Market Overview

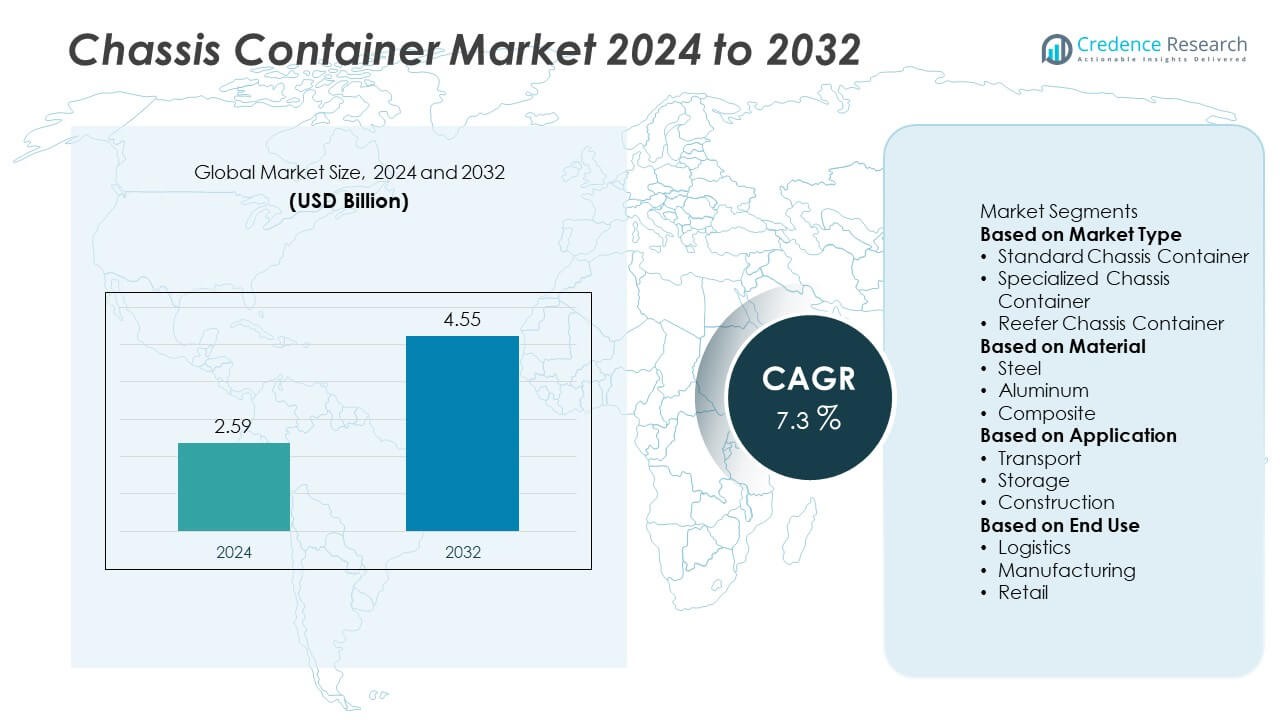

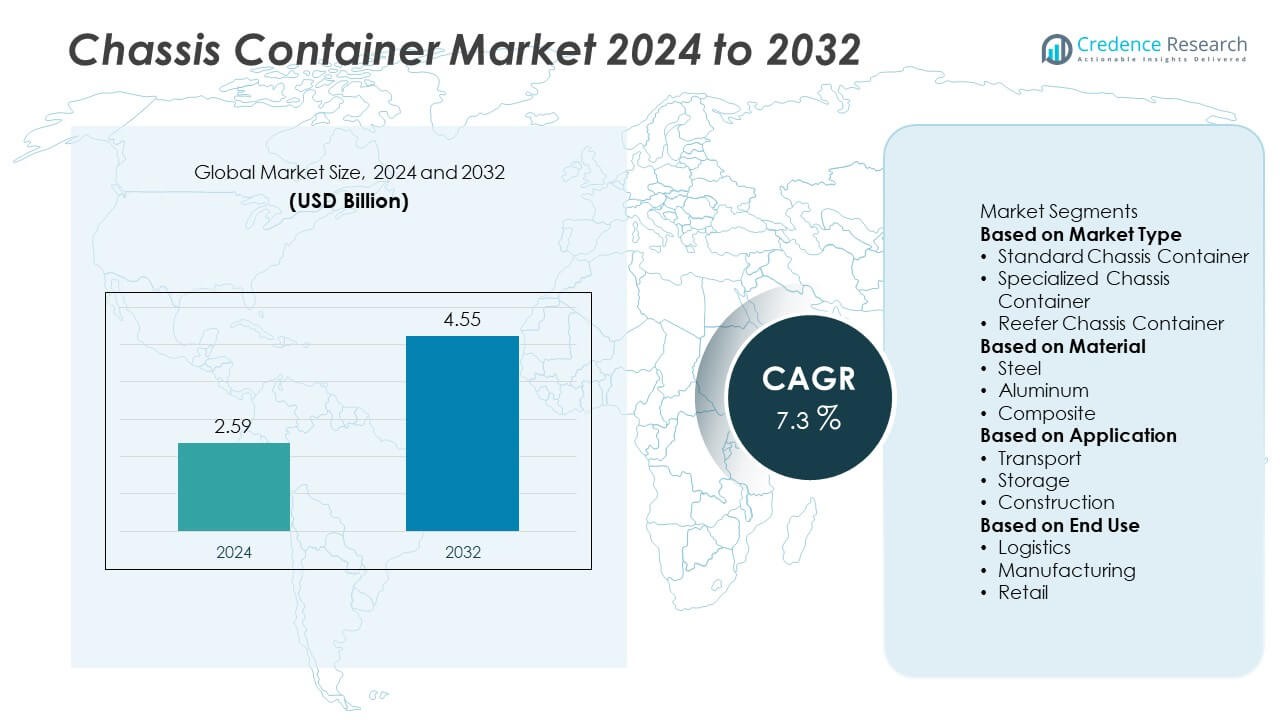

The Chassis Container market was valued at USD 2.59 billion in 2024 and is projected to reach USD 4.55 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chassis Container Market Size 2024 |

USD 2.59 Billion |

| Chassis Container Market, CAGR |

7.3% |

| Chassis Container Market Size 2032 |

USD 4.55 Billion |

Top players in the Chassis Container market include CMA CGM, COSCO Shipping, HapagLloyd, Evergreen Marine, Wan Hai Lines, ONE, Seaboard Marine, Hanjin Shipping, P and O Ferries, and K Line. These companies focus on enhancing intermodal connectivity, expanding container chassis fleets, and integrating digital solutions for efficient cargo handling. Asia-Pacific leads the market with 36% share, driven by strong port infrastructure and high container traffic in China, India, and Southeast Asia. North America holds 31% share, supported by intermodal freight growth and investments in logistics automation. Europe accounts for 25% share, benefiting from major shipping routes, well-developed ports, and ongoing fleet modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Chassis Container market was valued at USD 2.59 billion in 2024 and is expected to reach USD 4.55 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Rising global container trade and e-commerce expansion drive demand, with standard chassis containers holding the largest share due to their wide application across ports and logistics hubs.

- Trends include adoption of lightweight aluminum and composite chassis for fuel efficiency, digital fleet management solutions, and investments in automated intermodal infrastructure to improve turnaround times.

- The market is moderately competitive with players like CMA CGM, COSCO Shipping, Evergreen Marine, and HapagLloyd focusing on fleet expansion, technology integration, and partnerships with port operators to enhance supply chain reliability.

- Asia-Pacific leads with 36% share, followed by North America at 31% and Europe at 25%, driven by high container traffic, intermodal network upgrades, and strong demand from transport and storage applications.

Market Segmentation Analysis:

By Market Type

Standard chassis containers dominate the market with over 50% share, driven by their wide use in intermodal freight transport. They are preferred by logistics providers and port operators for their cost-effectiveness and compatibility with multiple container sizes. Specialized chassis containers serve niche requirements such as oversized cargo, while reefer chassis containers are gaining traction with the rising demand for temperature-controlled logistics in food and pharmaceutical sectors. The growth of e-commerce and international trade continues to boost demand for standard chassis containers as they support efficient container handling and quick turnaround times in shipping operations.

- For instance, RailRunner’s 40′ reefer chassis has a load capacity of 55,100 lbs road / 67,200 lbs rail and a tare weight of 9,900 lbs.

By Material

Steel chassis containers lead the market with about 60% share because of their superior strength, durability, and ability to withstand heavy loads. They are widely used in long-haul freight and port operations where high structural reliability is critical. Aluminum chassis containers are growing in popularity due to their lighter weight, which improves fuel efficiency and lowers transportation costs. Composite materials are emerging as a sustainable option, offering corrosion resistance and extended service life, supporting adoption in regions with strict environmental regulations and high humidity conditions.

- For instance, Busby International’s slider chassis (designed for standard ISO containers) has a maximum cargo capacity of 105,500 lbs, with a tare weight of 13,500 lbs.

By Application

Transport accounts for the dominant 70% share of the market, driven by the increasing movement of goods across ports, rail networks, and highways. Chassis containers play a crucial role in connecting intermodal transport systems, ensuring smooth cargo transfers and reducing downtime. Storage applications contribute a steady share, particularly in freight yards and distribution centers where containers are held temporarily. The construction sector is adopting chassis containers for material movement and site storage, further supporting demand. Rising trade volumes and global supply chain integration are expected to sustain transport as the leading application segment.

Key Growth Drivers

Rising Global Trade and Containerization

The expansion of international trade is a major driver for the chassis container market. Growing containerized cargo volumes require efficient transport solutions to move goods across ports, rail, and road networks. Standard chassis containers support seamless intermodal operations, reducing turnaround time and improving logistics efficiency. The growth of e-commerce and just-in-time supply chains further increases demand for container chassis. Emerging markets are also investing in port infrastructure, creating new opportunities for chassis deployment and strengthening the market’s growth prospects worldwide.

- For instance, TRAC Intermodal is North America’s leading marine chassis provider and pool manager with the largest fleet of marine chassis in the U.S., enabling rapid response capacity during peaks at ports.

Increasing Demand for Temperature-Controlled Logistics

The need for refrigerated transport is driving demand for reefer chassis containers. Growth in pharmaceuticals, perishable food exports, and cold-chain logistics boosts the adoption of chassis designed for temperature-controlled containers. Rising global consumption of frozen and processed foods adds to this momentum. Reefer chassis ensure secure handling of refrigerated units and maintain efficiency across transport modes. Investments in cold-chain infrastructure and international regulatory compliance for temperature-sensitive goods further accelerate demand for these specialized chassis, making this a key growth area for manufacturers and fleet operators.

- For instance, Qingdao CIMC Special Reefer Co., Ltd produces 4,000 special container units per year, serving markets like North America and Eastern Europe.

Infrastructure Development and Fleet Modernization

Ongoing investments in logistics and transport infrastructure significantly drive the chassis container market. Governments and private players are expanding port capacity, building inland container depots, and upgrading road connectivity to support growing trade volumes. Fleet modernization programs encourage replacement of old chassis with advanced, lightweight, and fuel-efficient designs. The focus on reducing turnaround time and enhancing operational efficiency promotes the adoption of new chassis technologies. This trend supports market expansion as logistics providers upgrade fleets to meet regulatory standards and growing demand for faster cargo movement.

Key Trends & Opportunities

Adoption of Lightweight and Sustainable Materials

Manufacturers are increasingly using aluminum and composite materials to produce lighter chassis containers, improving fuel efficiency and lowering operating costs. These materials offer high corrosion resistance and longer service life, reducing maintenance expenses for fleet operators. The shift toward sustainability and stricter emissions regulations encourage the adoption of eco-friendly materials. This trend creates opportunities for companies to develop innovative chassis solutions with reduced carbon footprints, aligning with global green logistics goals and appealing to environmentally conscious shipping and logistics providers.

- For instance, TRAC Intermodal’s 40-foot lightweight chassis has a tare weight of 5,050 pounds, making it 1,650 pounds lighter than its standard 40’ gooseneck chassis.

Technological Integration and Smart Tracking

Integration of telematics and IoT solutions in chassis containers is becoming a key opportunity. Smart chassis enable real-time tracking of location, load status, and performance, helping logistics providers optimize fleet management. Predictive maintenance alerts reduce downtime and extend chassis life. Digitalization supports better inventory control and enhances visibility across supply chains. As shippers demand transparency and data-driven decision-making, the adoption of connected chassis is expected to grow rapidly, opening avenues for manufacturers to offer value-added solutions and differentiate in a competitive market.

- For instance, Gurtam’s Wialon GPS tracking platform and its other products monitor over 5 million assets worldwide, giving fleet operators real-time visibility into vehicle location and status.

Key Challenges

High Initial Investment and Maintenance Costs

The cost of purchasing and maintaining chassis containers poses a challenge, especially for small logistics providers. High steel and aluminum prices contribute to rising manufacturing costs, affecting affordability. Regular inspections, tire replacements, and compliance with safety regulations add to operational expenses. These factors may deter smaller players from fleet expansion. Leasing options and financing programs are becoming popular, but cost remains a significant barrier that can slow adoption rates, particularly in cost-sensitive regions.

Port Congestion and Supply Chain Disruptions

Frequent port congestion and global supply chain disruptions negatively impact chassis container availability and utilization. Shortages during peak shipping seasons lead to operational inefficiencies and delayed cargo movement. Events like pandemics, geopolitical tensions, and labor strikes exacerbate chassis imbalances across regions. This unpredictability forces logistics providers to invest in contingency planning, which increases costs. Improving coordination between shipping lines, port operators, and chassis pool managers is essential to mitigate these challenges and ensure smooth cargo flow.

Regional Analysis

North America

North America holds 30% market share, driven by strong intermodal freight transport and growing e-commerce demand. The United States leads with large containerized cargo volumes, supported by advanced port infrastructure and inland logistics hubs. Investment in chassis pool systems improves asset utilization and reduces downtime. Canada contributes through cross-border trade and fleet modernization programs, ensuring compliance with safety and emissions standards. Demand for specialized and reefer chassis is rising with the expansion of cold-chain logistics. The focus on automation, digital tracking, and fleet replacement continues to drive steady growth across the regional chassis container market.

Europe

Europe accounts for 27% market share, supported by well-developed port infrastructure and robust trade within the EU. Major countries such as Germany, the Netherlands, and Belgium drive demand through high container throughput at key ports like Rotterdam and Hamburg. The market benefits from stringent regulations encouraging fleet modernization and low-emission chassis adoption. Growth in intra-European logistics and cross-border trucking further fuels demand. Reefer chassis adoption is strong in the food and pharmaceutical sectors. Rising investment in digital supply chain solutions and smart fleet tracking systems is enhancing efficiency and supporting sustained chassis container demand.

Asia-Pacific

Asia-Pacific leads the chassis container market with 34% market share, making it the largest and fastest-growing region. China dominates with massive containerized trade volumes, strong port capacity, and rapid fleet expansion. India is witnessing rising demand due to logistics infrastructure development and government initiatives promoting containerization. Southeast Asian nations are emerging as key trade hubs, driving the need for chassis fleets. The region also shows growing adoption of lightweight and composite chassis to improve fuel efficiency. Rising manufacturing output, urbanization, and international trade continue to strengthen Asia-Pacific’s position as the primary growth engine for this market.

Latin America

Latin America holds 5% market share, with Brazil and Mexico as leading contributors. Expanding manufacturing sectors and improving port infrastructure are boosting containerized trade and driving demand for chassis containers. Government investments in logistics corridors and public-private partnerships support market development. Reefer chassis adoption is rising with growth in agricultural exports such as fruits, meat, and dairy products. However, economic volatility and high import costs for chassis components pose challenges. Regional manufacturers are focusing on cost-effective production and leasing options to improve accessibility and support steady growth across logistics and transportation industries.

Middle East & Africa

Middle East & Africa represent 4% market share, showing steady growth driven by rising trade activity and infrastructure investments. GCC countries, including the UAE and Saudi Arabia, are developing major logistics hubs to diversify economies, boosting demand for chassis containers. Ports like Jebel Ali and King Abdullah Port handle significant container volumes, driving fleet expansion. Africa is seeing gradual adoption, led by South Africa and Nigeria, where investments in port modernization are improving trade efficiency. Demand for reefer chassis is growing to support food imports and exports. Regional focus on logistics development is expected to sustain growth momentum.

Market Segmentations:

By Market Type

- Standard Chassis Container

- Specialized Chassis Container

- Reefer Chassis Container

By Material

By Application

- Transport

- Storage

- Construction

By End Use

- Logistics

- Manufacturing

- Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Chassis Container market includes key players such as CMA CGM, P and O Ferries, COSCO Shipping, Wan Hai Lines, ONE, Evergreen Marine, Seaboard Marine, Hanjin Shipping, HapagLloyd, and K Line. The market is moderately consolidated, with leading players focusing on expanding their fleet capacity, optimizing chassis utilization, and strengthening global logistics networks. Strategic partnerships with port operators and intermodal transport providers help improve turnaround times and service reliability. Investments in digital platforms for tracking, scheduling, and predictive maintenance are enhancing operational efficiency. Companies are also upgrading fleets with lightweight and durable materials to improve fuel efficiency and meet regulatory standards for emissions. Regional expansion and joint ventures are common strategies to capture growth in high-potential markets such as Asia-Pacific and North America. The competitive environment is driven by innovation, cost optimization, and the ability to offer flexible, scalable solutions for global trade and intermodal logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CMA CGM

- P and O Ferries

- COSCO Shipping

- Wan Hai Lines

- ONE

- Evergreen Marine

- Seaboard Marine

- Hanjin Shipping

- HapagLloyd

- K Line

Recent Developments

- In August 2025, Wan Hai Lines named the final ship “WAN HAI A20” in its 13,100 TEU series at Samsung Heavy Industries.

- In August 2025, Wan Hai Lines launched a new Far East-to-East Mediterranean service branded FM1 using vessels of 4,300-5,000 TEU capacity.

- In August 2025, Hapag-Lloyd updated its Online Business Suite to include Live ETA feature, showing ETA deviations for “CH shipments” in real-time.

- In February 2025, Evergreen Marine approached shipyards to build up to 14 LNG dual-fuel newbuild vessels.

Report Coverage

The research report offers an in-depth analysis based on Market Type, Material, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chassis containers will grow with rising global trade and port activity.

- Adoption of lightweight aluminum and composite materials will improve fuel efficiency.

- Digital tracking and telematics integration will enhance fleet management and visibility.

- Standard chassis containers will continue dominating due to versatility and lower maintenance.

- Reefer chassis demand will rise with growth in cold chain logistics and perishables transport.

- Asia-Pacific will remain the largest market, driven by expanding manufacturing and exports.

- North America will see growth from intermodal transport network upgrades and fleet renewal.

- Manufacturers will focus on modular designs to reduce downtime and improve efficiency.

- Partnerships between shipping lines and leasing companies will strengthen market penetration.

- Sustainability initiatives will push development of eco-friendly coatings and energy-efficient chassis systems.