Market Overview:

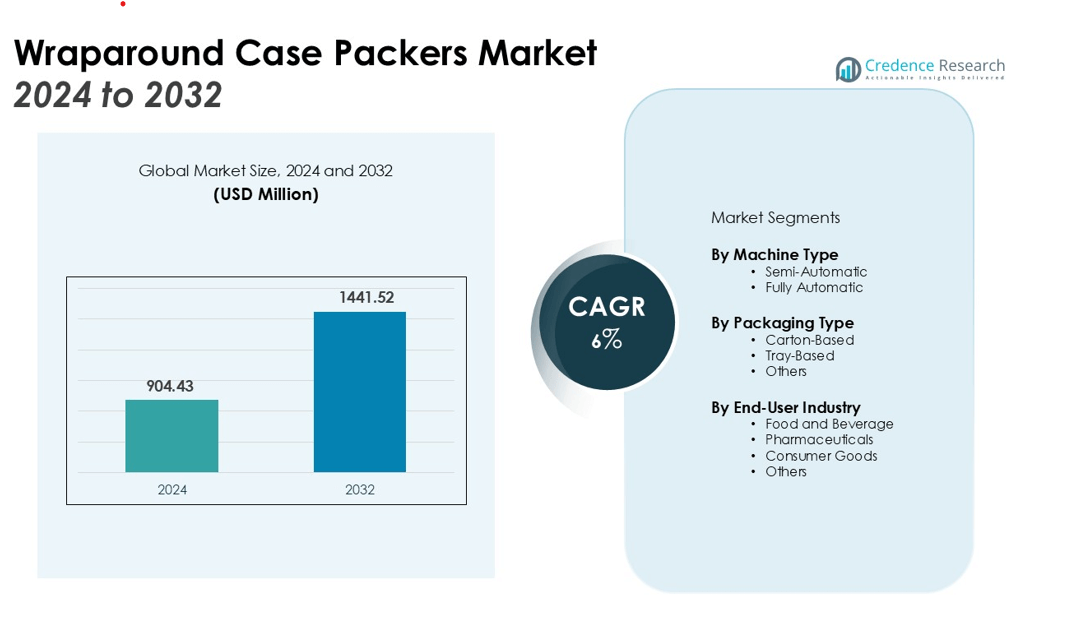

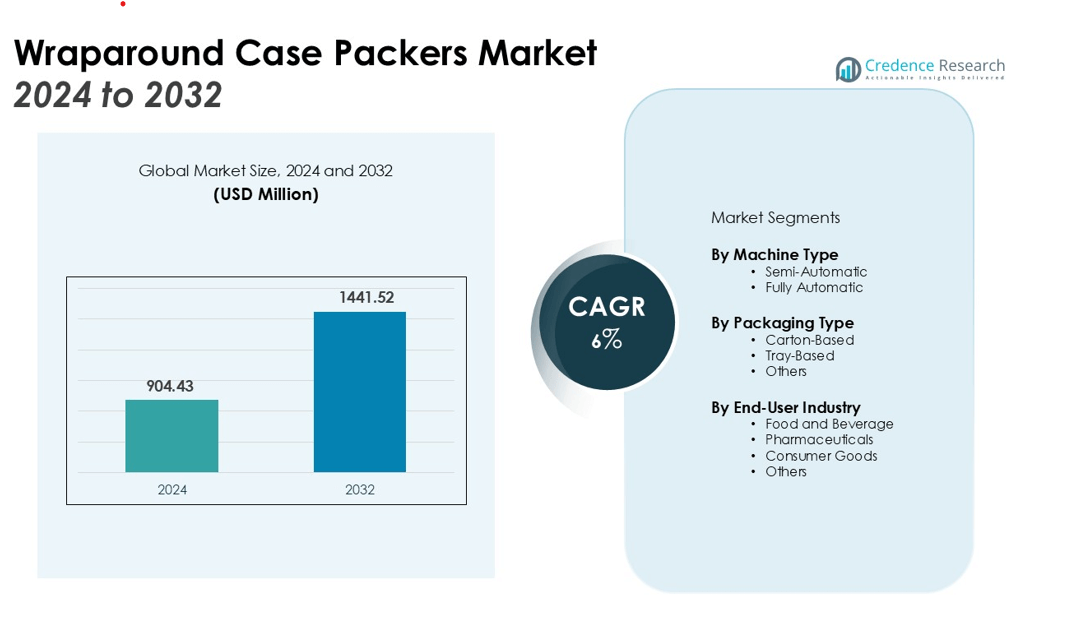

The Wraparound Case Packers Market size was valued at USD 904.43 million in 2024 and is anticipated to reach USD 1441.52 million by 2032, at a CAGR of 6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wraparound Case Packers Market Size 2024 |

USD 904.43 million |

| Wraparound Case Packers Market, CAGR |

6% |

| Wraparound Case Packers Market Size 2032 |

USD 1441.52 million |

The market is primarily driven by the need for high-speed packaging solutions that minimize labor costs while improving product safety and shelf appeal. Additionally, the shift towards sustainable packaging, including recyclable and biodegradable materials, is enhancing the adoption of wraparound case packers. Innovations in technology, such as the integration of robotics and AI for enhanced precision, further boost market growth. The increasing focus on reducing packaging waste and improving operational efficiency further accelerates the adoption of wraparound case packers in various industries.

Regionally, North America holds a significant share of the Wraparound Case Packers Market, driven by the well-established manufacturing base and demand for advanced packaging solutions in industries like food and beverage, pharmaceuticals, and consumer electronics. Europe follows closely, supported by stringent regulations on packaging waste and a strong focus on automation. The Asia Pacific region is anticipated to witness the highest growth, fueled by rapid industrialization, increased production capacities, and expanding retail and e-commerce sectors.

Market Insights:

- The Wraparound Case Packers Market is valued at USD 904.43 million and expected to reach USD 1441.52 million by 2032, growing at a CAGR of 6%.

- The market benefits from the increasing demand for high-speed, efficient packaging systems in industries like food, beverage, and pharmaceuticals.

- A shift towards sustainable packaging solutions is driving the adoption of wraparound case packers, as they accommodate eco-friendly materials without compromising speed.

- Technological advancements in robotics and AI improve speed, precision, and efficiency in packaging, contributing to market growth.

- The expansion of e-commerce and retail sectors is increasing the demand for packaging systems capable of handling various product sizes and formats.

- North America holds the largest market share, followed by Europe, while Asia Pacific is growing rapidly due to industrialization and e-commerce expansion.

- Challenges such as high initial investment and adaptability to different materials exist, but emerging markets present opportunities for growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for High-Speed and Efficient Packaging Solutions

The Wraparound Case Packers Market benefits from the increasing need for high-speed packaging systems that reduce labor costs and enhance operational efficiency. Manufacturers across industries, such as food and beverage, pharmaceuticals, and consumer goods, require rapid, reliable, and cost-effective packaging solutions to keep pace with growing consumer demand. The efficiency of wraparound case packers makes them essential for businesses seeking to improve production speed and reduce manual labor, aligning with the ongoing trend of automation in manufacturing.

- For instance, Robopac USA offers industrial wrap-around case packers that can handle up to 85 cases per minute, delivering the high-speed performance required in modern production environments.

Shift Toward Sustainable Packaging Solutions

The increasing focus on sustainability drives the adoption of wraparound case packers in various industries. With environmental concerns escalating, companies are prioritizing recyclable and biodegradable packaging options to meet regulatory standards and consumer preferences. Wraparound case packers accommodate the use of eco-friendly materials, making them ideal for packaging solutions that support sustainability goals. This shift significantly boosts the demand for these systems in industries that are aligning their packaging processes with sustainability initiatives.

- For instance, Artema Pack provides wraparound machines that can be set up to handle more than 15 different packaging formats, a versatile solution that optimizes cardboard consumption for a variety of products.

Technological Advancements and Integration of Robotics

Technological advancements, including the integration of robotics and AI, play a key role in the growth of the Wraparound Case Packers Market. These innovations enable packers to deliver enhanced precision, improve speed, and optimize the overall packaging process. The adoption of robotic arms, vision systems, and other automated technologies helps manufacturers achieve higher packaging accuracy, reduce product damage, and ensure faster throughput, contributing to the overall efficiency of the packaging line.

Expansion of E-Commerce and Retail Sectors

The rapid expansion of e-commerce and retail sectors is another significant driver for the Wraparound Case Packers Market. The rise of online shopping and the increasing demand for packaged goods require packaging systems capable of handling various products with different packaging needs. Wraparound case packers are particularly effective in meeting these demands, as they are adaptable to different packaging formats and can process a wide range of product sizes, ensuring that companies in e-commerce and retail can scale their packaging processes efficiently.

Market Trends:

Growing Adoption of Automation and Robotics in Packaging Lines

A significant trend in the Wraparound Case Packers Market is the increasing adoption of automation and robotics in packaging lines. Automation allows manufacturers to optimize production speeds, reduce human error, and lower operational costs. The integration of robotic technologies, such as vision systems and AI-driven components, enhances the precision of packaging while minimizing product damage. This trend aligns with the industry’s broader shift toward Industry 4.0, where manufacturers invest in smart machinery and integrated systems to streamline operations. As manufacturers face rising labor costs and higher demand for efficiency, automation in wraparound case packers has become a crucial factor driving the market’s growth. The trend toward more flexible, high-speed packaging systems is particularly noticeable in industries such as food, beverages, and pharmaceuticals.

- For instance, robotics company FANUC offers packaging software capable of coordinating multiple robots to pick and place up to 2,000 items per minute on one production line.

Shift Toward Eco-Friendly and Sustainable Packaging Materials

Another key trend shaping the Wraparound Case Packers Market is the growing demand for sustainable packaging solutions. With heightened environmental awareness, both consumers and regulatory bodies are pushing companies to adopt eco-friendly materials for packaging. This has led to an increased use of recyclable, biodegradable, and compostable materials in wraparound case packing. Manufacturers are looking for systems that can handle these materials without compromising the efficiency of packaging operations. As sustainability continues to be a priority, wraparound case packers are evolving to accommodate these eco-friendly solutions. The ability to efficiently handle sustainable materials while maintaining high-speed production is becoming a critical consideration for manufacturers. This trend is helping shape the future of the market, ensuring that wraparound case packers remain at the forefront of environmentally conscious packaging solutions.

- For instance, Sidel’s Cermex WB47 case packer is designed for flexibility, running wrap-around blanks at a speed of up to 30 blanks per minute.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the main challenges in the Wraparound Case Packers Market is the high initial investment and ongoing maintenance costs. While these packaging systems offer significant long-term benefits, the upfront cost for acquiring and installing wraparound case packers can be a barrier for smaller manufacturers. The complexity of these machines requires specialized technicians for maintenance, which adds to the operational expenses. For many companies, particularly small- and medium-sized enterprises, the cost-to-benefit ratio can initially appear unfavorable, limiting their ability to invest in advanced packaging technologies. This challenge affects the rate of adoption, especially in emerging markets where cost constraints are more prominent.

Adaptability to Varying Packaging Materials

Another challenge is the adaptability of wraparound case packers to various packaging materials. The growing demand for sustainable packaging materials, such as biodegradable and recyclable films, requires wraparound case packers to adjust their settings and handling mechanisms. Not all systems are designed to efficiently handle these new materials without compromising speed or accuracy. Manufacturers need to ensure that their equipment can switch seamlessly between different materials, which can increase operational complexity and downtime. The lack of flexibility in some models can restrict their use in diverse industries, hindering broader adoption in markets focused on eco-friendly packaging solutions.

Market Opportunities:

Expansion of E-Commerce and Demand for Customizable Packaging

The rapid expansion of e-commerce presents significant growth opportunities for the Wraparound Case Packers Market. As online retail continues to thrive, the demand for packaging solutions that can handle a wide range of products efficiently and securely increases. Wraparound case packers are well-suited to meet these needs due to their ability to handle various packaging sizes and types. Manufacturers in e-commerce seek packaging systems that can deliver both speed and precision, minimizing shipping costs and product damage. This demand for customizable and scalable packaging solutions opens up new opportunities for wraparound case packers to gain a larger share of the market.

Growth of Sustainable Packaging Solutions

Sustainability is another key opportunity for the Wraparound Case Packers Market. With growing consumer awareness and stricter regulations, businesses are prioritizing eco-friendly packaging options. Wraparound case packers that support recyclable, biodegradable, and compostable materials are in high demand as industries, including food and beverage and pharmaceuticals, adopt greener practices. Companies that invest in these advanced packaging systems not only enhance their sustainability profiles but also appeal to environmentally-conscious consumers. The ability to offer flexible solutions for sustainable packaging creates substantial growth potential for wraparound case packers in the coming years.

Market Segmentation Analysis:

By Machine Type:

The market is primarily divided into semi-automatic and fully automatic wraparound case packers. Semi-automatic machines hold a substantial share due to their cost-effectiveness and flexibility in small to medium-scale operations. Fully automatic machines are gaining traction due to their higher efficiency, ability to handle large volumes, and integration with other automated systems in high-demand manufacturing environments.

By Packaging Type:

The packaging type segment includes carton-based, tray-based, and others. Carton-based packaging is the dominant segment, driven by its widespread use in various industries, especially in food and beverage. Tray-based packaging, while smaller in market share, is growing due to its applicability in industries like consumer goods, where product display plays a key role in marketing.

- For instance, Bradman Lake’s RA120 carton closer, a key component in carton-based packaging lines, is designed for high efficiency and can process up to 120 cartons per minute.

By End-User Industry:

The end-user industry segment consists of food and beverage, pharmaceuticals, consumer goods, and others. The food and beverage sector is the largest end-user, driven by the need for high-speed packaging solutions in mass production lines. Pharmaceuticals follow closely, as the industry requires precise, secure packaging for sensitive products. Consumer goods are growing in demand due to the increase in e-commerce and retail packaging needs.

- For instance, in the food sector, Syntegon’s Elematic 2001 wrap-around case packer offers a high-speed solution capable of handling an infeed of up to 600 products per minute to accommodate mass production lines.

Segmentations:

- By Machine Type:

- Semi-Automatic

- Fully Automatic

- By Packaging Type:

- Carton-Based

- Tray-Based

- Others

- By End-User Industry:

- Food and Beverage

- Pharmaceuticals

- Consumer Goods

- Others

- By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America: Dominating the Market

North America accounted for 35% of the Wraparound Case Packers Market, driven by its advanced manufacturing sectors and high demand for automation across industries such as food and beverage, pharmaceuticals, and consumer goods. The region benefits from a well-established manufacturing infrastructure that prioritizes efficiency, speed, and cost reduction. As companies in North America increasingly focus on sustainability and reducing operational costs, the demand for automated packaging solutions like wraparound case packers has grown substantially. The region’s mature regulatory environment and innovation-driven market further support the widespread adoption of these systems.

Europe: Focus on Sustainability and Packaging Innovation

Europe held 27% of the Wraparound Case Packers Market, supported by stringent packaging regulations and an increasing emphasis on sustainability. The European Union’s packaging waste directives have pushed industries toward adopting environmentally friendly and energy-efficient packaging solutions. Wraparound case packers are in demand as they allow businesses to meet sustainability targets without sacrificing efficiency. The region’s robust food, beverage, and pharmaceutical industries are key drivers, with manufacturers seeking to modernize their packaging processes to align with both regulatory requirements and consumer preferences for eco-friendly products.

Asia Pacific: Rapid Growth Driven by Industrialization and E-Commerce

Asia Pacific represented 30% of the Wraparound Case Packers Market and is expected to witness the highest growth. Rapid industrialization and the growing e-commerce sector are driving this expansion. The region’s expanding retail market and increasing demand for packaged goods make it a key player in the global packaging industry. Countries like China and India are witnessing significant advancements in manufacturing, which include adopting automated packaging systems to streamline production. The rise of online shopping and the demand for faster, efficient packaging solutions have further accelerated the adoption of wraparound case packers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Langen Group

- AFA Systems Ltd.

- Massman Automation Designs, LLC

- Brenton Engineering

- Cama Group

- Douglas Machine Inc.

- Krones AG

- Econocorp Inc.

- GEA Group

- Hartness International Inc.

- Mpac Group plc

- IMA Group

Competitive Analysis:

The Wraparound Case Packers Market is highly competitive, with key players such as Tetra Pak, Cama Group, Pro Mach, KHS GmbH, and SOMIC GmbH leading the market. These companies focus on developing high-speed, fully automated packaging solutions that enhance flexibility, minimize downtime, and improve operational efficiency. Technological innovations, such as robotic integration, AI-driven controls, and tool-less changeovers, are shaping the market. Companies like EndFlex and Bradman Lake emphasize modular designs and custom solutions to meet diverse industry demands. Competition is driven by a mix of established global players and emerging companies focusing on regional markets and niche applications, with an increasing emphasis on sustainability and technological advancements.

Recent Developments:

- In August 2025, Douglas Machine was acquired by Sani-Matic, a portfolio company of Hamilton Robinson Capital Partners. This acquisition aims to expand Sani-Matic’s offerings in hygienic cleaning solutions.

- In July 2025, The IMA Group acquired Medical Research Network (MRN) LLC, a clinical research site in New York City that focuses on trials for central nervous system (CNS) disorders.

Report Coverage:

The research report offers an in-depth analysis based on Machine Type, Packaging Type, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for high-speed, automated packaging solutions will continue to rise across industries.

- Increasing adoption of sustainable packaging materials will drive the growth of wraparound case packers.

- Technological advancements in AI, robotics, and machine learning will enhance the efficiency and precision of these systems.

- E-commerce growth will further accelerate the need for flexible packaging solutions capable of handling various product types and sizes.

- Regional expansion, particularly in emerging markets, will present new opportunities for market growth.

- Manufacturers will continue to prioritize energy-efficient and environmentally friendly packaging solutions to meet sustainability goals.

- Customization and modular designs will become more prevalent, enabling businesses to adapt quickly to changing market demands.

- The pharmaceutical industry’s growing need for secure and efficient packaging will contribute significantly to market expansion.

- Integration with other automated systems will be a key factor in increasing the value proposition of wraparound case packers.

- Companies will continue to invest in R&D to innovate and offer technologically advanced solutions, keeping pace with evolving market needs.