Market Overview:

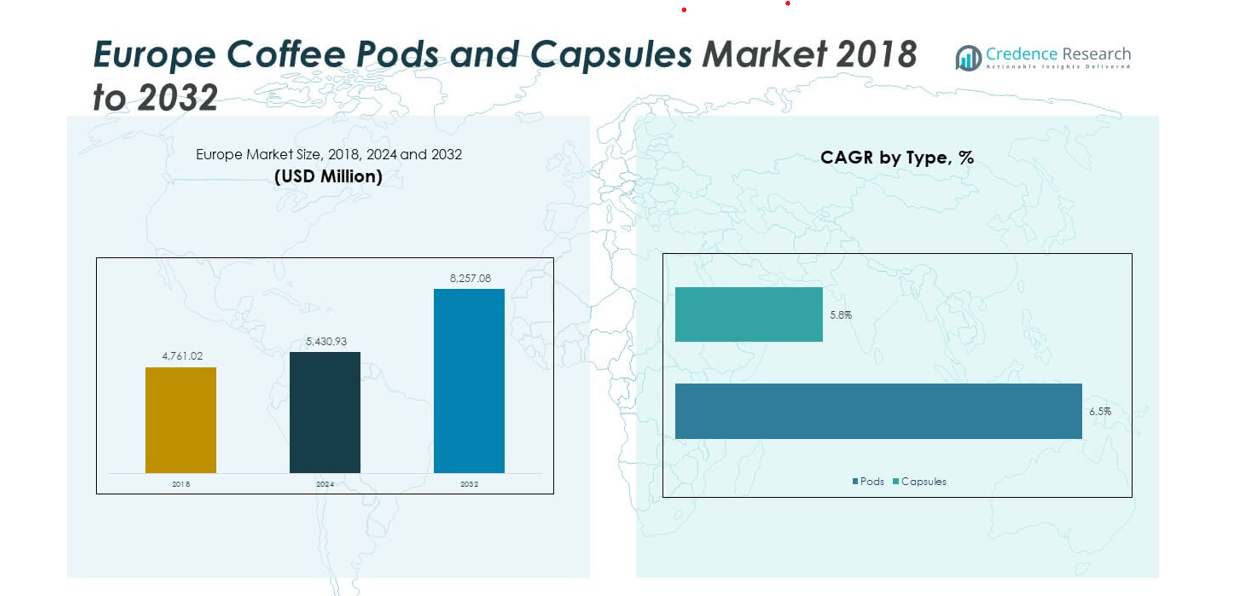

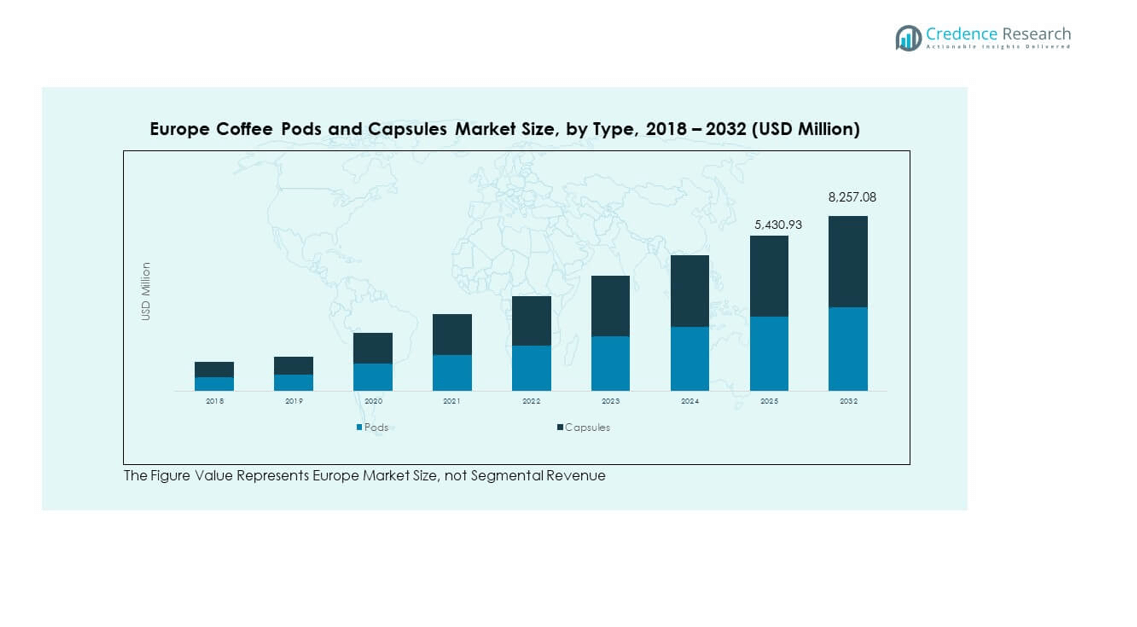

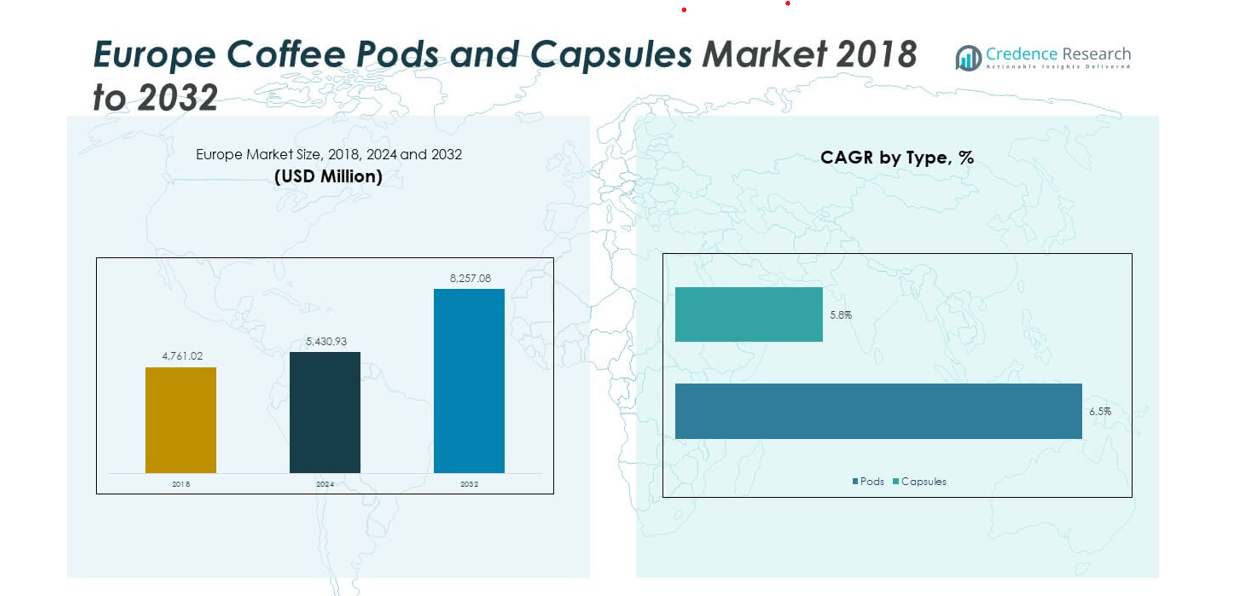

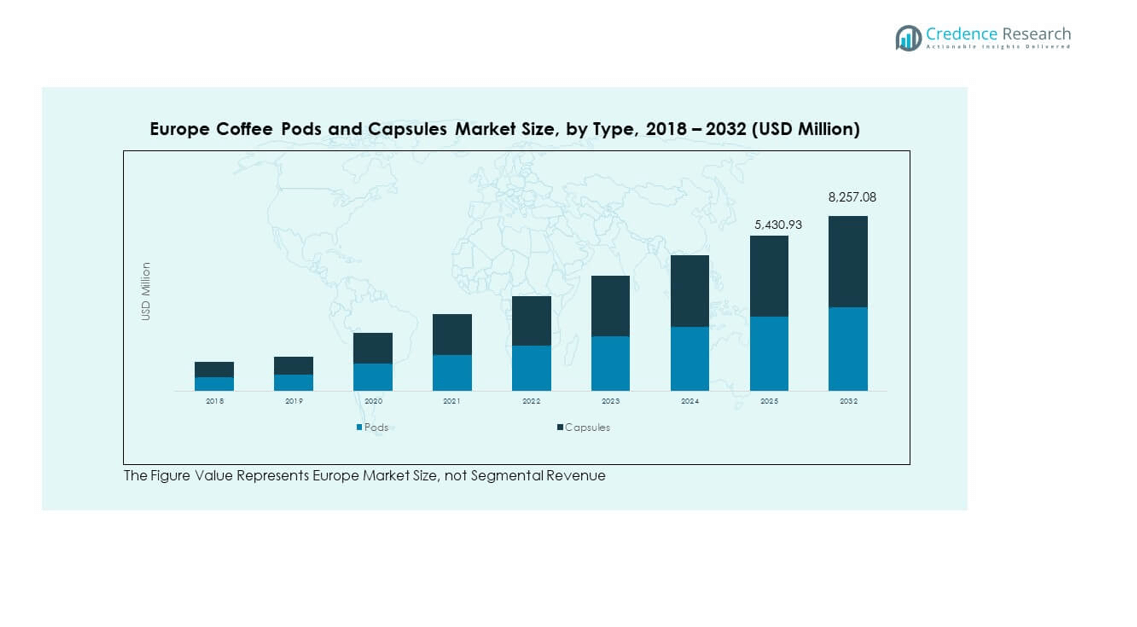

The Europe Coffee Pods Capsules Market size was valued at USD 6,296.28 million in 2018 to USD 7,477.30 million in 2024 and is anticipated to reach USD 11,594.05 million by 2032, at a CAGR of 5.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Coffee Pods Capsules Market Size 2024 |

USD 7,477.30 million |

| Europe Coffee Pods Capsules Market , CAGR |

5.64% |

| Europe Coffee Pods Capsules Market Size 2032 |

USD 11,594.05 million |

The market is growing due to the increasing popularity of single-serve brewing systems and strong consumer preference for premium coffee. Rising awareness of sustainability is influencing packaging innovations, with companies introducing bioplastics and compostable formats. Expanding e-commerce platforms and subscription-based delivery models are further boosting accessibility. It reflects a shift toward convenience, customization, and environmentally conscious consumption.

Western Europe leads the market, driven by established coffee traditions in Germany, Italy, France, and the UK. Southern Europe remains a key contributor due to café culture and household adoption of capsules. Northern Europe is emerging with demand centered on eco-friendly and fair-trade certified options. Eastern Europe is gaining importance as urbanization and affordability increase capsule penetration. It shows a balanced mix of mature and emerging opportunities across the continent.

Market Insights:

- The Europe Coffee Pods Capsules Market was valued at USD 6,296.28 million in 2018, reached USD 7,477.30 million in 2024, and is projected to attain USD 11,594.05 million by 2032, expanding at a CAGR of 5.64%.

- Western Europe holds over 55% share, led by Germany, Italy, France, and the UK due to strong coffee traditions and high capsule adoption.

- Eastern Europe contributes nearly 20% share, with Russia and Poland driving growth through rising urbanization and increasing machine penetration.

- Capsules dominate the segment distribution with about 60% share in 2024, supported by premium positioning and machine compatibility.

- Pods account for nearly 40% share in 2024, appealing to price-sensitive consumers and sustaining demand through affordability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Convenient Coffee Consumption in Urban Households:

The Europe Coffee Pods Capsules Market benefits from the growing preference for convenient brewing solutions among busy households. Urban lifestyles encourage the adoption of single-serve coffee machines that save time while ensuring consistent taste. Consumers are increasingly drawn toward products offering quick preparation without compromising quality. It supports premiumization of the at-home coffee experience, replacing traditional brewing practices. Brands highlight machine compatibility and ease of use as selling points. Millennials and working professionals drive this demand, aligning with their fast-paced routines. The trend has solidified capsules and pods as staples in modern households.

- For instance, Nespresso VertuoLine technology, with its patented Centrifusion™ extraction system, delivers a personalized brew after a 30-second heat-up time. The company reported a global recycling rate for its aluminum capsules in a March 2025 progress document, illustrating both convenience and a growing commitment to sustainability in urban homes.

Premiumization of Coffee Products Across Multiple Consumer Segments:

The Europe Coffee Pods Capsules Market shows strong momentum in premiumization, with consumers willing to pay more for quality and variety. Demand for specialty coffee flavors and blends continues to rise. International and regional brands position capsules as premium offerings with unique intensity levels. It creates differentiation in a competitive market where quality remains a key determinant. Cafés and restaurants further fuel the trend by promoting branded pods for home use. Households increasingly associate premium capsules with café-style experiences. The growing link between premium consumption and brand loyalty reinforces sustained demand across Europe.

- For instance, Lavazza offers premium capsule lines such as “A Modo Mio” with proprietary blends maintaining high organoleptic standards, reinforcing its positioning in the high-end market segment.

Sustainability Commitments Driving Packaging Innovation and Consumer Trust:

Packaging innovation remains a vital driver in the Europe Coffee Pods Capsules Market. Consumers demand eco-friendly and recyclable solutions aligned with environmental concerns. Brands invest in bioplastics, compostable materials, and aluminum-free designs to enhance sustainability. It strengthens corporate image and builds consumer trust in environmentally conscious markets. Regulations in Western Europe reinforce adoption of sustainable materials. Younger consumers, particularly in Northern Europe, view eco-friendly capsules as a purchasing priority. The transition highlights how sustainability is embedded in growth strategies for long-term leadership.

Expansion of E-Commerce and Subscription-Based Coffee Models:

The Europe Coffee Pods Capsules Market gains momentum from the rapid growth of e-commerce platforms and direct-to-consumer channels. Subscription-based services ensure recurring demand and steady revenue flows. It enables personalization of flavor profiles and convenient doorstep delivery. Online retail platforms support product accessibility for both established brands and smaller entrants. The digital shift expands reach beyond traditional retail outlets. Promotions and targeted marketing strategies drive higher adoption rates among younger buyers. The growing digital coffee ecosystem reinforces convenience and strengthens long-term consumption trends.

Market Trends:

Shift Toward Functional and Specialty Coffee Capsules with Unique Attributes:

The Europe Coffee Pods Capsules Market is witnessing a surge in demand for specialty and functional coffee varieties. Consumers show interest in organic, fair-trade, and fortified capsules offering health benefits. It aligns with rising awareness of wellness-focused lifestyles. Specialty blends infused with vitamins, superfoods, or adaptogens are gaining visibility. Brands leverage product differentiation to expand consumer bases. Coffee enthusiasts seek unique origins and flavor authenticity through single-origin capsules. This evolving demand highlights diversification in offerings beyond conventional coffee flavors.

- For instance, Starbucks by Nespresso offers specialty capsules with caffeine content ranging from approximately 54 mg to 98 mg for Original Line blends, but the amounts are not precisely measured and can vary slightly. Additionally, the decaf options have a much lower caffeine content, and the larger Vertuo pods contain significantly more caffeine.

Integration of Smart Coffee Machines Enhancing Capsule Experience:

Technological advancement influences the Europe Coffee Pods Capsules Market through the integration of smart coffee machines. Consumers adopt devices with connectivity features, allowing customization and precision brewing. It enhances compatibility with branded capsules and strengthens brand loyalty. Machine-linked apps enable users to track consumption and explore new blends. Smart systems also support eco-friendly brewing by optimizing capsule usage. Growing consumer preference for technology-driven convenience ensures sustained interest. This integration reinforces capsules as part of a larger digital lifestyle ecosystem.

- For instance, the De’Longhi Dinamica Plus machine features a 3.5” full-touch display and Coffee Link App connectivity, enabling remote customization of espresso recipes, automatic maintenance alerts, and integration with multiple coffee blends to enhance user experience.

Rising Popularity of Private Labels and Affordable Capsule Options:

The Europe Coffee Pods Capsules Market observes rapid growth in private labels offering affordable capsule alternatives. Retailers introduce cost-effective products to attract price-sensitive consumers. It provides competition to established brands without reducing quality expectations. Private labels gain share in Eastern Europe, where affordability is a decisive factor. Consumers value the balance between cost and flavor variety. Retail partnerships strengthen distribution and availability across supermarkets. This trend emphasizes how affordability strategies expand market penetration in diverse consumer groups.

Growing Influence of Ethical Sourcing and Transparency in Coffee Supply Chains:

Transparency in sourcing is becoming central to the Europe Coffee Pods Capsules Market. Consumers increasingly demand traceability from farm to capsule. It encourages brands to highlight fair-trade and ethical sourcing certifications. Companies promote sustainable farming partnerships to appeal to conscious buyers. Transparency initiatives also strengthen compliance with European sustainability regulations. Ethical messaging enhances brand value and differentiates offerings in competitive markets. The trend reflects consumer alignment with responsible and ethical consumption practices.

Market Challenges Analysis:

Regulatory Barriers and Sustainability Compliance Across Multiple Regions:

The Europe Coffee Pods Capsules Market faces stringent regulatory frameworks related to sustainability and waste management. Governments in Western Europe impose rules that require recyclable or compostable packaging, raising compliance costs. It challenges smaller players with limited resources to adapt quickly. Companies must balance innovation with affordability while meeting eco-standards. Regulatory variations across countries complicate operations for multinational brands. Compliance pressure also impacts material sourcing strategies. Ensuring alignment with evolving rules is critical for sustained participation in the market.

Rising Inflationary Pressures and Shifting Consumer Spending Behavior:

The Europe Coffee Pods Capsules Market is influenced by inflation, which impacts both production and retail pricing. Rising raw material costs for coffee beans and sustainable packaging raise overall expenses. It leads to higher consumer prices, potentially reducing demand among price-sensitive segments. Eastern Europe, where affordability dominates decisions, is most affected. Competitive pricing strategies strain profit margins for smaller firms. Inflation also shifts consumer interest toward private labels or value-based offerings. Maintaining growth in such conditions requires efficiency and strategic pricing management.

Market Opportunities:

Expansion of Bioplastic Capsules and Compostable Packaging Formats:

The Europe Coffee Pods Capsules Market offers strong opportunities in sustainable packaging innovation. Bioplastic capsules and compostable formats are gaining consumer and regulatory support. It enables companies to strengthen brand positioning while aligning with eco-conscious consumer values. Western and Northern Europe remain key regions for these innovations. Partnerships with packaging firms drive material breakthroughs. This opportunity highlights the market’s long-term shift toward greener product offerings.

Emergence of Personalized Coffee Subscriptions and Digital Integration:

The Europe Coffee Pods Capsules Market shows opportunities in digital-driven models such as personalized subscriptions. Consumers prefer customized blends and automated deliveries. It builds long-term loyalty and ensures consistent revenue streams. Digital platforms enhance engagement by offering targeted recommendations and discounts. Integration with smart brewing systems strengthens consumer attachment to specific brands. Expanding these services across regions supports broader adoption of premium and functional capsules.

Market Segmentation Analysis:

By Type

The Europe Coffee Pods Capsules Market is divided into pods and capsules. Pods appeal to consumers valuing convenience and affordability, while capsules dominate due to premium positioning and wide brand portfolios. It shows steady growth in both categories, driven by strong household adoption.

- For instance, in Germany, the coffee pod and capsule market continued its growth in 2024, partly driven by consumers aged 14 and older seeking premium offers like Nespresso’s Original Line, which includes capsules made with up to 80% recycled aluminum and offers compatibility with popular single-serve machines.

By Packaging Material

Packaging material segments include conventional plastic, bioplastics, fabric, and others. Conventional plastic retains significant share due to cost efficiency. Bioplastics gain momentum from sustainability commitments and EU regulations. Fabric and other alternatives serve niche buyers focused on compostability and eco-friendly credentials.

- For instance, Nespresso introduced paper-based capsules certified “OK compost HOME and INDUSTRIAL” by TÜV Austria, now sold in at least two countries as of 2023, leveraging compostability aligned with EU packaging waste regulations.

By Coffee Type

The market splits into traditional and decaf. Traditional coffee maintains leadership, supported by high consumption in major European countries. Decaf expands steadily, reflecting growing health-conscious behavior and demand from older demographics. It is shaping new product launches to meet lifestyle needs.

By Distribution Channel

Store-based retail, including supermarkets and specialty stores, remains dominant, offering broad accessibility. Non-store-based channels grow faster, fueled by e-commerce platforms and direct-to-consumer models. It highlights the shift toward online subscriptions and personalized coffee delivery.

Segmentation:

By Type

By Packaging Material

- Conventional Plastic

- Bioplastics

- Fabric

- Others

By Coffee Type

By Distribution Channel

- Store-Based

- Non-Store Based

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe

Western Europe dominates the Europe Coffee Pods Capsules Market, holding more than 55% of total share. The UK, France, Germany, Italy, and Spain account for the majority of demand, supported by high household coffee consumption and strong brand loyalty. Germany leads within the sub-region, fueled by a robust premium coffee culture and the presence of leading manufacturers. The UK follows closely, driven by growing adoption of at-home brewing machines and e-commerce subscriptions. France and Italy maintain strong positions due to deep-rooted café traditions and preference for quality blends. It shows consistent revenue growth supported by innovation in flavors and eco-friendly packaging formats.

Eastern Europe

Eastern Europe represents around 20% share of the Europe Coffee Pods Capsules Market. Russia is the key market, supported by rising urban coffee culture and expanding retail networks. Countries such as Poland and Czech Republic also show increasing consumption, supported by affordability and growing penetration of machine-compatible capsules. Demand in this sub-region reflects a shift from traditional instant coffee to convenient pod-based systems. Store-based retail continues to dominate, but online sales channels are rapidly expanding. It is emerging as a growth cluster where price-sensitive consumers still influence product positioning.

Southern and Northern Europe

Southern Europe, including Italy, Spain, and other Mediterranean countries, accounts for about 15% of market share. Italy plays a central role, blending cultural heritage with modern capsule adoption. Spain follows with strong household penetration and rising café chains promoting capsule formats. Northern Europe, with countries like Sweden, Denmark, and Finland, contributes close to 10% share, with consumers showing strong preference for sustainable and fair-trade certified coffee options. Scandinavian markets often lead in bioplastic capsule adoption due to strict environmental regulations. It reflects a steady balance between tradition and innovation, ensuring both regions remain vital contributors to long-term market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- JDE Peet’s N.V.

- Luigi Lavazza S.p.A.

- Illycaffe S.p.A.

- Melitta Group Management GmbH & Co. KG

- Dualit Limited

- Caffitaly System S.p.A.

- Segafredo Zanetti (Massimo Zanetti Beverage Group)

Competitive Analysis:

The Europe Coffee Pods Capsules Market is characterized by strong competition between multinational coffee brands and regional players. Leading companies such as JDE Peet’s, Luigi Lavazza, Illycaffè, and Melitta Group maintain dominance through extensive product portfolios and established retail networks. Innovation in flavors, machine compatibility, and sustainable packaging continues to define differentiation strategies. Smaller players emphasize niche positioning, including organic and compostable capsule offerings, to gain traction in specific consumer clusters. It reflects a dynamic competitive landscape where sustainability and direct-to-consumer models are central to brand growth and consumer loyalty.

Recent Developments:

- In September 2025, Melitta Group Management GmbH announced a major partnership as the Official Coffee Partner of Real Madrid football club. Under a five-year agreement, Melitta will install over 200 professional coffee machines and supply coffee across Real Madrid’s Santiago Bernabéu stadium, training ground, and offices, accompanied by joint marketing activities across the football club’s platforms. This partnership reinforces Melitta’s brand presence and showcases high-quality coffee solutions to millions of visitors and fans annually.

- In January 2025, Illycaffè S.p.A. joined Coffee Capsule Recycling Netherlands, a significant partnership aimed at improving disposal and recycling of used aluminium and plastic coffee capsules in the Netherlands. This collaboration supports ambitious recycling targets, increasing aluminium capsule recycling rates from 25% to 75% and plastic capsule rates from 5% to 60%. The move reflects Illycaffè’s commitment to sustainability and circular economy principles within the European coffee capsule market.

- In February 2024, JDE Peet’s N.V. expanded its collaboration with Costa Coffee by launching a range of aluminium coffee capsules in Great Britain. This strategic move supports premiumization with Costa-branded capsules compatible with the L’OR Barista system, emphasizing sustainability through the use of infinitely recyclable aluminium. The extended partnership aims to offer consumers a wider selection of high-quality single-serve coffee options at home, enhancing the coffee experience while promoting circular economy initiatives in Britain.

Report Coverage:

The research report offers an in-depth analysis based on type, packaging material, coffee type, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable capsules will drive bioplastic adoption across European households.

- Direct-to-consumer subscription models will expand, creating stronger recurring revenue streams.

- Technological innovation in capsule machines will enhance convenience and customization.

- Premiumization trends will strengthen capsule dominance over pods in key markets.

- Eco-friendly regulations in Western Europe will accelerate packaging material transitions.

- Decaf segment will gain more traction with health-conscious consumers across mature markets.

- Store-based channels will remain important, but online platforms will record faster growth.

- Regional players will expand through strategic partnerships and niche product innovation.

- Price sensitivity in Eastern Europe will encourage affordable product lines and private labels.

- Continuous flavor innovation will fuel differentiation and reinforce brand loyalty in the market.