Market Overview:

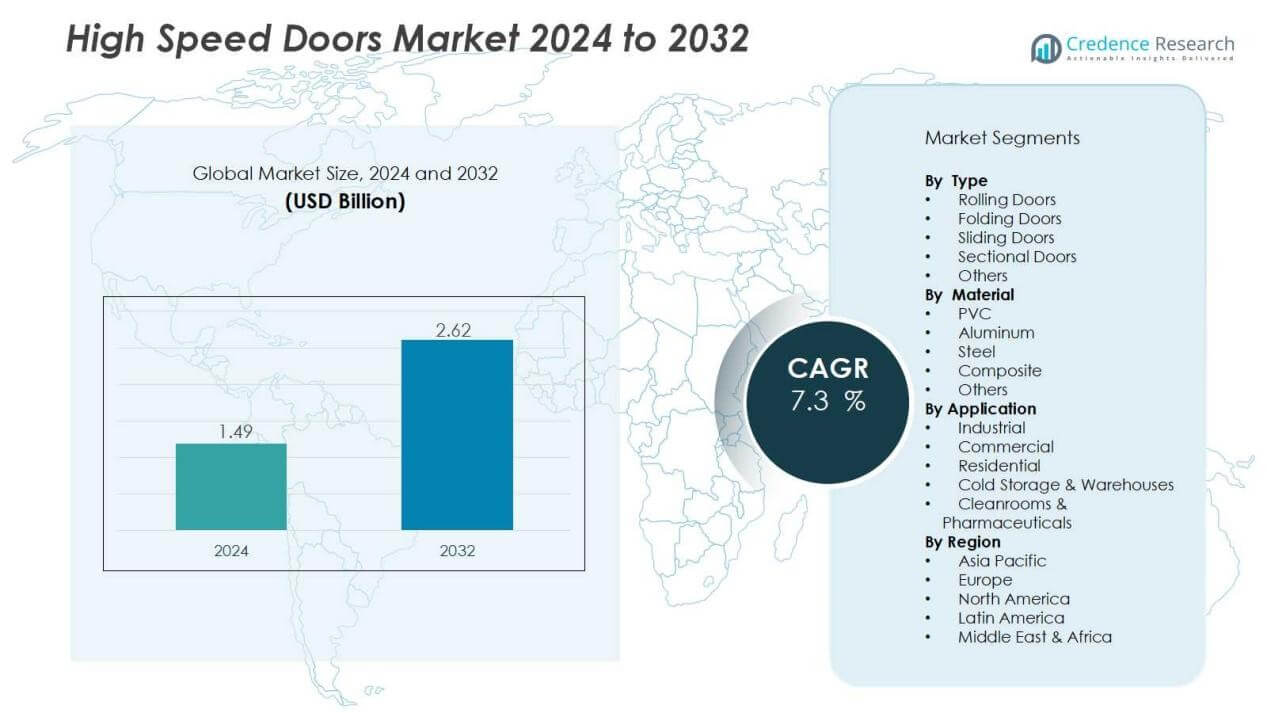

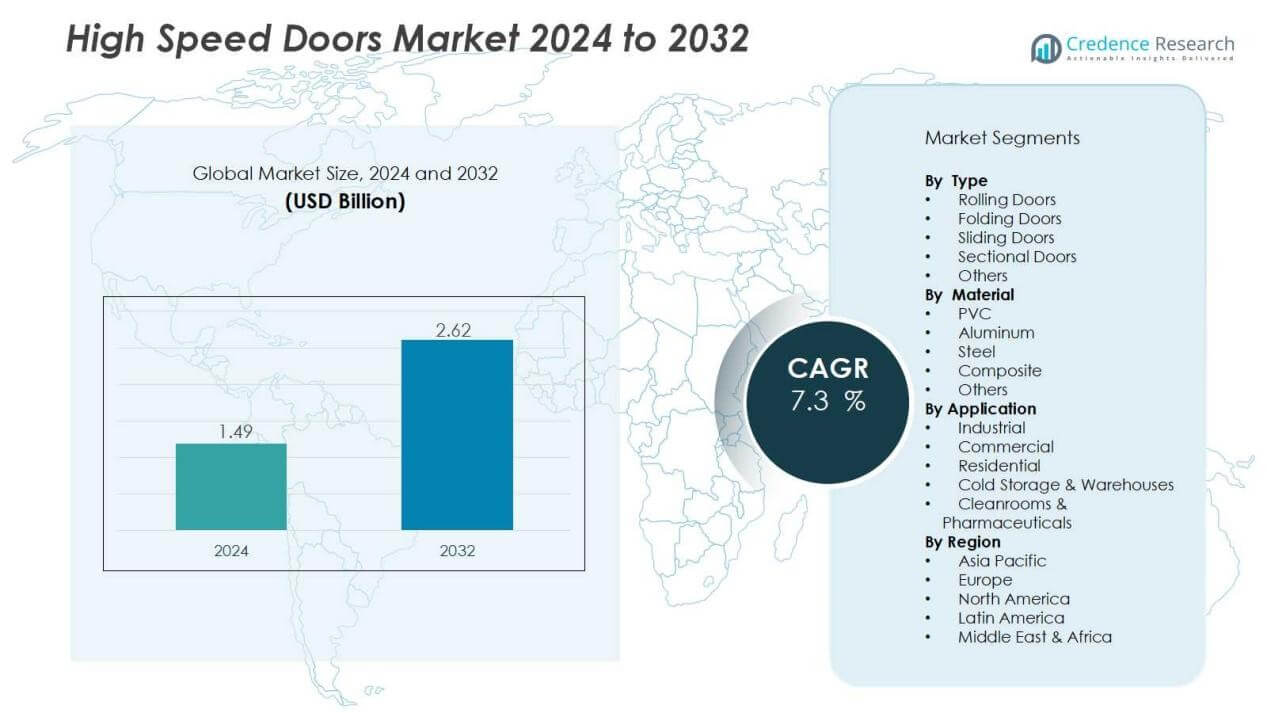

The high speed doors market size was valued at USD 1.49 billion in 2024 and is anticipated to reach USD 2.62 billion by 2032, at a CAGR of 7.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Speed Doors Market Size 2024 |

USD 1.49 Billion |

| High Speed Doors Market, CAGR |

7.3% |

| High Speed Doors Market Size 2032 |

USD 2.62 Billion |

Key growth drivers include the rising need for controlled environments in manufacturing, pharmaceuticals, and food processing. High speed doors help reduce contamination risks, improve safety, and minimize energy loss, making them essential in logistics hubs and warehouses. Growing automation, increasing safety regulations, and the need for rapid material handling in high-traffic facilities further strengthen demand.

Regionally, Europe leads the market due to strong manufacturing and logistics sectors, coupled with strict safety standards. North America follows closely, supported by advanced warehousing infrastructure and demand for efficient operations. The Asia-Pacific region is expected to record the fastest growth, driven by rapid industrialization, urban expansion, and rising investment in smart manufacturing facilities in countries such as China and India. Together, these factors highlight the global momentum of the high speed doors market.

Market Insights:

- The high speed doors market size reached USD 1.49 billion in 2024 and is projected to hit USD 2.62 billion by 2032, reflecting strong demand growth.

- Energy efficiency remains a key driver, with high speed doors helping reduce heat loss, cut energy bills, and support sustainability goals.

- Manufacturing, food, and pharmaceutical industries dominate adoption, using high speed doors to maintain hygiene, safety, and regulatory compliance.

- Expanding logistics, warehousing, and e-commerce sectors push demand, with fast door cycles improving traffic flow and productivity.

- Technological advancements, including IoT integration, sensors, and automated access systems, are transforming product functionality and safety features.

- Challenges include high initial costs, complex installation needs, and recurring maintenance, which limit adoption in cost-sensitive regions.

- Regionally, Europe leads with 37% market share, North America holds 29%, and Asia Pacific, at 24%, records the fastest growth through industrialization and smart city projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy Efficiency and Cost Savings:

The high speed doors market is driven by the growing focus on energy efficiency. These doors minimize heat loss, reduce energy bills, and maintain stable indoor climates. Warehouses, cold storage facilities, and cleanrooms rely on them to improve operational savings. It supports sustainability targets while offering faster returns on investment for facility owners.

- For instance, ASSA ABLOY’s high-speed doors open and close within seconds, reducing air exchange and maintaining optimal internal temperatures, which contributes to minimized energy costs and improved productivity, with doors operating at speeds of up to 8 feet per second.

Growing Adoption in Manufacturing, Food, and Pharmaceutical Industries:

Industries with strict hygiene and safety standards are major adopters of high speed doors. The high speed doors market benefits from their ability to reduce contamination and improve workflow. Food processing units and pharmaceutical plants use them to comply with global regulatory frameworks. It ensures smooth material handling while limiting risks from dust, pests, and external pollutants.

- For instance, Maviflex high-speed doors used in food processing facilities open and close at speeds up to 2.0 meters per second, effectively reducing air exchange and contamination risks during high traffic operations.

Expansion of Logistics, Warehousing, and E-Commerce Sectors:

Rapid growth in global logistics and e-commerce increases the need for efficient facility operations. The high speed doors market gains momentum from rising warehouse construction and automation. Fast door cycles enable higher traffic flow, improve productivity, and reduce downtime. It supports seamless movement of goods, which is critical for time-sensitive supply chains.

Technological Advancements and Integration with Smart Systems:

New product innovations strengthen the adoption of high speed doors worldwide. The high speed doors market benefits from sensors, IoT integration, and automated access control systems. These features enhance safety, extend product life, and improve user convenience. It positions high speed doors as advanced solutions for modern industrial and commercial facilities.

Market Trends:

Market Trends:

Integration of Smart Technologies and Advanced Automation

The high speed doors market is witnessing strong adoption of smart technologies. Modern models now integrate sensors, IoT platforms, and automated access controls to improve efficiency and safety. Companies focus on predictive maintenance features that reduce downtime and extend service life. Demand for touchless and remote-controlled systems has grown due to heightened awareness of hygiene and operational convenience. It also reflects the rising trend of digitalization in industrial and commercial infrastructure. Manufacturers invest in R&D to develop products that align with Industry 4.0 standards and support smart facility management systems.

- For instance, Rytec’s Spiral® high-speed doors equipped with Rytec Connect® have completed over 1,000,000 operating cycles before requiring major maintenance—ensuring virtually uninterrupted performance and extended service life.

Focus on Sustainability, Durability, and Industry-Specific Customization

The high speed doors market is influenced by the shift toward eco-friendly and durable solutions. Energy-saving designs and recyclable materials are gaining preference among industrial buyers. Industries such as pharmaceuticals, food processing, and logistics increasingly demand customized doors tailored to sector-specific requirements. It supports regulatory compliance while enhancing facility performance in high-traffic environments. Growing interest in long-life materials and insulated doors further highlights the importance of sustainability. Manufacturers now compete by offering tailored solutions that combine environmental responsibility with operational efficiency.

- For instance, Nergeco’s high-speed flexible door for standard logistics utilizes a multi-composite frame that is more corrosion-resistant than 316L stainless steel, offering enhanced durability while reducing energy consumption between areas with different environments through rapid closing mechanisms.

Market Challenges Analysis:

High Initial Costs and Complex Installation Requirements:

The high speed doors market faces hurdles due to high upfront investment and installation challenges. These doors require advanced components, precision engineering, and skilled labor for setup, which increases costs. Small and medium enterprises often hesitate to adopt them due to budget constraints. It limits penetration in price-sensitive markets, especially in developing economies. Complex installation also demands ongoing maintenance, raising total cost of ownership. This factor creates a barrier for wider adoption across industries with limited resources.

Maintenance Demands and Limited Awareness in Emerging Regions:

The high speed doors market also struggles with recurring maintenance needs and limited product awareness. High usage in industrial environments leads to wear and tear, requiring timely servicing. Companies in emerging regions often lack access to proper service networks, affecting product performance. It reduces customer confidence and slows replacement demand. Lack of awareness about long-term benefits further restricts adoption. Stronger education, aftersales support, and cost-effective models are needed to address these challenges.

Market Opportunities:

Rising Demand from Expanding Industrial and Commercial Infrastructure:

The high speed doors market presents significant opportunities due to rapid industrialization and urban growth. Expanding warehousing, logistics hubs, and manufacturing facilities create strong demand for efficient door solutions. Food and pharmaceutical industries seek contamination control, while retail and automotive sectors require faster operations. It aligns with the growing need for safety, energy savings, and productivity improvements. Increasing government investments in smart cities and industrial corridors further boost adoption. Companies that provide durable and sector-specific solutions stand to gain a competitive edge.

Innovation in Sustainable and Technology-Driven Door Systems:

The high speed doors market benefits from rising interest in sustainable and smart technologies. Energy-efficient, insulated, and recyclable door designs are gaining traction among environmentally conscious buyers. Integration with IoT platforms, automation systems, and predictive maintenance features creates growth opportunities. It supports facility managers in reducing downtime, lowering costs, and enhancing operational safety. Demand for customized products across cold storage, healthcare, and logistics strengthens this trend. Manufacturers focusing on eco-friendly innovation and digital integration can expand their market presence.

Market Segmentation Analysis:

By Type:

The high speed doors market is segmented into rolling doors, folding doors, sliding doors, and others. Rolling doors hold the largest demand due to their suitability for warehouses, logistics hubs, and cold storage units. Folding and sliding doors are widely adopted in commercial spaces, automotive facilities, and cleanrooms where space optimization and frequent access are essential. It benefits from rising adoption of sectional and hybrid door models that combine durability with faster operation. Demand for advanced door types will expand as industries prioritize efficiency and safety.

- For instance, the Wayne Dalton FireStar® Rolling Fire Door Model 700C, widely used in warehouses, is tested for a minimum of 20,000 reliable operation cycles, underscoring its durability and fast operation essential for high-traffic industrial facilities.

By Material:

Materials used in high speed doors include PVC, aluminum, steel, and composites. PVC dominates due to its lightweight structure, cost-effectiveness, and suitability for environments requiring frequent operation. Aluminum and steel segments grow steadily with rising demand for durability, insulation, and security features. It reflects the increasing preference for hybrid material doors that combine strength with energy efficiency. Composite materials are gaining traction in sectors emphasizing long lifecycle and sustainability.

- For instance, ASSA ABLOY’s HS9120GHY high-speed door uses a 900 g/m² PVC curtain and has been certified for 1,000,000 opening-and-closing cycles in performance testing.

By Application:

Applications of high speed doors cover industrial, commercial, and residential sectors. Industrial facilities account for the largest share due to their critical need for efficiency, safety, and contamination control. Commercial buildings, retail outlets, and healthcare centers are adopting these doors for better access control and operational convenience. It also finds growing use in residential complexes for garages and high-end properties. Expanding logistics and pharmaceutical sectors continue to create strong demand for application-specific solutions.

Segmentations:

By Type

- Rolling Doors

- Folding Doors

- Sliding Doors

- Sectional Doors

- Others

By Material

- PVC

- Aluminum

- Steel

- Composite

- Others

By Application

- Industrial

- Commercial

- Residential

- Cold Storage & Warehouses

- Cleanrooms & Pharmaceuticals

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Europe:

Europe held 37% market share in 2024, leading the global high speed doors market. Strong logistics networks, advanced manufacturing, and strict energy efficiency regulations drive adoption across the region. Countries such as Germany, France, and the U.K. focus on high-performance infrastructure that demands reliable door systems. It benefits from mature supply chains and a strong presence of established manufacturers. Demand in automotive, pharmaceuticals, and food processing industries reinforces market leadership. Growth is also supported by government initiatives aimed at reducing energy consumption in industrial facilities.

North America:

North America accounted for 29% market share in 2024, securing its position as the second-largest market. The region benefits from advanced warehousing, widespread automation, and investments in cold storage infrastructure. The U.S. dominates demand with strong e-commerce growth and industrial upgrades, while Canada shows steady expansion in logistics and retail. It also gains momentum from stricter workplace safety standards and demand for operational efficiency. High adoption in pharmaceuticals and food supply chains further supports revenue growth. Regional players focus on integrating IoT-enabled solutions to enhance competitiveness.

Asia Pacific:

Asia Pacific captured 24% market share in 2024 and is projected to grow at the fastest rate. Rapid industrialization in China, India, and Southeast Asia drives large-scale adoption of high speed doors. The high speed doors market in this region benefits from expanding e-commerce, growing food production, and infrastructure investments. It is further supported by government-backed industrial corridors and smart city projects. Rising demand for contamination control in pharmaceuticals and food processing strengthens opportunities. Local and global manufacturers invest heavily to meet the region’s rising demand and cost-sensitive customer base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Angel Mir

- ASSA ABLOY

- Chase Doors

- ASI

- Dortek

- Hart Doors

- Hormann

- Efaflex

- Jdoor

- Rite-Hite

- Tosh Automation

- Rytec

- PerforMax

- TNR

Competitive Analysis:

The high speed doors market is highly competitive with global and regional players focusing on innovation, customization, and service expansion. Key companies include Angel Mir, ASSA ABLOY, Chase Doors, ASI, Dortek, Hart Doors, Hormann, Efaflex, Jdoor, Rite-Hite, Tosh Automation, and Rytec. It is shaped by strong investments in automation, energy-efficient solutions, and smart integration technologies that enhance safety and reduce downtime.Leading manufacturers differentiate through durability, advanced materials, and compliance with international safety standards. Many players emphasize aftersales services and predictive maintenance to strengthen customer loyalty. It also benefits from growing partnerships between door manufacturers and automation system providers, which enhance value-added offerings. Competition remains intense in emerging markets where cost-sensitive buyers demand balance between affordability and quality. Global brands focus on expanding distribution networks, while local companies leverage regional expertise and pricing flexibility to sustain their market positions.

Recent Developments:

- In January 2025, ASSA ABLOY acquired InVue, a US-based provider of connected asset protection and access control solutions, enhancing their global security solutions portfolio.

- In December 2024, Chase Doors launched the ColdGuard GEN II Sliding Door, featuring faster panel speeds and enhanced durability, designed especially for cold storage environments.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and Region . It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high speed doors market will witness stronger adoption across logistics hubs to support faster goods movement.

- It will gain momentum from rising demand for contamination-free environments in pharmaceuticals and food processing.

- Technological advancements will drive integration of IoT, sensors, and automated access systems in new installations.

- Energy-efficient and insulated door solutions will become standard choices across cold storage and warehouses.

- Manufacturers will expand customization to meet sector-specific requirements in automotive, healthcare, and retail industries.

- It will experience growing opportunities in Asia Pacific, fueled by industrialization and infrastructure development.

- Sustainability will play a larger role, with recyclable materials and eco-friendly designs gaining traction.

- Service-based models offering maintenance and predictive monitoring will strengthen customer relationships and adoption rates.

- Global players will pursue strategic partnerships and acquisitions to expand reach in emerging markets.

- It will continue evolving into a technology-driven segment, aligned with smart factory and smart city initiatives.

Market Trends:

Market Trends: