Market Overview

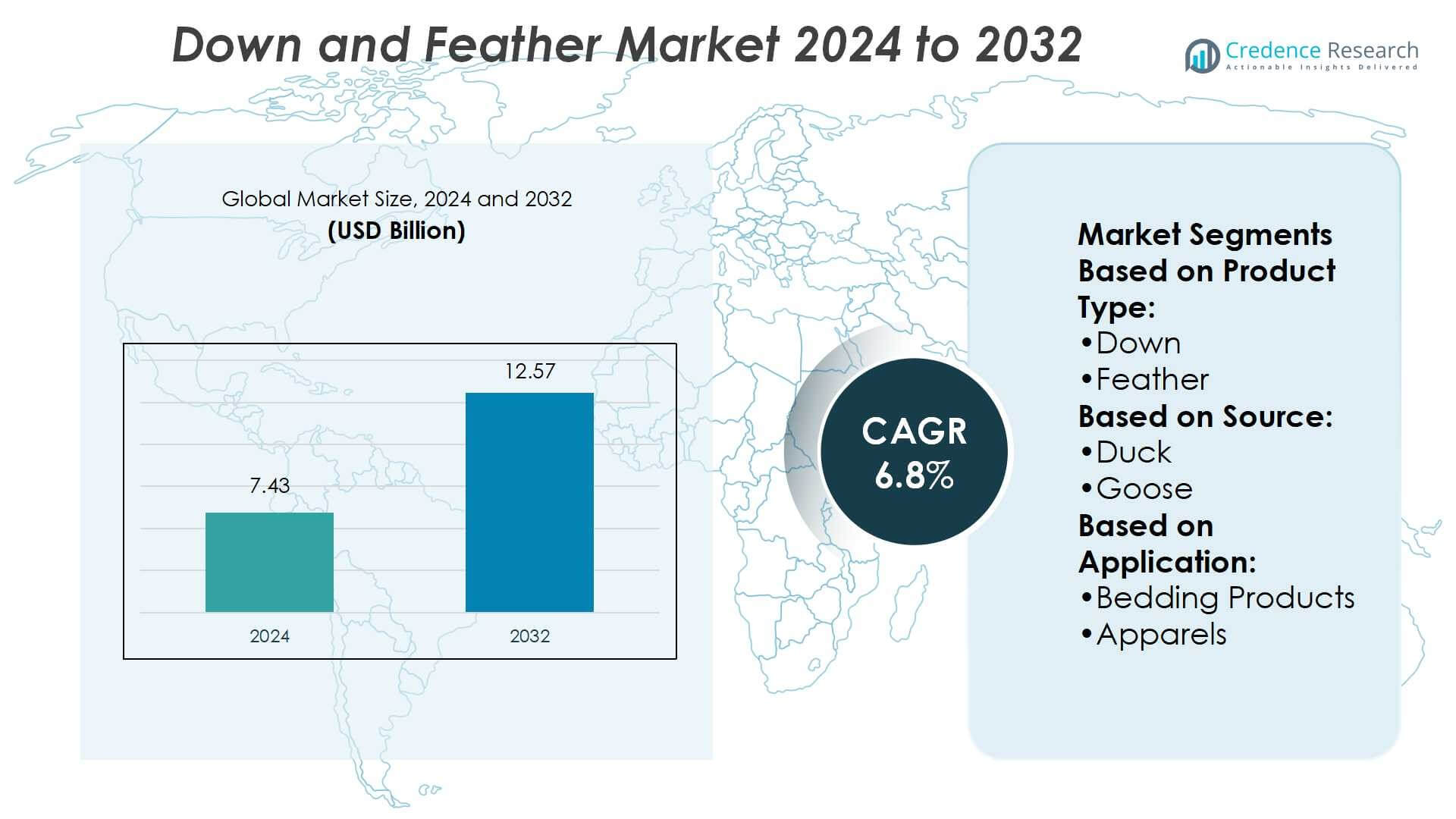

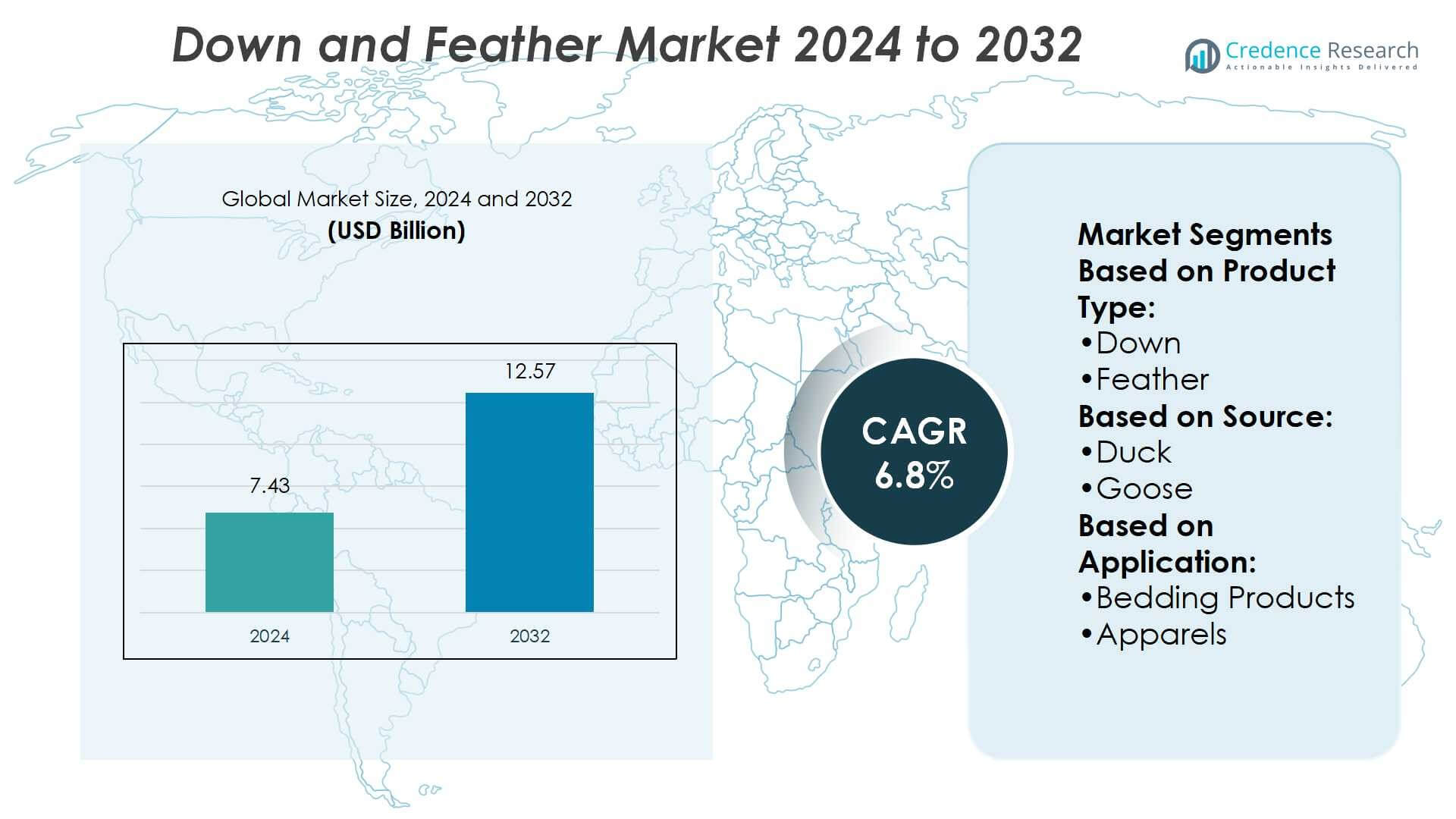

Down and Feather Market size was valued at USD 7.43 billion in 2024 and is anticipated to reach USD 12.57 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Down and Feather Market Size 2024 |

USD 7.43 Billion |

| Down and Feather Market, CAGR |

6.8% |

| Down and Feather Market Size 2032 |

USD 12.57 Billion |

The Down and Feather Market is driven by rising demand for premium bedding, luxury hospitality, and high-performance outdoor apparel that values comfort and insulation. Growing consumer focus on sleep wellness and sustainable living supports adoption of natural fillings over synthetic alternatives. Ethical sourcing and certifications such as the Responsible Down Standard strengthen trust and market appeal. Trends highlight innovation in lightweight, moisture-resistant products, recycling practices, and blending techniques that enhance durability and functionality. Expanding e-commerce platforms and lifestyle upgrades in emerging economies further accelerate demand, while global brands emphasize transparency and eco-friendly positioning to stay competitive.

North America leads the Down and Feather Market with strong demand in bedding and outdoor apparel, while Europe follows with emphasis on sustainability and premium products. Asia-Pacific grows rapidly as China dominates production and exports, supported by rising incomes in emerging economies. Latin America and the Middle East & Africa show moderate but steady expansion driven by hospitality and lifestyle upgrades. Key players include Shamokin Carbons, Tianjin Yunhai Carbon Element Products Co., Ltd., Mitsubishi Chemical, Bilbaína de Alquitranes S.A, DONGSUNG CORPORATION, SUMMIT CRM Limited, Ukrgraphit, Rain Carbon Inc., Sojitz JECT Corporation, and ASBURY CARBONS.

Market Insights

- The Down and Feather Market was valued at USD 7.43 billion in 2024 and is projected to reach USD 12.57 billion by 2032, growing at a CAGR of 6.8%.

- Rising demand for premium bedding, luxury hospitality, and outdoor apparel continues to drive market growth.

- Ethical sourcing and certifications such as Responsible Down Standard are shaping consumer trust and product preference.

- Innovation in lightweight, moisture-resistant, and blended materials enhances durability and broadens applications.

- Competition remains strong as global and regional players focus on sustainability, branding, and digital presence.

- Price volatility, synthetic alternatives, and compliance costs present restraints that challenge consistent profitability.

- North America leads, Europe follows with sustainability focus, Asia-Pacific expands rapidly with China as a hub, while Latin America and Middle East & Africa grow steadily through hospitality and lifestyle upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Bedding and Home Furnishing Applications

The growth of the Down and Feather Market is strongly supported by demand for premium bedding products. Consumers prefer down and feather fillings for duvets, pillows, and comforters due to their superior insulation and comfort. It provides lightweight warmth, making it attractive for both luxury and mass-market households. Hotels and hospitality operators also drive purchases by adopting high-quality feather-filled products to enhance guest experiences. Rising urbanization and improving living standards further contribute to adoption in the home furnishings segment. It continues to be a key driver of consistent revenue growth.

- For instance, Shamokin Carbons’ new facility in Mexico processes amorphous graphite with annual production capacity over 30,000 metric tons per year for precision-sized material.

Expanding Role in Outdoor Apparel and Performance Clothing

The increasing popularity of outdoor and sports apparel boosts the use of down and feather insulation. Jackets, sleeping bags, and performance wear rely on these materials for warmth without adding bulk. It offers unmatched breathability and compressibility, which appeals to travelers and adventure enthusiasts. Growing participation in winter sports and recreational activities sustains demand from this application. Leading apparel brands are also promoting responsibly sourced down, which aligns with ethical and environmental trends. This rising adoption strengthens market performance across fashion and outdoor segments.

- For instance, Arc’teryx products, including the Cerium series, utilize high fill power down. The Cerium Hoody, for example, is noted to have 850-fill-power down, often combined with synthetic insulation in moisture-prone areas.

Sustainability and Circular Economy Initiatives Creating New Opportunities

Sustainability trends are reshaping consumer preferences toward natural and biodegradable materials. Down and feather products offer advantages over synthetic alternatives by reducing landfill waste and energy consumption during production. It is increasingly marketed as an eco-friendly filling option across bedding and apparel. Brands highlight certifications like Responsible Down Standard (RDS) to strengthen customer trust. Circular economy practices, including recycling and reusing down from old products, are gaining traction. These initiatives support higher acceptance and brand value in global markets.

Growing Middle-Class Population and Rising Disposable Incomes

Economic growth in emerging regions has created a strong consumer base for premium comfort goods. Rising incomes allow households to invest in high-quality bedding and insulated outerwear. It aligns with consumer interest in luxury living and improved sleep quality. Expansion of retail channels, both online and offline, supports wider access to feather-filled goods. The hospitality industry in developing countries also adopts down-filled bedding to meet international standards. This broad consumer shift ensures steady momentum for the Down and Feather Market across multiple regions.

Market Trends

Increasing Focus on Ethical and Responsible Sourcing Practices

One of the most prominent trends shaping the Down and Feather Market is the emphasis on ethical sourcing. Consumers increasingly demand transparency in supply chains and assurance of cruelty-free practices. It has driven widespread adoption of certifications such as the Responsible Down Standard (RDS) and Traceable Down Standard (TDS). Brands use these certifications to differentiate themselves and build trust with environmentally conscious buyers. Fashion and bedding manufacturers now highlight responsible sourcing in marketing campaigns to appeal to a wider audience. This growing focus on ethical production strengthens consumer loyalty and creates new value in the market.

- For instance, Mitsubishi Chemical maintains ISO 14001 certification for its Ibaraki Plant and certain R&D centres. This includes documented environmental management systems, monitored processes for raw material sourcing, and periodic audits by external certification bodies.

Rising Popularity of Lightweight and High-Performance Products

The trend toward lightweight, high-performance products is boosting the appeal of down and feather fillings. Outdoor apparel and activewear brands rely on the material for superior warmth-to-weight ratios. It is also preferred in sleeping bags and travel gear where packability is essential. Consumers seek products that combine comfort with practicality, reinforcing down’s competitive edge over synthetic alternatives. Product innovations focus on enhancing durability and moisture resistance to expand usability in diverse environments. This trend ensures continued relevance across lifestyle and adventure markets.

- For instance, Down with fill power values of 750 cubic inches per ounce or higher. This allows for excellent insulation with less weight, which is how some high-performance, full-length mummy bags can achieve a packed weight under 900 grams.

Integration of Advanced Processing and Blending Techniques

Manufacturers are increasingly investing in advanced processing technologies to improve product quality. Blending down with synthetic fibers or applying water-repellent treatments enhances performance and broadens applications. It helps extend product life while meeting consumer expectations for functionality. Companies are also using automation and improved cleaning techniques to ensure hypoallergenic properties. These innovations improve consistency and reduce allergens, making feather products more appealing to health-conscious consumers. The integration of advanced processing methods is redefining industry standards and expanding product diversity.

Expanding Presence Across E-Commerce and Specialty Retail Channels

E-commerce and specialty retail platforms are transforming product accessibility in the Down and Feather Market. Consumers increasingly purchase duvets, pillows, and jackets online due to convenience and product variety. It has encouraged manufacturers to strengthen their digital presence with detailed product descriptions and certifications. Luxury brands use online platforms to highlight premium collections, while smaller companies expand reach through marketplaces. Omni-channel strategies also integrate physical stores with digital sales to maximize customer engagement. This growing retail transformation continues to shape distribution and consumer purchasing behavior worldwide.

Market Challenges Analysis

Market Challenges Analysis

Concerns Over Animal Welfare and Regulatory Compliance Pressures

The Down and Feather Market faces rising scrutiny regarding animal welfare and sourcing practices. Growing consumer awareness has placed pressure on manufacturers to prove ethical treatment of animals in supply chains. It creates challenges for companies unable to meet international standards like the Responsible Down Standard. Stricter regulations and monitoring systems increase compliance costs and slow production cycles. Negative publicity linked to unethical sourcing practices damages brand reputation and reduces consumer confidence. Maintaining transparency and traceability remains difficult in fragmented global supply networks. These concerns continue to limit growth opportunities for less adaptable players.

Competition from Synthetic Alternatives and Price Volatility Risks

Synthetic insulation materials such as polyester and microfiber pose a significant challenge to down and feather products. They offer lower costs, easier maintenance, and water resistance, which appeal to budget-conscious consumers. It forces manufacturers to justify premium pricing through superior comfort and sustainability credentials. Fluctuating raw material costs, driven by agricultural cycles and supply disruptions, add further risk. Global trade dynamics and transportation expenses also contribute to price instability across regions. This unpredictability affects long-term planning and profitability for market participants. Addressing these challenges requires consistent innovation and stronger value propositions to sustain demand.

Market Opportunities

Expansion in Premium Bedding and Hospitality Segments

The Down and Feather Market holds strong opportunities within luxury bedding and hospitality industries. High-end hotels and resorts are investing in premium duvets, pillows, and comforters to improve guest experiences. It creates steady demand for manufacturers offering certified, high-quality products. Rising consumer focus on sleep wellness also drives sales of premium bedding for residential use. Brands promoting natural insulation as a healthier and more sustainable alternative strengthen their competitive edge. Expansion into wellness-focused and luxury-driven categories enables companies to capture long-term revenue streams. This shift supports higher value creation across established and emerging markets.

Innovation in Sustainable Materials and Circular Economy Practices

Opportunities are also emerging through advancements in sustainable sourcing and product recycling. Companies developing closed-loop systems to reclaim down from used products are gaining market visibility. It aligns with consumer interest in eco-friendly and biodegradable alternatives to synthetic fillings. Blending down with advanced fibers or enhancing water resistance through eco-safe treatments expands functional applications. Manufacturers promoting recyclable packaging and traceable supply chains further strengthen market positioning. Growing partnerships between apparel brands and ethical sourcing initiatives open new revenue streams. These sustainable innovations offer growth potential across lifestyle, fashion, and outdoor product categories.

Market Segmentation Analysis:

By Product Type

The Down and Feather Market is divided into down and feather segments, each serving distinct consumer needs. Down dominates due to its superior insulation, softness, and lightweight nature, making it ideal for luxury bedding and premium outerwear. It provides unmatched thermal efficiency, driving its preference in high-end duvets and jackets. Feather, while less soft, offers structural support and durability, making it suitable for pillows and cushions. Consumers seeking budget-friendly options often choose feather-filled products due to lower costs. Brands frequently combine down and feather to balance comfort and affordability, creating versatile product lines. This segmentation highlights a clear divide between performance-driven and cost-conscious demand.

- For instance, many high-end jackets use down fill having fill power of 900 cubic inches per ounce, producing garments that weigh under 350 grams with down encased in ultralight shell fabrics.

By Source

Source-based segmentation reveals strong demand for goose down due to its higher fill power and superior insulation properties. It appeals to premium markets in luxury bedding and high-performance outerwear where durability and warmth are essential. Duck down and feather remain popular in mid-range products, offering affordability while maintaining adequate quality. Mixed sourcing has grown in relevance, providing manufacturers with flexibility to meet varying consumer price points. Global supply fluctuations often influence sourcing preferences, with regional availability shaping purchasing strategies. Goose remains the benchmark for premium positioning, while duck ensures broader consumer access. Mixed products continue to address demand for balanced quality and cost.

- For instance, Rain Carbon Inc. operates at large scale. For instance, the company has an annual capacity of 2.4 million metric tons of calcined petroleum coke (CPC), one of the world’s largest single volumes for that product.

By Application

Bedding products account for the largest share due to widespread use of down and feather in duvets, pillows, and comforters. It remains a primary driver of steady sales in both residential and hospitality sectors. Apparels form a dynamic segment, particularly in outdoor jackets, sleeping bags, and performance clothing, where insulation and lightweight comfort are key. Rising participation in adventure tourism and winter sports supports strong apparel demand. The “others” category includes cushions, upholstery, and specialty products, reflecting diverse consumer applications. Growth within this segment is supported by innovation in design and expansion into niche lifestyle categories. Each application segment reinforces the broad relevance of natural insulation across industries.

Segments:

Based on Product Type:

Based on Source:

Based on Application:

- Bedding Products

- Apparels

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

North America holds 35% of the Down and Feather Market share in 2023. The United States drives most demand with strong sales in bedding products and outerwear. Hotels and luxury resorts also support steady growth by using premium duvets and pillows. Canada follows with a preference for insulated clothing due to cold winters. Mexico adds smaller demand, mainly through bedding imports. High consumer awareness of animal welfare has increased the use of certified down. The region remains one of the most advanced markets, with companies investing in sustainability and premium branding.

Europe

Europe accounts for 28% of the market share in 2023. Germany, France, Italy, and the UK are leading consumers of luxury bedding and outerwear. Cold weather in northern Europe supports strong sales of jackets, duvets, and comforters. Eco-conscious buyers prefer responsibly sourced down, pushing brands to adopt certification standards. EU regulations ensure strict compliance, which improves trust but raises production costs. Many companies also focus on recycling down and blending it with new materials. The region sets benchmarks in product quality, sustainability, and innovation.

Asia-Pacific

Asia-Pacific holds 22% of the market share in 2023. China is the largest producer and exporter of down and feather worldwide, with a strong domestic consumer base as well. India and Southeast Asia are growing markets, supported by rising incomes and demand for quality bedding. The region benefits from lower costs of production, giving it a global competitive edge. Consumers are now shifting toward premium products with certifications and better processing standards. E-commerce platforms play a big role in boosting sales across urban areas. This region continues to expand quickly due to economic growth and rising lifestyle standards.

Latin America

Latin America contributes 8% of the market share in 2023. Brazil and Argentina are the leading countries, where colder regions support demand for insulated bedding and clothing. Fashion trends and increasing urban populations also drive sales. Local production is limited, so the region depends heavily on imports of premium products. Growth opportunities exist for international brands to expand through partnerships. Consumers are becoming more aware of eco-friendly products, though adoption is still slower compared to Europe. Demand is gradually rising with improvements in income levels and lifestyle preferences.

Middle East & Africa

The Middle East & Africa region holds 7% of the market share in 2023. Gulf countries show demand for luxury bedding in hotels and resorts, while North Africa sees need for insulated products during colder seasons. The region relies mostly on imports due to limited local production. Transport costs and weaker certification systems pose challenges for growth. However, rising wealth in the Gulf region and growth in boutique hotels create new opportunities. Lifestyle upgrades and increasing tourism continue to support gradual expansion of demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shamokin Carbons

- Tianjin Yunhai Carbon Element Products Co., Ltd.

- Mitsubishi Chemical

- Bilbaína de Alquitranes, S.A

- DONGSUNG CORPORATION

- SUMMIT CRM Limited

- Ukrgraphit

- Rain Carbon Inc.

- Sojitz JECT Corporation

- ASBURY CARBONS

Competitive Analysis

The Down and Feather Market companies such as Shamokin Carbons, Tianjin Yunhai Carbon Element Products Co., Ltd., Mitsubishi Chemical, Bilbaína de Alquitranes S.A, DONGSUNG CORPORATION, SUMMIT CRM Limited, Ukrgraphit, Rain Carbon Inc., Sojitz JECT Corporation, and ASBURY CARBONS. The Down and Feather Market is characterized by a mix of global leaders and regional manufacturers competing on product quality, sustainability, and pricing strategies. Companies focus on maintaining strong sourcing networks, advanced cleaning and processing technologies, and compliance with ethical standards to differentiate themselves. Growing consumer demand for certified and responsibly sourced down has intensified competition, pushing firms to highlight transparency and traceability across supply chains. Innovation in blending natural insulation with performance-enhancing treatments, along with expansion into e-commerce and hospitality partnerships, shapes competitive positioning. Branding, digital engagement, and sustainable practices continue to play vital roles in securing long-term growth and building customer loyalty in this market.

Recent Developments

- In April 2025, Sartorius, a global leader in bioprocess solutions, entered into a non-exclusive CDMO collaboration with Mabion S.A., a biopharmaceutical company based in Poland. This partnership aims to provide customers with a seamless, integrated service offering that accelerates biologics development and manufacturing, reduces complexity, and ensures high-quality product delivery to market faster and more efficiently.

- In June 2024, Ecolab Life Sciences, through its Purolite resin business, and Repligen Corporation commercially launched DurA Cycle, a new Protein A chromatography affinity resin designed specifically for large-scale purification in commercial biologics manufacturing, particularly for monoclonal antibodies.

- In May 2024, the Nigerian National Petroleum Company (NNPC) Energy Services Limited and Schlumberger signed a technical cooperation agreement to strengthen upstream operations. The agreement is part of strategic reforms aimed at opening up opportunities in the country’s oil and gas industry.

- In April 2024, Baker Hughes won a contract to supply gas technology equipment for work on the third phase of Saudi Aramco’s Main Gas System (MGS) project. Although new oilfield projects in Saudi Arabia have been delayed following a government order to halt the expansion of the country’s oil production capacity, Aramco’s developments is likely to accelerate over the following years.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium bedding and comfort products will continue to rise globally.

- Outdoor and performance apparel will drive steady growth for down insulation.

- Ethical sourcing and certification standards will remain central to consumer trust.

- E-commerce channels will expand market reach across both developed and emerging regions.

- Sustainable processing and recycling practices will shape long-term competitiveness.

- Blended products combining natural and synthetic materials will see stronger adoption.

- Luxury hospitality will create consistent demand for high-quality duvets and pillows.

- Rising incomes in emerging economies will boost sales of mid-range down products.

- Product innovations in moisture resistance and durability will enhance usability.

- Branding and transparency will play a critical role in securing customer loyalty.

Market Challenges Analysis

Market Challenges Analysis