Based on End-User:

- Automotive

- Electronics

- Aerospace

- Biomedical

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Sol-Gel Products market, making it one of the leading regions. The region benefits from strong demand in automotive, aerospace, and electronics manufacturing. It supports large-scale adoption of sol-gel coatings for corrosion resistance and weight reduction in critical components. The U.S. drives most of the regional demand with its well-established aerospace sector and rising investment in electric vehicles. It also benefits from technological collaborations between universities and private companies, which promote innovation in hybrid sol-gel materials. Canada contributes through growing construction projects that integrate energy-efficient glass solutions. Increasing regulatory focus on sustainability further accelerates the use of water-based and low-VOC sol-gel formulations.

Europe

Europe accounts for a market share of 28% and is a key hub for advanced manufacturing and research activities. The region is home to major automotive OEMs and aerospace companies that rely on sol-gel coatings for high-performance surface protection. It benefits from strict environmental standards that push industries toward sustainable solutions. Germany, France, and the UK lead adoption with strong focus on R&D and functional glass applications. It also sees growing integration of sol-gel solutions in solar panel manufacturing to support EU renewable energy targets. Renovation activities in commercial buildings and adoption of smart glass systems contribute to steady market growth. Manufacturers in Europe continue to invest in nanotechnology-based coatings for next-generation applications.

Asia-Pacific

Asia-Pacific holds a market share of 30%, making it the fastest-growing region in the Sol-Gel Products market. The region benefits from rapid industrialization and large-scale production facilities in China, Japan, South Korea, and India. It supports significant demand for sol-gel coatings in electronics manufacturing, where precision and purity are critical. Expanding solar energy projects and construction of smart cities in China and India further boost consumption. It also gains from strong government initiatives encouraging sustainable building materials and clean energy technologies. The presence of major semiconductor fabs drives use of sol-gel formulations in wafer protection and cleaning processes. Asia-Pacific remains a focal point for investment in cost-effective and high-volume sol-gel production.

Latin America

Latin America accounts for a market share of 6% and is gradually expanding its adoption of sol-gel products. The region experiences rising demand in construction, automotive assembly, and renewable energy projects. Brazil and Mexico drive growth with investments in modernizing infrastructure and energy-efficient solutions. It benefits from partnerships with international suppliers that bring advanced coatings technologies to local markets. Sol-gel products are increasingly used for protecting pipelines, industrial equipment, and architectural glass. Growth in the automotive aftermarket supports additional consumption of corrosion protection coatings. Regional adoption remains slower compared to major markets, but improving industrial capacity is expected to support steady growth.

Middle East & Africa

Middle East & Africa hold a combined market share of 4% in the Sol-Gel Products market. The region shows demand growth from infrastructure development, oil and gas, and renewable energy sectors. Gulf countries invest in smart city projects and solar farms, creating opportunities for sol-gel glass coatings. It benefits from rising construction of commercial complexes that incorporate energy-efficient glazing solutions. South Africa contributes with demand in mining equipment protection and industrial coatings. It also sees gradual adoption in healthcare applications, including biomedical coatings and dental materials. The market remains in early growth stages but presents potential for expansion as technology awareness improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PPG Industries, Inc.

- Premium Coatings and Chemicals Pvt Ltd.

- Sol-Gel Technologies Ltd.

- Mitsubishi Materials Corporation

- SOCOMORE

- Axalta Coating Systems

- CHEMAT TECHNOLOGY INC.

- Porcelain Industries

- GAEMA TECH Co., LTD.

- BASF SE

- Nanovations Pty Ltd.

- Dow

- CMR Coatings GmbH

- Akzo Nobel N.V.

- Fuji Silysia Chemical Ltd.

- 3M

- SCHOTT AG

- IK4-TEKNIKER

- Chase Corporation

Competitive Analysis

The competitive landscape of the Sol-Gel Products market features key players such as PPG Industries, Inc., Premium Coatings and Chemicals Pvt Ltd., Sol-Gel Technologies Ltd., Mitsubishi Materials Corporation, SOCOMORE, Axalta Coating Systems, CHEMAT TECHNOLOGY INC., Porcelain Industries, GAEMA TECH Co., LTD., BASF SE, Nanovations Pty Ltd., Dow, CMR Coatings GmbH, Akzo Nobel N.V., Fuji Silysia Chemical Ltd., 3M, SCHOTT AG, IK4-TEKNIKER, and Chase Corporation. These companies focus on developing advanced sol-gel formulations for diverse applications, including automotive coatings, electronics protection, and architectural glass treatments. Many players invest heavily in research and development to introduce water-based, low-VOC, and nanotechnology-enhanced solutions that meet sustainability regulations. Strategic collaborations with research institutes help accelerate innovation and reduce time-to-market for new products. Several companies expand production capacity in Asia-Pacific to meet growing demand from semiconductor, solar, and construction sectors. Mergers, acquisitions, and partnerships strengthen market presence and improve global distribution networks. Leading suppliers emphasize creating multifunctional coatings that combine anti-corrosion, anti-fog, and UV protection to offer value-added solutions. Competitive pricing, product performance, and compliance with environmental standards remain crucial factors influencing market share among these players.

Recent Developments

- In 2025, PPG launched Fusion Pro II, a ceramic-type sol-gel non-stick coating. It offers improved non-stick durability, hardened finish, and it omits intentionally added PFAS.

- In 2023, Sol-Gel Technologies reported it planned to start Phase 3 testing of SGT-610 (patidegib) for Gorlin syndrome in late 2023.

- In 2023, BASF entered a partnership with 3Helix Inc. to commercialize collagen-hybridizing peptide (CHP) technology for personal care. Launch of initial products set for 202

Report Coverage

The research report offers an in-depth analysis based on Product Type, Formulation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sol-Gel Products market will see steady growth driven by demand in automotive, aerospace, and electronics.

- Manufacturers will focus on water-based and low-VOC formulations to meet global sustainability goals.

- Hybrid and multifunctional sol-gel coatings will gain traction for combining multiple protective properties.

- Adoption in solar panels and smart glass applications will rise with renewable energy projects.

- R&D efforts will create nanotechnology-enhanced products with higher durability and performance.

- Electronics and semiconductor industries will remain major consumers due to miniaturization trends.

- Increased collaborations between research institutes and manufacturers will accelerate product commercialization.

- Emerging economies in Asia-Pacific will attract investments in high-volume sol-gel production facilities.

- Demand for self-cleaning, anti-reflective, and anti-fog coatings will grow in construction and transport.

- Regulatory pressure on emission reduction will encourage industries to transition to eco-friendly sol-gel solutions.