Market Overview

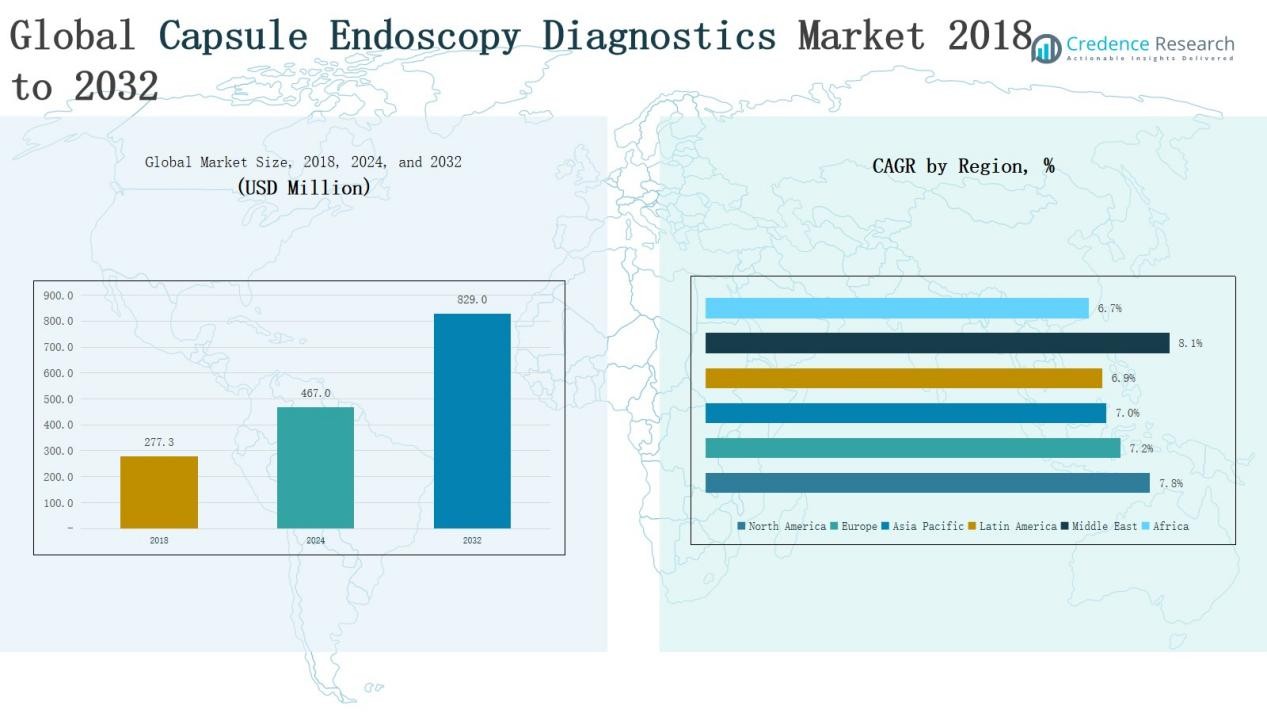

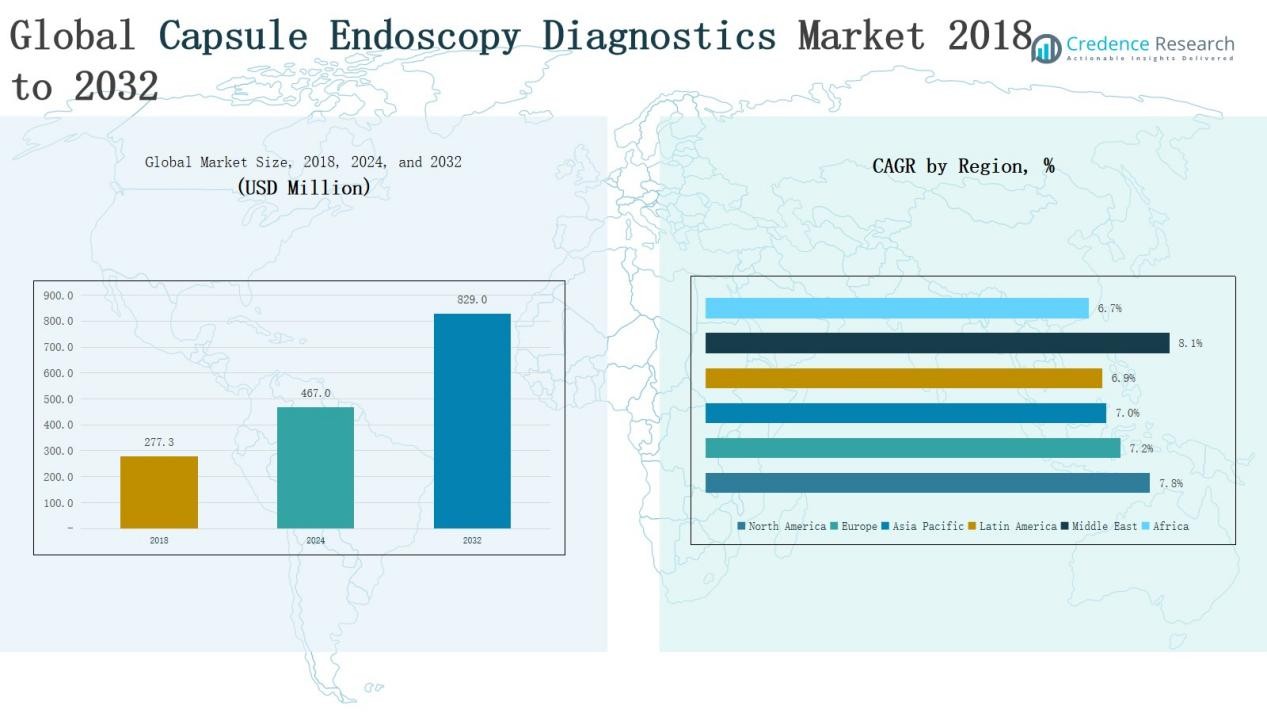

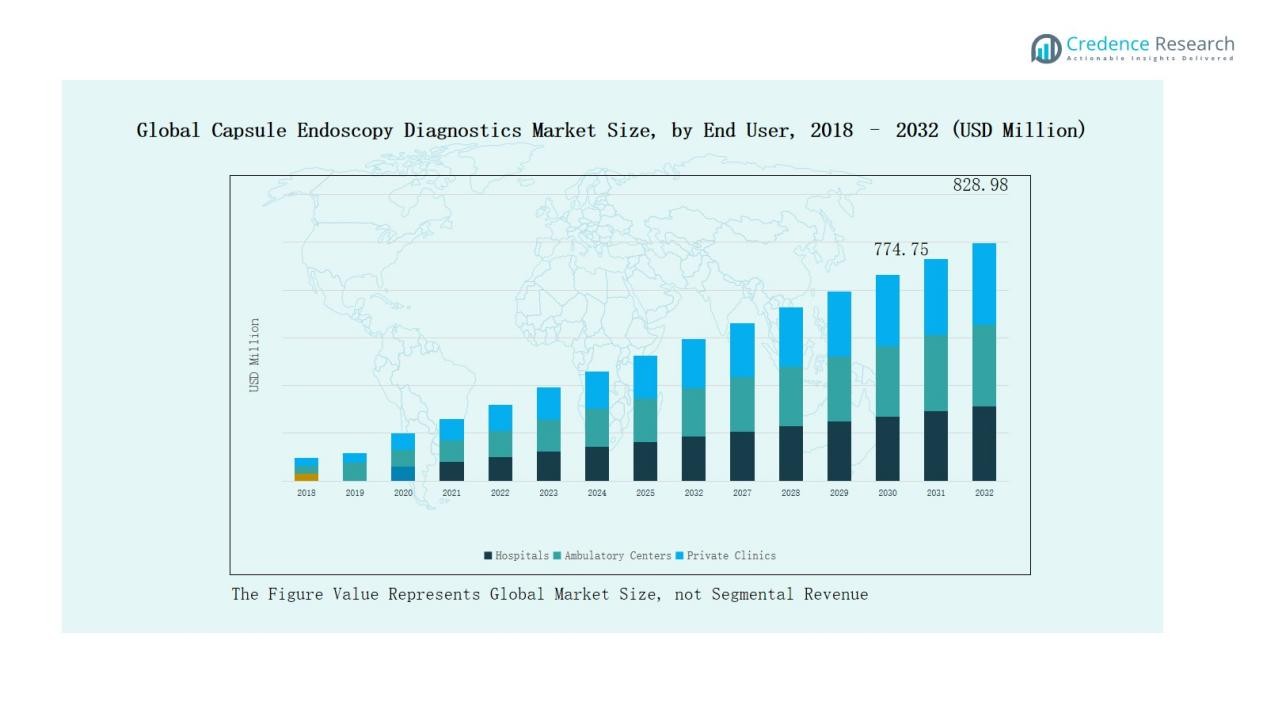

Global Capsule Endoscopy Diagnostics Market size was valued at USD 277.3 million in 2018 to USD 467.0 million in 2024 and is anticipated to reach USD 829.0 million by 2032, at a CAGR of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Capsule Endoscopy Diagnostics Market Size 2024 |

USD 467.0 Million |

| Capsule Endoscopy Diagnostics Market, CAGR |

7.37% |

| Capsule Endoscopy Diagnostics Market Size 2032 |

USD 829.0 Million |

The Global Capsule Endoscopy Diagnostics Market is driven by established players including Medtronic plc, Olympus Corporation, CapsoVision, IntroMedic Co., Ltd., Jinshan Science & Technology, Fujifilm Holdings Corporation, Check-Cap Ltd., RF System Lab, AnX Robotica Corp., and Chongqing Science & Technology Co. These companies maintain leadership through advanced product portfolios, global distribution networks, and continuous R&D investments in high-resolution imaging, AI-enabled diagnostics, and longer battery life. Among regions, North America led the market in 2024 with a 36.5% share, supported by strong healthcare infrastructure, favorable reimbursement frameworks, and early adoption of innovative diagnostic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Capsule Endoscopy Diagnostics Market grew from USD 277.3 million in 2018 to USD 467.0 million in 2024 and is projected to reach USD 829.0 million by 2032.

- Capsule endoscopes led the product segment with a 62% share in 2024, driven by non-invasive design, patient comfort, and improved imaging capabilities.

- Obscure gastrointestinal bleeding accounted for 45% of disease applications in 2024, supported by rising prevalence of undiagnosed bleeding and capsule endoscopy’s diagnostic effectiveness.

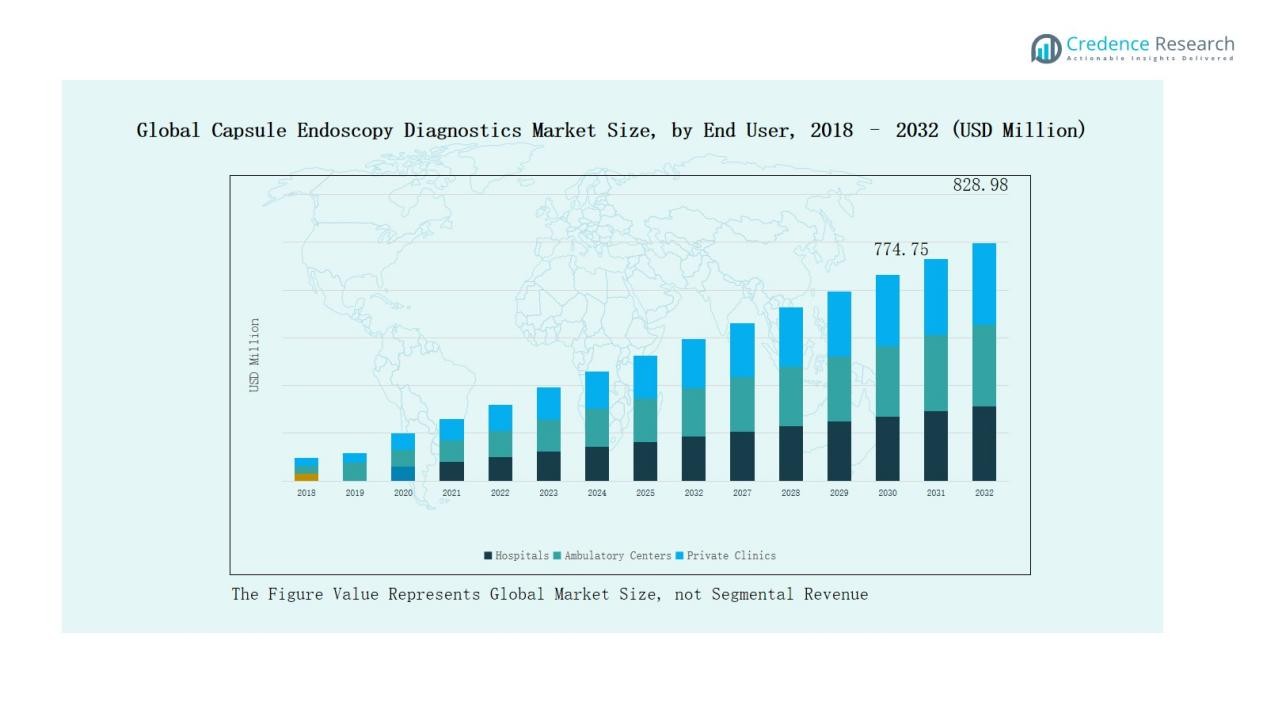

- Hospitals dominated the end-user segment with a 52% share in 2024, reinforced by advanced infrastructure, skilled specialists, and high patient inflow for gastrointestinal diagnostics.

- North America led globally with a 36.5% share in 2024, supported by healthcare infrastructure, reimbursement support, and strong adoption of innovative capsule technologies.

Market Segment Insights

By Product

Capsule endoscopes dominate the product segment, accounting for nearly 62% market share in 2024. Their strong adoption results from non-invasive nature, patient comfort, and high diagnostic accuracy. Advances in high-resolution imaging and extended battery life further support this leadership. Recorders, workstations, and software continue gaining traction, particularly with AI-powered features that enhance efficiency, streamline image analysis, and reduce diagnostic time, driving wider acceptance among healthcare providers.

- For instance, Medtronic received FDA clearance for its PillCam Small Bowel 3 system, featuring improved imaging quality and adaptive frame rate technology to enhance diagnostic yield.

By Disease Type

Obscure gastrointestinal bleeding (OGIB) is the leading disease application, holding nearly 45% market share in 2024. Rising prevalence of undiagnosed intestinal bleeding cases drives strong reliance on capsule endoscopy. The method’s effectiveness in detecting small intestinal bleeding sources has boosted clinical adoption. Crohn’s disease and small bowel tumors are secondary growth drivers, with growing emphasis on early detection, patient monitoring, and improved outcomes supporting market expansion in these indications.

By End User

Hospitals lead the end-user segment, capturing nearly 52% market share in 2024. Their dominance is supported by advanced medical infrastructure, availability of skilled gastroenterologists, and ability to manage complex diagnostics. The growing patient volume for gastrointestinal disorders reinforces their leadership. Ambulatory surgical centers and diagnostic centers are expanding rapidly, driven by demand for convenient outpatient services, affordability, and accessibility. This shift highlights the increasing role of decentralized healthcare delivery models worldwide.

- For instance, UnitedHealth Group highlighted that ambulatory surgery centers (ASCs) in the U.S. provide faster, safer, and more affordable care alternatives for gastrointestinal procedures compared to traditional hospitals.

Key Growth Drivers

Rising Prevalence of Gastrointestinal Disorders

The increasing global burden of gastrointestinal (GI) diseases is a primary driver for capsule endoscopy adoption. Disorders such as obscure gastrointestinal bleeding, Crohn’s disease, and celiac disease are rising due to lifestyle changes, aging populations, and dietary factors. Capsule endoscopy offers a non-invasive and highly accurate method for early diagnosis, improving patient outcomes and reducing treatment delays. Growing awareness and physician recommendations are strengthening demand across hospitals and diagnostic centers worldwide.

- For instance, the Canadian Association of Gastroenterology highlighted capsule endoscopy’s effectiveness in diagnosing obscure GI bleeding and evaluating Crohn’s disease severity.

Technological Advancements in Capsule Design

Continuous innovation in capsule technology is boosting the market’s growth. Advanced capsules now feature higher-resolution cameras, longer battery life, improved image transmission, and even AI-enabled image analysis for enhanced diagnostic accuracy. These advancements reduce procedure times and improve detection rates for small bowel tumors and bleeding. Companies are focusing on R&D to expand capabilities such as multi-sensor integration and controlled navigation. Such improvements are making capsule endoscopy more efficient and widely accepted.

- For instance, Olympus launched its EndoCapsule 10 system in Japan, offering upgraded image sensors and enhanced battery performance designed for prolonged small bowel examinations.

Preference for Minimally Invasive Diagnostics

Patients and healthcare providers increasingly prefer capsule endoscopy over traditional invasive procedures such as endoscopy and colonoscopy. The painless, sedation-free experience offers better comfort, shorter recovery times, and reduced hospital stays. This preference is supported by the growing emphasis on patient-centric care and outpatient diagnostic procedures. Insurance coverage and cost-effectiveness in developed markets also contribute to adoption. This shift toward non-invasive diagnostics is fueling steady demand, particularly in regions with strong healthcare infrastructure.

Key Trends & Opportunities

Integration of Artificial Intelligence (AI)

AI integration in capsule endoscopy is transforming diagnostic efficiency. AI-powered image analysis tools help physicians detect abnormalities faster and with greater accuracy, reducing human error and improving patient outcomes. Automated algorithms are being applied to conditions like Crohn’s disease and tumors, enabling early detection. This trend creates opportunities for technology providers to expand offerings. As AI becomes more accessible, demand for intelligent diagnostic platforms is expected to rise across developed and emerging healthcare markets.

- For instance, AnX Robotica received FDA approval for its NaviCam ProScan, the first AI-assisted reading tool designed specifically for small bowel capsule endoscopy to detect suspected bleeding, marking a significant regulatory milestone in AI integration.

Expansion in Emerging Markets

Emerging economies present strong opportunities for market expansion, driven by rising healthcare investments, improving diagnostic infrastructure, and growing awareness about minimally invasive procedures. Countries in Asia Pacific, Latin America, and the Middle East are adopting capsule endoscopy at a rapid pace due to increasing gastrointestinal disease prevalence and a larger patient base. Partnerships between global players and local healthcare providers are further enhancing access, making these regions the fastest-growing markets for capsule endoscopy diagnostics.

- For instance, Medtronic received approval from the U.S. Food and Drug Administration (FDA) for its PillCam Capsule Endoscopy system for at-home use. It has also received other FDA clearances and expanded indications for different PillCam products over time.

Key Challenges

High Cost of Procedures and Devices

The significant cost of capsule endoscopy devices and related diagnostic procedures remains a key challenge. Advanced capsules with high-resolution imaging and AI integration increase expenses, limiting affordability in low- and middle-income regions. Limited insurance coverage in many countries adds to patient burden, reducing adoption rates. For wider market penetration, manufacturers must focus on developing cost-effective solutions, while policymakers need to improve reimbursement frameworks to make this diagnostic tool more accessible globally.

Technical Limitations and Incomplete Diagnostics

Despite advancements, capsule endoscopy faces technical challenges that limit diagnostic outcomes. Issues such as incomplete transit through the gastrointestinal tract, image quality loss, and capsule retention reduce diagnostic reliability. In complex cases, physicians often require additional imaging or invasive procedures, which undermines its stand-alone value. Overcoming these limitations requires further R&D in navigation control, power efficiency, and multi-sensor capabilities. Addressing these gaps is essential for building trust and wider adoption among healthcare professionals.

Regulatory and Reimbursement Barriers

Strict regulatory requirements and inconsistent reimbursement policies hinder market growth. Obtaining approvals for innovative capsule technologies often involves long timelines, raising costs for manufacturers. Moreover, reimbursement frameworks vary widely across regions, with many healthcare systems offering limited or no coverage for capsule endoscopy. This lack of standardization affects adoption rates, particularly in emerging markets. Streamlined approval pathways and stronger insurance support are crucial to unlocking the full potential of capsule endoscopy diagnostics worldwide.

Regional Analysis

North America

North America led the market with revenues of USD 94.62 million in 2018, rising to USD 162.90 million in 2024, and projected to reach USD 297.60 million by 2032 at a CAGR of 7.8%. The region captured a 36.5% share in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, and a high prevalence of gastrointestinal disorders. Rapid adoption of capsule technologies and strong presence of key players reinforce its leadership. North America remains the largest and most established market globally, with continuous innovation driving long-term growth.

Europe

Europe generated USD 77.76 million in 2018, increasing to USD 129.98 million in 2024, and is projected to reach USD 228.47 million by 2032 at a CAGR of 7.2%. With a 29.2% share in 2024, Europe stands as the second-largest market. Strong adoption in Germany, the UK, and France, supported by robust healthcare systems and growing awareness of minimally invasive diagnostics, fuels regional expansion. Collaborative research programs and wider accessibility of capsule devices are expected to enhance Europe’s position, making it a stable and competitive market contributor.

Asia Pacific

Asia Pacific was valued at USD 63.73 million in 2018, expanding to USD 105.15 million in 2024, and forecasted to reach USD 181.55 million by 2032 at a CAGR of 7.0%. Holding a 23.6% share in 2024, the region benefits from large patient pools, increasing healthcare investments, and growing prevalence of gastrointestinal conditions. Rising adoption in China, India, and Japan, supported by improved infrastructure and awareness, underpins strong growth. Though penetration remains lower than developed regions, Asia Pacific demonstrates the fastest expansion in patient access, offering high long-term potential.

Latin America

Latin America recorded USD 21.88 million in 2018, rising to USD 35.97 million in 2024, and expected to reach USD 61.76 million by 2032 with a CAGR of 6.9%. The region represented 8.1% of the global market in 2024, with Brazil and Mexico leading adoption. Growth is supported by gradual improvements in healthcare infrastructure and increased awareness of non-invasive diagnostics. However, limited reimbursement and affordability challenges hinder faster uptake. With steady demand for improved gastrointestinal solutions, Latin America remains an emerging growth region with untapped opportunities.

Middle East

The Middle East market was valued at USD 12.04 million in 2018, increasing to USD 21.15 million in 2024, and forecasted to reach USD 39.63 million by 2032 at the fastest CAGR of 8.1%. Holding a 4.7% share in 2024, the region benefits from rising healthcare investments, especially across the GCC countries, and growing adoption of advanced diagnostics. Expanding medical facilities and government-backed healthcare initiatives are driving acceptance of capsule endoscopy. The Middle East demonstrates strong future growth potential and is emerging as a lucrative market for global players.

Africa

Africa generated USD 7.29 million in 2018, rising to USD 11.84 million in 2024, and projected to reach USD 19.98 million by 2032 at a CAGR of 6.7%. The region accounted for only 2.6% of the global market in 2024, constrained by limited infrastructure, high device costs, and low awareness. However, partnerships with global healthcare companies and ongoing modernization efforts are improving access to diagnostics. Rising gastrointestinal disease cases highlight unmet needs, making Africa a developing yet important market with opportunities for cost-effective capsule endoscopy solutions.

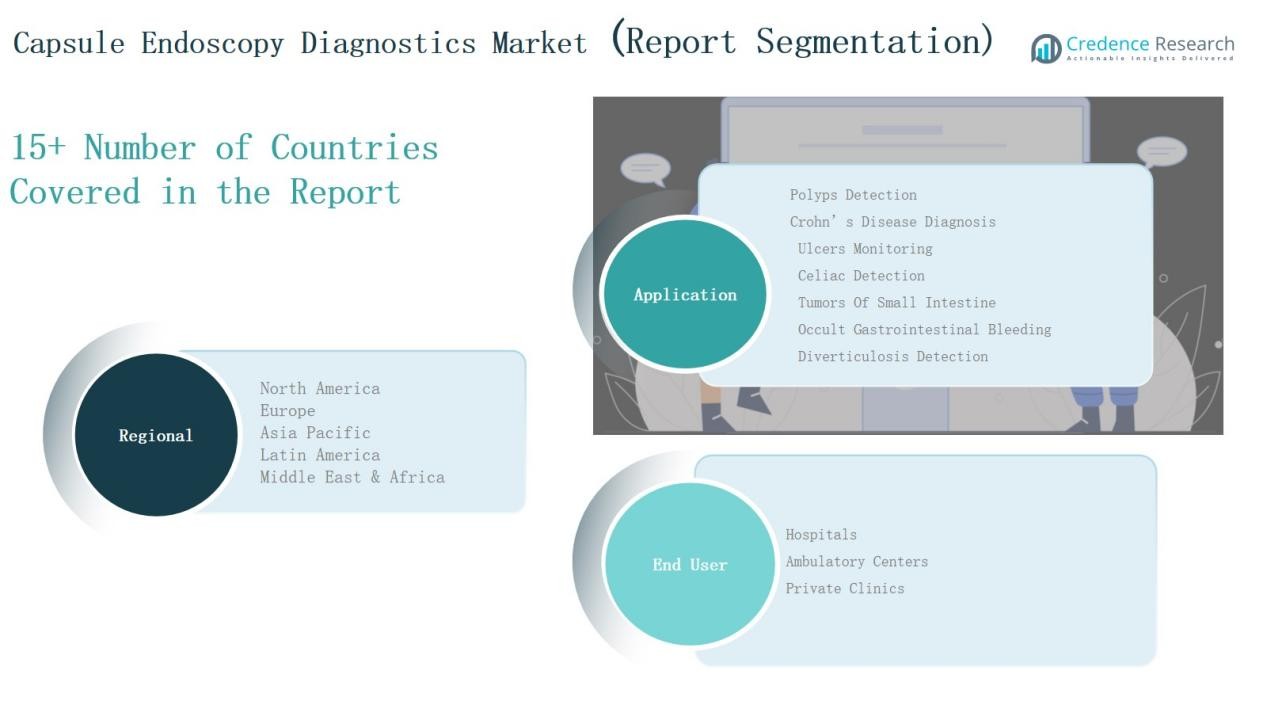

Market Segmentations:

By Product

- Capsule Endoscopes

- Recorders

- Workstations

- Software

By Disease Type

- Obscure Gastrointestinal Bleeding (OGIB)

- Crohn’s Disease

- Small Bowel Tumors

- Celiac Disease

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Capsule Endoscopy Diagnostics Market is characterized by the presence of established multinational corporations and specialized regional players, each striving to strengthen their market position through innovation and strategic initiatives. Leading companies such as Medtronic plc, Olympus Corporation, CapsoVision, IntroMedic, Jinshan Science & Technology, and Fujifilm Holdings Corporation dominate with extensive product portfolios, global distribution networks, and strong R&D capabilities. These players focus on advancing capsule technologies with features like high-resolution imaging, longer battery life, and AI-enabled diagnostic support to improve detection accuracy and efficiency. Emerging companies and regional manufacturers contribute by offering cost-effective solutions tailored to local market needs, expanding accessibility in developing economies. Strategic partnerships, mergers, and acquisitions remain critical strategies to expand product offerings and geographic presence. Competition continues to intensify as firms seek to balance technological sophistication with affordability, shaping a dynamic and rapidly evolving market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Medtronic plc

- Olympus Corporation

- CapsoVision, Inc.

- IntroMedic Co., Ltd.

- Jinshan Science & Technology (Chongqing) Group Co., Ltd.

- Check-Cap Ltd.

- RF System Lab

- AnX Robotica Corp.

- Fujifilm Holdings Corporation

- Chongqing Science & Technology Co.

Recent Developments

- In January 2025, CapsoVision received U.S. FDA clearance for its CapsoCam Plus capsule endoscopy device, now approved for pediatric patients aged two and older. This marks a significant expansion allowing non-invasive diagnostics for children.

- In January 2024, AnX Robotica received FDA clearance for its NaviCam Small Bowel (SB) Video Capsule Endoscopy Systemwith expanded use for patients aged two and above, including tether-assisted esophagus visualization.

- In December 2024, Medtronic announced the first successful patient ingestion of its new PillCam Genius SB Kit, offering simplified equipment management and remote procedure capabilities.

- In May 2025, AnX Robotica unveiled NaviCam XS, NaviCam XST, and ESView 3.0at DDW, adding real-time esophageal view through a tethered capsule design.

Report Coverage

The research report offers an in-depth analysis based on Product, Disease Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of capsule endoscopy will increase due to growing demand for minimally invasive diagnostics.

- AI integration will enhance accuracy and reduce physician workload in gastrointestinal diagnosis.

- Hospitals will continue to lead adoption, supported by advanced infrastructure and skilled specialists.

- Diagnostic centers will expand usage as outpatient demand for affordable procedures rises.

- Technological innovations will deliver capsules with longer battery life and improved imaging.

- Regional growth will accelerate in Asia Pacific and the Middle East with rising healthcare investments.

- Cost-effective capsule models will drive penetration in low- and middle-income countries.

- Collaborations between global players and local providers will expand access in emerging markets.

- Regulatory improvements and broader reimbursement coverage will support higher adoption rates.

- Competition will intensify as established firms and new entrants focus on product differentiation.