Market Overview:

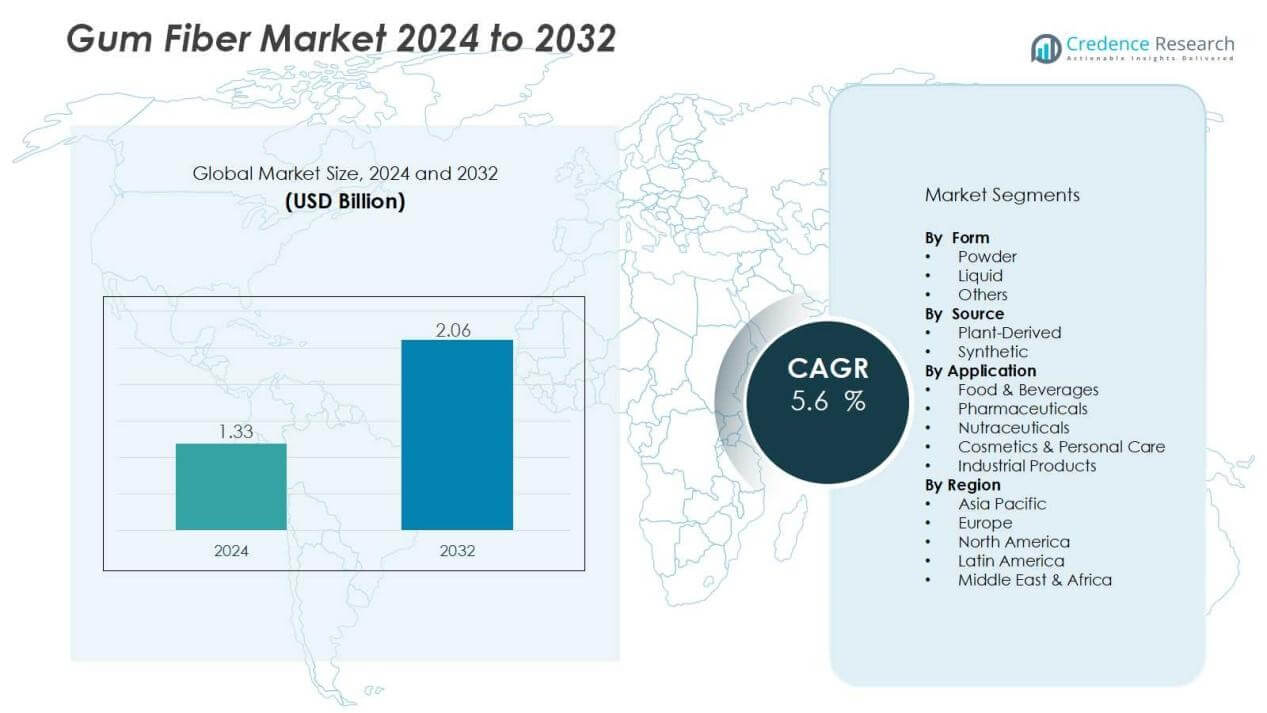

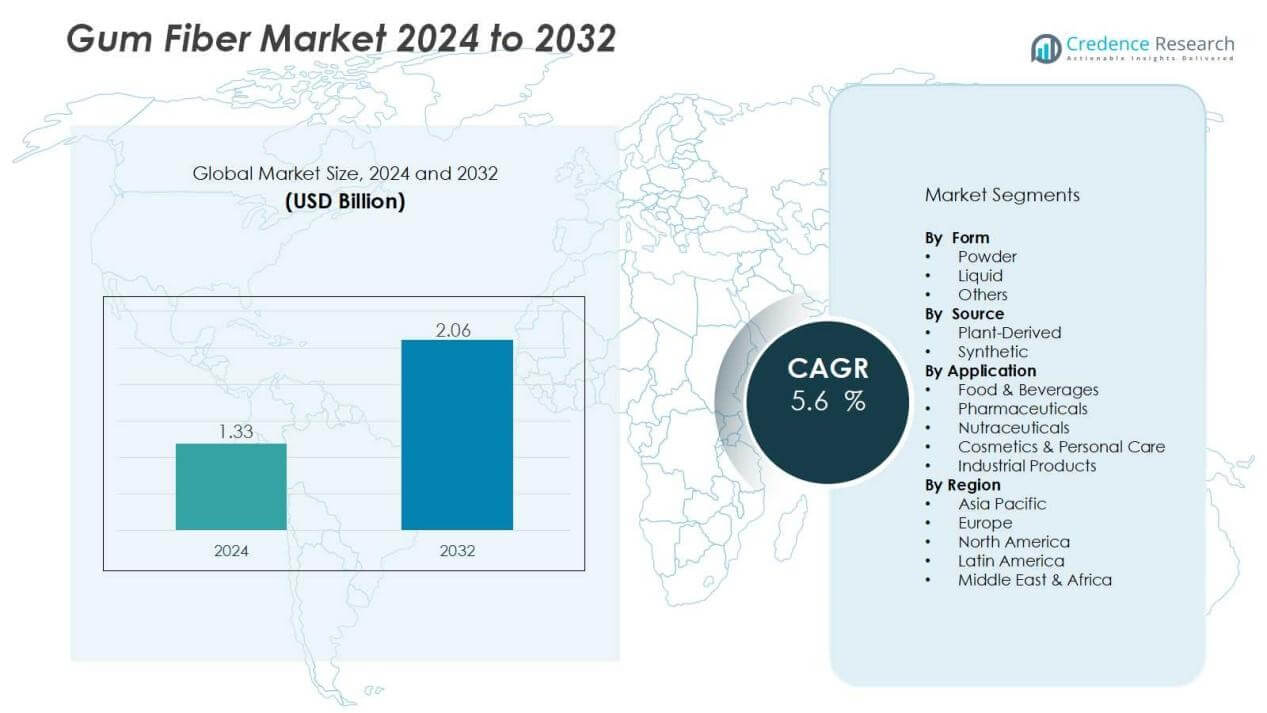

The gum fiber market size was valued at USD 1.33 billion in 2024 and is anticipated to reach USD 2.06 billion by 2032, at a CAGR of 5.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gum Fiber Market Size 2024 |

USD 1.33 Billion |

| Gum Fiber Market, CAGR |

5.6% |

| Gum Fiber Market Size 2032 |

USD 2.06 Billion |

Key drivers include the expanding use of gum fiber in bakery, dairy, and confectionery products for texture and stability. Its functional properties, such as water retention and fiber enrichment, support increasing adoption in dietary supplements and nutraceuticals. Rising consumer preference for natural thickeners over synthetic alternatives further accelerates market penetration. Additionally, growth in vegan and gluten-free food categories boosts demand for gum fiber in new product launches.

Regionally, North America holds a significant share due to strong demand from the food and beverage industry and well-established nutraceuticals markets. Europe follows closely, driven by strict regulations supporting clean-label and sustainable ingredients. Asia Pacific is expected to record the fastest growth, supported by rising processed food consumption in India, China, and Southeast Asia. Meanwhile, Latin America and the Middle East & Africa are emerging markets, supported by expanding food processing industries and increasing health awareness.

Market Insights:

- The gum fiber market was valued at USD 1.33 billion in 2024 and is projected to reach USD 2.06 billion by 2032, growing at a CAGR of 5.6%.

- Rising demand for natural and clean-label ingredients drives adoption as manufacturers reformulate products without artificial additives.

- Expanding applications in nutraceuticals and dietary supplements strengthen demand due to digestive health and prebiotic benefits.

- Growth in plant-based and gluten-free food categories supports gum fiber use in alternative meat, dairy, and baked goods.

- Pharmaceutical and cosmetic industries increasingly adopt gum fiber for its role as a binder, excipient, thickener, and stabilizer.

- Supply chain volatility and price fluctuations remain major challenges, influenced by climatic conditions and regional dependence.

- North America leads with 34% share, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and the Middle East & Africa account for 8% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Natural and Clean-Label Ingredients:

The gum fiber market benefits strongly from the consumer shift toward natural and clean-label ingredients. Food and beverage manufacturers are reformulating products to exclude artificial additives, creating opportunities for gum fiber as a natural stabilizer and emulsifier. It enhances texture, shelf stability, and consistency in bakery, dairy, and confectionery goods. Growing health awareness supports its acceptance as a functional dietary fiber.

- For instance, Ashland’s Aquasorb™ A-500 cellulose gum has shown exceptional water-binding capacity, improving bakery product yield and shelf life by enhancing moisture retention.

Expanding Applications in Nutraceuticals and Dietary Supplements:

Gum fiber has gained traction in nutraceuticals due to its digestive health and prebiotic properties. The gum fiber market sees rising adoption in fiber-enriched supplements and functional foods targeting gut health. It aligns with the growing demand for preventive healthcare solutions. Expanding product launches in probiotics and fiber supplements further strengthen its role in this segment.

- For instance, ISC Gums, in collaboration with Nexira and TIC Gums, supported a human study where 40 grams of acacia gum intake was linked to a reduction in self-reported 24-hour calorie intake to an average of 1,590 calories from 1,790 in the control group, indicating a satiety effect beneficial for dietary supplements with fiber claims.

Growth of Plant-Based and Gluten-Free Food Categories :

The growing popularity of plant-based and gluten-free diets supports new opportunities for gum fiber. It serves as a versatile additive that enhances structure and mouthfeel in vegan and gluten-free foods. The gum fiber market leverages this trend by supplying key ingredients for alternative meat, dairy substitutes, and baked goods. Rising demand from younger consumers with lifestyle-driven dietary choices amplifies its relevance.

Strong Presence in Pharmaceutical and Cosmetic Formulations :

Pharmaceutical companies use gum fiber as a binder, disintegrant, and controlled-release agent in tablets and capsules. The gum fiber market also expands into cosmetics, where it functions as a thickener and stabilizer in creams, lotions, and gels. It meets industry needs for natural and safe excipients. Increasing R&D investment in natural ingredient-based formulations ensures sustained demand from these industries.

Market Trends:

Integration of Gum Fiber in Functional and Specialty Foods

The gum fiber market is witnessing growing use in functional and specialty food categories, driven by rising consumer focus on digestive health, weight management, and preventive nutrition. It is being incorporated into fortified beverages, high-fiber snacks, and meal replacements to improve nutritional value and texture. Manufacturers are using gum fiber to meet demand for low-calorie, high-fiber formulations that align with health-conscious lifestyles. Clean-label trends also push companies to highlight gum fiber as a natural, plant-derived source of dietary fiber. The ingredient’s ability to act as both a stabilizer and a prebiotic positions it as a multifunctional solution. It supports innovation across bakery, dairy alternatives, and nutrition bars, making it integral to product differentiation in competitive markets.

- For instance, Alland & Robert demonstrated that acacia gum increased softness by 25% in white sandwich breads after 4 days of manufacturing and improved water retention, delivering a better sensory experience without compromising taste or color, highlighting the fiber’s direct impact on product quality.

Increasing Role of Sustainability and Technological Advancements:

Sustainability trends are shaping procurement and sourcing strategies within the gum fiber market, with producers focusing on ethical supply chains and reduced environmental footprints. Companies are investing in sustainable harvesting methods and certifications to meet regulatory and consumer expectations. It is also benefiting from advancements in processing technology that improve purity, functionality, and consistency of gum fiber across applications. The rise of digital tools in food formulation enables manufacturers to optimize gum fiber usage for specific product needs. Growing collaborations between ingredient suppliers and food manufacturers highlight its expanding versatility. This trend ensures gum fiber remains central to product innovation, regulatory compliance, and sustainability commitments across industries.

- For instance, Nexira controls sustainable acacia gum harvesting from wild trees over large areas in the Sahel region, managing the product flow from over 4 million trees that support local communities and ensure ecological balance. Companies are investing in sustainable harvesting methods and certifications to meet regulatory and consumer expectations.

Market Challenges Analysis:

Supply Chain Volatility and Price Fluctuations :

The gum fiber market faces challenges from unstable raw material supply and fluctuating prices. Production often depends on climatic conditions and regional harvesting practices, which create risks of inconsistency. It struggles when poor crop yields or logistical disruptions limit availability. Price volatility impacts manufacturers and end-users, forcing companies to balance costs while maintaining quality standards. Dependence on specific producing regions heightens exposure to geopolitical and trade-related risks. This instability can slow long-term investments and affect growth strategies in both food and non-food sectors.

Competition from Synthetic and Alternative Ingredients:

The gum fiber market also encounters strong competition from synthetic stabilizers and alternative natural fibers. It must compete on cost-effectiveness, performance, and scalability in industries where price sensitivity is high. Synthetic additives often offer more predictable functionality, making them attractive for large-scale manufacturers. Alternative plant-based fibers are emerging as substitutes, intensifying competitive pressures. Regulatory differences across regions also create hurdles for global standardization and adoption. Market players are challenged to differentiate gum fiber through innovation, sustainability claims, and health-related benefits to secure their position.

Market Opportunities:

Expanding Role in Functional Nutrition and Health-Oriented Products:

The gum fiber market presents strong opportunities in functional nutrition and health-focused foods. Rising consumer demand for digestive wellness, weight management, and fiber enrichment is pushing manufacturers to expand product portfolios. It is increasingly used in dietary supplements, fortified beverages, and fiber-rich snacks, aligning with preventive healthcare trends. Growth in the probiotic and prebiotic space creates further scope for gum fiber as a synergistic ingredient. Clean-label and natural claims amplify its value in attracting health-conscious consumers. This opportunity positions gum fiber as a versatile component in next-generation food and beverage innovations.

Growing Adoption in Emerging Economies and Industrial Applications:

The gum fiber market also benefits from rapid expansion in emerging economies with rising disposable incomes and urbanization. It supports the growing demand for processed foods, bakery items, and convenience nutrition in Asia Pacific, Latin America, and Africa. Pharmaceutical and cosmetic applications provide additional growth avenues through natural excipients and stabilizers. Increasing investment in sustainable sourcing enhances its appeal among global buyers. Manufacturers that expand distribution and build partnerships in high-growth regions can capture significant market share. These dynamics underline the market’s potential to diversify across both consumer-driven and industrial segments.

Market Segmentation Analysis:

By Source:

The gum fiber market is segmented by source into plant-derived and synthetic categories. Plant-derived gum fiber dominates due to strong consumer preference for natural and clean-label ingredients. It finds wide application in food, pharmaceuticals, and cosmetics where sustainability and health benefits are prioritized. Synthetic sources maintain niche adoption in industrial uses where cost and consistency matter. It continues to benefit from expanding natural product launches across global markets.

- For Instance, India is the world’s largest producer of guar gum, supplying approximately 80% of the global output. Annual production figures vary, with recent reports estimating India’s guar seed crop at roughly 850,000 tons per year.

By Application:

The gum fiber market includes applications in food and beverages, pharmaceuticals, nutraceuticals, cosmetics, and industrial products. Food and beverages lead, driven by demand for texture, stability, and fiber enrichment in bakery, dairy, and confectionery items. Pharmaceuticals use gum fiber as a binder and release agent, while nutraceuticals adopt it for prebiotic benefits. Cosmetics incorporate it as a thickener in lotions and gels. Industrial sectors apply it in adhesives and coatings, broadening its scope.

- For Instance, Promitor Soluble Corn Fiber (SCF) has been shown in human gut microbiome studies to increase bifidobacteria counts over a 14-day intake period.

By Form:

The gum fiber market is classified by form into powder, liquid, and others. Powder form holds the largest share due to its ease of blending, storage, and consistent functionality in formulations. Liquid gum fiber is gaining demand in ready-to-drink beverages and liquid supplements. It offers better solubility and uniform distribution in liquid applications. Manufacturers continue to innovate with customized forms to meet diverse processing requirements.

Segmentations:

By Source

By Application

- Food & Beverages

- Pharmaceuticals

- Nutraceuticals

- Cosmetics & Personal Care

- Industrial Products

By Form

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America accounted for 34% share of the gum fiber market in 2024, while Europe held 28%. Both regions benefit from established food processing industries and strict regulatory frameworks supporting clean-label products. It is widely adopted in bakery, dairy, and functional beverages where consumers demand natural stabilizers. Growth is reinforced by advanced nutraceutical and dietary supplement sectors. Pharmaceutical companies in these regions also integrate gum fiber as a natural excipient in tablets and capsules. Strong distribution networks and R&D collaborations ensure continued dominance.

Asia Pacific

Asia Pacific contributed 25% share of the gum fiber market in 2024, with China and India leading growth. Rising disposable incomes, urbanization, and increasing demand for processed foods drive strong adoption. It is increasingly used in bakery, confectionery, and dairy alternatives that appeal to young urban populations. Nutraceuticals and health supplements provide additional momentum with expanding awareness of digestive wellness. Regional manufacturers are investing in affordable product offerings to capture a diverse consumer base. Government support for food innovation and industrial applications strengthens long-term opportunities.

Latin America and Middle East & Africa:

Latin America accounted for 8% share of the gum fiber market in 2024, while the Middle East & Africa represented 5%. Both regions are experiencing steady demand growth through expanding food and beverage industries. It is gaining traction in bakery, confectionery, and dietary supplements as consumer health awareness rises. Pharmaceutical and cosmetic applications further support adoption, particularly in urban centers. Limited local production creates import reliance, but international players are building presence through partnerships. Expanding infrastructure and rising middle-class consumption patterns make these markets increasingly attractive for future investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nexira

- Ingredion

- Kerry Group plc

- Agrigum International Limited

- ADM

- Ashland

- Hawkins Watts Limited

- Farbest Brands

- Gum Arabic Company

Competitive Analysis:

The gum fiber market is characterized by strong competition among global and regional players. Key participants include Nexira, Ingredion, Kerry Group plc, and Agrigum International Limited, each holding significant presence across food, pharmaceutical, and cosmetic applications. It is driven by innovation, with companies focusing on clean-label solutions, functional benefits, and sustainable sourcing practices. Players emphasize R&D investments to enhance product performance in dietary supplements, beverages, and plant-based foods. Strategic partnerships and acquisitions remain central to expanding distribution networks and entering high-growth emerging markets. Companies also prioritize certifications and traceable supply chains to strengthen brand credibility and meet regulatory standards. The market reflects a balance of established multinationals and specialized suppliers competing on product differentiation and application expertise.

Recent Developments:

- In April 2025, Nexira launched the GLP-1 Collection, featuring Carolean™, a patent-pending ingredient supporting appetite control and healthy weight management, unveiled at Vitafoods Europe.

- In May 2025, Ingredion and Amyris announced the winding down of their RealSweet joint venture, with Amyris taking full ownership of the precision fermentation plant in Brazil and Ingredion gaining exclusive access to fermented Reb M technology.

Report Coverage:

The research report offers an in-depth analysis based on Source, Application, Form and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The gum fiber market will see wider adoption in functional foods and nutraceuticals focused on digestive health.

- It will benefit from rising demand for clean-label and natural ingredients in global food formulations.

- Expansion in gluten-free and plant-based products will increase gum fiber’s role as a stabilizer.

- Technological advancements in processing will enhance product quality, purity, and functional performance.

- Pharmaceutical companies will continue to integrate gum fiber as a natural excipient in oral drugs.

- Cosmetic and personal care brands will adopt gum fiber in formulations requiring natural thickeners.

- Emerging economies in Asia Pacific, Latin America, and Africa will drive strong consumption growth.

- Sustainability initiatives and ethical sourcing practices will shape long-term procurement strategies.

- Collaborations between ingredient suppliers and food manufacturers will create opportunities for product innovation.

- Health-conscious consumer behavior will sustain steady demand for gum fiber across diverse industries.